Chart of the week (26 2025)

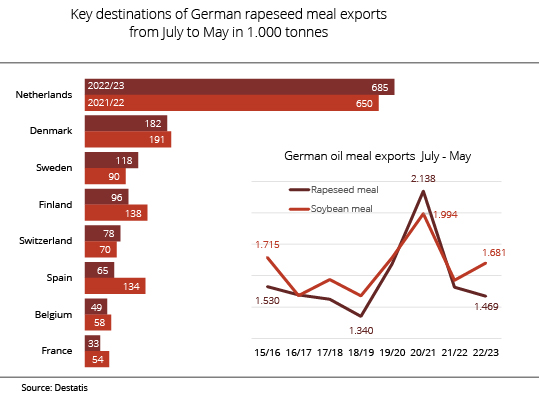

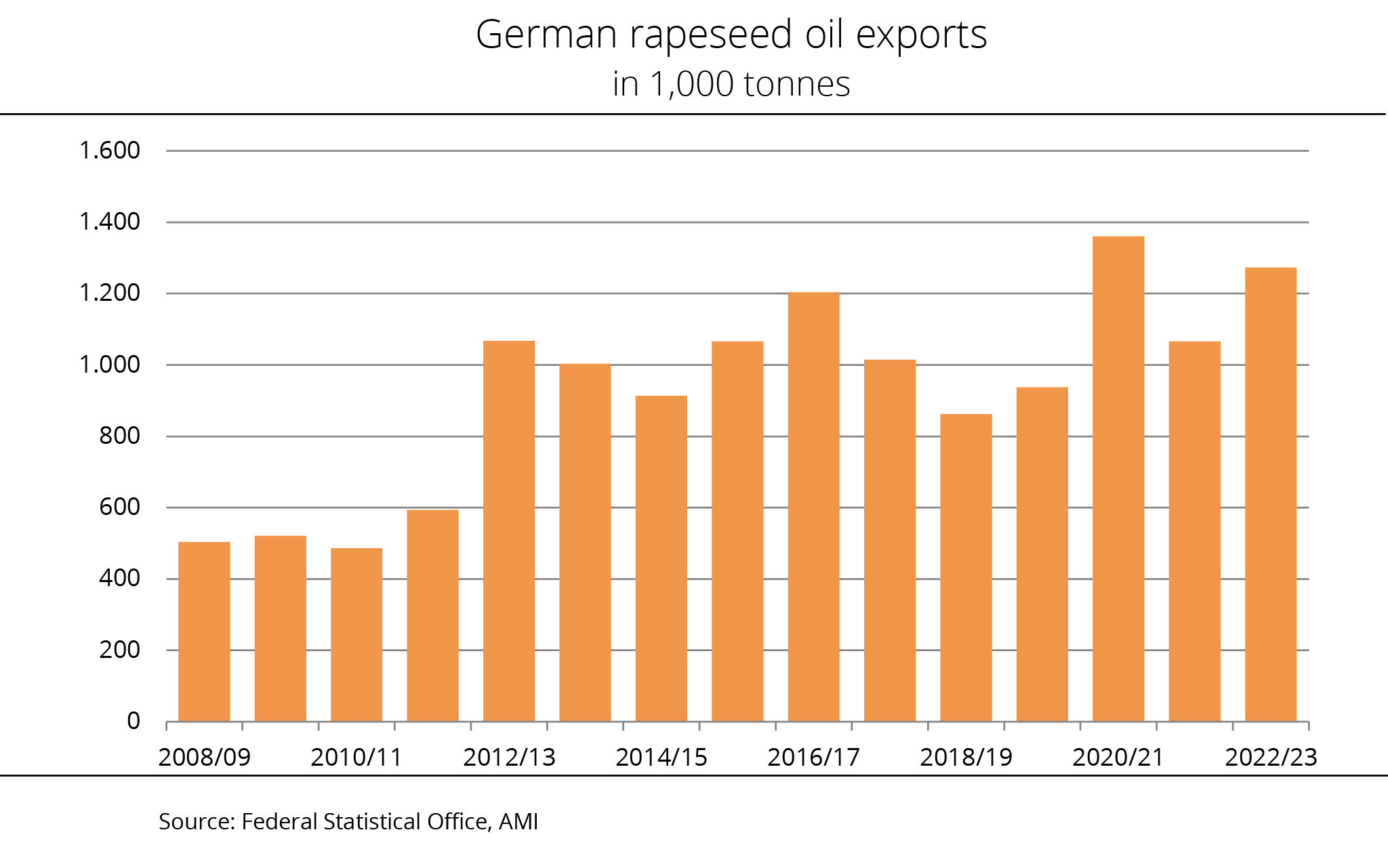

German rapeseed meal exports in decline

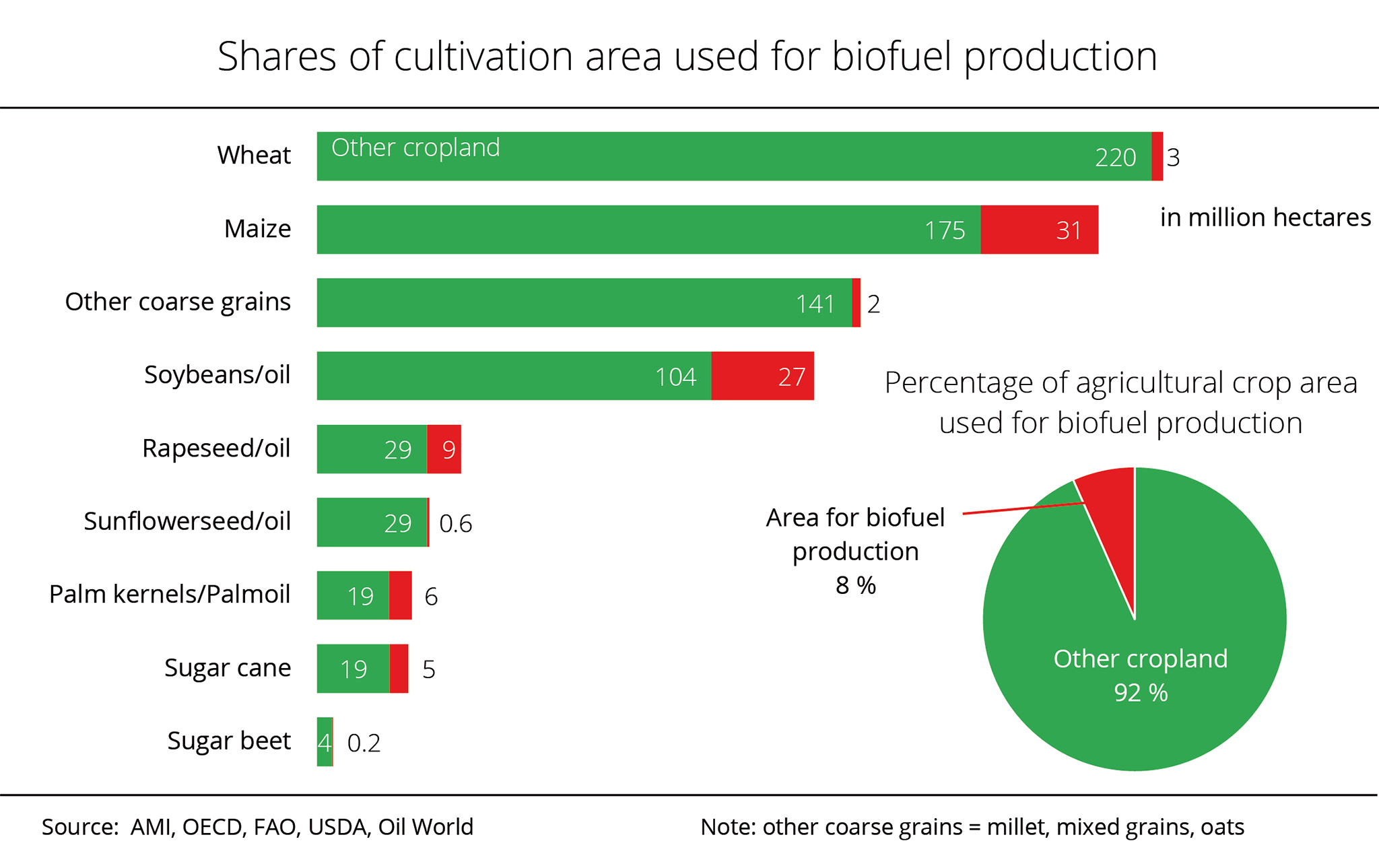

The decline in rapeseed meal exports has prompted the Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP) to strongly oppose the proposed reduction of the cap on biofuels from cultivated biomass as outlined in the Federal Ministry for the Environment's draft bill to amend the greenhouse gas quota legislation. The legislation is intended to implement the revised Renewable Energy Directive (Red III) at the national level and is under enormous time pressure, because Germany has already allowed the directive's implementation deadline to lapse.

The association has once again emphasised that the biodiesel market is by far the most important outlet for German and European rapeseed producers, as well as for German rapeseed mills, which have a combined processing capacity of approximately 10 million tonnes of seed. The production of biofuels and the availability of domestic rapeseed meal are mutually dependent. The UFOP has repeatedly pointed out this relationship as a prime example of an integrated bioeconomy. The association has therefore called on the German Minister of Agriculture Alois Rainer to push for raising the cap to 5.3 per cent during the ongoing interdepartmental coordination on the greenhouse gas quota legislation. The increase would help compensate for the decline in overall energy demand in the transport sector resulting from the re-introduction of tax incentives for electromobility. The association has also emphasised that biofuels make a significant contribution towards climate change mitigation - without placing a burden on the federal budget, since they are subject to full taxation.

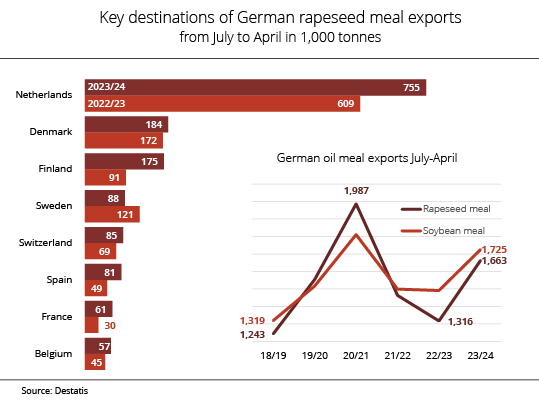

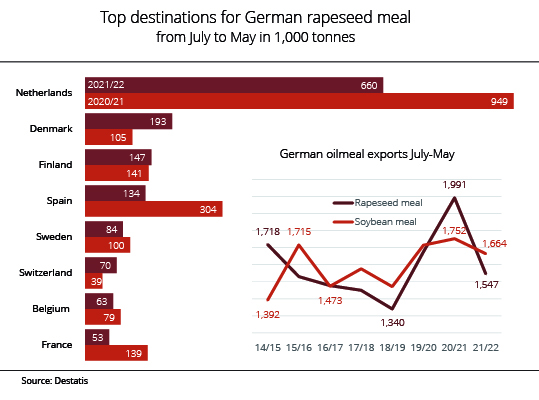

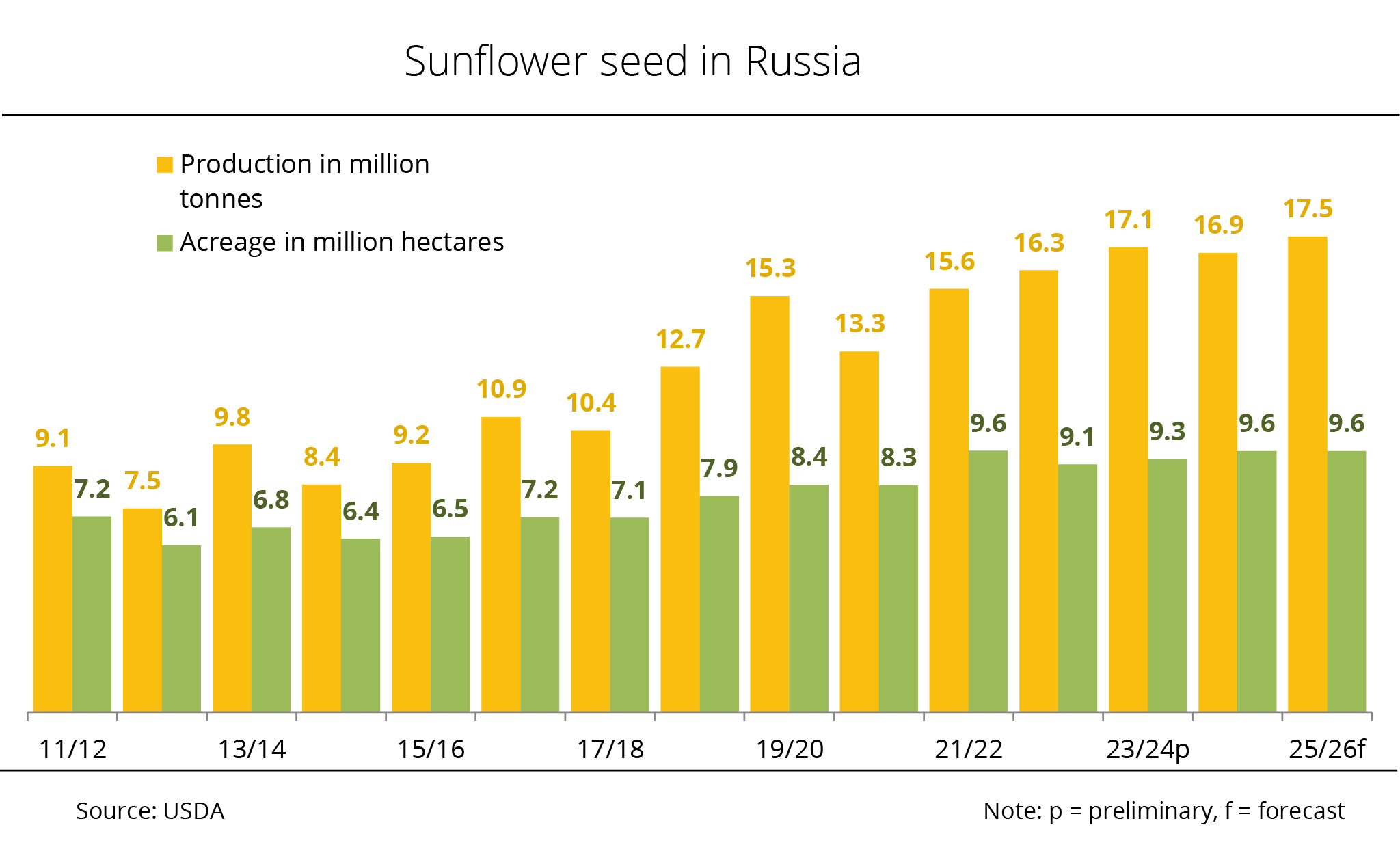

According to data from the German Federal Statistical Office, Germany exported just over 1.4 million tonnes of rapeseed meal from July 2024 to April 2025. This was down 9 per cent on the same period a year earlier. Nearly all of this volume (around 1.3 tonnes) was delivered to EU member states. The largest share, 589,000 tonnes, went to the Netherlands, representing a decrease of almost 17 percent compared to the same period the previous year. Rapeseed meal deliveries to Sweden dropped 2 per cent.

In contrast, exports to Denmark, Finland and France showed a positive trend. Denmark, Germany's second largest trading partner for rapeseed meal, ramped up its imports 2 per cent to 184,000 tonnes. Exports to France saw a remarkable rise. Due to a smaller domestic harvest, France strongly relied on imports, which climbed around 70 per cent year-on-year to nearly 99,000 tonnes. Outside the EU, Switzerland remained the most important export destination, followed by the UK.

Chart of the week (25 2025)

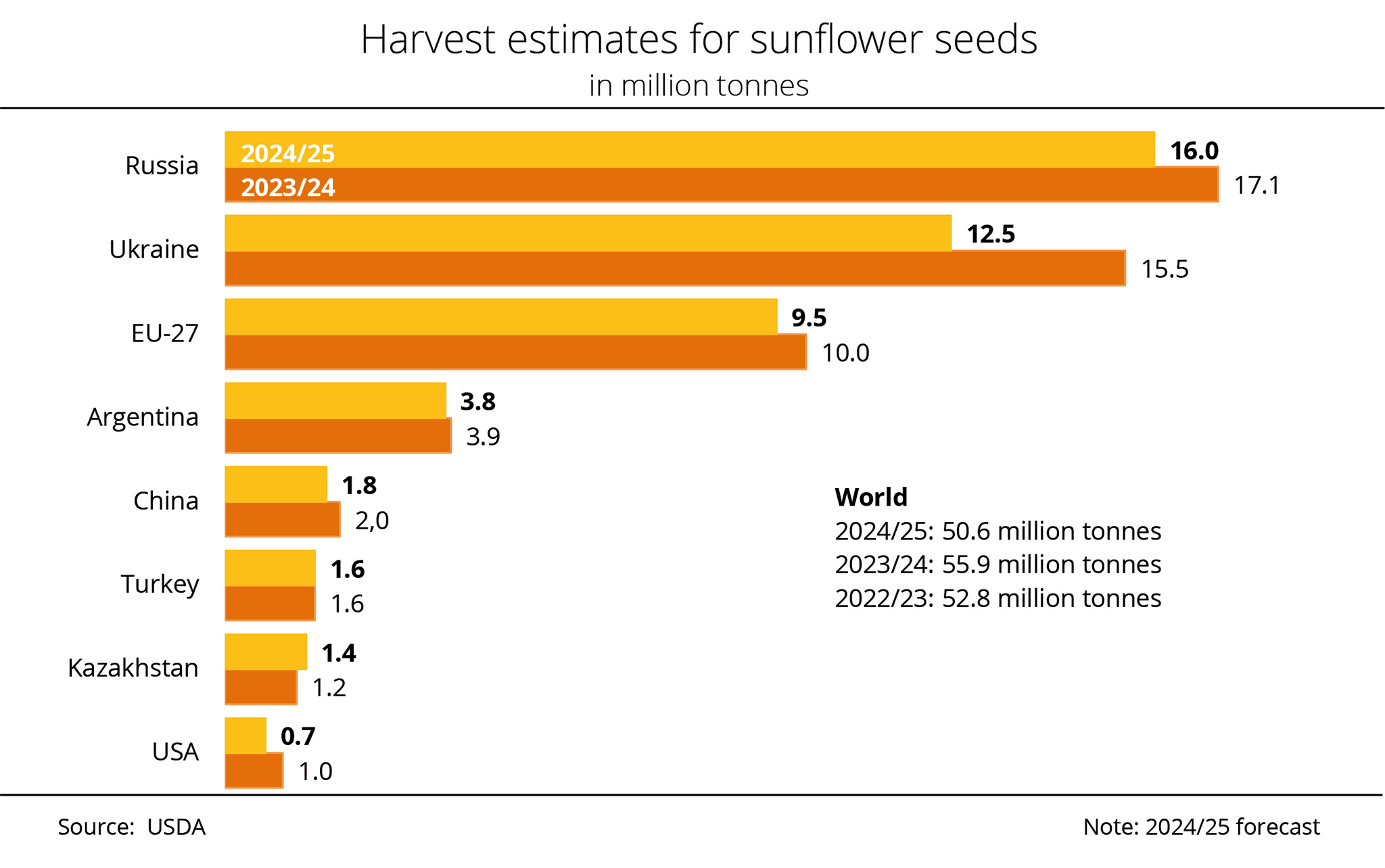

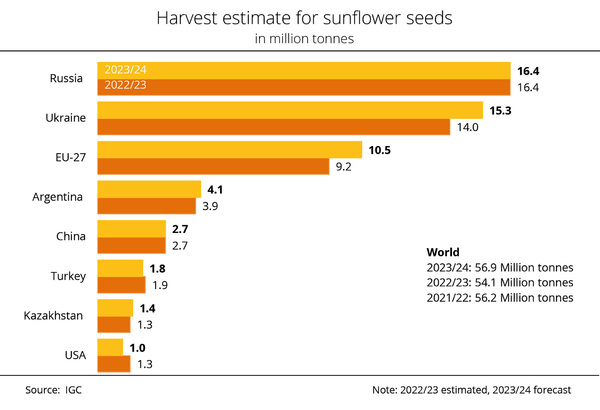

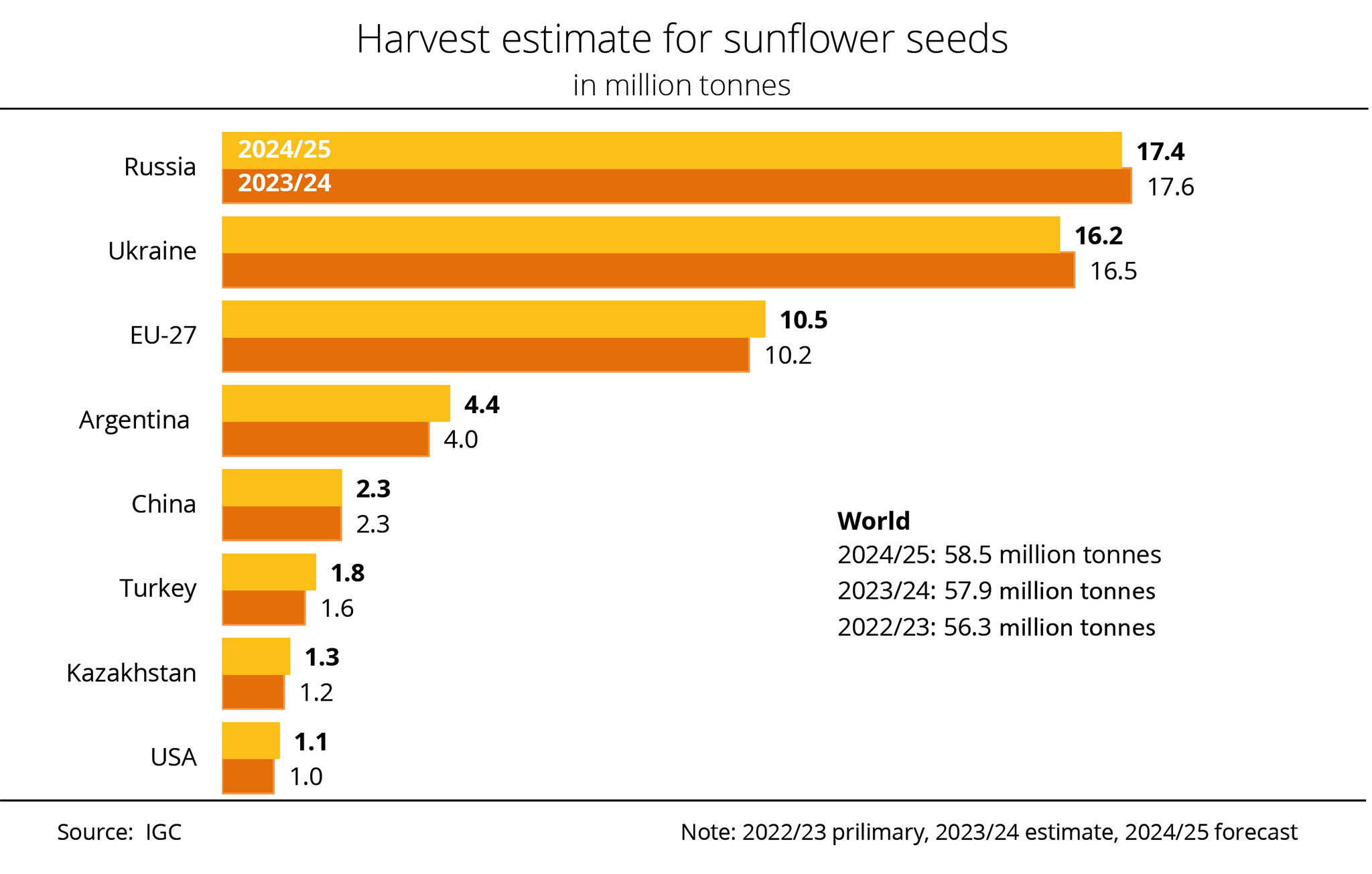

Russia's sunflower seed harvest set to hit record level

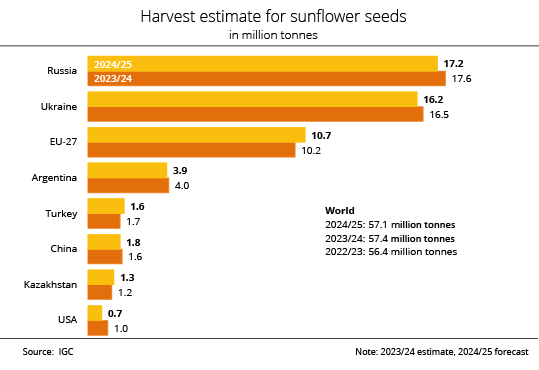

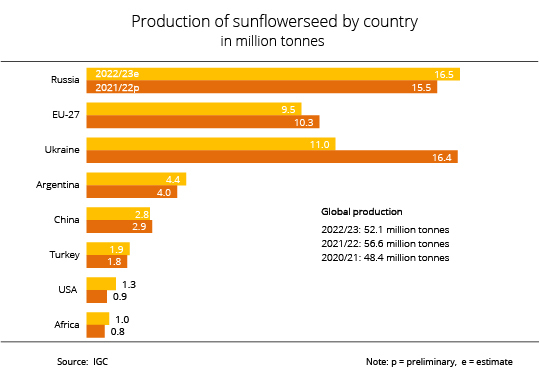

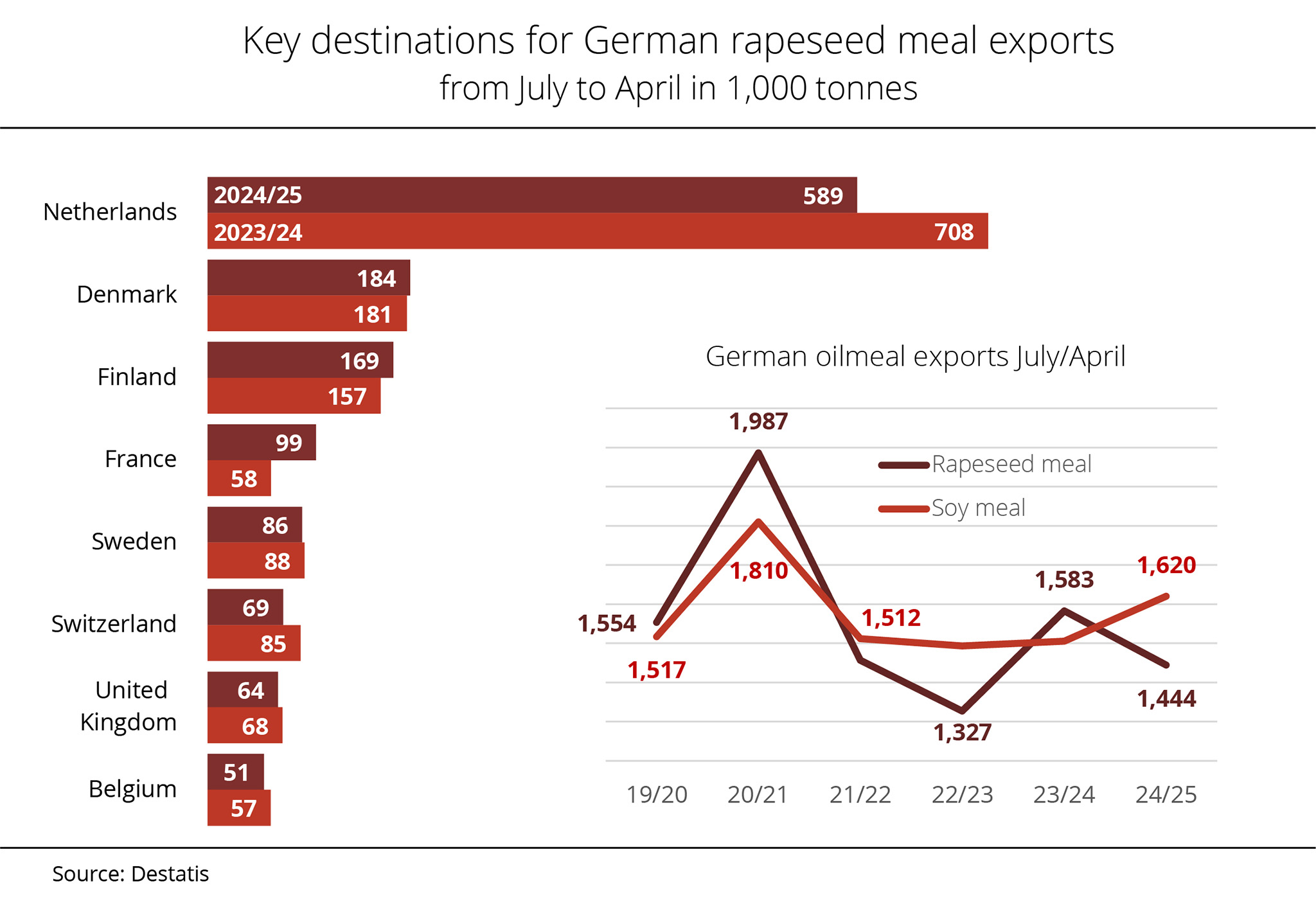

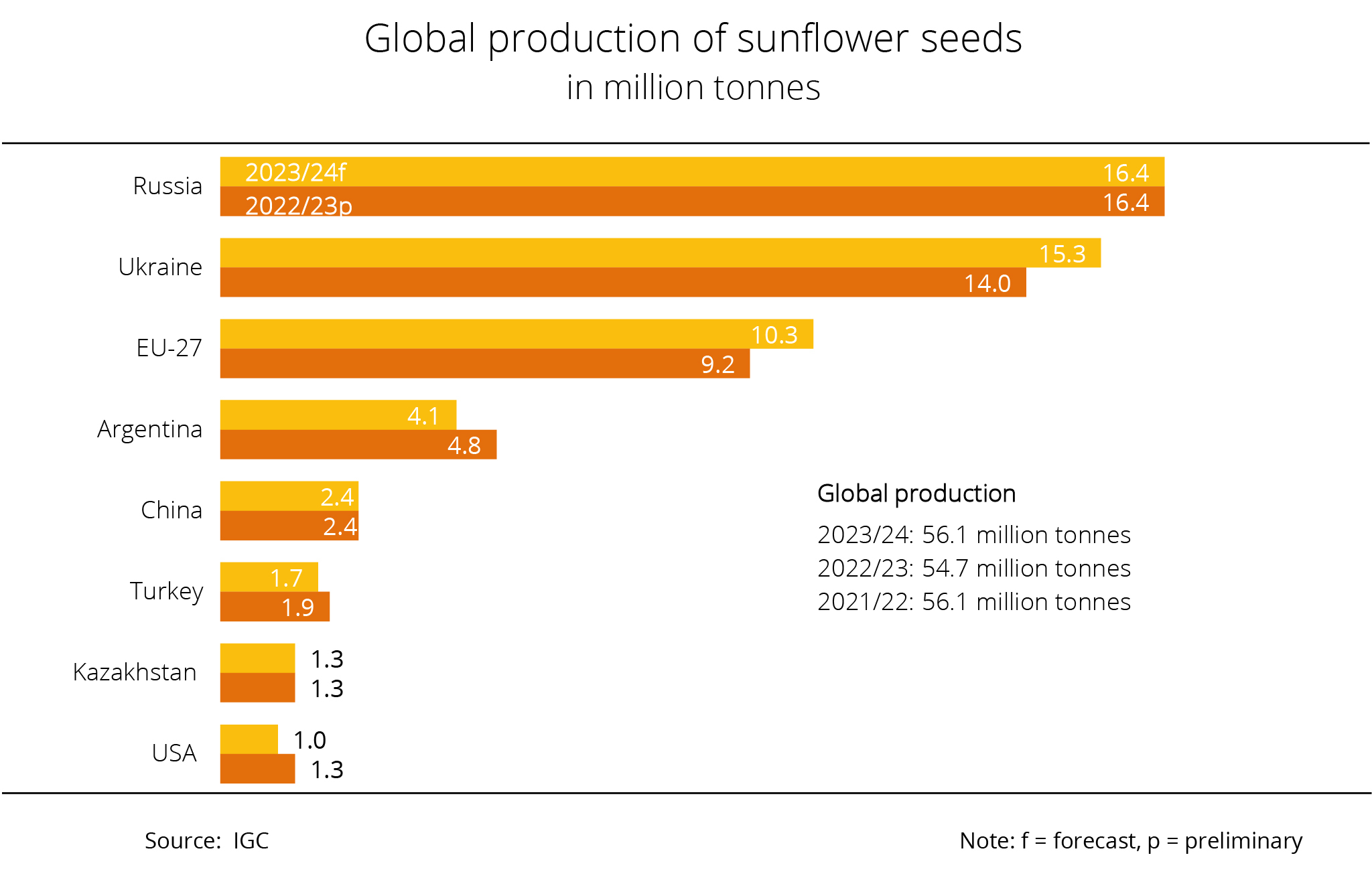

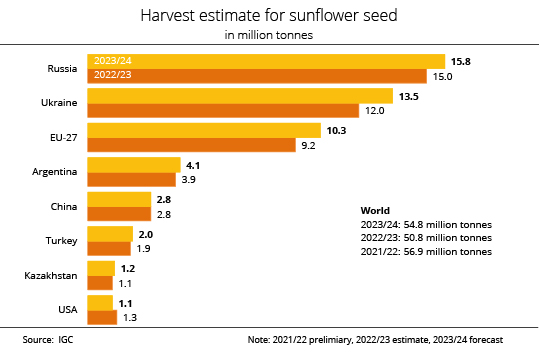

Russia is the world's largest producer of sunflower seed. The country's harvest is expected to a reach new record high in the coming season – although the sunflower area will presumably remain unchanged.

The US Department of Agriculture (USDA) recently published its June estimate for global oilseed production. According to the report, Russia's output of sunflower seed for the upcoming crop year is estimated at 17.5 million tonnes. This figure would not only represent a 4 per cent increase over the running season and an 11 per cent rise compared to the long-standing average, but also a new record harvest from an unchanged production area of 9.6 million hectares. The estimated increase is attributed to higher yields. Sowings are just about complete. As of 23 May 2025, approximately 8.4 million hectares had already been sown with sunflowers, compared to 7.0 million hectares the previous year. Weather conditions for the 2025/26 crop year are currently expected to be favourable. The USDA therefore expects an average yield of 18.2 decitonnes per hectare, which would be the third highest on record.

With that, Russia remains the world's leading producer of sunflower seed, ahead of Ukraine and the EU-27. According to the USDA estimate, Russia is seen to account for slightly more than 31 per cent of global output in the coming season, followed by Ukraine at just under 26 per cent and the EU-27 at 18 per cent. Most of Russia's sunflower seed harvest is processed domestically, with part of it later exported as meal or oil.

Chart of the week (24 2025)

Drought in Australia expected to decimate rapeseed yields

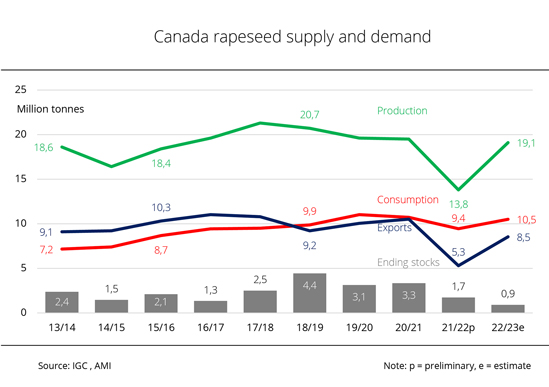

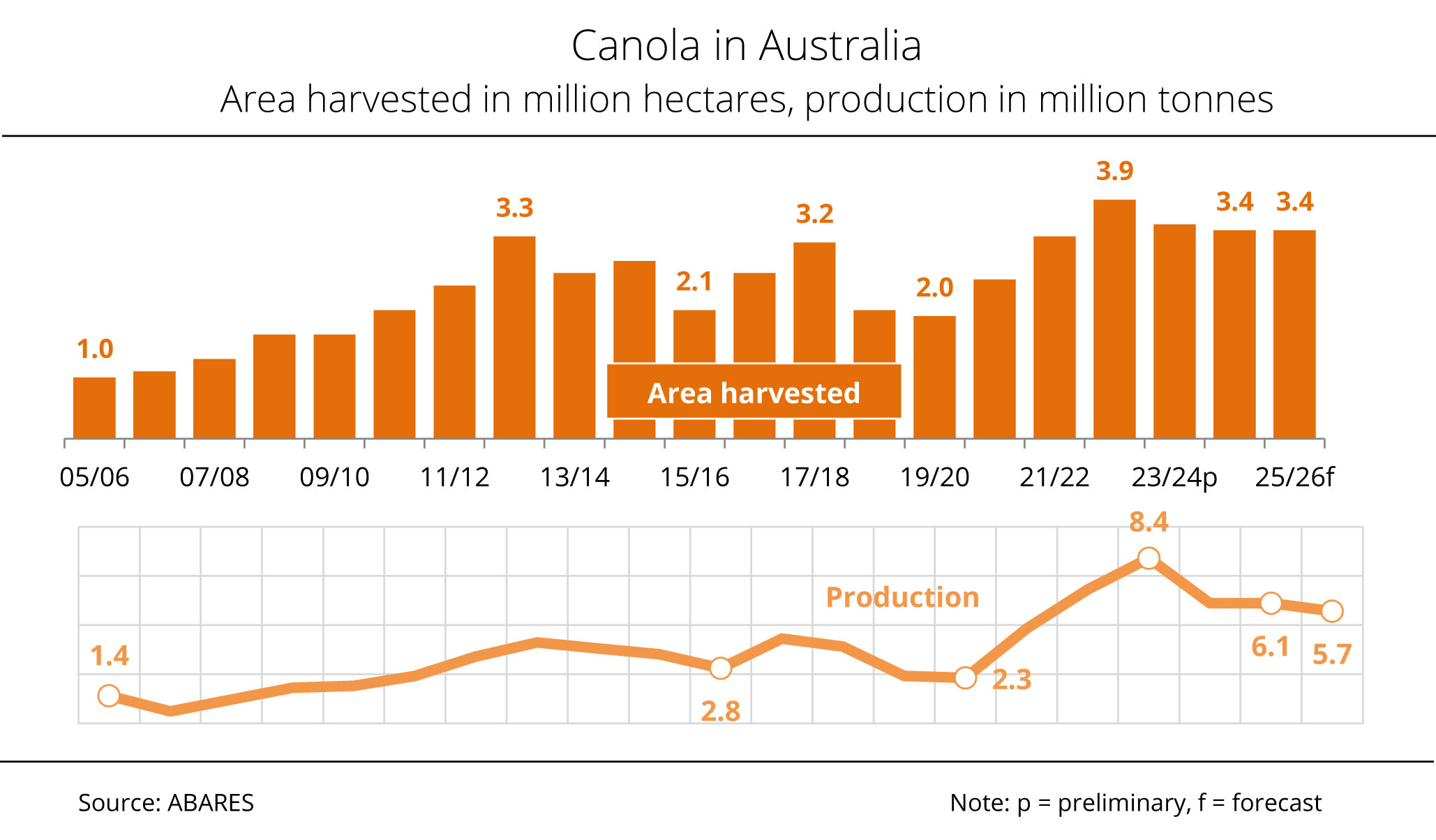

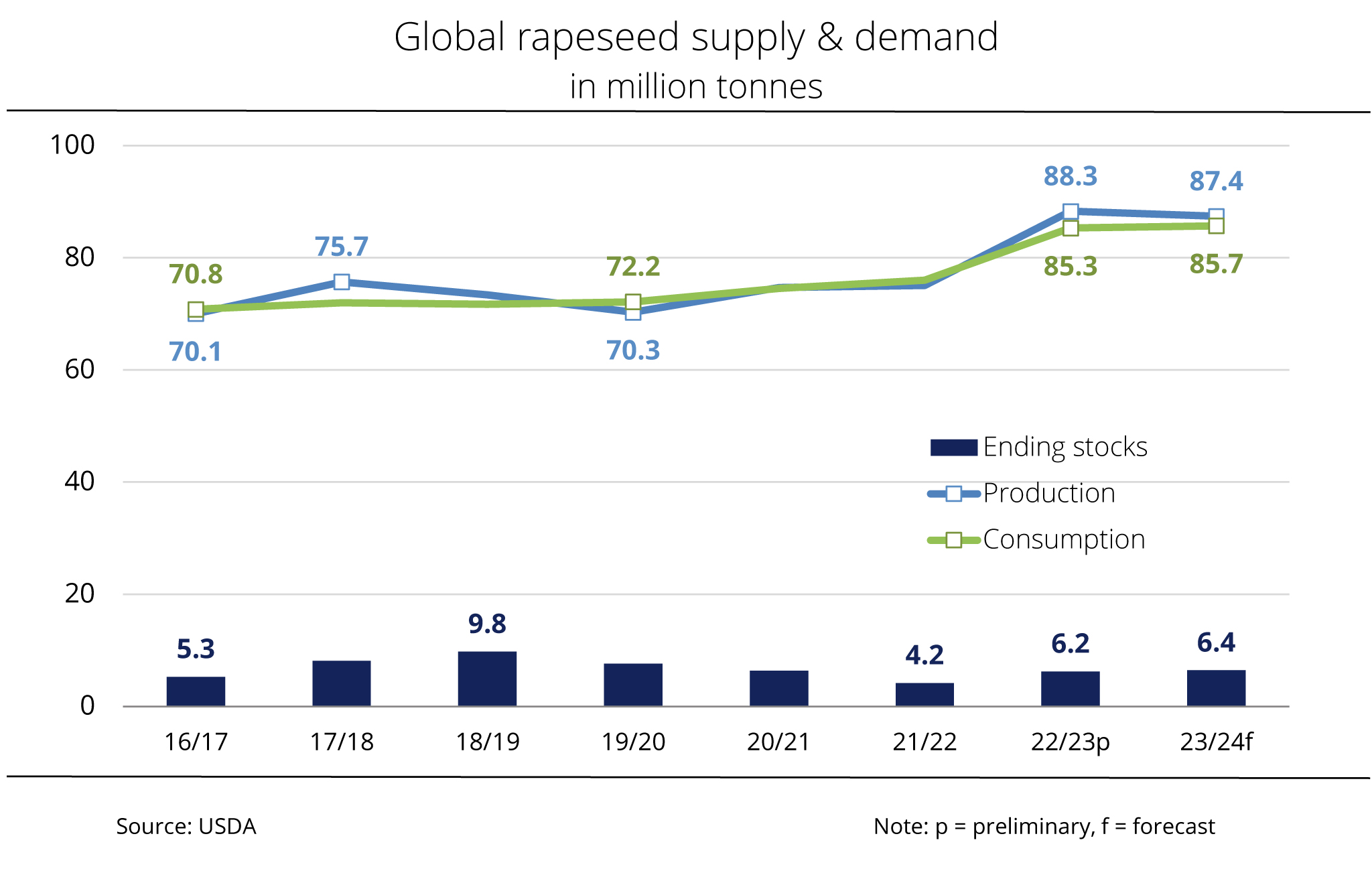

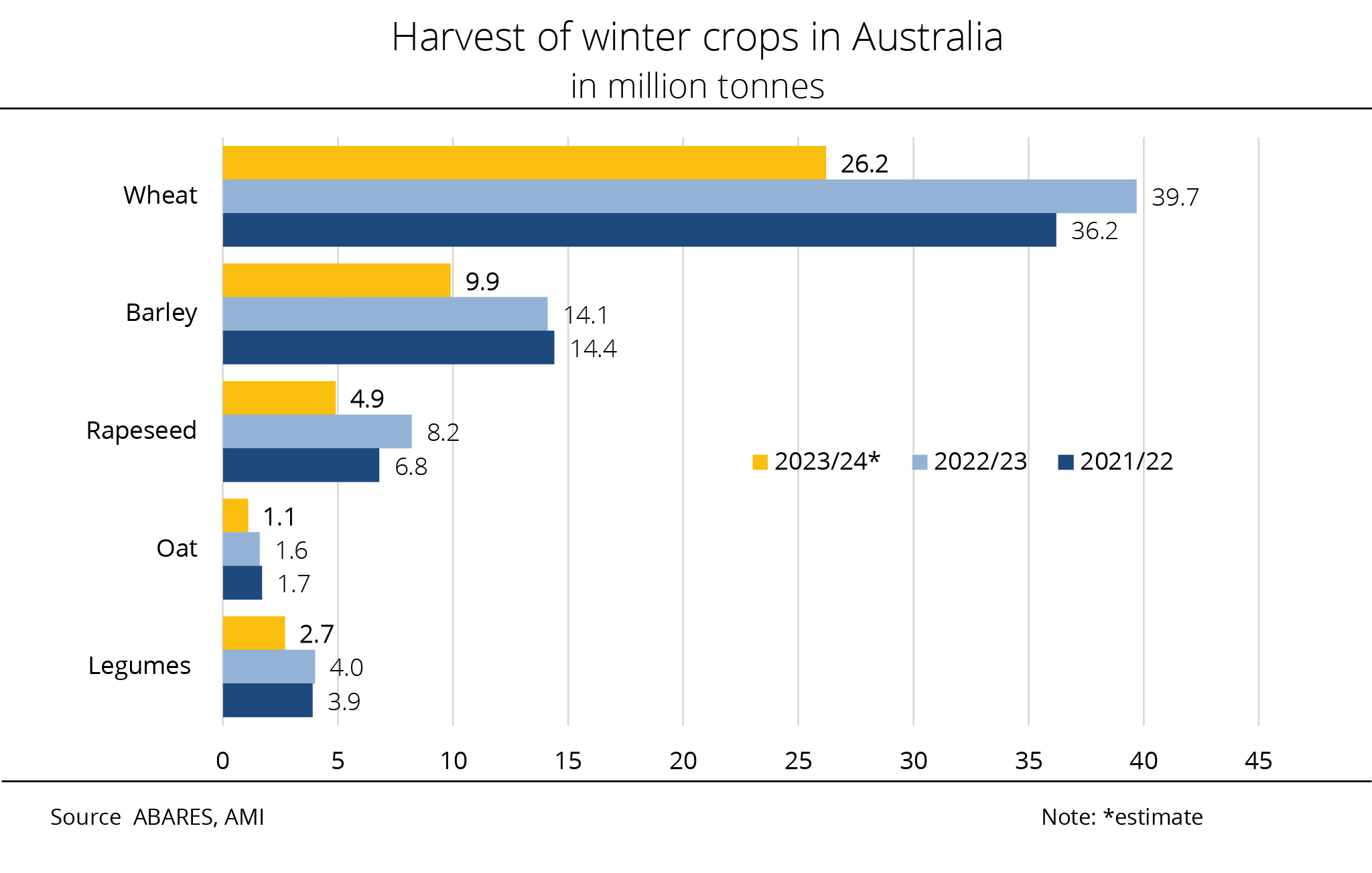

The Australian Department of Agriculture, Fisheries and Forestry (DAFF) has lowered its forecast for rapeseed production in 2025/26. Reduced yields and a slight drop in production area are expected to limit export potential – carrying implications for the global market.

The new outlook, published by the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), presents a more cautious assessment of Australian canola cultivation, production and exports in the 2025/26 season compared to forecasts from the US Department of Agriculture (USDA) and the International Grains Council (IGC).

ABARES projects a modest decrease in canola area to just under 3.4 million hectares. Production is estimated at just over 5.7 million tonnes – around 400,000 tonnes below the current season's output. According to research by Agrarmarkt Informations-Gesellschaft (mbH), the decline is primarily due to lower yields resulting from the continued dryness. In many regions, soil moisture levels are below those of the previous year, which has a negative impact on sowing, plant growth and, ultimately, yields.

The ABARES forecast is lower than those issued by the USDA and IGC. The IGC expects Australian production to reach around 6 million tonnes, whereas the USDA projects slightly more than 6.1 million tonnes. This discrepancy is also reflected in export expectations: ABARES projects canola exports of 4.6 million tonnes for 2025/26 – around 200,000 tonnes less than the current season and almost 1.4 million tonnes below the 2023/24 level. In contrast, the USDA expects export volumes to remain stable.

Chart of the week (23 2025)

Romania remains the EU's largest producer of sunflower seed

According to the estimate, the dry pea area for the 2025 harvest totals around 139,100 hectares, representing a 7.6 per cent increase. According to research by Agrarmarkt Informations-Gesellschaft (mbH), production is mainly concentrated in northern and eastern Germany. Mecklenburg-Western Pomerania and Lower Saxony account for an estimated 33,200 and 13,000 hectares, respectively. Saxony-Anhalt is expected to cultivate a total of 21,800 hectares, while Brandenburg and Thuringia contribute around 16,000 and 15,300 hectares. In other words, the accumulated area in these five states is seen at around 99,300 hectares, which translates to just over 71 per cent of Germany's total pea area.

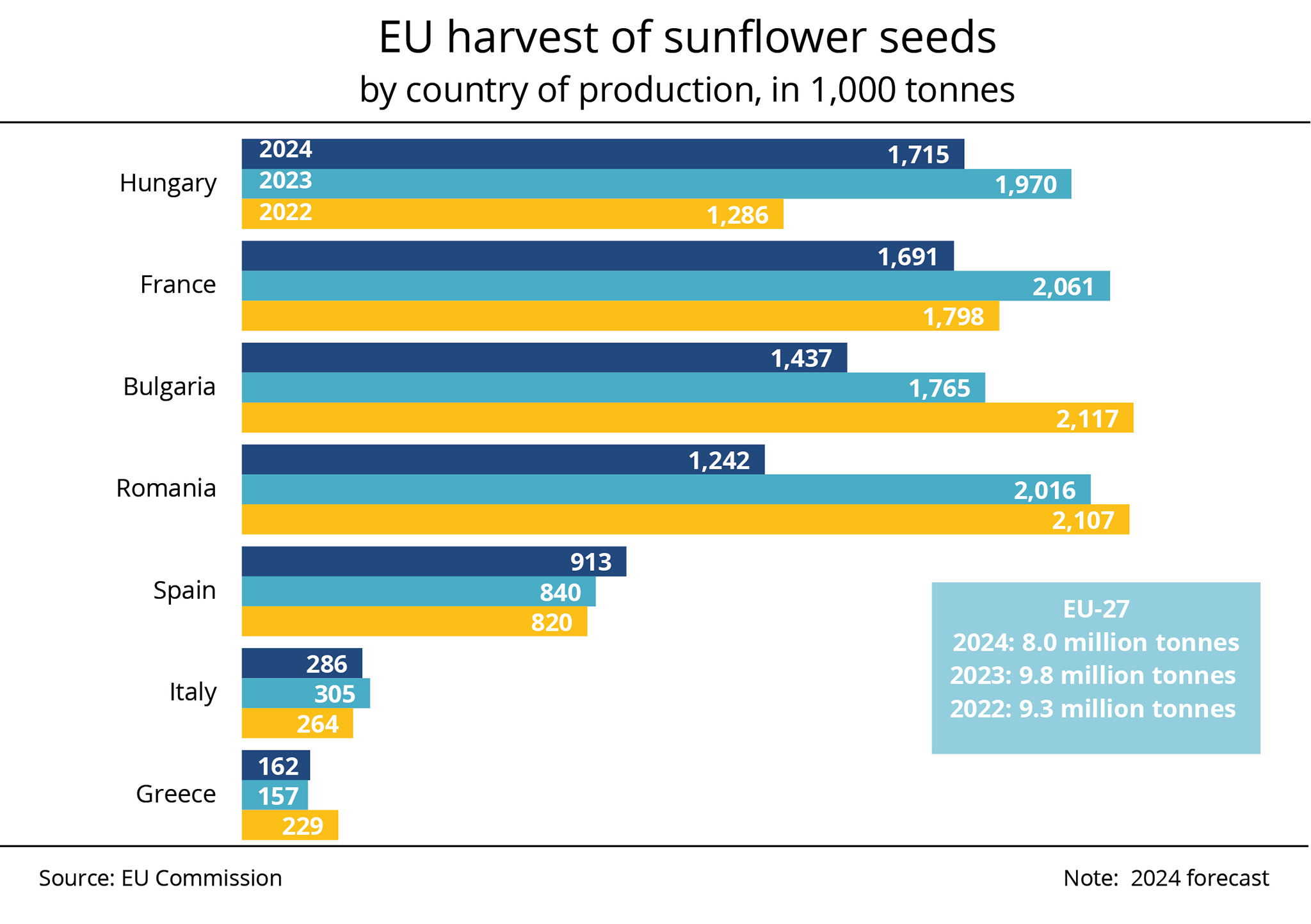

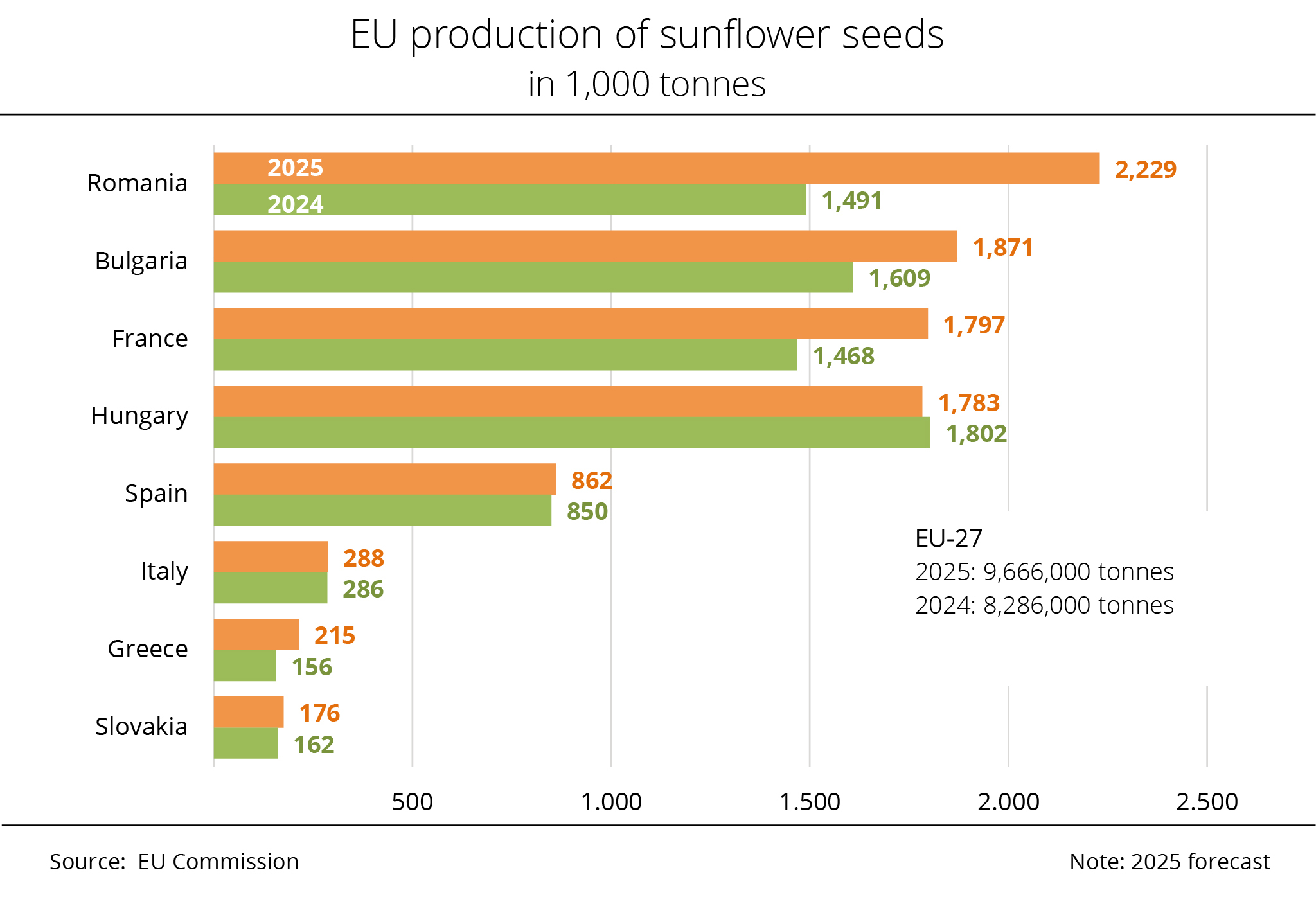

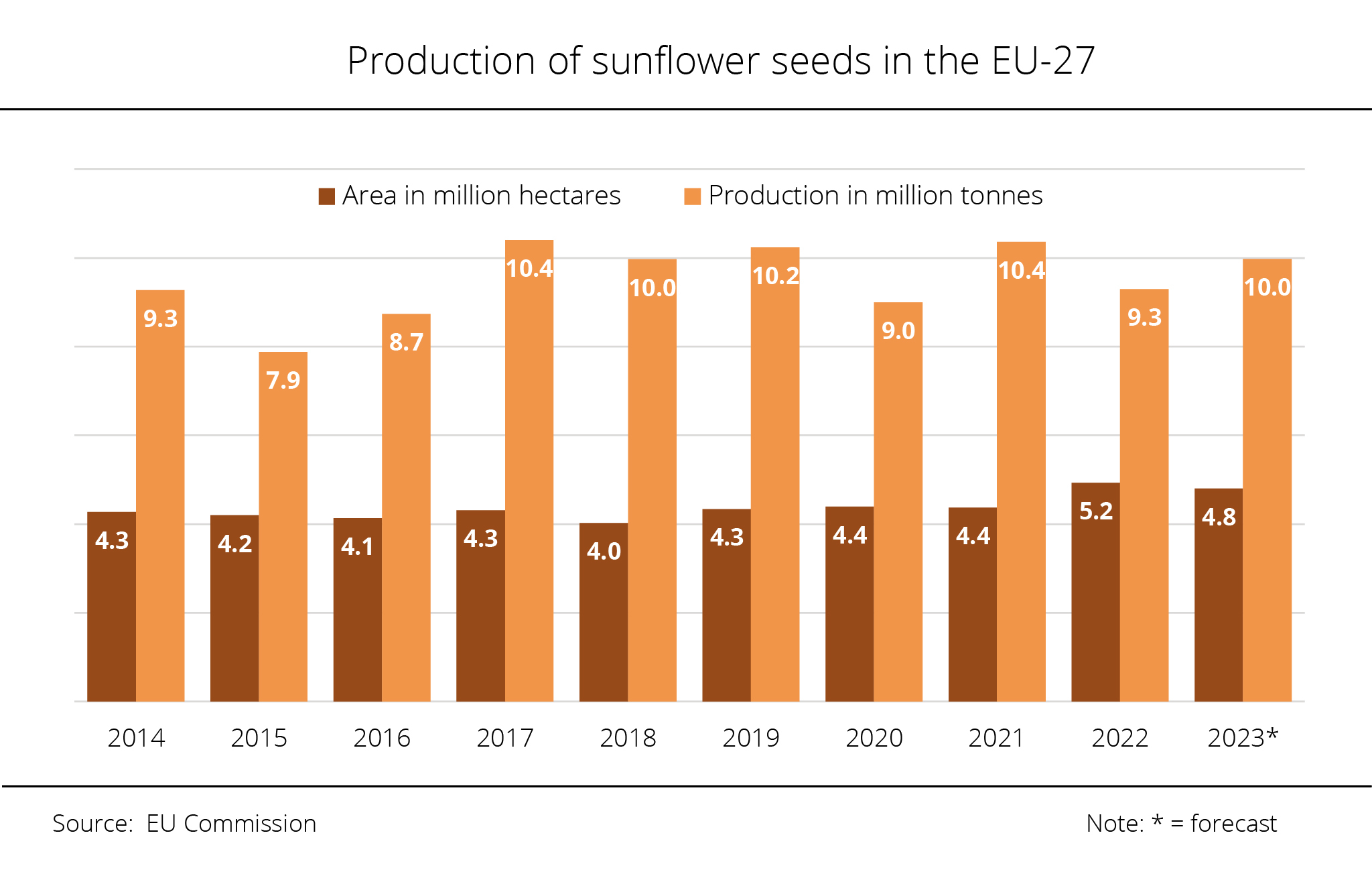

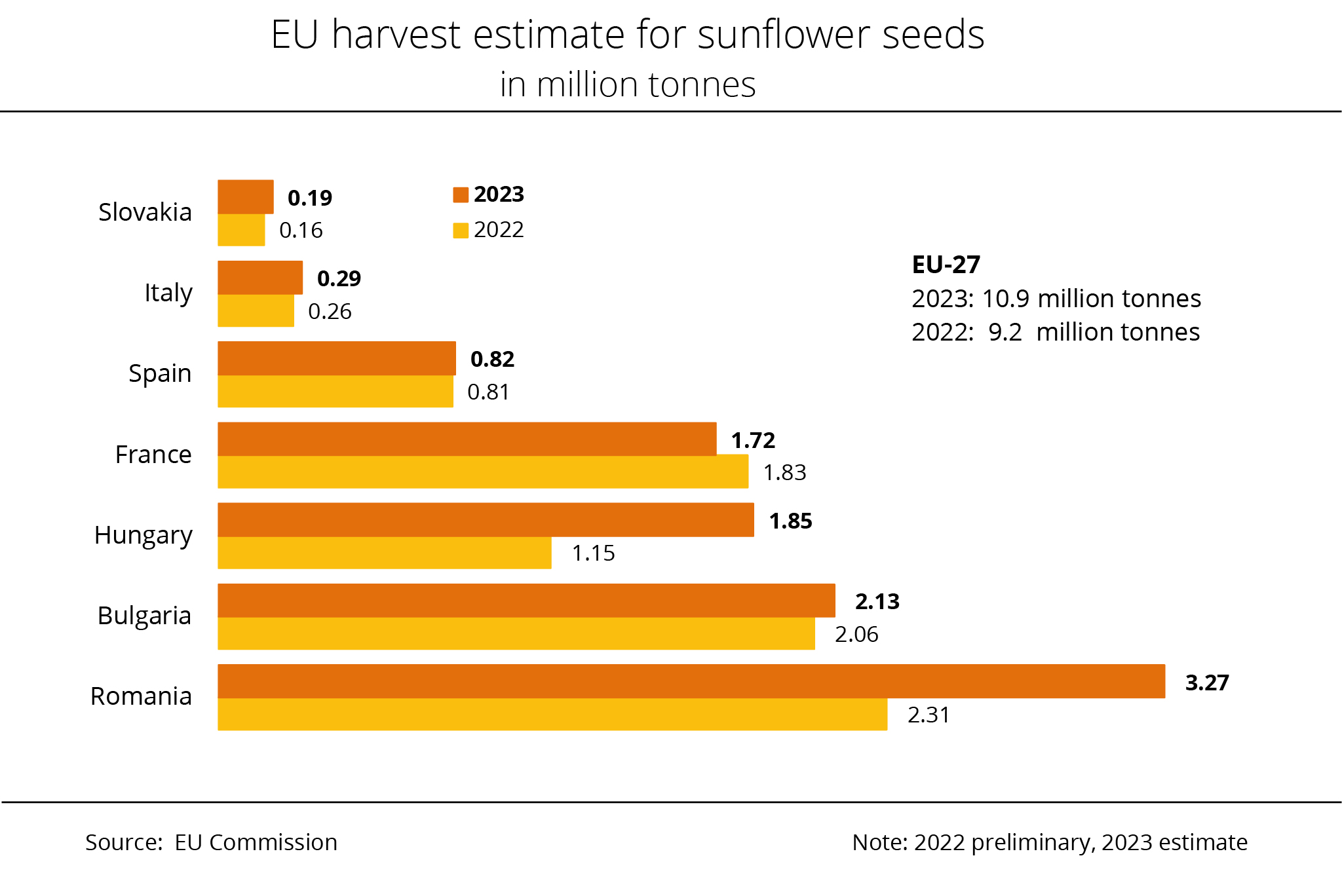

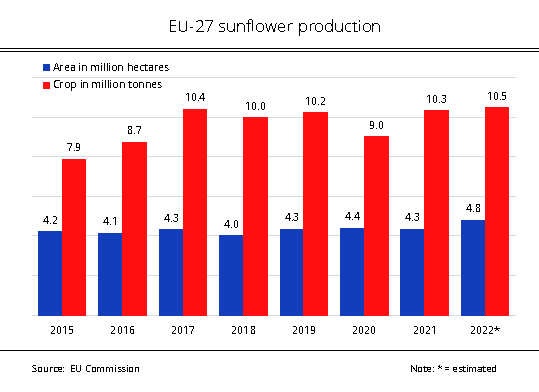

The EU Commission projects a sunflower seed harvest of 9.7 million tonnes for 2025. This would represent a 17 per cent increase on the previous year, when disappointing yields limited production.

With a projected 2.2 million tonnes and 50 per cent rise, Romania is once again expected to top the list of EU producers, followed by Bulgaria with 1.9 million tonnes (up just over 16 per cent year-on-year). France is also seen to harvest more than in 2024, with 1.8 tonnes currently projected, reflecting a rise of just over 22 per cent. Harvests in Hungary and Spain are expected to reach 1.8 million tonnes (down 1 per cent) and 862,000 tonnes (up just over 1 per cent), respectively. Italy's harvest is also projected to grow, reaching 288,000 tonnes (up around 1 per cent). For Greece, the EU Commission anticipates a significant harvest increase, projecting a 38 per cent rise year-on-year to 215,000 tonnes. Compared to the major producers of sunflower seed, Germany only plays a secondary role in the EU, with output estimated at 128,000 tonnes.

According to research by Agrarmarkt Informations-Gesellschaft (mbH), the general increase in supply of sunflower seed in the EU-27 is mainly based on expected higher yields, which are forecast to rise just over 21 per cent to, on average, approximately 21 decitonnes per hectare, as the EU sunflower area has been reduced 4 per cent to 4.6 million hectares.

Chart of the week (22 2025)

Legume area with strong increase in Germany

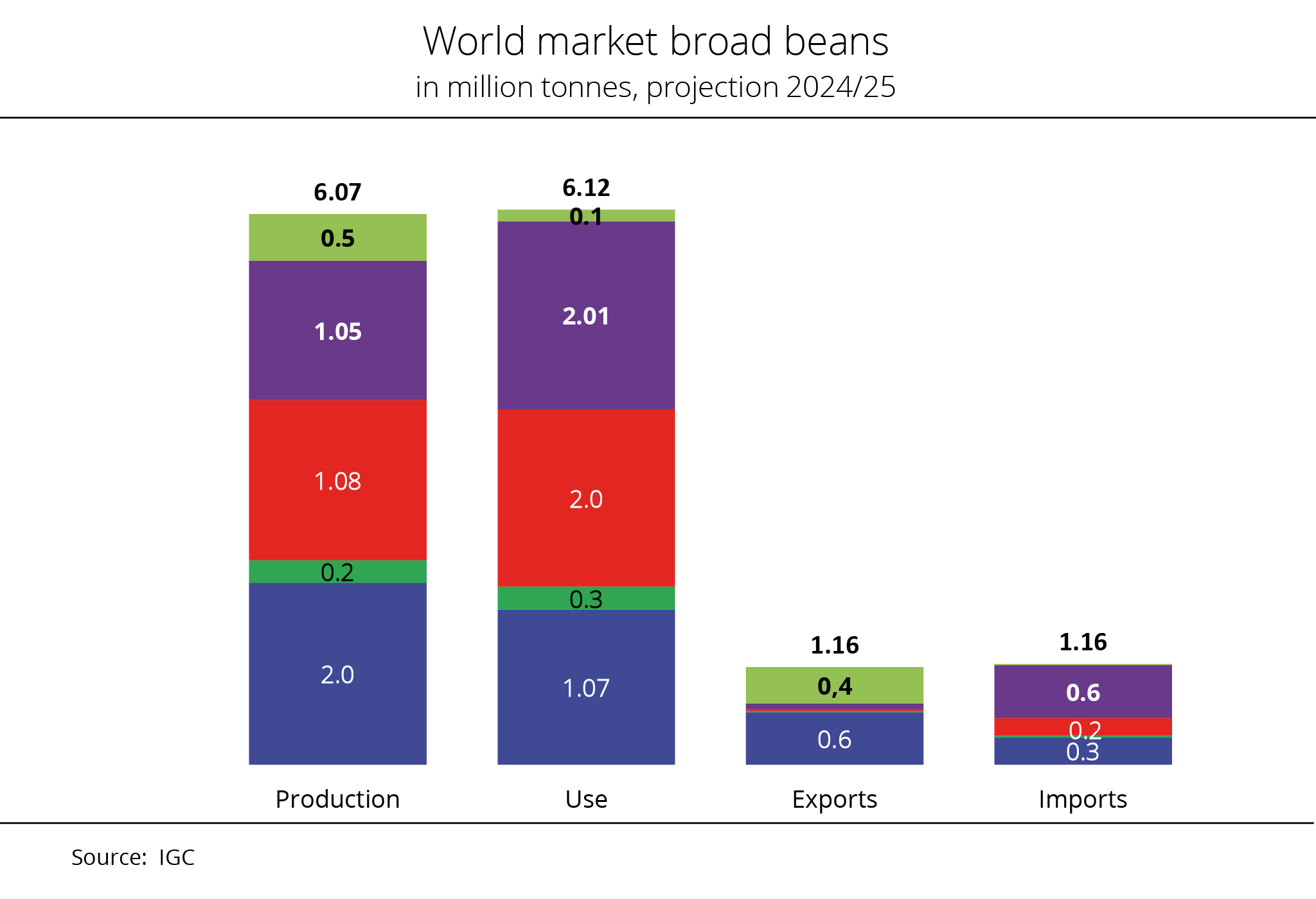

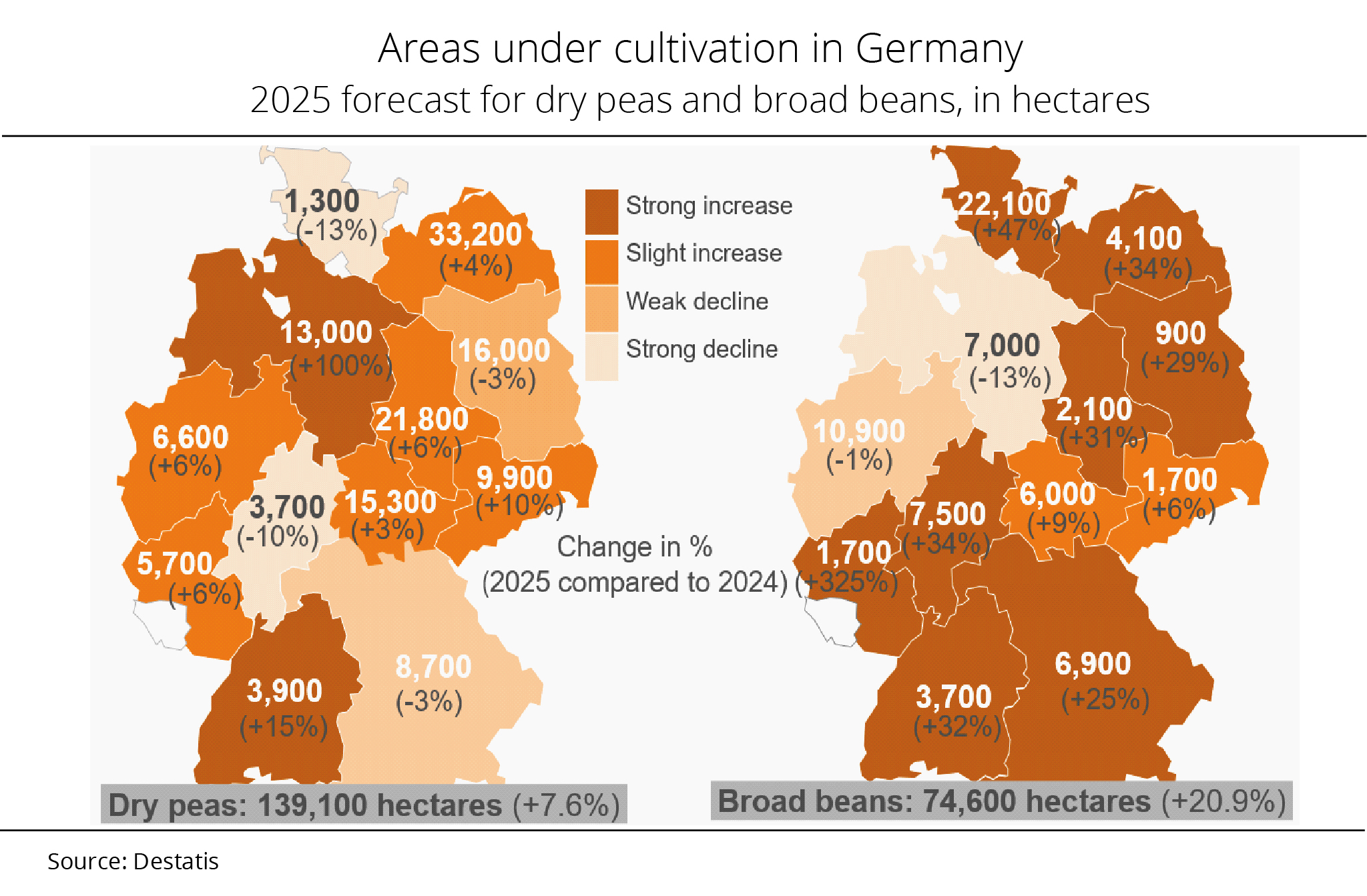

The cultivation area for pulses in Germany continues to expand, according to a recent first estimate by the German Federal Statistical Office. Dry peas and broad beans, in particular, have shown notable growth.

According to the estimate, the dry pea area for the 2025 harvest totals around 139,100 hectares, representing a 7.6 per cent increase. According to research by Agrarmarkt Informations-Gesellschaft (mbH), production is mainly concentrated in northern and eastern Germany. Mecklenburg-Western Pomerania and Lower Saxony account for an estimated 33,200 and 13,000 hectares, respectively. Saxony-Anhalt is expected to cultivate a total of 21,800 hectares, while Brandenburg and Thuringia contribute around 16,000 and 15,300 hectares. In other words, the accumulated area in these five states is seen at around 99,300 hectares, which translates to just over 71 per cent of Germany's total pea area.

The German Federal Statistical Office also anticipates a substantial expansion in broad bean area, projecting around 74,600 hectares across Germany for 2025, which is a significant 21 per cent rise compared to the previous year. The largest areas are in Schleswig-Holstein with 22,100 hectares and North Rhine-Westphalia with 10,900 hectares. Although North Rhine-Westphalia is seeing a slight downward trend in broad bean area, the state remains a key production region. Hesse and Thuringia are also reporting increases, with areas reaching 7,500 hectares and 6,000 hectares, respectively. In Baden-Wuerttemberg and Bavaria, the broad bean production area is expected to grow 32 per cent and 25 per cent, respectively. In Rhineland Palatinate, the area under broad beans is seen to triple to 1,700 hectares – a particularly dynamic growth, albeit from a relatively low level.

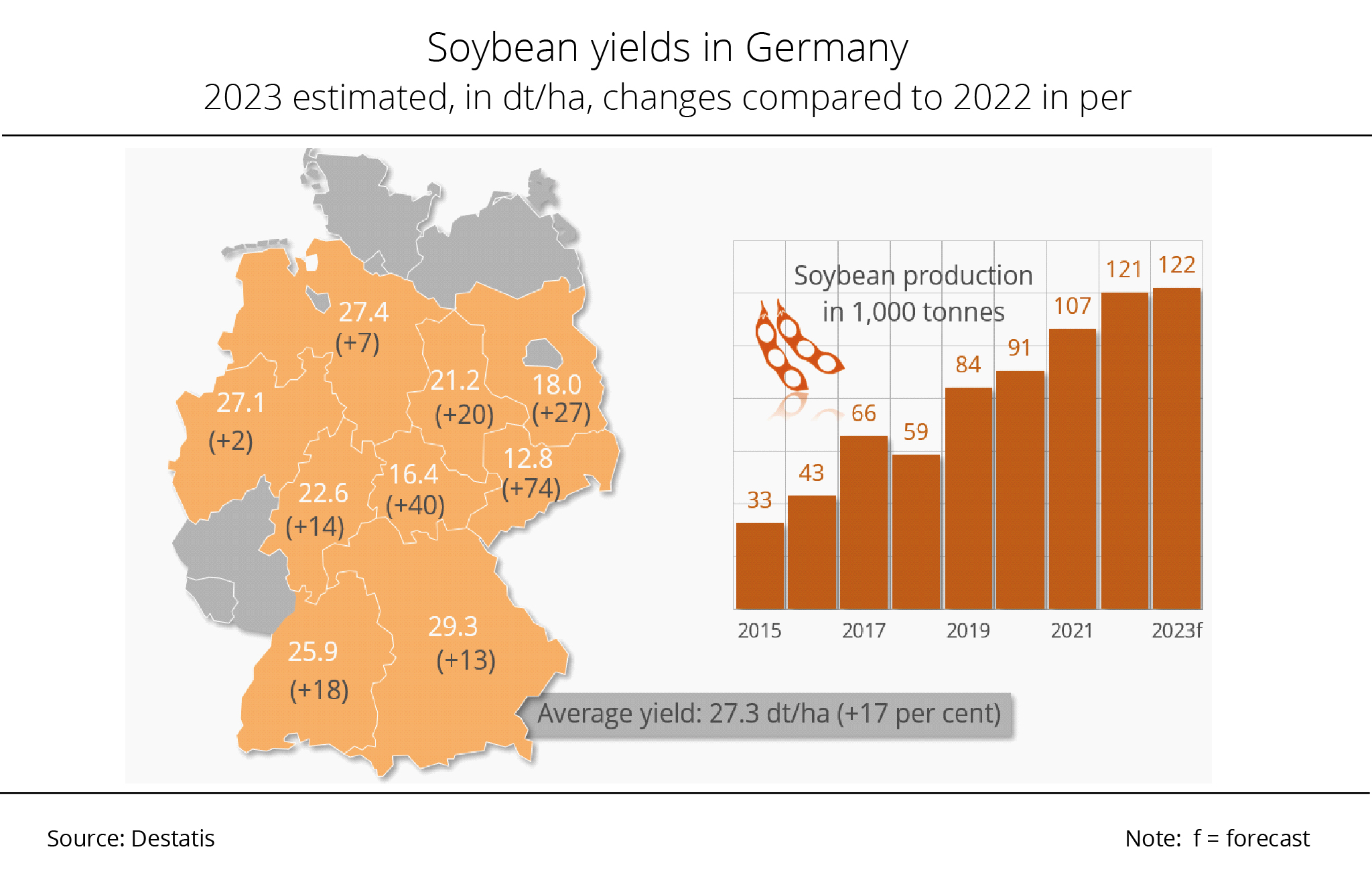

The changes in soybean cultivation are slightly more moderate. The total area for 2025 is anticipated to reach 40,900 hectares, representing a 1 per cent increase year-on-year. Production is mainly located in southern Germany, with Bavaria and Baden-Wuerttemberg reporting around 22,800 hectares and approximately 5,600 hectares, respectively. In other words, these two states account for around 69 per cent of the total soybean area in Germany. In Saxony-Anhalt and Brandenburg, soybean cultivation is anticipated to cover 3,400 hectares and 2,100 hectares of land, respectively.

Chart of the week (21 2025)

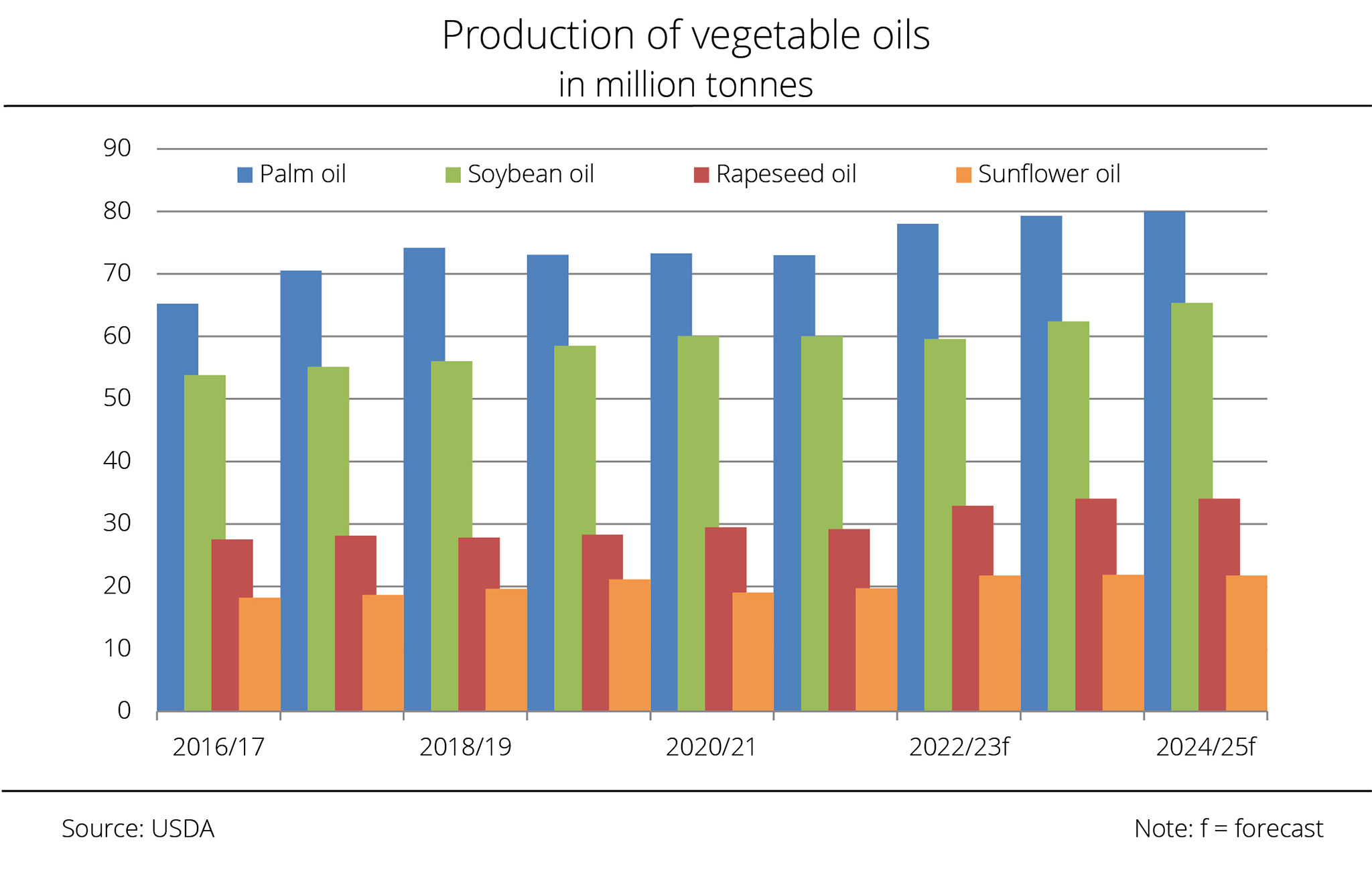

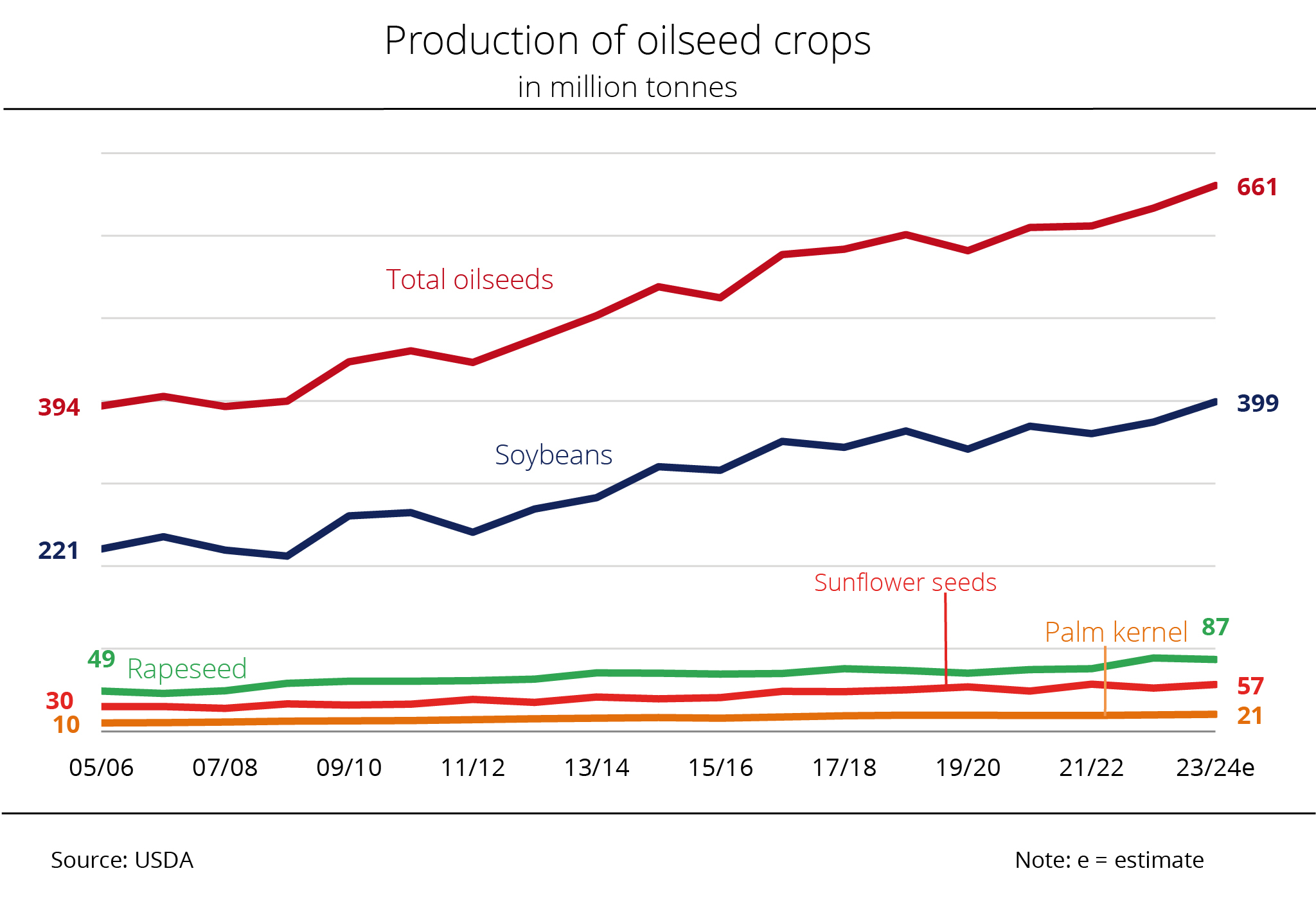

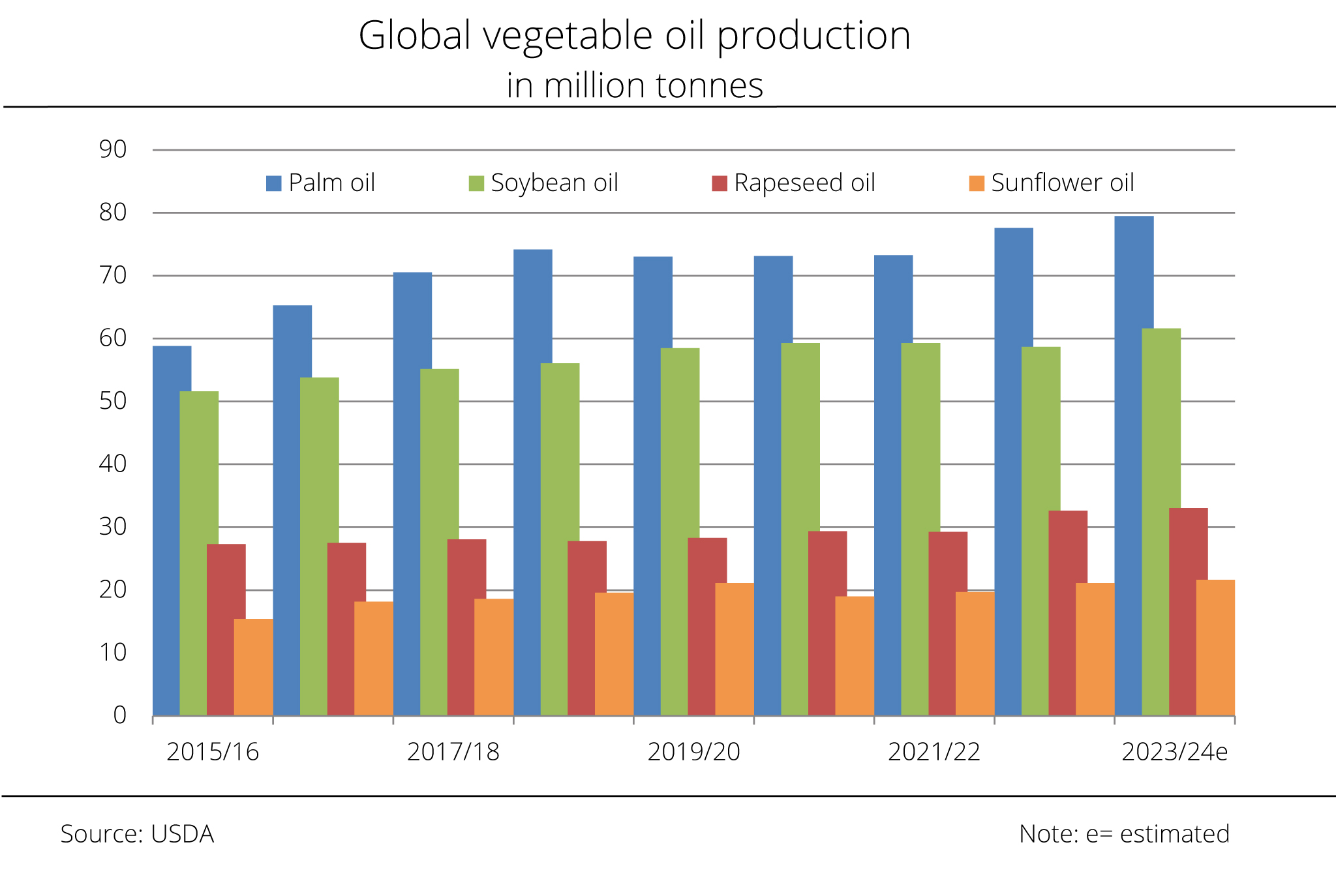

Global 2025/26 vegetable oil production set to hit record levels

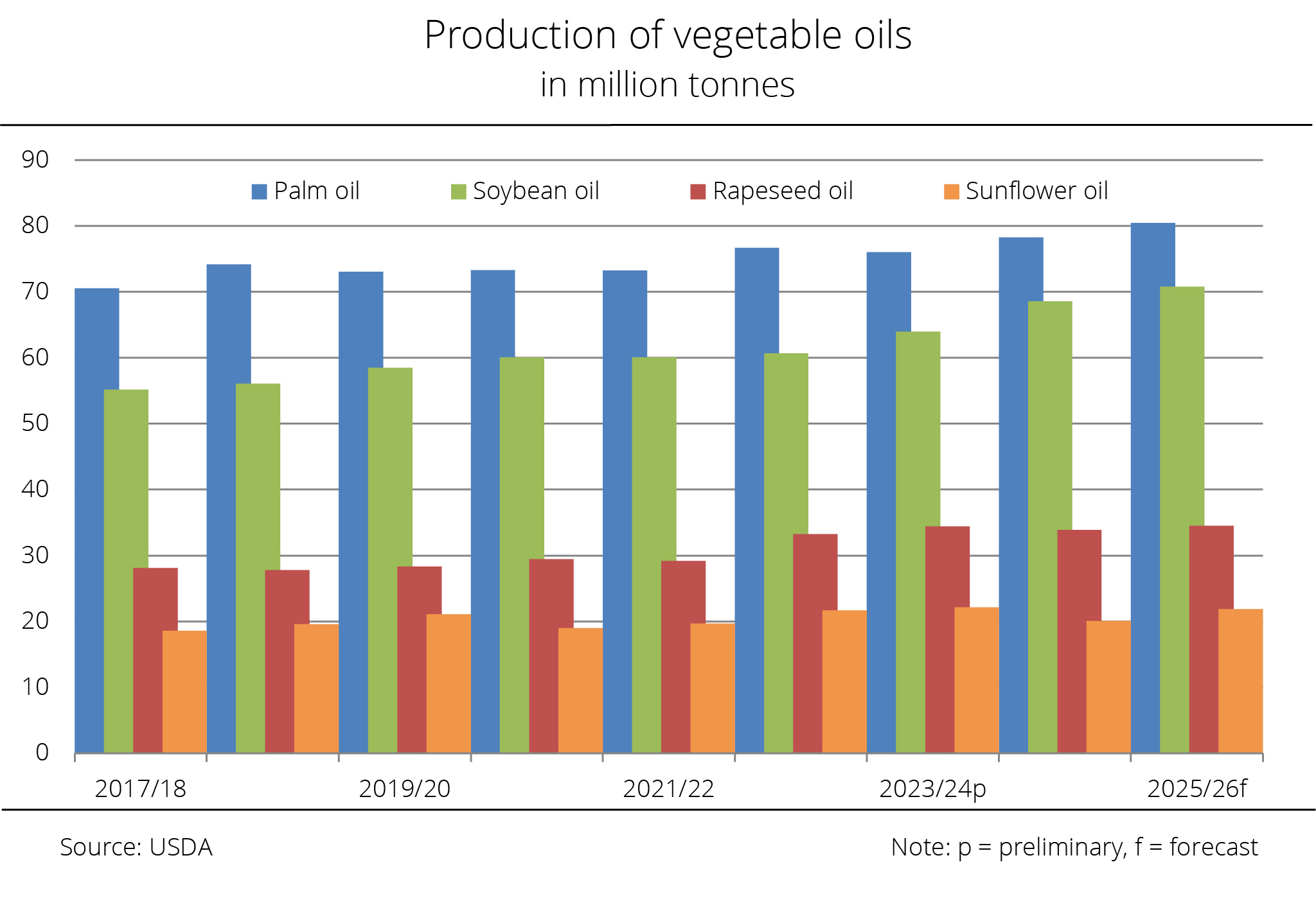

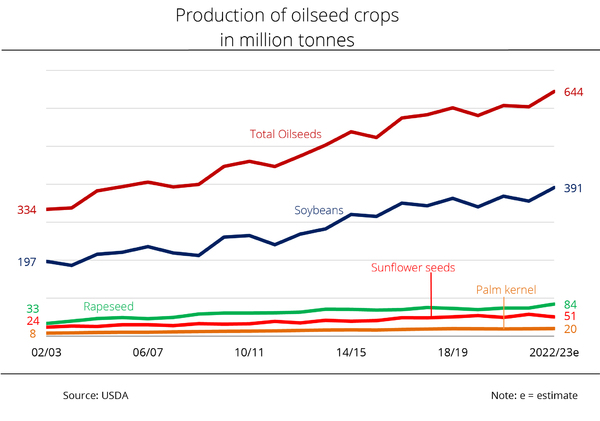

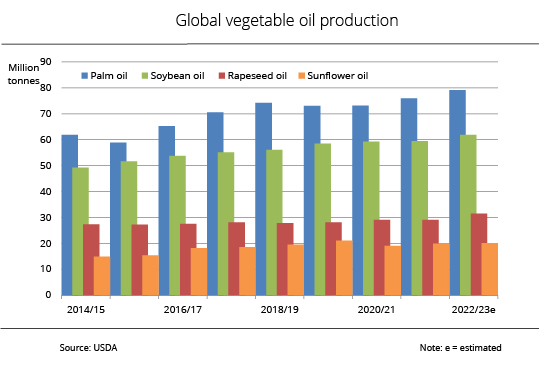

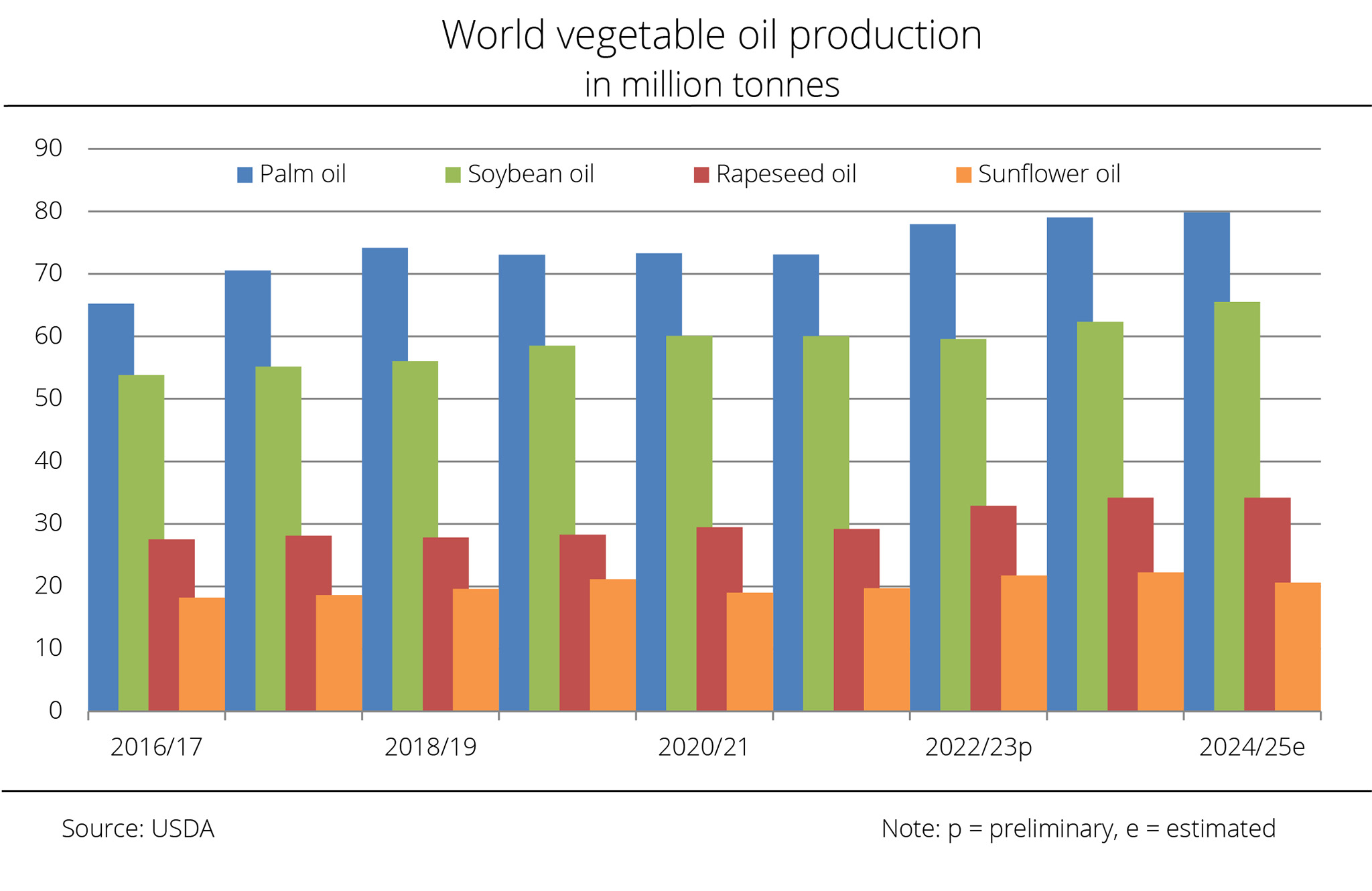

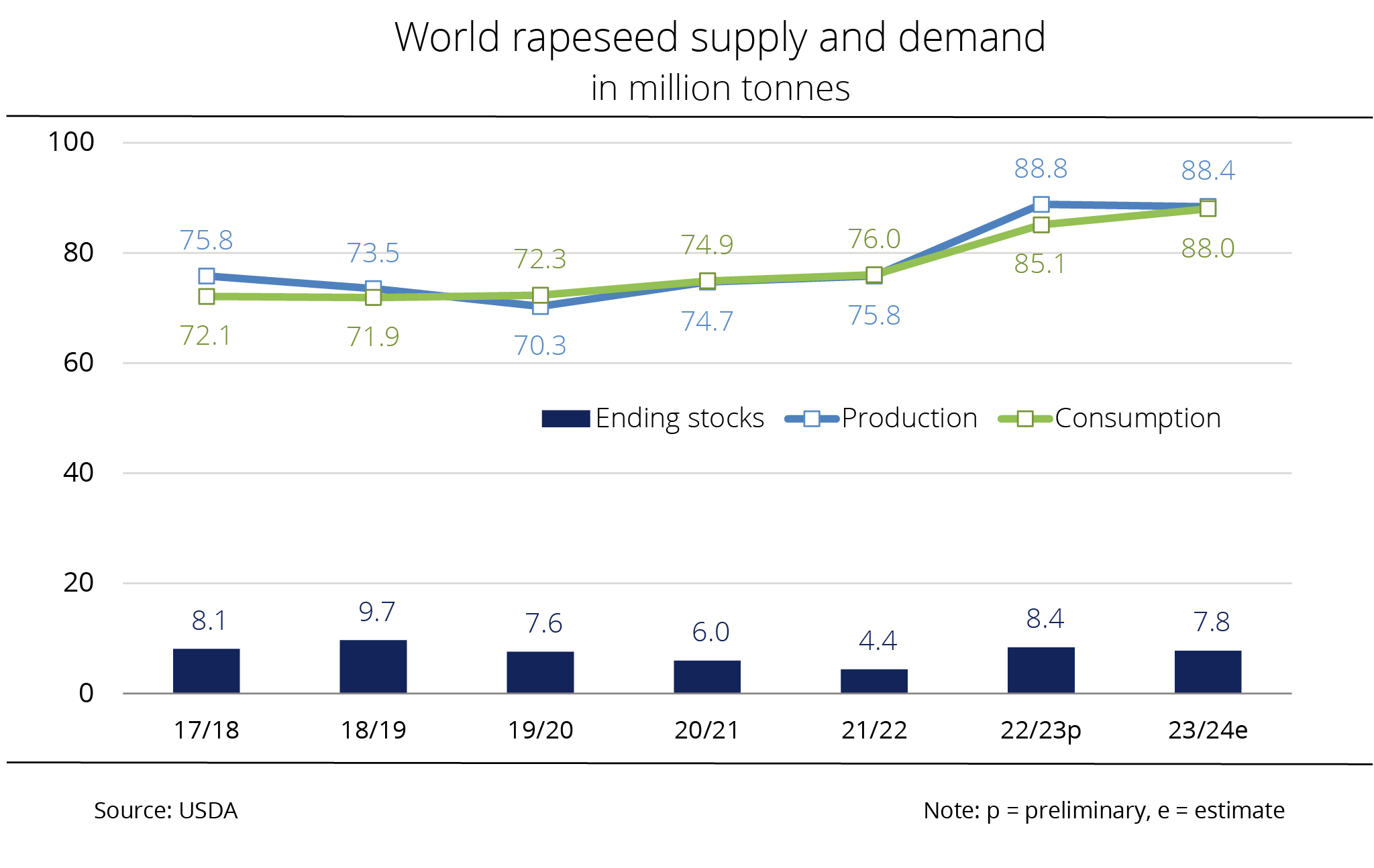

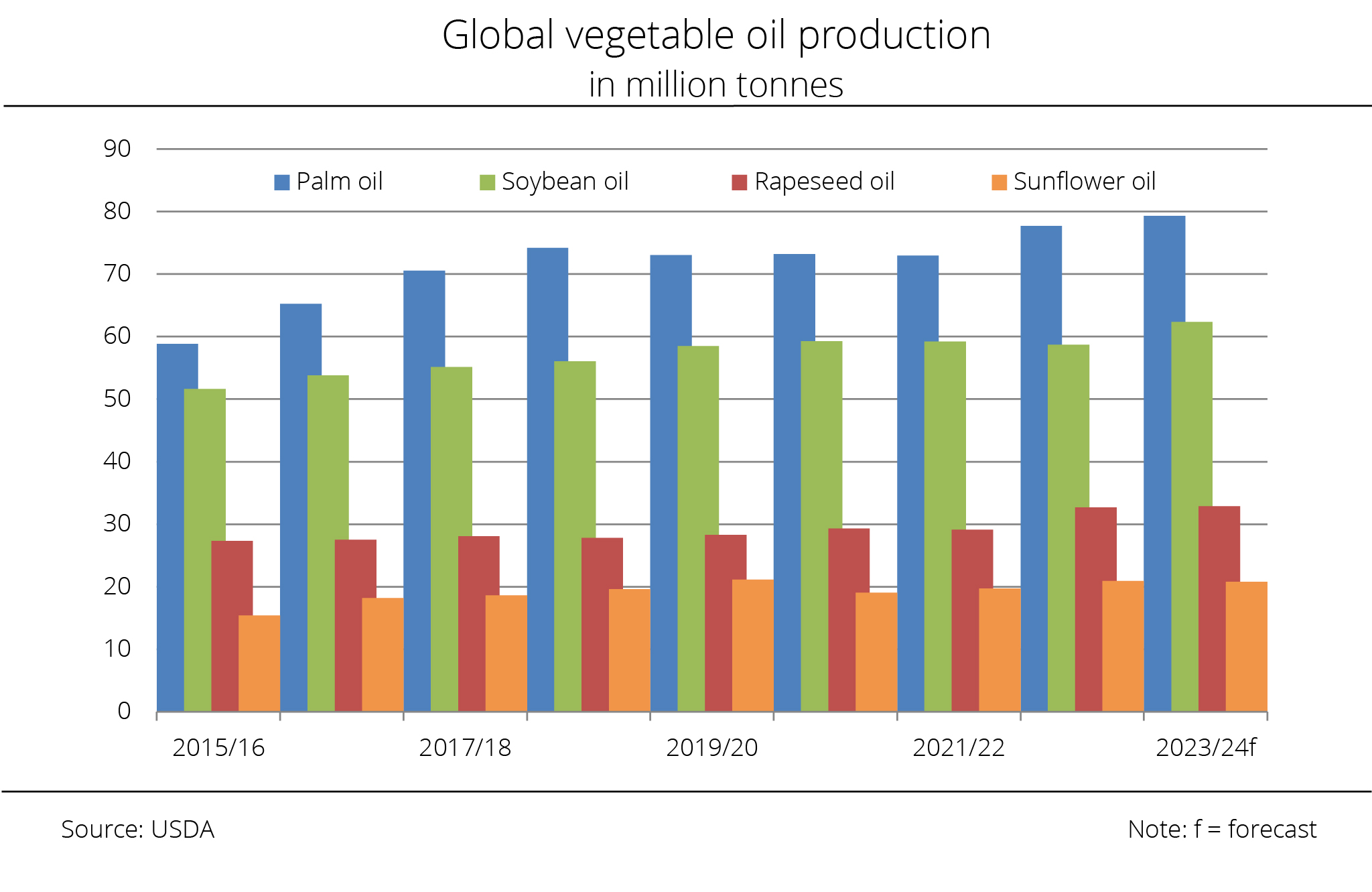

According to the latest outlook published by the US Department of Agriculture (USDA), global production of vegetable oils in 2025/26 is expected to reach 234.5 million tonnes. This would represent a 6.7 million tonnes rise compared to 2024/25. In other words, production could fully cover the projected demand of 228.9 million tonnes.

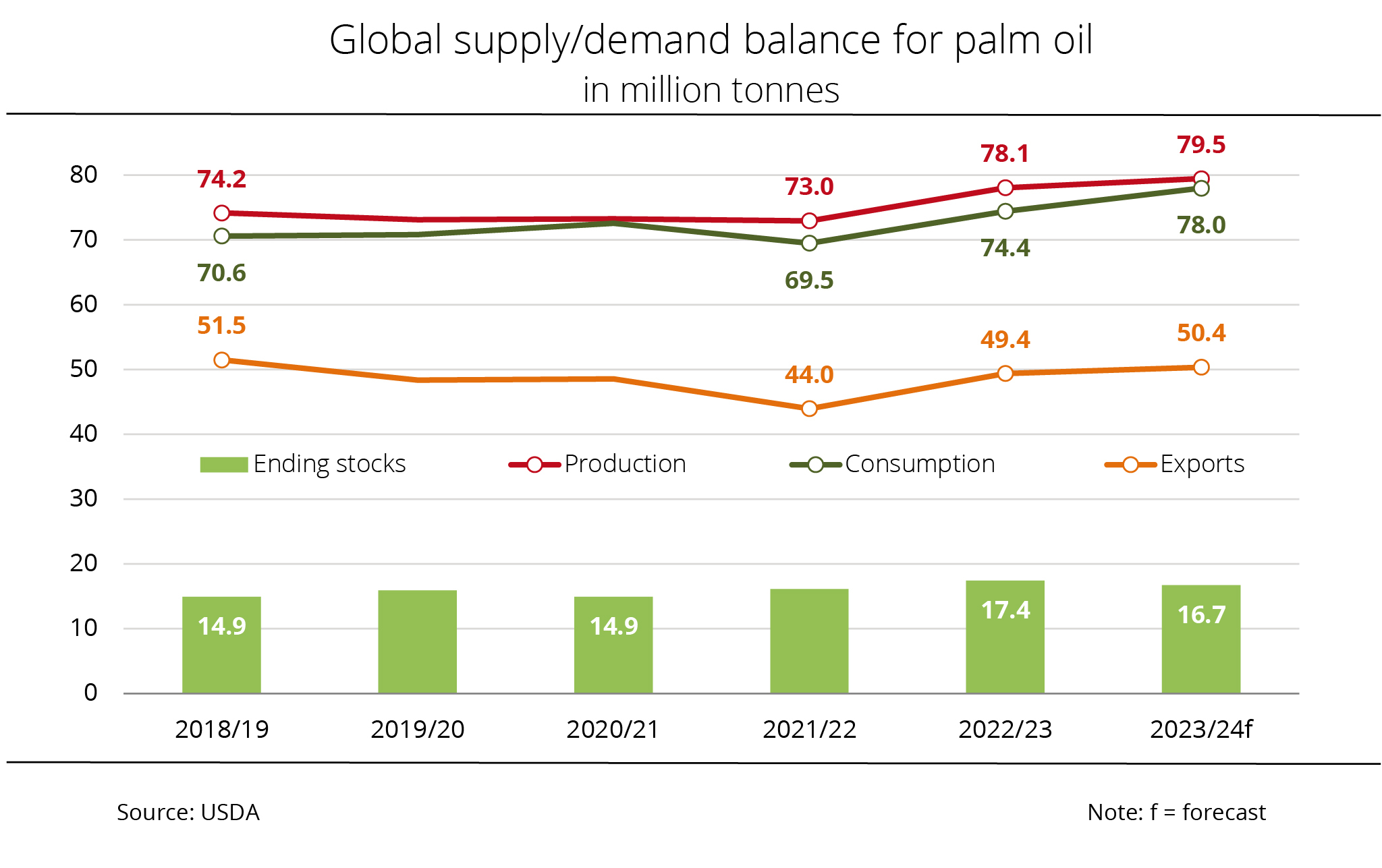

According to research by Agrarmarkt Informations-Gesellschaft (mbH), palm oil is set to remain the world's most important vegetable oil in terms of production and consumption, with global output estimated at a record 80.4 million tonnes. This translates to a 2.2 million tonne increase over 2024/25. Indonesia remains the largest producer with an output of 47.5 million tonnes, followed by Malaysia with 19.2 million tonnes and Thailand with just under 3.4 million tonnes.

Soybean oil production is expected to grow just under 2.2 million tonnes to 70.8 million tonnes in the coming crop year, potentially setting a new record. China, by far the largest importer of soybeans, remains the main producer of soybean oil with 20.5 million tonnes, followed by the US with just over 13.3 million tonnes. Production of rapeseed oil is projected to rise 617,000 tonnes to a total of 34.5 million tonnes in 2025/26. Sunflower seed oil output is seen to grow around 1.8 million tonnes to 21.9 million tonnes, primarily due to higher production in Ukraine and the EU-27.

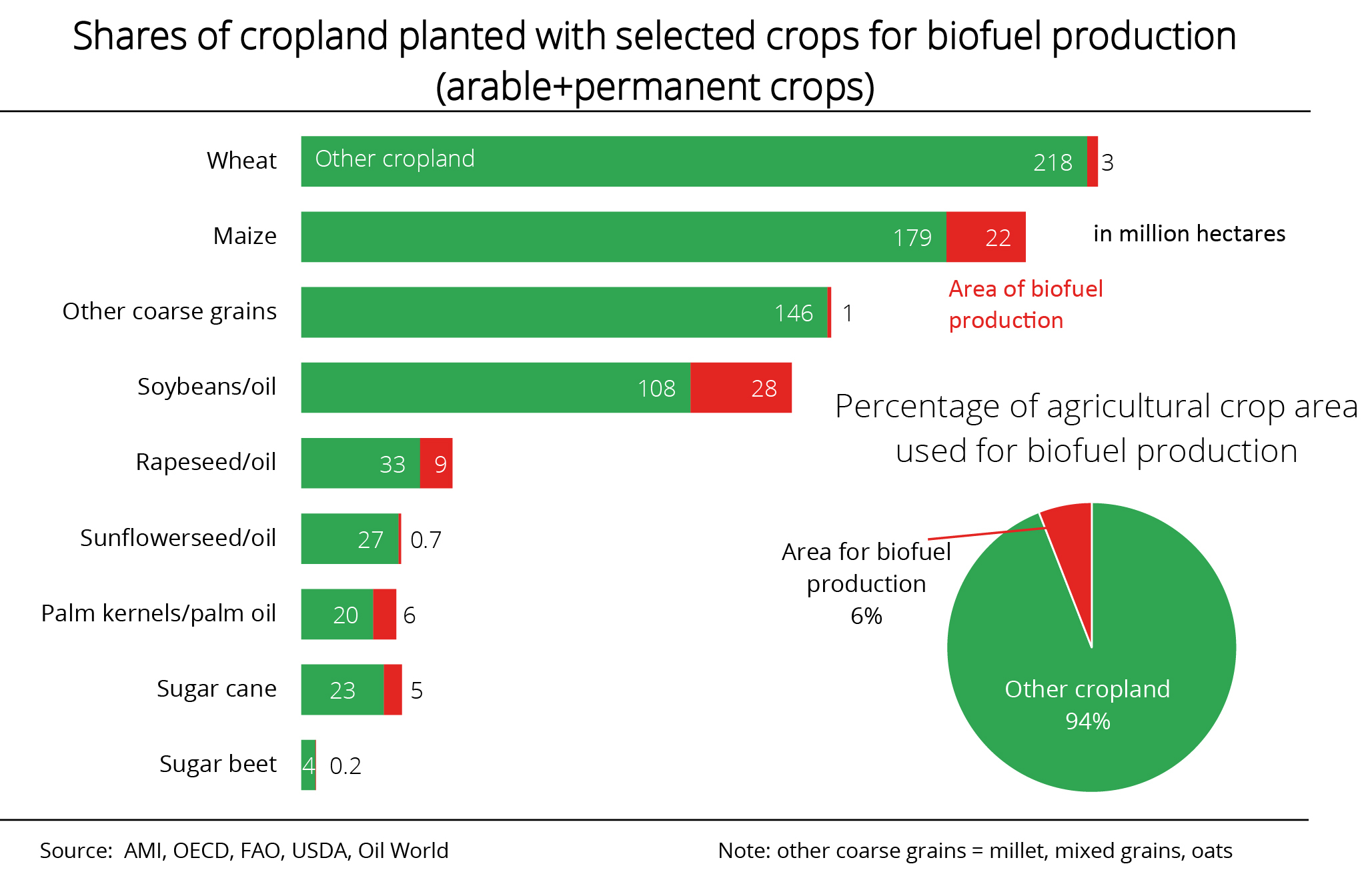

Amid the ongoing critical debate on the eligibility of biofuels derived from waste oils, the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has renewed its criticism of the double counting of so-called advanced biofuels from defined waste categories. The UFOP argues that the term is misleading, because the Renewable Energy Directive (RED II) allows double counting only if feedstocks are processed using innovative technology, a requirement also stipulated by the Delegated Directive EU 2024/1405. The association has called on Federal Environment Minister Schneider to put an end to what it describes as an incentive to commit fraud by categorically excluding the eligibility of POME-based biofuels in the forthcoming revision of the Federal Immission Control Ordinance (BImSchG). Market research shows that POME (Palm Oil Mill Effluent) is in fact "produced" rather than exclusively obtained as a by-product.

The UFOP argues that on the assumption that 5 per cent to 10 per cent of global vegetable oil production could be collected as waste oils, the volume of waste oils would amount to between 11.7 and 23.4 million tonnes globally. However, the association urges that this globally available volume be properly categorised within a redesigned subsidy framework for both national and European fuel markets, reasoning that competition for waste oils – from sectors such as shipping and aviation – is set to increase not only within the EU but worldwide.

The legal cap on the share of biofuels derived from waste oils under Part B of ANNEX IX of RED II to 1.7 per cent and 1.9 per cent in Germany already reflects the political will to impose necessary limits. The UFOP has emphasised that, after all, waste oils are also derived from "cultivated biomass, including from palm oil plantations". The fact that this cap does not apply to waste oils listed in Part A represents a flaw in policy design. According to the association, in combination with double counting, this increases incentives for fraud at the expense of the entire biofuel supply chain, including agriculture. The UFOP has therefore called for this regulatory loophole to be closed. The association has emphasised the need for a technology- and feedstock-neutral approach to all greenhouse gas reduction options in the transport sector to ensure that the 2030 climate protection targets remain achievable.

Chart of the week (20 2025)

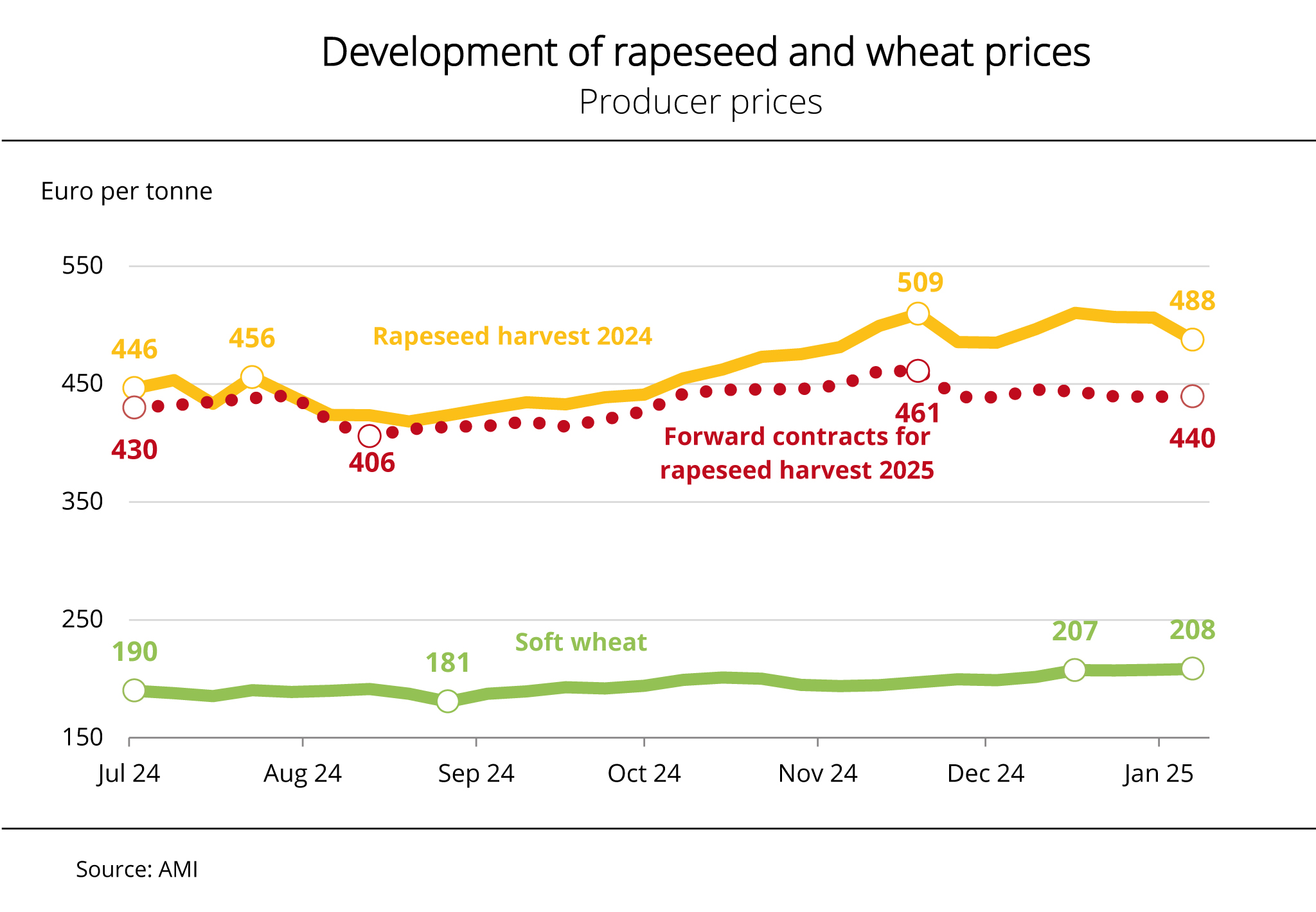

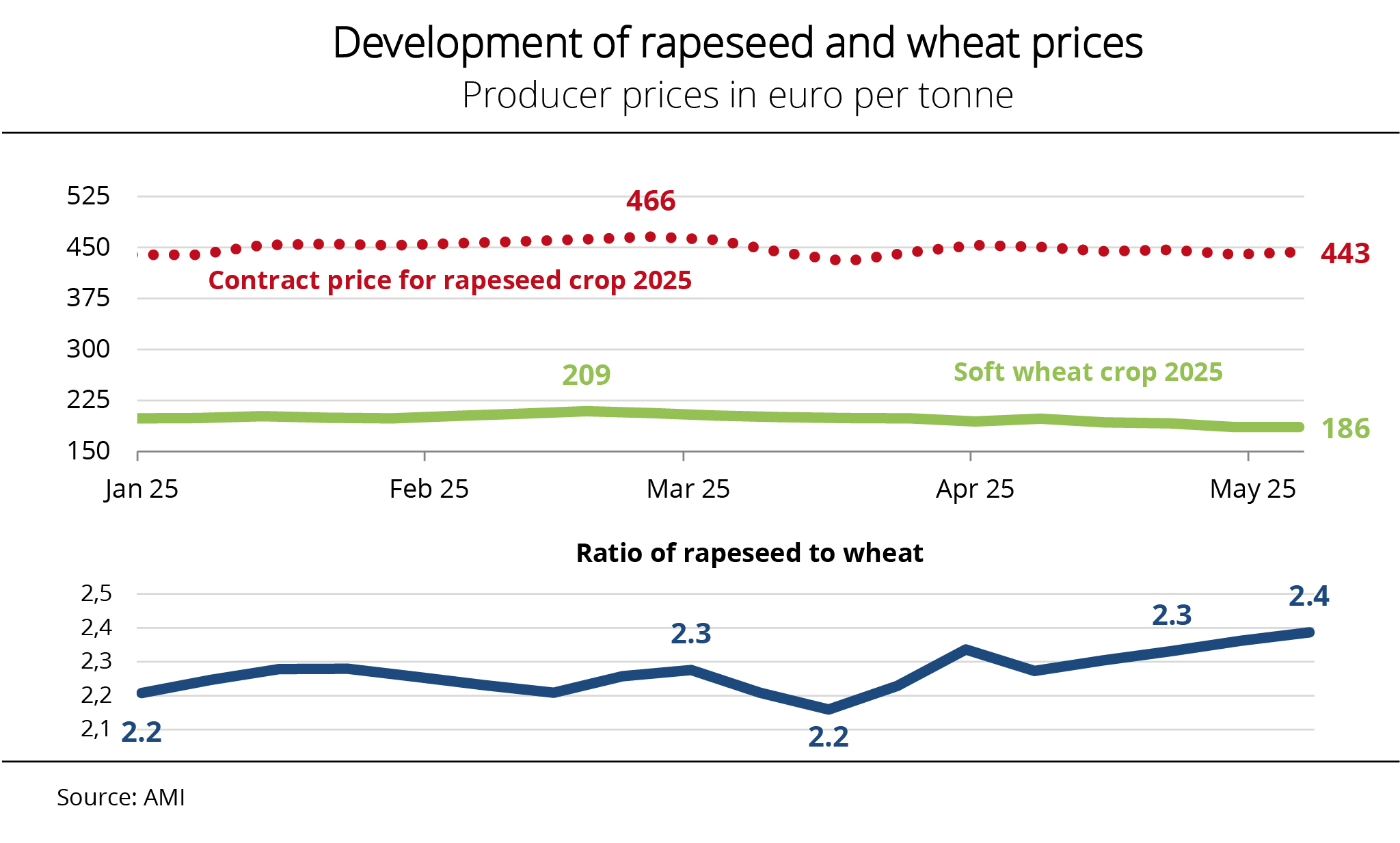

2025 sowings – rapeseed remains economically attractive

The price gap between forward contract prices for soft wheat and rapeseed from the 2025 crop has recently widened to a ratio of 1 to 2.4, making rapeseed production for the 2026 harvest even more appealing.

In early May 2025, rapeseed growers in Germany received an average of EUR 443 per tonne ex farm for forward contracts from the 2025 crop, more than twice the price buyers paid for one tonne of soft wheat. This compares to EUR 441 per tonne in early May 2024. Price stimuli were temporarily provided by the futures market.

Canadian stocks were in decline due to rising exports, tightening supply and influencing prices in Paris. Rapeseed prices also benefited from the weakening euro which enhances the competitive position of European commodity on the global market. Meanwhile, weather conditions in Ukraine raised concerns as April was marked by dryness and frost. These conditions could reduce yield potential for the 2025 harvest and further tighten supply. Additional rainfall is also needed in Germany to realise the full yield potential of rapeseed crops. If the lack of rain continues, prices could rise noticeably in the coming weeks, offering farmers further incentive to sow winter rapeseed in 2025.

Producer prices for soft wheat from the 2025 crop decreased over the past weeks. At EUR 186 per tonne, they were around EUR 22 per tonnes lower than at the same time in 2024. Given the unattractive prices, current activities have focused on clearing warehouses and fulfilling forward contracts on the domestic market, with minimal attention to new business.

Chart of the week (19 2025)

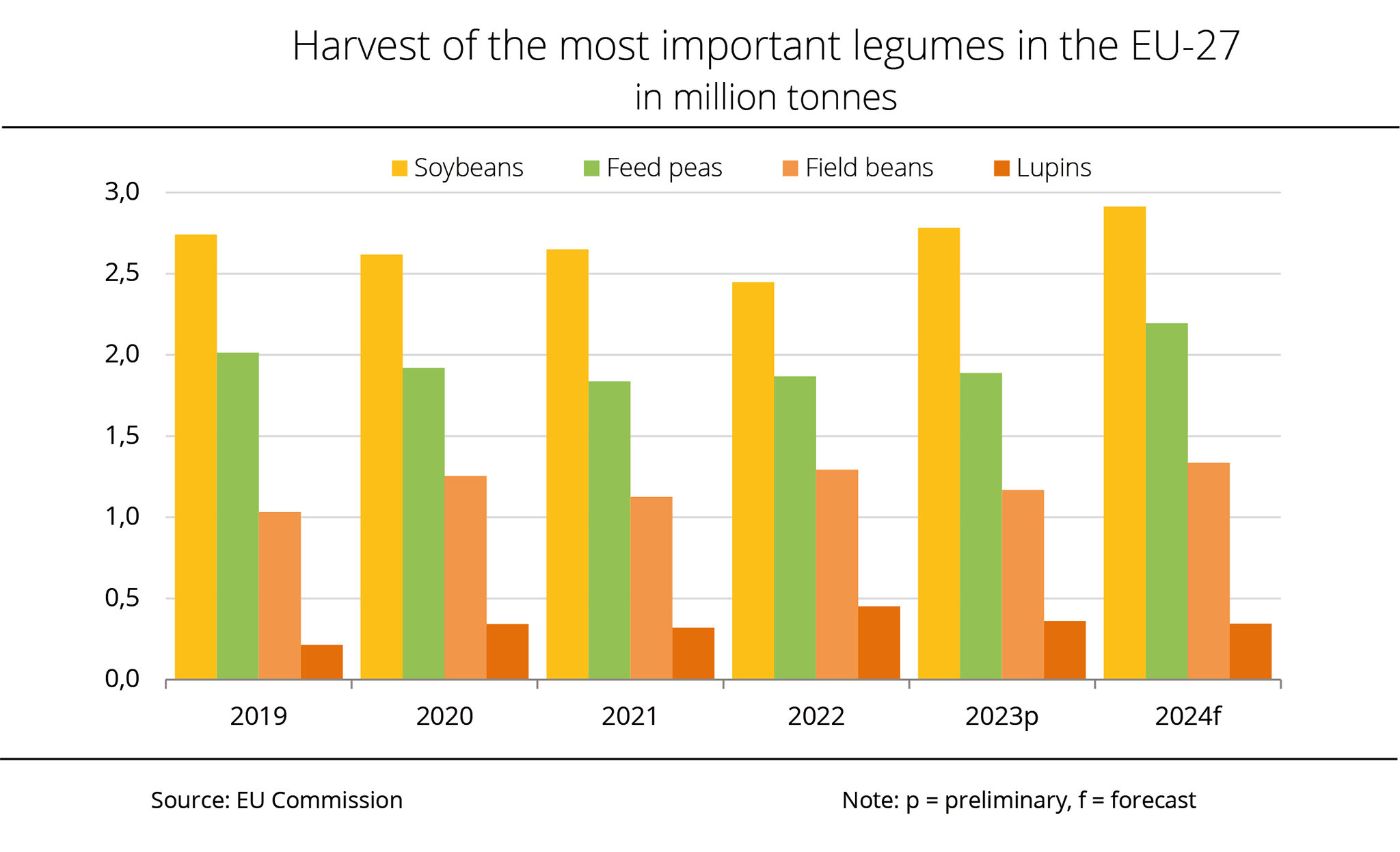

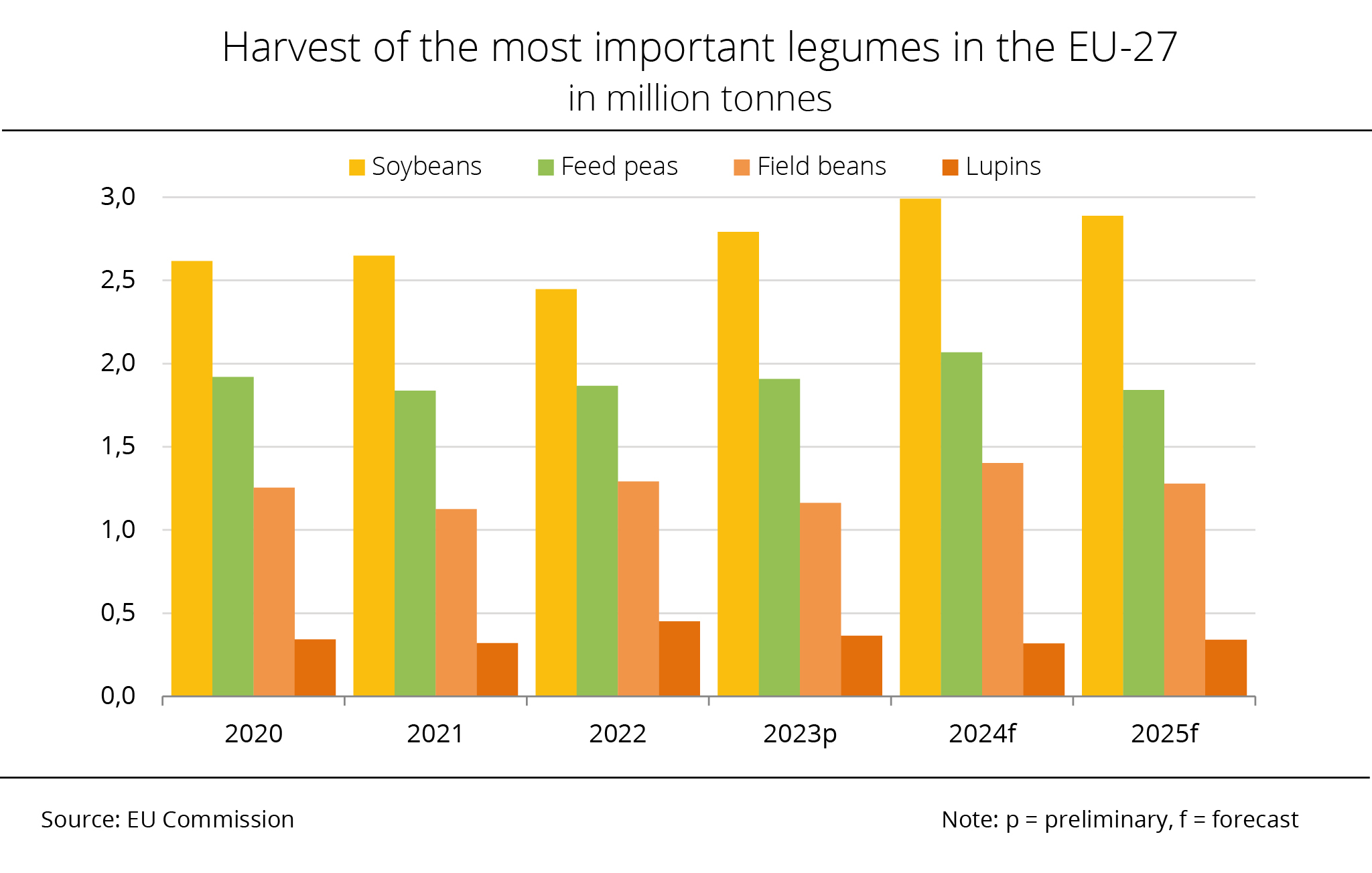

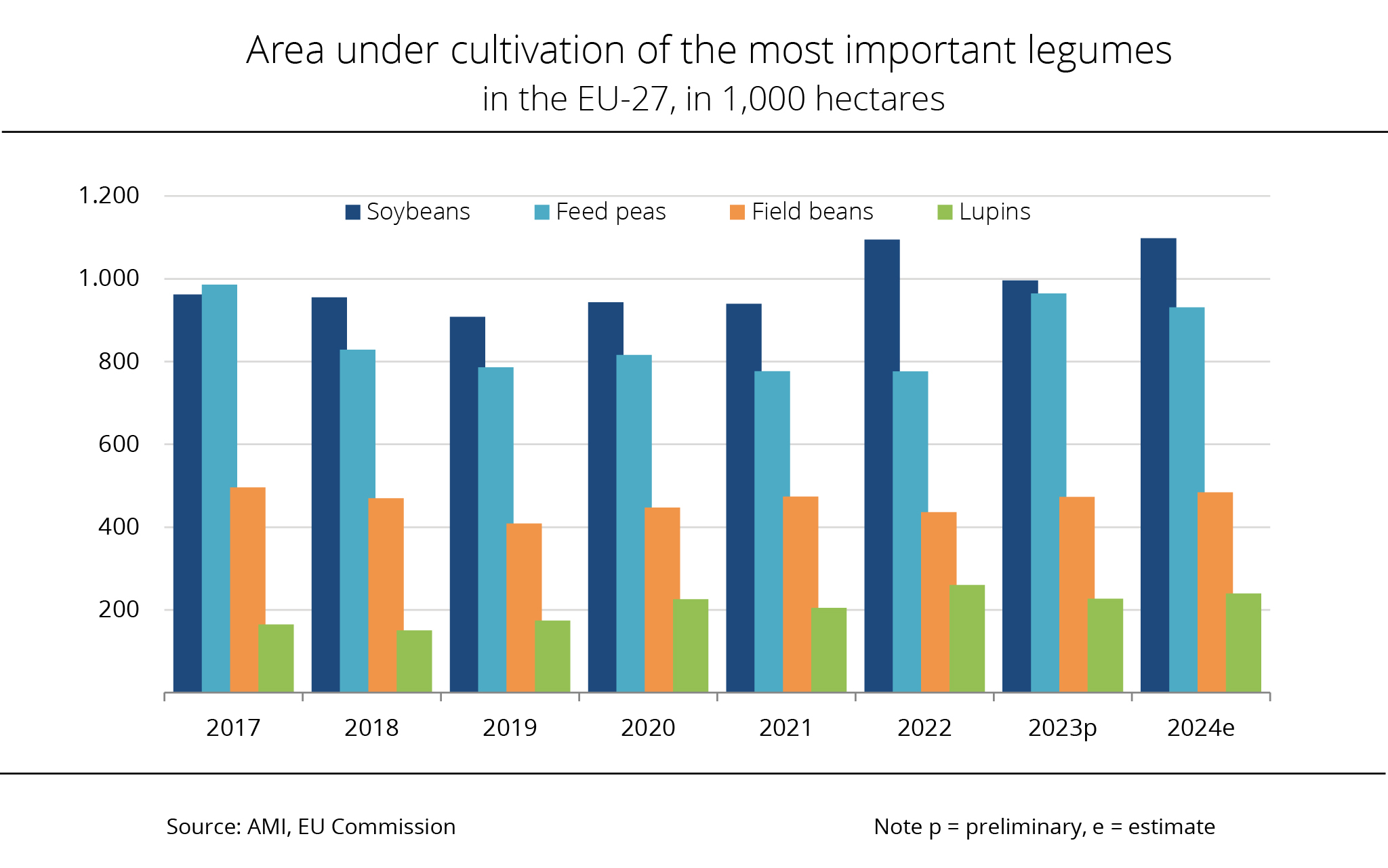

EU Commission expects reduced cultivation of legumes

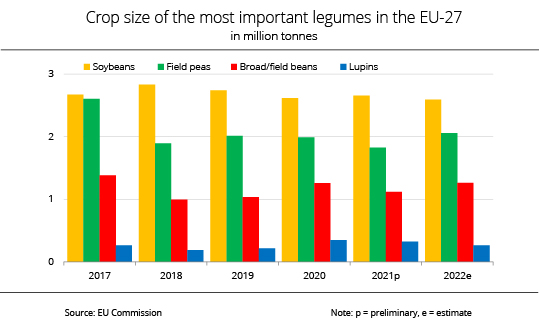

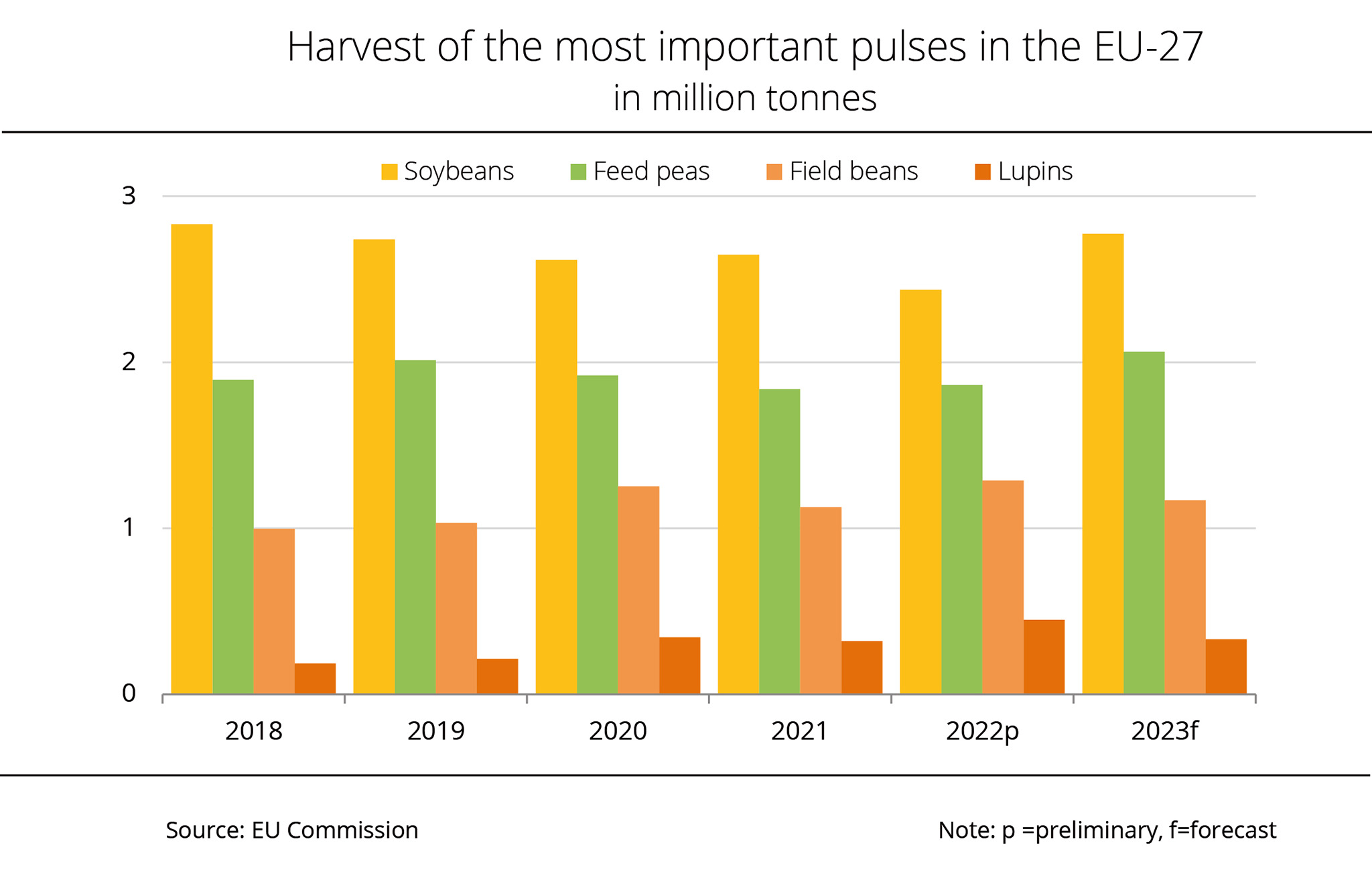

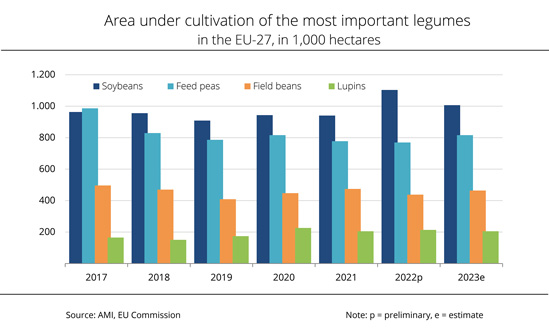

According to estimates by the EU Commission, EU production of legumes for the 2025 harvest will fall 6 per cent short of the previous year's outcome. The harvest will nevertheless be higher than average. Dry peas are seen to record the strongest decline.

In its estimate published at the end of April, the EU Commission expects the legume harvest in the EU to reach just over 6.3 million tonnes in 2025. This would translate to a 6 per cent decline year-on-year. The harvest would also fall just short of the 6.9 million tonne bumper harvest recorded in 2017 (EU-28). According to Agrarmarkt Informations-Gesellschaft (mbH), the drop is mainly due to an almost 19 per cent reduction in area planted. Yields have so far been projected at 22.7 decitonnes per hectare, up from 20.7 decitonnes per hectare the previous year.

Above all, the harvest of feed peas will presumably drop 11 per cent compared to the previous year, reaching 1.8 million tonnes. At just less than 2.9 million tonnes and accounting for 45 per cent of the total legume crop, soybean remains the most important legume in the EU. The harvest is seen to be 3 per cent smaller than the previous year due to the reduction in soybean area. The area of field beans also decreased. The EU Commission estimates EU output at 1.3 million tonnes, representing an around 9 per cent decline compared to the previous year. Sweet lupins are the only crop expected to exceed the previous year's harvest of 318,000 tonnes, with output rising to 341,000 tonnes.

The Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP) has appealed to the new German government to continue promoting domestic protein crops sustainably in the future. In the interests of a sustainable economy, the market should pull the production area. The projects funded by the German Ministry of Agriculture, such as the joint project "LeguNet", are leading the way to a network of market players from crop breeding, production and consultancy through to product development and marketing innovative ideas. The result should be added value that benefits all members in the supply chain and is the basis for business continuity. However, the association has criticised that the benefits this type of crop provides for biodiversity and climate change mitigation are not properly and appropriately priced in. According to the UFOP, government funding should close this gap by providing financing that accompanies the development process.

Chart of the week (18 2025)

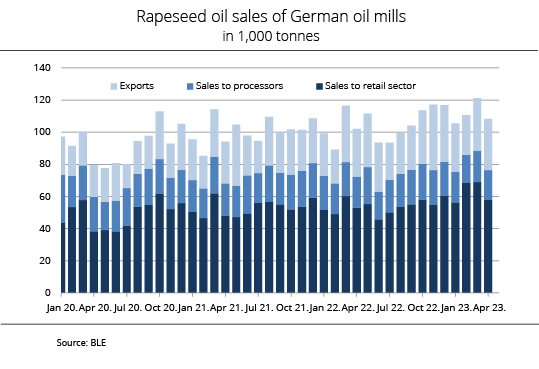

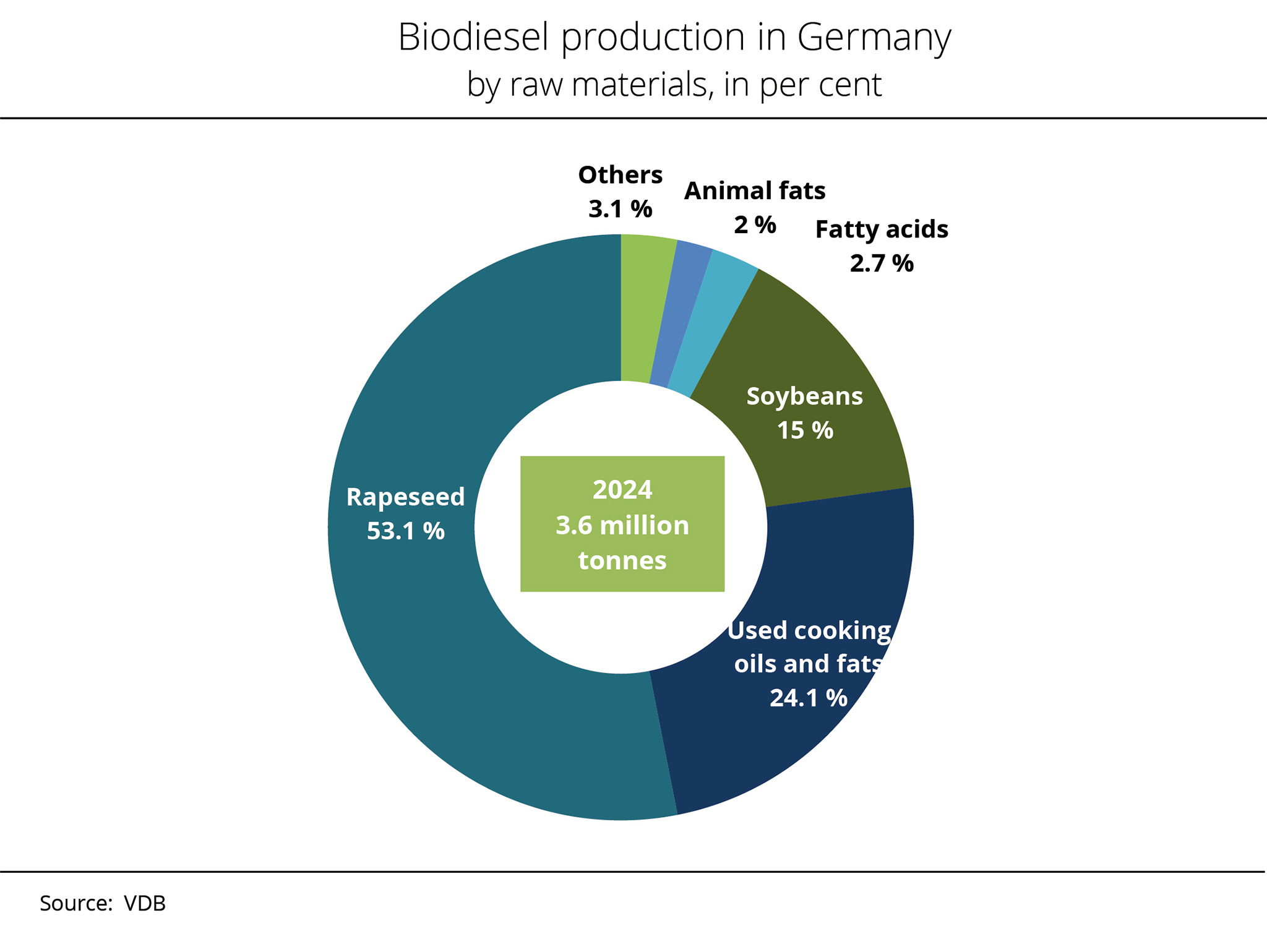

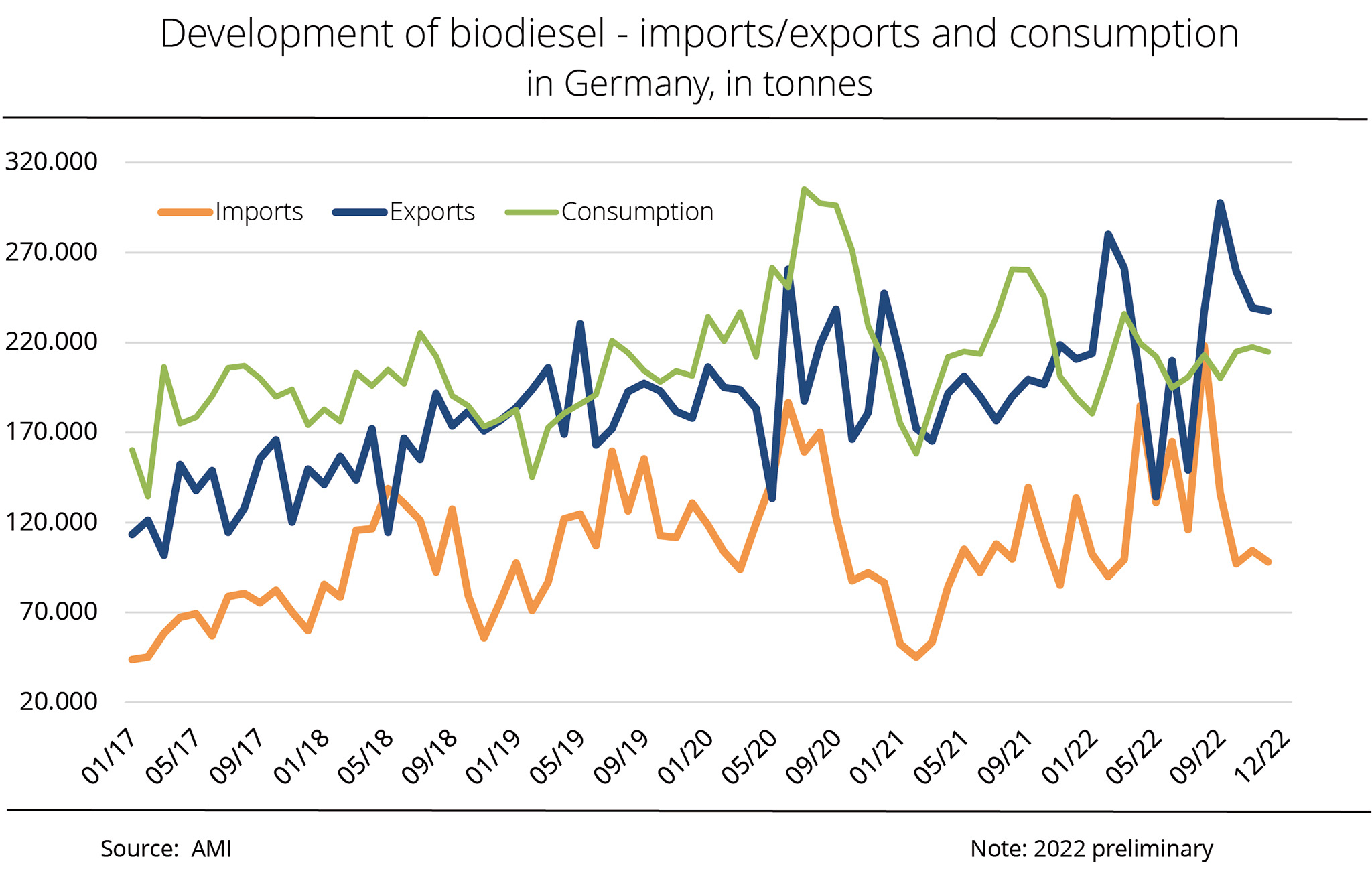

Rapeseed remains the dominant feedstock in biodiesel production

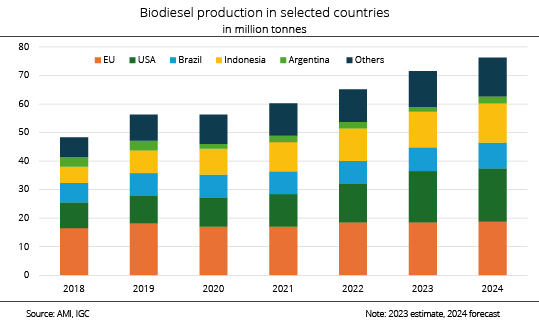

Germany is the largest producer of biodiesel in Europe. According to the latest data from the Verband der Deutschen Biokraftstoffindustrie (VDB, Association of the German Biofuels Industry), total biodiesel production in Germany reached around 3.6 million tonnes in the calendar year 2024, representing year-on-year increase of 100,000 tonnes.

More than half of this production was based on rapeseed as a feedstock, with rapeseed oil-based biodiesel accounting for around 53.1 per cent of total output in 2024. Used cooking oils and fats ranked second, accounting for 24.1 per cent, followed by soybean oil at 15.0 per cent. Animal fats, which have only counted as feedstock in German biofuel production since 2021, made up 2 per cent of production. In contrast, palm oil is no longer used in German biodiesel production and fuel applications, because biodiesel and HVO made from this tropical oil have not been credited towards meeting greenhouse gas reduction targets since 2023.

The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has stated that approximately 1.45 million tonnes of rapeseed oil were processed into biodiesel in Germany in 2024, adding that this volume is roughly equivalent to the year's rapeseed harvest. This means that the German biodiesel industry is the primary market for domestically grown rapeseed. Accordingly, demand for rapeseed oil to produce fuel also yields approximately 2.2 million tonnes of rapeseed meal, which is currently by far the most important GM-free protein source in dairy cattle feeding. This value chain is a perfect example of an integrated bioeconomy with market potential, because in future rapeseed oil and methyl ester respectively may play a greater role in the so-called molecular transformation within the chemical industry. The UFOP has urged that this transformation be reflected and funded under the national and EU bioeconomy strategies, emphasising that the corresponding harvest is basically also available to the food market as a "reserve" at any time.

Chart of the week (17 2025)

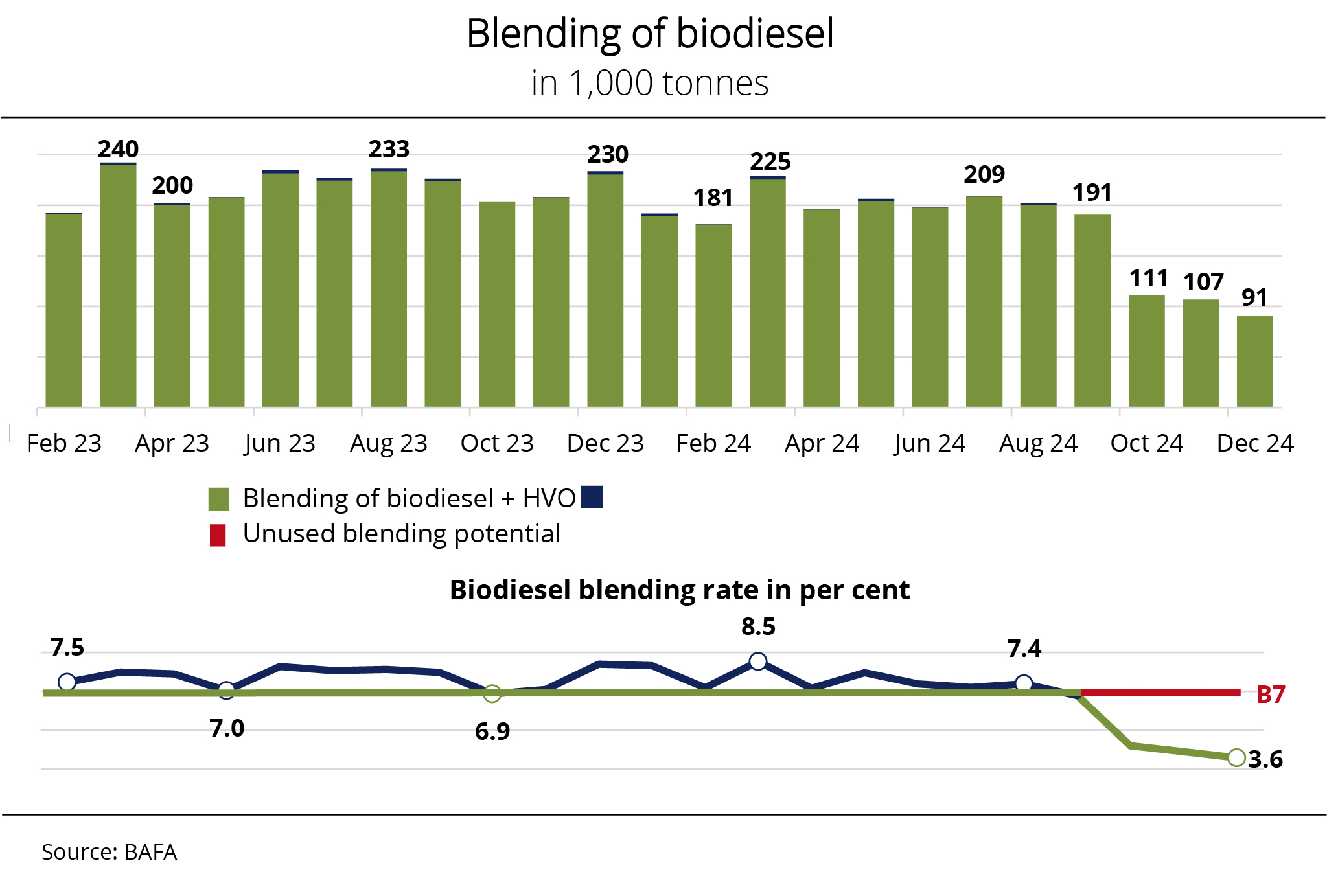

HVO flexibly buffers biofuel demand

Hydrotreated vegetable oil (HVO) is used to meet greenhouse gas reduction obligations, although the cap of 7 per cent by volume in fossil diesel fuel is insufficient to fulfill the requirements. The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has highlighted this issue and renewed its call on the Federal Ministry of Economics and the Federal Office of Economics and Export Control (BAFA) to include HVO shares in future official statistics to enhance transparency.

The association has underlined its position by pointing to the expansion of European HVO production capacity to approximately 5 million tonnes and the larger number of fuel traders and importers.

With the introduction of the sustainable aviation fuel (SAF) mandate introduced in 2025, demand for HVO is expected to rise further, potentially leading to additional price increases for HVO – even in the fuel market.

Chart of the week (16 2025)

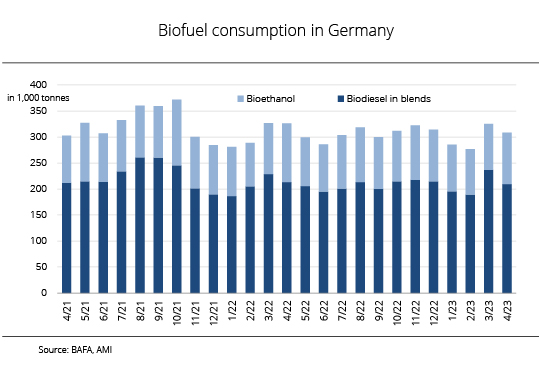

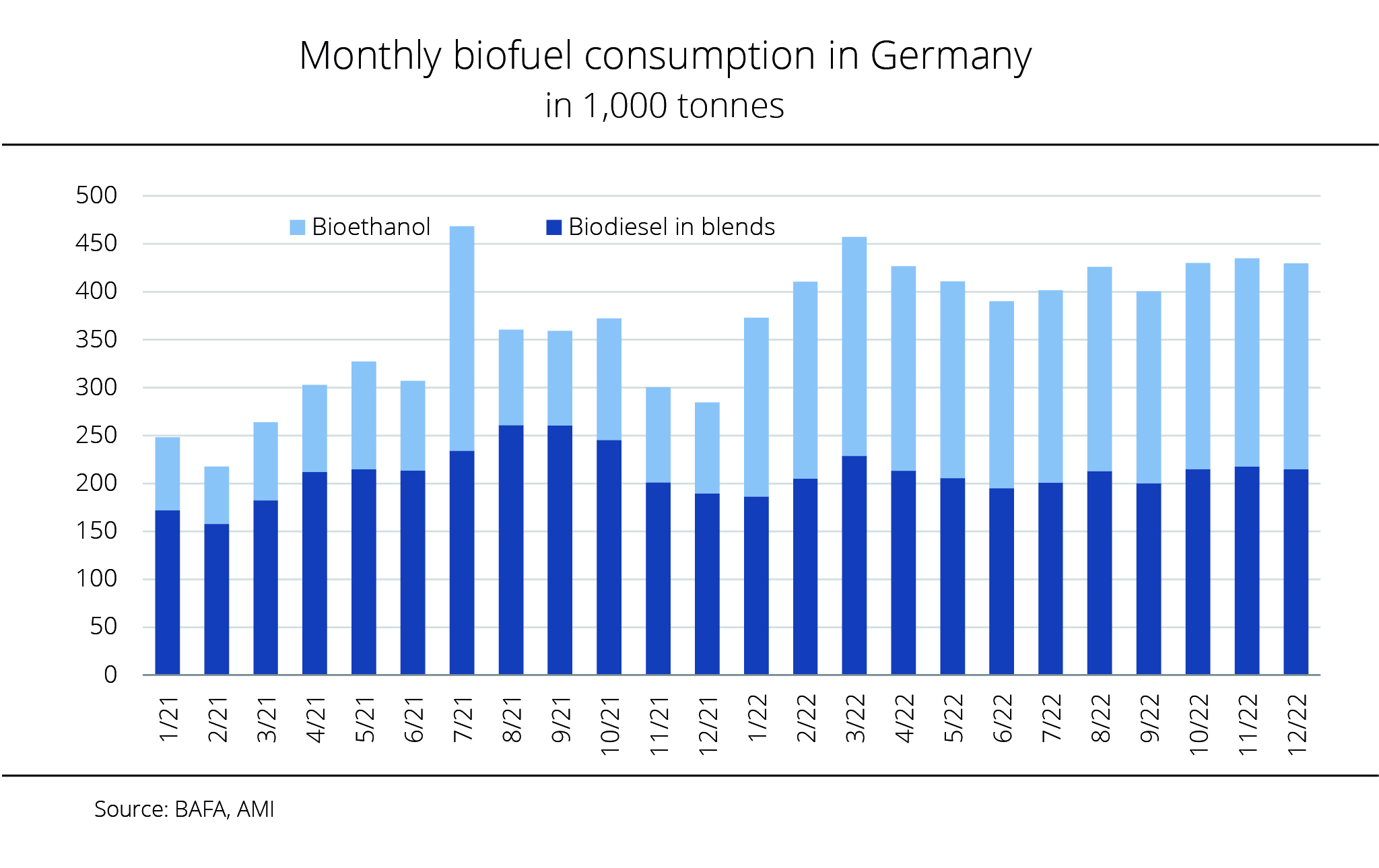

For the first time, less biodiesel used in blends than bioethanol

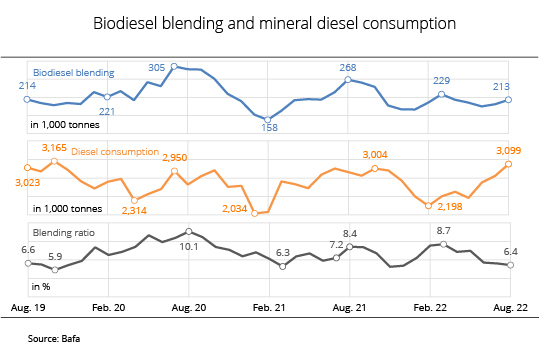

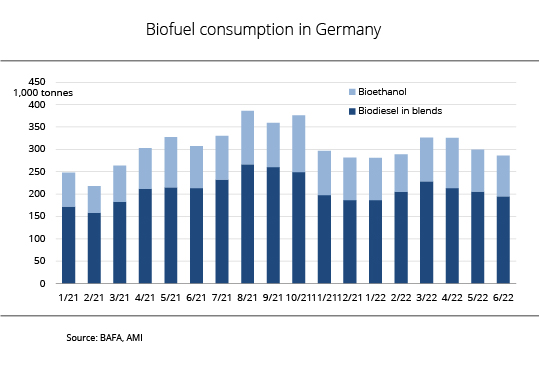

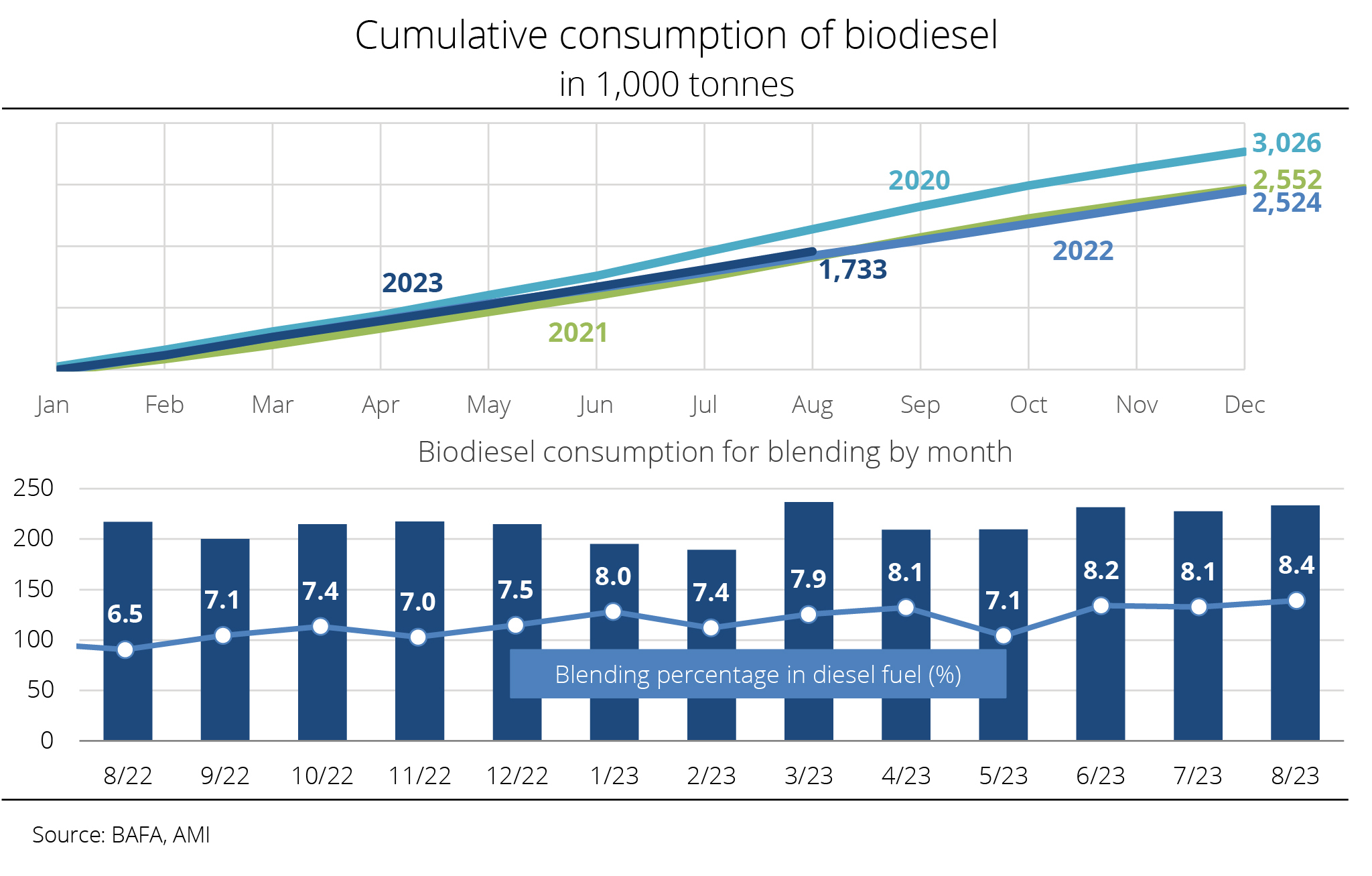

Biodiesel consumption for blending purposes has declined steadily since July 2024. In the second half-year, usage fell to an alltime low.

In December 2024, biodiesel use for blending to meet greenhouse gas reduction targets dropped to a historic low of 90,800 tonnes. This compares to approximately 107,000 tonnes in November. According to the Federal Office for Economic Affairs and Export Control (BAFA), combined consumption of biodiesel and hydrotreated vegetable oil (HVO) declined to around 2.1 million tonnes in 2024, a decrease of 20.6 per cent compared to the previous year. The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has called on the new German government to abolish the double counting of biofuels derived from certain waste oils and fats listed in Annex IX Part A of the Renewable Energy Directive (RED II). UFOP has urged that this change be made as soon as possible as part of the upcoming amendment to the Federal Immission Control Act (BImSchG).

Chart of the week (15 2025)

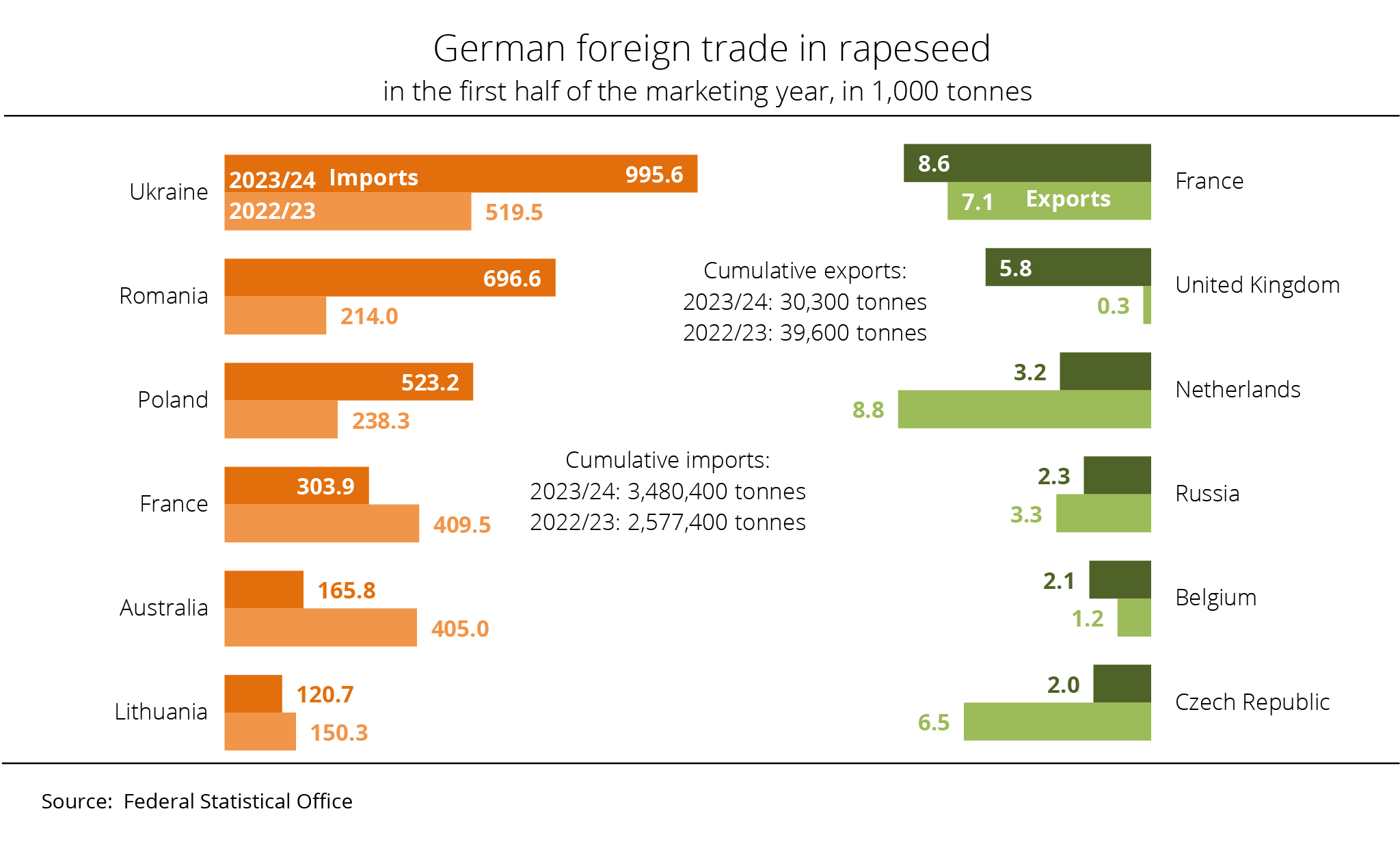

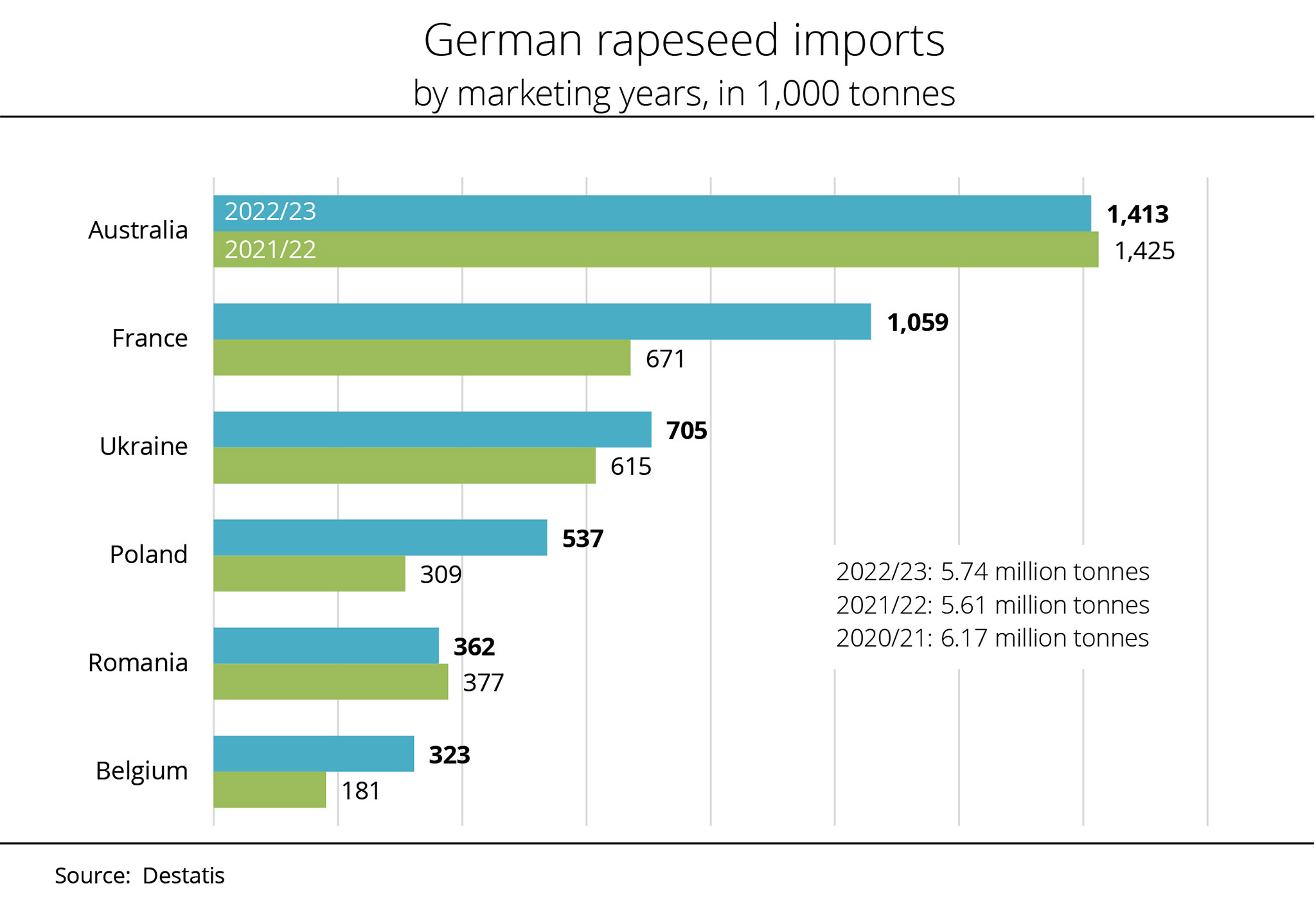

Germany's rapeseed imports decline

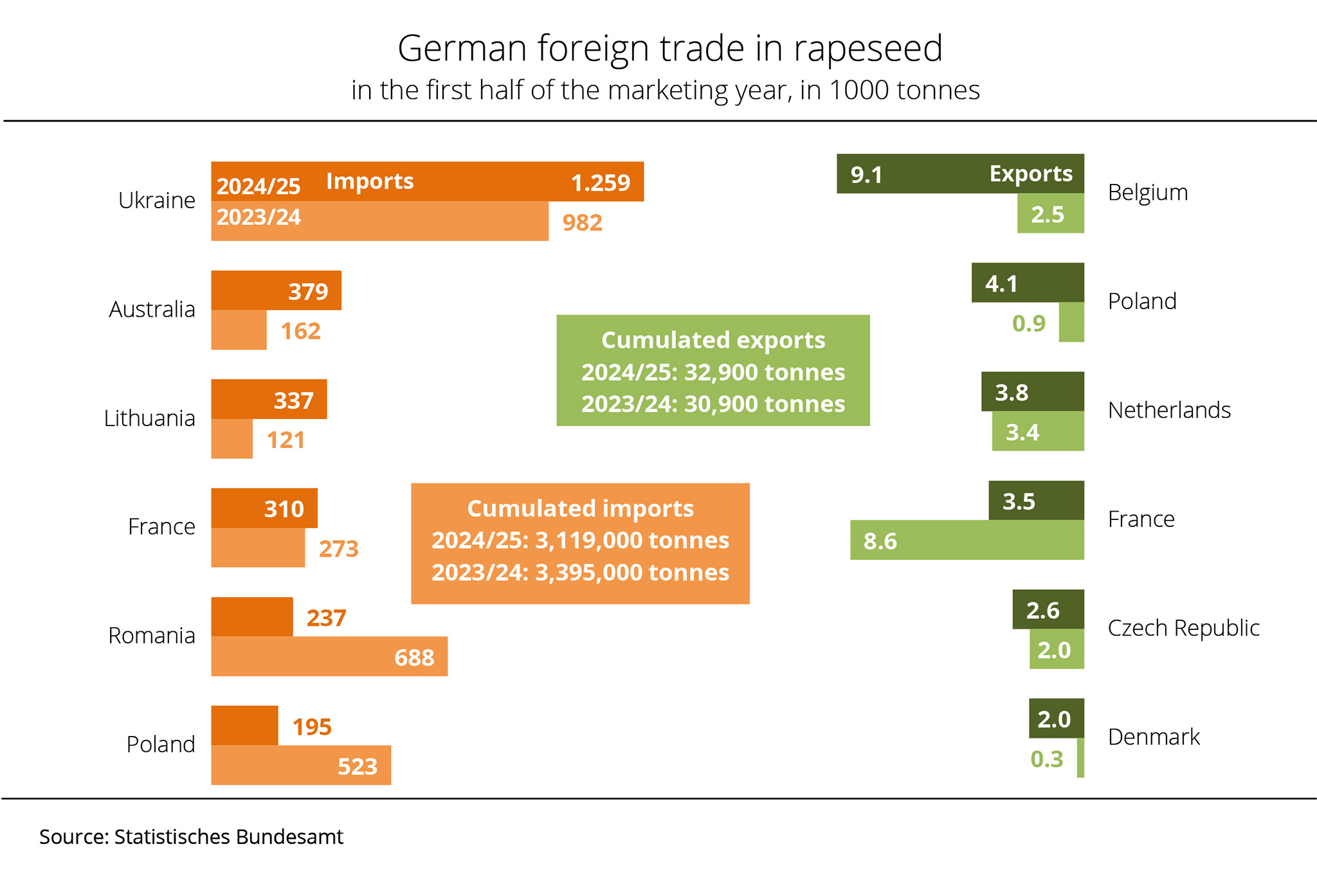

Germany harvested less rapeseed in 2024 than in the previous year. Despite the smaller domestic supply, rapeseed imports in the first half of the 2024/25 season remained below the previous year’s levels.

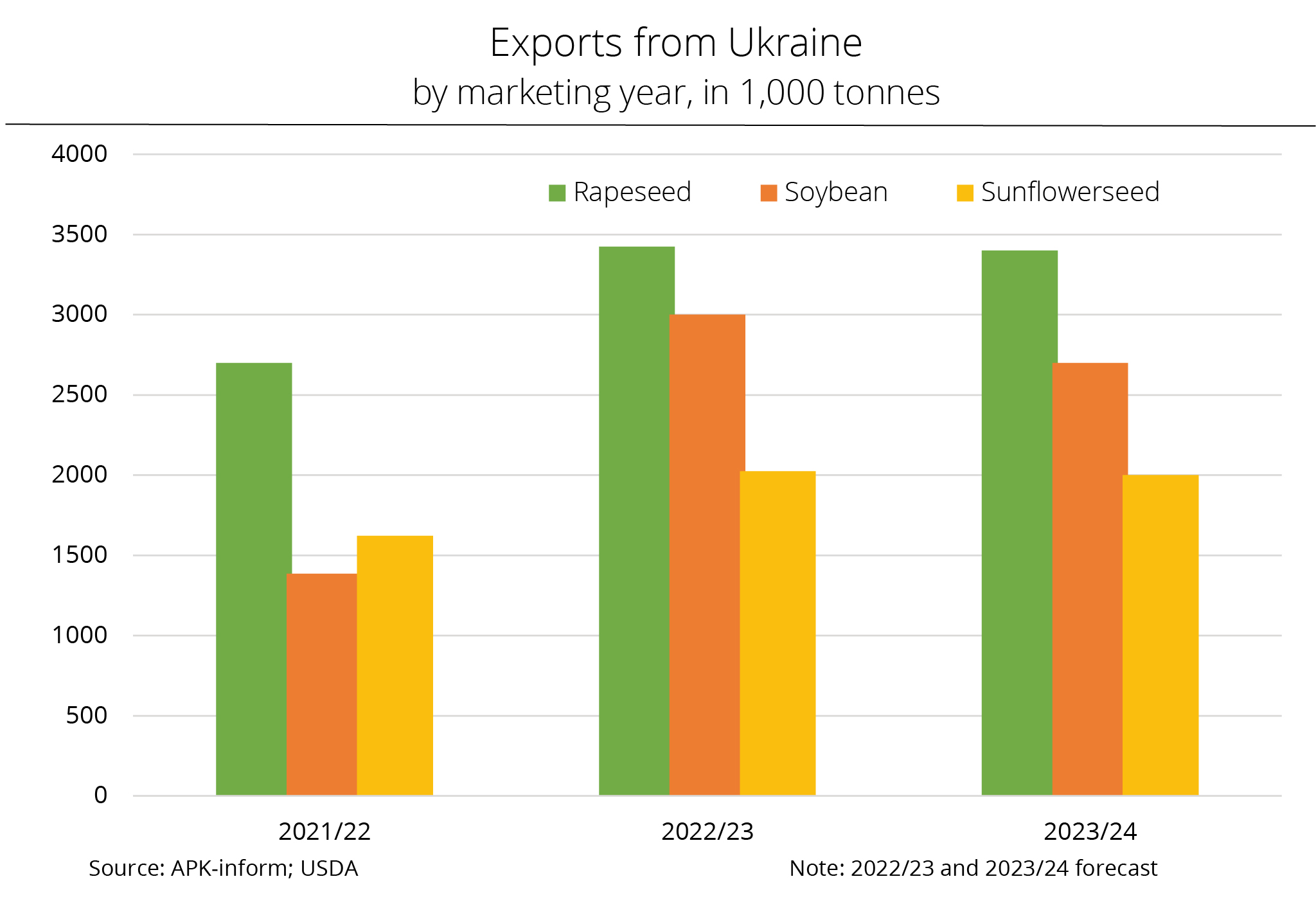

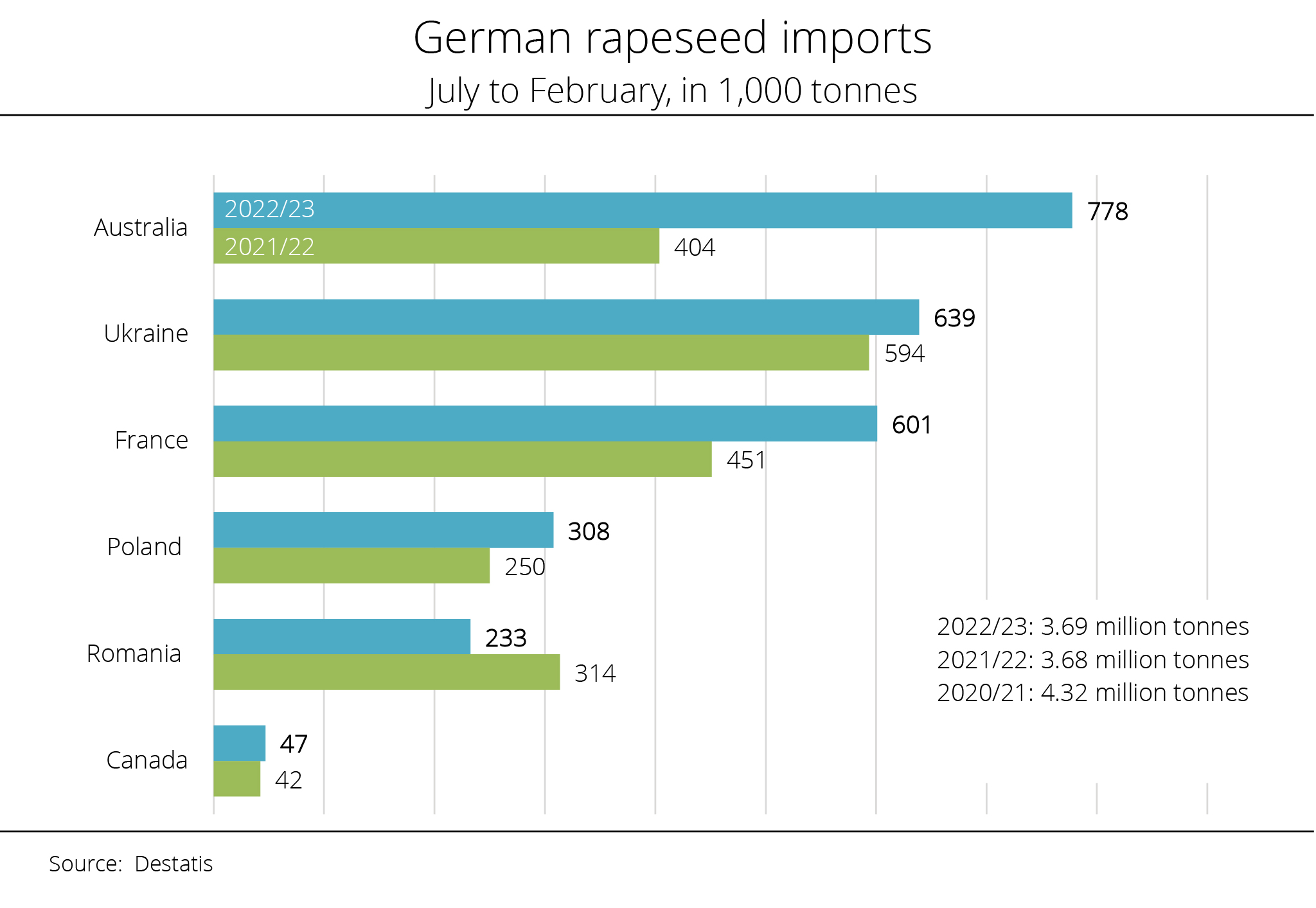

According to data from the German Federal Statistical Office, Germany imported approximately 3.1 million tonnes of rapeseed in the first half of the 2024/25 season, an 8 per cent decline compared to the previous year. Ukraine remains the primary country of origin in the current season. Despite the ongoing war, the country delivered 1.3 million tonnes to the German market, around 28 per cent more year-on-year. This was the largest volume on record. The increase is driven by concerns over further attacks on Ukrainian warehouse and transport facilities.

According to Agrarmarkt Informations-Gesellschaft (mbH), the pace of deliveries is expected to slow in the second half of the marketing year, as Ukraine itself can only draw on a harvest that is 21 per cent smaller than the previous year. Meanwhile, the focus is moving towards the second supply wave from Australia, the second-largest supplier. With 378,900 tonnes delivered so far, Australia has more than doubled its exports to Germany compared to the previous year’s 161,600 tonnes. Neighbouring EU countries supplied approximately 1.4 million tonnes, a 32 per cent decline year-on-year. The largest EU suppliers were Lithuania (337,000 tonnes), followed by France (310,000 tonnes) and Romania (237,000 tonnes).

Germany is the EU's largest net importer, with annual imports averaging between 5.5 million and 5.7 million tonnes. This is due to the fact that German oil mills process approximately 9.4 million tonnes of rapeseed per year, keeping exports relatively low. In the first six months of the current season, Germany exported only around 32,900 tonnes of rapeseed, which was up 6 per cent on the same period last year despite the smaller domestic harvest. Most German rapeseed exports go to other EU member states, with Belgium (around 9,100 tonnes), Poland (4,100 tonnes) and the Netherlands (3,800 tonnes) as the primary destinations.

Chart of the week (14 2025)

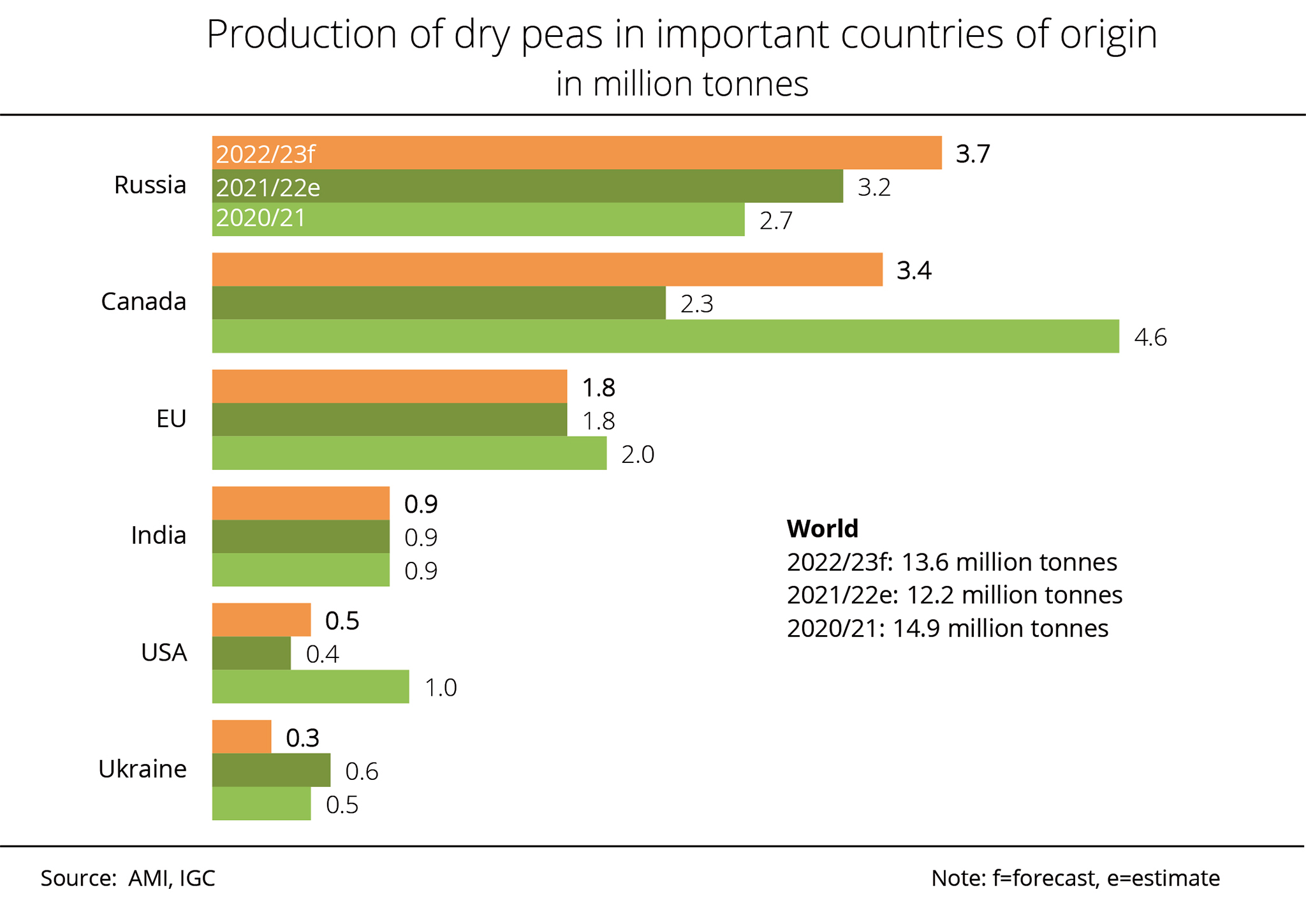

IGC expects substantial expansion of dry pea production in Russia

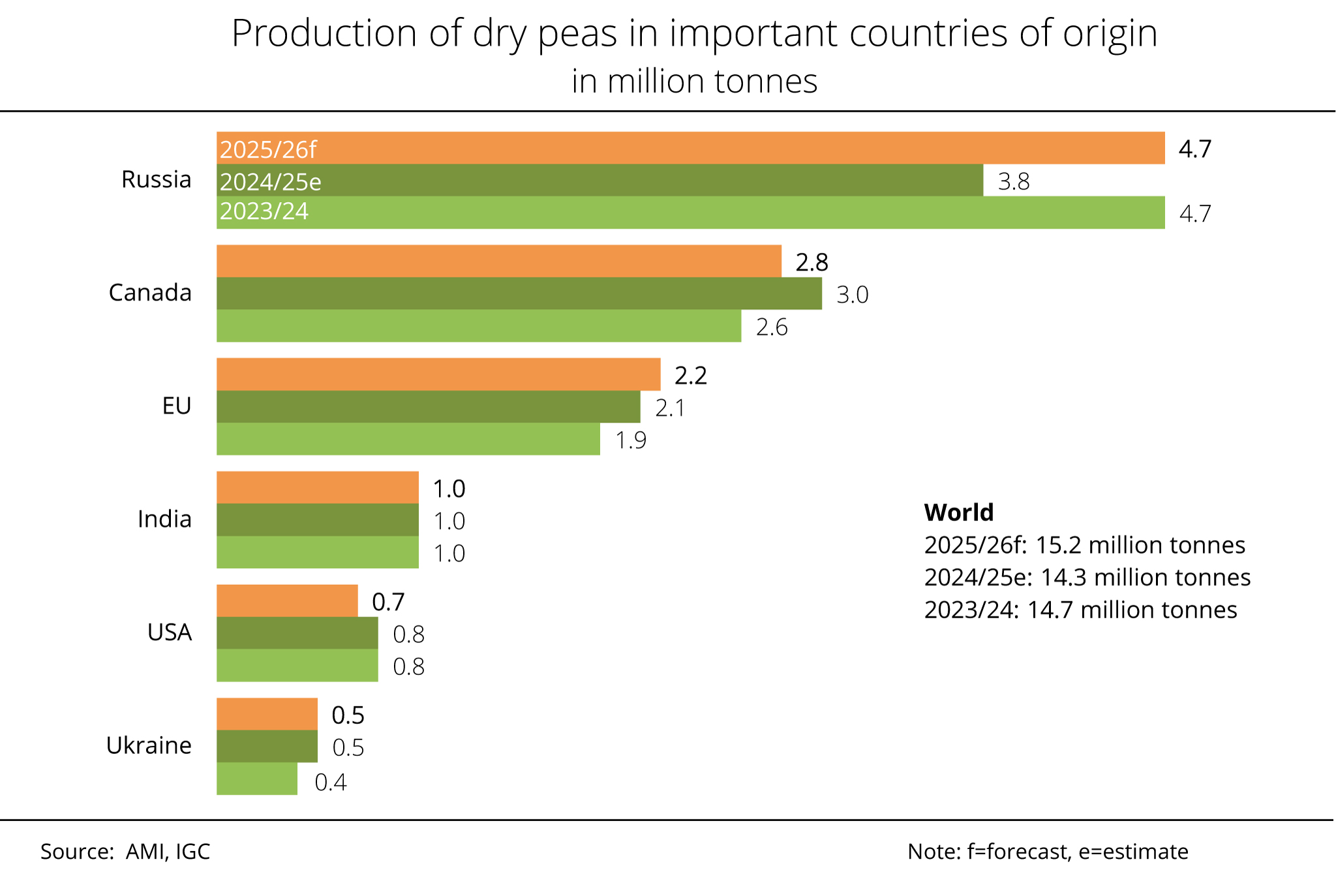

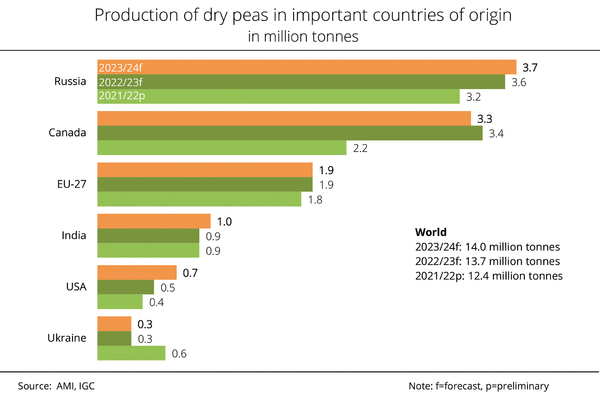

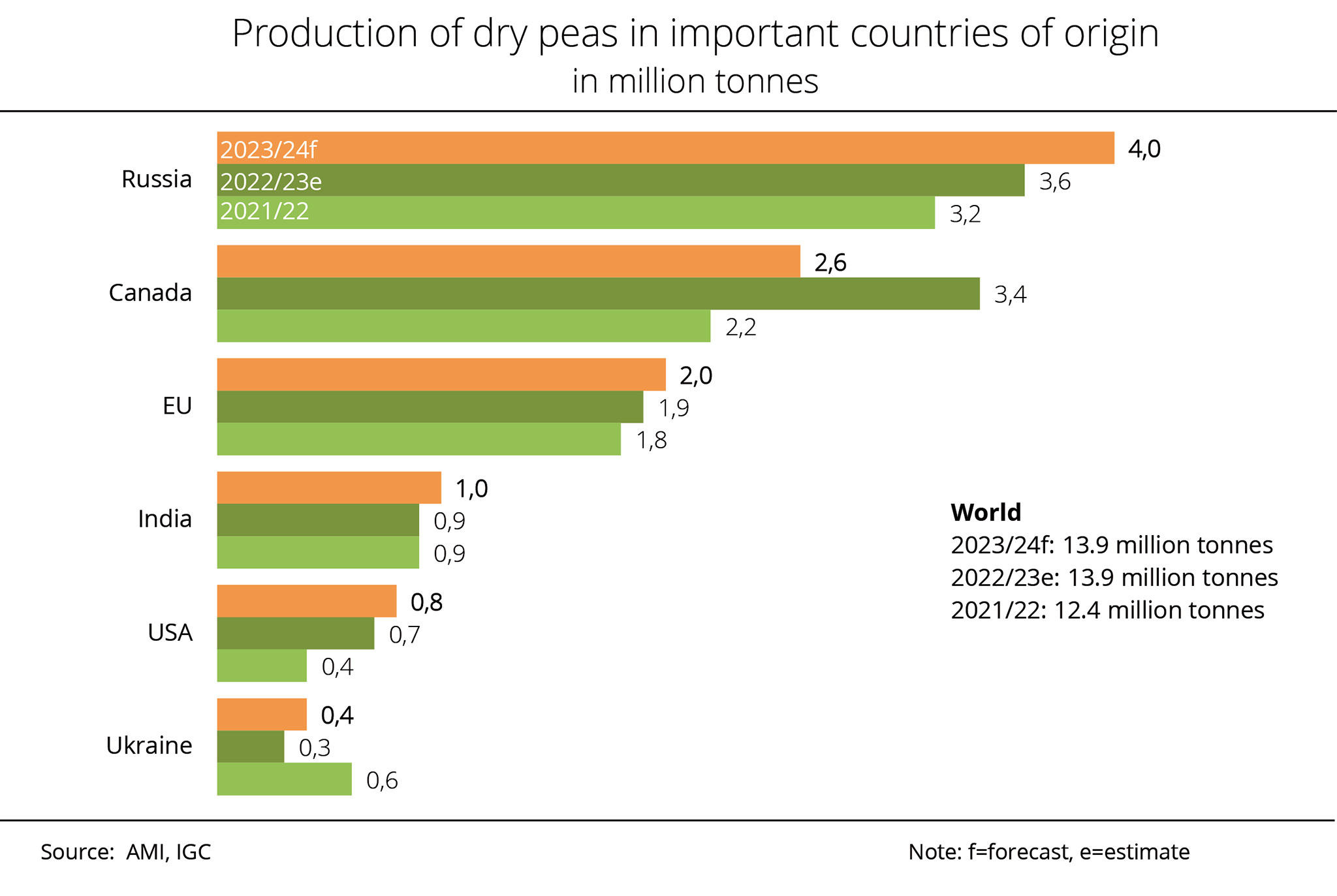

The International Grains Council (IGC) expects a rise in global dry pea production for the upcoming season. Whereas Russia is projected to harvest more dry peas in 2025 than a year earlier, Canada's harvest is seen to fall short of the previous year's level.

The IGC assumes that world dry pea output will amount to 15.2 million tonnes in the 2025/26 marketing year, representing a substantial increase of 6.3 per cent over the previous season. Research by Agrarmarkt Informations-Gesellschaft (mbH) suggests that this would mark an eight-year high. The forecast is mainly based on a higher harvest estimate for Russia, where the harvest is seen to grow around 900,000 tonnes, or 23.7 per cent, year-on-year to 4.7 million tonnes. The increase is attributed to an expansion in area sown, fuelled by strong export demand. This means that Russia will remain the largest dry pea producer worldwide.

Canada ranks second with a presumed production of 2.8 million tonnes, representing a decline of 200,000 tonnes or 6.7 per cent. In other words, the historically low output of 2.2 million tonnes recorded in the 2021/22 season would be surpassed significantly. However, if the current trade uncertainties continue, Canada's dry pea area could be reduced even further, bringing the Canadian harvest down to a level significantly lower than previously expected. The reason is that China, in particular, is a crucial market for Canadian dry peas. The EU-27 follows in third place, with production projected at 2.2 million tonnes and an increase of approximately 100,000 tonnes.

The US dry pea harvest is projected to decline to 700,000 tonnes, a drop of around 100,000 tonnes from 2024. Production in India and Ukraine is seen to remain stable at 1.0 million and 0.5 million tonnes.

In view of the EU's strong demand for feed protein imports, the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has once again underlined the great exploitable potential for growing dry peas and other large-grained pulses such as soybeans, peas and lupins, in Germany and across Europe. From the perspective of the UFOP, these crops are key factors in resilient crop rotations aimed at mitigating climate change. According to the UFOP, the production of protein crops in particular has numerous positive effects on the environment and agricultural soils, such as biological nitrogen fixation and the provision of feed and habitat for flower-visiting insects.

The association has called on the new German government to strengthen and provide reliable support for a comprehensive protein plant strategy that includes cultivation, product development and sales promotion to unlock this potential in Germany, adding that economic incentives are essential for encouraging crop diversification with grain legumes in the long term. The UFOP has highlighted the urgent need for research and investment in crop breeding, cultivation efficiency and development of new products both for human consumption and livestock feed.

Chart of the week (13 2025)

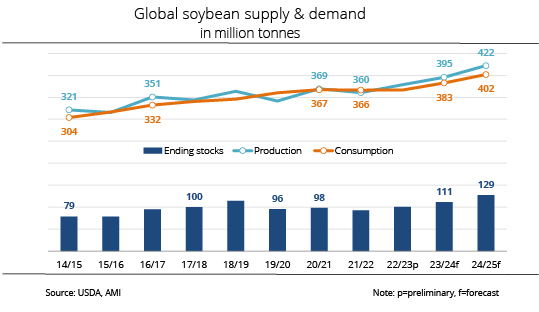

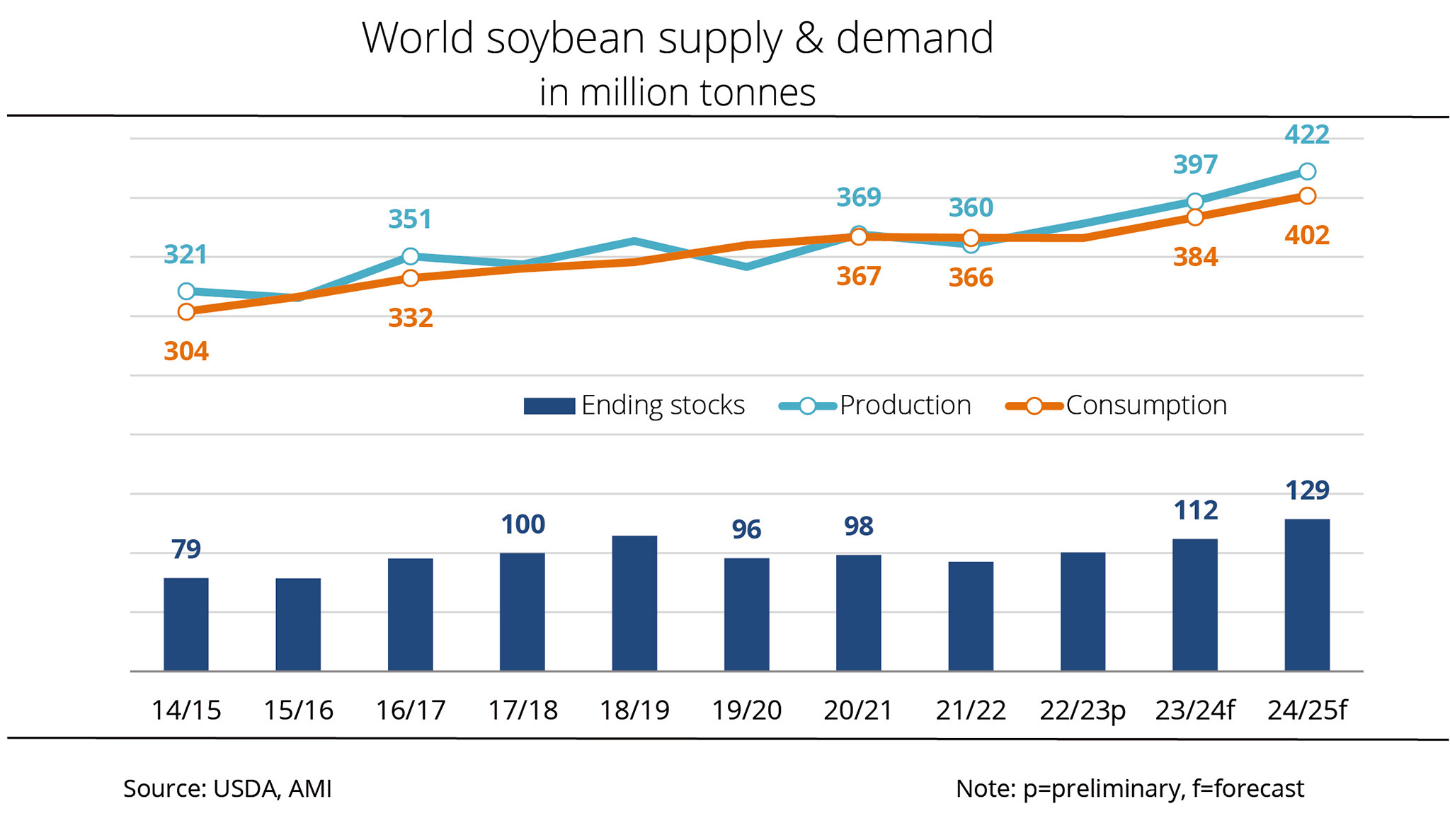

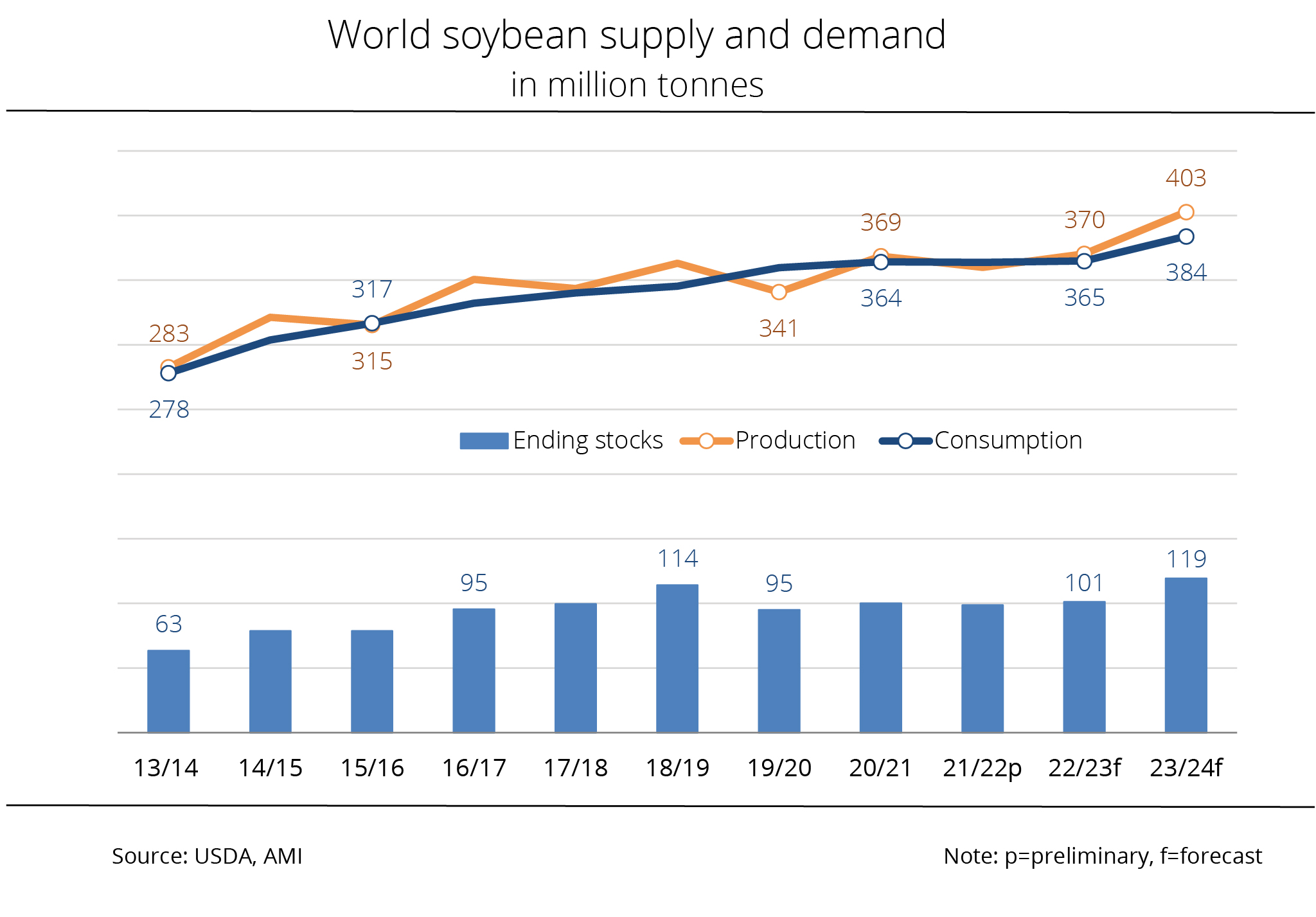

EU is key market for US soy

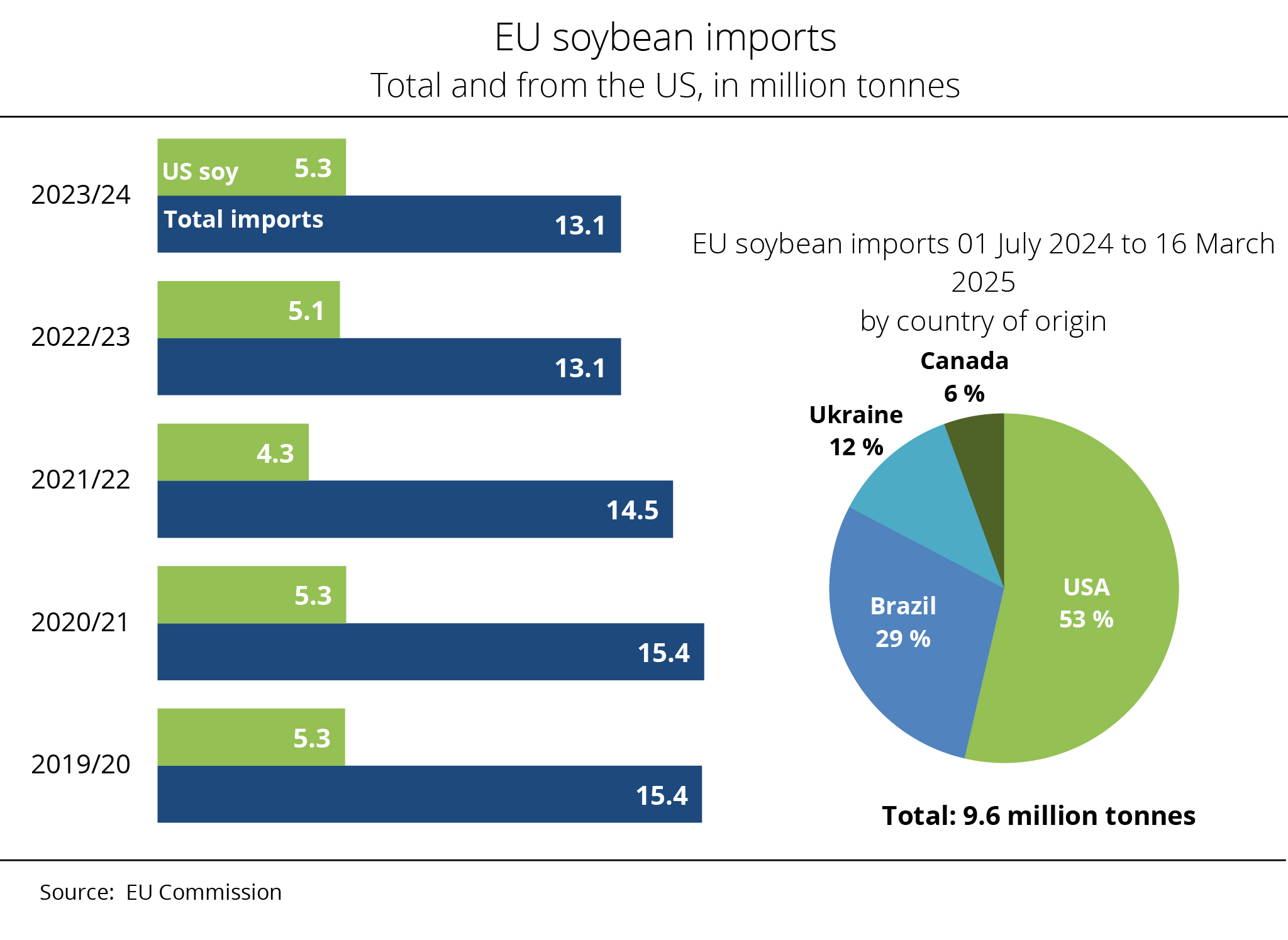

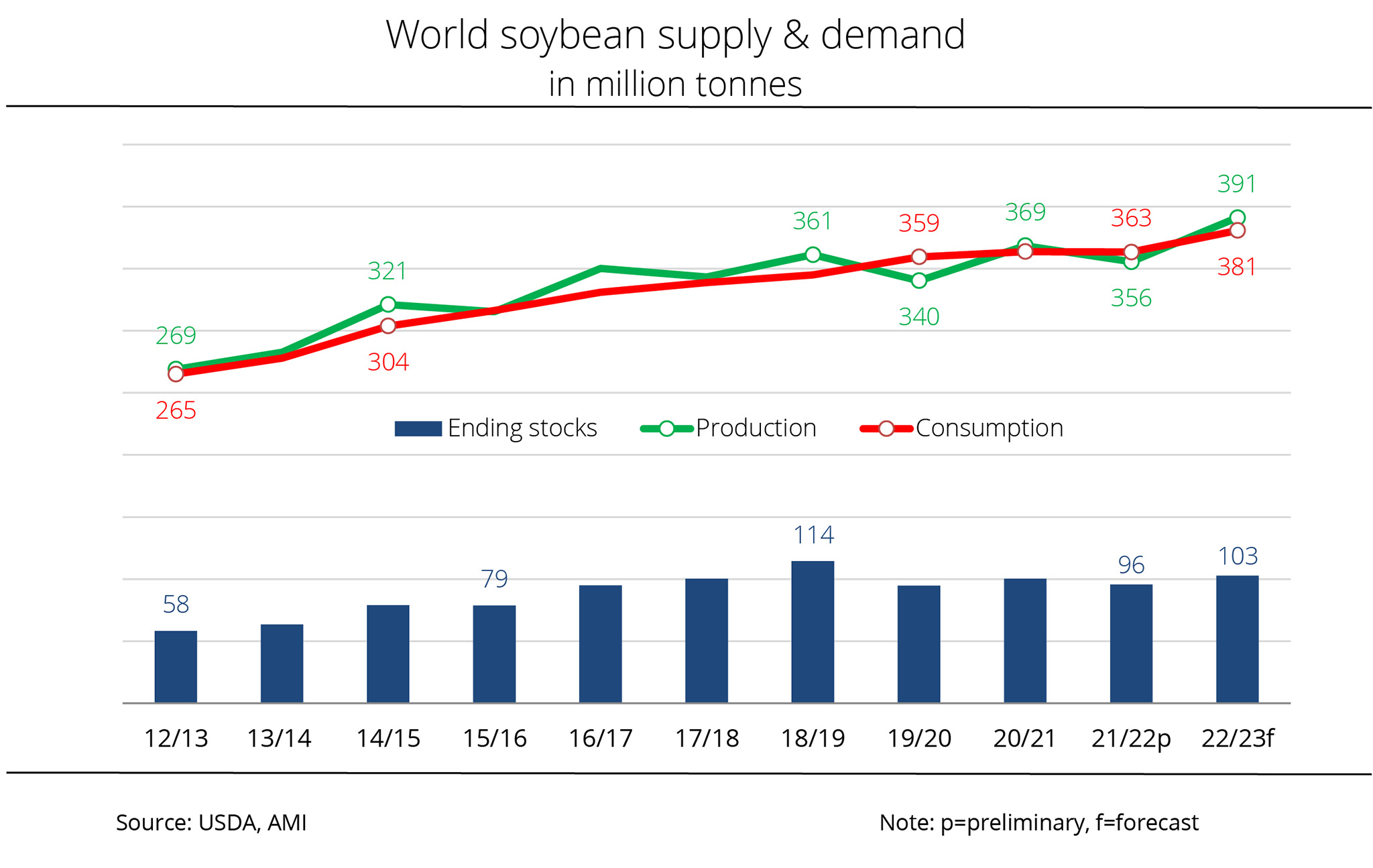

The European Union (EU) is the primary market for US soybeans, second only to China. However, the EU has announced initial retaliatory tariffs in response to US tariff policies. This move is expected to negatively impact US soybean sales.

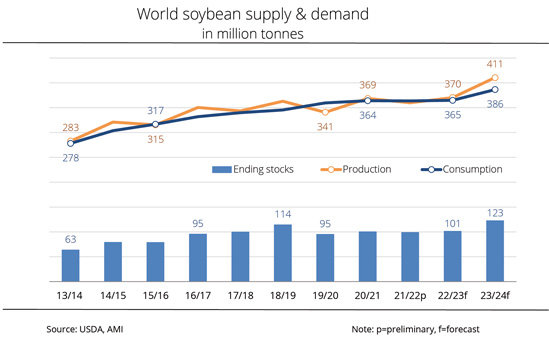

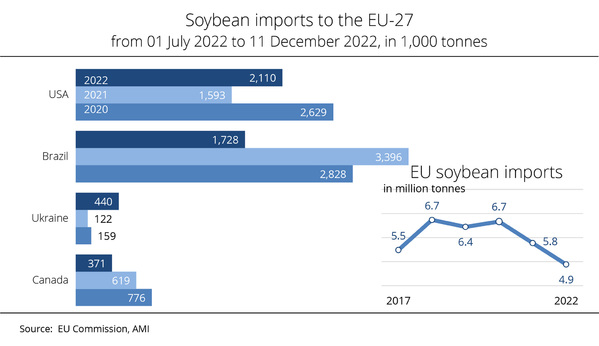

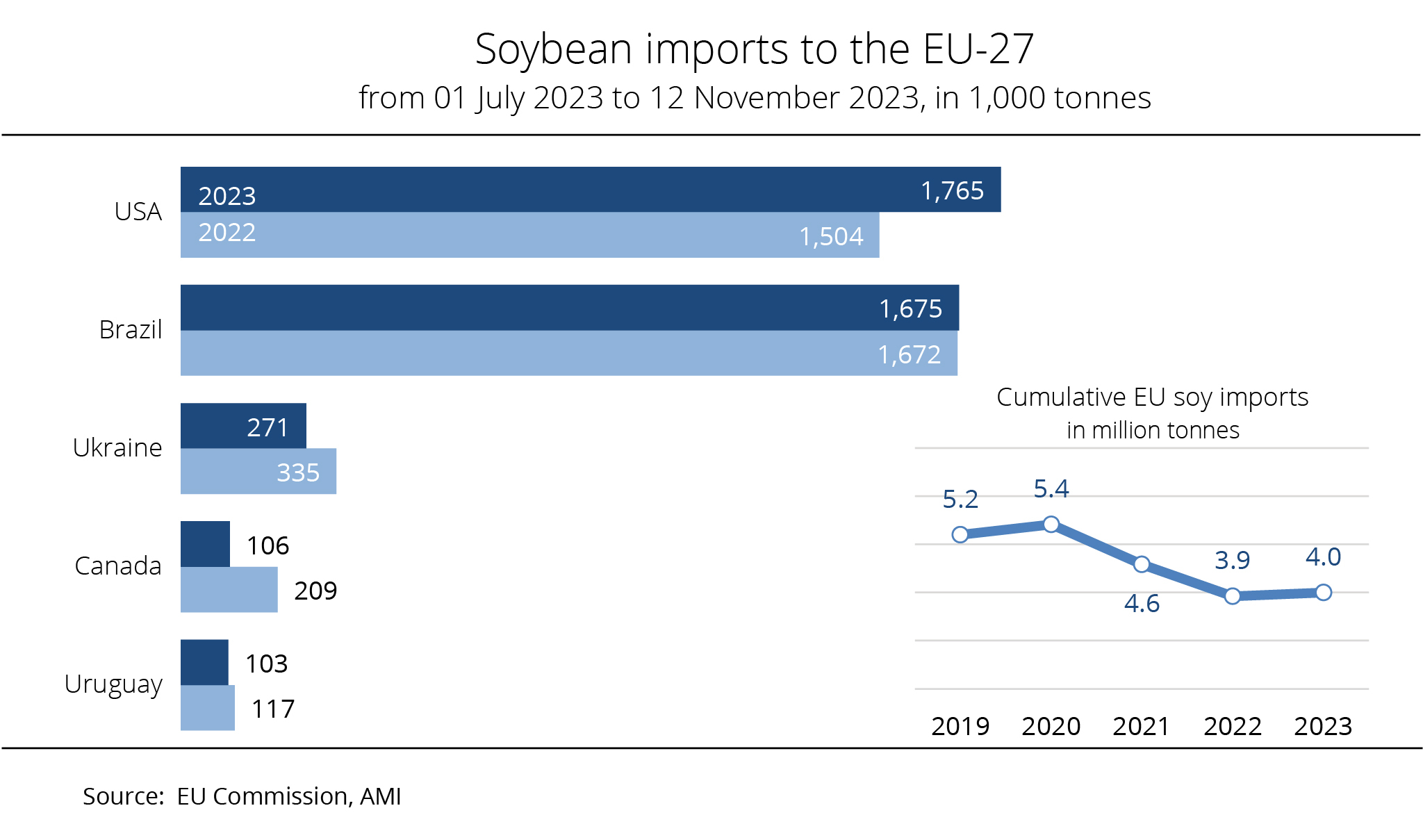

After Brazil, the US is the world's second-largest supplier of soybeans. With national production totalling just under 119 million tonnes, approximately 50 million tonnes of US soybeans are expected to be shipped across the world's oceans in the 2024/25 season. While China is the main recipient, the European Union also imports a significant share, making it the second most important market for the US. According to data from the EU Commission, the EU purchased a total of 13.1 million tonnes of soybeans from abroad in the past crop year. Of this, approximately 5.9 million tonnes came from Brazil, while 5.3 million tonnes were sourced from the US, representing a share of nearly 41 per cent of total imports.

The picture has been slightly different in the current season. As of 16 March 2025, the EU had obtained around 9.6 million tonnes of soybeans from abroad, with the US accounting for the largest share – 5.1 million tonnes, or just over 53 per cent. Agrarmarkt Informations-Gesellschaft (mbH) has noted, however, that the Brazilian harvest did not take place until February/March 2025. This suggests that, in the coming months, soybeans will primarily be sourced from South America's 2025 harvest.

Another key factor is the EU Commission's announcement of a 25 per cent penalty tariff on US agricultural products, including soybeans, in retaliation for the additional tariffs the US imposed on steel and aluminium imports. The tariffs could take effect as of mid-April. Given the ample global supply, EU importers are likely to turn to South American soybean suppliers to meet their needs. Ukraine is also expected to move further into focus as a supplier. In this scenario, the losers would be US soybean producers as they would lose a crucial market.

Chart of the week (12 2025)

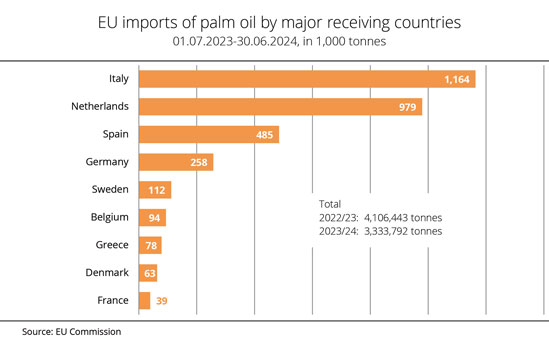

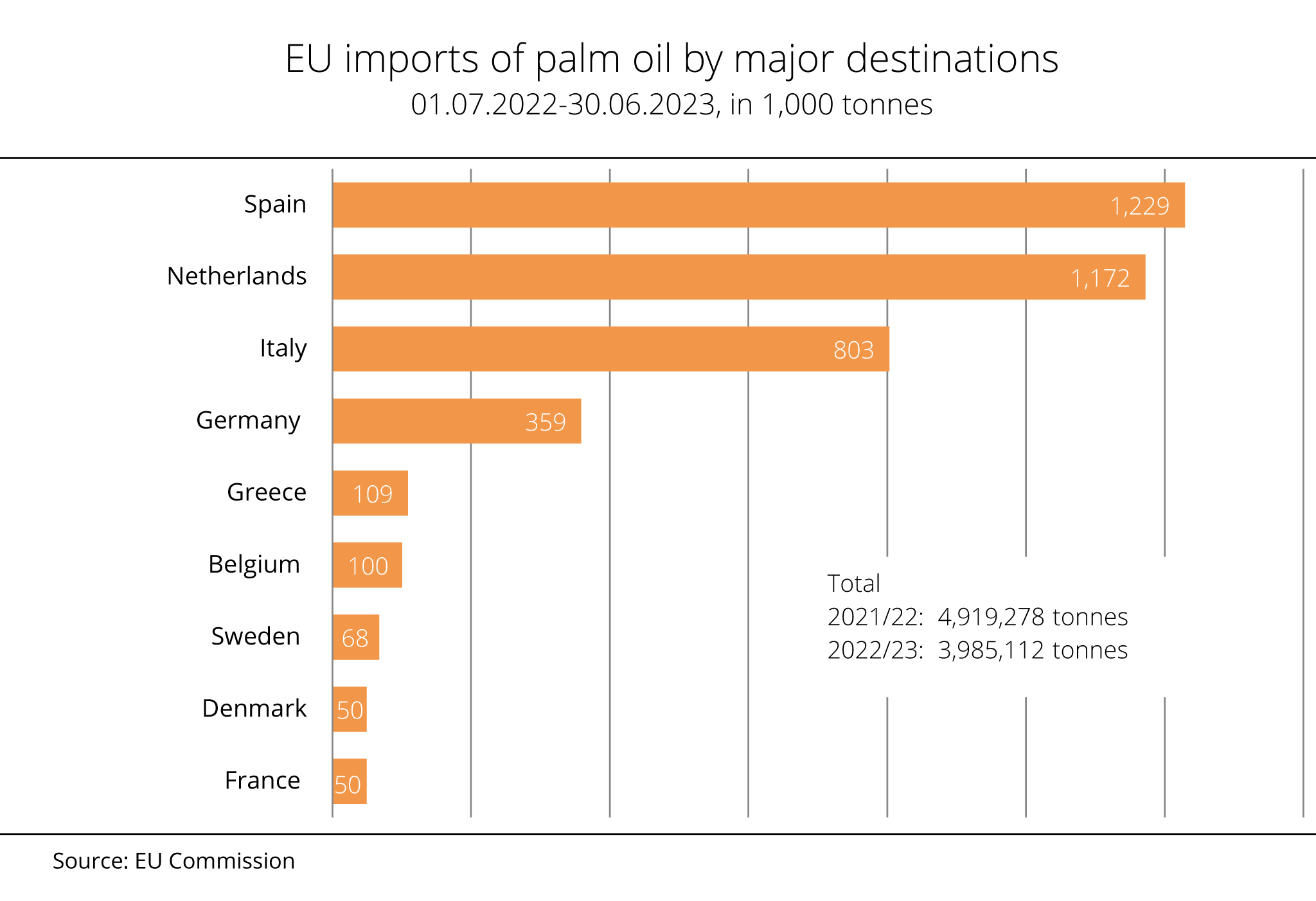

EU-27 imported significantly less palm oil

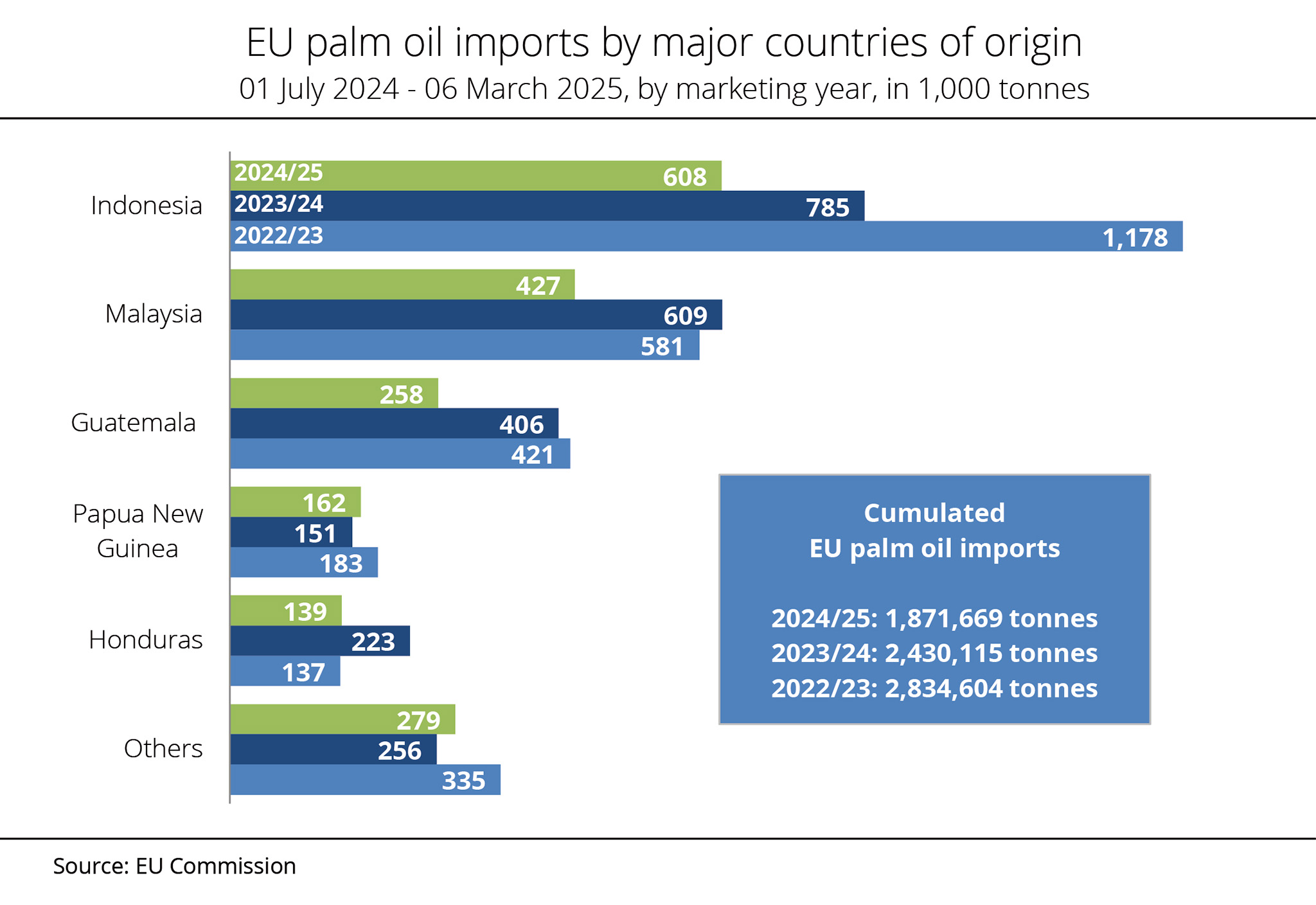

The EU imported significantly less palm oil between July 2024 and early March 2025 than in the same period a year earlier, reflecting an overall decline in intra-Community consumption.

According to latest data from the EU Commission, the Union received just under 1.9 million tonnes of palm oil from abroad between 1 July 2024 and 6 March 2025, which represents a sharp decline compared to the 2.4 million tonnes received during the same period the previous year. Between July 2022 and March 2023, EU-27 palm oil imports had still totalled around 2.8 million tonnes.

Indonesia remains the leading supplier, with 608,100 tonnes. However, the country's deliveries between July and early March dropped 23 per cent year-on-year. Imports from Malaysia, the second largest supplier, declined around 30 per cent to 426,000 tonnes. According to research by Agrarmarkt Informations-Gesellschaft (mbH), the slowdown in shipments from Guatemala was even sharper, at 37 per cent. Papua New Guinea was the only country of origin to marginally increase its delivery volumes during the stated period.

The Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP) attributes the decline in palm oil imports primarily to the expiration of the EU Renewable Energy Directive (RED II) provision allowing biofuels from palm oil to be credited, which is set to end by 2030. Furthermore, the association has underlined that biodiesel supply in Germany - and consequently the EU - is rising due to the double counting of biofuels from certain waste oils towards greenhouse gas reduction obligations. Virtual and creditable previous-year GHG reduction quotas are rushing physical volumes from Germany into the EU market. According to UFOP, this trend is also reflected in the surplus of biodiesel exports from Germany, which rose from 1.27 million tonnes in 2023 to 1.62 million tonnes.

Chart of the week (11 2025)

Vegetable oil prices exceed previous year's levels

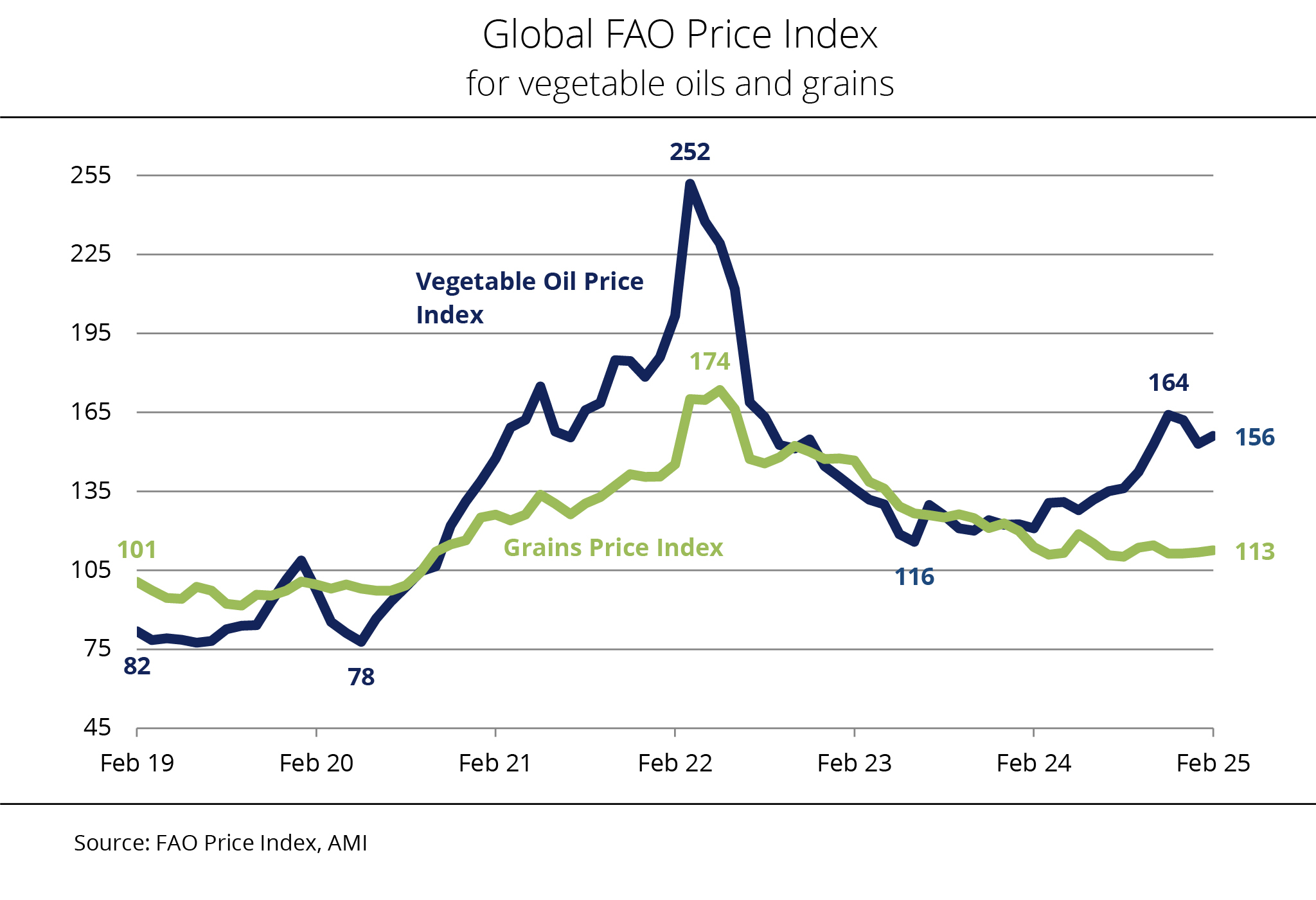

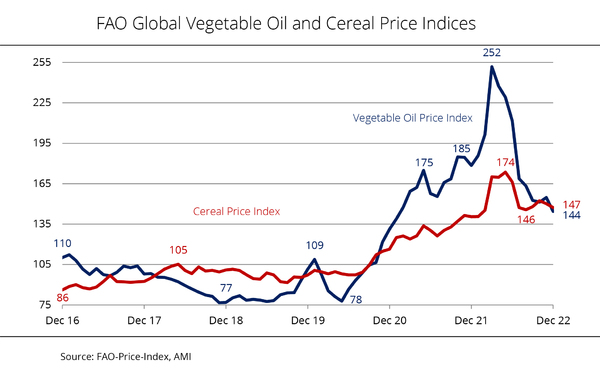

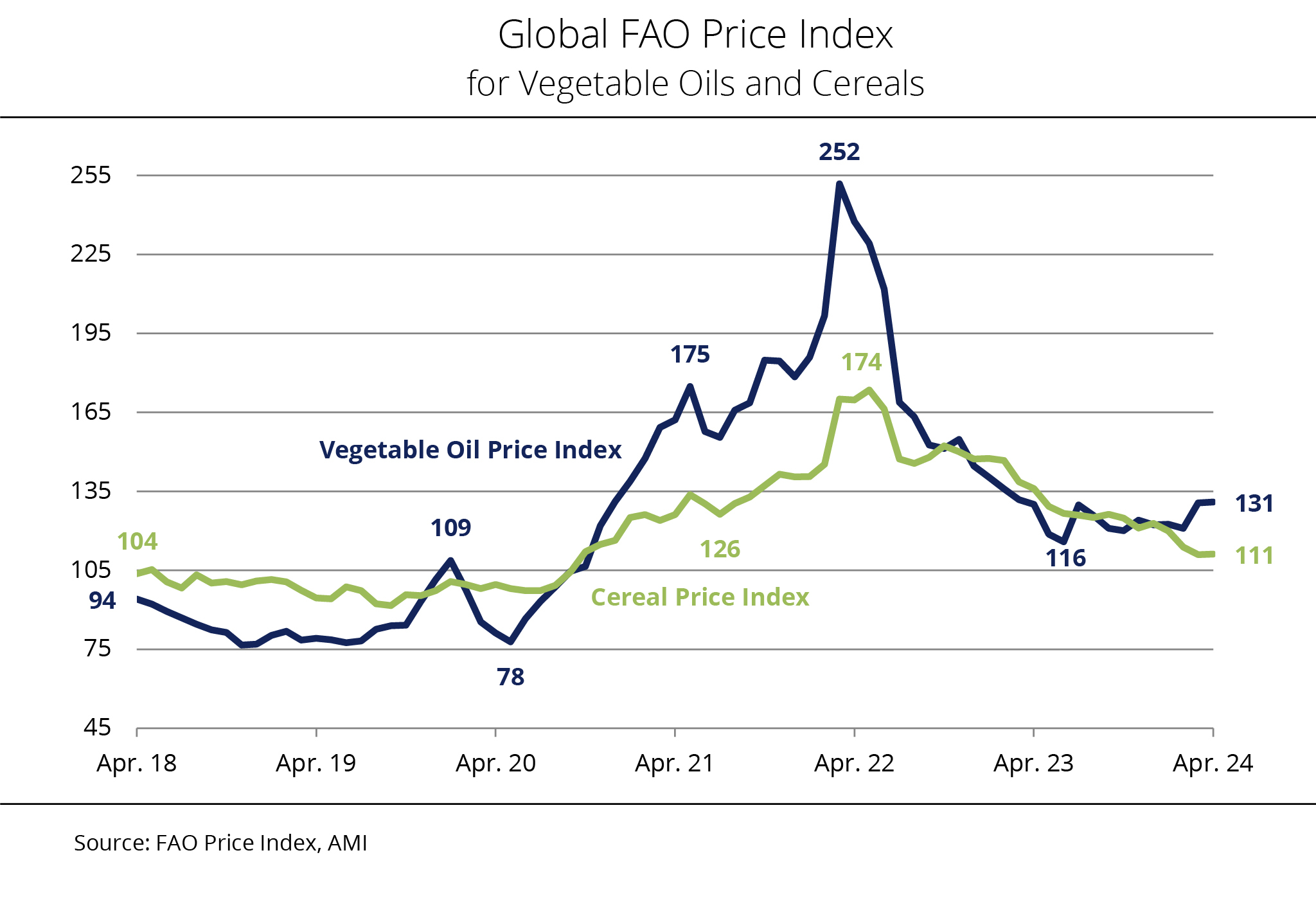

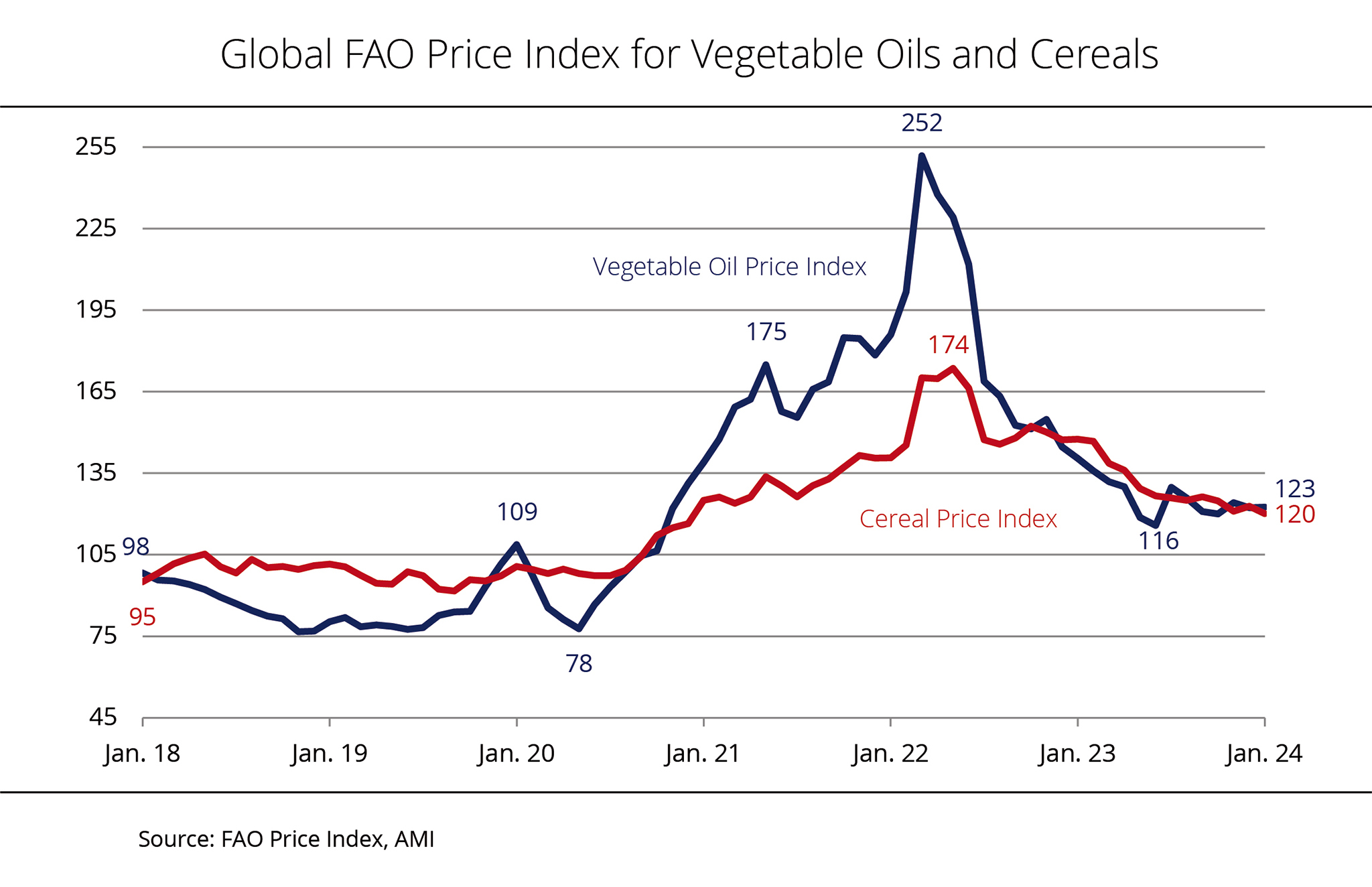

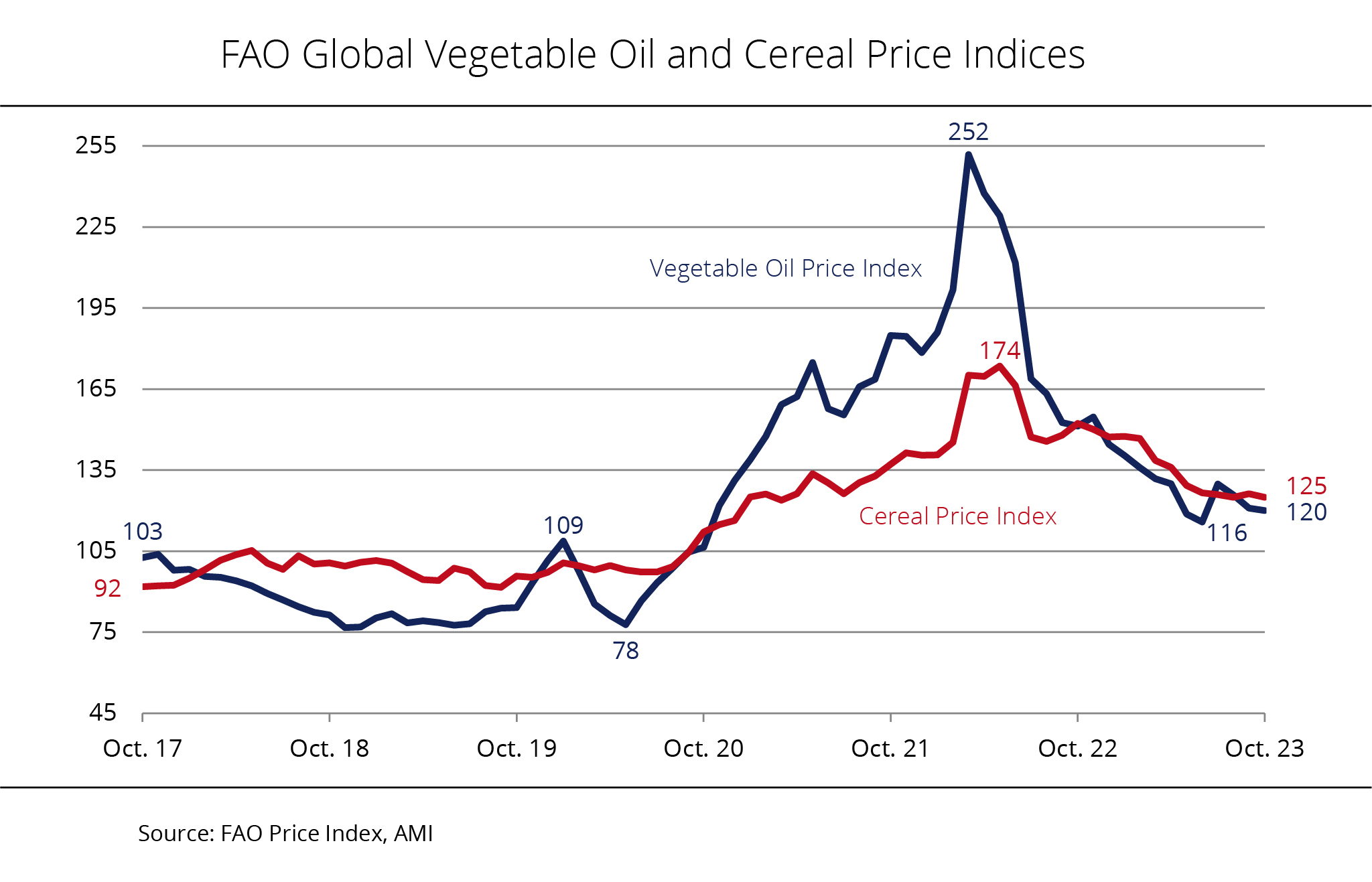

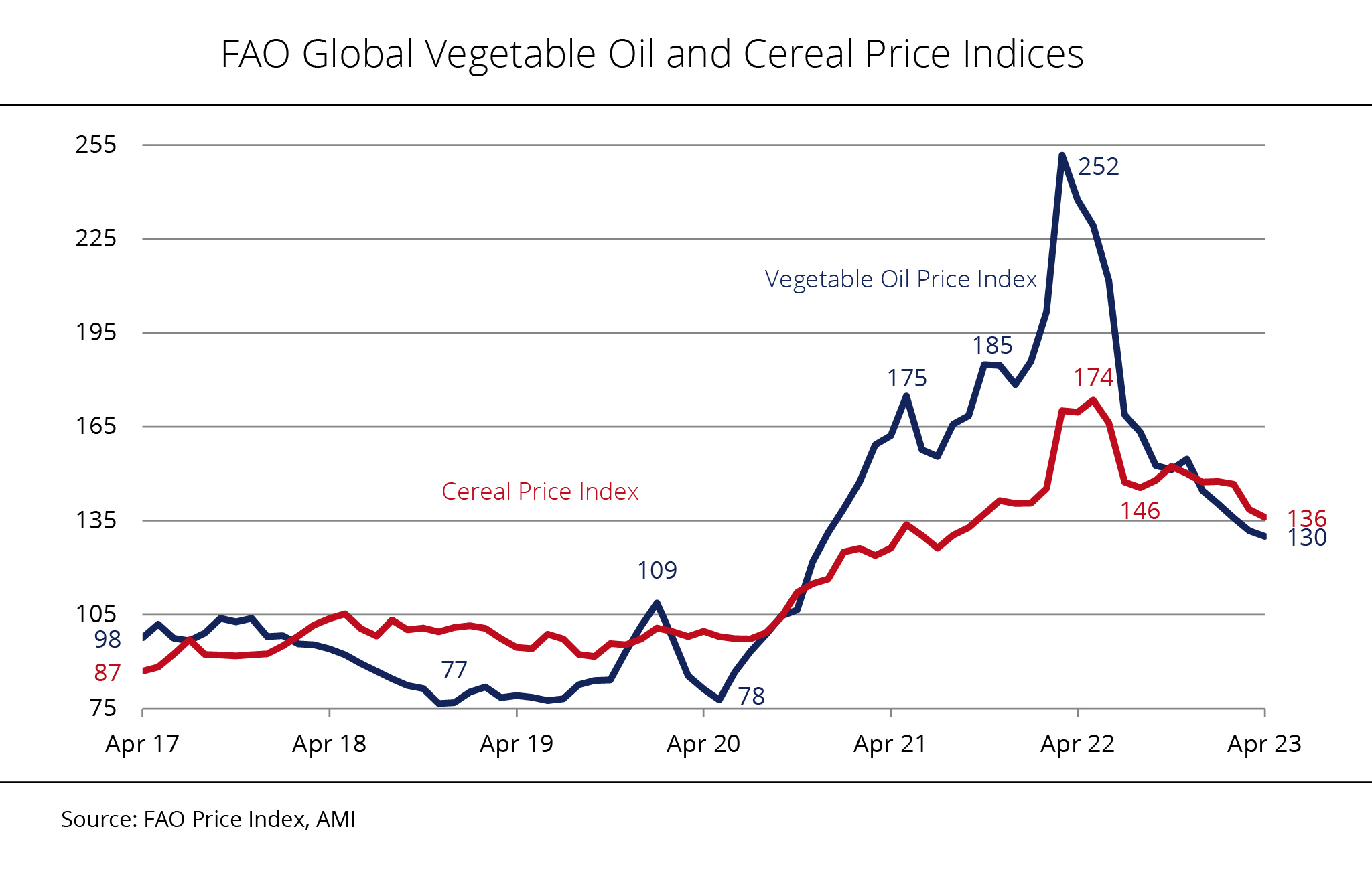

The FAO vegetable oil price index rose in February. The surge in palm oil prices was the main factor driving the index, although all vegetable oils reflected in the index experienced an increase.

The FAO price index for vegetable oils reached approximately 156.0 points in February 2025, which represents a 2 per cent increase month-on-month. Compared to the same month last year, the increase amounts to as much as 29.1 per cent. The key factor was a rise in international palm oil prices, which followed a brief slump in January 2025. Prices rebounded due to the seasonally lower production in key Southeast Asian palm oil-producing countries. Bids also benefited from prospects of increased demand from Indonesia's biofuels industry based on higher blending quota requirements.

This trend also lent supported international soybean oil prices, which FAO experts primarily attribute to strong demand from the food industry. As a result, export prices for sunflower oil and rapeseed oil surged as well, mainly due to concerns over limited supply in the coming months.

The FAO Grain Price Index for experienced a slight 0.7 per cent rise in February, reaching an average of 112.6 points. Wheat prices especially benefited from tighter supply in Russia and concerns over harvesting conditions in Eastern Europe and the US. Maize prices continued to climb, supported by supply shortages in Brazil and strong US export demand.

The FAO vegetable oil price index tracks monthly changes in international export prices for vegetable oils and grains, calculated as a trade-weighted average.

Chart of the week (10 2025)

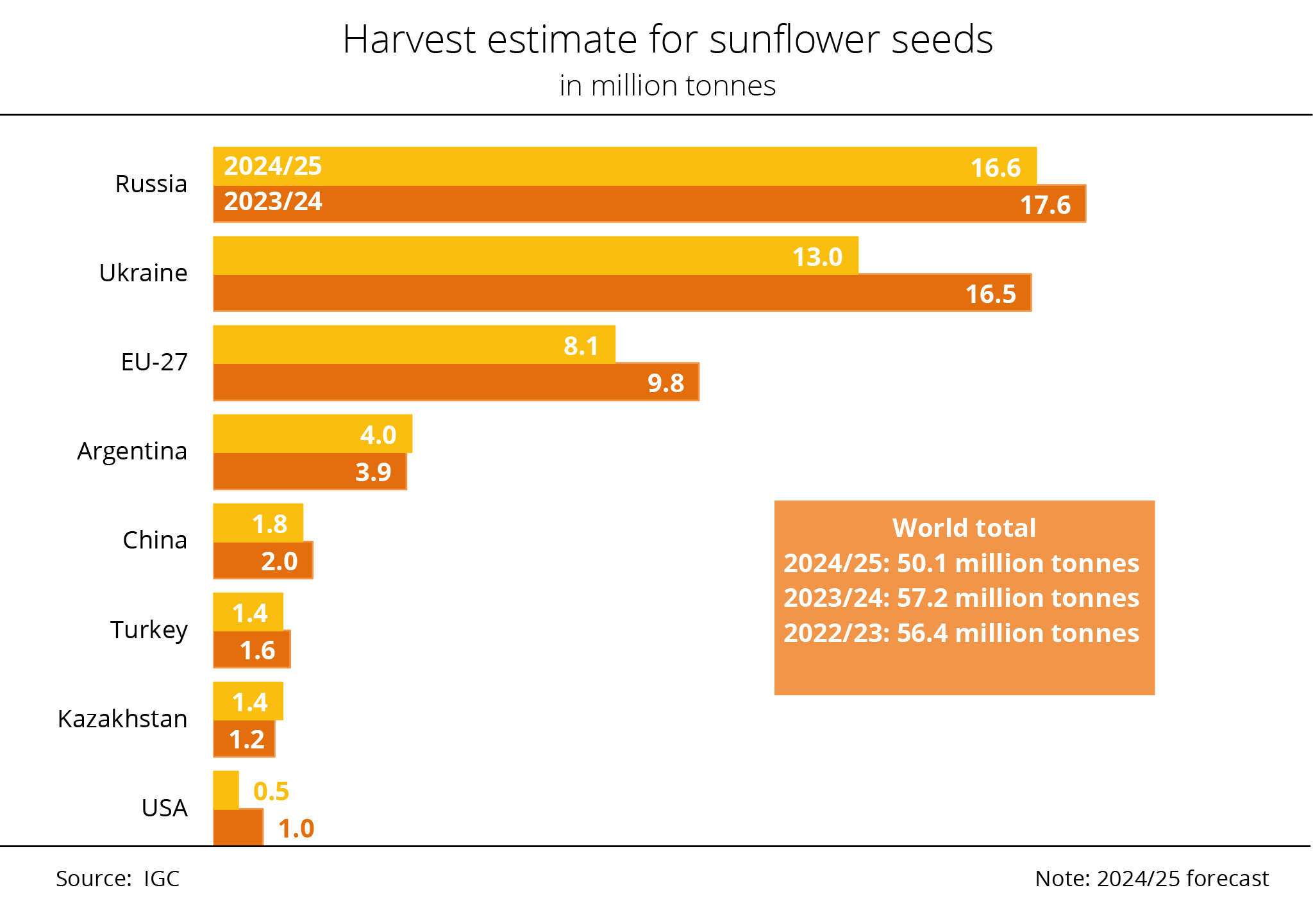

Smallest sunflower seed harvest in four years

According to recent data from the International Grains Council (IGC), global sunflower seed production will probably reach 50.1 million tonnes in the current season. This figure is not only 100,000 tonnes lower than previously expected, representing a 12.4 per cent decline compared to the 2023/24 crop year, but also marks the smallest harvest in four years.

According to the IGC data, Russia, Ukraine and the EU - the three largest producers of sunflower seed - experienced especially sharp harvest declines compared to the previous year. In Argentina, harvest operations are currently in full swing. Extreme heat and dry conditions recently reduced yields in the country's most important sunflower seed producing regions. In light of this, the IGC lowered its forecast 100,000 tonnes from the previous month. However, research by Agrarmarkt Informations-Gesellschaft (mbH) suggests that approximately 90 per cent of the crops were still in good or excellent condition as of mid-February. Consequently, the harvest, currently projected at 4.0 million tonnes, is expected to increase around 2.6 per cent on 2024.

The US harvest is also seen to be smaller than previously forecast. At around 500,000 tonnes, it likely amounts to only half the previous year’s total of 1.0 million tonnes. By contrast, the estimate for Ukraine's harvest was slightly revised upward. The currently expected 13.0 million tonnes nevertheless represent a 21.2 per cent decline from the previous year’s volume.

Chart of the week (09 2025)

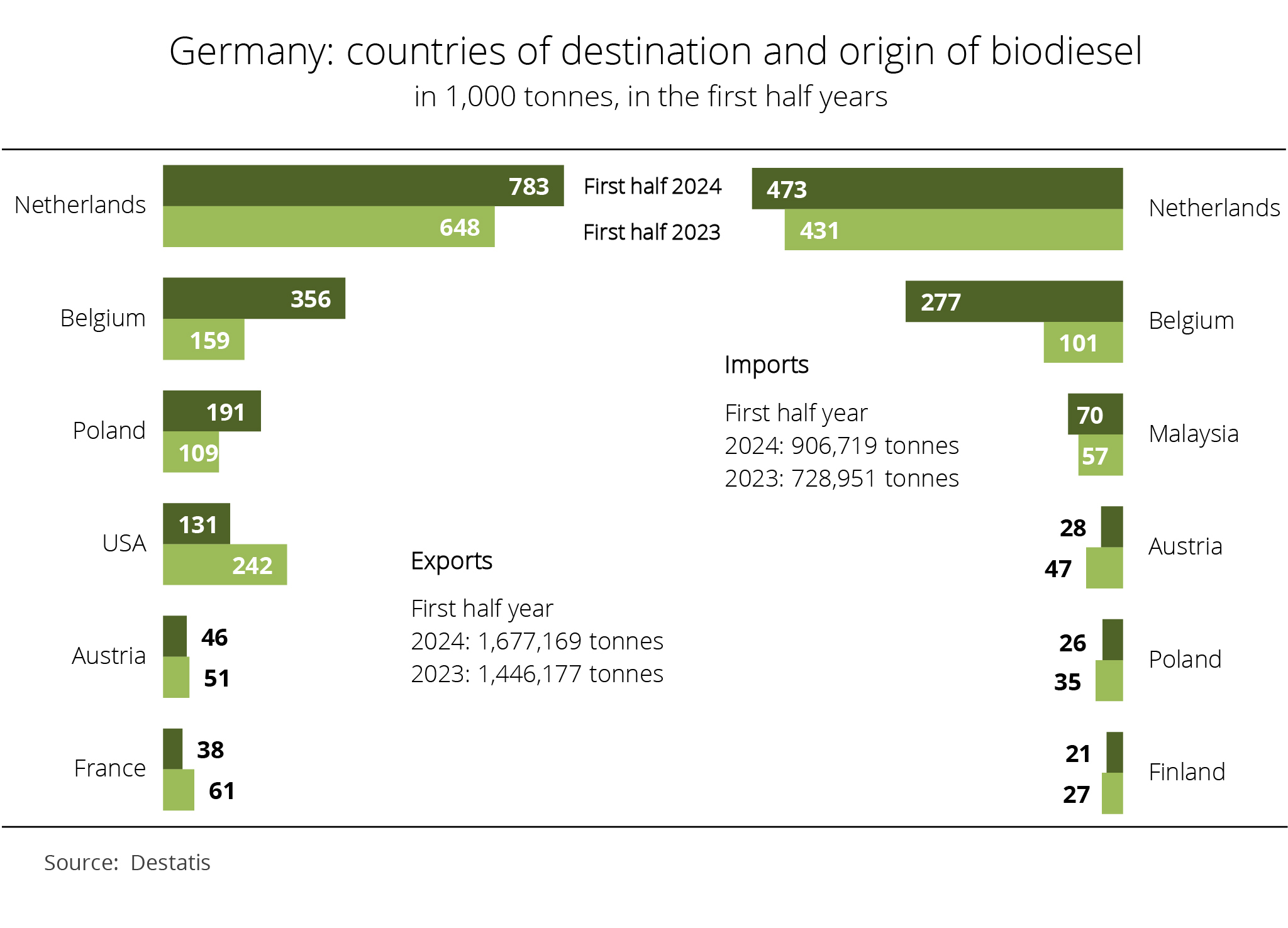

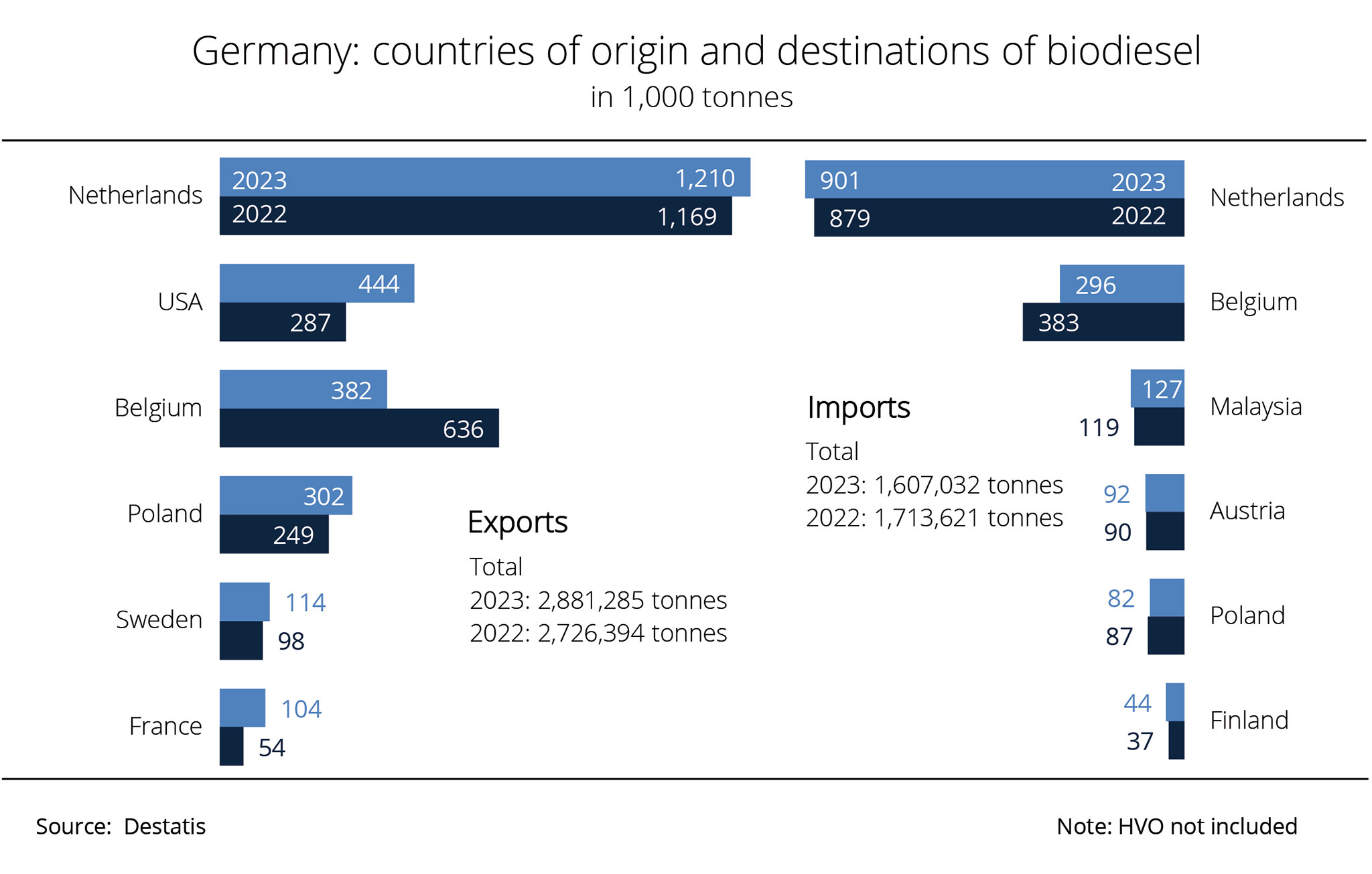

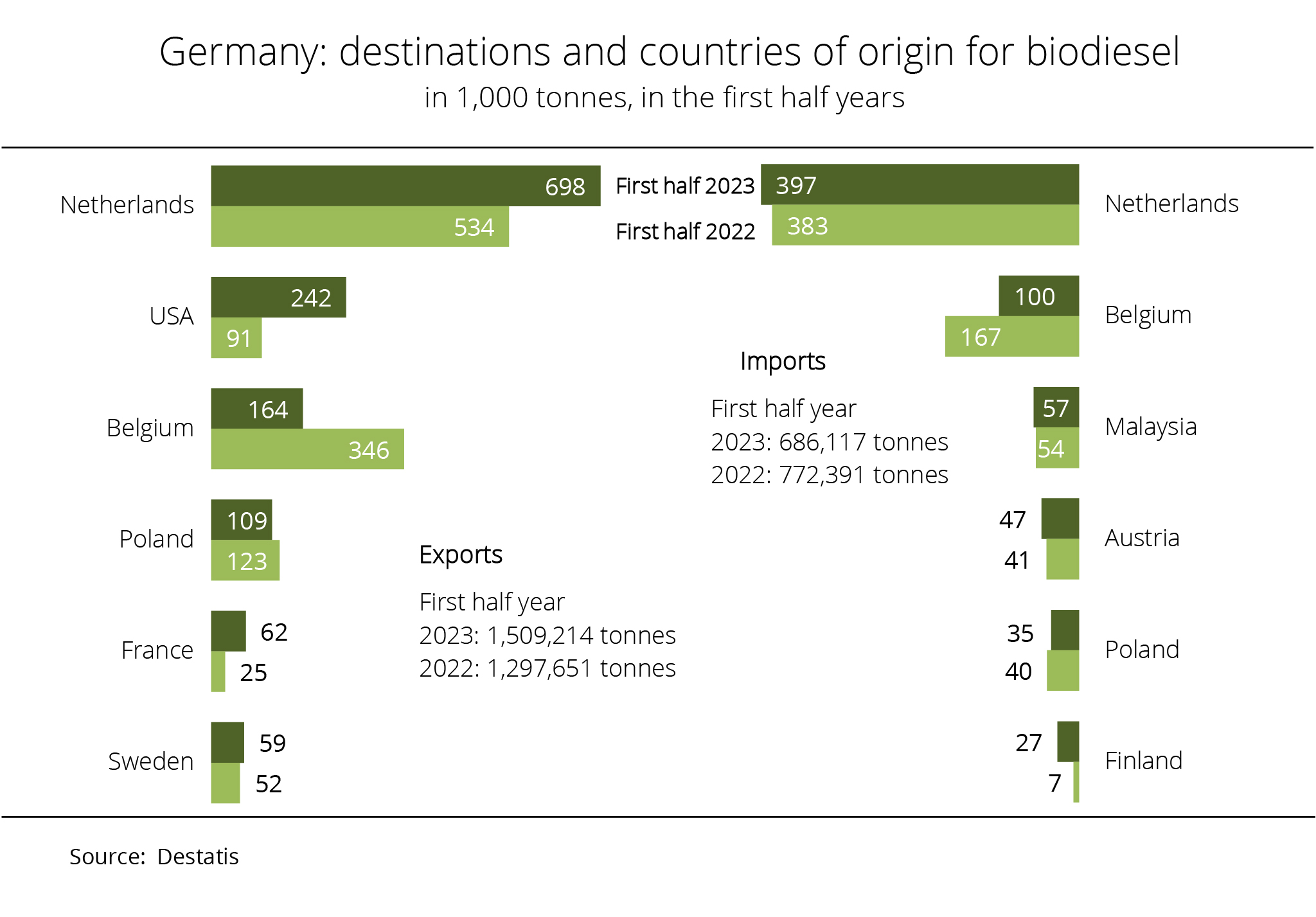

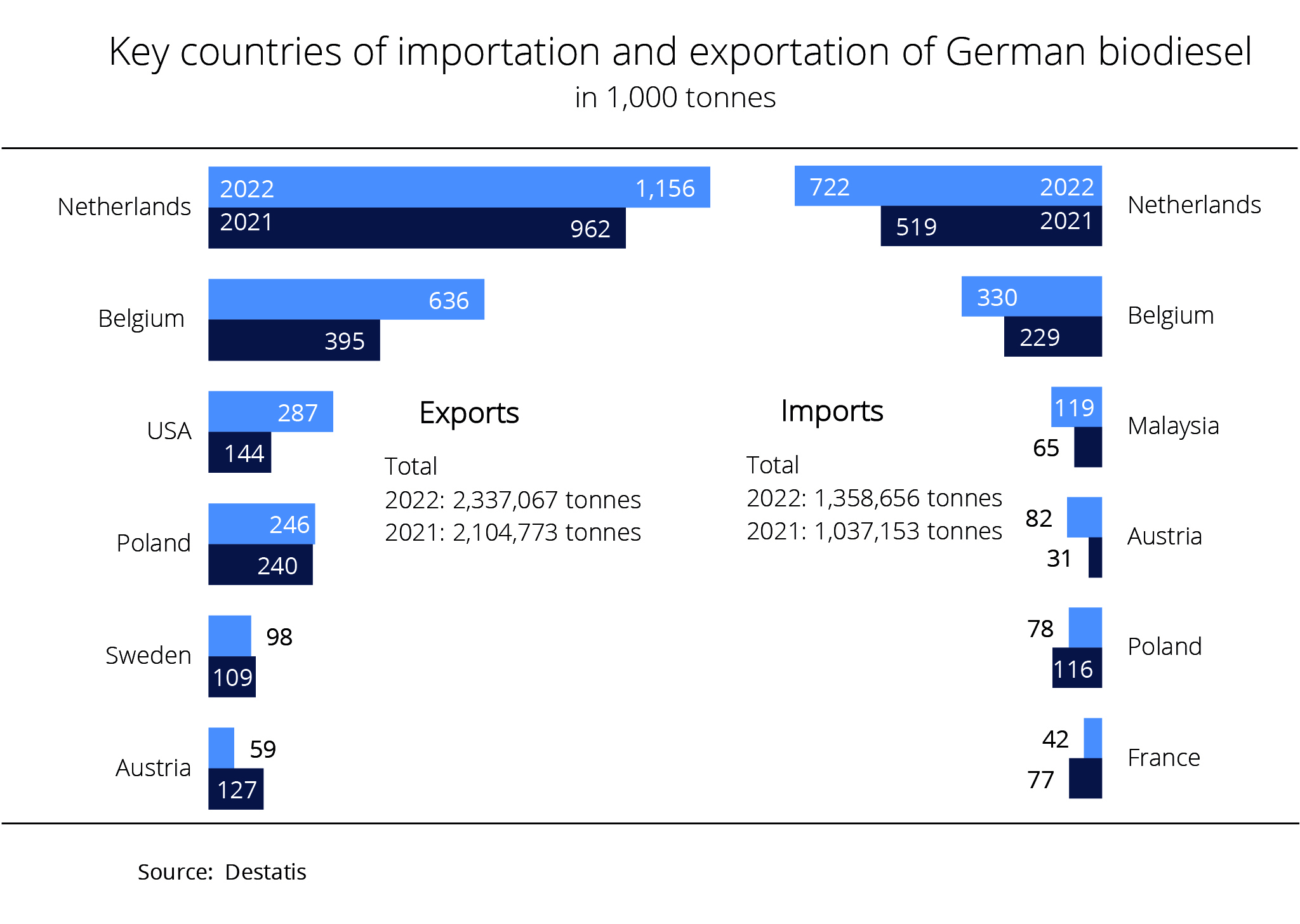

Biodiesel exports reached record high

UFOP: competition for GHG efficiency is driving RME exports

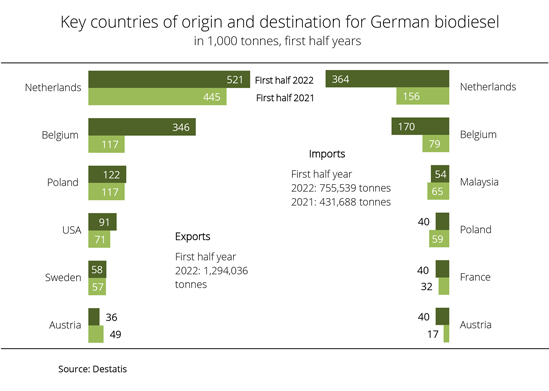

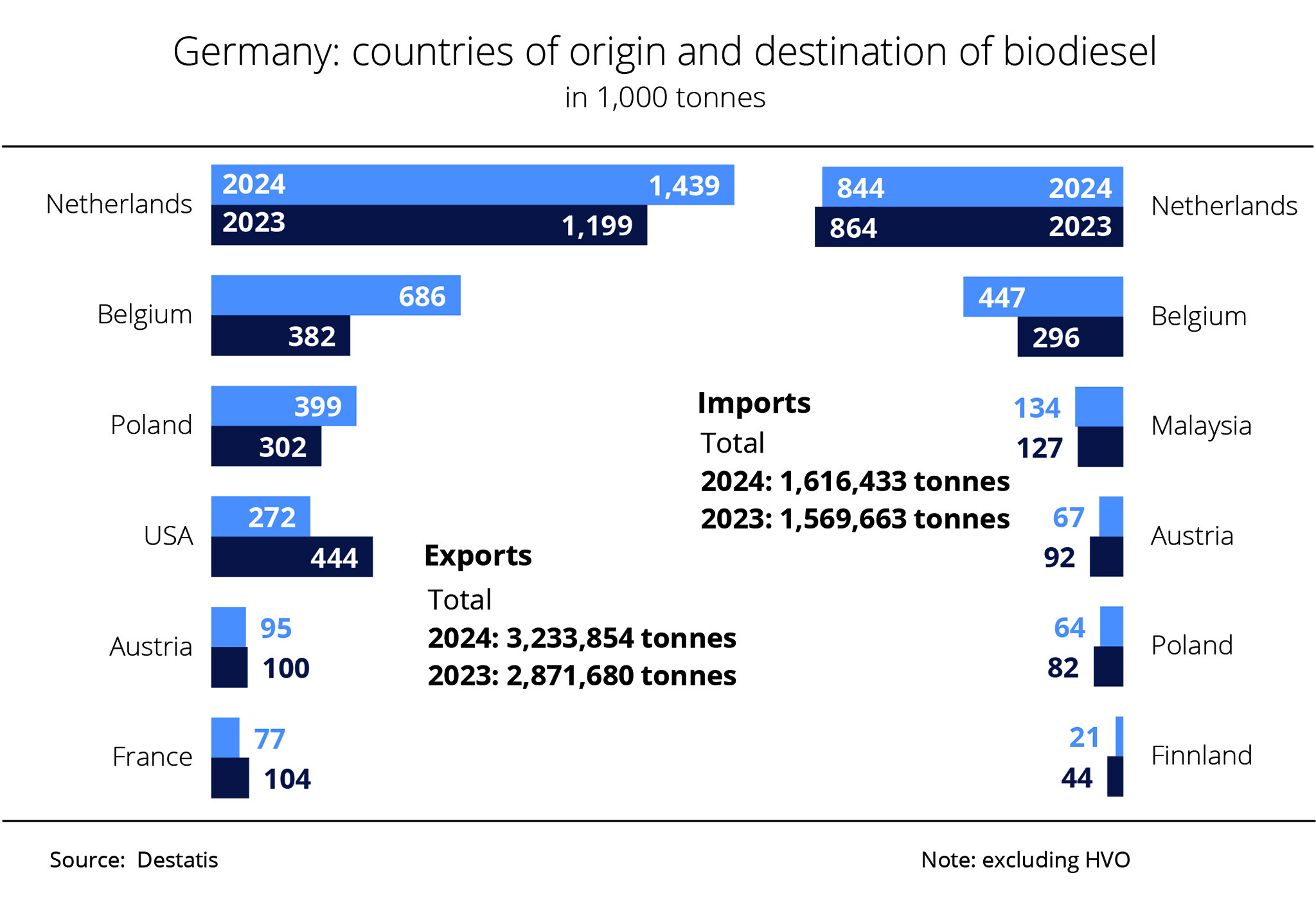

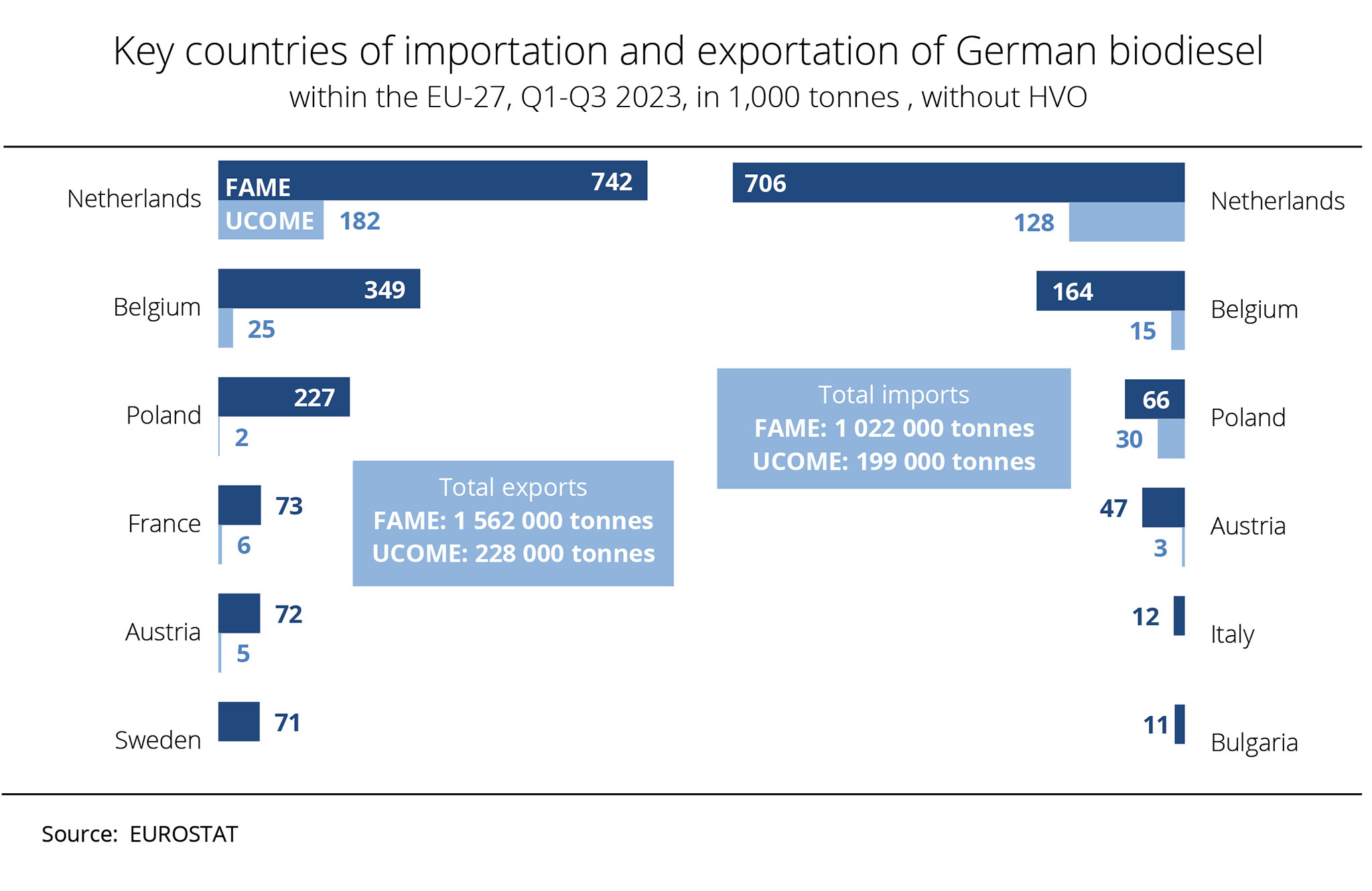

Biodiesel exports from Germany rose for the third consecutive year in 2024, exceeding imports by approximately 1.61 million tonnes. According to information published by the German Federal Statistical Office, they hit a new record of around 3.2 million tonnes. The Netherlands, where Rotterdam serves as the most important hub for world trade in biofuels, remained by far Germany's key trading partner for biodiesel, with shipments increasing 20 per cent year-on-year to just over 1.4 million tonnes.

Exports to Belgium increased 80 per cent to 638,300 tonnes, making Belgium the second largest recipient of German biodiesel. By contrast, exports to the US declined 40 per cent to 271,900 tonnes. According to research by Agrarmarkt Informations-Gesellschaft (mbH), Germany imported 1.6 million tonnes of biodiesel, a decrease of around 3 per cent compared to 2023. The largest volumes came from the Netherlands, Belgium, Malaysia and Austria. Notably, imports from Belgium rose 51 per cent (approximately 151,000 tonnes) to 447,400 tonnes. Imports from Malaysia increased just under 6 per cent. Most of the allegedly fraudulent imports from China obviously also came via Rotterdam in 2024, as data from the German Federal Statistical Office indicate that China itself delivered only 4,000 tonnes directly to Germany.

According to the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP), the German GHG quota policy, the associated competition for GHG efficiency and, in particular, the double counting of biodiesel based on certain waste oils are the main factors driving this trend, which is characterised by a displacement or shift of commodity flows. With regard to fuels in consumers' vehicle tanks the short formula is RME in – UCOME out. The physical threshold for replaceability is set by the diesel (B7) standard, which specifies that HVO must be added when the maximum of 7 per cent by volume is reached. The UFOP has explained that given the rising greenhouse gas reduction obligations and continuing decline in diesel consumption, HVO is currently the only alternative in the diesel market.

In light of the absence of a strategy to increase biodiesel consumption in Germany – despite the country's failure to meet climate protection targets in the transport sector –, the UFOP has pointed out that Germany once again exported a considerable GHG reduction potential in the transport sector last year, namely 1.61 million tonnes of RME. Carriers increasingly owe the duty to their customers to provide proof of their contributions to mitigating climate change. The association has stressed that the switch to pure biodiesel can be implemented immediately and is also the most cost-effective option.

Chart of the week (08 2025)

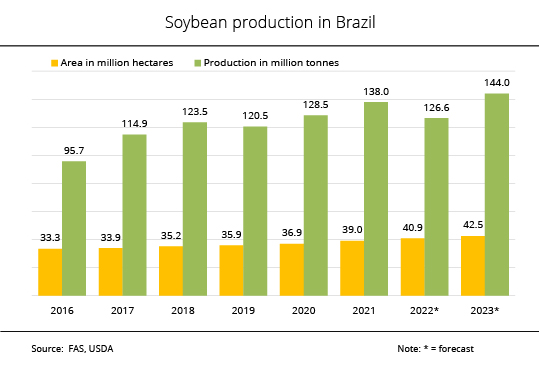

Brazilian soybean harvest set to hit another record high - UFOP: Will the EUDR be able to stop the expansion of soybean area?

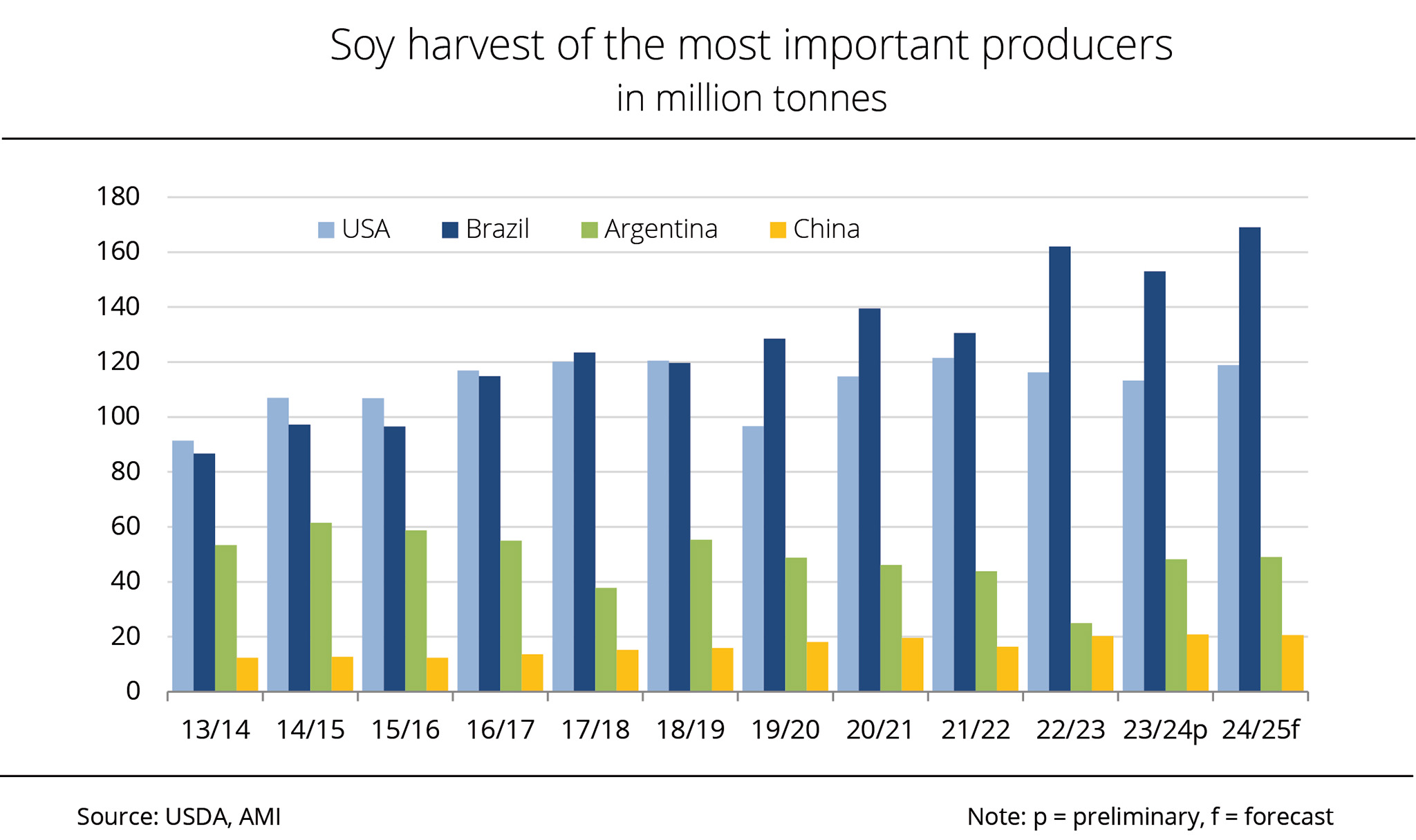

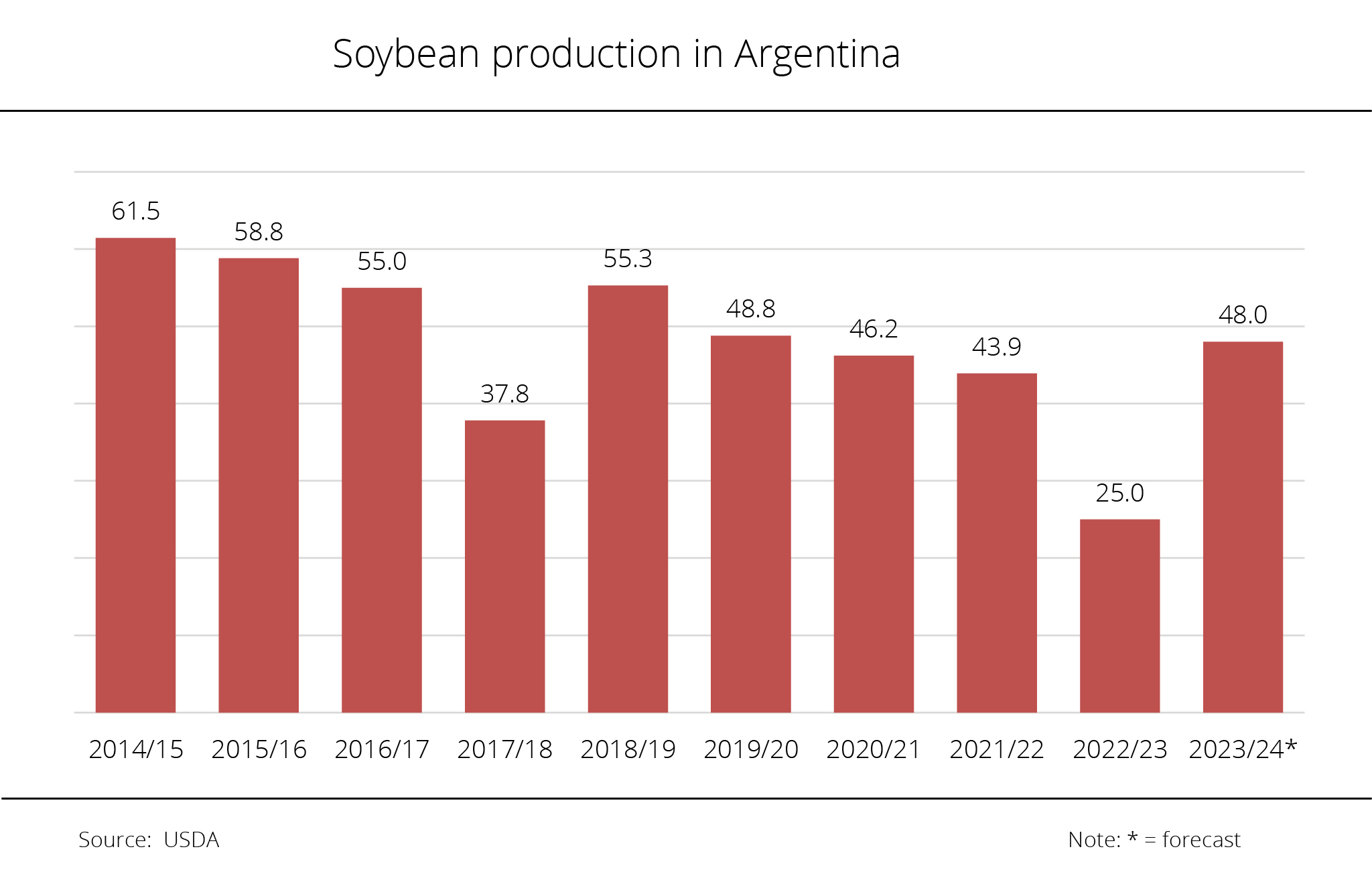

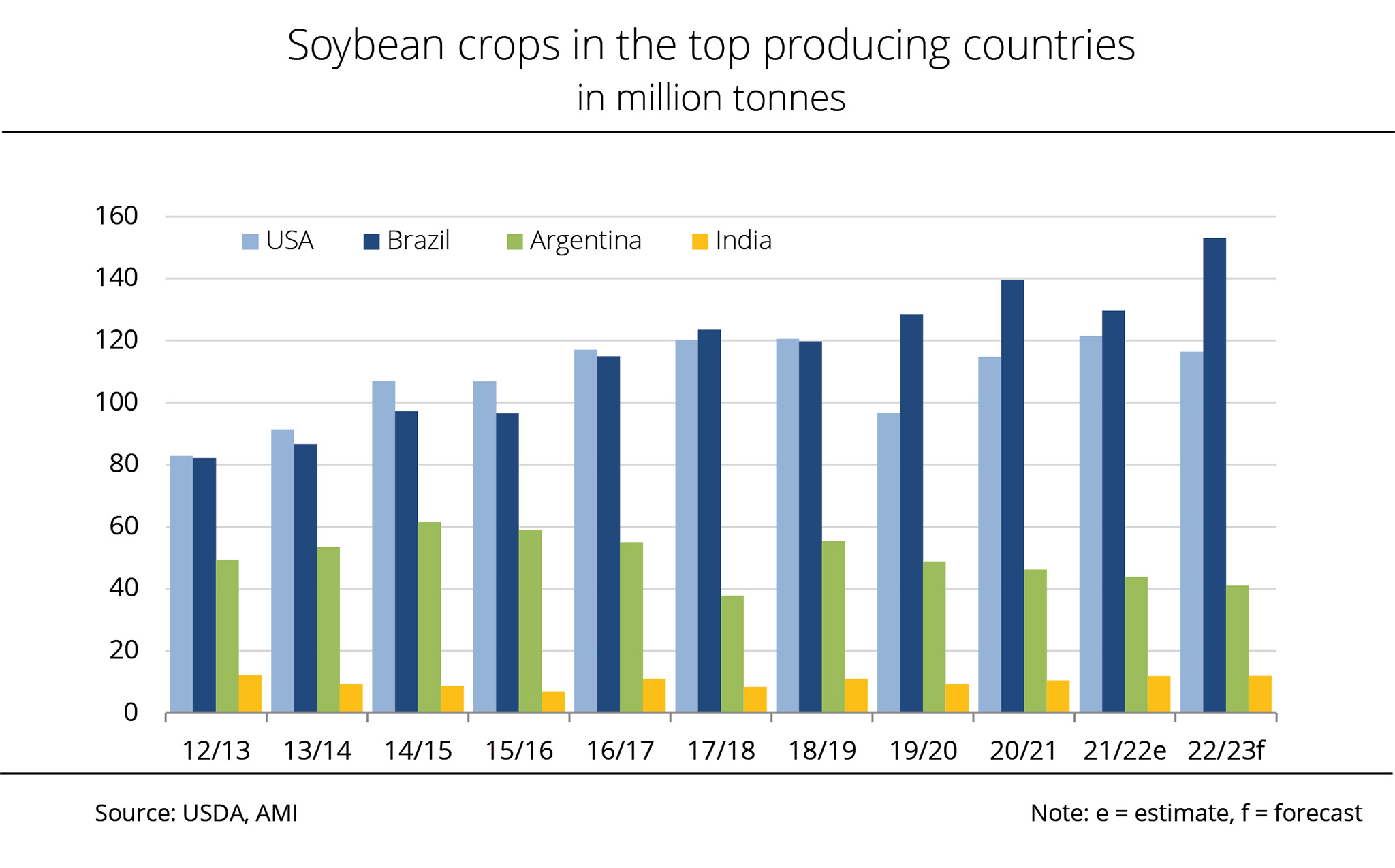

Brazil and Argentina continue to consolidate their shares in the global soybean market this marketing year, with Brazil expecting another bumper crop.

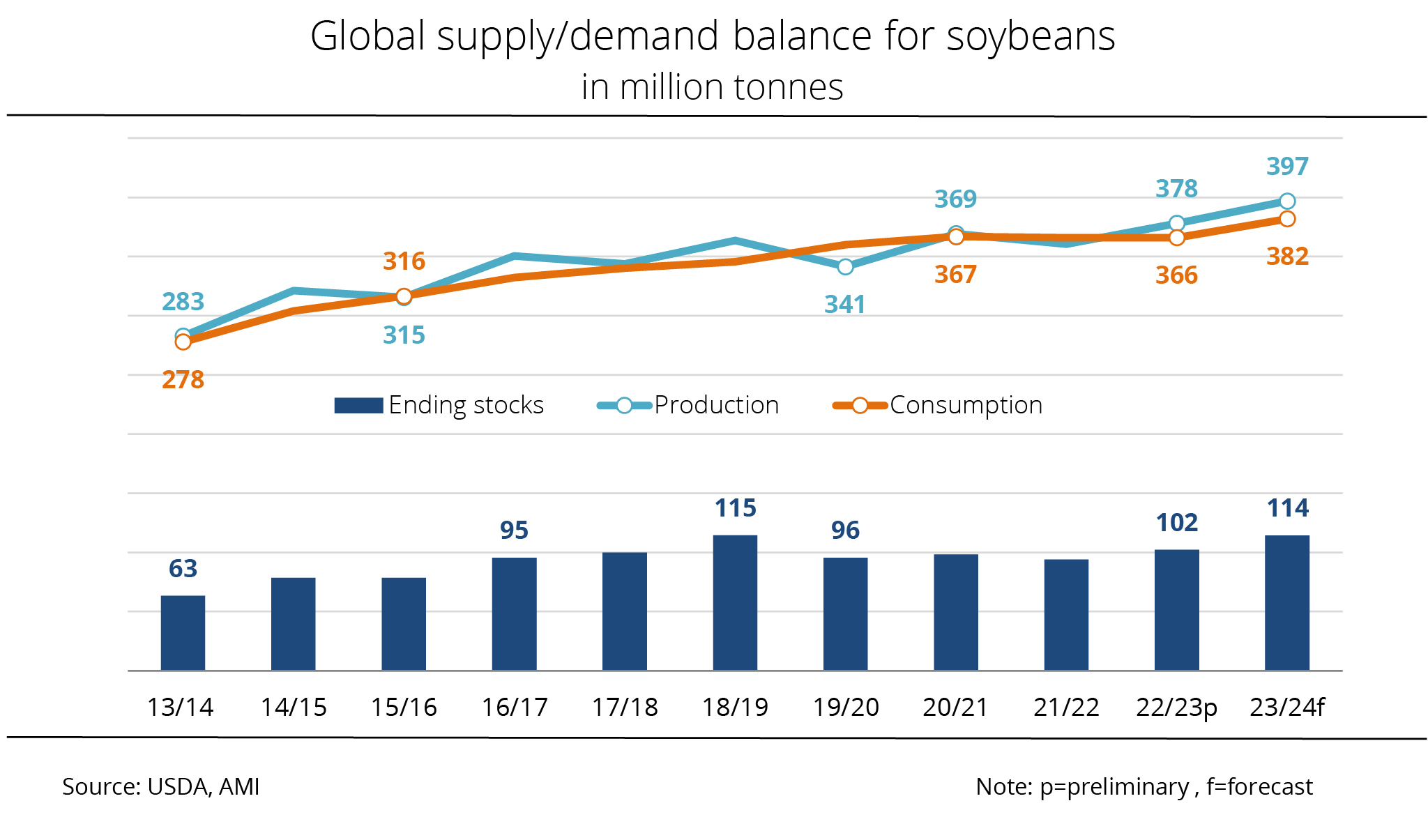

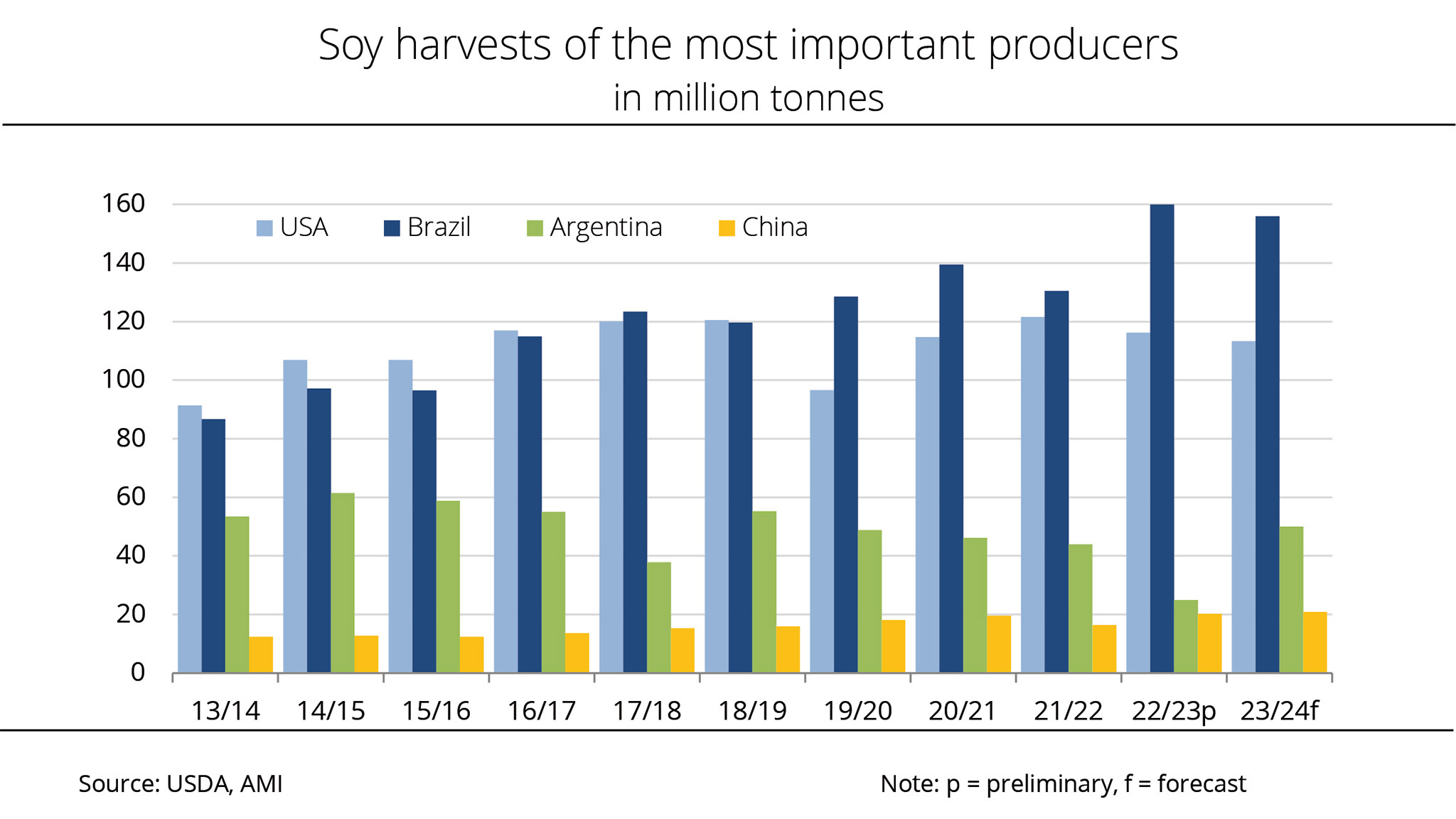

Brazil, the US and Argentina are the world's main producers of soybeans, collectively accounting for 80 per cent of global production. China follows a long way behind with a market share of 5 per cent. According to estimates from the US Department of Agriculture (USDA), Brazil is set to harvest a record volume of around 169 million tonnes of soybeans in the current crop year. This figure compares to 153 million tonnes a year earlier. Based on a 1.3 million hectare expansion in soybean area to 47.4 million hectares, Brazil consolidates its position as the world's number one soybean producer ahead of the US. The Brazilian soybean harvest is currently in full swing. As of 7 February 2025, the harvest was approximately 15.1 per cent complete, the long-standing average for the same date being 18.4 per cent. Yields have previously been reported as more than satisfactory. In the US, the soybean harvest was already complete by the end of the year 2024, totalling around 118.8 million tonnes. This translates to an almost 5.6 million tonne increase over the previous year and is presumably the largest crop in three years.

Argentina, which ranks third among the world's most important producers, is also projected to see a slightly larger harvest compared to the previous year. According to research by Agrarmarkt Informations-Gesellschaft (mbH) the country is expected to harvest 49 million tonnes, around 790,000 tonnes more than the previous year. In contrast, latest USDA estimates indicate that China's harvest will decline around 190,000 tonnes from the past year, falling to 20.7 million tonnes.

In view of the unabated rise in Brazil's soybean area, the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has questioned the potential regulatory effect of the EU Deforestation Regulation (EUDR). The UFOP fears that the soybean marketing chain from Brazil will be split into two streams – one flowing to the European Union, with proof of land use as of January 2020, and another serving Brazil's primary soybean market China. According to information published by Statista, China imported approximately 106 million tonnes of soybeans in 2023. With an average yield of approximately 3.3 tonnes per hectare, this translates to a land area requirement of approximately 32 million hectares. For comparison: Ukraine's total cropland extends over 33 million hectares. In view of the extension of the implementation period of the EUDR until the end of 2025, the UFOP has said that it remains to be seen whether the EUDR and companies' voluntary commitment to protect primeval forests will create a positive impact on the environment, adding that the effectiveness of such measures will be limited unless rules are agreed to protect primeval forests and biodiversity across all global commodity flows.

Chart of the week (07 2025)

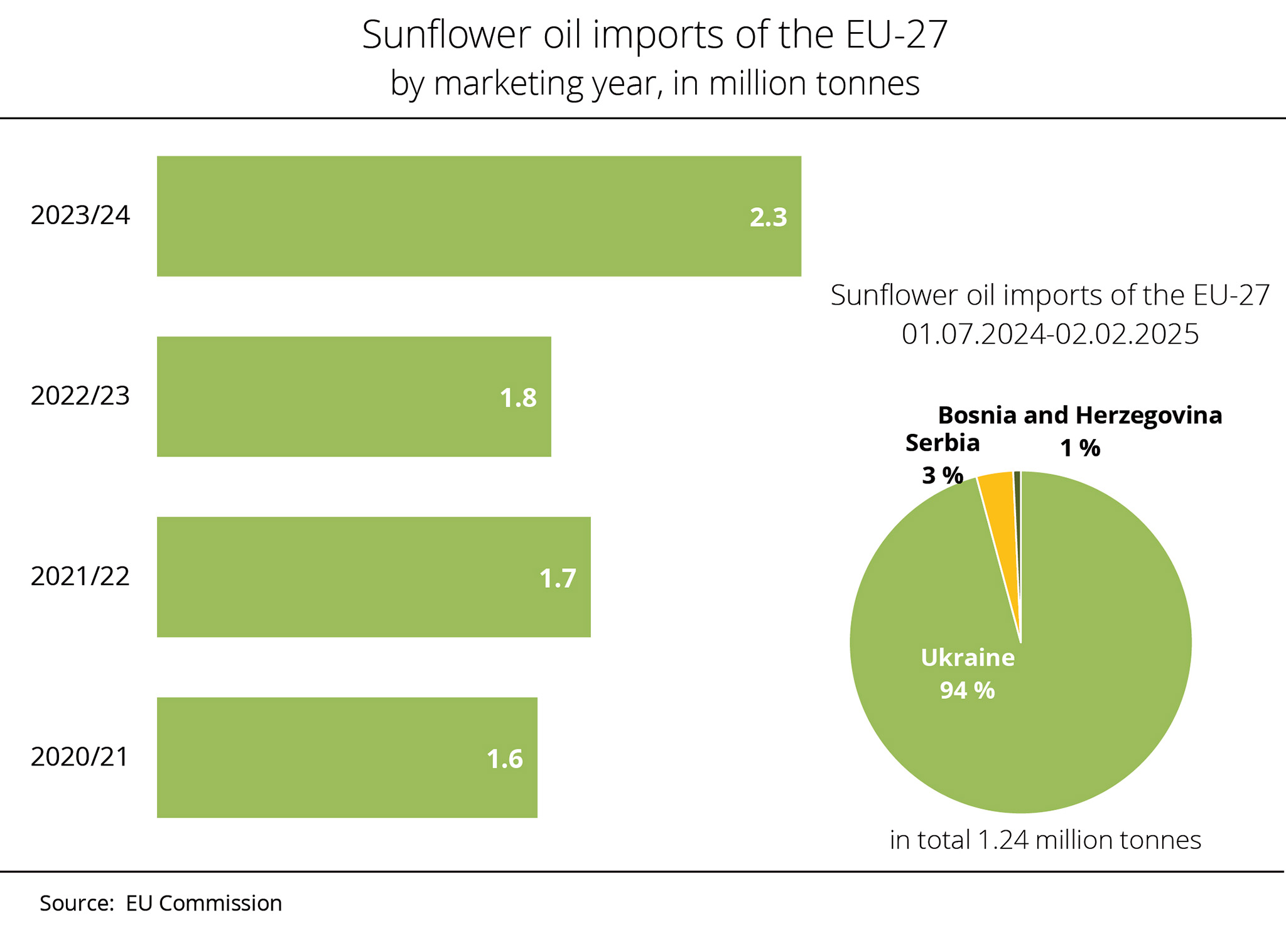

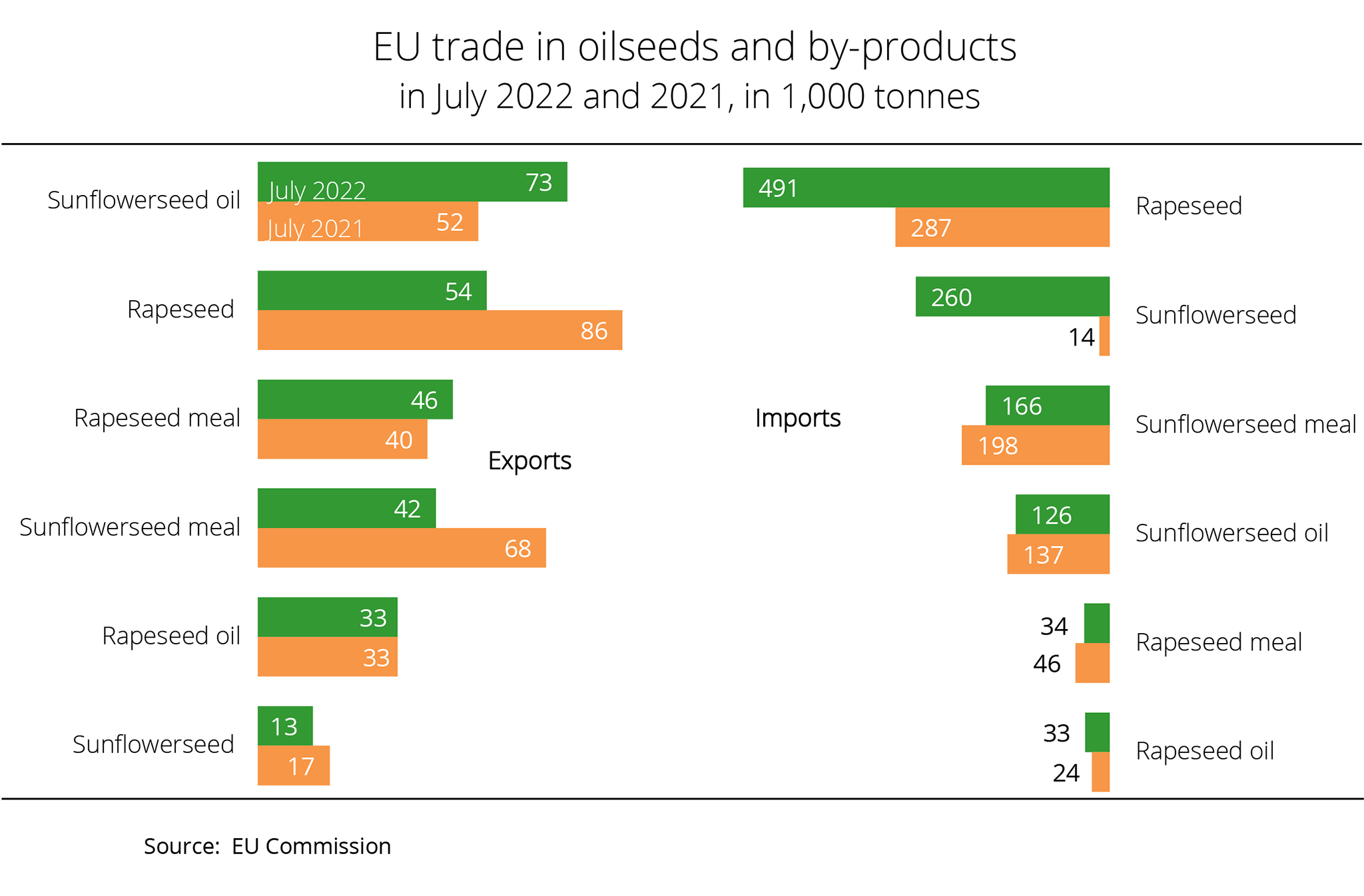

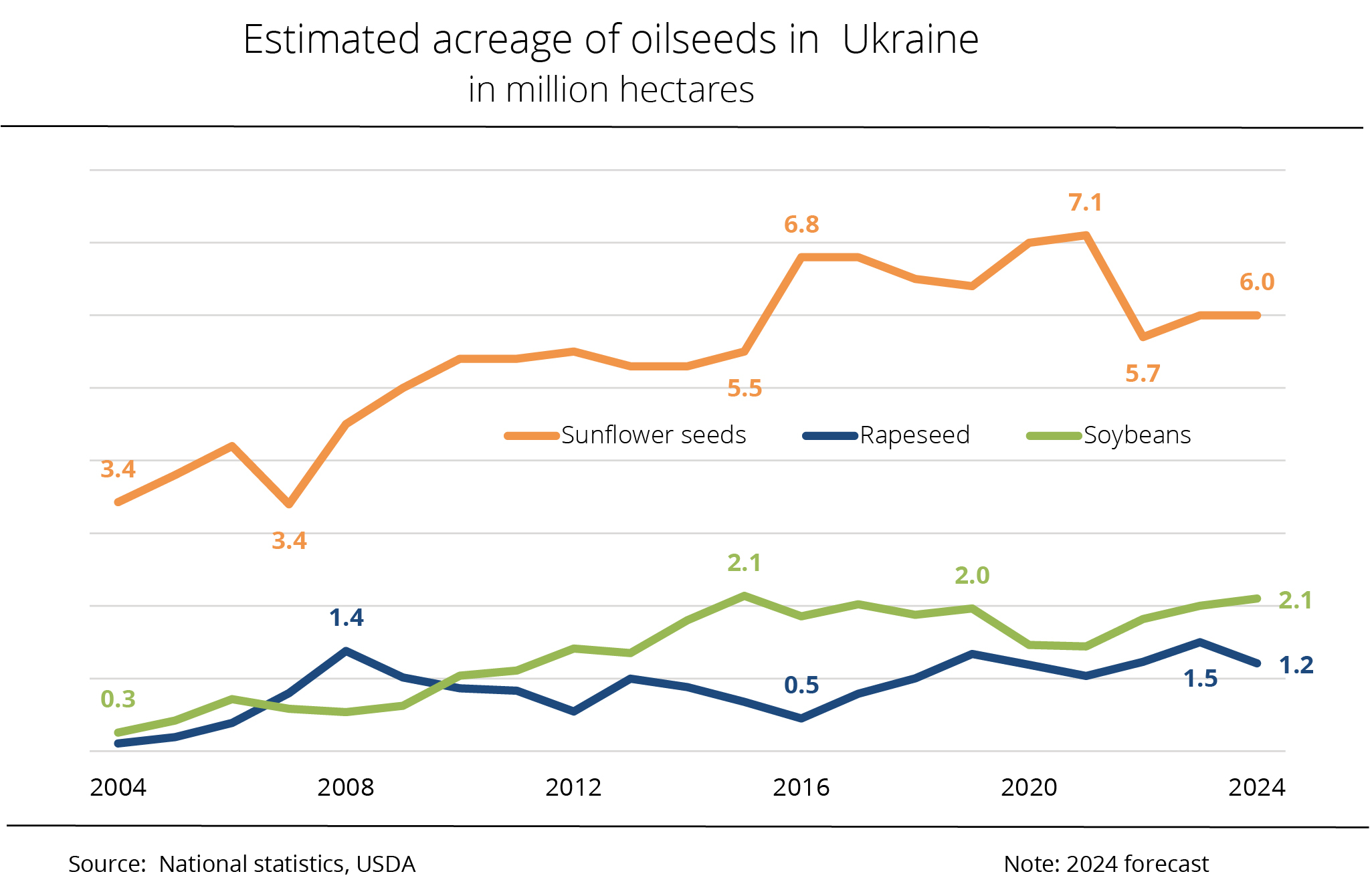

Ukraine covers bulk of EU sunflower seed oil imports

Figures published by the EU Commission show that Ukraine remains by far the largest supplier of sunflower seed oil to the EU-27, despite a Ukrainian decline in feedstock supply compared to the previous year.

From 1 July 2024 to 2 February 2025, the EU- 27 imported around 1.24 million tonnes of sunflower seed oil, which was significantly less than the 1.51 million tonnes imported during the same period the previous year, but more than the 1.13 million tonnes recorded in the 2022/23 marketing season. However, imports slowed down substantially in recent weeks, with weekly import volumes falling from nearly 59.000 tonnes in December to just under 25,000 tonnes at the beginning of February.

Ukraine is the by far leading country of origin, delivering 1.17 million tonnes of sunflower seed oil to the EU so far this season. According to research by Agrarmarkt Informations-Gesellschaft (mbH), this translates to a market share of 94 per cent. However, the volume is nevertheless lower than the 1.40 million tonnes supplied during the same period the previous year. The decline is due to the significant drop in feedstock supply in the running season, which has reduced processing and limited Ukraine's sunflower seed oil export potential. Serbia and Bosnia are the second and third most important suppliers, holding market shares of 3 per cent and just under 1 per cent respectively. However, their exports also remained short of the previous year's levels.

Chart of the week (06 2025)

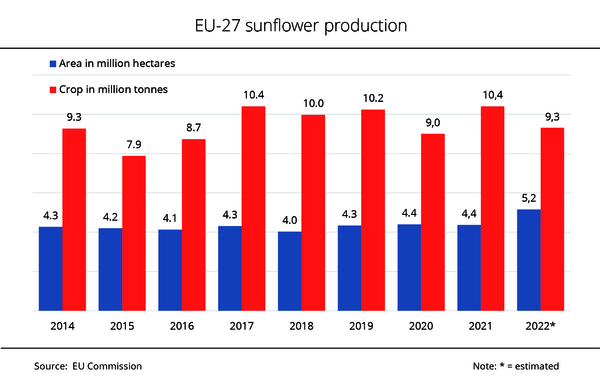

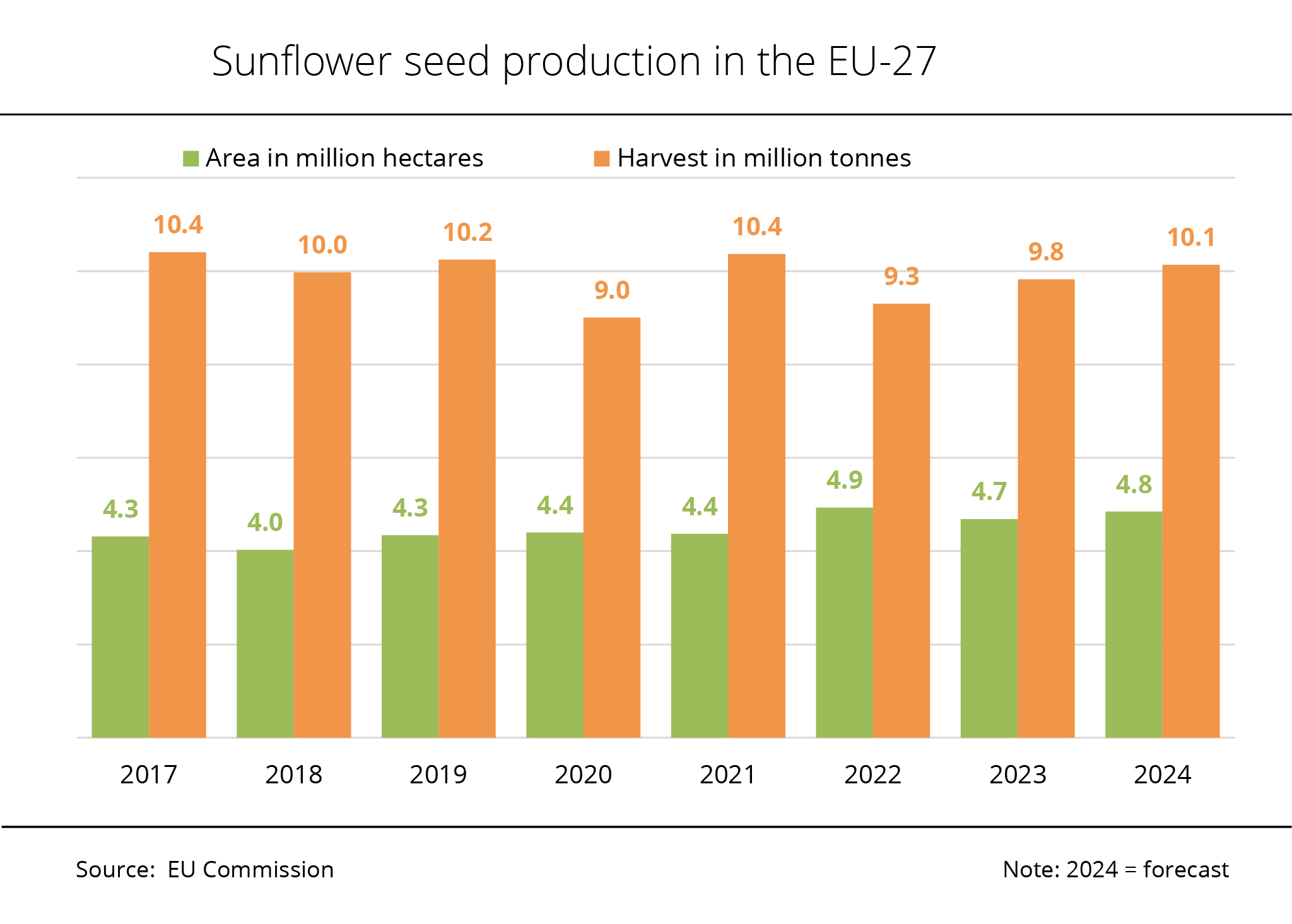

Hungary becomes the EU's top sunflower seed producer for the first time

The EU Commission slightly lowered its forecast of sunflower seed output in its February estimate for the 2024 oilseed harvest.

According to recent information by the EU Commission, the 2024 EU sunflower seed harvest is seen to total around 8.0 million tonnes, 7,000 tonnes less than expected at the end of December. The revision increases the year-on-year decline to 18 per cent, as unfavourable weather conditions throughout the year significantly curtailed yield potential. The harvest also falls 18 per cent short of the long-term average, representing the EU's smallest sunflower seed harvest since 2015.

The downward revision is mainly due to the smaller crop in Germany. The Commission now forecasts German production at 127,000 tonnes, 7,000 tonnes below the December estimate. This represents a 25 per cent drop from 2023, but remains just about 20 per cent above the five-year average. Many farmers had expanded sunflower cultivation significantly in 2022 following the start of the war in Ukraine and the sharp rise in producer prices, but scaled back production the following year.

The harvest in Romania also declined compared to 2023, falling 38 per cent to 1.2 million tonnes. Despite a record area planted with sunflower seed, this would represent the country's smallest harvest in fifteen years. As a result, Romania lost its top position as the EU's largest producer, dropping to the fourth place. In contrast, Hungary climbed to first place for the first time, harvesting 1.7 million tonnes despite a presumed 13 per cent decline from the previous year. In France, crop development and harvest operations were severely impacted by persistent rainfall, according to research by Agrarmarkt Informations-Gesellschaft (mbH). With 1.7. million tonnes currently projected, France ranks second largest producer within the Community despite an 18 per cent decrease compared to the previous year.

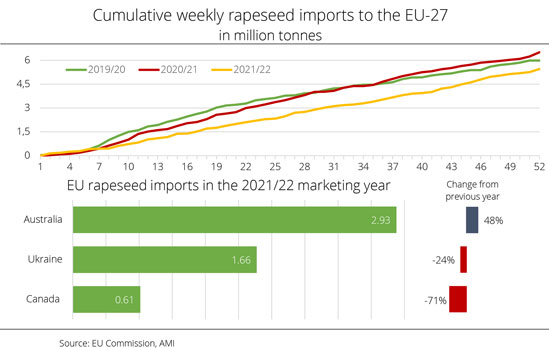

Chart of the week (05 2025)

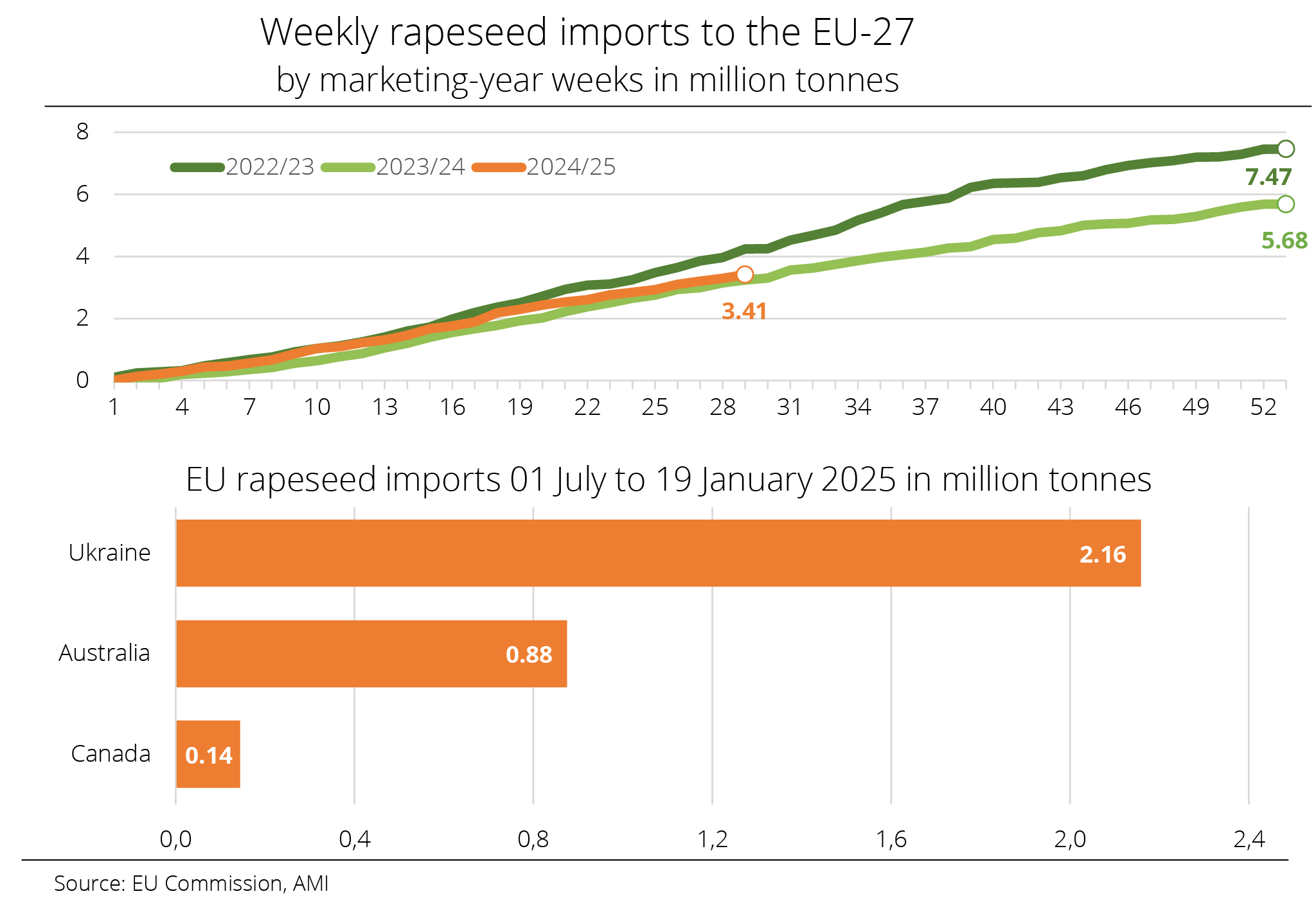

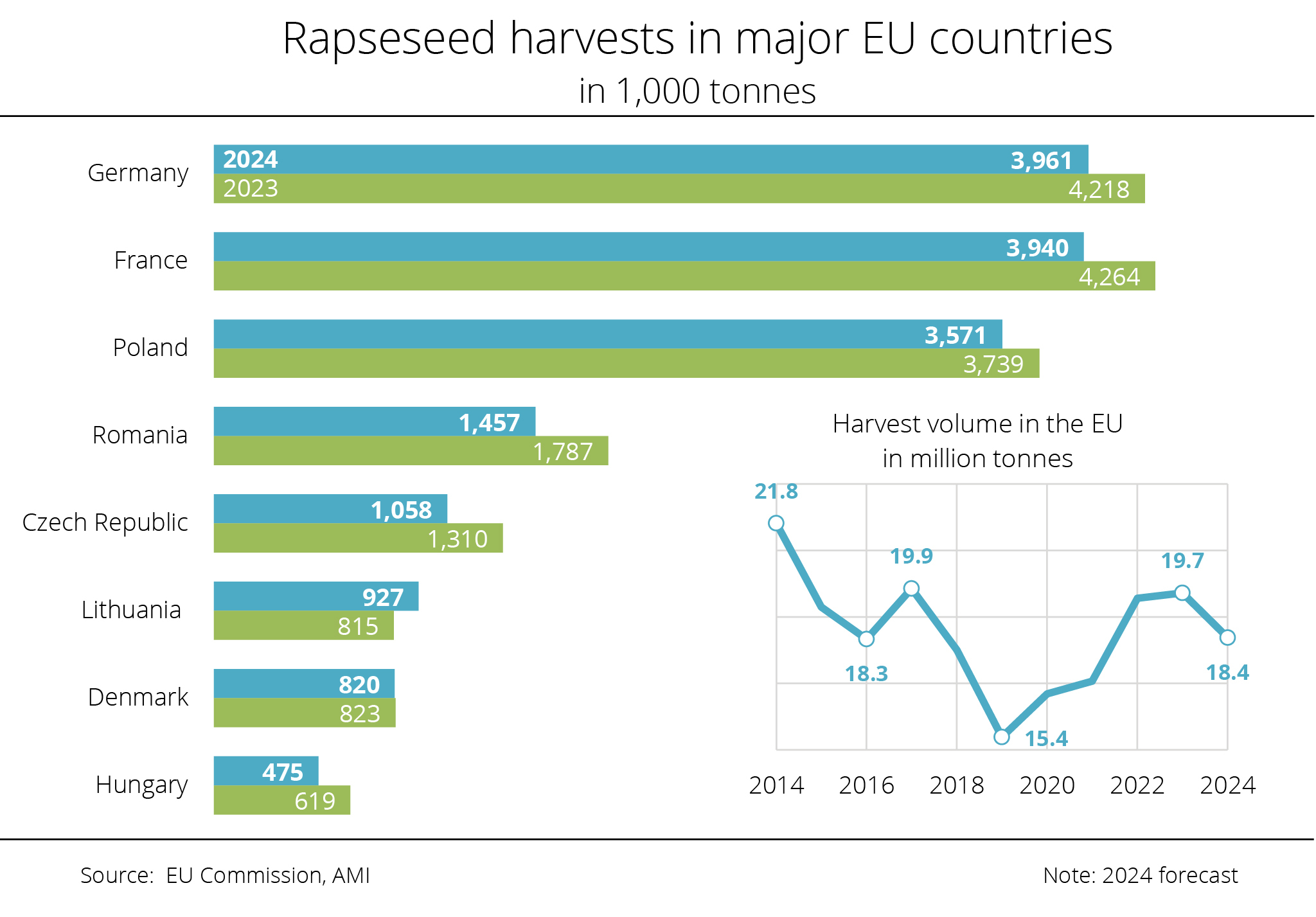

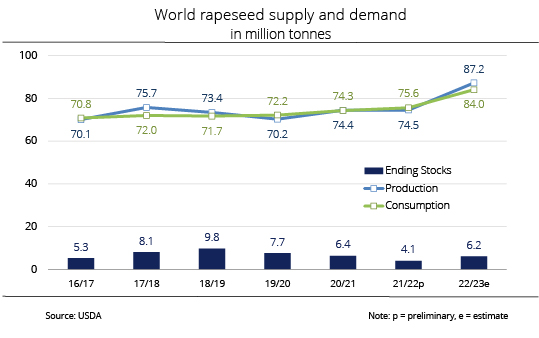

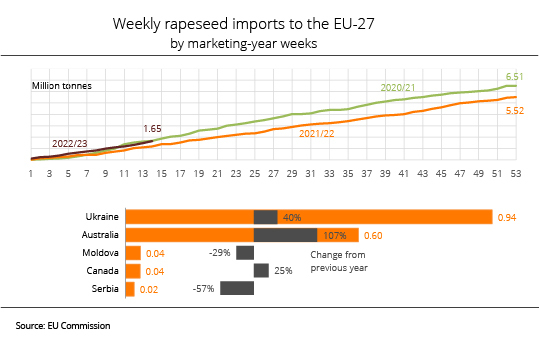

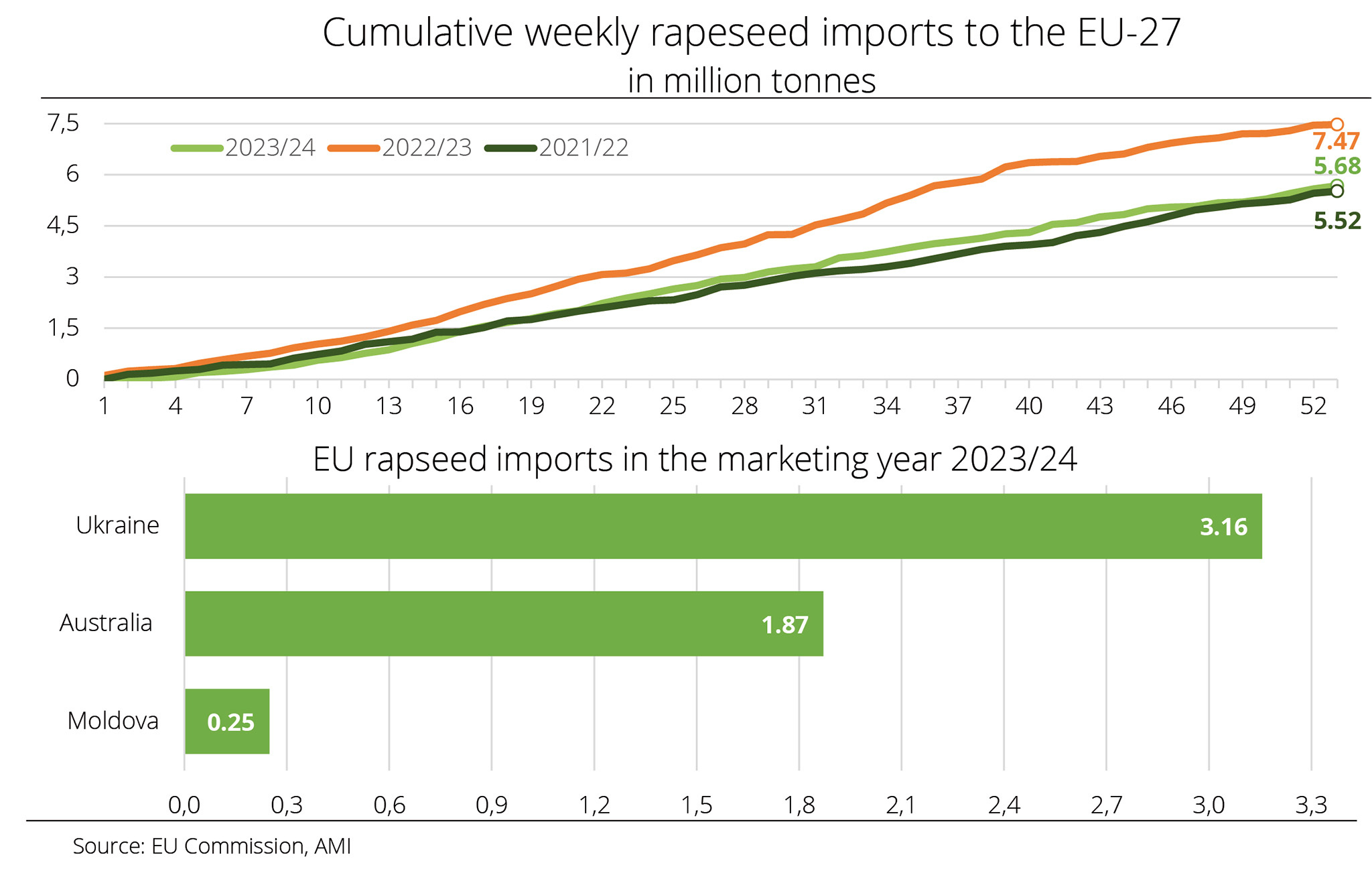

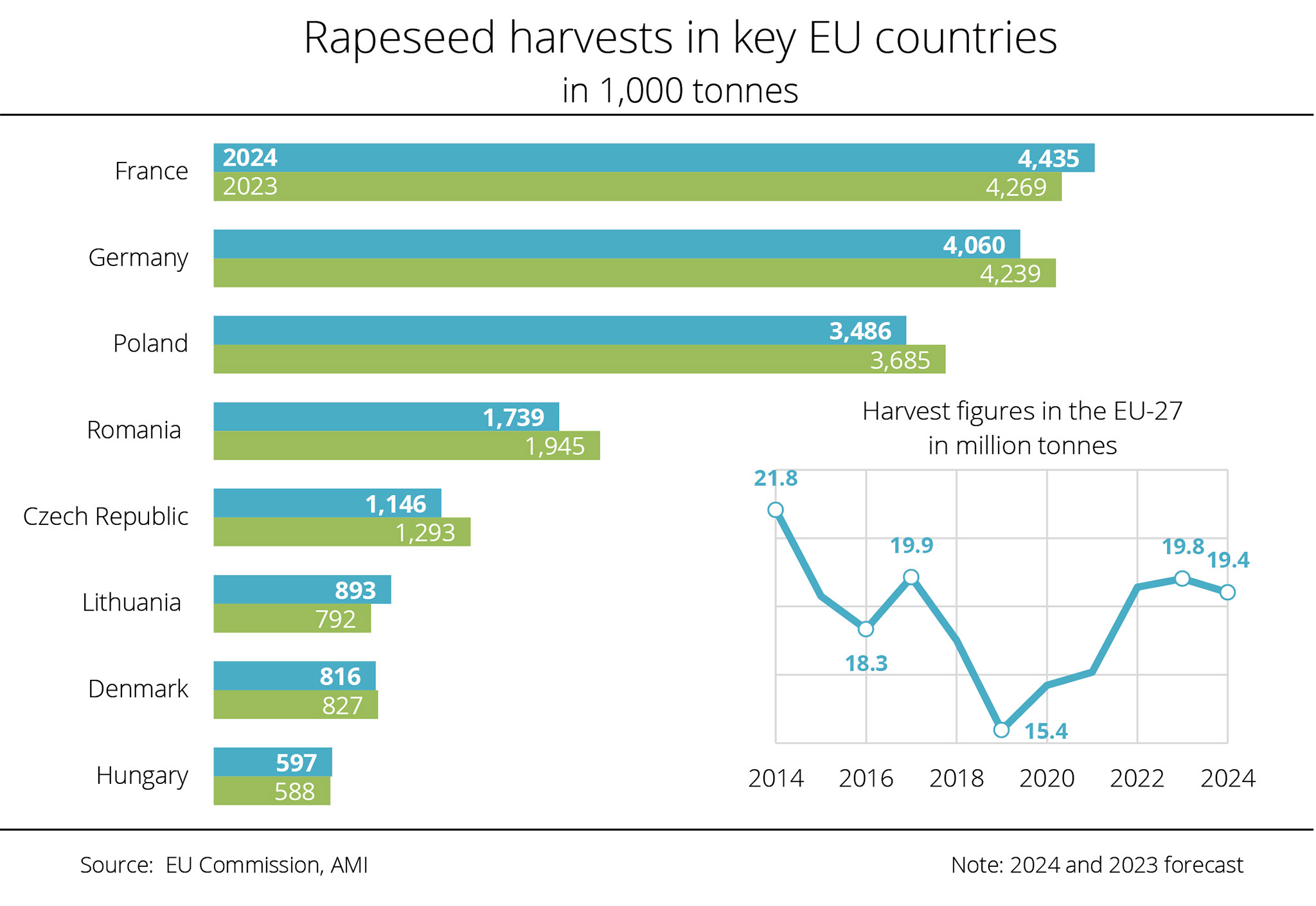

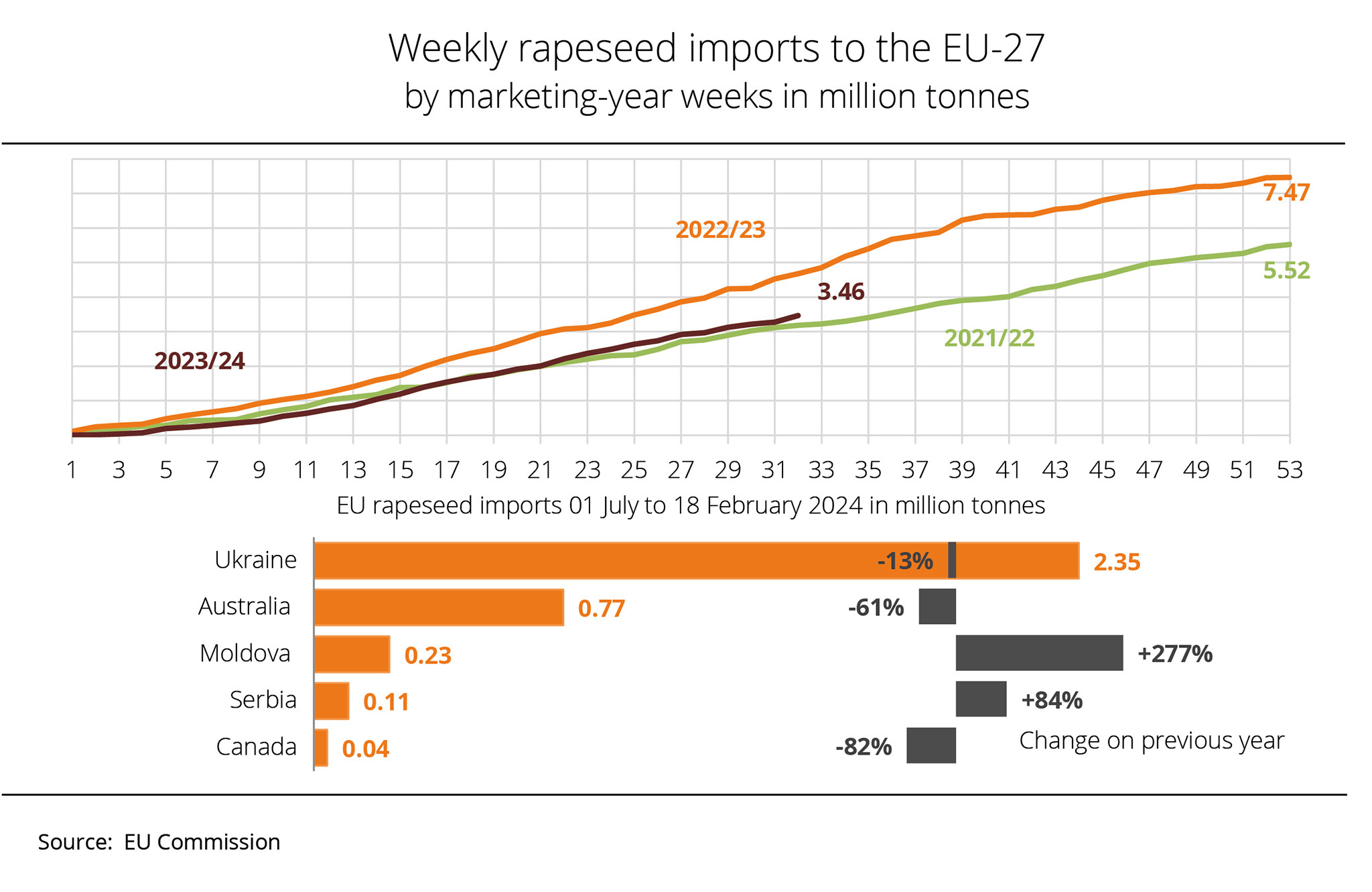

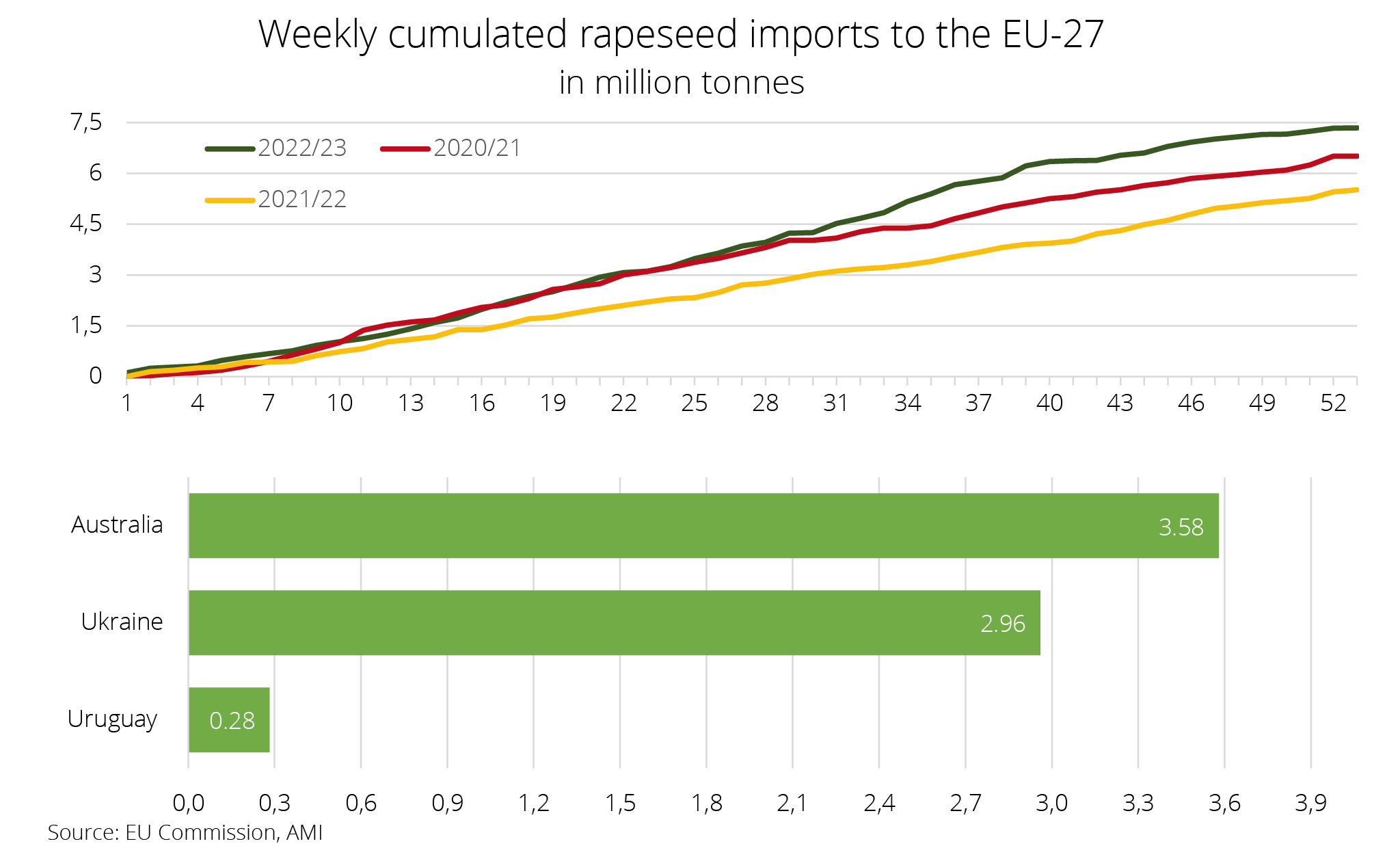

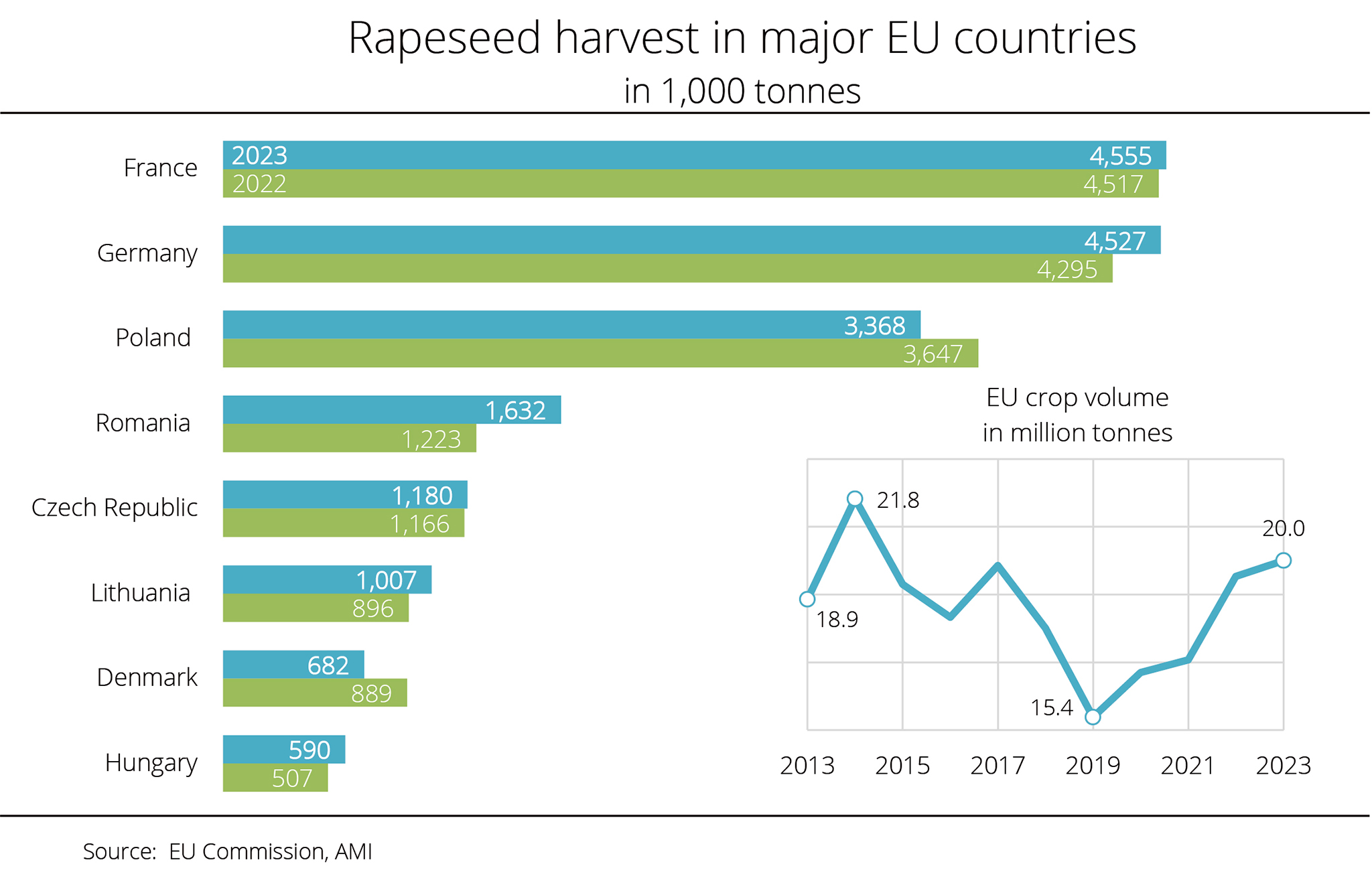

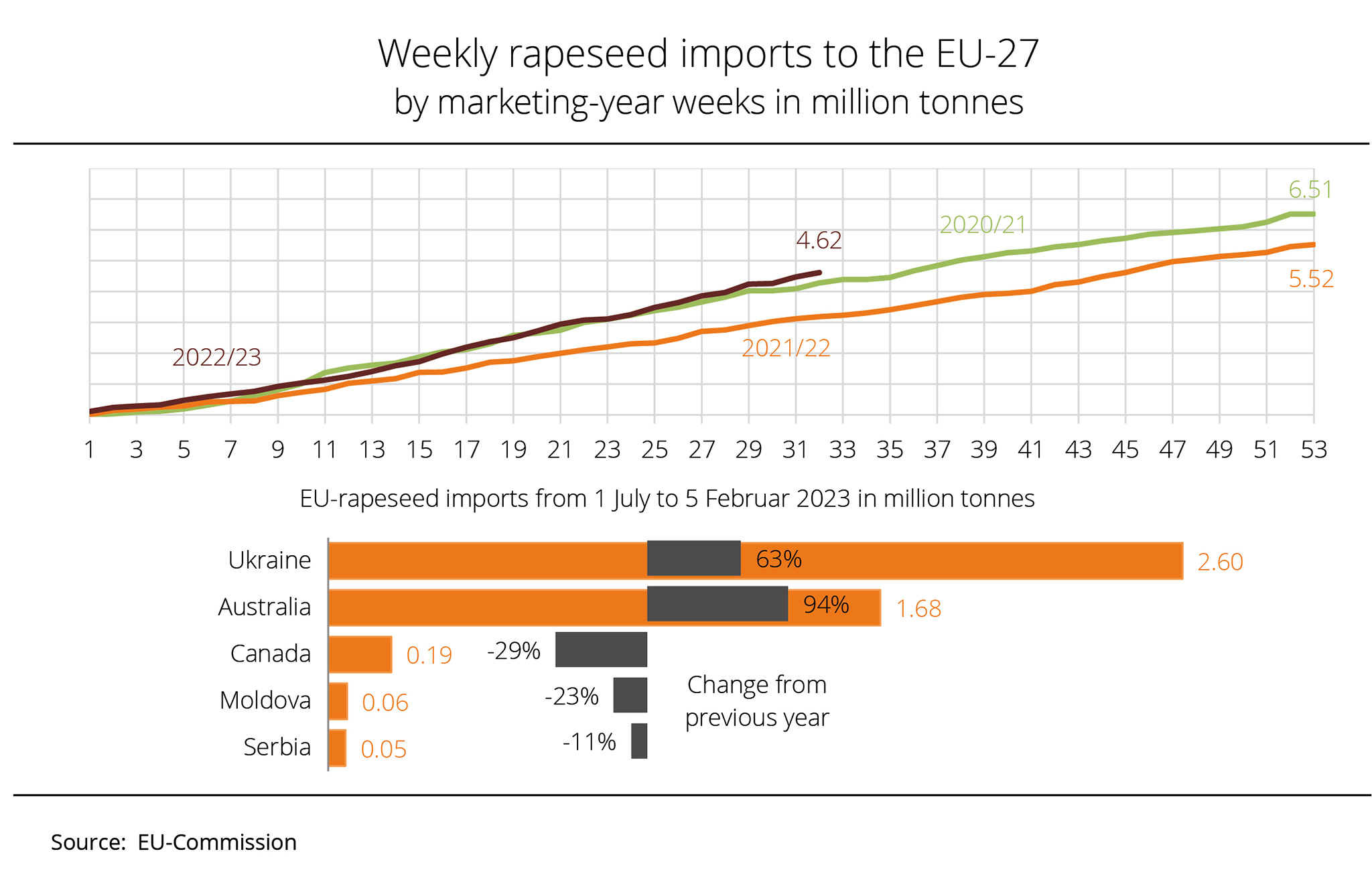

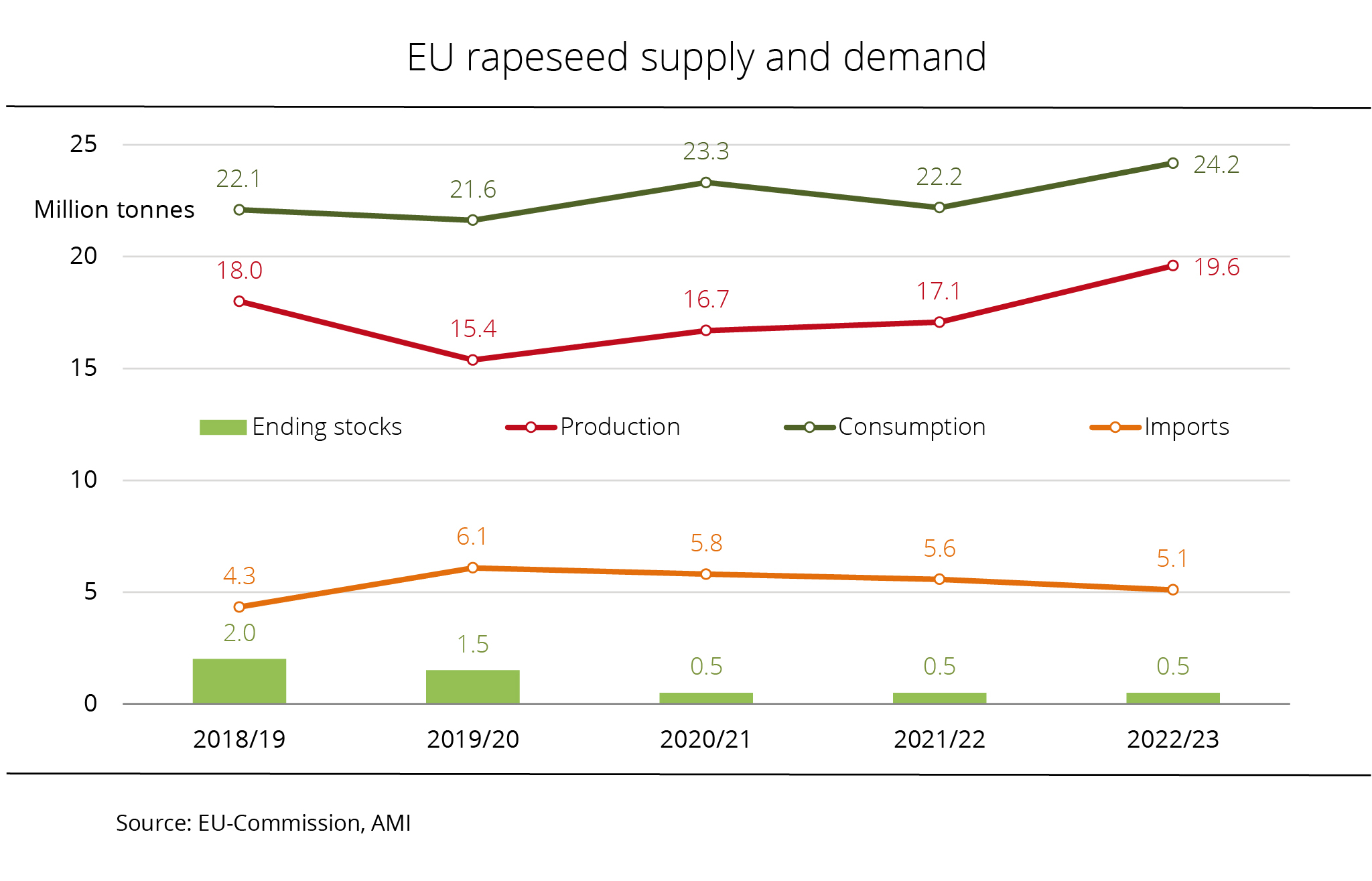

Higher demand for rapeseed imports due to smaller EU harvest

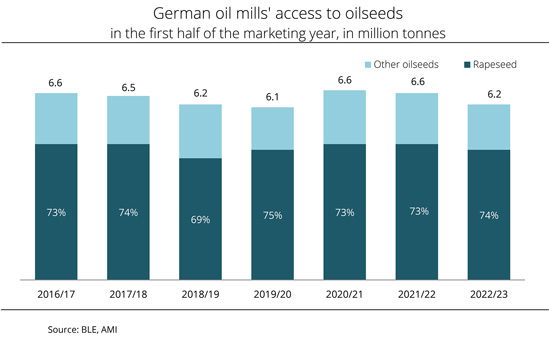

The EU Commission significantly lowered expectations concerning the European 2024 rapeseed harvest at the end of last year, reducing its forecast to approximately 17.2 million tonnes. Given the smaller crop and an expected rapeseed processing volume of about 23 million tonnes, this means that the EU will rely more on imports. Most imports go to German oil mills, which have a processing capacity of approximately 10 million tonnes of rapeseed. Whereas Ukraine was the most important rapeseed source in the first half of the crop year, Canada and Australia moved into focus towards the turn of the year.

Between the beginning of the 2024/25 crop year and 19 January 2025, EU rapeseed imports totalled 3.4 million tonnes, representing an increase of just over 5 per cent over the previous year. Accounting for 63 per cent of EU imports, Ukraine remains the key country of origin, as in previous years, seeing a slight rise in deliveries from 2.1 million tonnes the previous year to 2.2 million tonnes. The second wave of imports from Australia will increasingly move into focus in the second half of the crop year. By mid-January, Australia had already placed 875,000 tonnes of rapeseed on the EU market. According to research by Agrarmarkt Informations-Gesellschaft (mbH), this represents an around 19 per cent rise on the previous year's reference period. Accounting for almost 26 per cent of EU rapeseed imports, Australia remains the second most important rapeseed supplier to the EU, followed by Canada with 144,000 tonnes. Canadian deliveries more than tripled compared to the previous year, if at a low level. Because Canadian farmers grow genetically modified varieties, the use of rapeseed oil derived from Canadian rapeseed is restricted in the EU. Imports are therefore mainly used for biofuel production. In contrast, Serbia and Moldova supplied only a fraction of the previous year’s volume.

Chart of the week (04 2025)

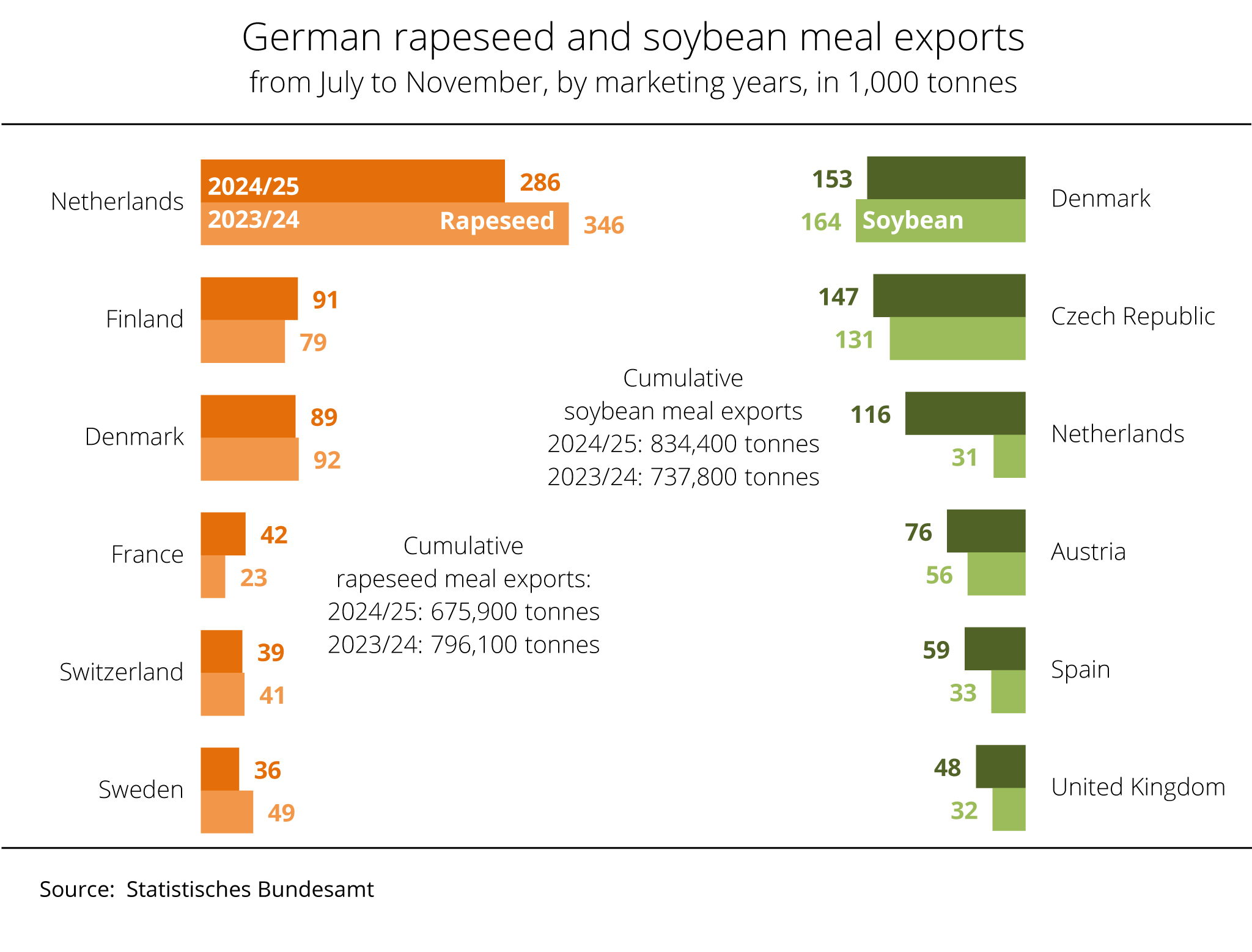

Germany exported more soybean meal and less rapeseed meal

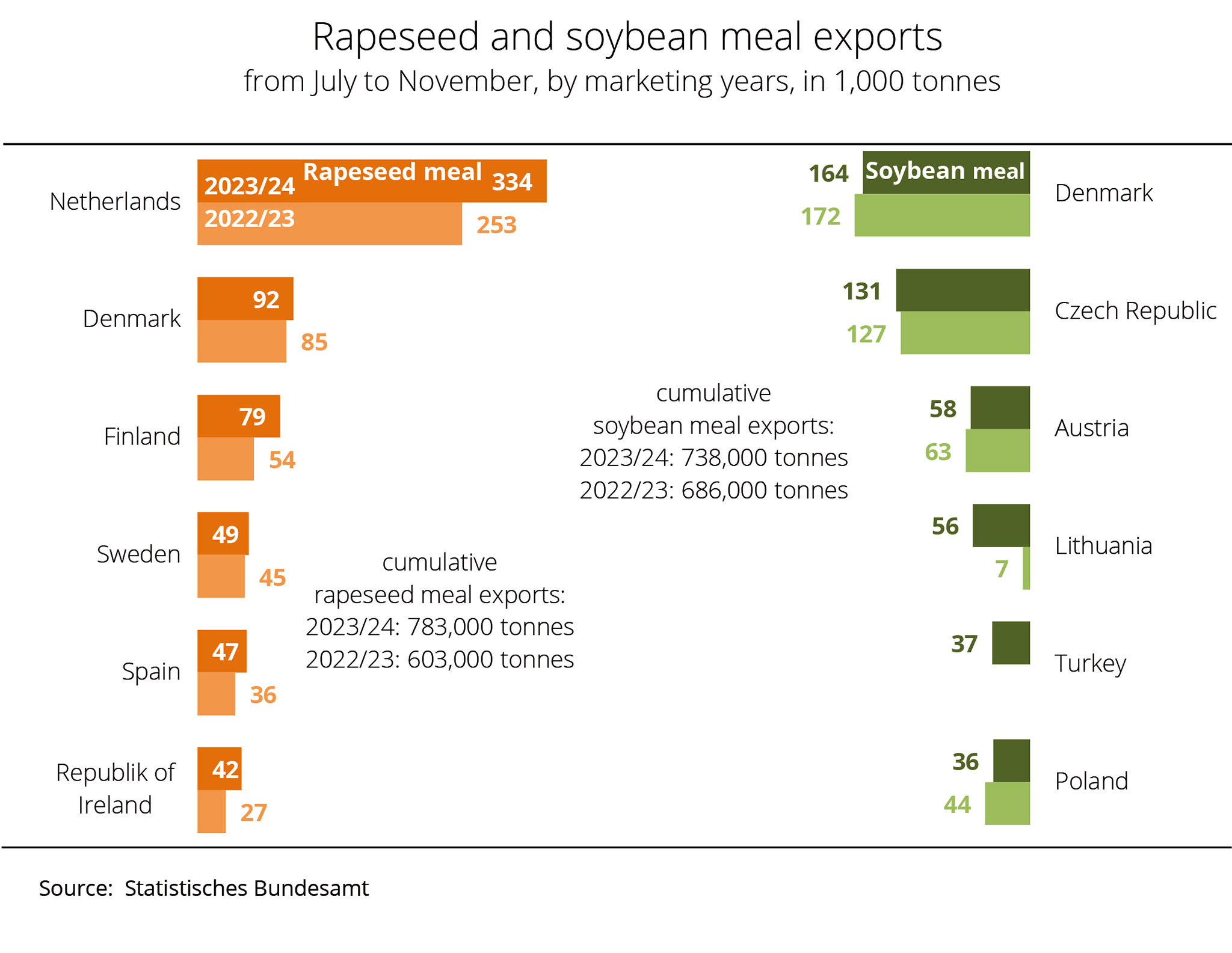

According to information from the German Federal Statistical Office, German oil mills increased their soybean exports 13 per cent to 834,000 tonnes in the period July to the end of November 2024 compared to the same period in 2023. At the same time, exports of rapeseed meal declined around 15 per cent to 675,900 tonnes.

According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), most rapeseed and soybean meal produced in Germany was exported to other EU countries. The ports in the Netherlands were the main recipients for global shipments, as they were in previous years. From July to November 2024, Germany sold around 285,800 tonnes of rapeseed meal to this neighbouring country, representing a 17 per cent decline from the same period the previous year. At around 89,200 tonnes, Denmark also received 3 per cent less, dropping down to third place among the most important recipients. Rapeseed meal exports to Sweden and Switzerland also remained below the previous year's levels. German deliveries to Finland rose around 16 per cent to 91,000 tonnes compared to the first five months of the 2023/24 marketing year. Notably, deliveries to France climbed around 81 per cent, reaching 42,000 tonnes.

The soybean meal produced also went mostly to EU countries. Denmark, one of the EU's leading producers of pork, is the largest market. Nevertheless, in the period from July to November 2024, Germany's deliveries of soybean meal dropped approximately 6 per cent to 153,200 tonnes compared to the same year-earlier period. In contrast, deliveries to the Netherlands jumped 31,000 tonnes to 116,000 tonnes.

Chart of the week (03 2025)

Price gap over wheat makes rapeseed production more attractive

Ex-farm prices of rapeseed climbed over the course of the year. By the end of 2024, they hovered around the mark of 500 EUR per tonne, a level not seen since the start of the war in Ukraine. Soft wheat moved up and down at the producer level throughout the year but did not exceed the previous year's level slightly until December. As a consequence, the price spread between rapeseed and soft wheat has grown continuously. Most recently, rapeseed fetched almost 2.5 times the price of wheat.

Ex-farm prices of rapeseed and soft wheat surged sharply over the past weeks. Futures market prices of rapeseed almost reached levels last recorded nearly three years ago when concerns over global supply were rising at the start of Russia's war of aggression against Ukraine. Despite ongoing volatility, the smaller supply from Europe, Canada and Australia in particular is currently supporting prices. Support has also come from the crude oil and soybean markets. Developments on the cash market were similar, even though producer prices were under pressure at the beginning of the year, falling back below the line of 500 EUR per tonne. Nevertheless, prices at the beginning of 2025 were almost EUR 100 per tonne higher than the previous year.

Producer prices of soft wheat fluctuated strongly throughout 2024, eventually climbing above the level of 200 EUR per tonne in December. This led to a price gap of around 7 EUR per tonne on the previous year. Early-year trading has been quite moderate with a wait-and-see approach prevailing. Processors are well supplied and are waiting out the current weakening trend for the moment. In any case, producers show little willingness to sell at the current price level.

The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has noted that a price gap in favour of rapeseed increases the crop's attractiveness in crop rotation planning. At the same time, the UFOP has emphasised that producer prices should always be at a level that will allow farms to generate sustainable profits.

Given the current and foreseeable tough economic environment, the UFOP expects the new German government to make the right decisions to address regulative challenges appropriately. The UFOP has stressed the need for a holistic and sustainable arable farming strategy to ensure competitive and future-proof arable farming. The economy should be taken into appropriate account as a guiding principle, alongside societal acceptance. The economy should be taken into appropriate account as a guiding principle, alongside societal acceptance. In the future, the definition and remuneration of ecosystem services resulting from the diversification of crop rotations with oil and protein crops will become increasingly important. The association has emphasised that nevertheless, the harvest result in combination with an attractive producer price should be main factors determining a farm's financial balance

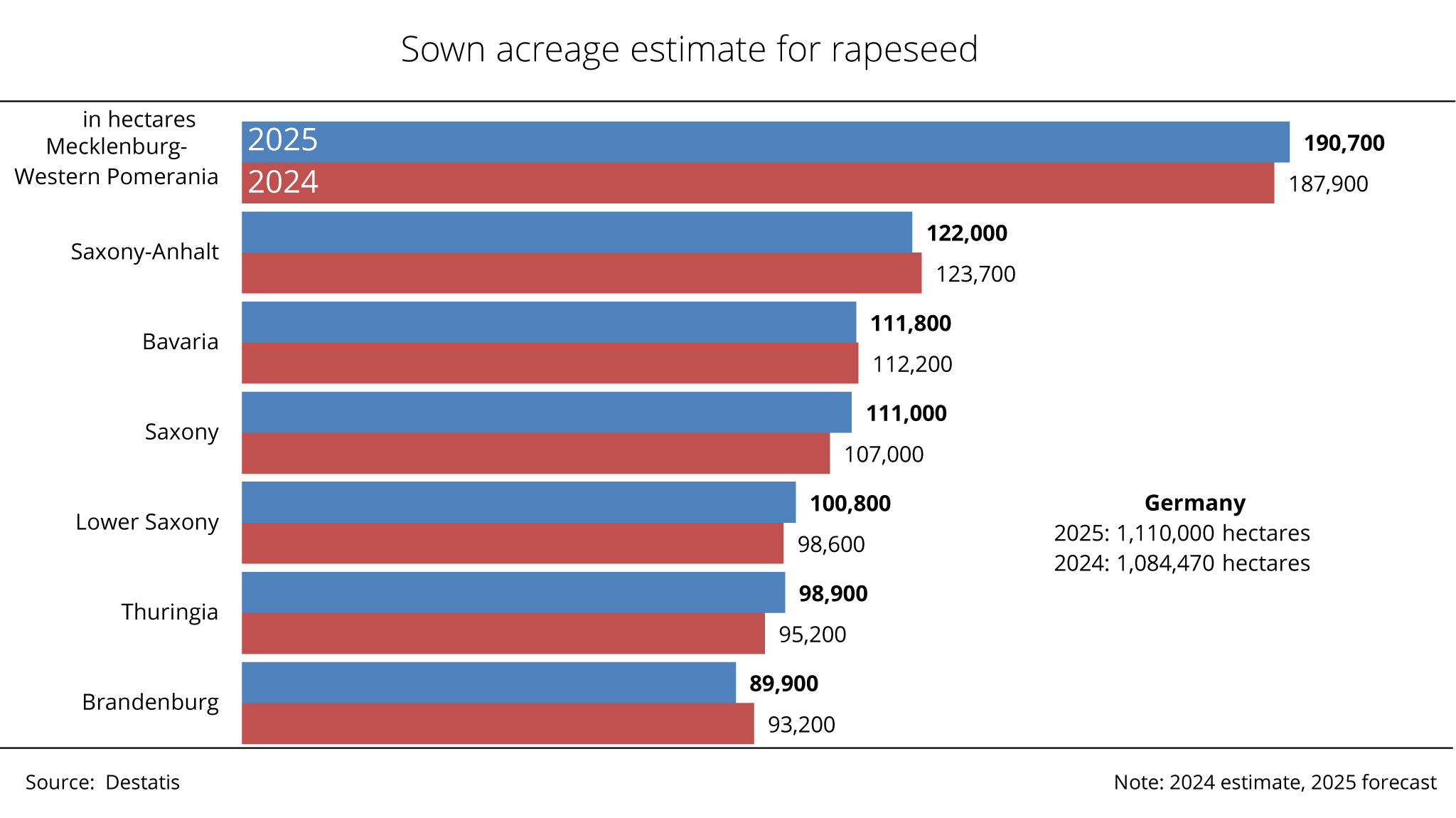

Chart of the week (01 2025)

German Federal Statistical Office expects increase in rapeseed hectarage in Germany

The rapeseed area in Germany has been expanded in nearly all German states, reaching a total of 1.1 million hectares. Declines were only recorded in Brandenburg and North Rhine-Westphalia. This is the result of the latest forecast published by the German Federal Statistical Office (Destatis).

In its mid-November 2024 estimate, the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) anticipated a decline of several 10,000 hectares in area sown with winter rapeseed, projecting a total of 1.05 to 1.09 million hectares. The association attributed the reduction in planted area to insufficient price incentives for crop rotation planning, adding that traders and processors should set the required price signals well in advance of sowing. The UFOP also pointed out that, due to increasing demand for biofuels production - particularly as palm oil becomes less available as a feedstock - rapeseed is currently in high demand, and this trend is expected to continue. By 2023, the demand gap is set to widen and rapeseed, particularly rapeseed oil, will be needed as an "iLUC free" feedstock to close the gap. By way of a qualification, the UFOP has emphasised that feedstock potential is dependent on crop rotation restrictions. It is widely acknowledged that rapeseed can be grown every four years to ensure resilience and sustainability in arable farming.

The UFOP views both the result of its own estimate and the forecast by the German Federal Statistical Office as initial guidance for the 2025 harvest area and as a first yield estimate. The rapeseed acreage estimated by the German Federal Statistical Office translates to a 2.3 per cent increase compared to the previous year, which would represent the second largest winter rapeseed acreage since 2018. Based on the area sown with rapeseed and average yields over the past five years, Agrarmarkt Informations-Gesellschaft mbH (AMI) has estimated the rapeseed harvest at just over 4 million tonnes. The UFOP has emphasised that the area sown is, by nature, not the same as the area harvested. The importance of rapeseed cultivation in eastern Germany is noteworthy. Just over 55 per cent of the German rapeseed area is located in Brandenburg, Mecklenburg-Western Pomerania, Saxony-Anhalt, Saxony and Thuringia.

Chart of the week (51 2024)

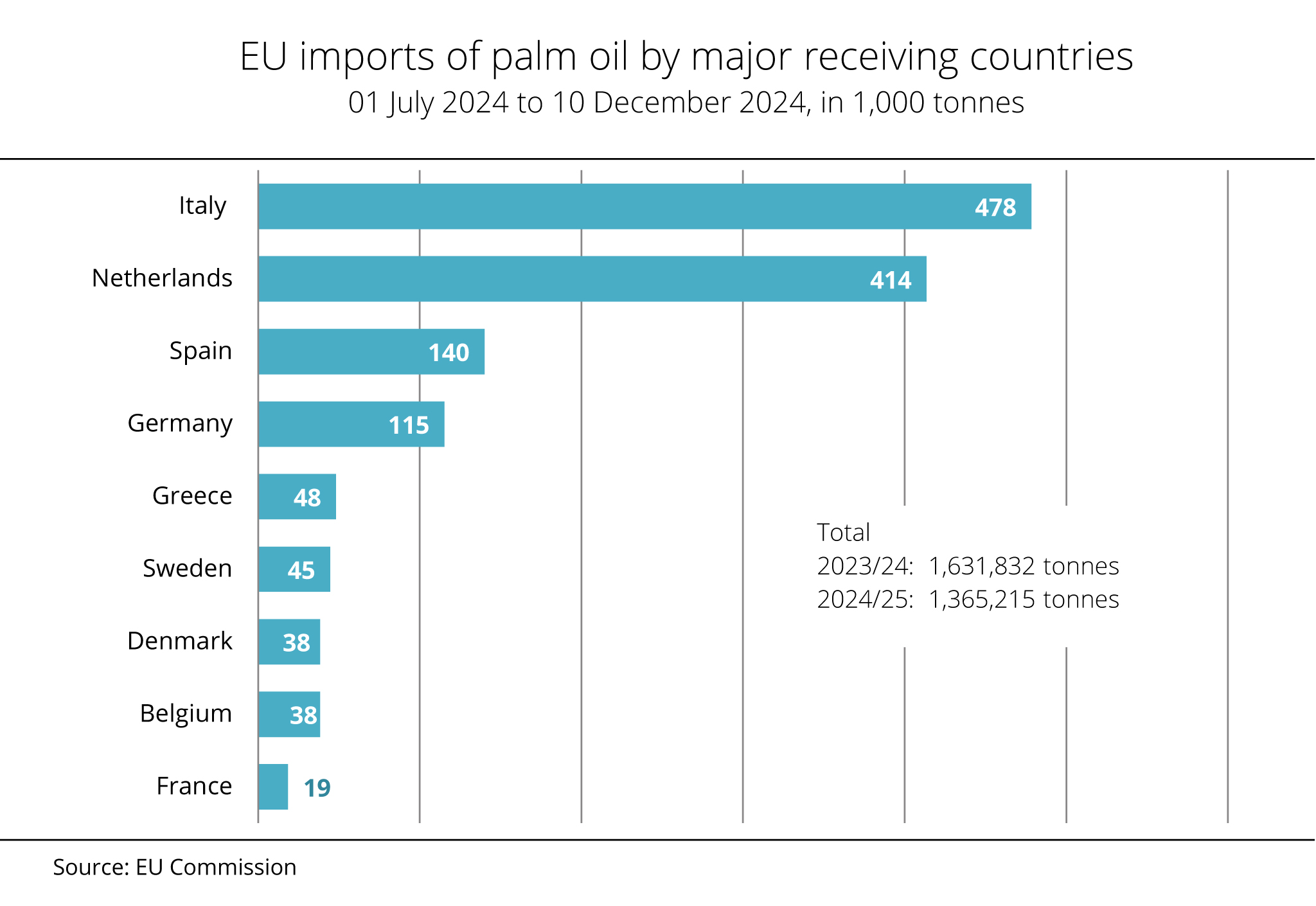

Palm oil imports to the European Union continue to dwindle

EU demand for palm oil continues to decline, as is once again confirmed by the EU Commission's import figures. The decrease is partly due to EU regulations requiring proof of deforestation-free supply chains.

In the period 1 July 2024 to 10 December 2024, the EU-27 imported just less than 1.4 million tonnes of palm oil, which represents a 16 per cent decrease on the same period in 2023. Indonesia remained the most important country of origin, exporting just under 476,000 tonnes and accounting for 35 per cent of the total, followed by Malaysia with 286,000 tonnes. In both cases, delivery volumes fell significantly short of those recorded for the period July to December 2023. Italy imported the largest volume, increasing its imports 8 per cent to 478,000 tonnes. The Netherlands, the central hub for onward export to other member states, was the second largest importer. However, it should be noted that the country is also a key location for European biofuel production. Palm oil imports to the Netherlands dropped 11 per cent compared to the previous year to 414,000 tonnes.

Spain recorded the sharpest decline, more than halving its imports to 140,000 tonnes. Sweden's imports decreased around 39 per cent. On the other hand, several other EU member states increased their imports. According to research by Agrarmarkt Informations-Gesellschaft (mbH), these countries include Greece, France, Denmark, and Germany. Receiving 115,000 tonnes, Germany recorded a 32 per cent rise in palm oil imports compared to the same period the previous year.

The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has pointed out that growing imports of waste oils have displaced the corresponding volumes of palm oil virtually in all member states. The association has noted that the extensive imports of waste oils are also viewed critically because they could also come from palm oil. In other words, supporting the use of waste oils also leads to a pull effect for palm oil. Because of this, the RED II provides for a 1.7 per cent cap on waste oil-based biofuels (ANNEX IX, Part B of the RED II). In Germany, the limit has been set at 1.9 per cent with the approval of the EU Commission. According to the UFOP, this cap is being circumvented by the incentive of double counting waste oils outlined in Part A of Annex IX. The ensuing incitement to committing fraud has sparked a debate on tightening certification and monitoring requirements. The UFOP has called on the new German government, which will be elected next year, to reconsider and reform this incentive to create a steering instrument that promotes domestic bio-methane production. The association argues that double counting will then benefit domestic agriculture rather than biodiesel producers in Asia.

Chart of the week (50 2024)

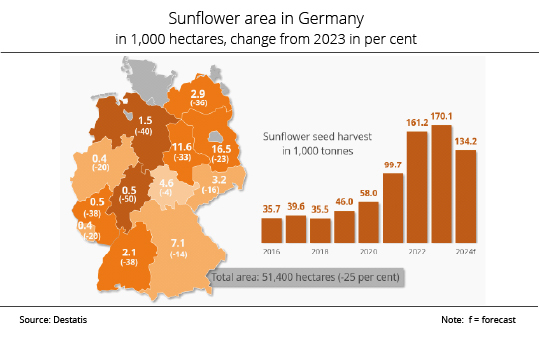

Area under sunflowers declined

In view of a significant decline in area planted with sunflowers, Germany's sunflower harvest is expected to fall short of the previous year's figures. The higher yields can only help mitigate the reduction in output.

According to preliminary information by the German Federal Statistical Office, German farmers harvested around 134,200 tonnes of sunflower seed in 2024. This was down just over 21 per cent on the previous year. The decline is mainly based on a 25 per cent decline in production area compared to the previous year to 51,400 hectares. According to research by Agrarmarkt Informations-Gesellschaft (mbH), all German federal states recorded reductions, with Hesse and Lower Saxony seeing the sharpest declines. Brandenburg remains the leading sunflower seed producing state in Germany, with 16,500 hectares under sunflowers despite a 23 per cent drop from the previous year.

The expected yield increases did not fully offset the substantial reduction in area planted. Yields are estimated at 26.1 decitonnes per hectare, nearly 6 per cent higher than the previous year. The main factors driving this increase were sufficient rainfall and mild temperatures during the summer, and relatively dry conditions at harvest time.

For many years, the sunflower area in Germany hovered around 20,000 to 22,000 hectares. However, in the wake of the Russian war against Ukraine, it expanded to a record 86,000 hectares. From the perspective of the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP), the reduction in sunflower area is understandable because the temporarily overheated producer prices have dipped back to normal levels and farmers have increasingly switched back to winter-planted crops with expected higher contribution margins. Nevertheless, this year's level reflects farmers' growing interest in producing this summer crop. To stabilise this development, traders and processors need to offer medium-term production and delivery contracts. Increased consultation efforts and the implementation of demonstration projects could also help push this development forward. According to the association, this is the only way to establish the sunflower market in Germany at a permanently higher level.

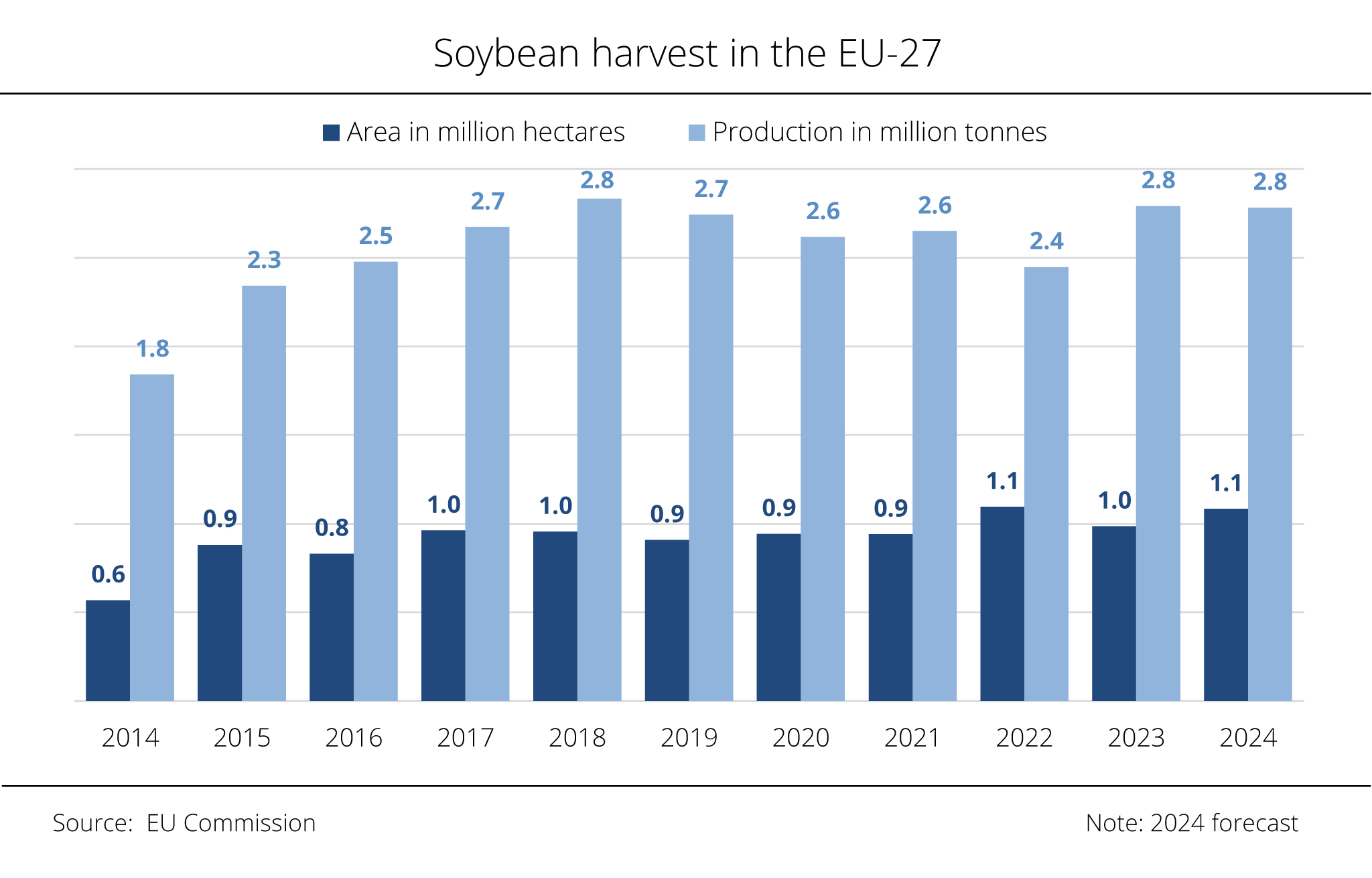

Chart of the week (49 2024)

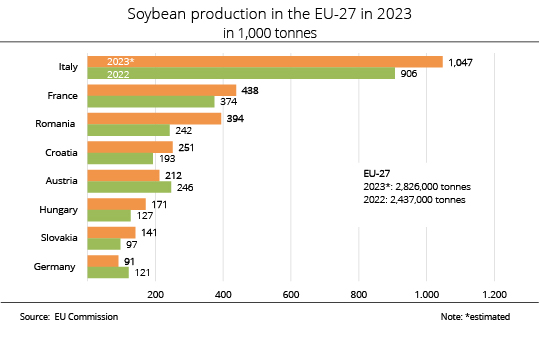

EU soybean harvest just below previous year

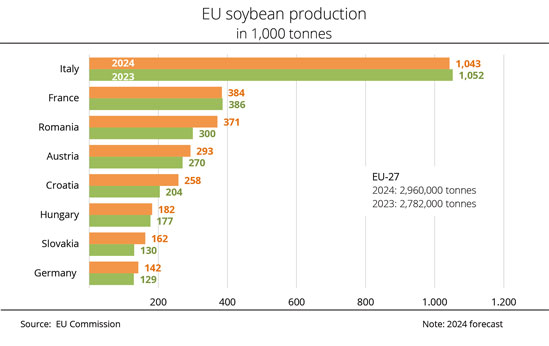

An updated estimate by the EU Commission suggests that this year’s soybean harvest in the EU-27 fell slightly short of the previous year's level, despite an expansion in the production area for the 2024 harvest. The decrease primarily reflects a decline in harvest in Romania.

In its latest estimate, the EU Commission marginally lowered its forecast for soybean production in the EU. The Commission put the 2024 soybean harvest at just under 2.8 million tonnes, which is down 10,000 tonnes on the previous year despite a 10 per cent increase in production area. The key reason for the decline was lower yields due to unfavourable growing conditions throughout the year. The EU average yield of 25.7 decitonnes per hectare not only fell short of the previous year's result of 28.3 decitonnes per hectare but was also shy of the long-term average of 28.1 decitonnes per hectare.

The Balkan states, especially Romania, recorded the sharpest declines in yield. In Romania, drought conditions led to a 44 per cent slump to 171,000 tonnes compared to the previous year, despite a nearly 10 per cent increase in acreage. Hungary's soybean output is estimated at 260,000 tonnes, representing a 50 per cent rise year-on-year. However, considering the doubling of the country's production area, this result also remains below expectations.

According to research by Agrarmarkt Informations-Gesellschaft (mbH), Italian farms produced 1 million tonnes of soybeans, almost 5 per cent less than in 2023. Nevertheless, Italy remains the number one soybean producer in the EU, notwithstanding an almost 3 per cent reduction in soybean area compared to the previous year.

Chart of the week (48 2024)

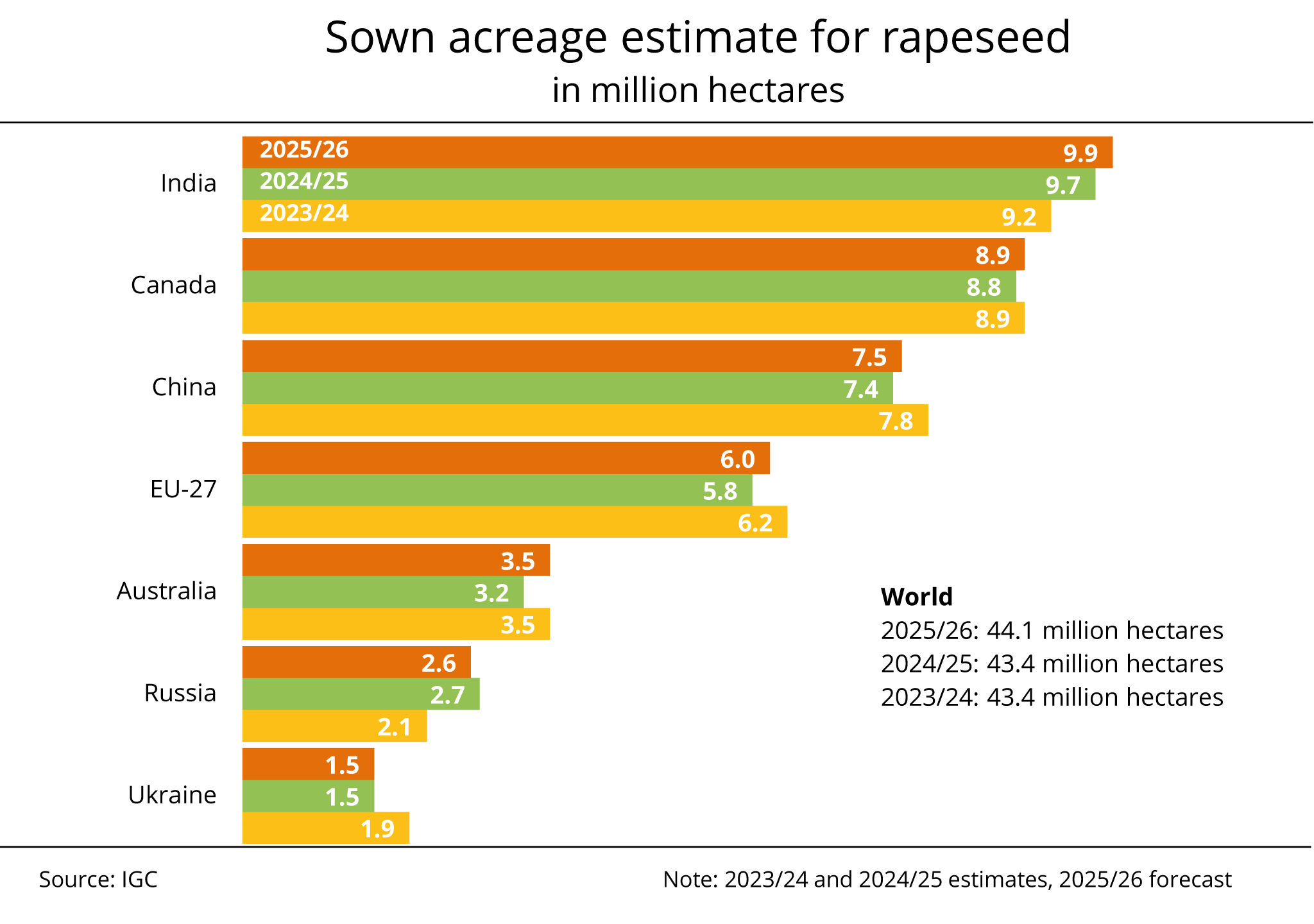

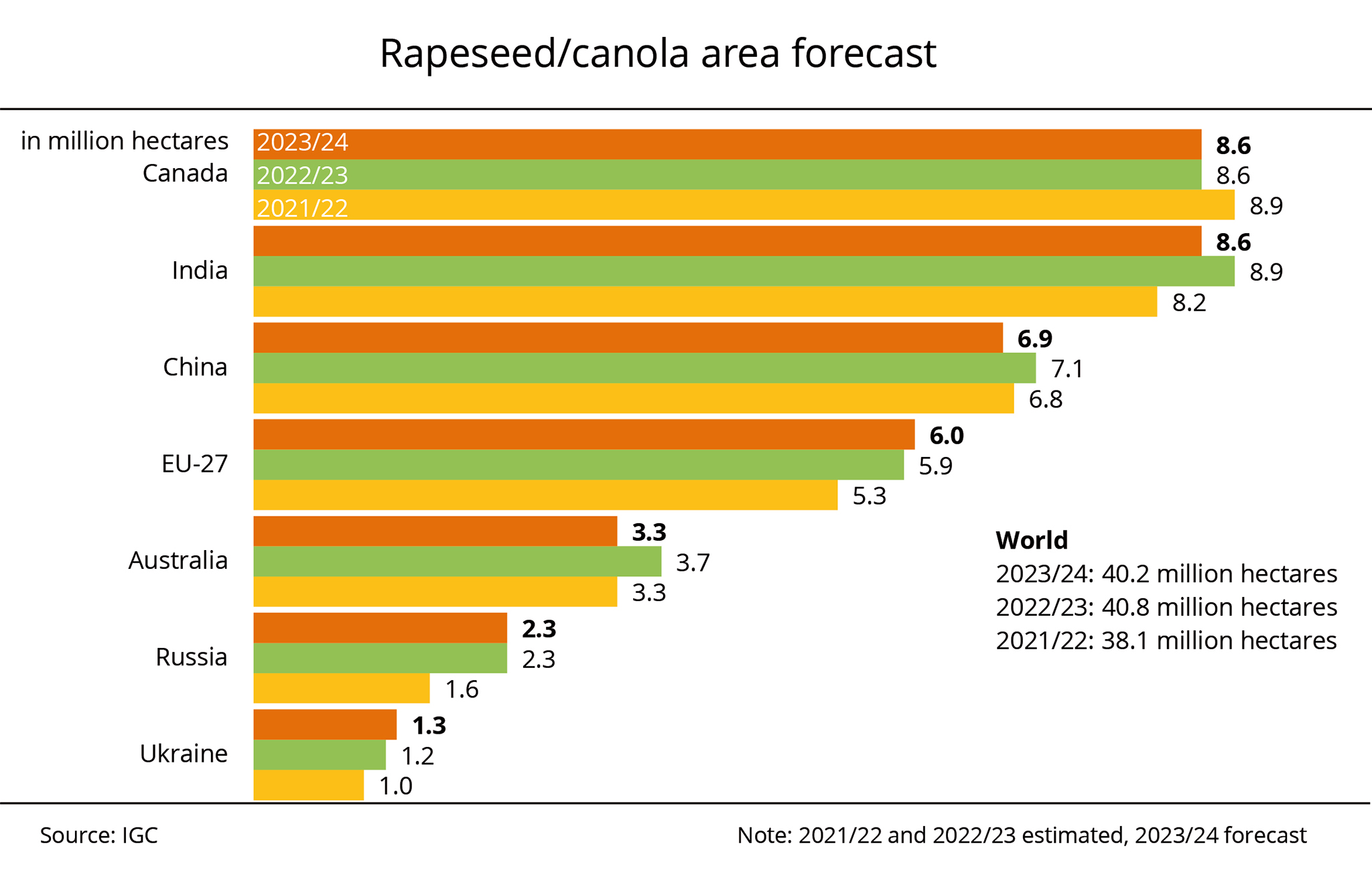

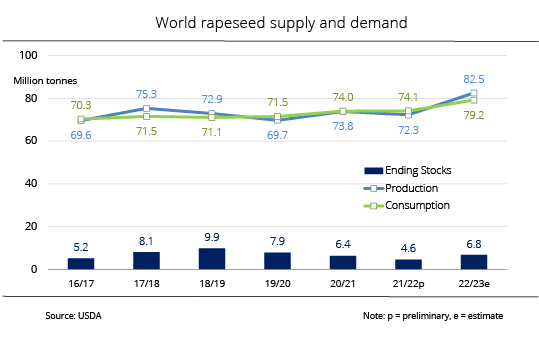

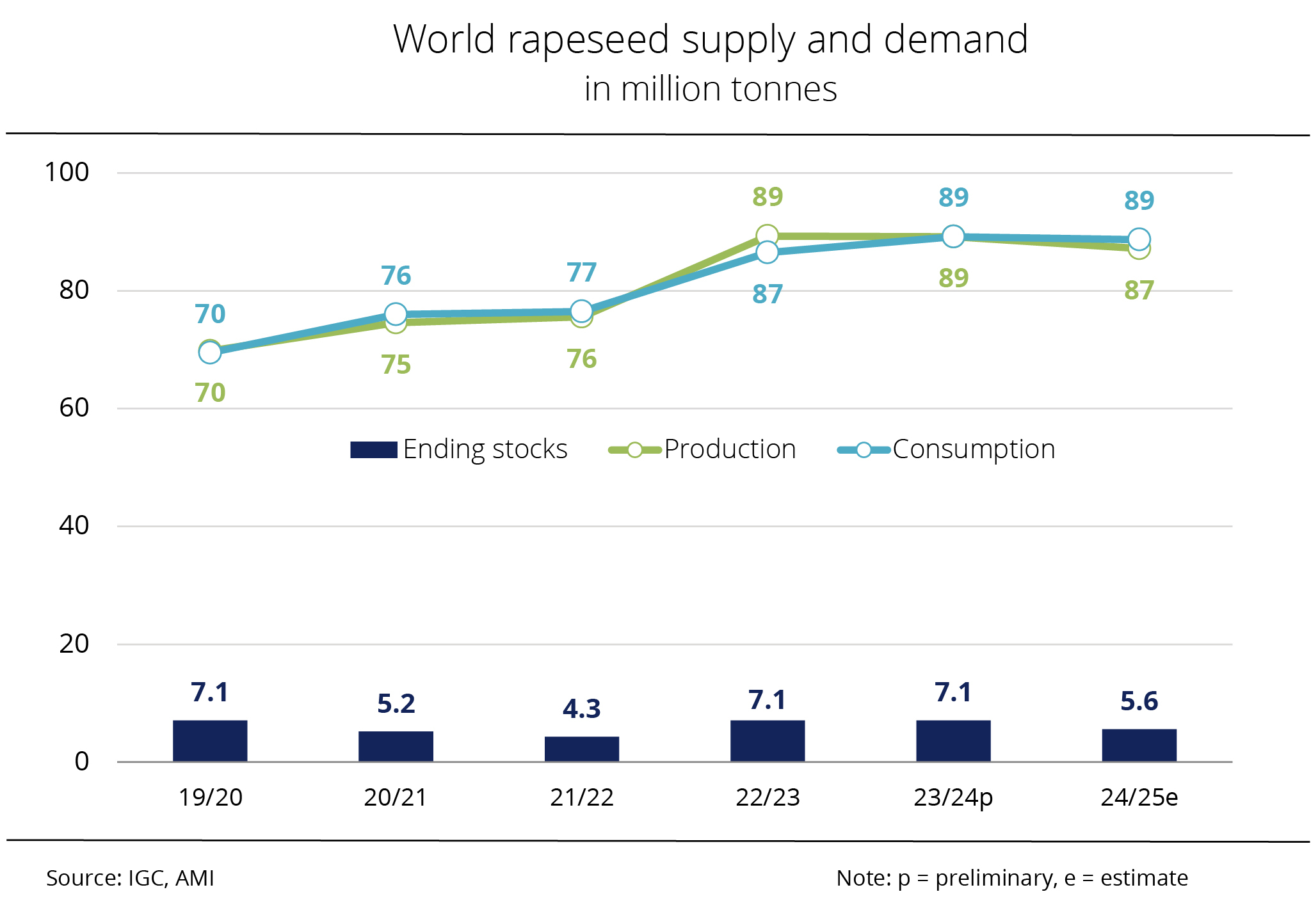

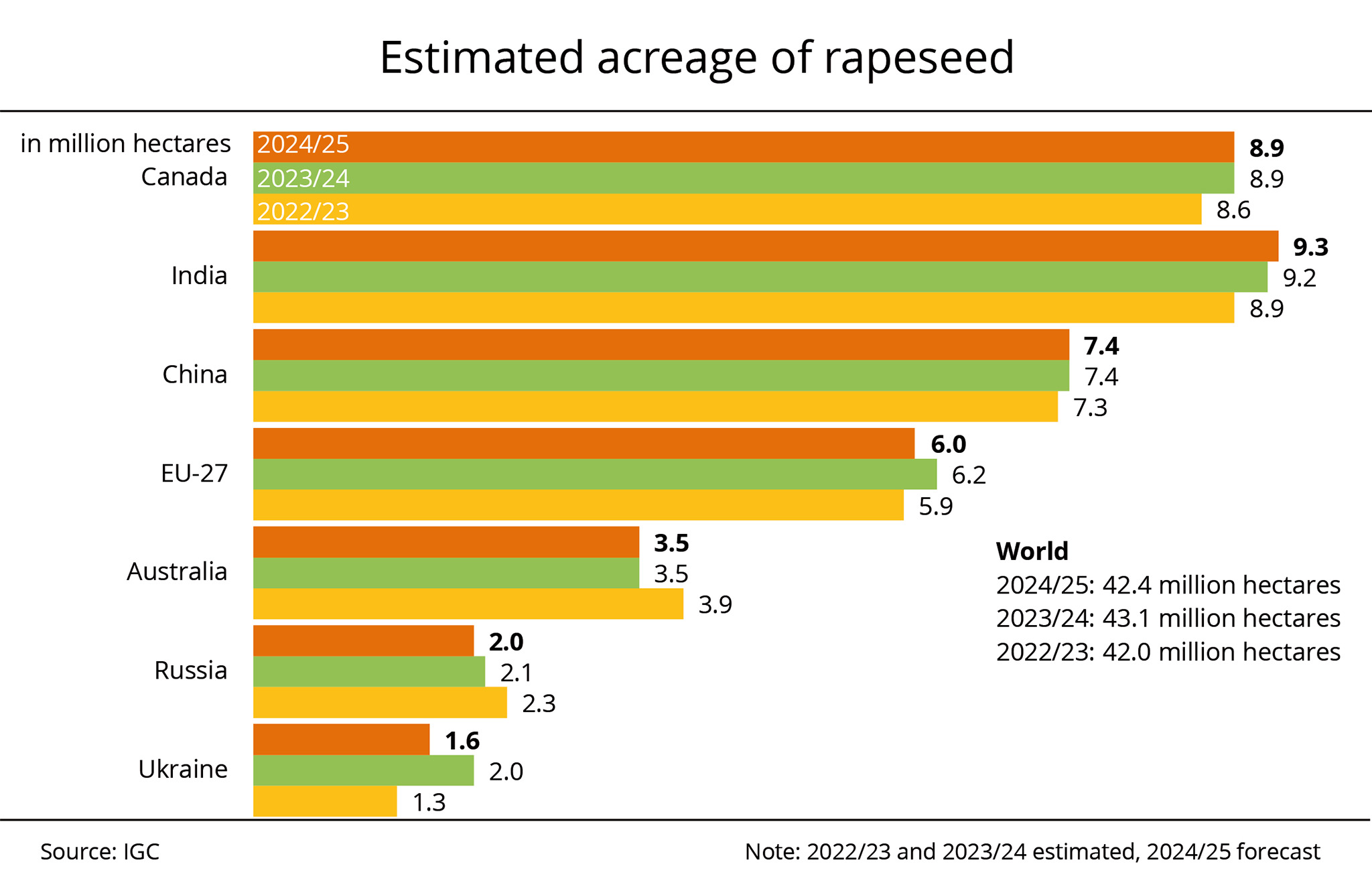

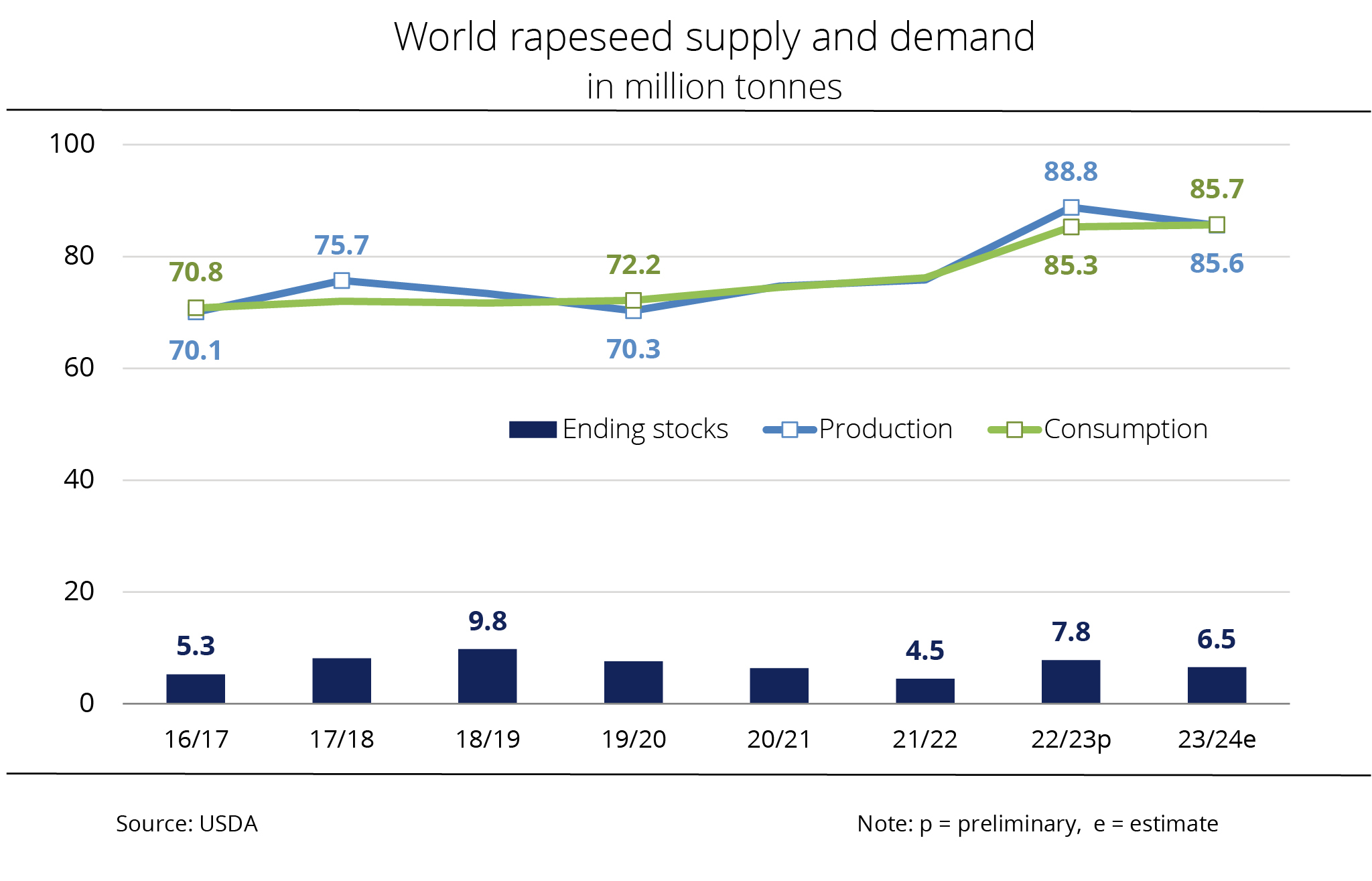

IGC projects marginal increase in global rapeseed area for the 2025 harvest

Whereas the rapeseed area in Russia is expected to decline, acreages in the EU-27, Australia, Canada, India, and the US are likely to record increases.

In its latest estimate, the International Grains Council (IGC) has forecast the global rapeseed area for the 2025/26 marketing season at 44.1 million hectares. This translates to a 1.4 per cent rise compared to the current season and would be the largest rapeseed area on record. The EU's output available for the 2024/25 season was significantly limited due to reductions in area and disappointing yields. EU farmers are now anticipated to have expanded their production areas nearly 4 per cent to 6.0 million hectares. According to the IGC, the expansions are mainly driven by attractive prices. Recent reports from Germany suggest that rapeseed stocks are generally in good condition despite strong autumn rains in some regions and dry spells in Eastern Germany at the time of sowing. Only a small fraction of the land required re-sowing.

The outlook for rapeseed production in the major exporting nations is currently still uncertain. In India, conditions for sowing and germination in the country's most important rapeseed producing region Rajasthan are defined by drought. What is more, the rapeseed area has declined an estimated 7.2 per cent, falling to 3.12 million hectares. In Canada and Australia, sowings will not start for several months. Current expectations suggest expanded production areas in both countries – provided demand remains steady. In the US, an 8.3 per cent increase in rapeseed area is also considered possible. According to research by Agrarmarkt Informations-Gesellschaft (mbH), the rise would be based on growing demand from the fuel sector as a consequence of the US Environmental Protection Agency's (EPA) decision to promote biofuels for road and air traffic. In mid-2024, the EPA approved the use of rapeseed oil as a feedstock for biofuels production, which approval has led to a strong rise in rapeseed imports.

Chart of the week (46 2024)

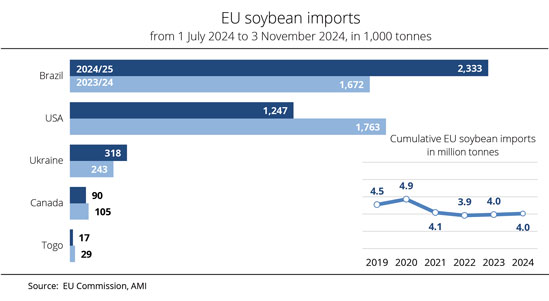

Brazil leads in EU soybean imports

Soybeans are the most important oilseed crop imported by the European Union, ahead of rapeseed. In the first four months of the current crop year, the EU imported the highest volume of soybeans since 2021/22.

According to information published by the EU Commission, the EU purchased just over 4.0 million tonnes of soybeans between July and early November 2024. This translates to a rise of around 70,000 tonnes from the same period in the season 2023/24. Brazil and the US remained the main soybean suppliers, with Brazil significantly increasing its delivery volumes. Specifically, the EU received 2.3 million tonnes of soy from Brazil in the first four months, up from 1.7 million tonnes in the previous year, raising Brazil's share of imports to 57.9 per cent. In other words, Brazil is by far the most important country of origin for soybeans for the EU. The main reasons for this key role are competitive pricing and abundant feedstock availability.

During the same period, EU imports from the US amounted to 1.2 million tonnes, around 516,000 tonnes less than the previous year, reducing the US share of imports to 31 per cent. Imports from Canada also declined, whereas Ukraine increased its soybean volumes on the EU market. The impending introduction of the EU Deforestation Regulation (EUDR) led importers to place plenty of orders for meal in the first few months of the marketing year to stockpile supplies.

Chart of the week (45 2024)

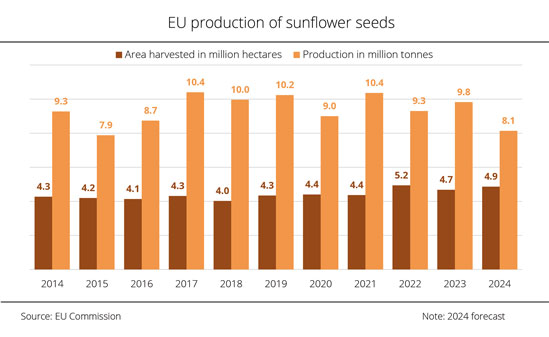

EU Commission expects smallest EU sunflower seed crop in nine years

Poor weather conditions in 2024 have considerably reduced sunflower yields across the EU. Notwithstanding an expansion in production area, total output remains well below previous years.

According to EU Commission estimates, EU sunflower seed production in 2024 amounts to just over 8.1 million tonnes. This represents a 17 per cent drop from 2023 and also the smallest harvest since 2015. Although the sunflower area increased 4 per cent to 4.9 million hectares, the expansion did not offset the 20 per cent yield decline to 16.7 decitonnes per hectare. These lowest yields seen in 12 years are due to the unfavourable weather conditions throughout the growing season.

Romania remains the most important production region in the EU-27 with a record 1.3 million hectares planted with sunflowers. However, the country's output of 1.2 million tonnes falls far short of the previous year's 2.0 million tonnes. According to research by Agrarmarkt Informations-Gesellschaft (mbH), production in Germany declined for the second consecutive year in 2024. Nevertheless, the area planted with sunflowers remains well above the level recorded before Russia's attack on Ukraine. In the wake of the attack, many farmers in Germany had expanded their sunflower areas significantly in 2022.

Abundant rainfall recently also fuelled concerns over the yield potential in France. The EU Commission recently projected just under 1.8 million tonnes, which would be a 14 per cent drop from 2023.

Chart of the week (44 2024)

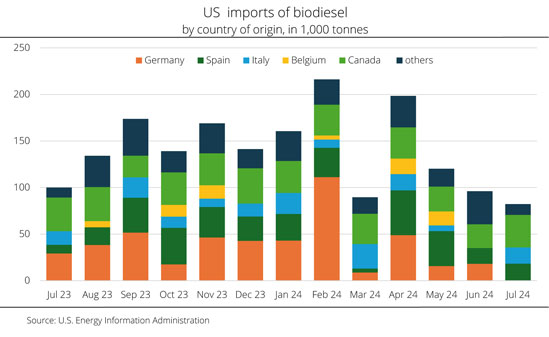

Germany is a leading biodiesel supplier to the US

US biodiesel imports have been plentiful over the past few months. Since 2022 import volumes have even doubled. Given the attractive price level, EU origins in particular have dominated.

Germany produces significantly more biodiesel than any other EU member state and consequently plays a vital role in supplying the US. This significance is reflected in US import figures. The amount of biodiesel Germany supplied in February 2024 is especially noteworthy, accounting for just under 58 per cent of total shipments. However, import volumes from Germany declined as the year progressed.

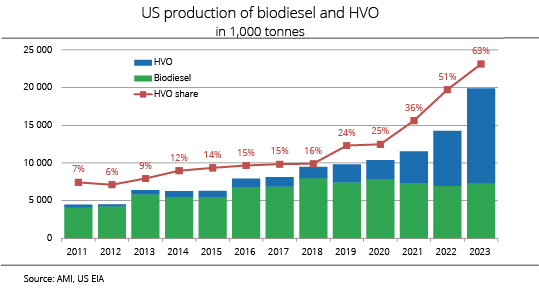

Notwithstanding robust imports and growing competition from renewable fuels, US biodiesel fuel production also increased 5 per cent year-on-year to 5.6 million tonnes in 2023. Consequently, biodiesel consumption in 2023 reached its highest level since 2017. Nevertheless, the U.S. Energy Information Administration expects US biodiesel production to decrease in the current year.

Chart of the week (43 2024)

Grains Council expects increase in canola exports from Canada

The Canadian canola harvest for 2024 is expected fall just short of the previous year's level. With rising consumption and strong export demand, ending stocks are likely to decrease notably.

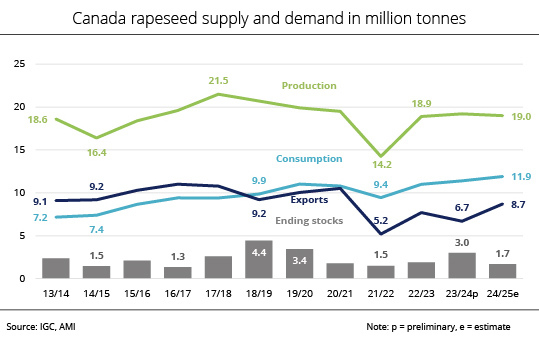

According to recent information by the International Grains Council (IGC), Canada's 2024 canola harvest amounts to 19.0 million tonnes. This would translate to a 1 per cent decline from 2023. In September, the US Department of Agriculture anticipated a harvest of 20 million tonnes. The revised estimate is likely based on a slightly smaller production area and lower yields. Favourable weather conditions in late September and early October expedited the progress of harvest operations. Most of the crop has already been collected.

Canada and the EU-27 are the world's leading producers of canola and rapeseed, each producing approximately 20 million tonnes per year. In the current season, the EU relies more on imports to supply its oil mills, including from Canada, due to a smaller harvest.

With Canadian domestic consumption slightly rising to 11.9 million tonnes, the country will have a surplus of 7.1 million tonnes. Nevertheless, stocks are projected to drop to 1.7 tonnes, well below the 3.0 million tonnes recorded the previous year. The decline is primarily attributed to an expected increase in exports. According to research by Agrarmarkt Informations-Gesellschaft (mbH), Canada is set to ship 8.7 million tonnes of canola across the world's oceans, almost 30 per cent more than in 2023/2024. The main reason for this increase is fairly tight global supply, as availability of rapeseed from Ukraine and Australia, the other major rapeseed exporting countries, is reduced. However, the use of Canadian rapeseed in the EU is restricted because of its genetically modified varieties. This makes the biofuels market the most important trade channel for Canadian canola oil.

Chart of the week (42 2024)

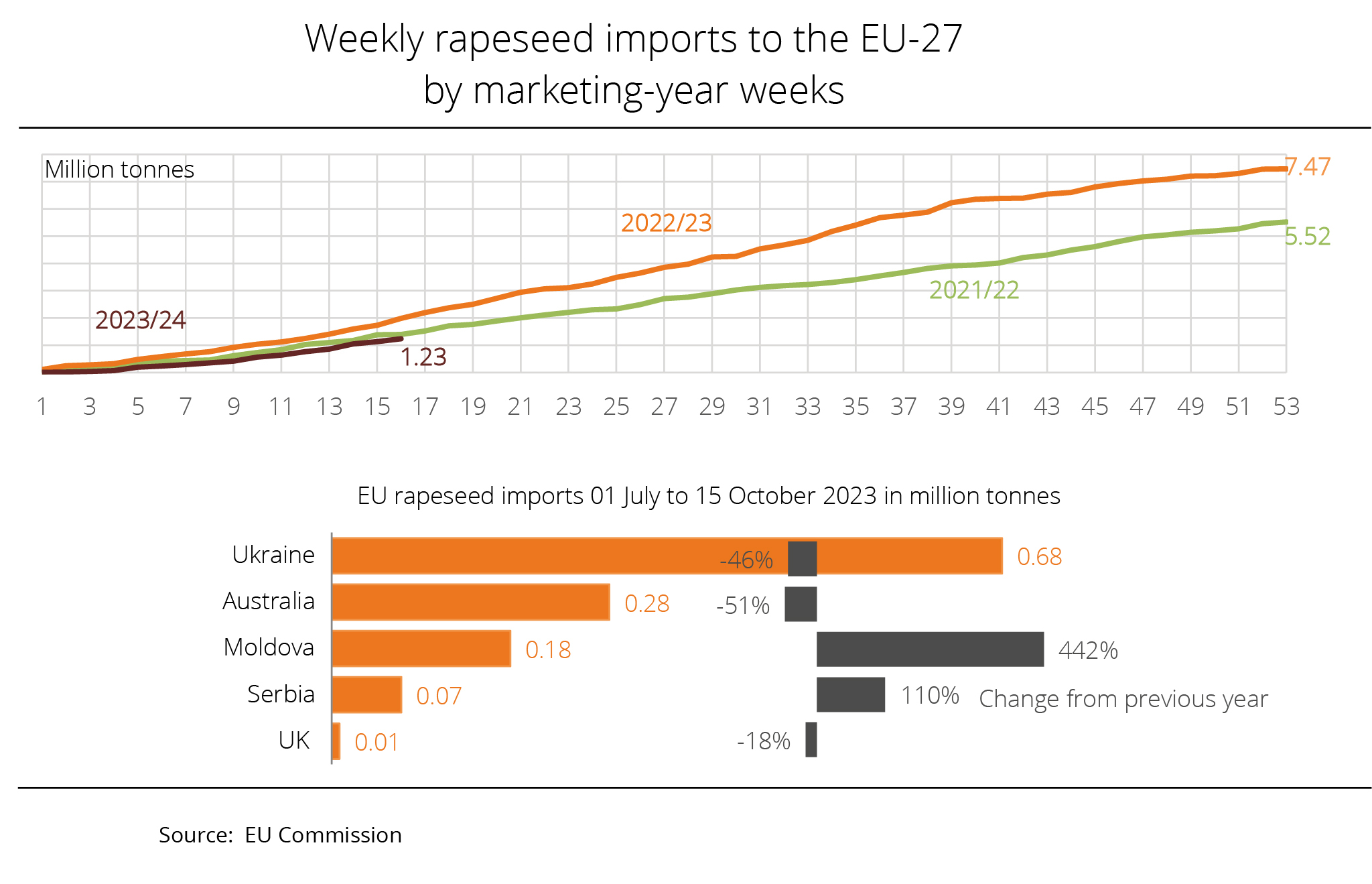

Plentiful rapeseed imports to the EU

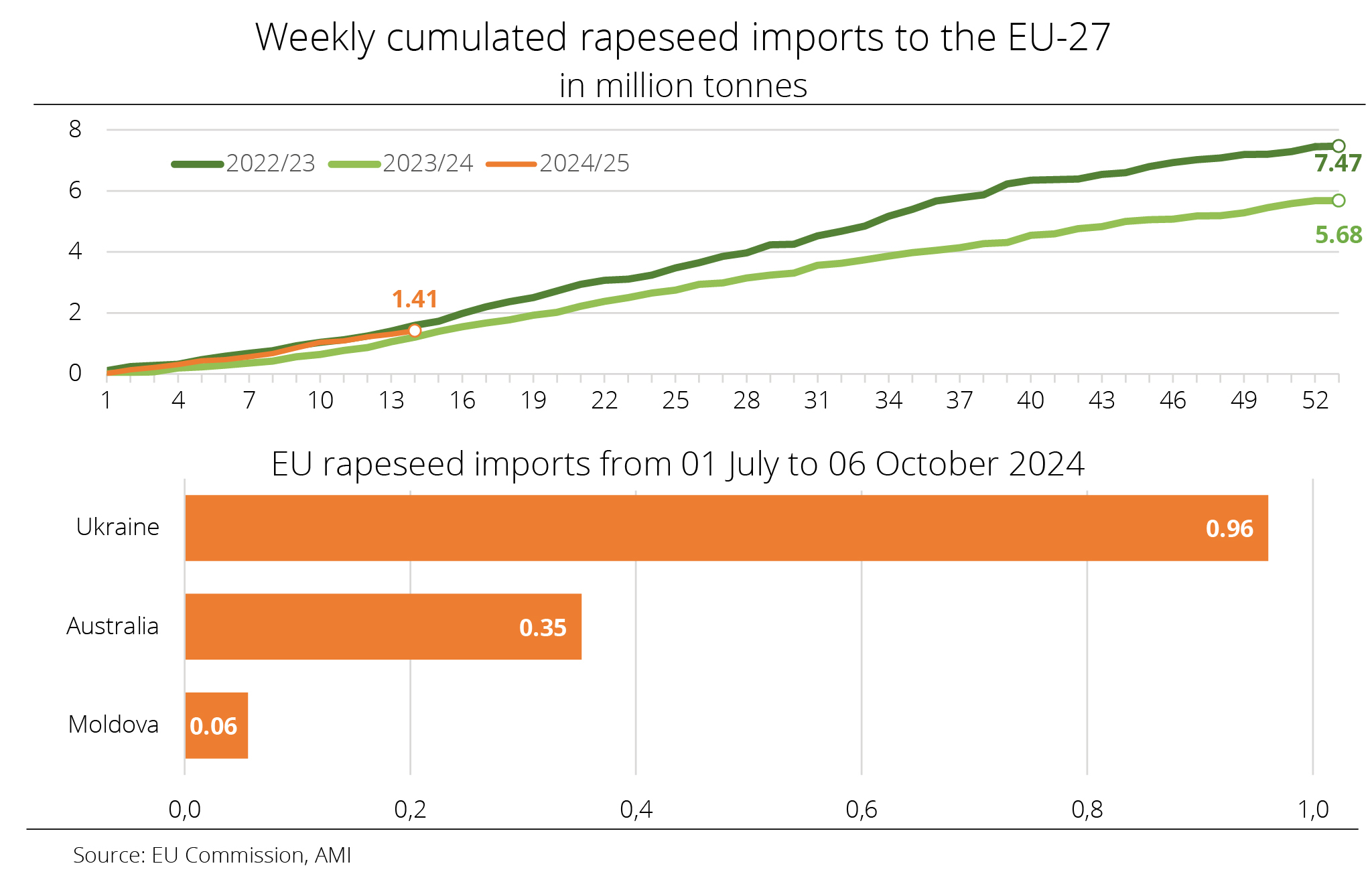

In the first quarter of the running crop year, rapeseed imports to the EU exceeded those of the same period last year. Just over two thirds of those imports came from Ukraine.

Between the beginning of the crop year and 6 October 2024, EU-27 imports of rapeseed amounted to 1.41 million tonnes, which represents an increase of just over 17 per cent on the previous year. The imports are used to supplement supply from EU production. Demand for imports is high this season due to the sub-standard 2024 harvest.

Ukraine remains the most important country of origin, supplying 960,400 tonnes. This translates to a 68 per cent share of imports and a 60 per cent increase from the previous year's 599,400 tonnes. However, according to Agrarmarkt Informations-Gesellschaft (mbH), Ukraine is unlikely to sustain this export volume in the coming months. This expectation is based on the 25 per cent harvest decline compared to the previous year, which severely curtails the country's export potential. Australia is the EU's second most important rapeseed supplier, delivering 351,800 tonnes and accounting for 25 per cent of EU rapeseed imports. This translates to an increase of 3 per cent over the same period a year earlier. Moldova ranks third, supplying 56,200 tonnes. Deliveries from Moldova more than halved compared to the same time a year earlier. Most of this rapeseed likely originated from Ukraine. Canada has not supplied any significant quantity this crop year but could increase its share of imports due to its exceptionally large harvest and the loss of China as an importing country. However, the use of Canadian rapeseed in the EU is restricted because of its genetically modified varieties. This makes the biofuels market the most important trade channel for Canadian rapeseed oil.

Chart of the week (41 2024)

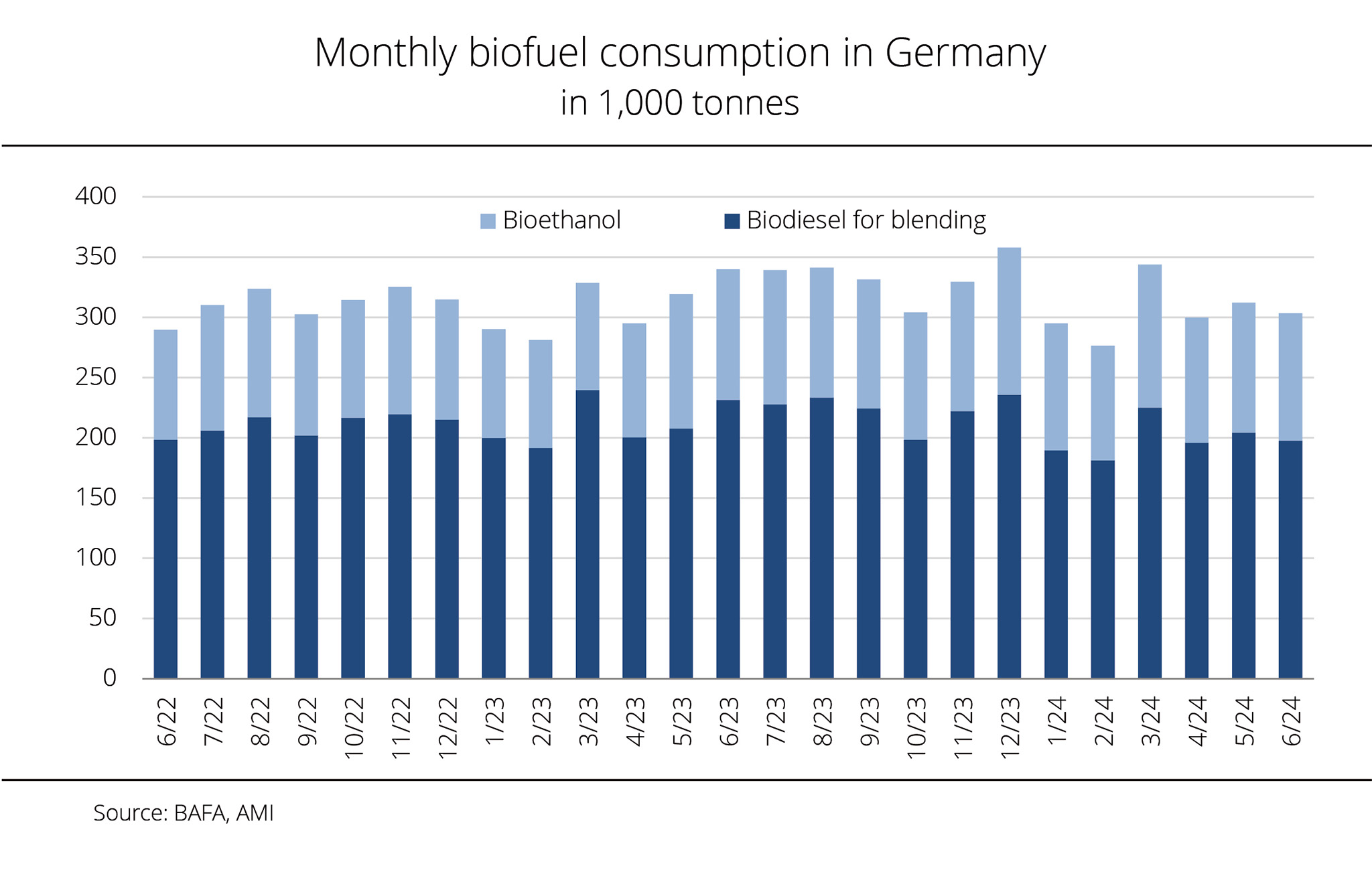

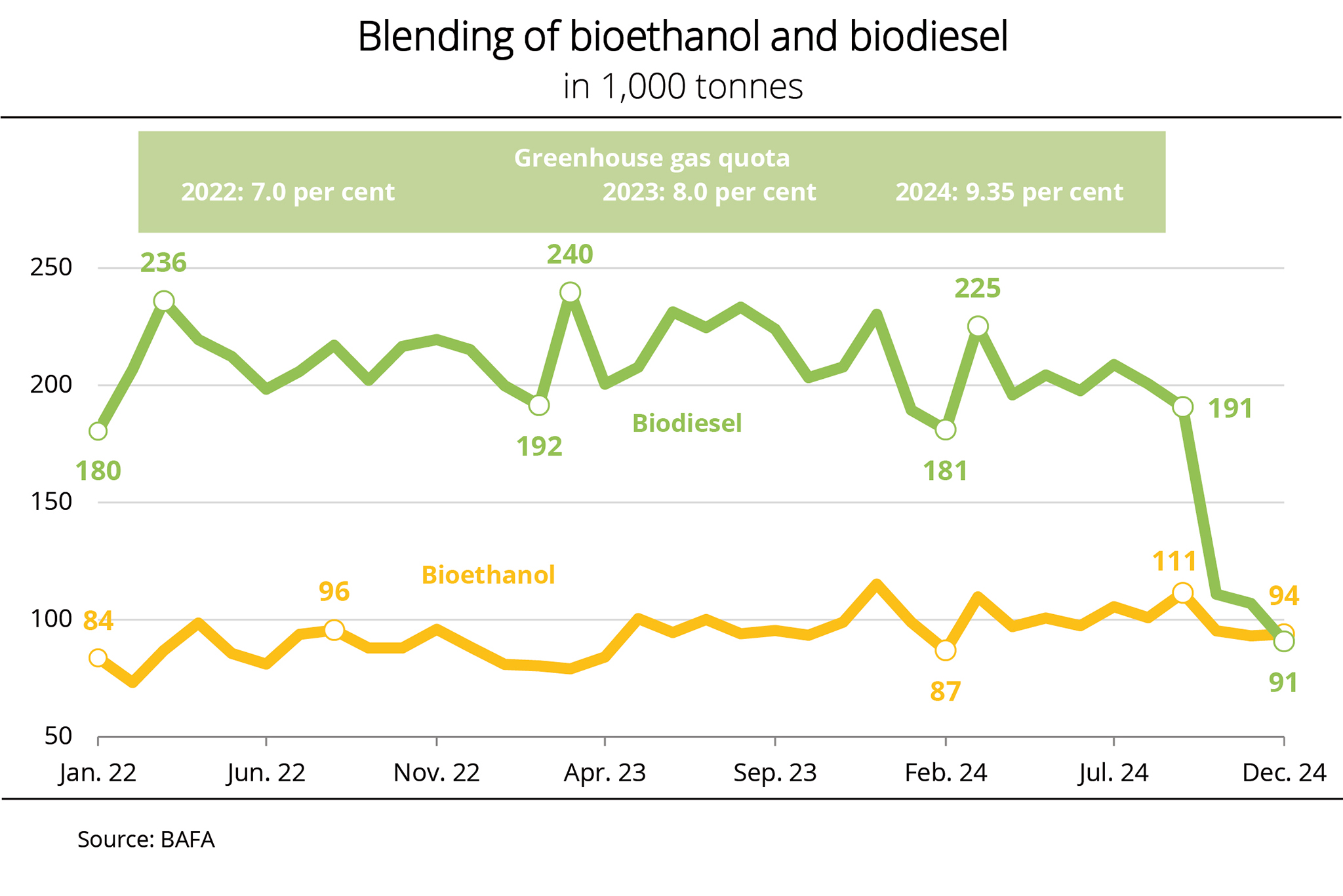

Decline in biodiesel use

In the first half of 2024, biodiesel consumption declined sharply compared to the previous year. Bioethanol use increased during the same period.

According to the Federal Office of Economics and Export Control (BAFA), consumption of biodiesel fell by 3% to 197,700 tonnes in June compared to the previous month.

In the year-on-year comparison, the decline amounts to as much as 14.6 per cent. Consumption of diesel reached a volume of 2.5 million tonnes in June 2024, up 4.7 per cent on the previous month, while remaining 3.6 per cent below the previous year's volume. As a result, the incorporation rate dipped significantly to 7.4 per cent, a level below the half-year average and clearly below the rate of 8.3 per cent recorded in June 2023. In the first half of 2024, the use of biodiesel for blending amounted to around 1.2 million tonnes, down 7.0 per cent from the same period in 2023. Consumption of B7 diesel fuel reached just over 14.2 million tonnes, falling almost 5 per cent short of the previous year's volume. Consequently, according to research by Agrarmarkt Informations-Gesellschaft (mbH), the average incorporation in blends dropped 0.2 percentage points to 7.7 per cent compared to the year-earlier period.

The use of bioethanol also declined in June 2024. At 105,800 tonnes, consumption was down 2.1 per cent on the previous month. Bioethanol use in blends decreased 3.3 per cent, although it remained 3.0 per cent above the level recorded in June 2023. On the other hand, the use in ETBE rose 14.5 per cent month-on-month, while falling 40.4 per cent compared to June 2023. Overall, the use of bioethanol in the first half of the year totalled 636,400 tonnes, exceeding the previous year's volume by just about 8.3 per cent. During the same period, petrol consumption rose 0.7 per cent. As a consequence, the incorporation rate increased 0.5 percentage points to 7.4 per cent.

In light of these trends, the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) expects sales of biodiesel and HVO in Germany to continue their downward trajectory. The association has projected overall demand for 2024 at 2.4 million tonnes, equivalent to the biodiesel and HVO sales volume in 2019. That year, legislation stipulated a greenhouse gas quota obligation of 4.0 per cent (2024: 9.35 per cent), but it did not allow for the option to double or triple count biofuels from specific waste oils and for e-mobility purposes. Nor was it possible to offset UER certificates, which are suspected of being fraudulent.

Making reference to the planned revision of greenhouse gas quota obligation legislation and redefinition of the annually increasing quota requirements, the UFOP has called for an ambitious increase of the greenhouse gas quota obligation to compensate for multiple crediting and the necessary increase in the proportional share of e-mobility in transport performance. Since the diesel fuel standard caps the incorporation of biodiesel at 7 per cent by volume and the market for B10 is not accessed through public petrol stations, the forthcoming amendment of legislation should go along with the development of a fuel strategy that, in particular, starts off the use of biodiesel in heavy goods vehicles. Without such strategy, the UFOP fears that German biodiesel producers may have to export more of their output, giving away greenhouse gas emission reduction potential to other member states. The UFOP therefore regards Federal Minister of Transportation Volker Wissing's one-eyed focus on paraffinic fuels as inappropriate. Emphasising the bridging function of biofuels from cultivated biomass in particular, the UFOP has stressed the need for a comprehensive strategic approach that includes all compliance options.

Chart of the week (40 2024)

German soybean harvest down from previous year

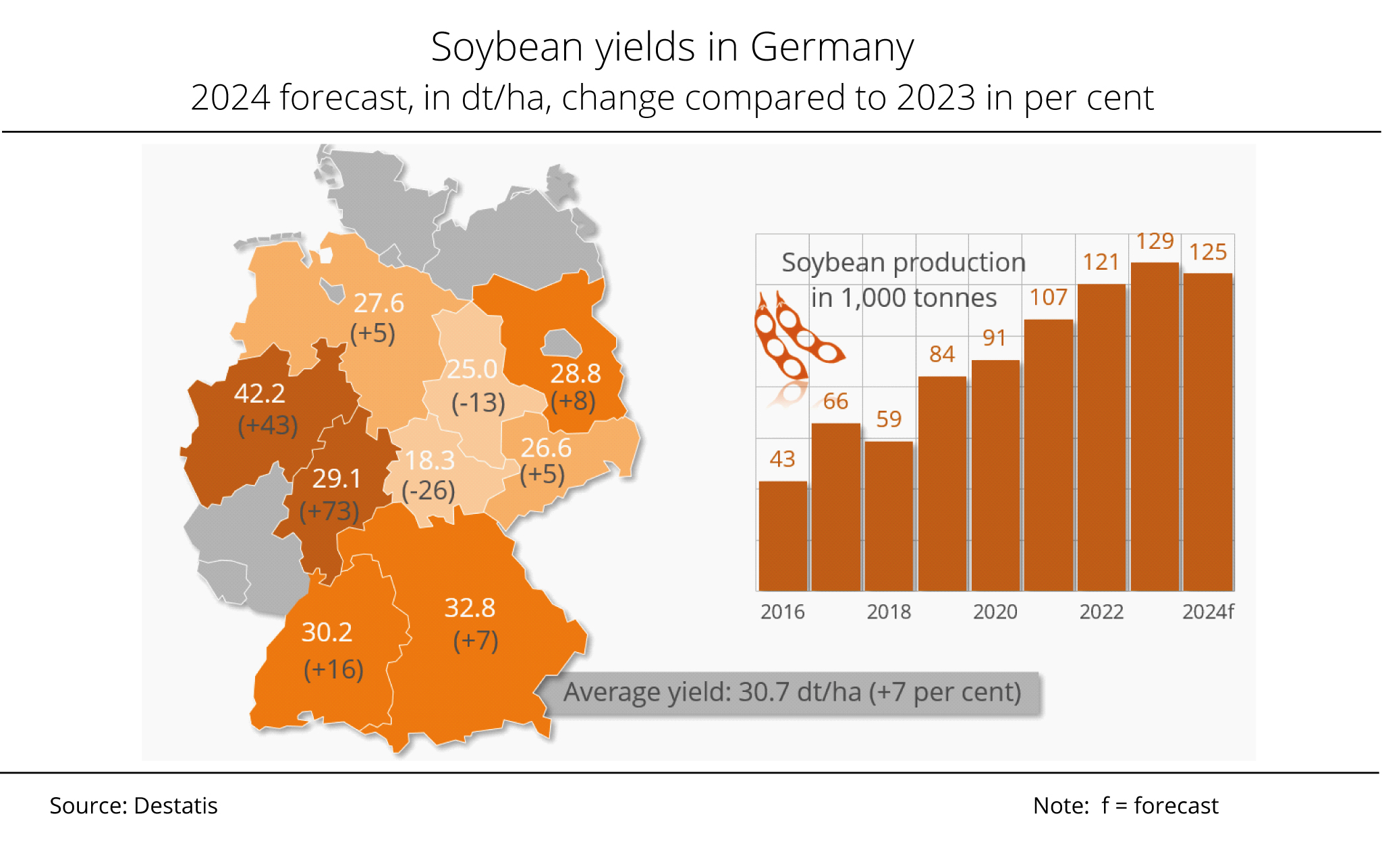

In view of a significant reduction in area, the 2024 soybean harvest will probably fall short of the previous year's output. However, the decline will be partially offset by increases in yield.

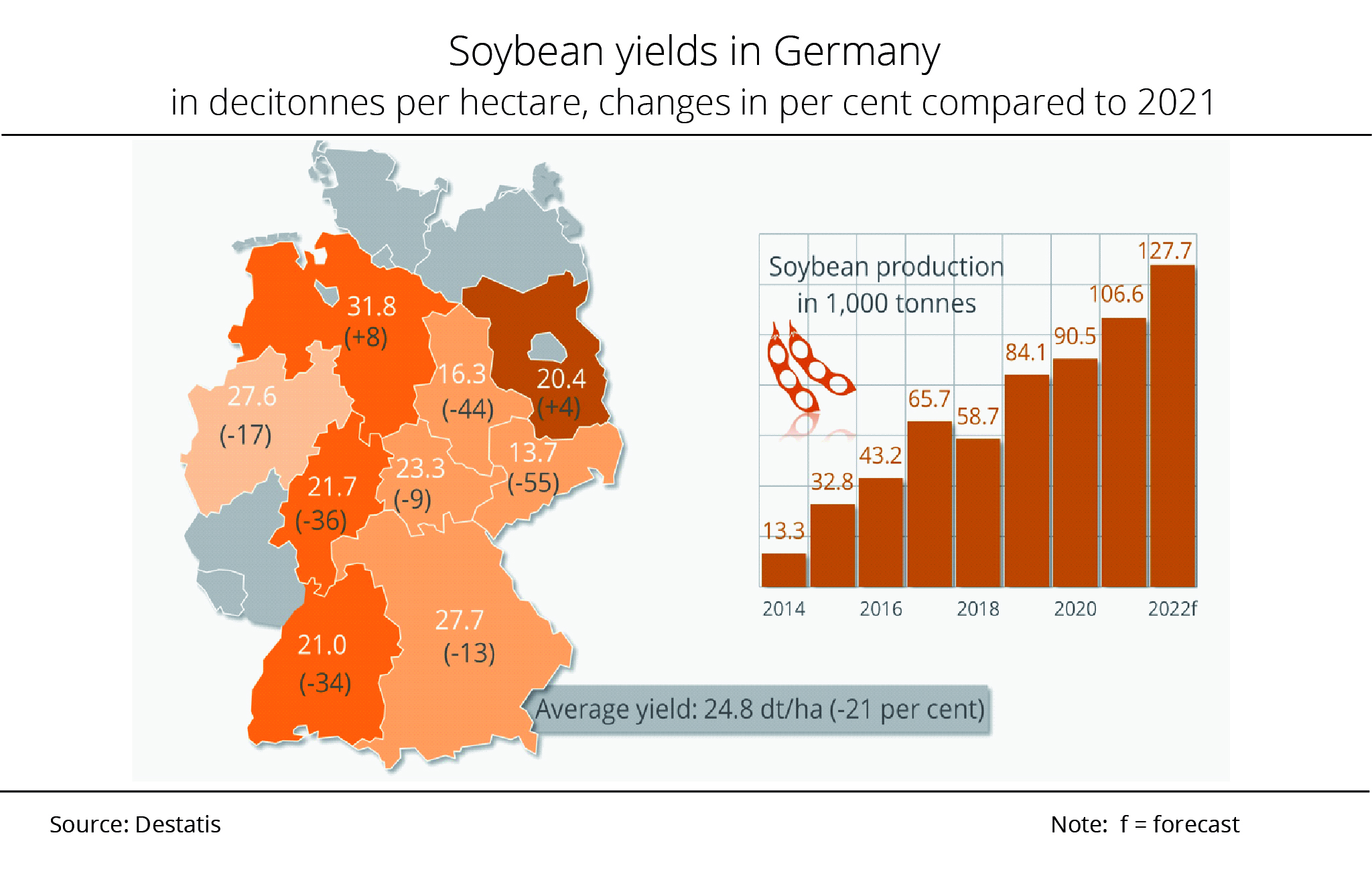

According to Agrarmarkt Informations-Gesellschaft (mbH), soybean farming did not play an appreciable role in Germany until 2015. Since then, the area has grown continually and significantly. However, in 2024, it has been reduced good 9 per cent to 40,600 hectares.

According to preliminary information by the German Federal Statistical Office, 124,500 tonnes of soybeans were probably harvested from the significantly reduced area, around 4,500 tonnes less than the previous year. Consequently, yields are likely to exceed the previous year's level. Soybean yields will presumably reach on average 30.7 decitonnes per hectare, representing a just under 7 per cent rise compared to the previous year. Only Thuringia and Saxony-Anhalt are expected to experience lower yields. Bavaria and Baden-Wuerttemberg are anticipated to remain the most important production regions.

The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has underlined the remarkable substitution potential of German or EU-grown soybean, given Germany's immense demand for imports. In 2023, soybean imports reached 3.4 million tonnes, of which approximately 2.7 million tonnes came from the USA. The strong demand for higher-protein feedstuff opens up opportunities for sales and increases in area under cultivation of locally grown soybeans and grain legumes, as well as rapeseed meal from rapeseed processing. From the perspective of the UFOP, legumes are crucial crops in resilient crop rotations geared to climate change mitigation and should play a key role in the future design of the Common Agricultural Policy (CAP) when it comes to justifying transfer payments by societal benefits.

Chart of the week (39 2024)

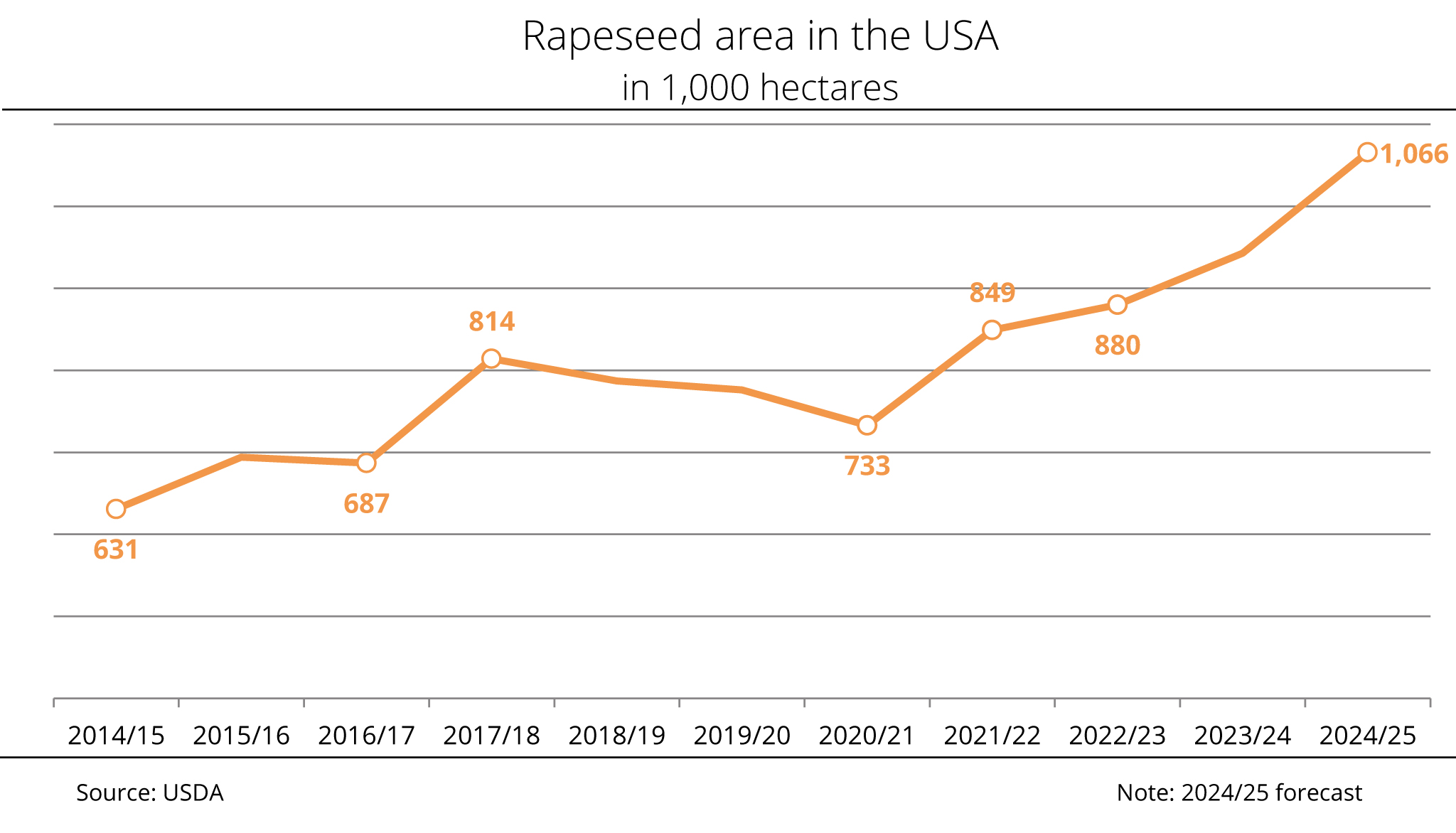

Canola production in the US is booming

The US biofuel market is experiencing dynamic growth, making canola cultivation increasingly attractive for farmers in the northern US. Their Canadian counterparts are also benefiting, because the US is a major market for both canola meal and oil.

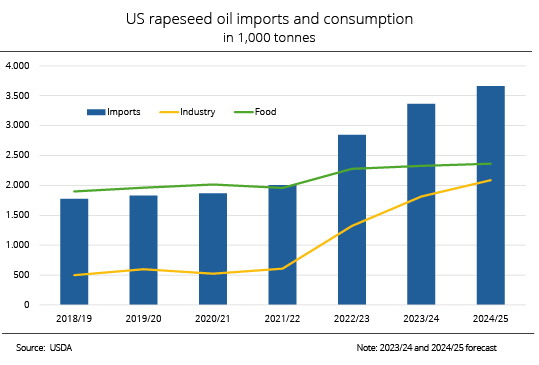

Canola cultivation in the US is on the rise. According to the US Department of Agriculture (USDA), the area dedicated to canola exceeds 1 million hectares for the first time in the 2024/25 season. This represents a 13 per cent increase from the previous year. If yields remain consistent with the previous season, the USDA expects a record harvest of just over 2.1 million tonnes. This would position the US as a globally significant producer of canola and rapeseed. All of the key canola-producing states in the US have expanded their cultivation areas. North Dakota accounts for the lion's share of 830,000 hectares. The state is followed by Montana and Washington, each with around 80,000 hectares, and Idaho and Minnesota, each with about 38,000 hectares. Notably, the canola areas in North Dakota, Montana and Washington have all risen to record highs.

According to research by Agrarmarkt Informations-Gesellschaft (mbH), the growth of canola production in the US is driven by dynamic demand for meal as feed for dairy production and for canola oil as a key feedstock for biofuel production. In particular, the Renewable Fuel Standard (RFS) at the national level and the Low Carbon Fuel Standard (LCFS) in California, where more than 50 per cent of transport fuels are now biobased, have led to brisk demand and attractive prices for producers. However, despite this growth, US production cannot keep pace with demand. Consequently, US imports of canola meal and oil, primarily from Canada, continue to increase steadily.

Chart of the week (38 2024)

USDA expects four-year low for sunflower seeds

According to the latest forecast by the US Department of Agriculture (USDA), the sunflower seed harvest is set to decline worldwide. In particular the EU-27 and Ukraine are seen to bring in smaller harvests.