Chart of the week (52 2019)

Global rapeseed area stable

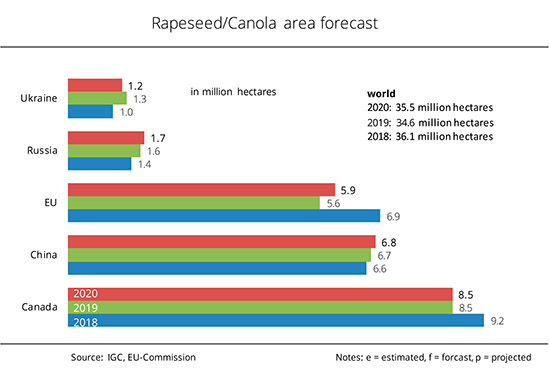

Whereas the rapeseed areas in the EU-28, Russia and China are expected to see a slight rise in the coming marketing year, the production area will presumably remain constant in Canada and likely decline somewhat in Ukraine.

According to the latest information published by the International Grain Council (IGC), the global rapeseed area in 2020/21 will probably be up 3 per cent from the current marketing year to 35.5. million hectares. In the EU-28, Russia and China, the area is expected to increase. More specifically, the EU area planted with rapeseed could rise 7.4 per cent to 5.9 million hectares following the sharp decline in 2019/20, although, according to Agrarmarkt Informations-Gesellschaft mbH (AMI), the sowing campaign was impaired by unfavourable weather in the north and east of the EU. In Russia, the IGC expects the area to expand 6.3 per cent to 1.7 million hectares due to the global growth in demand. The rapeseed area in China is seen to increase 1.2 per cent to 6.8 million hectares.

By contrast, the Canadian production area is anticipated to remain unchanged at 8.5 million hectares. Canadian farmers decided not to expand the rapeseed area due to the uncertainty of demand – especially from China – for Canadian rapeseed exports. Chinese rapeseed imports virtually came to a standstill in 2019 because of political disagreements. At the same time, large stocks and smaller exports to the EU are putting a damper on market expectations. European oil mills preferably draw on rapeseed from Eastern Europe, because it is GM-free, ensuring that the rapeseed meal produced can be marketed easily.

Nevertheless, the IGC expects the Ukrainian rapeseed hectarage to decline 7.1 per cent to 1.2 million hectares. About 1.1 million hectares have been sown to date, with the remaining land likely to be sown in spring. However, due to the continued drought, the Ukrainian crops in the fields are in a less than ideal condition. Consequently, it remains to be seen whether farmers will confirm the ICG's expectation as regards sowings in spring.

From the perspective of the Union zur Förderung von Oel- und Proteinpflanzen (UFOP), the trend in EU rapeseed area is alarming as regards domestic market supply, because the production area is in decline – with one of the reasons being drought-induced low per-hectare yields. The organisation argues that there is an obvious lack of stimuli from processors, with no adequate price bids ahead of the sowings to push rapeseed production. After sowings are complete, processors complain about the need for imports to offset the shortage, UFOP has observed, challenging the oil mills' strategy to secure feedstock.

Chart of the week (51 2019)

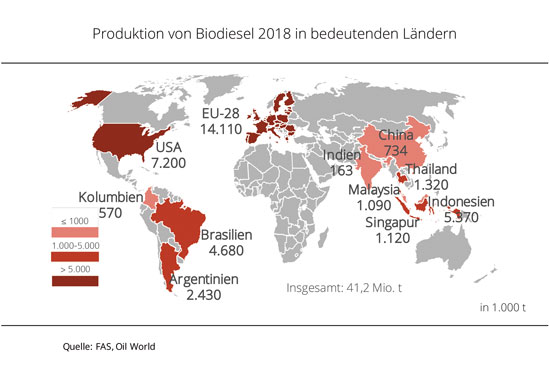

EU remains largest biodiesel producer

In the EU, biodiesel production has increased for another year, accounting for more than one third of world production.

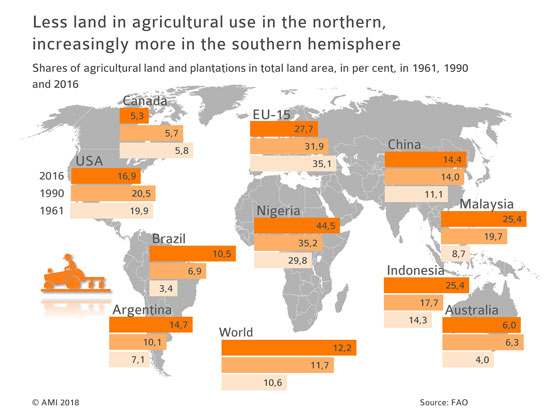

The single most important biodiesel producer is the European Union, which accounted for 34 per cent of global output of 41 million tonnes in 2018. The term “biodiesel” is used in the statistics to refer to biodiesel (FAME = fatty acid methyl ester), hydrogenated vegetable oil (HVO) and biofuels made from vegetable oils in petroleum refineries. Whereas in Europe biodiesel is mainly based on rapeseed oil, soybean oil is the primary source on the American continent. Soybean oil is a by-product of soybean meal production. It is used in biodiesel production in the wake of the steady expansion of soybean area and soy processing to cover demand for soybean meal for animal feeding. The most important biodiesel producers are the EU-28, the US, Brazil and Argentina. The Southeast Asian region has gained more and more importance in the biodiesel market. In the key palm oil producing countries, Indonesia and Malaysia, biodiesel production is on a steady increase, driven by increasing glut and the associated pressure on prices in the vegetable oil markets. Contrary to the EU, these countries are raising their domestic blending quota requirements (Indonesia: B20 / B30) to stabilise producer prices and to reduce foreign exchange expenses on oil imports. For the second time, global output of vegetable oils exceeds the level of 200 million tonnes in the 2019/2020 marketing year.

Chart of the week (50 2019)

Global biodiesel production is increasing

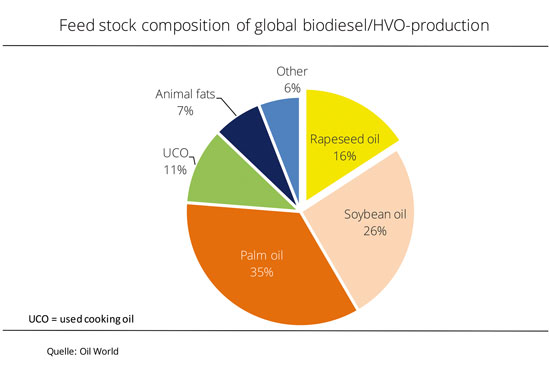

More and more biodiesel is being produced. As in the previous year, palm oil accounts for the largest share of feed stock, followed by soy and rapeseed oil.

Production of biodiesel, and, consequently, the use of feedstocks has increased all over the world. The percentages of feedstocks used remained virtually unchanged from 2017: 35 per cent palm oil, 26 per cent soybean, 16 per cent rapeseed oil, 11 per cent used cooking fats, 7 per cent animal fats and 6 per cent other fats. Palm, soybean and rapeseed oil remained the most important feedstock sources. This will likely change in 2019, because prices for individual components vary quite considerably over 2018.

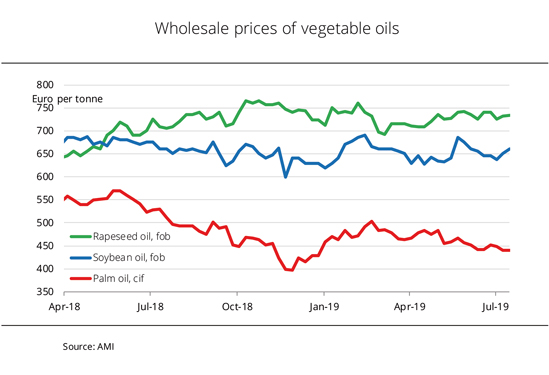

Rapeseed oil is at a high level and cost on average EUR 96/t more in September 2019 than in the previous year. As a result, the gap to soybean, sunflower and palm oil has widened significantly. Biodiesel production from soybean and palm oil is expected to increase in North and South America as well as Southeast Asia.

In the EU 28, it remains to be seen whether the share of biodiesel from waste oils and fats will continue to increase at the expense of rapeseed oil.

Feedstock percentages could also change in the wake of the smaller rapeseed harvest caused by drought, the transition to soybean processing and the more than EUR 300 per tonne price gap at times between palm oil and rapeseed oil.

Chart of the week (49 2019)

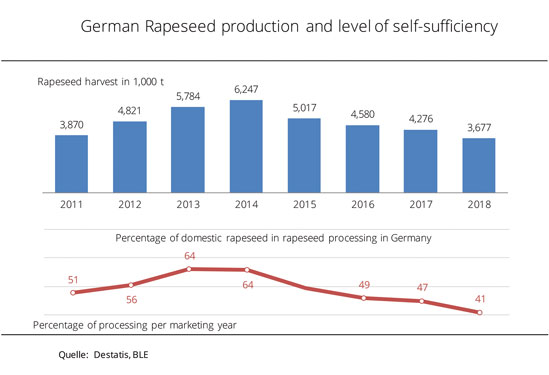

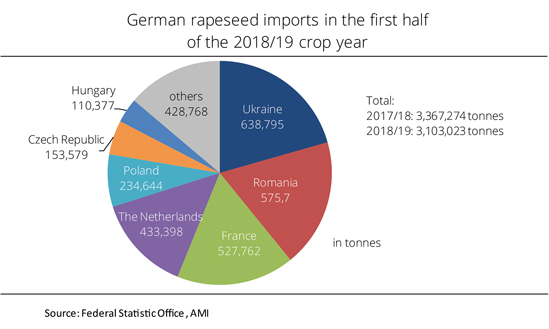

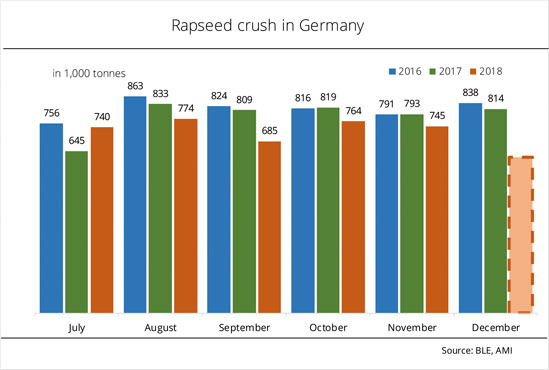

Share of domestic rapeseed in processing declines

As in the previous year, the small rapeseed harvest has reduced the share of rapeseed from Germany in processing. The remaining demand will be covered by imports from other EU countries and the Ukraine.

Supply of rapeseed depends foremost on the domestic harvest volume and consumption. One of the world's largest oilseed-processing countries, Germany needs imported oilseeds, mostly rapeseed (approximately 60 per cent), in addition to oilseeds from its domestic crop. In 2018/19, Germany processed 12.6 million tonnes of oilseeds, of which 71 per cent (approximately 8.9 million tonnes) were rapeseed. Like in the previous year, almost 60 per cent of this demand was covered by rapeseed from abroad. The majority came from EU countries. According to Agrarmarkt Informationsgesellschaft (mbH), France delivered the largest volume of 1.5 million tonnes, followed by Romania with an increase of one third and 640,000 t.

A significant amount – almost 740,000 tonnes, or 10 per cent more than the previous year – came from Ukraine. The total amount of rapeseed processed in Germany yielded 3.8 million tonnes of rapeseed oil and 5.1 million tonnes of Non-GMO rapeseed meal. The amount of rapeseed oil is more than needed for the production of food and transport fuels and for uses in the oleochemical industry. About 1 million tonnes of rapeseed oil went to the German food industry, another 1 million tonnes to the engineering sector. More than 860,000 tonnes (net) of rapeseed oil were exported.

Chart of the week (48 2019)

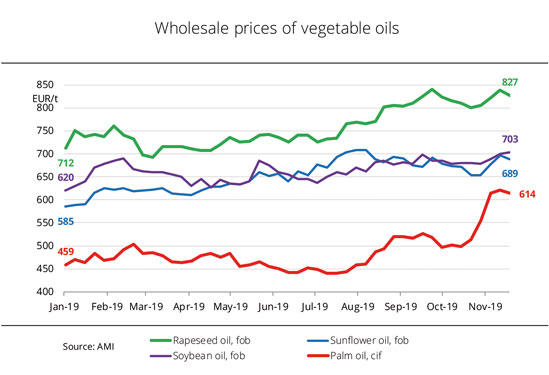

Palm oil supports vegetable oil market

Palm oil has become considerably more expensive over the past two months on support from prices in Kuala Lumpur. It also pulled up prices of other vegetable oils.

Prices for vegetable oils have firmed significantly in the second half of 2019. Palm oil saw the biggest increase, rising 37 per cent since the beginning of July to the recent equivalent of EUR 614 per tonne cif Rotterdam. Rapeseed oil surged 14 percent, soybean oil 10 per cent and sunflower oil 2 per cent. Rapeseed oil was the main driving force for the other vegetable oils from August to September, because the exceptionally early rise in demand from the biodiesel industry drove up rapeseed oil prices. However, since mid October the biggest support has come from rocketing prices for palm oil. Palm oil prices were mainly driven by the jump in palm oil prices in Kuala Lumpur which, according to Agrarmarkt Informations-Gesellschaft (mbH), have soared 30 per cent since 15 October 2019 to the recent equivalent of EUR 573 per tonne, the highest level in two years. They were fuelled by buoyant Indonesian and Malaysian exports in November 2019, prospects of lower output in 2020, and rising demand. Demand is expected to grow, especially because of Indonesia's pending biodiesel programme which aims at raising blending quota requirements from 20 to 30 per cent. The price gap between palm oil and other vegetable oils has narrowed as a result.

The sharp rise in palm oil prices also pulled up soybean oil prices. In other words, soybean oil has continuously been more expensive than sunflower oil since the beginning of October.

Chart of the week (47 2019)

FAO vegetable oil price index climbed

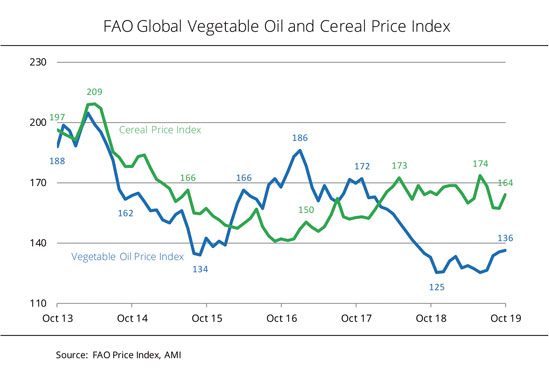

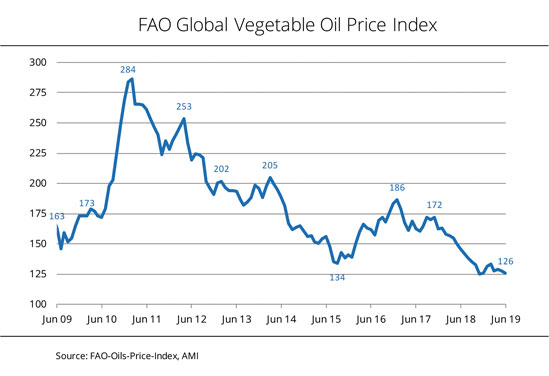

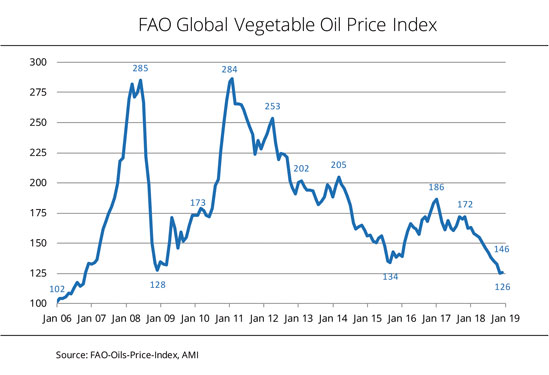

The FAO vegetable oil price index hit its highest level since September 2018 at on average 136 points in October 2019. However, the index still remained considerably below the 2018 average of 144 points.

Higher palm oil prices sent the index up in October 2019 and more than offset the weaker sunflower and rapeseed oil prices. In other words, international asking prices for palm oil rose for the fourth month running. Whilst July prices were at the equivalent of EUR 417 per tonne, those in October were just over EUR 55 per tonne higher. The reason was strong global buying interest and expectations that production would slow down in the leading countries of origin. Moreover, Indonesia is likely to raise it blending quota requirements for biodiesel in the coming year.

By contrast, sunflower oil prices waned. Large harvests in the Black Sea region boosted processing and consequently also led to an increase in supply of by-products on the global market. At the same time, the EU processed surprisingly high volumes of rapeseed. This meant that plenty of rapeseed oil was produced and prices were forced down.

The October cereal price index also rose, reaching on average 164 points. This was up around 4.2 per cent from the previous month, but down 1 per cent on the previous year's figure. According to the FAO, the key factor for the increase was international wheat prices, which received support from brisk exports and low harvest prospects in Argentina and Australia. Moreover, global maize export prices saw a massive rise, because international demand picked up and there were signs of a small US harvest. The rise in the FAO index was limited by somewhat firmer prices of rice.

Chart of the week (46 2019)

Prices for soybean meal: focus on Brazilian crop

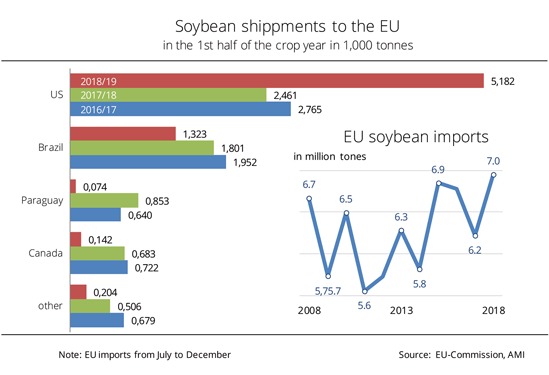

Modest per-hectare yields and a small production area led to the smallest rapeseed harvest in the EU in 13 years. EU imports have already just about doubled.

The dry autumn of 2018 thwarted many a farmer's sowing plans and led to the smallest EU rapeseed area in more than 10 years. Due to the unfavourable weather, total output in the EU and Germany hit rock bottom at just under 17 million tonnes and less than 3 million tonnes respectively.

In the preceding years, European oil mills processed 47 million tonnes of oilseeds, with rapeseed accounting for 24 million tonnes. EU rapeseed harvests covered just about 90 per cent of demand from oil mills. This figure is unlikely to be reached this year; the EU Commission's forecast is for 75 per cent. As a result, there is a need to increase rapeseed imports. European oil mills purchased around 2.6 million tonnes from abroad in the ongoing season. This compares to only 1.3 million tonnes year-on-year. These imports will increase to approximately 5.5 million tonnes by the end of the marketing year.

Ukraine has established itself as the primary source of rapeseed from non-EU countries over recent years. In the running marketing year, the country has already supplied 2 million of the total of 2.6 million tonnes of rapeseed imports. According to information from Agrarmarkt Informations-Gesellschaft (mbH), supply is supplemented by Canadian rapeseed this year. Due to the trade dispute with China and the associated surplus – China has previously been the main recipient of Canadian rapeseed –, Canadian producers are desperately seeking new markets. Canadian rapeseed is usually genetically modified and therefore subject to strict regulations which do, however, not exclude the use of the oilseed meals in livestock feed. The EU procures smaller amounts from Moldova, Serbia and Russia.

Chart of the week (45 2019)

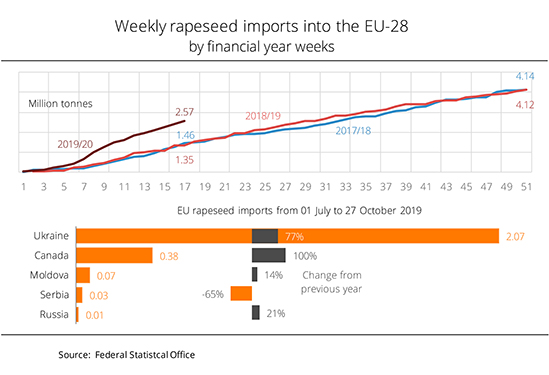

Small rapeseed harvest is pushing up imports

Modest per-hectare yields and a small production area led to the smallest rapeseed harvest in the EU in 13 years. EU imports have already just about doubled.

The dry autumn of 2018 thwarted many a farmer's sowing plans and led to the smallest EU rapeseed area in more than 10 years. Due to the unfavourable weather, total output in the EU and Germany hit rock bottom at just under 17 million tonnes and less than 3 million tonnes respectively.

In the preceding years, European oil mills processed 47 million tonnes of oilseeds, with rapeseed accounting for 24 million tonnes. EU rapeseed harvests covered just about 90 per cent of demand from oil mills. This figure is unlikely to be reached this year; the EU Commission's forecast is for 75 per cent. As a result, there is a need to increase rapeseed imports. European oil mills purchased around 2.6 million tonnes from abroad in the ongoing season. This compares to only 1.3 million tonnes year-on-year. These imports will increase to approximately 5.5 million tonnes by the end of the marketing year.

Ukraine has established itself as the primary source of rapeseed from non-EU countries over recent years. In the running marketing year, the country has already supplied 2 million of the total of 2.6 million tonnes of rapeseed imports. According to information from Agrarmarkt Informations-Gesellschaft (mbH), supply is supplemented by Canadian rapeseed this year. Due to the trade dispute with China and the associated surplus – China has previously been the main recipient of Canadian rapeseed –, Canadian producers are desperately seeking new markets. Canadian rapeseed is usually genetically modified and therefore subject to strict regulations which do, however, not exclude the use of the oilseed meals in livestock feed. The EU procures smaller amounts from Moldova, Serbia and Russia.

Chart of the week (44 2019)

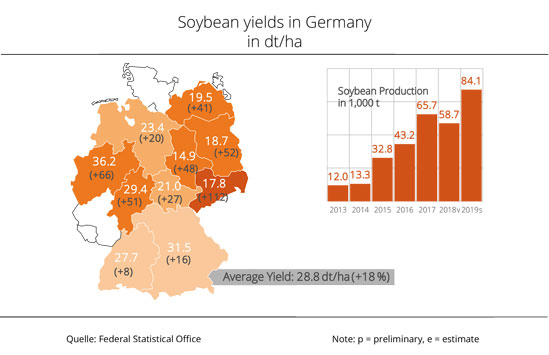

Soybean yields on a sharp rise

Soybean farming has become increasingly important in Germany. Soybean area and output have been growing since 2016.

In the current marketing year, the German soybean harvest surged 43 per cent to 84,100 tonnes. In other words, the country has taken yet another step towards closing up to the EU's top producers Italy, Romania and France. According to Agrarmarkt Informations-Gesellschaft (mbH) (AMI), significant amounts of soybeans have only been grown in Germany since 2015. Back then, 12,000 hectares of land were under soybean cultivation, producing a yield of 27.3 decitonnes per hectare and a harvest of 33,000 tonnes. Since that time, the soybean area has more than doubled to reach 29.000 hectares. The amount harvested has also more than doubled. Yields were lower than average in the previous year, at 24 decitonnes per hectare, but are expected to be up around 5 decitonnes per hectare at just under 29 decitonnes per hectare in 2019. Bavaria and Baden-Wuerttemberg together account for around 84 percent of total soybean production in Germany. Bavaria is the top producer with an area of 16,000 hectares and an output of 49,000 tonnes, followed by Baden-Wuerttemberg with 7,600 hectares and 21,000 tonnes. However, farmers in North Rhine-Westphalia generated the highest yields of 36 decitonnes per hectare, whereas farmers in Bavaria and Baden-Wuerttemberg reached 32 decitonnes per hectare and 28 decitonnes per hectare respectively.

In view of the rising demand for GM-free proteins for animal feed and the human diet, the Union zur Förderung von Oel- und Proteinpflanzen (UFOP) sees a large growth potential for soy together with the other large-grained pulses. Farmers have a growing interest in opening up a new marketing alternative with grain legumes and expanding the range of rotation crops with flowering plants. UFOP has underlined that this fact should be taken into account when developing an agricultural strategy that is geared to be economically sustainable. According to the association, the unique selling point of "GM-free" and regional origin promote product acceptance by consumers and create a clear marketing advantage.

Chart of the week (43 2019)

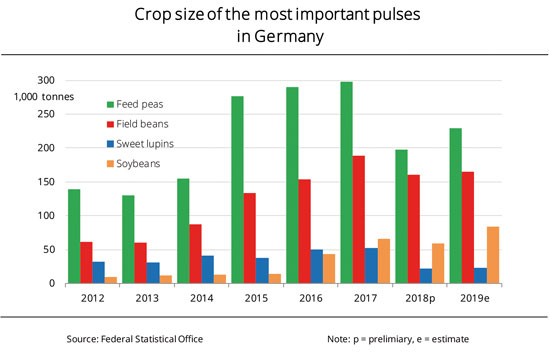

More soybeans from Germany

The increase in area sown with pulses held out the prospect of a larger crop already in spring. Significant growth in yield in some places added to heighten crop expectations further.

Following the weak previous year due to poor weather, the 2019 legume crop is expected to be slightly larger again. In the past year, just less than 439,000 tonnes were harvested due to a reduction in planted area and sharp declines in yield. The current year's harvest is projected to be up around 14 per cent at 501,000 tonnes. On German average, soybean production saw an especially significant rise. At 84,000 tonnes, 2019 production was up 43 per cent from the previous year. However, feed pea output was also up 16 percent and the field bean harvest increased 3 per cent. The sweet lupin harvest was only marginally larger than a year earlier.

Soybeans have only been grown in Germany to any significant degree since 2015. Ever since then, the area has increased by 17,000 hectares. Compared to the previous year alone, it expanded 5,100 hectares to 29,000 hectares. Bavarian farmers are the by far most important soybean producers, accounting for just less than 60 per cent of total German output. Increases in area sown and yield all across Germany led to an increase in tonnage harvested in 2019.

According to Agrarmarkt Informations-Gesellschaft (mbH), the pronounced growth in output of feed peas is based on an expansion in area and higher yields. Of the total soybean area of 74,800 hectares, the largest hectarage is found in Bavaria, followed by Saxony-Anhalt. However, due to significant increases in yield, the largest tonnage, 37,000 tonnes, was harvested in Mecklenburg-Western Pomerania. Although the field bean area decreased 11 per cent compared to the previous year, the amount harvested grew due to increases in yield. Schleswig-Holstein farmers achieved yields of 46.3 decitonnes per hectare, which was up 12 decitonnes per hectare from the previous year. At around 10,000 hectares, North Rhine Westphalia has the largest field bean area in Germany. The federal state also brought in the largest harvest, 37,700 tonnes.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP), referring to the overall stability of the trend, demands the German government to develop grain legumes as an increasingly important source of protein for animal feed, but also human diet. In view of the agricultural strategy, these crops must move into focus as multi-talented crops to expand the range of rotation crops, increase biodiversity and improve the greenhouse gas balance by organically binding atmospheric nitrogen for succeeding crops.

Alongside rapeseed, grain legumes are the only GM-free protein alternative to soybean imports. UFOP argues that the development of such strategy is a touchstone of whether the German government is serious about promoting the bioeconomy for the purposes of a regional circular flow economy not just for carbon, but also for nitrogen. The association has underlined that this strategy would also go a long way towards enhancing public acceptance. Therefore, the existing promotional approaches via networks should be stabilised and intensified.

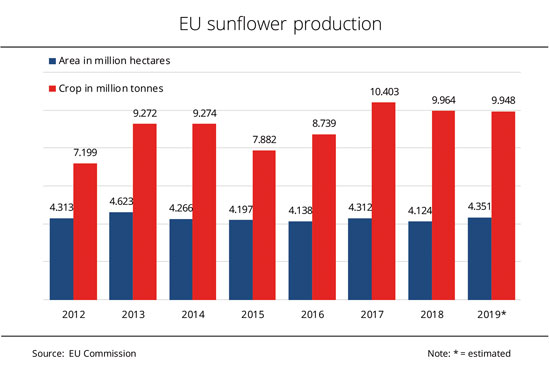

Chart of the week (42 2019)

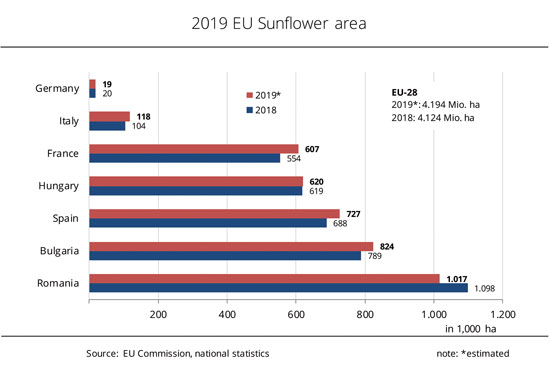

2019 EU sunflower crop falls just short of previous year's level

Sunflowers are the second most important oilseed crop in the EU, currently occupying one third of the total production area.

The unfavourable growing conditions in 2019 primarily affected winter crops. The productivity of summer crops, such as sunflowers, was less impaired. The drought in spring was sub-optimal for germination, but it allowed farmers to sow the seed timely. According to information published by the EU Commission, the total EU area sown with sunflowers amounts to 4.4 million hectares. This translates to a 5.5 per cent rise from 2018. The five-year mean was also exceeded by 3 per cent. The largest sunflower areas are in Romania (1.3 million hectares), Bulgaria (0.8 million hectares) and Spain (0.7 million hectares).

Most regions did not receive sufficient rain during the growing season. As a result, crop forecasts were lowered for many parts of Europe due to the heat spells in the summer. The yield forecast for the EU-28 is an average of 22.9 decitonnes per hectare. This would be 1.3 decitonnes per hectare below the previous year's yield. Agrarmarkt Informations-Gesellschaft (mbH) reports that Slovenia, Romania and Spain are projected to see the sharpest decline in yield, of 12 per cent on average. Nevertheless, Romania is expected to bring in the largest harvest. At 3.2 million tonnes, sunflower production is likely to exceed the previous year's output by 0.2 million tonnes. In contrast, Bulgarian output is seen to remain almost unchanged from the previous year at 1.9 million tonnes. Although it has the third largest sunflower area, Spain only ranks fifth of EU sunflower producers, with an output of 0.8 million tonnes due to below-average yields. The country is outranked by Hungary and France, which are forecast to produce 1.8 and 1.3 million tonnes respectively. The total EU harvest in 2019 amounts to 9.95 million tonnes, which is only down 0.2 per cent from 2018.

Chart of the week (41 2019)

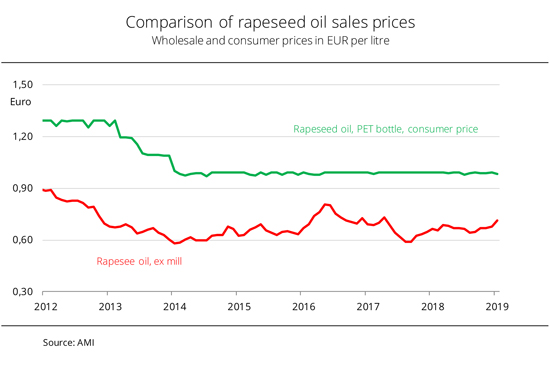

Fluctuations in feedstock prices hardly move consumer prices

The drought-reduced rapeseed harvests in Germany in 2018 and 2019 have had little impact on consumer price levels for edible rapeseed oil.

Below-average yields regularly raise the question of whether the limited domestic feedstock supply will make processed products more expensive. For example whether prices for rapeseed oil or margarine will rise as a result of the small 2019 rapeseed harvest. For German rapeseed producers, the harvest was financially disappointing. However, this allows only limited conclusions to be drawn on the development of consumer product prices. The reason is that the shortage is absorbed by rapeseed imports, especially from eastern Europe, that were secured in good time to meet German demand. The German food industry exclusively uses GM-free rapeseed, and so do German oil mills in the production of rapeseed meal as the most important opposed GM-free source of feed protein. Some companies label their trading units as "GM-free". This declaration is already found on many dairy products and it is well established in the food retailing sector today.

According to information published by Agrarmarkt Informations-Gesellschaft (mbH), consumer prices for rapeseed oil virtually remained at the same level of EUR 0.99 per litre on German average over the past five years. By contrast, movements of wholesale prices for rapeseed oil ex oil mill were much more pronounced – but had little impact on consumer prices.

There is also only a limited correlation between producer prices for rapeseed and oil mills' asking prices for rapeseed oil. Whereas rapeseed oil has steadily increased 11 per cent since March 2019, prices for rapeseed only rose 5 per cent over the same period. The use of rapeseed oil in biodiesel fuel production also has virtually no impact on the price level of edible rapeseed oil for consumers. In other words, the controversial “food-or-fuel debate” ignores the de-facto developments in the market.

Chart of the week (40 2019)

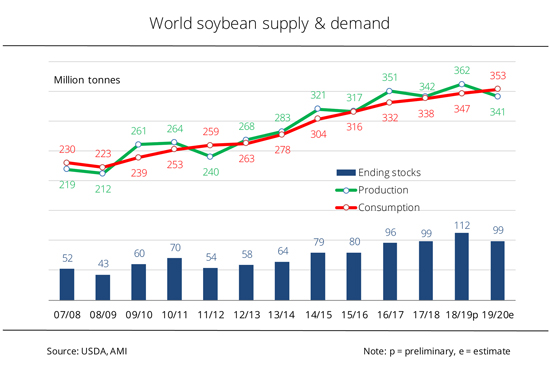

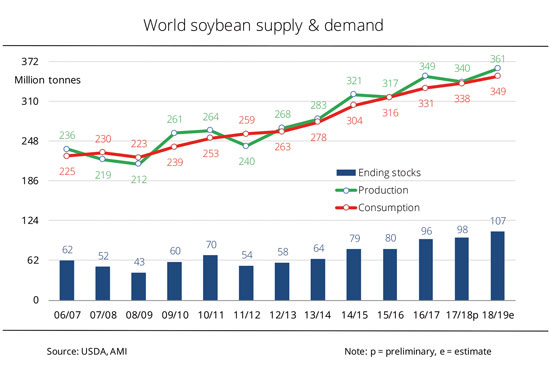

Outlook for global soybean stocks loweredl

In its latest publication, the US Department of Agriculture (USDA) substantially lowered its estimate of the 2019/20 soybean stocks. However, stocks are still seen to be large.

In its latest forecast for international soybean supply in the 2019/20 marketing year, the USDA made some adjustments. Beginning stocks were pegged at 112.4 million tonnes, down 1.85 per cent from the previous month's estimate. Also, the output forecast was lowered marginally to 341.4 million tonnes. The biggest adjustment was made for soybean ending stocks. The estimate of 99.2 million tonnes is down 2.5 per cent from the August estimate and would translate to an 11.8 per cent drop from the previous year's record. However, it would still be the second largest tonnage ever and, according to Agrarmarkt Informations-Gesellschaft (mbH), make the start into the new processing season extremely comfortable.

The USDA also made significant adjustments to its production outlook for individual US states. However, these adjustments almost offset each other on balance. Not surprisingly, the harvest estimate for the US was slightly lowered again by 1.3 per cent to 98.87 million tonnes. This means that the harvest would fall just over 20 per cent short of the previous year's record. It would also be the poorest harvest in six years. Heavy rain and flooding delayed US soybean plantings in spring and impaired the early stages of plant development. The crops did not completely recover from this poor start during the rest of their growth phase. This is confirmed by both the weekly figures on US crop progress and condition and the monthly USDA harvest estimates.

Chart of the week (39 2019)

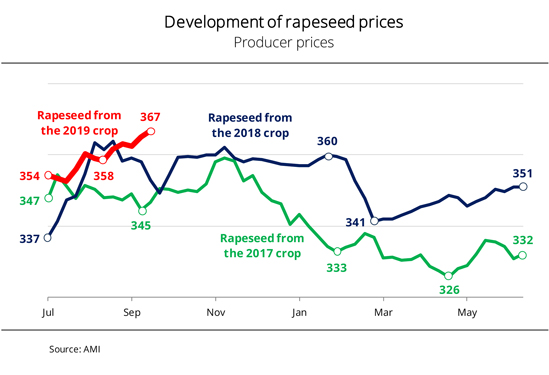

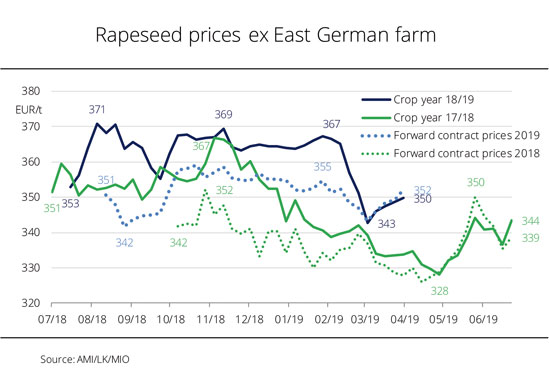

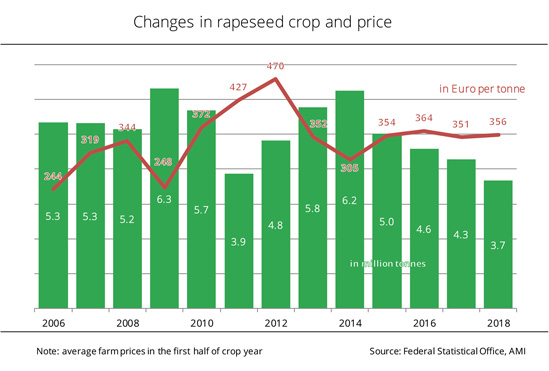

Rapeseed prices clearly exceed year-ago level

The small EU rapeseed crop and firm forward prices drove up producer prices for rapeseed considerably. Also, feedstock demand from oil mills picked up over the past weeks.

At the beginning of the 2019/20 marketing year, farm rapeseed prices climbed sharply. The rise was due to the small rapeseed harvest in Germany and the EU in 2019. At the beginning of July, prices were at EUR 354 per tonne. At the end of August, they already surpassed the mark of EUR 360 per tonne and most recently, they hit EUR 367 per tonne. In other words, rapeseed prices were up EUR 14 per tonne from the previous year and even EUR 20 per tonne from 2017.

According to Agrarmarkt Informations-Gesellschaft (mbH), although prices significantly exceeded the year-earlier level, farmers' inclination to sell did not pick up until calendar week 37. Before then, farmers held back on their produce because they found that the price level was much too low given the small crop. Only the noticeable jump in prices in calendar week 37 encouraged farmers to recommence selling their produce. The higher price level for rapeseed oil and higher margins spurred rapeseed processing in the oil mills.

Support also came from the futures exchange in Paris. Price quotes for rapeseed prices have increased 6 per cent since July.

Chart of the week (38 2019)

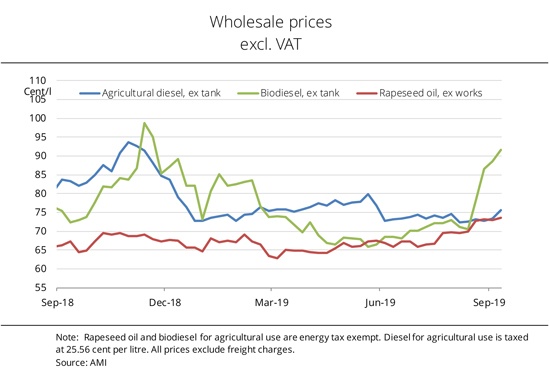

Biodiesel prices soar

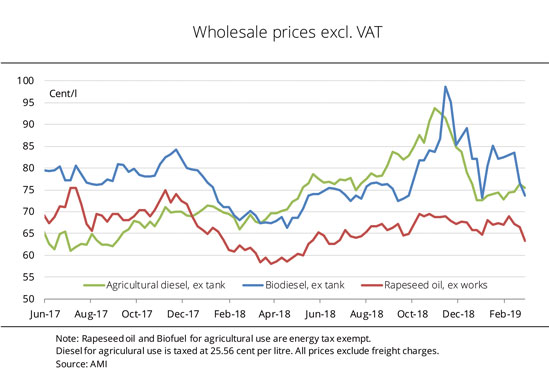

Buoyant demand for biodiesel, especially rapeseed methyl ester, hasn’t just driven biodiesel prices, but also rapeseed oil prices.

Wholesale prices for biodiesel have seen a sharp rise since 14 August 2019, from 70.5 euro cents per litre in mid August to recently 91.6 euro cents per litre. This translates to an approximately 30 per cent increase. The current price exceeds the year-ago level by 27 per cent. The mark of 90 euro cents per litre was not cracked until November in 2018. According to Agrarmarkt Informations-Gesellschaft (mbH), the price increase is due to growing demand for biodiesel. From October onwards, rapeseed methyl ester (RME), without any additives, is the primary material blended into diesel fuel to ensure winter diesel quality. The fatty acid composition of rapeseed oil accounts for the edge rapeseed oil-based biodiesel has over biodiesel based on soybean oil and, above all, palm oil.

As a result, demand for RME rises every year in September, driving up prices. The requirements for winter diesel apply to diesel fuel all over the northern part of the European Union. The above-mentioned property of rapeseed oil is unique. For this reason, national commitment targets indicate a minimum need for rapeseed methyl ester. Moreover, mineral oil companies, which are subject to the obligation to meet the GHG reduction quota, are required to meet such quota by the end of the year (calendar year = quota year). This is why they are stocking up on RME for the fourth quarter. In 2019, the companies started to order RME in mid August already. This was a month earlier than the previous year.

Higher demand for RME has also pulled up wholesale prices for rapeseed oil, which recently reached 73.5 euro cents per litre. Only prices for agricultural diesel have remained at a relatively constant level of around 76 euro cents per litre since July 2019.

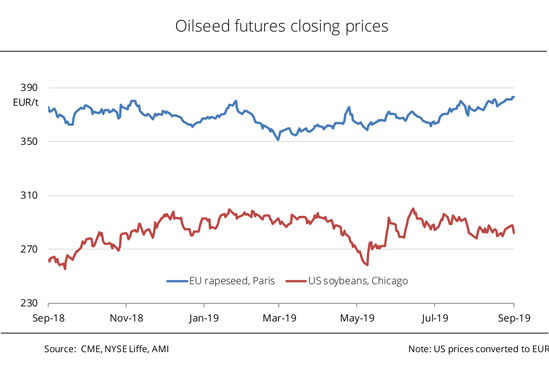

Chart of the week (37 2019)

Small EU harvest drives rapeseed prices

Whereas the small harvests in the EU and buoyant RME demand from the biodiesel industry sent rapeseed prices in Paris rising, US soybean prices were guided by mixed stimuli.

Paris rapeseed prices have been on a steady rise since the beginning of March 2019. Reaching EUR 351.50 per tonne – the lowest level since June 2018 – on 4 March 2019, they recently closed at EUR 383 per tonne. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), prices were driven by the small EU rapeseed harvest. The trend was also supported by increasing prices for palm oil. Forward prices of rapeseed were also lifted by the sharp rise in demand for biodiesel. At the same time, along with UCOME, which is in demand at all times, rapeseed methyl ester (RME) has been ordered since mid August for incorporation in blends from October onwards to meet winter diesel requirements. Market participants said that, consequently, demand for RME had picked up earlier than usual.

On the other hand, Chicago soybean prices did not show a clear trend. Seldom ever have analysts' and the USDA's assessments of soybean plantings been so disparate. Due to massive delays in planting in the US, the volume of the US harvest was still uncertain. Depending on weather conditions and US crop development, prices will rise or decline. The intensifying trade war between the US and China weighs heavily on prices. China has collected an additional 5 per cent punitive tariff on soybean shipments from the US since 1 September 2019. However, the extra tariff is of a more symbolic nature. In fact, its purpose is rather to demonstrate that China has no intention to back down in the trade dispute with the US. This assumption is based on the fact that the Chinese government has already strictly prohibited domestic companies from purchasing US agricultural products, such as soybeans. This means that an agreement in the US-China trade dispute recedes further into the distance. Although soybean prices have declined EUR 18 per tonne since June 2019 to recently EUR 282 per tonne, they were still EUR 20 per tonne above the year-ago level.

Chart of the week (36 2019)

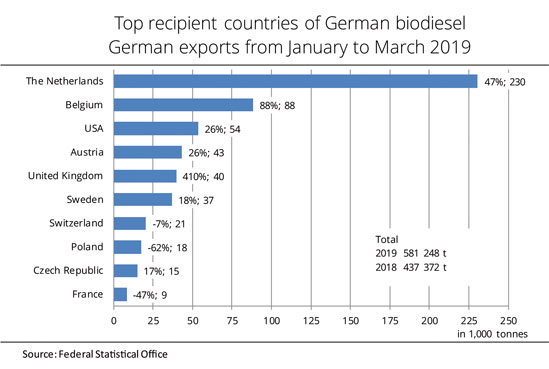

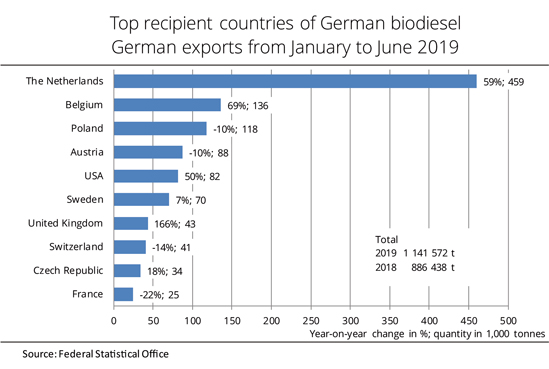

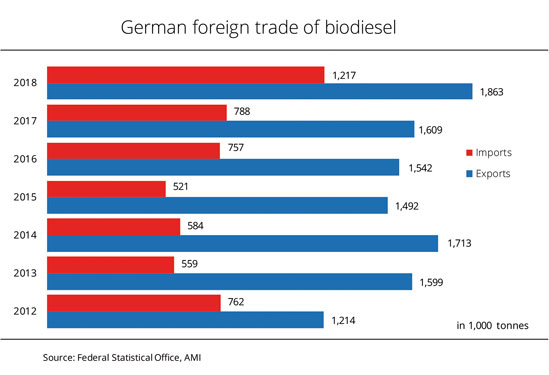

Biodiesel exports rose sharply

German biodiesel exports rose sharply in the first half year of 2019 compared to 2018. The Netherlands is the primary country of destination and by far the most important trading platform in Europe.

In the first half year of 2019, biodiesel exports increased significantly year-on-year by approximately 0.225 million tonnes to 1.14 million tonnes. This translates to approximately one third of Germany's annual output. The majority of exports went to other EU countries. Their share rose 30 per cent from the previous year to 1 million tonnes. With a 59 per cent increase and approximately 0.46 million tonnes, the Netherlands is by far the most important recipient and transit country for reshipments to other countries.

Great Britain saw the largest relative increase. The country purchased 43,290 tonnes of biodiesel from Germany in the first half year of 2019. This was almost triple the volume bought in 2018. Belgium also raised import volumes by more than half to 136.000 tonnes. The US, which ranked third of the top recipient countries in the quarter-on-quarter comparison until March 2019, purchased 82,000 tonnes and slipped to rank five in the half-year comparison. Nevertheless, the country raised its biodiesel imports from Germany by half compared to the same period last year. This translates to the third largest increase among the top ten importing countries of German biodiesel. According to information published by Agrarmarkt Informations-Gesellschaft (mbH), some recipient countries also saw considerable declines in imports. Above all, French imports of German biodiesel dropped around 22 per cent to 25,000 tonnes in the first half year of 2019 compared to the same period 2018. Poland and Austria lowered their import volumes 10 per cent to 118,000 and 88,000 tonnes respectively.

From the perspective of the Union zur Förderung von Oel- und Proteinpflanzen (UFOP), these figures underline the importance and competitiveness of the German oil mill and biodiesel industries. One of the reasons is that the German market easily absorbs rapeseed meal that is obtained as a by-product in rapeseed processing. Due to the geographical situation of Germany within the EU and the receptiveness of the country's livestock industry – especially in dairy feeding – biodiesel exports also safeguard rapeseed production in neighbouring EU states. Because the German rapeseed harvest was small again this year, at approximately 2.8 million tonnes, UFOP is concerned that the trade channels for rapeseed imports could become firmly established. However, the association has pointed out that producer prices must increase, if German production is to safeguard supply. UFOP has reminded oil mills and biodiesel producers that the obligation to reduce greenhouse gas emissions will increase to 6 per cent in 2020. Public and political acceptance of the biofuels policy also depends on the volume domestic rapeseed production contributes to feedstock supplies, UFOP has warned.

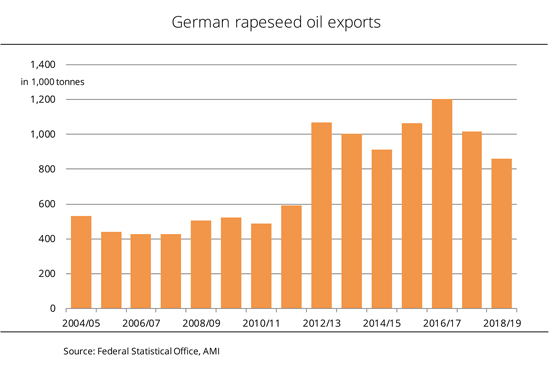

Chart of the week (35 2019)

German rapeseed oil exports fell 15 per cent

German exports of rapeseed oil shrank for the second year running in the 2018/19 marketing year. Above all, demand from some EU member states dropped sharply.

German exports of rapeseed oil slowed considerably in 2018/19 compared to the previous year and even decreased by as much as one third compared to 2016/17. In the past marketing year, only 860,700 tonnes of rapeseed oil were sold abroad. This translates to a 15 per cent decline from 2017/18. In other words, exports dropped to the lowest level in seven years. Agrarmarkt Informations-Gesellschaft mbH (AMI) has suggested that the reason for the slowdown is probably the lower availability of feedstock, which was even scarcer in 2018 than it had been in 2017.

The largest volumes went to the Netherlands, the hub of international trade, which received around 491,700 tonnes. However, this was down 14 per cent year-on-year. Poland, which had been the second most important purchaser of German rapeseed oil in the preceding five years, slid to fourth place, based on a 60 per cent decline in 2018/19. The decrease could be due to the rise in Polish production of rapeseed oil. Poland was displaced by Belgium in 2018/19, which imported 85,400 tonnes of rapeseed oil, around 22 per cent more than a year earlier. Demand from the EFTA states (Iceland, Norway and Switzerland) had already slumped 66 percent in 2017/18, but almost halved again to 15,200 tonnes in 2018/19. The reason was a two-thirds decline in Norway's demand for imports to 6,000 tonnes. On the other hand, Great Britain doubled its imports of German rapeseed oil to 11,200 tonnes.

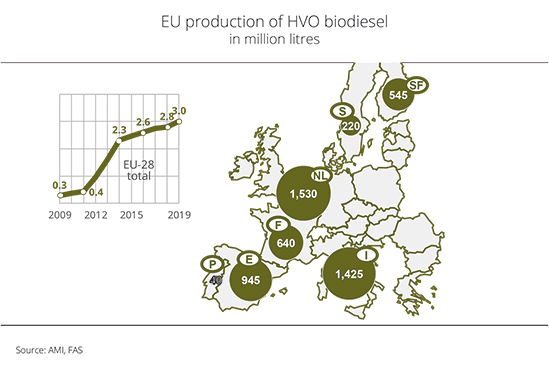

Chart of the week (33 2019)

Mineral oil groups ramp up HVO production in the EU

Production of hydrogenated vegetable oil (HVO) in the European Union has picked up pace since 2012. Mineral oil groups, such as Neste, Eni and Total, were the main entities promoting the creation of corresponding capacities. From the perspective of the Union zur Förderung von Oel- und Proteinpflanzen (UFOP), the key reason for the development is that the iLUC Regulation introduced in 2015 permits that biofuels from waste oils and fats can be counted double. At the same time, pressure on prices has increased in the international vegetable oil markets.

Palm oil has become cheaper and cheaper relative to soybean and, above all, rapeseed oil. Plant operators can order the feedstock flexibly, depending on price. However, the mineral oil group Total underestimated the opposition from French farmers in June 2018. The farmers staged a massive protest against Total's plans to initially use approximately 0.5 million tonnes of palm oil as a feedstock at La Mede. This translates to about 0.14 million hectares of additional palm oil plantations.

HVO plants can use a wide range of feedstocks, such as native vegetable oil, animal fats, fish oil, and used cooking oil as well as oils that are by-products of different industrial processes, such as tall oil from the wood and paper industries, palm oil mill effluent and palm fatty acid distillate (PFAD). In view of these feedstock options, UFOP has urged the EU to step up certification and documentation requirements.

HVO output in the EU is estimated at 2.8 billion litres in 2018 and expected to rise slightly to 3 billion litres in 2019. The planned production facilities in France and Italy are expected to boost production to 3.5 and 4.5 billion litres respectively from 2020 onwards. These volumes are major factors in making the EU the largest producer of alternative diesel fuels in the world. According to information published by Agrarmarkt Informations-Gesellschaft mbH (AMI), production of biodiesel including HVO in 2019 will amount to around 14.2 billion litres.

HVO is made by saturating the double bonds in the fatty acid molecules of vegetable and animal oils and fats with hydrogen. Propane is produced as a by-product. The product can be modified in the HVO production process, so that HVO can be blended with fossil fuels at 7 per cent (the same as biodiesel) or more to make regenerative diesel or biokerosene. This means that HVO can be incorporated specifically and irrespective of the time of year (winter quality) for existing vehicle fleets in the carriage of goods or in traditional kerosene. Contrary to fatty acid methyl ester production (biodiesel), this method involves very high investment costs.

Along with the option of double counting and superior GHG reduction values compared to conventional biodiesel from vegetable oils, the feedstock price is key to the preference of using HVO. UFOP has noted that the European biodiesel industry is challenged to accept this competition for GHG efficiency and further improvement of product quality as a prerequisite to ensure its future competitiveness. UFOP supports, within the scope of its resources, research projects on biodiesel and rapeseed oil fuels (https://www.ufop.de/biodiesel-und-co/biodiesel/forschung-und-entwicklung/).

Chart of the week (32 2019)

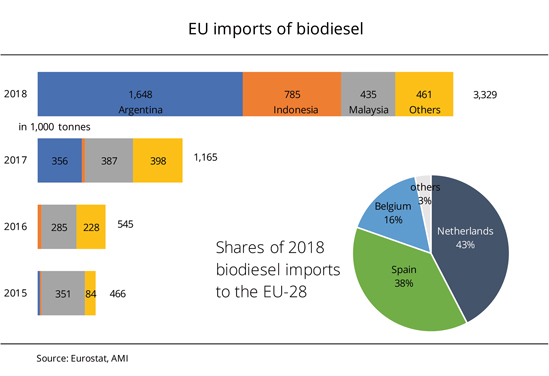

Planned anti-subsidy duties on palm oil methyl ester ineffective

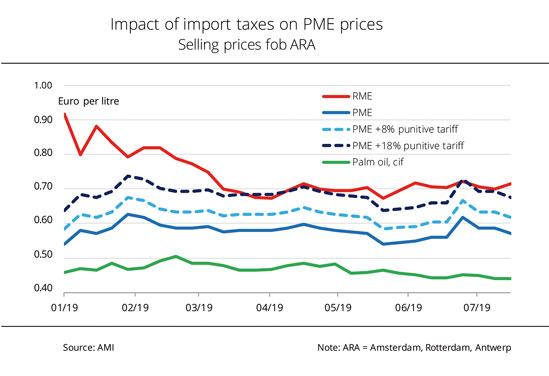

The preliminary anti-subsidy duties announced by the EU Commission will not reduce imports of palm oil-based biodiesel. This is the conclusion the Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has drawn from a comparison of 8 per cent and 18 per cent duty increases.

In the anti-subsidy proceedings against Indonesia, the responsible committee of the EU Commission agreed at the end of July 2019 to impose preliminary punitive tariffs. These tariffs will be between 8 per cent and 18 per cent and will presumably come into force on 5 September 2019. The reason given for this step was that the Indonesian government supports biodiesel exports by providing tax breaks and low-priced palm oil. The tariff increases are intended to offset competitive disadvantages for the European biodiesel industry.

UFOP has pointed out that the scheduled punitive tariffs will not raise the price for palm oil methyl ester (PME) to the price level of rapeseed oil methyl ester (RME). In other words, European rapeseed production, as a feedstock source for biodiesel production, will not benefit from the step taken. UFOP does not agree with the low level of the punitive tariffs. The association argues that just in the past weeks the EU Commission itself has taken a very critical stance on the issue of indirect changes in land use in connection with European biofuels policy.

The revision of the Renewable Energy Directive (RED II) provides that palm oil-based biofuels must be reduced as from 2024, until which year the levels consumed in 2019 will serve as the maximum value, to be scaled down to zero by 2030. UFOP contends that the EU Commission's hesitation to impose efficient punitive tariffs prevents the tariffs from having a reducing effect on consumption in the European Union in 2019. Because of this, the association has called on the EU Commission to impose higher and more efficient punitive tariffs in order to make a perceptible contribution towards avoiding negative impacts on land use in Indonesia.

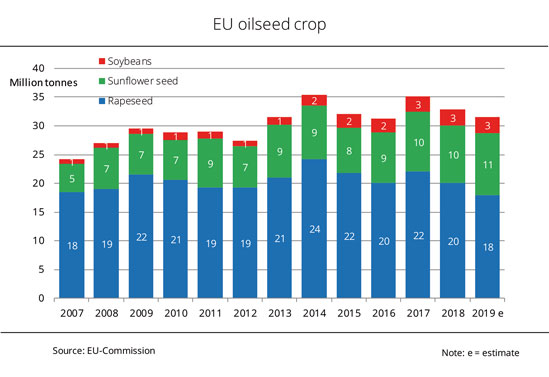

Chart of the week (31 2019)

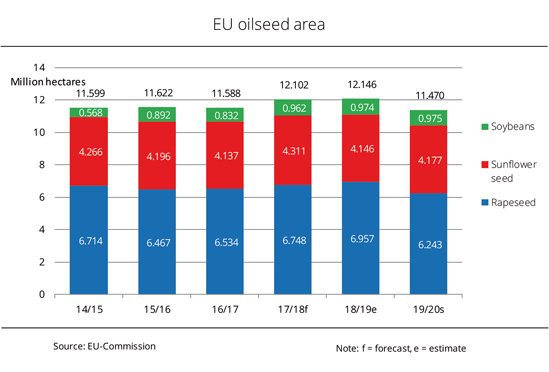

EU oilseed crop smaller yet again

Weather conditions have led to a reduced 2019 EU rapeseed harvest, bringing production down to a 13-year low. At the same time, the sunflower crop is expected to hit a record.

For the second time in two years, the EU oilseed crop is set to be smaller than the previous year. The EU Commission estimates 2019 output at 31.7 million tonnes. This would not only be down 4 per cent from the year-ago level, but also 5 per cent below the long-standing average.

The decline in rapeseed is especially severe. The reasons are a drought-related 15 per cent reduction in EU rapeseed area and poor yields that are provisionally estimated at 3 tonnes per hectare. This yields a rapeseed harvest of just less than 18 million tonnes, which would be down 10 per cent from 2018 and just over 3 million tonnes from the average in recent years. The German rapeseed harvest is seen at a disappointing level of just less than 3 million tonnes. At 17 per cent, it accounts for the lowest share in EU rapeseed output in the past 25 years. At the same time, EU soybean production is projected to remain stable at 2.9 million tonnes, because low yields will likely offset the expansion in soybean area.

By contrast, the EU Commission expects a larger EU sunflower harvest. In addition to the 6 per cent rise in area, yields could also see a slight increase compared to the previous year with the result that sunflowerseed output could increase to a new record of an estimated 10.7 million tonnes.

Chart of the week (30 2019)

France bans palm oil from biofuels

France is tightening up regulations on the use of palm oil as a feedstock in biofuels production. However, this only applies to palm oil eligibility within France. As a result, biofuels produced in France could push their way onto the EU market, toughening supply and price competition.

The French regulation No. 2019-570 published last month ends the eligibility of biofuels such as palm oil methyl ester (biodiesel) and hydrogenated vegetable oil from palm oil (HVO) for public funding. The regulation will come into force on 1 January 2020 together with the new tax system. It also provides that as of 31 December 2019, economic operators will no longer be allowed to include palm oil-based biofuels in their mass balances.

This provision especially affects the mineral oil group Total. The group only took the refinery at La Mède into operation to produce HVO in July 2019. The plant has an annual capacity of 500,000 tonnes. According to the Total group, the maximum amount of palm oil processed will be 300,000 tonnes and the minimum amount of rapeseed oil from French production will be 50,000 tonnes. The remaining supply need of 150,000 tonnes is to be covered with used oils and animal fats (UCO). In other words, the French government is implementing the authorisation regulation introduced by the EU iLUC Regulation (2015/1513/EU) and continued by the revised Renewable Energy Directive (RED II). The regulation allows member states to prepone the phase-out of palm oil-based fuels instead of starting to discontinue their use, based on the quantity sold in 2019, from 2024 onwards and end it altogether by 2030. In this sense, France will fulfil its obligation ten years earlier.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) urges the German government to follow the French example and ban palm oil as soon as possible. UFOP basically welcomes the constraint that excludes palm oil from producers' mass balances, because biofuels feedstocks must be delivered physically rather than being documented on paper. The feedstocks also fall under the national caps on biofuels from cultivated biomass, which in Germany is 6.5 per cent. This is why UFOP fears that there will be shifts in the market if the Total plant eventually produces palm oil-based HVO that will be exported for account purposes in other member states. The international vegetable oil markets are characterised by considerable supply and, consequently, price pressure as it is, the association has emphasised to support its call. The importance of the European biodiesel market is shown in 4 million hectares of rapeseed cultivation and the amount of GM-free high-protein animal feed generated as a by-product of rapeseed oil production, UFOP has underlined. According to UFOP, the sustainability of soybean production should be doubted, especially since the Brazilian government changed.

According to information published by Agrarmarkt Informations-Gesellschaft (AMI), the Council of Palm Oil Producing Countries (CPOPC), of which Indonesia and Malaysia are members, has announced that it will bring a complaint before the World Trade Organisation (WTO) to challenge the constraint.

Chart of the week (29 2019)

EU soybean area at ten-year high

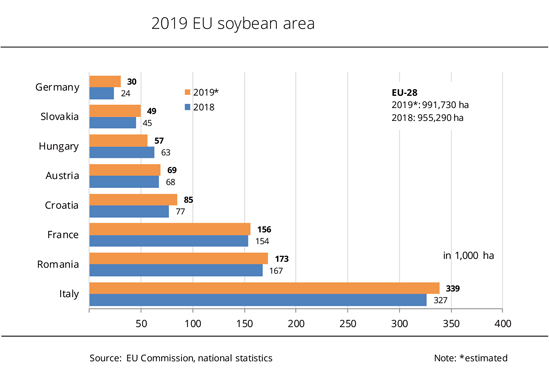

The soy area in the EU has risen 4 per cent compared to 2018 and even tripled over the past ten years. The most significant growth, although of a small total area, is seen in Germany.

According to information published by the EU Commission, the EU soybean area has tripled over the past ten years to almost 1 million hectares. By far the most soybeans are grown in Italy. The country accounts for just less than one third of the total EU soy area. The second largest soybean producer is Romania, with 173,000 hectares dedicated to soybean cultivation. Germany has recorded a 25 per cent increase in area from the previous year to 30,000 hectares. This compares to a soybean area of 12,000 hectares in 2015. Croatia, where soybeans are produced on 85,000 hectares, saw the second largest increase, of 10.3 per cent. The only major soy producing country recording a decline in soybean area is Hungary. The decrease amounts to 6,000 hectares.

According to Agrarmarkt Informations-Gesellschaft (AMI), the large increases in soy area in many EU regions will result in larger harvests. In Germany, the harvest could rise almost one third to 78,000 tonnes. Despite the big increase in area in Croatia, the Croatian harvest is expected to fall 2 per cent short of last year's crop due to weather-induced drops in yield. Romania will presumably also harvest fewer soybeans, although the land devoted to growing soybeans increased compared to 2018. The EU projects the biggest decline in production, of 17 per cent, for Hungary. This is not surprising, however, given the 10 per cent decline in area.

From the perspective of the Union zur Förderung von Oel- und Proteinpflanzen (UFOP), the increase to 30,000 hectares in Germany is a good piece of news. UFOP calls for an adequate expansion of the subsidies policy for domestic protein plants that aims at advancing not only soybeans, but grain legumes in general as a GM-free source of protein. Moreover, the association argues that grain legumes should also be taken into account in the German government's agricultural strategy expected for the autumn of 2019 as an essential element of local crop rotation systems.

In view of growing criticism of the new Brazilian government's soybean and primeval forest policies, doubt should be cast on the capability of satisfying the call for deforestation-free procurement if the requirement only leads to deflection effects. According to UFOP, the reignited debate on soybeans is leading to a considerable damage to the image of the livestock industry. Because of this, UFOP strongly criticises that the EU agreement with the MERCOSUR countries undermines European standards on environmental protection, but also crop protection, and that these standards are being sacrificed in favour of a one-eyed export policy. The inconsistency of intertwining climate and industrial policies couldn't be greater, the association contends in view of the current debate on the steps needed to protect the climate.

Chart of the week (28 2019)

Palm and soybean oil lose a lot of ground

The vegetable oil price index of the Food and Agriculture Organization of the United Nations (FAO) dropped 12 per cent over the past marketing year and is currently at a level lower than that recorded in December 2018.

The FAO vegetableprice index shows the changes in international prices for ten different vegetable oils, weighted with their export shares in world trade. Following a slight rise in the first half year 2019, the index declined 6 points to 126 points. This translates to a 1.6 per cent decrease from the previous month and also the lowest level since December 2018. The decline is due to the slide in palm and soybean oil prices. International prices for palm oil at the Kuala Lumpur exchange dropped just less than 10 per cent over the past 6 months, Agrarmarkt Informations-Gesellschaft (AMI) has reported. The reason was sluggish demand on the global market on which the largest palm oil producing countries, Indonesia and Malaysia, account for almost 90 per cent of palm oil supplies. Seasonal growth in output in Southeast Asia also had a negative impact on the market. Prices of soybean oil also flagged, because low export prospects and forecasts of adequate global supply generated pressure.

In contrast, prices of sunflower and rapeseed oil did not follow the downward trend. The reason was continued buoyant demand based on expectations of smaller harvests in key countries of origin.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has noted that the price situation in the vegetable oil markets would be even more dramatic, if countries such as Argentina, Brazil, the US and Indonesia did not ease market pressure by raising national blending quota requirements for soybean and palm oil biofuels, which leads to a rise in producer prices. With production capacities of more than 6 million tonnes, Indonesia is the world's largest producer of biodiesel. The country is promoting a programme to launch diesel with a 30 per cent incorporation rate (B30). UFOP stated that while governments in Germany and other EU countries are hiding behind a “food-or-fuel debate” that doesn’t draw on hard facts, these states are demonstrating how “bioeconomics” work. The association assumes that the countries in question – except the US – will take this biofuels policy into account in their national climate and energy plans they are required to provide by the end of 2020 under the Paris climate protection agreement. UFOP is again calling for a clear political commitment to “cultivated biomass” as an option to decarbonise the transport sector.

Chart of the week (27 2019)

Global rapeseed production covers demand despite drought

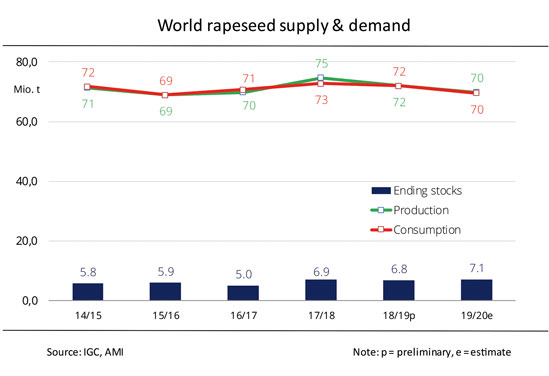

In its current global rapeseed supply outlook for 2019/20, the International Grain Council (IGC) anticipates a considerable decline in world production. At the same time, global stocks are expected to rise to a record high.

In its recent forecast for the 2019/20 marketing year, the International Grain Council (IGC) projects global rapeseed production at 69.8 million tonnes. In other words, the harvest is set to drop 3 per cent from the previous year's level. This is a result of inadequate rainfall and distribution of rain over the growth period, as it was the previous year. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), the EU harvest will amount to approximately 17.9 million tonnes of rapeseed. This would be down just less than 2 million tonnes from the previous year. The IGC expects the biggest decrease to occur in France, which continues to be the number one rapeseed producer in the EU, producing 4 million tonnes, Romania and Germany. According to the harvest estimate of the Deutscher Raiffeisenverband (DRV), the German harvest will decrease 16 per cent year-on-year to 3.1 million tonnes.

Canada is also projected to see a significantly smaller harvest of 18.9 million tonnes. On the other hand, the IGC expects the Ukrainian harvest to reach 3.7 million tonnes. This is up approximately 1 million tonnes from the previous year and 1.7 million tonnes more than the five-year average. The rise is primarily due to the expansion of rapeseed area by one third compared to the previous year. Rapeseed cultivation has become very attractive in Ukraine, because rapeseed is the country's most expensive, and therefore a very profitable, oilseed crop. Moreover, demand from exporters and processors is high.

Larger harvests in Ukraine and Australia cannot offset the decline in the EU. If demand from German or European oil mills for feedstock remains unchanged, imports will have to increase 30 per cent compared to 2018. Because of this, supplies, especially from Ukraine, are set to force their way into the EU market in the coming marketing year. However, whether they actually will, depends on whether European rapeseed producers will be as reluctant to sell their rapeseed as they were after the 2018 harvest. At the time, oil mills had been forced to find new suppliers.

Although the IGC forecasts a significant drop in harvest, the organisation also expects an increase in global rapeseed stocks. At 7.1 million tonnes, stocks are even projected to reach the highest level in ten years, first and foremost because of rising stocks in Canada. The latter are likely due to the continuing delivery problems as regards shipments to China.

Chart of the week (26 2019)

Small rapeseed harvest coincides with strong demand for oil

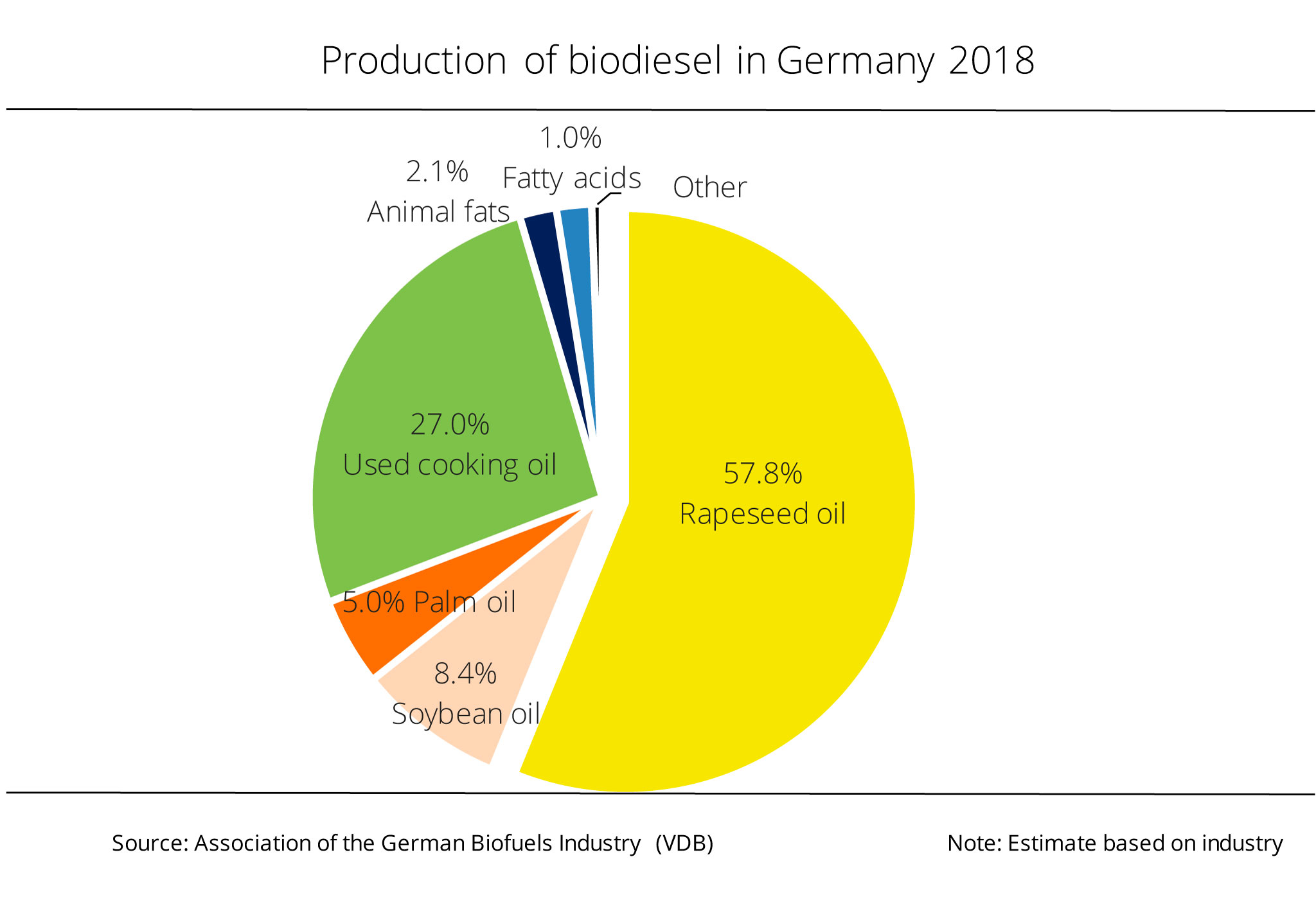

Demand for biodiesel is unbroken. The main constituent in Germany is and remains rapeseed oil, but German rapeseed production does not cover demand.

Due to the poor growing conditions that have been accompanying winter rapeseed since it was sown, Germany will only see a small rapeseed crop in 2019. The estimate is for around 3.1 million tonnes. This would translate to a 17 per cent drop from the already weak previous year and would also be the smallest winter rapeseed crop in 21 years.

At the same time, German demand for rapeseed is high. In 2018, German production of biodiesel alone amounted to 3.2 million tonnes. According to the Association of the German Biofuels Industry (VDB), the key feedstocks are rapeseed oil, which accounts for just less than 60 per cent, and used cooking oils and fats, which account for 27 per cent. The latter are sourced from collections (from kitchens, restaurants and other sources) that are required by law. Soybean and palm oil play a comparatively small role as feedstocks. Animal fats, fatty acids and other feedstocks together account for no more than 5 per cent.

Biodiesel produced in Germany first and foremost covers demand from the mineral oil companies, which according to BAFA amounted to 2.3 million tonnes in 2018. These companies have to comply with the 4 per cent GHG reduction obligation, as they did the previous year. This mandatory rate will increase to 6 per cent as from 2020. Consequently, it is foreseeable that demand for rapeseed oil for biodiesel production will also rise in the coming year, because, in addition, the amount of palm-oil based biodiesel will be limited to the 2019 tonnage as a maximum.

Chart of the week (25 2019)

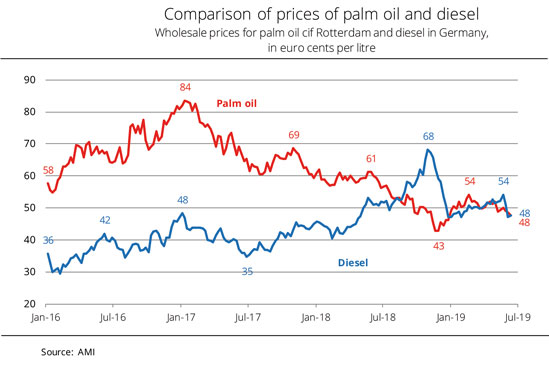

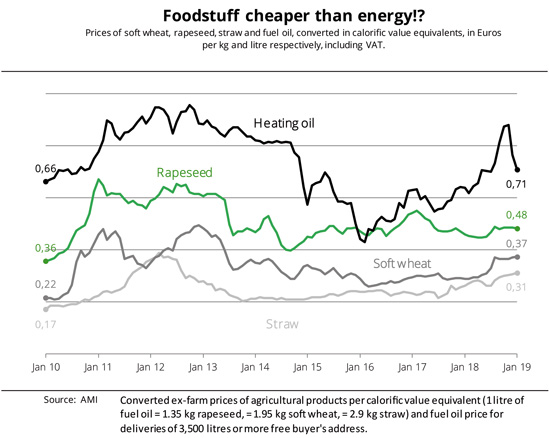

Palm oil cheaper than diesel fuel

Selling prices for palm oil and diesel fuel have recently converged to the same level, after the former had even been at a lower price for six months. The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has drawn attention to the regulation laid down in the redrafted European Renewable Energy Directive (RED II) that specifies the reference amount of biofuels from cultivated biomass involving a high risk of changes in land use.

The regulation sets out that from 2024 onwards, the amount of palm oil-based fuels (biodiesel or hydrogenated vegetable oil) that counts towards national quota obligations in 2019 must gradually be reduced to “zero” tonnes by 2030.

UFOP fears that the use of palm oil will increase, because palm oil prices have tumbled to a very low level since January 2017, temporarily even falling below the price for diesel fuel. The main reason is the continuing rise in global supplies of vegetable oil, especially palm oil. Experts estimate that in Indonesia alone supplies will grow from 37 million tonnes in 2017 to 43 million tonnes in the running year. The oversupply has of course led to pressure on prices. A particularly sharp decline in prices was seen in November 2018, with prices plunging to a level last seen nine years earlier, Agrarmarkt Informations-Gesellschaft (mbH) has reported.

During the same period, crude oil prices moved in the opposite direction, climbing substantially due to US penalties against Iraq and the OPEC countries' self-imposed cuts in crude output. Moreover, reduced output in Russia and the US limited supply and drove up oil prices. In Germany, diesel peaked at 68.14 euro cents per litre net ex tank storage facility, which was a six-year high. This meant that diesel prices exceeded those of palm oil for the first time in July 2018 and remained above that level for several weeks. From UFOP's standpoint, it would be absurd if palm oil-based fuels, of all things, would benefit from these freak changes in prices in 2019.

Chart of the week (24 2019)

Cultivation of legumes is attractive

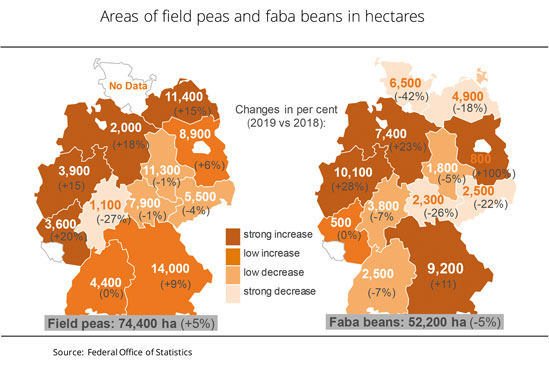

Legumes have increasingly gained importance in German agriculture and are taking up more and more cultivation area.

The German area of land devoted to growing feed peas has been expanded compared to the 2018 crop year, whereas the area planted with faba beans has slightly declined. In other words, just less than 180,000 hectares are planted with pulses - which, in Germany, also include soybeans and sweet lupins - for the 2019 crop.

Bavaria, the largest territorial state in Germany, occupies first place for most pulses except faba beans, of which North Rhine Westphalia is the number one producer. Faba beans are primarily grown in northern and western Germany, more specifically, Lower Saxony, Schleswig-Holstein, Mecklenburg-Western Pomerania and Hesse, along with the states mentioned above.

In contrast, outside Bavaria, most field peas are grown in eastern Germany, which accounts for approximately 60 per cent of the German area. Field pea, occupying an estimated 74,400 hectares in Germany, is the number one legume, followed by faba bean with 52,200 hectares. The soybean area has caught up, probably reaching 28,000 hectares this year and surpassing the area of 25,000 hectares planted with sweet lupins.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) believes that this welcome development is due to an increasing acceptance and higher awareness among farmers. The association has explained that grain legumes cannot only make a considerable contribution towards biodiversity and consequently diversification of crop rotation systems, but also towards closing the national protein gap.

However, compared with other arable crops, the development is still in its infancy. Therefore, UFOP expects that the agricultural strategy anticipated for the autumn will also create the economic conditions for a lasting increase in cultivation area. UFOP has emphasised that the development of regional value chains, for example in food economics, is key to stimulating demand and boost production.

UFOP has urged that drawbacks in yield levels and stability and in protein or feed quality should be eliminated by intense, publicly funded accompanying research in plant breeding. According to UFOP, the agricultural strategy should therefore incorporate a funding concept that will provide for a goal-driven development with milestones.

Chart of the week (23 2019)

Romanian sunflower crop expected to be smaller

The scaleback in Romanian sunflower area is forecast to lead to a drop in the country's sunflower production compared to the previous year. Nevertheless, the EU Commission expects an increase in overall EU sunflower production.

The EU Commission has pegged the 2019 sunflower area in the EU-28 at 4.2 million hectares. This translates to an around 70,000 hectare rise from a year earlier. France has expanded the area sown with sunflowers by around 10 per cent. An increase in area of around 5 per cent is also recorded for Spain and Bulgaria. According to information published by the EU Commission, Romania - the top sunflower producer - has reduced its sunflower area by 7 per cent. Nevertheless, the country's production area of more than 1 million hectares continues to be the largest in the EU.

The EU Commission expects EU sunflower output to rise 2 per cent to 10.1 million tonnes due to the increase in area sown. The expected decline in Romania, where production is seen to decrease 9 per cent to 2.8 million tonnes, is more than offset by significantly higher crop expectations for France, Slovakia, Bulgaria and Hungary. The EU Commission has projected yields at on average 24.1 decitonnes per hectare. This would be roughly at the previous year's level and 2.1 decitonnes per hectare above the long-time average.

Chart of the week (22 2019)

Biodiesel exports rose substantially

German biodiesel exports increased sharply in the first quarter of 2019, with exports to Great Britain seeing the biggest growth.

In the first three months of 2019, German exports of biodiesel surged around 33 per cent to 581,248 tonnes year-on-year. Around 87 per cent of these exports were shipped to EU-28 countries. This was up just over 37 per cent from the previous year. The top purchaser of German biodiesel was the Netherlands, with imports soaring 47 per cent to 230,465 tonnes. However, Great Britain recorded the biggest increase, purchasing 40,000 tonnes of biodiesel from Germany, which was more than five times as much as in the year-earlier period. Belgium, the US and Austria also recorded large quantities and strong growths. Belgium purchased a total of 88,350 tonnes, which means that the country almost doubled its imports year-on-year. On the other hand, exports to the US, at 53,696 tonnes, were up 26 per cent from the reference period. Austria followed with total imports of 43,450 tonnes in the period under consideration. This was also up almost 26 per cent year-on-year. According to Agrarmarkt Informations-Gesellschaft (mbH) Sweden and the Czech Republic also imported larger amounts of German biodiesel compared to the same period a year earlier. In contrast, shipments to Switzerland and, first and foremost, France declined.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has underlined the importance the export markets have for German biodiesel producers as the buyers of feedstock from rapeseed growers. These exports have a stabilising effect on prices and consequently safeguard rapeseed cultivation and marketing, UFOP has pointed out. Demand was not least driven by national biofuel mandates to meet renewable energy targets in the transport sector. The mandate specifies a binding share of renewable energy of at least 10 per cent in 2020 and 14 per cent in 2030, UFOP has emphasized.

Chart of the week (21 2019)

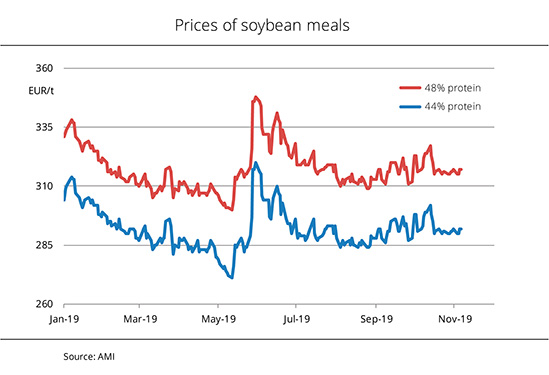

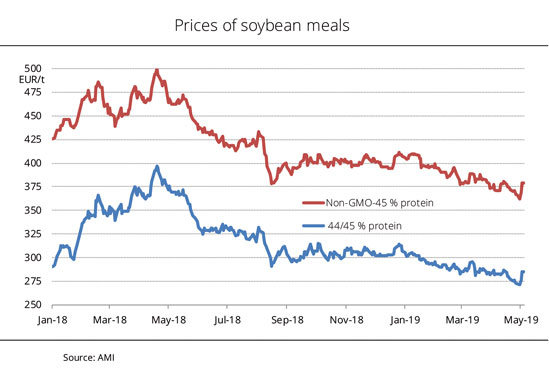

Surplus of soybean meal also forces down prices for protein alternatives

The large harvests in Argentina and Brazil and reduction in US sales opportunities in China have pushed soybean prices into a downward spiral internationally.

Soybean meal has become literally cheap over the past few weeks. German wholesale prices declined 3.5 per cent just since the beginning of the month, with 44% soybean meal falling to the level of almost EUR 270 per tonne. GMO-free soybean meal dropped by the same percentage to recently EUR 370 per tonne. This means that soybean meal decreased more than EUR 30 per tonne since its mid-January price peak. The continued extreme weakness in prices has stimulated farmers' interest to buy. Asking prices for soybean meal recently hit a low last seen in September 2017. What is more, in the past seven years, there were only three months in which soybean meal was cheaper than it is now.

Consequently, farmers took advantage of the very favourable offers and increasingly concluded supply contracts which even covered a period of up to one year. Conventional soybean meal delivered free to farmyard was almost one fourth cheaper than a year earlier. By contrast, GMO-free batches “only” had a price advantage of just under 18 per cent. The plunge in prices hit suppliers hard. The latter raised their asking prices EUR 10 per tonne on 15 May 2019. It is not yet known whether lasting keen interest in buying at this price level has in fact been generated.

The Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP) is deeply concerned about this development in prices. The reasons are both the large harvests in Argentina and Brazil and the trade dispute between the US and China. On the one hand, the plunge in prices enhances the pressure on income in the US soybean belt. On the other hand, the scale of the challenge of advertising the profitability of a protein plant strategy in Germany and the EU will increase if the price for soybean meal (which serves as a base price) remains on a downward slide.

Chart of the week (20 2019)

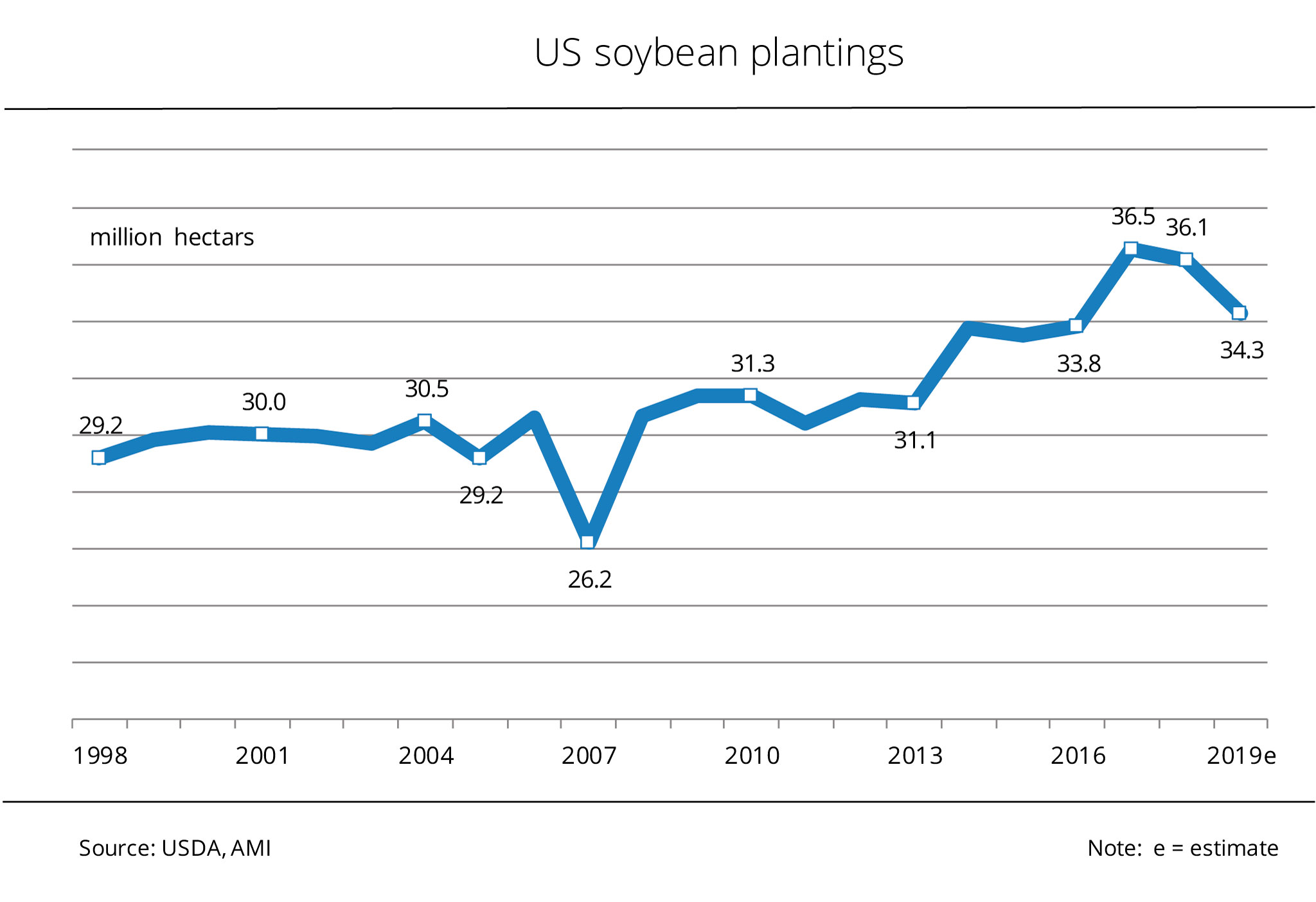

Tight supply of soybeans in 2019/20

The US will presumably harvest the smallest tonnage of soybeans in four years in 2019.

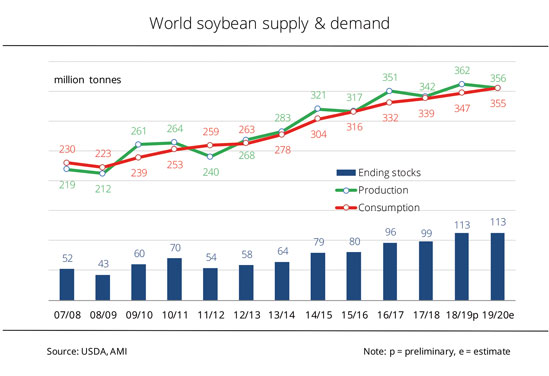

In its first outlook on the 2019/20 supply situation for soybeans, the USDA expects a decline in production combined with growth in consumption. The US authority sees the 2019/20 global soybean harvest at 356 million tonnes. This translates to an around 6 million tonne drop from 2018/19. Production is anticipated to rise slightly in China and Paraguay and actually hit a record high in Brazil, while falling to the lowest level in four years in the US. As a result, Brazil would be the number one producer with an output of 123 million tonnes, followed by the US with 113 million tonnes.

At the same time, global consumption is estimated to increase 8 million tonnes compared to 2018/19, to 355 million tonnes. The main reason is growing processing figures in Brazil and Argentina. Due to high demand for soybean meal, these countries are expected to ramp up processing by 1 million tonnes and 3 million tonnes of soybeans respectively. Many other countries are also projected to see a slight rise in processing.

2019/20 global trade in soybeans is seen at 151 million tonnes, which is almost the previous year's level. Brazil remains the top exporter, although the country is expected to export slightly less than it does in the current season. By contrast, a considerable increase in exports is projected for the US, although export destinations have changed from China to Europe. China and the EU remain the principal importing countries in 2019/20. Whereas China is forecast to see a slight rise in consumption - despite the rampant African Swine Fever virus -, the EU's soybean imports are likely to decrease slightly compared to 2018/19.

Due to the virtually balanced calculated output to consumption ratio, the USDA does not expect any significant changes in supplies for 2019/20. In the current season, stocks are already set to reach a record high of 113 million tonnes. This quantity will be sufficient to cover world demand for 3.7 months.

Chart of the week (19 2019)

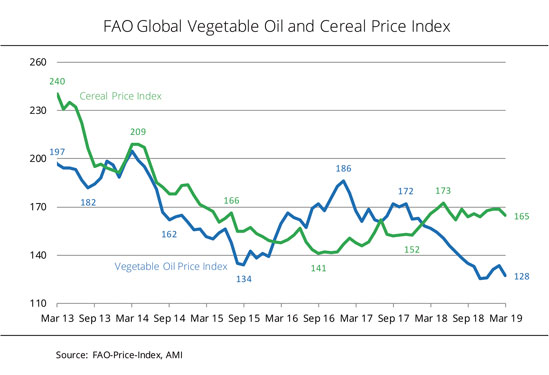

FAO vegetable oil price index at eleven-year low

The global price index for vegetable oils came under pressure in March. It slumped 4.4 per cent to 128 points, the second lowest level in eleven years. The average vegetable oil price index for 2018 as a whole was 144 points.

Very good market supply with palm oil combined with stagnating world demand led to an increase in stocks in Malaysia and Indonesia, the two most important palm oil producing countries. This situation caused prices to drop from the previous month. The same also applies to prices of soybean and rapeseed oil. In other words, prices of palm oil failed to continue the rise started in December. Soybean oil also flagged in March 2019, because profitable margins for soybean meal pushed US crushing forward, producing a surplus of soybean oil as a result. Prices of rapeseed oil also dropped significantly. According to FAO, this was due to unexpectedly large stocks in Canada and the good harvest outlook for rapeseed in the Black Sea region. However, the main reason was pressure on prices in the palm oil market.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) believes that demand for biofuels from vegetable oils will be the key factor determining future changes in prices. As a consequence of promoting biofuels from waste oils and fats by counting them double or improving their position with regard to greenhouse gas reduction efficiency for quota allowance, waste oils are currently the preferred biodiesel feedstock. In other words, they are displacing vegetable oil-based biodiesel. In a market where the automotive fuels standard puts a 7 per cent (by volume) cap on biodiesel incorporation in blends, this situation creates corresponding pressure on prices. UFOP has pointed out that this effect is not only seen in Germany, but also at an international level, and that it is another explanation for the eleven-year low. Waste oils and fats are traded globally today. The most important exporter to the EU is China.

The cereal price index also came under pressure in March, with wheat prices seeing the sharpest fall. According to FAO, the key reason was large global export supplies combined with curbed demand, especially for US wheat. The consistently positive forecasts for the 2019 harvest also weighed prices down. Maize prices also came under pressure from ample export supplies and the large harvest estimate for Argentina. The decline of the FAO index was limited by somewhat firmer prices of rice. The average cereal price index for 2018 as a whole was 165.3 points.

Chart of the week (18 2019)

Palm oil production grows faster than consumption

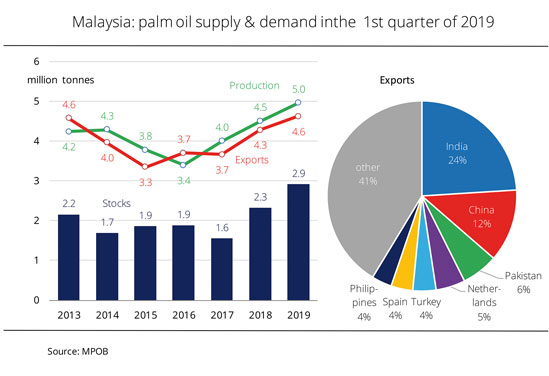

The productivity of oil palm trees seasonally decreases from October onwards. Nevertheless, January/March 2019 palm oil production was up, on average, 10 per cent from a year earlier. By contrast, exports only increased 7 per cent.

In the first three months of the ongoing year, Malaysian production of palm oil amounted to just less than 5 million tonnes. Around 4.6 million tonnes went abroad. As a result, supplies continued to rise, as they have done continually since February 2017. They reached a record of 3.05 million tonnes in February 2019.

India and China were the traditional main buyers of palm oil in the first quarter of 2019, followed by the Netherlands and Pakistan. Spain surpassed the US and Philippines. India purchased around 1.1 million tonnes, which was just less than 30 per cent more year-on-year. It was also twice the amount exported to China. Nevertheless, China ordered 571,253 tonnes, which translates to an around 50 per cent rise from the same period last year. The Netherlands remained on third place, but the volume of 230,697 tonnes was down 16 per cent year-on-year. This may be due to the fact that other EU countries increased their direct shipments. For instance, Spain received 171,161 tonnes from Malaysia. This was a more than 50 per cent increase. Italy even doubled its imports to 124,612 tonnes. Germany does not play any significant role in foreign trade with Malaysia. Deliveries reached around 3,642 tonnes in the first quarter of 2019, which was only one fourth of the previous year’s amount.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) expects that pressure on prices of palm oil is going to increase in the wake of the growth in supplies and that, consequently, pressure to use more palm oil-based biodiesel in blends will also increase as crude oil prices are on a rising trend, driven by the US policy to isolate Iran as a supplier of crude oil. The Malaysian government has raised its blending mandate from 7 per cent in 2018 to 10 per cent in 2019.

Chart of the week (17 2019)

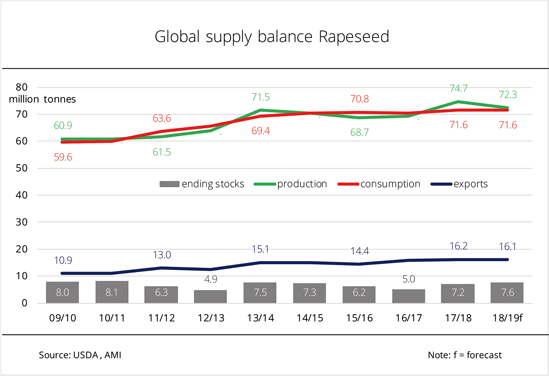

Global rapeseed balance substantially adjusted

In its latest estimate, the USDA has adjusted 2018/19 world rapeseed production considerably in some cases. This has also led to a rise in global rapeseed ending stocks.

Whereas beginning stocks and crushing uses for 2018/19 are estimated almost unchanged from the previous month at 7.2 and 68.4 million tonnes respectively, the US Department of Agriculture (USDA) expects a 1 million tonne surge in global production to 72 million tonnes. This figure only falls 2 million tonnes short of the previous year. The current rise is driven by an expected increase in output in India. The current forecast is for 8 million tonnes, up from 6.6 million tonnes the previous month.

At the same time, global consumption of rapeseed in 2018/19 is expected to reach the year-earlier level after all. The current forecast is up 0.5 per cent from the previous month at 71.6 million tonnes. Above all, 2018/19 consumption in India and Canada will probably exceed previous expectations. At the same time, the forecast for China is lowered somewhat, which limits global growth.

Global trade in rapeseed is forecast down substantially compared to the previous month. Trading in the world market in 2018/19 is projected at 16 million tonnes, instead of 17 million tonnes. This is almost the same level as the previous year. The reason for the adjustment is the current conflict between China and Canada. USDA recently lowered its imports and exports forecasts for both countries by 1 million tonnes each.

Arithmetically, the increase in production and decline in use would lead to larger world ending stocks for 2018/19. Ending stocks would not only exceed previous expectations by 1.1 million tonnes, but, reaching 7.6 million tonnes, also outstrip the previous year's figure. This means that rapeseed ending stocks would be the largest in eight years.

However, the Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has pointed out that, in terms of tradability and final use, Canadian rapeseed – which is usually genetically modified – cannot simply be exchanged for EU rapeseed. Because of this, German oil mills' imports from non-EU countries are primarily sourced from Eastern Europe or Australia. Accordingly, market players are paying special attention to crop development, harvest figures and stocks in these areas.

Chart of the week (16 2019)

Vegetable oils remain in strong demand

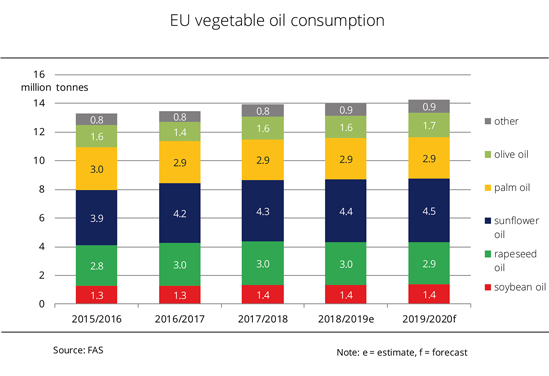

In the FAS forecast for 2019/20, EU vegetable oil production is projected to decline. At the same time, consumption is expected to increase further.

In its forecast for 2019/20, the United States Department of Agriculture Foreign Agricultural Service (FAS) projects EU oilseed processing and, consequently, vegetable oil production to decrease. In contrast, consumption is seen to increase 0.8 per cent to just less than 14 million tonnes. The reason given is higher demand in food production. However, the rise is curbed by a drop in use of vegetable oil for biofuel production.

As regards the 2019/20 rapeseed oil market, the FAS assumes that production of rapeseed oil from the European harvest will be reduced. In the wake of the expected slight increase in consumption, seed imports could exceed the previous year's level.

Sunflower oil production has risen steadily in the EU over the past years. Demand has been fuelled by competitive oil prices. Since supply of rapeseed oil is expected to decline, demand from the food industry for sunflower oil will probably grow again slightly to 4.45 million tonnes in 2019/20. However, the pace of increase is likely to slow. According to the FAS, demand for rapeseed oil will weaken somewhat. Demand from the food sector is anticipated to amount to 2.9 million tonnes in 2019/20.

Chart of the week (15 2019)

Interest in old-crop rapeseed has waned

Both buyers and sellers of rapeseed are notably reluctant at present. The former are stocked up well till the end of the season, but are also holding back as regards new-crop contracts. The latter are finding bids too low and their hopes as regards the 2019 harvest are somewhat clouded.

Nothing has been the same after the February price slide. Although the market is no longer as paralysed as it was three weeks ago, it definitely lacks momentum. This may be due to the slow pace at which prices are rising. In view of firming forward prices in Paris, farmers now continue to wait for a chance to obtain more money for the last rapeseed they have in storage. On the other hand, oil mills are adequately stocked up with rapeseed. They draw on extensive supply from imports. Consequently, the market is extremely calm at the moment.

However, what is new is that bids for rapeseed from the 2019 crop have exceeded those for old-crop rapeseed for approximately two weeks. This usually happens towards the end of the marketing year, especially when the crop forecast is low. Producers obviously find the contract prices much too low.

Weather conditions are the biggest uncertainty at present. Above-average high temperatures in the previous months and lack of rainfall in some areas have caused concerns about how the field crops might develop. However, things look good for the time being. Plants are not showing any signs of drought-related stress anywhere. In the wake of last year's experience, farmers are now especially wary. No farmer wants to conclude contracts for volumes they will not be able to supply.

Chart of the week (14 2019)

EU oilseed area in slight decline