Chart of the week (53 2020)

No rapeseed methyl ester means noticeably less rapeseed meal

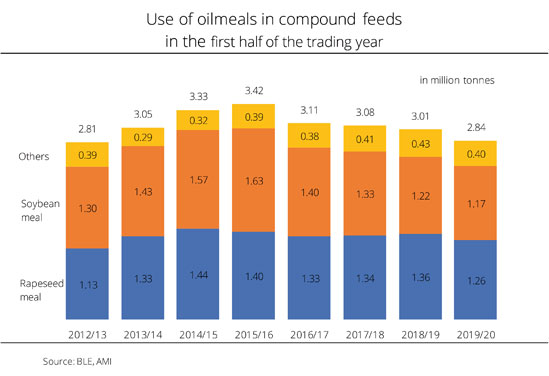

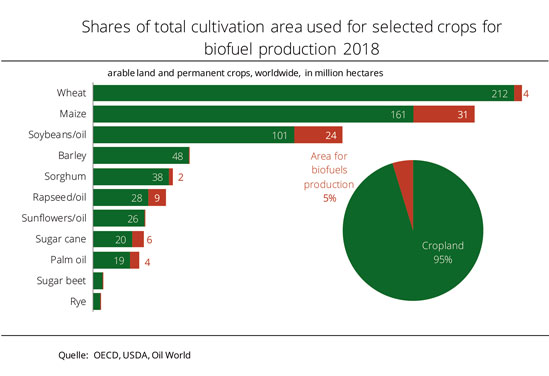

The German and European feed markets benefit significantly from the production of rapeseed-based biodiesel fuels. Rapeseed meal is generated as a joint product of oil production in this value chain, the Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP) has explained. GM-free rapeseed meal is the most important source of protein for animal feeding in Germany. In future, extracted rapeseed meal could also play an important role for the human diet, UFOP has underlined, referring to research projects the association supports.

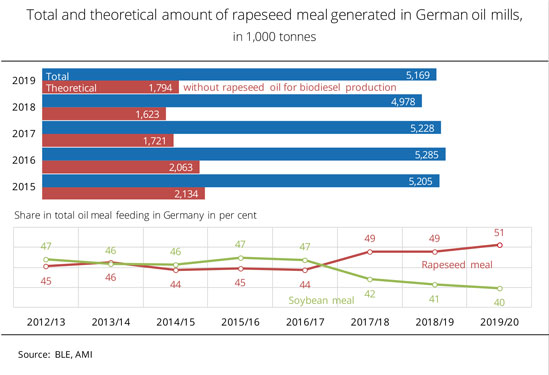

Germany is the main EU country for rapeseed processing, with around 9.0 million tonnes of rapeseed processed in 2019. This production generated just less than 3.8 million tonnes of rapeseed oil and just less than 5.2 million tonnes of rapeseed meal. Because in Europe, rapeseed varieties are exclusively bred without genetic manipulation (GM), and only licensed if bred without GM, the byproduct rapeseed meal is also GM-free. This fact encourages the use of rapeseed meal, especially in dairy feeding. Rapeseed meal can replace soybean meal completely without any loss in milk yield. Today, most milk and dairy products are labelled "without GM". The strong consumer demand for these products therefore supports regional production and processing of rapeseed – which is entirely in the interests of environmental and climate protection. At the same time, it reduces the reliance on imports of GMO soy and GMO soybean meal considerably. UFOP has calculated that 5.2 million tonnes of rapeseed meal are the equivalent of a soybean area of approximately 1.6 million hectares.

Whereas rapeseed meal has become a staple in animal feeding, sales of rapeseed oil are tied to its use in the biofuels market. The association has stated that supply of rapeseed oil by far outpaces the receptiveness of food markets (edible oils, convenience products). If future demand for rapeseed oil were to shrink because biodiesel is no longer counted as a contribution towards reducing greenhouse gas emissions in the transport sector, this would obviously have repercussions on rapeseed processing. In other words, two thirds of today's rapeseed meal production, approximately 3.4 million tonnes, would no longer be available. Imports of GMO soy would be needed to fill this gap. In purely arithmetic terms, this would translate to a soybean area of 1.1 million hectares in the past year. Consequently, sustained rapeseed cultivation in extended crop rotation systems with grain reduces the pressure on land in the countries of origin.

UFOP has contended that this effect is given too little attention in the current debate on the future biofuels policy. Instead, there are iLUC and "food-or-fuel" debates that don't draw on hard facts and from which policymakers should finally free themselves.

UFOP has expressly welcomed the protein plant strategy adopted by the European Union and German government. Rapeseed, by far the most important regional source of protein in the EU, is an absolute must in this strategy, UFOP has stressed. Complemented by grain legumes, rapeseed and sunflowers could ensure a more diversified crop rotation together with flowering plants. Biodiversity and soil fertility could be improved. This is why UFOP has called on policymakers to take a holistic view instead of hastily ruling out necessary land use options. UFOP has also directed this criticism at the Vice President of the EU Commission, Frans Timmermans, whose approach to implementing the Green Deal is leading to even more restrictions and competition-distorting conditions for arable farming. The association has called on the Vice President to take into account the general potential regional added value has for sustained arable farming. According to UFOP, sustainable biofuels from European production should be an integral part of this farming system.

Chart of the week (52 2020)

Share of rapeseed oil-based biodiesel increased

In view of the debate on the use of biofuels from cultivated biomass, the Union zur Förderung von Oel-und Proteinpflanzen e.V. (UFOP) has urged politicians to differentiate between the various types of feedstocks and their origins. The negative image of palm oil should not lead to a situation where the sustained biomass potential available in Germany and the European Union is no longer fully utilised.

The contradiction could not be bigger. On the one hand, the regulatory requirements for biomass crop cultivation in the EU are significantly tightened as a result of the Common Agricultural Policy (CAP) and stricter regulatory requirements for the use of fertilizers and crop protection products. On the other hand, the EU Commission also questions the use of biofuels from biomass, even if the biomass used is produced in the EU. For this reason, the UFOP has welcomed that the Federal Ministry for the Environment's bill to implement the Renewable Energy Directive (RED II) provides for phasing out the use of palm oil as a feedstock, because palm oil is associated with a high risk of generating indirect changes in land use.

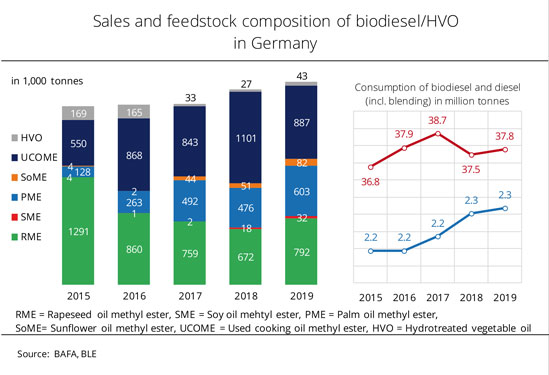

At the same time, UFOP has pointed out the role of rapeseed as a pioneer renewable in Germany and Europe. Production and marketing of biodiesel have also been pushed forward with the aim of creating new income prospects for farms. At the same time, soybeans have been partially replaced in the feeding trough. As a consequence of the implementation of the quota on greenhouse gas emission in Germany, the share of rapeseed oil methyl ester in consumption declined from approximately 1.3 million tonnes in 2015 to 0.67 million tonnes in 2018. From UFOP's point of view, it is gratifying that in 2019, the share rose back to approximately 0.8 million tonnes. According to UFOP, the reason was growing European competition for waste oils and fats resulting from the fact that many EU member states introduced double-counting towards renewable energy targets.

Demand for these waste feedstocks also comes from producers of hydrotreated vegetable oil (HVO). The UFOP has pointed out that HVO producers' processing capacity has increased to approximately 3.4 million tonnes. By contrast, soybean oil-based biodiesel only plays a secondary role in Germany, with production amounting to just less than 32,000 tonnes.

Chart of the week (51 2020)

Global soybean supply set to remain tight

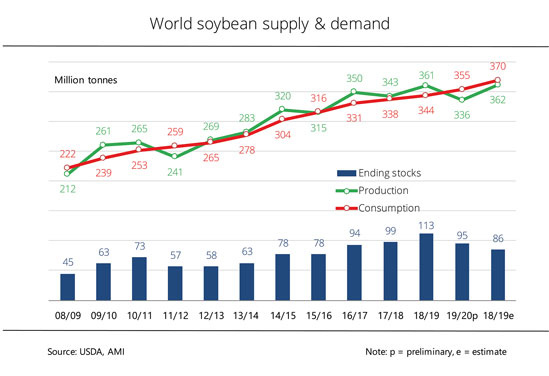

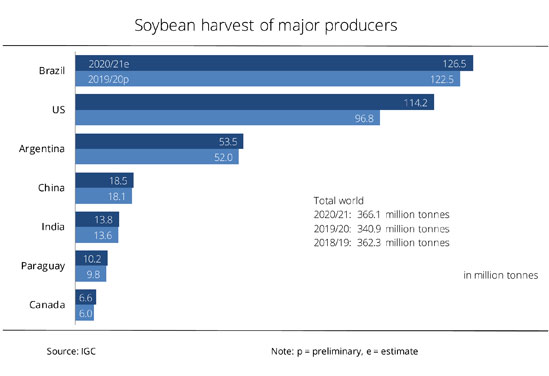

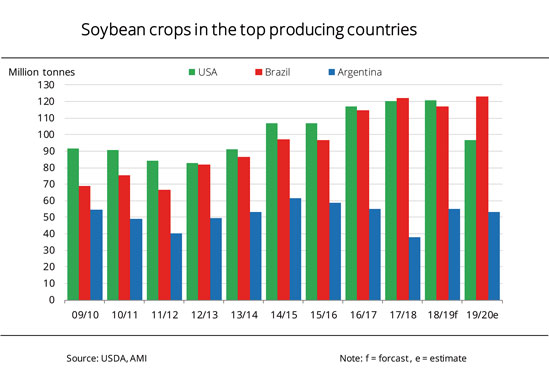

The USDA holds on to its high estimate for Brazilian soybean production in 2020/21. The agency also continues to expect a global record. Nevertheless, these volumes would not cover world consumption. The reason for the decline in stocks is the steady growth in China's import demand for soy.

In the oilseed market, attention is entirely focussed on the upcoming soybean harvest in South America, especially Brazil. Over the past several months, the La Niña weather phenomenon led to drought and delays in plantings. Although rainfall eased the situation, market participants recently remained sceptical about crop expectations. However, in its most recent estimate, the US Department of Agriculture (USDA) continued to expect a bumper crop of 133 million tonnes in Brazil. According to Agrarmarkt Informations-Gesellschaft (mbH), the USDA attributes this record to the recent rains and forecasts of more rain to come in the weeks ahead.

Whereas the outlook for the Brazilian harvest remained unchanged at a high level, expectations for Argentina were lowered and those for Canada raised. The global soybean crop was again seen at a new record high of 362 million tonnes. Expectations for world trade were barely adjusted. The only important thing to note is that Canadian exports were raised from 3.85 million tonnes the previous month to 4.2 million tonnes, based on the raised crop forecast. World ending stocks 2020/21 are expected at 86.6 million tonnes. This translates to a decline of 9.2 million tonnes year on year and would be the lowest level in five years.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has pointed out that this increase in soybean production is not just due to increases in yield, but also to expansions in area. According to information from the German Ministry of Agriculture (BMEL), the area planted with soybeans in the 2020/21 crop year is estimated at 38.3 million hectares for Brazil, 33.6 million hectares for the US and 17.3 million hectares for Argentina. These production regions determine global supply – which has immediate implications for the incomes of European producers. The UFOP has said that it has repeatedly underlined that German, and European, rapeseed is by far the most important domestic and, at the same time, GM-free source of protein. It not only helps to reduce soy imports. What's more, it is grown in crop rotation systems that, in the wake of the reform of the EU's Common Agricultural Policy (CAP), meet stricter environmental standards than production systems in the soybean-exporting countries. UFOP has complained that this ecological “value” is not remunerated. The added value and price for rapeseed are based on market conditions, more specifically prices for soybean meal and, above all, rapeseed oil. The price for rapeseed oil, in turn, is closely linked to the development in sales in the biofuels sector.

UFOP has urged that politicians must finally acknowledge that these interrelations exist in a supply chain that is certified as sustainable. "Farm to Fork" strategies relating to the promotion of national and European legume production will also come to nothing if the above-described interrelations are ignored. Therefore, UFOP has called upon the German government and parliaments to think holistically and gear the biofuels policy to domestic protein crops. The association has urged that the protein generated when processing rapeseed to produce biodiesel should be taken into account in greenhouse gas assessments. This step would go a long way towards developing an adequate and environmentally balanced “cultivated biomass policy”.

Chart of the week (50 2020)

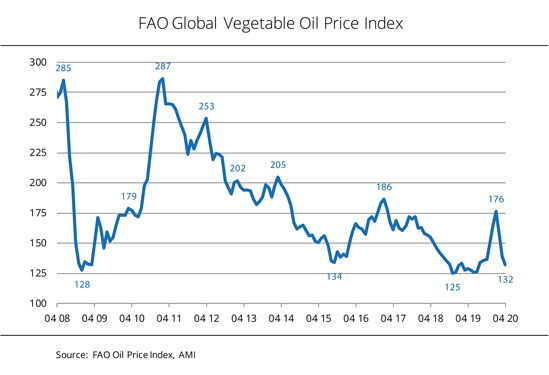

Vegetable oil price index hit multi-year high

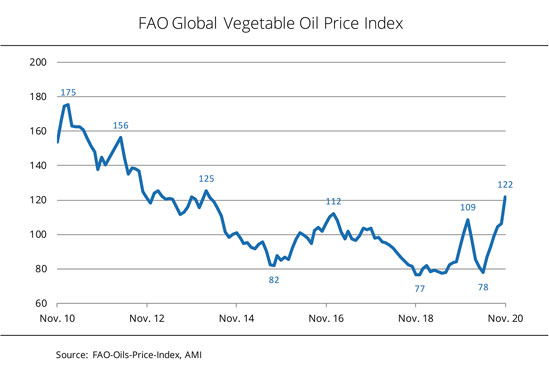

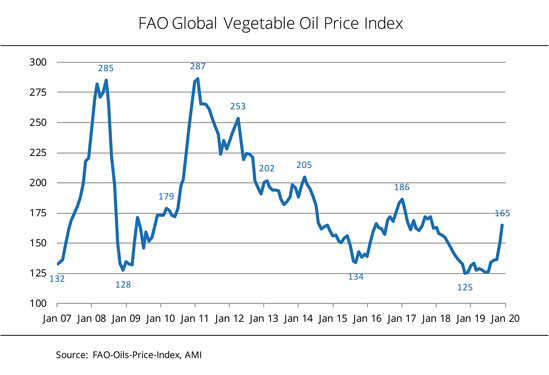

In November, the FAO vegetable oil price index reached its highest level since April 2014. It was driven by firming prices for all main vegetable oils, especially palm oil.

FAO's vegetable oil price index, which illustrates the changes in international prices of the ten most important vegetable oils in world trade, averaged 121.9 points in November. This translates to a significant rise of 15.4 points, or 14.5 per cent, month on month and marks the highest level since March 2014. Support primarily came from higher palm oil prices. However, prices for soybean, rapeseed and sunflower oil also edged higher in November.

According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), international prices of palm oil climbed for the sixth month running. The reason was the sharp decline in global stocks due to sub-standard output in the key palm oil-producing countries combined with buoyant global demand. Prices for soybean oil rose in the light of the reduced availability for exports in South America and strong buying interest, especially from India. Prices for rapeseed and sunflower oil also climbed based on limited supply. Moreover, all vegetable oil prices benefited from rising international mineral oil prices.

The Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP) sees the increase as an absolute necessity in view of producers' incomes and previous years' price levels. The association has made the point that rising production costs and regulatory requirements that lead to reduced yields can only be offset by sufficiently high producer prices. UFOP has strongly emphasised this point in relation to the EU Commission's current considerations regarding the biodiversity and "Farm to Fork" strategies. The association has called for an overall policy that would take into account and overcompensate for potential negative implications for farmers' incomes. Above all, the planned "Farm to Fork" strategy would have to be reflected in rising producer prices. UFOP has noted that arable farmers are seeking alternatives to extend crop rotation systems. Referring to the "10 + 10" strategy UFOP adopted last year, the association has pointed out that it wants to play an active role in this process.

Chart of the week (49 2020)

Soybean is the world's most important oilseed crop

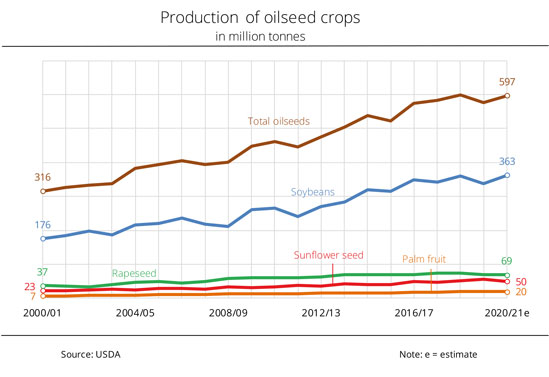

According to current USDA estimates, global production of oilseeds in the crop year 2020/21 will be around 597 million tonnes, which is up around 4 per cent year on year. After recent expectations of a record output of 605 million tonnes, the current forecast is slightly more cautious.

Since 2000, global oilseed production has nearly doubled. Soybean is the world's most important oilseed crop, accounting for 61 per cent of total oilseed production. Soybean farming has been heavily expanded over the past decades, especially in North and South America, in order to meet the growing demand for high-quality feed protein. At 363 million tonnes, the current crop year's soybean harvest is expected to be larger than ever. Production of palm fruits is also forecast to grow compared to 2019/20. It is seen to rise approximately 3 per cent to 20 million tonnes in the current crop year.

Global rapeseed production is expected to decline marginally on the year to 69 million tonnes. According to Agrarmarkt Informations-Gesellschaft (mbH), this outlook is based on harvest declines in major rapeseed producing countries, such as Canada, China and India. Global rapeseed production increased 14 per cent over the past decade and as much as 85 per cent compared to the year 2000.

Chart of the week (48 2020)

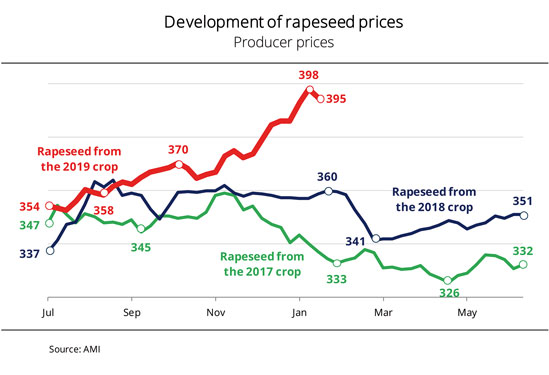

Scarcity of supply drove rapeseed prices

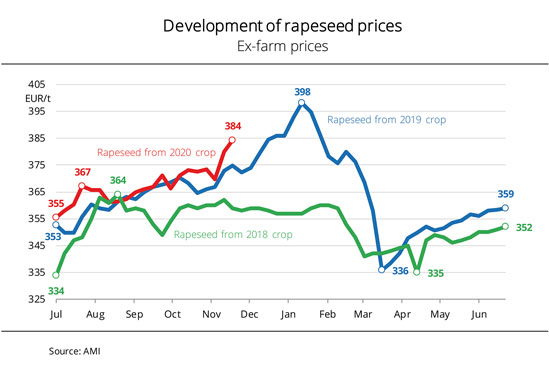

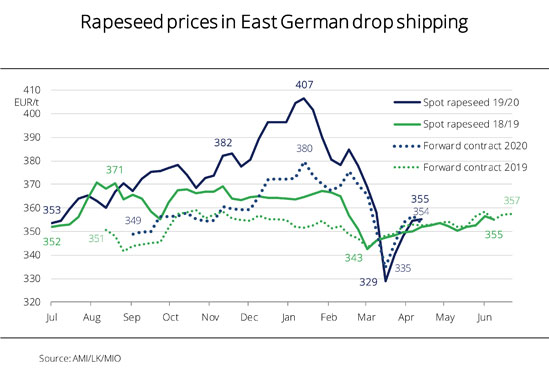

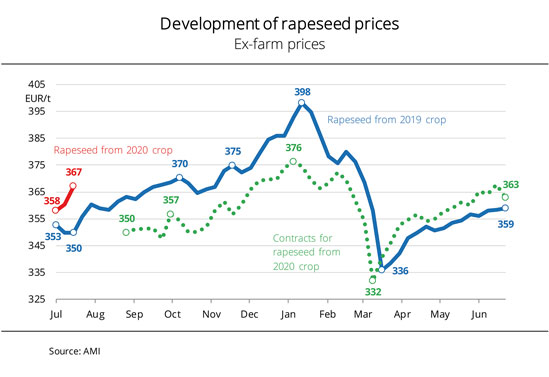

The rally in rapeseed prices in Paris also reached the German spot market and drove producer prices. For this reason, many farmers marketed their remaining stocks over the past two weeks. Considering the difficult overall environment, the Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP) sees the development of prices as a glimmer of light for arable farmers.

Rapeseed prices in Germany surged considerably over the past two weeks in the wake of very firm forward prices in Paris. MATIF prices exceeding EUR 415 per tonne led to the highest rapeseed prices since January 2020 in the German spot market in calendar week 47. According to research conducted by Agrarmarkt Informations-Gesellschaft (mbH), bids for rapeseed amounted to EUR 370 to EUR 400 per tonne ex farm in calendar week 47. This was up on average EUR 9 per tonne on the year and as much as EUR 25 per tonne compared to two years earlier. In some cases, the mark of EUR 406 per tonne was reached in drop shipping.

The higher price levels induced many producers to sell stocks in the past two weeks. As a result, stocks were largely cleared in some regions with only remaining quantities left in storage. Since contract business was also brisk with comparatively high prices, there have already been sales of rapeseed from the 2021 crop. Sales activities were also fuelled by memories of the price slide that started in January 2020. At the time, rapeseed plunged 16 per cent within two months. Many producers wanted to forestall this potential development by marketing their rapeseed early enough.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) sees this development of prices as a glimmer of light. Considering the fact that the situation in arable farming is fundamentally challenging due to low producer prices, weather-related declines in harvest volumes and increasing regulatory requirements, the essential question is whether the market will ever be able to fill the gap. The association has called on politicians to respond as promptly as possible. UFOP has said that anyone who believes that digitisation alone will solve this basic problem is in denial of the reality of international competition.

According to UFOP, the German government's agricultural strategy lacks an adequate approach to generating higher earnings through increased diversification. But only then will arable farming, enhanced to include pulse production, be an economic prospect – in line with the economic pillar of sustainability.

For years, producer prices have remained below a level that would allow farmers to make the investments that would be required to develop their farm businesses further

Chart of the week (47 2020)

EU sunflowerseed crop below average

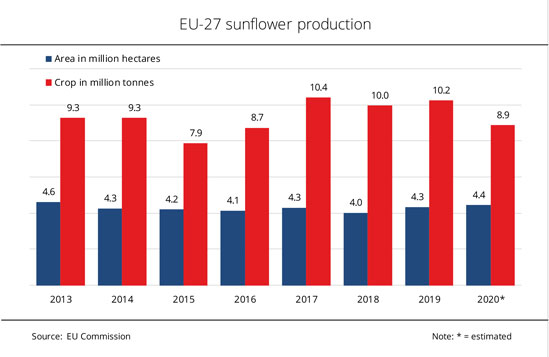

Despite considerable increases in area, 2020 sunflower output in the EU-27 was smaller than the previous year. In fact, it was significantly short of the long-term average. The reason is large losses in Romania and Bulgaria.

The European Union produced an estimated 8.9 million tonnes of sunflowerseed in 2020. This translates to a 13.4 per cent decline on the year and a 6 per cent decrease compared to the five-year mean. Compared to the previous year, the sunflower area was expanded 2.4 per cent to 4.4 million hectares, 6 per cent more than the five-year average. The poor EU harvest figure is due to considerable declines in yield. The average yield amounted to 20 decitonnes per hectare, which is down 16 per cent from a year earlier and 11 per cent compared to the long-term average. European processors will likely have to draw on more imports from third countries in the current crop year.

The significant decline in output is especially due to severe drops in yield in Romania and Bulgaria. The two largest sunflowerseed producing countries did not receive the amount of rain required for good yields at first. Then in October, excessive rainfall hampered and delayed the harvest. As a result, not all batches could be harvested in sufficient quality. In other member states, such as France, Spain and Germany, the weather conditions were mostly favourable, enabling these countries to bring in larger harvests than the previous year. However, the crops were insufficient to offset the shortfalls in Romania and Bulgaria.

Chart of the week (46 2020)

EU rapeseed imports declined despite smaller harvest

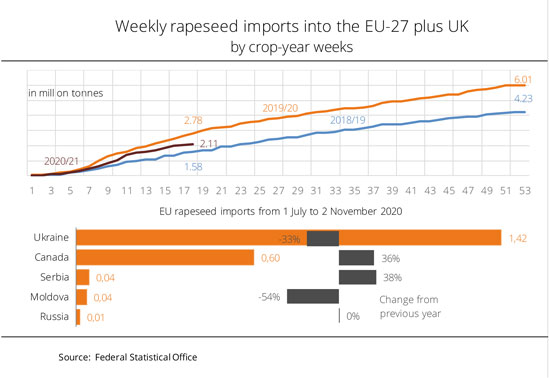

Although this year's rapeseed harvest was smaller than last year's, the EU 27 plus UK has previously imported less rapeseed.

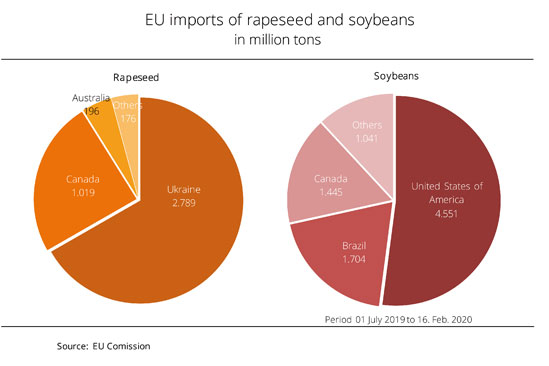

The EU-27 plus UK imported around 2.1 million tonnes of rapeseed in the first four months of the 2020/21 season. This was a 24 per cent decline compared to the same period last year, but approximately 34 per cent more than in 2018/19. The fluctuations are due to the rapeseed harvest volumes. In the crop year 2019/20, rapeseed production in the EU-27 plus UK was just under 15 per cent smaller than 2018/19. Larger imports from third countries were required in 2019/20 to cover European consumption requirements despite the small harvest.

According to Agrarmarkt Informations-Gesellschaft (mbH), the situation is somewhat different in the current crop year. Although EU-27 plus UK rapeseed output in 2020 decreased slightly further on the year (down 1 per cent), imports have previously been smaller than a year earlier. This could be linked to declining demand for rapeseed oil for biodiesel production.

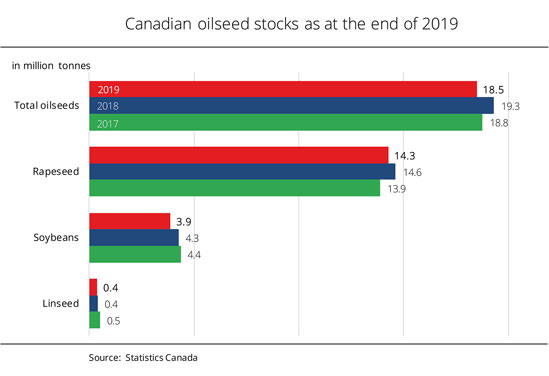

Alongside generally smaller imports, there have been significant changes in trade flows. Most imports came from Ukraine this crop year, as they did the previous year, but imports dropped 33 per cent. This trend is attributable to considerable harvest declines and smaller supply from Ukraine. The gap has partly been filled by imports from Canada. The country has supplied around 36 per cent more so far this crop year than it did in 2019/20.

Chart of the week (45 2020)

Incorporation rate in diesel fuel increased further

UFOP: openness to technology and higher quota obligations would pave the way for more climate protection.

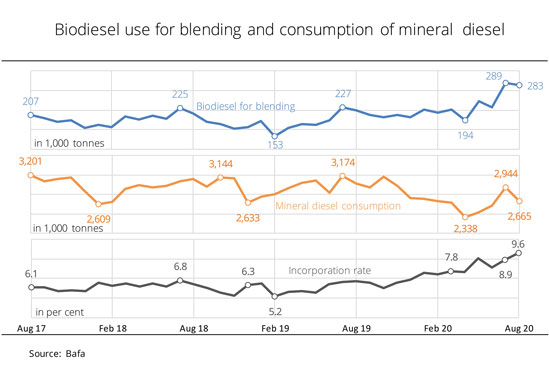

The incorporation rate of biodiesel in diesel fuel rose even higher in August. At 9.6 per cent, it surpassed the previous 9.1 per cent peak seen in May 2020.

In August 2020, 282,600 tonnes of biodiesel were used for blending, which was down 2.2 per cent from the previous month. At the same time, diesel consumption declined 9.5 per cent to 2.67 million tonnes. Total consumption of diesel and biodiesel fell 8.8 per cent to 2.95 million tonnes, whereas the share of biodiesel in total consumption increased to 9.6 per cent. Compared to the same month the previous year (218,400 tonnes), biodiesel consumption rose 23 per cent. At that time, the incorporation rate was only 6.7 per cent.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has pointed out that Federal Office for Economic Affairs and Export Control (BAFA) statistics also include the blended amounts of hydrotreated vegetable oil (HVO) in the figures for biodiesel. The diesel fuel standard DIN EN 590 limits the incorporation of biodiesel or fatty acid methyl ester to 7 per cent by volume. The difference is the amount of HVO that is blended with diesel. UFOP has emphasised that it is not known whether and in what amounts petroleum refineries co-process vegetable oils and fats when producing fuels. According to the existing statutory regulations, this option to meet the greenhouse gas emission reduction quota (GHG quota) will cease to exist at the end of 2020.

UFOP sees its July 2020 consumption estimate – of 2.6 million tonnes of biodiesel (including HVO) – basically confirmed. The association has said that the quota year 2020 is confirming that even a GHG quota that was raised from 2 per cent to 6 per cent is met, despite the fact that quotas cannot be carried over to the obligation year 2020. UFOP has stressed that openness to technology is paramount and must be brought forward now.

Therefore, the association has repeated its call for a gradual raise of GHG quota obligations to 16 per cent between 2020 and 2030. In other words, it once again clearly rejects the draft bill on the future development of the GHG quota presented by the Federal Ministry for the Environment (BMU). UFOP has argued that the draft provides for a freeze of the 6 per cent obligation until 2025. A raise (to 7.25 per cent) is not planned until 2026. According to UFOP, the BMU fails to recognise the acute need to mobilise all options existing already today to make it possible to reach the climate protection targets in the transport sector in 2030.

It is not easily comprehensible that the BMU freezes the de-carbonisation of the transport sector in the existing vehicle fleets at a time when the EU Commission and the European Parliament are discussing a 55 to 60 per cent reduction in greenhouse gas emissions. UFOP has said that it is irresponsible for the BMU to let five years go by unused for climate protection. UFOP has strongly criticised that the ministry also ignores the fuel industry's will to accept the challenge, fully in line with the BMU's Coalition for Climate Protection.

An approach that is open to technology and takes into account the sustainably available biomass from agriculture is the basis on which, even today, an effective contribution to protecting the climate can be made. At the same time, the urgently needed value added potential – and consequently earnings potential for farmers and rural areas as a whole – can be raised. UFOP has urged the BMU to finally adopt a course that would connect these two challenges.

Chart of the week (44 2020)

German soybean harvest 2020 hit record level

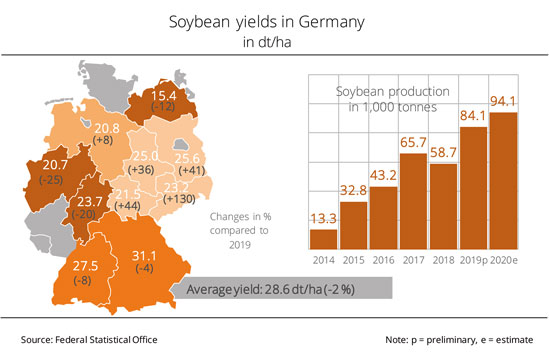

According to the German Federal Statistical Office, around 94,100 tonnes of soybeans were harvested in Germany in 2020. This was the largest quantity ever. Production grew 12 per cent on the year despite, on average, lower yields and shot up as much as 60 per cent compared to 2018.

German soybean production has increased more than tenfold since 2012 due to a steady expansion in production area. The soybean area for the 2020 harvest amounted to 32,900 hectares. This was up 14 per cent year-on-year. On the other hand, yields were slightly lower. Germany recorded a 2 per cent decline on the year to on average 28.6 decitonnes per hectare. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), western Germany saw the strongest drop in yields. North Rhine-Westphalia harvested around 25 per cent less than a year earlier, whereas yields in Hesse fell 20 per cent. Mecklenburg-Western Pomerania recorded a 12 per cent decrease. However, since production areas in Hesse and Mecklenburg-Western Pomerania were significantly expanded in 2020, soybean output there was nevertheless larger than in 2019.

Whereas yields in South Germany were also slightly down, those in eastern Germany generally rose considerably. Saxony-Anhalt registered the biggest increase at 130 per cent to 23.2 decitonnes per hectare.

Chart of the week (43 2020)

Soybean prices flying high

Brisk demand from China and dry weather conditions in Brazil have sent soybean prices on a sharp rise. However, the rally could soon be over as harvest pressure in the US increases.

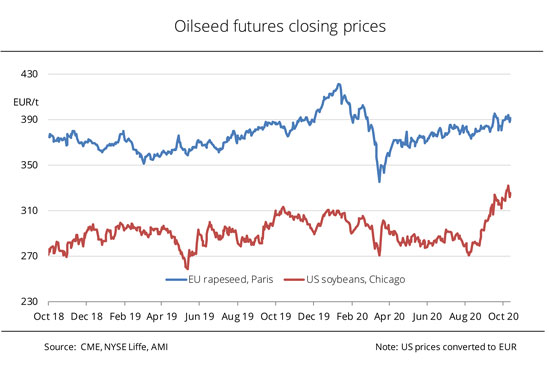

Soybean prices at the Chicago Stock Exchange have soared since the beginning of August. Since then, they have risen 20 per cent to the equivalent of EUR 325 per tonne. This is the highest level since May 2018. The driving factor in the past two and a half months has been dry sowing conditions in Brazil. This situation could delay sowings and also harvests – to the extent buoyant demand from China for US beans. This shows, on the one hand, how large China's soybean demand is and, and on the other, how limited supply from other countries of origin is. South American soy supply from the 2019/20 crop is used up. For this reason, China has repeatedly ordered large amounts from the US since mid August. New-crop soybeans will not come off the field in Brazil and Argentina until spring 2021. Another factor is also likely to propel the trade between China and the US. The two great powers are in the first phase of the current trade agreement in which China has pledged to purchase a total of USD 36.5 billion worth of agricultural feedstock from the US in the 2020/21 crop year.

Another factor pushing up soy prices in the past two weeks has been dry sowing conditions in Brazil. This situation could delay sowings and also harvests to the extent that the crop would be available on the global market later than usual. However, soybean prices could come under pressure in the coming weeks as the US harvest proceeds. So far, the harvest has progressed much more quickly than the 5-year average

Chart of the week (42 2020)

Larger global rapeseed harvest expected in 2020/21

The Australian rapeseed harvest in the 2020/21 crop year will probably be somewhat larger than expected the previous month. The harvest in Germany also exceeds expectations. Consequently, the world's harvest in 2020/21 is set to outstrip the previous year's level after all.

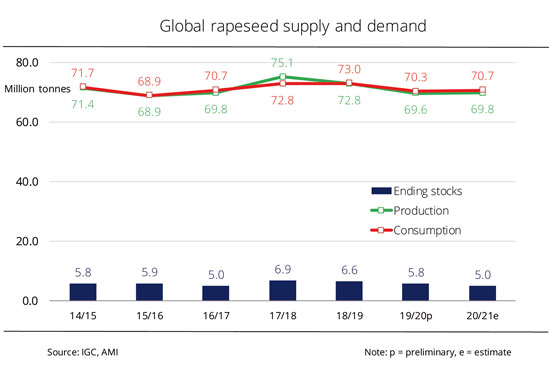

The International Grain Council (IGC) expects the world’s rapeseed harvest to reach approximately 69.8 million tonnes in the 2020/21 crop year. This would be up only 200,000 tonnes year-on-year, but 400,000 tonnes more than projected in August. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the growth in output is based on larger rapeseed harvests both in the EU-27 plus UK and Australia and China than the previous year. The increase in output in Australia has an especially strong impact. The country expects to harvest 3.3 million tonnes, approximately 43 per cent more than 2019/20. The increase will more than offset the declines forecast for Ukraine and Canada.

Global rapeseed consumption will probably reach 70.7 million tonnes in the current crop year, thus exceeding the previous year's level by 400,000 tonnes. The main reason is the higher consumption forecast for China, of 16.3 million tonnes. Chinese demand for processing uses is seen to grow. By contrast, consumption in the EU-27 plus UK is expected to decline 0.3 per cent to 22.2 million tonnes.

Since global consumption is expected to outstrip production for the third year running in 2020/21, this will be at the expense of global supplies. Ending stocks for the current crop year are expected to amount to 5 million tonnes. This would be down 0.8 million tonnes on 2019/20 and 1.6 million tonnes on 2018/19.

Chart of the week (41 2020)

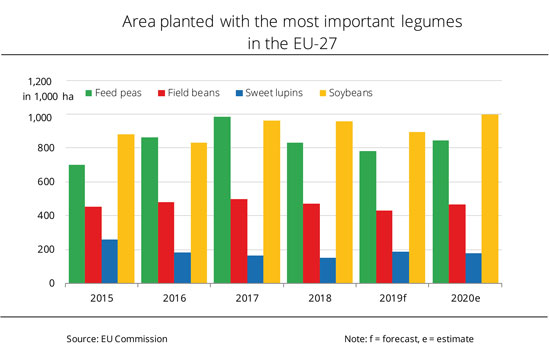

Larger EU legume harvest

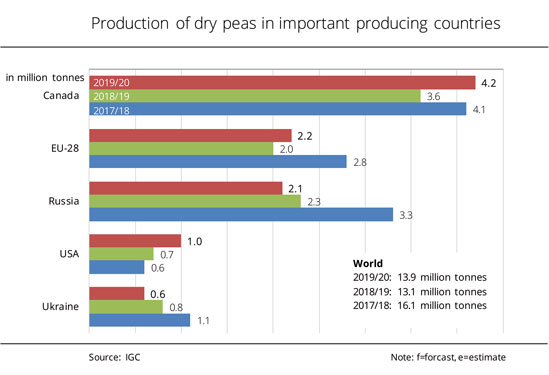

Not only has the production of field beans increased significantly in the EU-27, but so, too, has that of sweet lupins, dry peas and soybeans.

Legume production has grown considerably in the EU-27 in 2020. According to the EU Commission, a total of 6.5 million tonnes was harvested. This was up 7 per cent year-on-year. However, production fell short of the 2017 record of 7 million tonnes. Of the legume crops listed here, field beans saw a particularly big increase in output compared to the previous year. In 2020, the harvest amounted to approximately 1.2 million tonnes. This was up 16 per cent from 2019 and as much as 22 per cent from the weak year of 2018 when production collapsed. According to Agrarmarkt Informations-Gesellschaft (mbH), the increase is due to an expansion in area planted and a growth in yields. Sweet lupins also benefited from larger-scale production and higher yields in 2020. The harvest amounted to around 235,000 tonnes, a 12 per cent rise on 2019.

The most important legume crop in the EU-27 is soybean, which accounts for around 43 per cent of grain legume production. Farmers harvested around 2.8 million tonnes in 2020, approximately 3 per cent more than the previous year. This was due to a growth both in area planted and yields. The second most important legume crop in the EU-27 is dry pea. The output of 2.2 million tonnes was up 7 per cent from 2019, first and foremost due to an expansion in area planted. The latter increased 8 per cent to 852,000 hectares. The expansion in area more than offset the 1.6 per cent decline in yield to 25.5 decitonnes per hectare.

Chart of the week (40 2020)

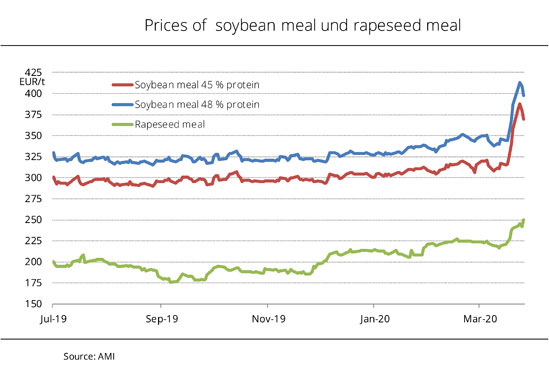

Prices for oilseed meals rose

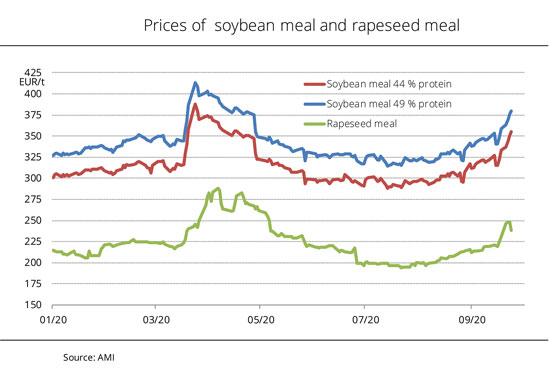

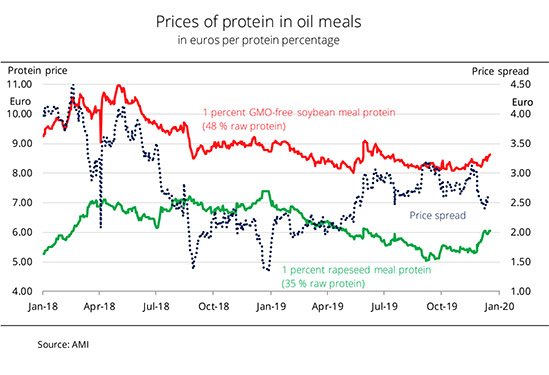

Whereas German soybean meal prices benefited from increased soybean prices in Chicago, rapeseed meal prices received support from limited supply and steady demand.

German prices for oilseed meals have climbed significantly since the beginning of August 2020, especially in September. Rapeseed meal surged EUR 22 to EUR 238 per tonne within a month and briefly reached its highest level since May 2020. Prices for soybean meal rose EUR 38 per tonne in the same period. Consequently, soybean meal with 49 per cent crude protein most recently cost EUR 380 per tonne and soybean meal containing 44 per cent crude protein was at EUR 355 per tonne. This was the highest price level in five months.

According to information published by Agrarmarkt Informations-Gesellschaft (mbH), September rapeseed meal prices on the German cash market were mainly driven by two factors. On the one hand, demand was at least steady, and in some regions even brisk, over the past four weeks. On the other hand, supply on nearby positions was limited, at least in the west of Germany. Only few oil mills still marketed spot commodity. The fact that it was only available in eastern Germany drew interest from buyers from all over the country. Orders were even placed from the Netherlands.

In September, soybean meal benefited mainly from firm stock price quotes in Chicago. The latter rose 10 per cent on the previous month, driven by continued buoyant demand from China for US soybeans.

Chart of the week (39 2020)

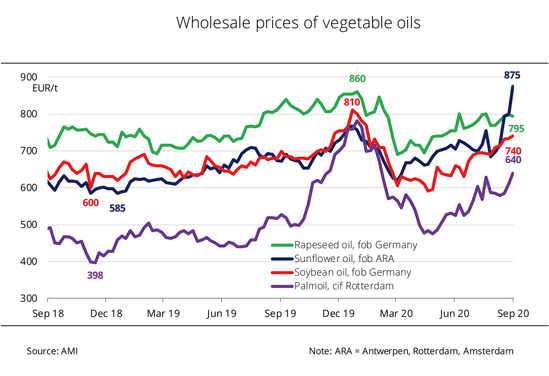

Sunflower oil more expensive than rapeseed oil

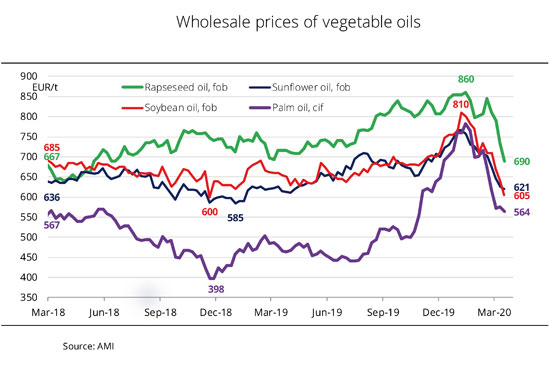

The most important vegetable oils have become more expensive since the Corona restrictions were eased. Especially sunflower oil has risen steeply over the past weeks.

Prices for vegetable oils have increased considerably in Germany since the beginning of May 2020. Support came mainly from the easing of Corona restrictions. The lifting of restrictions on private and public life, including freight and passenger road traffic, caused demand for transport fuels to rebound. This also led to a rise in demand for biodiesel for blending and, consequently, also increased interest in buying vegetable oils. The raise of the quota on greenhouse gas (GHG) emission from 4 per cent to 6 per cent in 2020 is also likely to account for the significant increase in demand. Because quotas can no longer be carried over from the previous year, GHG emission reduction requirements must be fully achieved by physical material that is placed on the market in 2020. This rule applies throughout the EU and is likely to result in a continuing growth in demand for biofuels till year-end.

According to information published by Agrarmarkt Informations-Gesellschaft (mbH), there were also other factors that lent support to prices in the past three weeks. For example, soybean oil benefited from firm soybean prices in Chicago. These were driven by China's brisk purchases and speculation about this year's US crop.

However, sunflower oil prices showed the steepest increase. The rally started on 11 August 2020. At the time, sunflower oil cost the equivalent of EUR 684 per tonne fob ARA. Within the following five weeks, it climbed almost EUR 200 per tonne, or 28 per cent, to EUR 875 per tonne, a level not seen in seven years. Consequently, sunflower oil was more expensive than rapeseed oil for the first time in more than two years. The main reason for the strong price surge was harvest delays in Ukraine, the by far most important supplier of sunflower oil to the EU. What's more, Ukrainian yields were even lower than expected. This put Ukrainian exporters who had already entered into extensive contracts with EU buyers in hot water. They are unable to meet their contractual obligations on time. This has resulted in an unexpected tightening of supply on the EU sunflower oil market, which is reflected in prices. In addition, global market demand for soybean and palm oil is increasing, causing European prices to firm.

Chart of the week (38 2020)

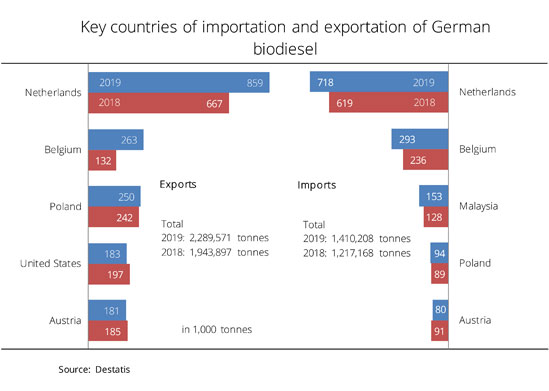

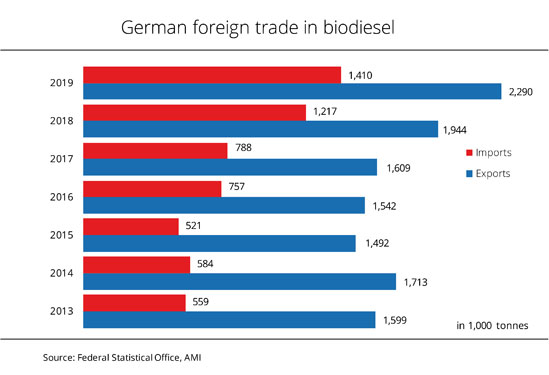

Germany stepped up biodiesel exports

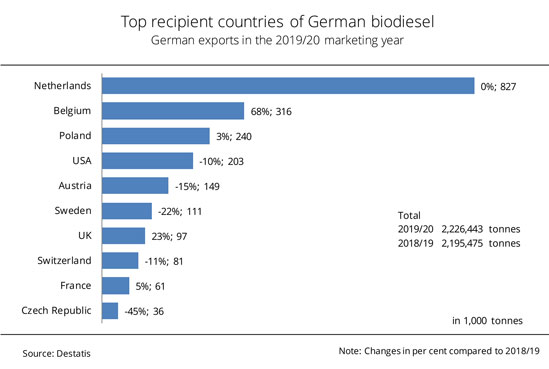

German biodiesel exports reached the level of 2 million tonnes for the second year running in 2019/20. Whereas the main buyer, the Netherlands, maintained its purchases virtually steady at the previous year's level, Belgium ramped up its biodiesel imports significantly.

German biodiesel exports continued to rise further in the 2019/20 crop year. The amount of around 2.2 million tonnes translates to an increase of 1.4 per cent on the year. In other words, sales have climbed just about 40 per cent over the past five years. Traditionally, the Netherlands receive the largest quantities for onward exports to other EU countries or non-EU countries. In 2019/20, the Netherlands remained the main recipient country with imports of around 827,000 tonnes, approximately the same tonnage as a year earlier. Belgium purchased approximately 316,000 tonnes of biodiesel. This translates to a rise of 68 per cent on 2018/19. This means that for the first time, the country is the second most important recipient of German biodiesel. Belgium has taken the place of Poland, which ordered 240,000 tonnes, only about 3 per cent more than the previous year. France also purchased somewhat more biodiesel than a year earlier (+ 5 per cent). Overall, however, the country has cut back its purchases considerably over the past five years. In 2014/15 Germany delivered almost 180,000 tonnes to France. In 2019/20 it was only 61,000 tonnes.

Biodiesel exports to the Czech Republic dropped sharply to 36,000 tonnes (- 45 per cent). Sweden, Austria, Switzerland and the US also ordered less than the previous year.

Chart of the week (37 2020)

Rapeseed oil exports rebounded

Following a decline in German rapeseed oil exports since the 2016/17's peak year, a trend reversal can now be identified for 2019/20. The Netherlands in particular absorbed more, but demand from Denmark and Belgium also picked up.

German rapeseed oil exports increased in the 2019/20 crop year, following a significant decline over two consecutive years. The peak level recorded in the 2016/17 crop year, of more than 1.2 million tonnes of rapeseed oil exports, was not reached. However, 935,000 tonnes translate to a respectable 8.6 per cent increase over the previous year.

The by far largest recipient country of rapeseed oil in 2019/20 was the Netherlands, which acts as a central hub for a great number of agricultural commodities. The country was followed by Belgium, Denmark, France and Norway as the most important destinations for German rapeseed oil. Belgium purchased around 95,000 tonnes from Germany (+ 11 per cent), whereas Denmark imported 60,700 tonnes (+ 21 per cent). Although shipments to France declined, the country remained a major market for Germany, with purchases amounting to 49,300 tonnes (- 12 per cent). Norway received substantially more than a year earlier, whereas Poland purchased substantially less. The drop in rapeseed oil exports in the years 2017 to 2019 have often been associated with tighter feedstock supply, lower levels of rapeseed processing and the resulting reduction in rapeseed oil output. However, if this were the case, the decline in exports would have continued in 2019/20, which it did not.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has said that the reason is the German biodiesel industry's importance as the primary recipient of rapeseed oil. The sector is the backbone of German rapeseed processing of more than 9 million tonnes per year, although production facilities are not utilised to capacity.

UFOP has indicated that the exports of rapeseed oil that is certified as sustainable could also be used in Germany to decarbonise fossil transport fuels and, consequently, to satisfy greenhouse gas reduction obligations in the transport sector. But only if the reduction obligations would be raised accordingly. UFOP has called for an adequate increase in greenhouse gas reduction obligations to put an end to "exporting" this potential out of the country.

The association has stressed that the German government must incorporate a gradual raise of GHG reduction obligations in the implementation of the revised Renewable Energy Directive (RED II) at national level, as it has been repeatedly called upon to do by the agricultural and biofuels industries.

Chart of the week (36 2020)

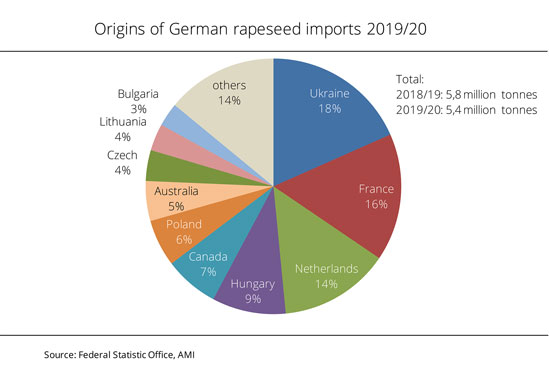

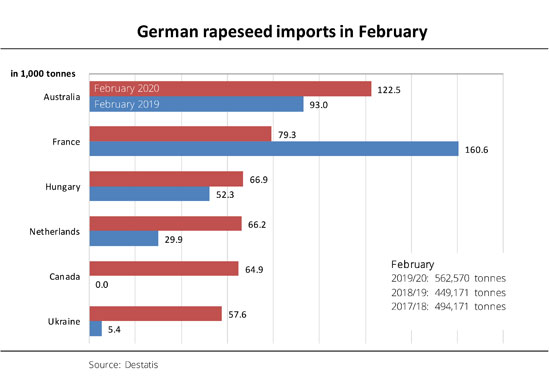

Ukraine delivered largest amount of rapeseed

Germany imported a total of 5.4 million tonnes of rapeseed and field mustard in the 2019/20 season. This was down 7 per cent year-on-year. The main reason was harvest declines in some EU countries that are vital to Germany's supply with rapeseed.

France is traditionally the most important supplier of rapeseed to Germany. The country supplied more than 1.5 million tonnes of rapeseed on average in the crop years 2014/15 to 2018/19. This translates to one fourth of total German rapeseed imports. However, 2019 was a disappointing crop year also for France and export opportunities were correspondingly limited. As a result, Germany received no more than 870,000 tonnes from France in 2019/20. This was a 44 per cent slump compared to both the previous year and the five-year average. Imports from other EU countries also decreased, for example from Romania, the Czech Republic or Belgium. Overall, Germany's imports from other EU countries in 2019/20 saw a more than 15 per cent decline year-on-year to 3.7 million tonnes.

Imports from other countries, above all Ukraine and Canada, offset this drop, at least partially. In recent years, Ukraine has steadily gained in importance as a rapeseed supplier for Germany. The Black Sea state contributed around 992,000 tonnes to German rapeseed supply in 2019/20, just over one third more than the previous year. However, the strongest rise was in imports from Canada. The country delivered around 372,000 tonnes in 2019/20, many times the quantities delivered in previous years. The previous year's volume alone was exceeded more than fivefold. This was against the background of increasing Canadian shipments to Europe in the wake of the trade dispute with China.

Germany covers just over 60 per cent of its rapeseed needs with commodity from abroad.

Chart of the week (35 2020)

Larger area planted with rapeseed for Germany's 2020 crop

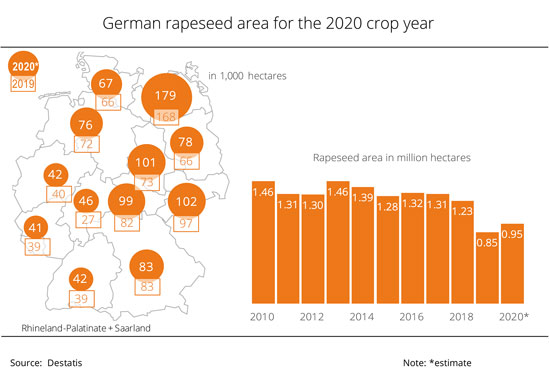

According to the German Federal Statistical Office's recent estimate, the area planted in Germany with rapeseed for the 2020 crop year will probably be larger than previously expected. The expansion will also be reflected in harvest figures.

In its most recent estimate, the German Federal Statistical Office put the German winter rapeseed area for the 2020 harvest at 954,200 hectares. This means that the area is slightly larger than previously projected and exceeds the previous year's hectarage by 12 per cent. However, production is still lower than average. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), difficult conditions at the time of sowing in the autumn of 2019 and unfavourable weather conditions in some parts of the country in spring 2020 forced some farmers either to decide against growing rapeseed or plough up planted land. In several German states, the rapeseed area was expanded significantly compared to the previous year. Hesse showed the largest increase in area. About 46,000 hectares were planted with winter rapeseed for the 2020 crop year in this state. This was up just less than 70 per cent from the previous year. In Saxony-Anhalt, the rapeseed area was expanded just under 40 per cent to 101,000 hectares. Farmers in Thuringia and Brandenburg planted 99,000 hectares and 78,000 hectares respectively with rapeseed, which was an increase of around 29 per cent. In both Baden-Wuerttemberg and Mecklenburg-Western Pomerania, the winter rapeseed area grew 7 per cent. In North Rhine-Westphalia, Rhineland Palatinate and Saxony, the expansion amounted to approximately 5 per cent.

With a rapeseed area of 179,000 hectares, Mecklenburg-Western Pomerania ranked first among Germany's rapeseed-producing states. Saxony followed in second place, as it did in 2019, with 102,000 hectares.

Chart of the week (34 2020)

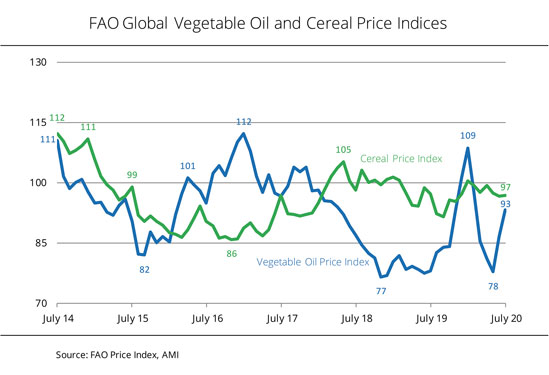

FAO vegetable oil price index increased yet again

Firm prices for palm, soybean and rapeseed oil drove the FAO vegetable oil price index higher in July. The cereal price index remained virtually unchanged at the previous month's level.

The FAO's vegetable oil price index, which illustrates the changes in international prices of the ten most important vegetable oils in world trade, rose to 93 points in July. This translates to an increase of 7 points or 8 per cent on the previous month and a five-month high. The surge of the index was spurred by firm prices for palm, soybean and rapeseed oil. Palm oil benefited from prospects of a slowdown in production in the wake of flooding in the most important palm oil-producing countries. Strong global demand for imports and continued concerns over labour shortages in Malaysia gave prices an additional lift. Rapeseed oil received support from growing demand from the biodiesel and food sectors in the EU.

On the other hand, the cereal price index remained at the previous month's level of 97 points in July. Wheat prices barely moved, despite a weakening US dollar, concerns over harvest prospects in Europe, the Black Sea region and Argentina, and high crop expectations in Australia. Barley prices also remained stable. Maize and sorghum rose due to China's recent purchases and concerns over growing conditions in the US. In contrast, prices for rice dwindled. The falloff was prompted by sluggish trading and prospects of a large 2020 crop.

Chart of the week (33 2020)

Harvest of sunflowerseed expected to hit record high

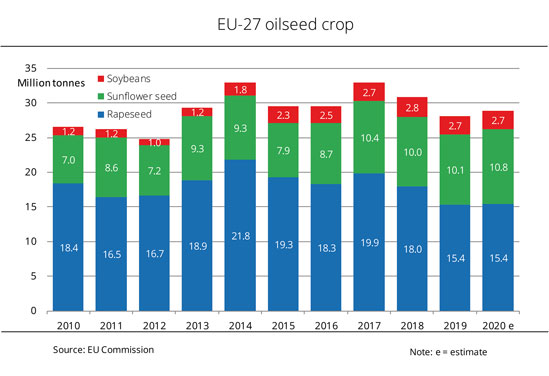

The oilseed harvest in the EU-27 is likely to see a slight rise in 2020. The main reason for this is the bumper crop of sunflowerseed.

The 2020 oilseed harvest in the EU-27 is set to be larger than the two previous years. The EU Commission estimates output at 29 million tonnes. This would translate to a rise of just under 3 per cent year-on-year. However, production would still fall about 4 per cent short of the long-term average.

The increase in sunflowerseed is especially large. The sunflower area has been expanded 2 per cent and yields are estimated 6 per cent higher year-on-year. In other words, farmers are expected to bring in a bumper crop of 10.8 million tonnes, which would be up 8 per cent from the previous year. In some EU states, sunflower production benefited from favourable conditions at the time of sowing and changes in land use. Based on quantity, sunflowerseed is the second most important oilseed crop in the EU-27. Rapeseed accounts for the largest share of oilseed production in 2020, as it did in previous years. The EU Commission expects just a slight rise from the previous year to 15.4 million tonnes. A larger area sown is offset by slightly lower per hectare yields.

The soybean harvest is seen at 2.7 million tonnes, on a par with the previous year's level.

Chart of the week (32 2020)

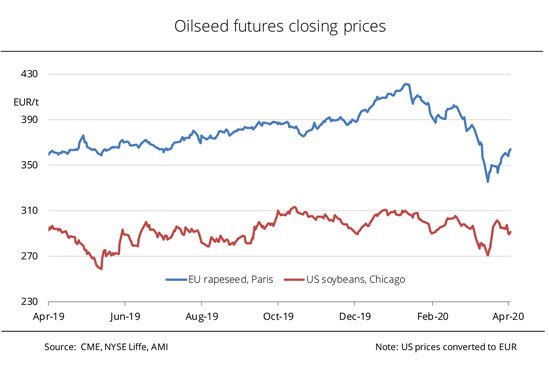

Forward prices for rapeseed and soybeans stand up to corona crisis

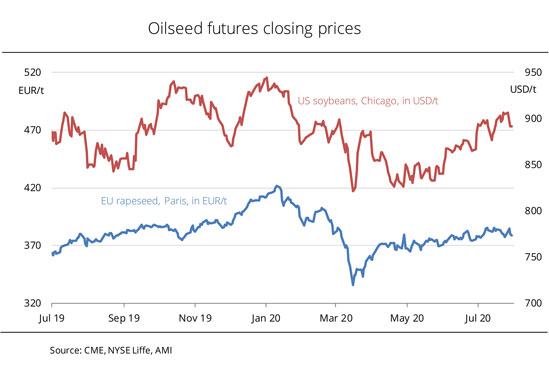

The restrictions in the wake of the corona crisis generated pressure on rapeseed and soybean prices in the first quarter of the calendar year of 2020. However, prices have firmed since then.

Starting at the beginning of the 2019/20 crop year, both rapeseed prices in Paris and soybean prices in Chicago gradually stepped up. In January 2020, rapeseed reached its highest level since March 2017 at EUR 421 per tonne. But then rapeseed lost about 20 per cent of its value within three months, whereas soybean prices eased 13 per cent during the same period. According to Agrarmarkt Informations-Gesellschaft (mbH), the decline was triggered by the corona crisis. Due to the extensive restrictions on contact and travel, palm oil and crude oil prices collapsed and also pulled down rapeseed oil. As a consequence of the corona crisis, consumption of fossil-derived diesel fell in many countries of Europe, in some cases significantly so. However, consumption of biodiesel and HVO showed a contrasting trend in Germany. The reason for the rise in demand was the raising of the greenhouse gas emission reduction target from 4.5 per cent to 6 per cent.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has pointed out that this reduction obligation not only applies in Germany, but also in all other EU member states. The greenhouse gas reduction requirement is legally based on the European Fuel Quality Directive (FQD). For this reason, UFOP has called on political leaders to take this regulation forward not only at national, but also at European level. The association has argued that a gradually increasing quota on greenhouse gas (GHG) emission stabilises demand for rapeseed oil and, consequently, also steadies prices for rapeseed growers throughout the EU. It therefore also helps to support the creation of value added in rural areas.

UFOP has also emphasised that combining the quota on GHG emission with an appreciable penalty has basically proven to be a successful instrument to intensify competition for efficiency as well as broaden the feedstock basis and processing technologies in the biofuels and mineral oil industries.

Rapeseed prices firmed in mid March 2020 already based on reviving demand and rose 13 per cent since. Moreover, prices were driven by prospects of a small rapeseed harvest in the EU in 2020. According to UFOP, soybean prices increased 9 per cent during the same period.

Chart of the week (31 2020)

Rapeseed prices exceed year-ago level

The 2020 rapeseed harvest will probably come in below average both in Germany and other EU countries. This has been driving up prices. The previous year's price level has been exceeded by 5 per cent even now.

Over the past weeks, producer prices for rapeseed from the 2020 crop have shot up. Since the beginning of July 2020, rapeseed prices have risen around EUR 9 per tonne to 367 per tonne. In other words, asking prices for rapeseed increased on average 10 per cent since their annual lows in mid March. Since the turn of the season, rapeseed prices have been well above the previous year's level. In mid July, the price advantage was almost EUR 20 per tonne year-on-year.

Support came from low EU harvest outlooks for 2020. Although harvests in the major rapeseed producing countries in the EU, such as Germany and France, are expected to increase slightly from the previous year, they are still set to fall significantly short of the long-term average again. Countries outside the EU are also expecting smaller rapeseed harvests. According to the International Grain Council (IGC), Ukrainian production will reach only 3 million tonnes, almost 11 per cent less than a year earlier. With Ukraine being one of the EU's top import origins, these prospects are fuelling concerns about rapeseed supply in the 2020/21 crop year, thus driving prices up even further.

The first yield reports show an unclear picture. It is too early for results to be conclusive. According to Agrarmarkt Informations-Gesellschaft (mbH), producers' willingness to sell new-crop rapeseed or conclude forward contracts is therefore very low at present. On the one hand, no one wants to run the risk of being unable to satisfy contracts they entered into. On the other hand, producers are speculating on further price rises.

Chart of the week (30 2020)

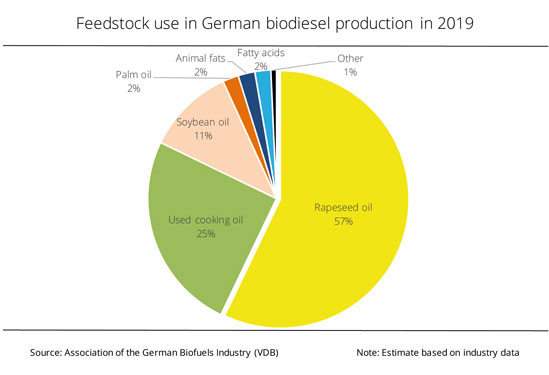

Rapeseed oil remains primary feedstock for German biodiesel production

The 2020 rapeseed harvest will probably once more be lower than average. However, this is not due to shrinking demand, the Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has emphasised, referring to the Germany biodiesel industry's feedstock requirements. In 2019, the industry produced 3.4 million tonnes of biodiesel, of which about 1.9 million tonnes were based on rapeseed oil. UFOP has pointed out that in view of the upcoming sowings, the producer price should "pull" the area sown to ensure that the feedstock supply chain is as short as possible.

Due to the poor growing conditions, the German rapeseed harvest will presumably to be small again. According to the latest estimate of the German Raiffeisenverband, this year's rapeseed harvest will be 14 per cent larger year-on-year at 3.2 million tonnes. However, it would still fall approximately 21 per cent short of the five-year average. UFOP has explained that one of the reasons is that with approximately 1 million hectares under rapeseed cultivation, the potential of area is far from being fully exploited.

Incentives for expanding the rapeseed area should come from producer prices, along with good sowing conditions from the end of August to the beginning of September. Forward contract prices are presently at approximately EUR 364 per tonne, approximately EUR 200 per tonne higher than those for wheat. Prices are supported by the fact that the rapeseed market in the European Union is characterised by a permanent shortage of cover to operate processing plants at full capacity. More specifically, according to statistics provided by the German Federal Office for Agriculture and Food (BLE), approximately 9 million tonnes of rapeseed were processed in German oil mills in 2019 – of which, according to calculations made by Agrarmarkt Informations-Gesellschaft (mbH), almost 3.9 million tonnes were of German origin – yielding about 3.8 million tonnes of rapeseed oil. UFOP has concluded that, consequently, demand for rapeseed in Germany remains strong.

Underlining the overall importance of rapeseed cultivation, the association has pointed out that, at the same time, flowering rapeseed fields and the integrated value chains associated with rapeseed processing – from GM-free fodder production to certified pharmaceutical glycerine – have a positive impact on the image of biodiesel, both among the public and in politics.

According to the Association of the German Biofuels Industry (Verband der Deutschen Biokraftstoffindustrie - VDB), in 2019 about 3.4 million tonnes of biodiesel were produced in Germany alone. The primary feedstock was rapeseed oil – as it was in previous years –, which accounted for 57 per cent. The use of used cooking oil and fats declined just less than 2 percentage points to 25 per cent year-on-year. The role of soybean oil, accounting for 11 per cent, increased somewhat compared to 2018 (8 per cent). The percentage of palm oil remained unchanged from the previous year at a relatively low 2 per cent. Animal fats, fatty acids and other feedstocks together accounted for no more than 5 per cent.

Chart of the week (29 2020)

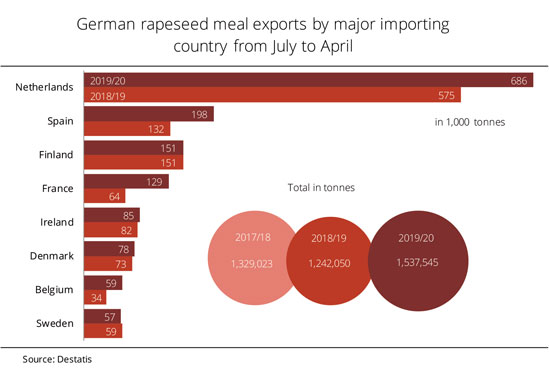

Germany raised rapeseed meal exports

From July 2019 to April 2020, Germany exported the largest amount of rapeseed meal in five years. The Netherlands and Spain once more imported the largest amounts for milk production.

From July 2019 to April 2020, Germany exported around 1.5 million tonnes of rapeseed meal. According to information published by the German Federal Statistical Office, this was up approximately 24 per cent year on year and the largest tonnage in five years. The Netherlands was the main recipient, taking 686,000 tonnes, which was up 19 per cent. Spain was the second largest importer with imports amounting to around 198,000 tonnes (up+ 33 per cent). Finland's imports remained at the previous year's level of 151,000 tonnes. Exports to France even doubled to 129,000 tonnes. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the surge is probably due to the small 2019 rapeseed harvest and the resulting lower utilization of oil mill capacities.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has stated that in terms of processing capacity (approximately 9 million tonnes) Germany is the primary producer and supplier of GM-free rapeseed meal within the EU 27. The “without GM” label on dairy products is a key demand factor, but does not lead to higher meal prices for farmers. The reason is that the label has arrived in the market and long ceased to be a unique selling point. Dairies, such as Campina or ARLA, have switched, either partially or – in the case of ARLA – completely, to GM-free feeding. UFOP has emphasised that the fact that a unique selling point is leading to land being set aside for specific crops is basically a success story.

However, the association has strongly criticised that politicians often fail to think integrated bioeconomy through. Anyone wanting to feed livestock not with imported soybeans and without causing forests to be destroyed and also wanting to strengthen and diversify regional arable farming, must not at the same time allow rapeseed-based biodiesel, the key pricing factor, to be discontinued. Therefore, UFOP has massively criticised plans to end the tax-based funding for biodiesel from rapeseed oil used in agriculture and forestry from 2021 onwards. In fact, the German Ministry of Agriculture is even deleting this environmentally friendly fuel from its incentive programme to improve energy efficiency in agriculture. UFOP has concluded that biofuels from cultivated biomass are obviously to be discontinued. This step would affect all main crops, such as grains, maize etc., which today are the key crops in renewables statistics. According to UFOP, alternative markets for the output of these crops are not in sight so that this would be the end of the future of agriculture in the bioeconomy.

Chart of the week (28 2020)

EU-28 rapeseed imports hit record level

EU-28 rapeseed imports from non-EU countries increased substantially in the 2019/20 marketing year. The underlying reason was the decline in EU rapeseed production over recent years. The by far largest supplier was Ukraine.

The EU-28 rapeseed market was characterised by extensive rapeseed imports from non-EU countries early on in the 2019/20 marketing year. The reason was the small 2019 rapeseed harvest, which according to information published by the EU Commission was down around 14 per cent from a year earlier at 17.1 million tonnes. This quantity was insufficient to cover internal demand or utilise oil mill capacities. Imports amounted to more than 1 million tonnes by as early as August 2019, whereas a year earlier, this level was not reached until the beginning of October. According to Agrarmarkt Informations-Gesellschaft (mbH), weekly imports from third countries consistently exceeded the previous years' levels as the marketing year progressed. In 2019/20, monthly rapeseed imports averaged 487,000 tonnes. This was 30 per cent more than the previous year's monthly average.

Ukraine was the main supplier. The country's sales to the EU-28 increased 32 per cent year-on-year to 2.9 million tonnes. Rapeseed imports from Canada rose especially sharply in 2019/20. The country quadrupled its shipments to 1.8 million tonnes. This was against the background of Canada's trade dispute with China, which resulted in Canada seeking new markets in Europe. By contrast, Australia exported around 30 per cent less than 2018/19 – 941.000 tonnes – because of its small rapeseed harvest.

Chart of the week (27 2020)

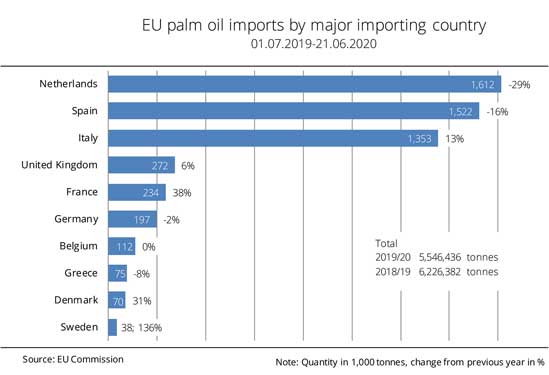

EU-27 plus UK imported less palm oil

The EU member states plus UK imported somewhat less palm oil in the marketing year that has now nearly ended than a year earlier. The Netherlands and Spain saw especially steep declines in imports.

The EU-27 plus UK imported around 5.5 million tonnes of palm oil between July 2019 and the end of June 2020. This was a drop of around 0.7 million tonnes or 11 per cent year-on-year. The Netherlands (circa 1.61 million tonnes), Spain (circa 1.52 million tonnes) and Italy (circa 1.35 million tonnes) remained the by far largest importers. Germany only imported around 0.2 million tonnes. According to EU Commission statistics, the Netherlands remained the largest EU palm oil importer within the EU, but the country was is also a palm oil exporter to other member states. According to investigations conducted by the Agrarmarkt Informations-Gesellschaft (mbH), Germany imported approximately 0.245 million tonnes from the Netherlands – the hub for onward exports – in the period from July 2019 to April 2020.

Spain imported the second largest amount of palm oil to the EU, despite a 16 per cent decline compared to 2018/19. By contrast, Italy raised its palm oil imports 13 per cent. The 38 per cent growth in palm oil imports to France, to 0.234 million tonnes, is especially noteworthy.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has welcomed the general decrease in palm oil imports. The association attributes this trend mainly to the decline in using palm oil in biodiesel fuel and hydrotreated vegetable oil (HVO) production. UFOP expects palm oil imports to decrease further as a consequence of the implementation of the delegated decree to implement the sustainability requirements for biomass with high or low iLUC risk. According to the association, the pace of the decline is going to depend on each member state's level of ambition to end the use of palm oil. Nobody has to wait until 2030.

UFOP has pointed out the unsatisfactory quality of data in the official statistics of the EU Commission and member states and called for the EU database announced in the Renewable Energy Directive (RED II) to be created as soon as possible on the lines of Nabisy, the database system of the German Federal Office for Agriculture and Food (BLE). Companies would then be required to keep records of feedstock types and origins for traceability. This would be the best way to avoid potential double crediting and fraud. Noting the international importance of complying with the requirements for sustainable production of agricultural feedstock, UFOP has emphasised the pioneering role biofuels from cultivated biomass are playing for other economic sectors.

Chart of the week (26 2020)

Field bean area on the increase

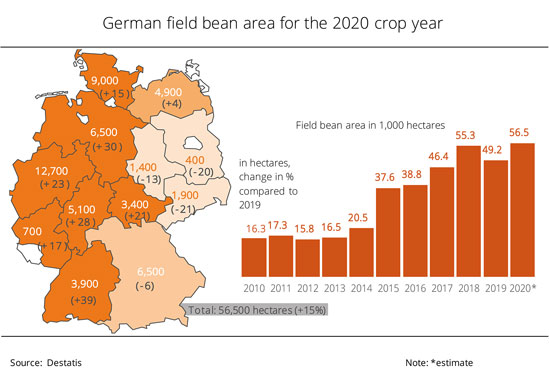

German farmers planted a larger area of land with field beans for the 2020 harvest. Especially in Baden-Wuerttemberg, the area has been considerably expanded.

According to information published by the German Federal Statistical Office, the area of land in Germany devoted to growing field beans for the 2020 harvest amounts to around 56,500 hectares. This translates to a 15 per cent increase year-on-year and sets a new record. In other words, the field bean area has more than tripled over the past ten years. The largest area is found in North Rhine-Westphalia, as it was last year. It comprises 12,700 hectares, which is an increase of 23 per cent. The German state with the second largest field bean area is Schleswig-Holstein, with 9,000 hectares under field bean production. This translates to an expansion of 15 per cent compared to the previous year. However, the biggest expansion in area is seen in Baden-Wuerttemberg, where the field bean hectarage rose 39 per cent to 3,900 hectares. Farmers expanded their field bean areas also in many other German states.

According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), declines in area have been recorded in Brandenburg, Saxony, Saxony-Anhalt and Bavaria. The strongest drop is seen in Saxony, where the area dwindled 21 per cent to 1,900 hectares. Brandenburg has the smallest area under field bean cultivation. Its area shrank 20 per cent to 400 hectares.

Chart of the week (25 2020)

EU-27 expands soybean production

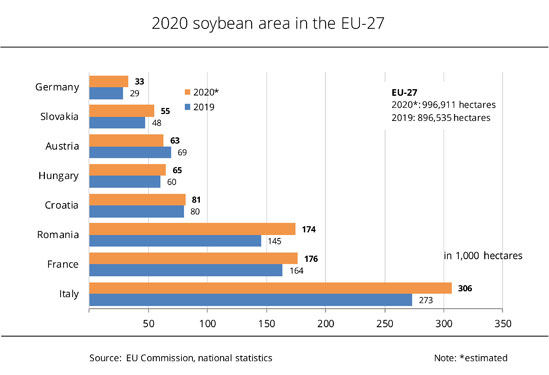

Soybean production in the EU-27 continues to grow further in 2020. The reason is significant increases in area in the most important EU member states.

According to information published by the EU Commission, soybean production in the EU-27 more than doubled over the past ten years. The area planted with soybeans in 2020 is reported to amount to almost 1 million hectares. This is up around 11 per cent year-on-year. Italy, with a soybean area of presumably 306,000 hectares and a 12 per cent increase in area, is likely to remain the by far biggest soybean producer of the EU-27. This means that the country retains its share of around one third of the total soybean area in the EU-27. The soybean area has also been significantly expanded in other EU member states. Romania has recorded an increase of 20 per cent to 174,000 hectares, whereas Slovakia has seen a 15 per cent rise to 55,000 hectares. German farmers also dedicated more land to soybeans than they did the previous year. 33,000 hectares translate to a 14 per cent increase. Only Austria has recorded a 9 per cent decline to 63,000 hectares because of excessively dry conditions at the time of sowing.

According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the soybean harvest is also likely to increase because of the expansion in production area in many EU countries. Germany did not harvest any significant amount of soybeans until 2016. This year, the EU Commission expects the country to harvest 91,000 tonnes. This would mean a doubling of German production over the past four years. Romania is assumed to see the biggest increase, of more than 20 per cent to 454.000 tonnes. A decline is only expected in Austria due to the reduction in area planted.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) views this development as confirmation of the general willingness of farmers to further expand the production of grain legumes. Depending on site conditions, grain legumes are a key crop to complement crop rotations for more sustainability and climate resilience. UFOP has noted that in the EU Commission's "Farm to Fork" strategy, this aspect is rightly a key aspect for creating regionality and adding local value. These crop rotation systems should also include rapeseed and sunflowers as additional flowering plants alongside grain legumes.

All in all, these crops contribute to improving biodiversity through different flowering times, soil quality through enrichment with humus and carbon, and climate protection through fewer nitrogen applications because of the nitrogen fixation capacity of grain legumes. The association has stressed that the cultivation of grain legumes contributes to producing GM-free feed and/or food protein, thus cutting the need for protein imports from non-EU countries.

UFOP therefore expects that the comprehensive ecosystem service approach will find its way into the aims of the agricultural strategy of the German Ministry of Agriculture. UFOP considers this to be a necessary requirement for ensuring that locally adapted crop rotation systems can also contribute to economic sustainability on arable farms. However, the association has pointed out that, in the end, consumers decide at the point of sale whether, and to what extent, extended crop rotation systems that provide the desired ecosystem service are also rewarded.

Chart of the week (24 2020)

More domestic rapeseed processed

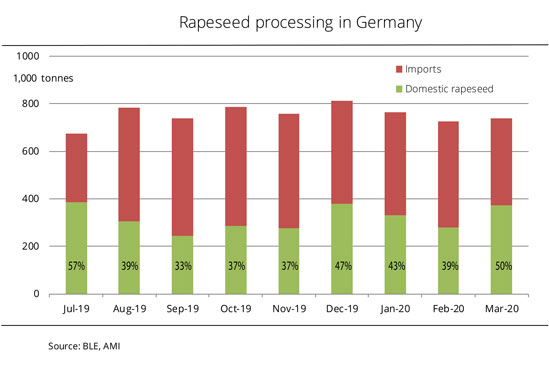

German rapeseed processing saw a slight rise in March 2020. The proportion of domestic rapeseed increased considerably.

According to figures published by the German Federal Office for Agriculture and Food (BLE), German oil mills processed more rapeseed in March than they did in February 2020. The total is reported at 737,000 tonnes, up approximately 10,000 tonnes from the previous month. However, it is not so much the tonnage as the origin of rapeseed processed that is noteworthy. According to calculations made by Agrarmarkt Informations-Gesellschaft (mbH), around 50 percent of the processing volume was sourced in Germany. This translates to a rise of 11 percentage points from the previous month. It is also the largest share of German rapeseed in total processing since the beginning of the crop year in July 2019, when it amounted to around 57 per cent due to the high availability of new-crop rapeseed. In the months that followed, German rapeseed processing was primarily based on imports. As a consequence, the use of domestic batches declined to less than 40 per cent between August and November. Rising rapeseed prices from December 2019 onwards stimulated sales of rapeseed from German producers, which led to a jump in domestic rapeseed processing to 47 per cent.

Between July 2019 and March 2020, German oil mills processed 6.8 million tonnes of rapeseed, 42 per cent domestic and 58 per cent non-domestic. In the same period a year earlier, processing amounted to 6.7 million tonnes, 41.5 per cent of which was from domestic production.

In view of these figures, the Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has pointed out that Germany is by far the most important oilseed-processing country in the EU. The key factors determining the amount of rapeseed required are demand for rapeseed oil for German biodiesel producers and the national protein animal feed market. UFOP has underlined that this demand also contributes to the diversity of crops in terms of more diversified cereal crop rotations, thus enhancing biodiversity and ecosystem services in other EU countries as well as non-EU countries such as Ukraine.

Chart of the week (23 2020)

More sunflowerseed in the EU-27

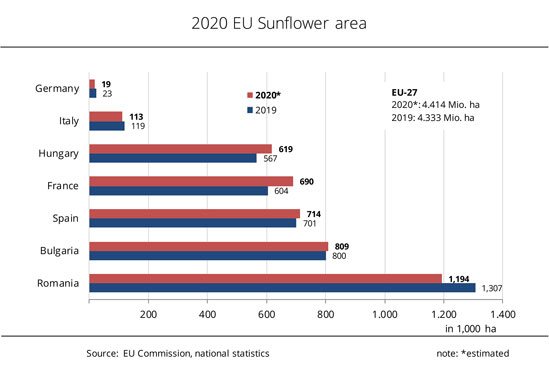

Although the sunflower area in Romania, the largest sunflower producer in the EU-27, is expected to decline compared to the previous year, the EU Commission projects an increase in overall output in the EU.

According to an EU Commission forecast, the EU-27 sunflower area to be harvested in 2020 will likely be around 4.4 million hectares. This would translate to an around 81,000 hectare increase year-on-year. In the April forecast, the Commission still expected a decline. The sunflower area in Romania is seen to have slumped 9 per cent to 1.2 million hectares. Nevertheless, the country remains the largest producer in the EU. The sunflower hectarage in Italy and Germany is also presumed to shrink compared to the previous year, by 5 per cent and 19 per cent respectively. By contrast, Bulgaria, Spain, France and Hungary are expected to see significant expansions in sunflower area in some places. According to an interpretation of the EU Commission's statistics provided by Agrarmarkt-Informations Gesellschaft (mbH), France is projected to see a particularly sharp increase. The French sunflower cultivation area amounts to 690,000 hectares, which is up 14 per cent year-on-year.

The EU Commission anticipates yields to hit 23.4 decitonnes per hectare (up 1.2 per cent year on year and 4.4 per cent above the five-year average). Consequently, EU sunflower production is likely to total up to 10.3 million tonnes due to the larger area sown. The anticipated decline in Romania will be more than offset by expectations of significantly larger crops in Slovenia, France and Bulgaria.

Chart of the week (22 2020)

Expectations for larger world rapeseed harvest

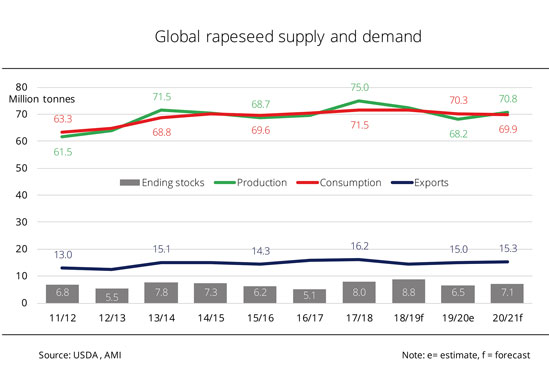

The US Department of Agriculture (USDA) expects global availability of rapeseed to be higher in the upcoming crop year than the current crop year. At the same time, the USDA anticipates rapeseed consumption to decline and ending stocks to increase as a result.

In its most recent estimate, the USDA put global 2020/21 rapeseed production at 70.8 million tonnes, up 2.6 million tonnes from the previous year. Output is projected to rise in Australia, Ukraine and also Canada, whereas consumption is seen to decrease somewhat. The USDA anticipates demand to amount to 69.9 million tonnes. This would be down around 350,000 tonnes from 2019/20. According to investigations conducted by Agrarmarkt-Informations Gesellschaft (mbH), consumption is likely to fall particularly sharply in the EU-28*). The decline in demand in the EU-28 in the upcoming crop year is projected at 23.1 million tonnes, around 325,000 tonnes fewer than 2019/20. Due to the falloff in utilisation and global increase in production, output will probably exceed consumption. This last happened two years ago.

Exports will presumably rise 0.3 million tonnes to 15.3 million tonnes, with larger exports from Australia and Ukraine expected to offset smaller exports from Canada. According to the USDA, 2020/21 rapeseed ending stocks are expected to hit around 7.1 million tonnes. This would be a 0.6 million tonne rise compared to 2019/20. Canada is likely to see an especially sharp rise of 0.75 million tonnes to 3.9 million tonnes. This would more than offset the decline in stocks in China, the EU-28, India and Japan.

Rapeseed cultivation is a major feedstock contribution towards the "Farm to Fork" strategy

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has pointed out that these rapeseed supplies are first and foremost used to cover feedstock demand for biodiesel production. More specifically, in 2018 the EU-28 used approximately 5.2 million tonnes of rapeseed oil to produce biodiesel fuel. This is the equivalent of approximately 13 million tonnes of rapeseed. Consequently, demand for biodiesel safeguards rapeseed production in Europe, the association has noted. However, the corresponding amount of rapeseed oil could at any time also be used to meet a growing demand for rapeseed oil for food uses, UFOP has emphasised. Moreover, the volume of approximately 8 million tonnes of GM-free rapeseed meal obtained in rapeseed processing reduces the demand for soybean imports from overseas and, consequently, the corresponding demand for land for soy production. UFOP has stressed that, all in all, rapeseed cultivation is an important contribution towards the "Farm to Fork" strategy the EU Commission presented last week.

*) Note: Despite Great Britain's departure from the EU, the USDA continues to use the EU-28

as a reference point.

Chart of the week (21 2020)

FAO vegetable oil price index falls to eight-month low

Decreases in prices of palm oil, soybean oil and rapeseed oil show through more strongly in the FAO price index than do increases in asking prices for sunflower oil. Consequently, the index declined for the third month running.

The April FAO price index for vegetable oils slipped 7.2 points, or 5.2 per cent, compared to the previous month to 131.8 points. This was the lowest level since August 2019 and also the third decline in three months running. The reason was falling prices for palm oil, soybean oil and rapeseed oil. In contrast, sunflower oil became more expensive. Palm oil dropped especially sharply compared to the previous month.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has stated that the slump was mainly due to the corona-related economic downturn and the associated sharp decline in diesel and biodiesel consumption to meet blending quota requirements. The pressure on prices was also exacerbated by the ruinous competition in crude oil production. Crude oil prices recently hit historic lows. UFOP has pointed out that, at the same time, larger than expected palm oil production and increased supplies in Malaysia put pressure on vegetable oil prices.

Prices for soybean oil and rapeseed oil were also pulled down. Soybean oil was under additional downward pressure from swelling supply based on a temporary significant increase in US processing volumes. In contrast, international sunflower oil prices rebounded slightly in April on support from brisk import demand and concerns about shortages in exportable supply.

Chart of the week (20 2020)

EU Commission expects larger legume production

The area planted with legumes in the EU-27 in the 2020/21 marketing year is seen to grow. The biggest increase is expected in soybean plantings.

The area in the EU-27 planted with legumes for the 2020 crop will presumably be up 9 per cent at 2.5 million tonnes. Soybeans account for the largest hectarage and see the biggest increase in area relative to other legume crops. According to information published by the EU Commission, soybeans occupy an area of just about 1 million hectares in 2020, which is up 11 per cent year-on-year. Italy is the biggest soybean producer in the European Community, followed by France and Romania. The Commission also expects significant area expansions in field beans and feed peas. Farmers in the EU-27 are estimated to have sown 470,000 hectares with field beans, which translates to a 9 per cent rise from 2019. The land dedicated to feed pea production is seen to have expanded 8 per cent to 840,000 hectares. In contrast, the sweet lupin area will presumably decline 3 per cent to 180,000 hectares.

Because of the increase in legume area, the EU Commission expects a total legume harvest of 6.7 million tonnes, up 10 per cent from the previous year. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), production of field beans and soybeans is likely to rise 12 per cent each. Soybean output would hit a record high of 2.95 million tonnes. Whereas feed pea production is projected to grow 8 per cent to 2.2 million tonnes, sweet lupins are expected to decrease around 2 per cent to 260,000 tonnes.

The Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP) has welcomed the development in crop production as a beneficial contribution towards greater diversity in crop rotation systems. At the same time, the association has drawn attention to a current initiative of Copa-Cogeca, the confederation of the Committee of Professional Agricultural Organisations and the European General Confederation of Agricultural Cooperatives. In view of the current corona crisis and the EU's continued strong reliance on imports of soybeans and rapeseed, Copa-Cogeca has called on the EU Commission to suspend the restrictions on the use of crop protection products for nitrogen-fixing crops grown on ecological priority areas to boost production of soybeans, peas, beans and lupins in the EU.

UFOP has also warned that a decline in production of biofuels made from sustainably produced European feedstock crops such as rapeseed would lead to a lower European supply of protein-rich GM-free joint products.

Chart of the week (19 2020)

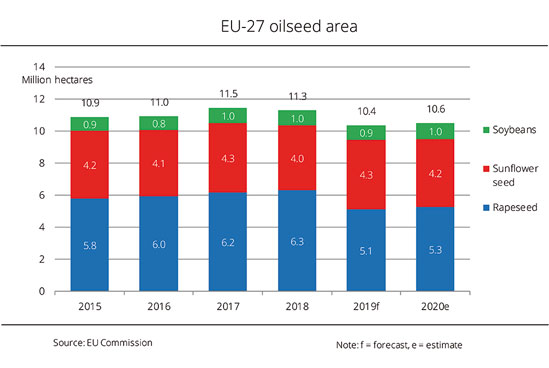

EU oilseed area rose slightly

In the EU-27, more land has been planted with oilseeds for the 2020 crop than the previous year. The increase is mainly due to the expansion in rapeseed and soy area.

The EU Commission estimates the EU-27 oilseed area for the 2020 crop at 10.6 million hectares. This would translate to a 1.4 per cent increase year-on-year, but imply an around 4.3 per cent decline compared to the five-year average. The increase is due to the growth in soybean and rapeseed area. According to information published by the EU Commission, rapeseed accounts for the largest share of the oilseed area, as it did in previous years. Rapeseed is reported to occupy 5.3 million hectares, which would be up 2.7 per cent year-on-year. Nevertheless, this hectarage is about 10 per cent short of the five-year average. Unfavourable weather conditions impeded rapeseed sowings in the autumn of 2019, especially in France, where some land had to be ploughed up. The soy area in the EU-27 is expected to grow around 0.1 million hectares to 1 million hectares, whereas the sunflower area is projected to shrink 0.1 million hectares to 4.2 million hectares.

According to Agrarmarkt Informations-Gesellschaft (mbH), the EU Commission anticipates that yields in the EU-27 will rise. This increase, together with the expected expansion in area, could lead to an oilseed harvest of 29.5 million tonnes. This would be up 1.5 million tonnes year-on-year. Soybean output is expected to amount to 2.95 million tonnes, up around 11 per cent, and rapeseed production is put at 16.5 million tonnes, up around 8 per cent. Sunflowers could remain at the same level as the previous year, 10 million tonnes.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) regrets that, given the limited expansion of the area planted with soybeans and other oilseeds, the possibilities have not been exhausted. The association has argued that the EU-wide growth potential for rapeseed area is at least 1 million hectares compared to 2018. This shortfall is addressed by importing rapeseed from non-EU countries. According to UFOP, the focus on increased regionality and transparency is the ground-breaking approach of the European "Farm to Fork" strategy and can considerably improve the climate balance of farming and the entire product chain all the way to the consumer. GM-free vegetable protein from regional production is the trend, but should not be forced through legal measures. In view of the publication of the "Farm to Fork" strategy the EU Commission has announced for the end of the month, UFOP has urged that, instead of legal requirements, adequate producer prices as well as proper and reliable funding should boost the hectarage under cultivation and diversity in the utilisation cascade.

Chart of the week (18 2020)

Rapeseed imports remain buoyant