Chart of the week (29 2022)

Australia is the EU's primary rapeseed supplier in 2021/22

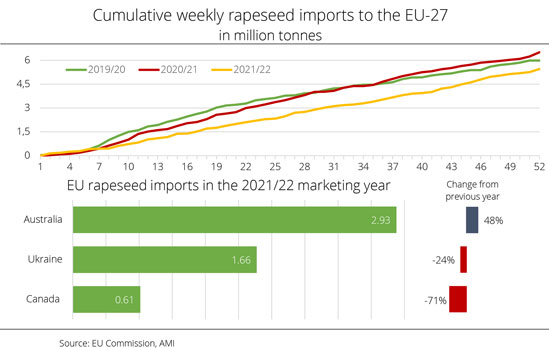

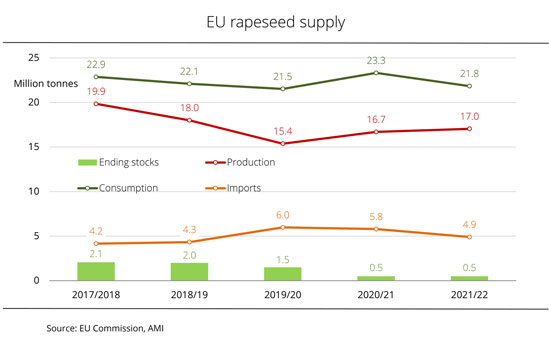

At 5.3 million tonnes, EU-27 rapeseed imports from non-EU countries fell just less than 500,000 tonnes short of the previous year's volume. Canada, the main supplier, lost much of its importance due to a small harvest. By contrast, Australia increased its market share considerably. However, the rise was not big enough to offset the decline in deliveries from Ukraine.

Although the EU rapeseed harvest was somewhat larger in 2021 than 2020, total supply in the EU-27 in the 2021/22 marketing year – estimated at 22.8 million tonnes – was around 1.2 tonnes smaller than that in the 2020/21 marketing year. The drop was due to lower beginning stocks. Demand from oil mills was initially covered by EU production. However, starting in the first half of the marketing year, the rapeseed volumes required to utilise the mills to their full capacity increasingly had to be imported from Australia, Ukraine and Canada.

According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), Canada's 2021/22 shipments of 611,300 tonnes were down around 71 per cent on 2020/21 due to the smaller supply that resulted from the drop in rapeseed harvested. This means that the share of Canadian origins in total imports dropped from 32 per cent in 2020/21 to merely 11 per cent, whereas deliveries from Australia surged 45 per cent to 2.9 million tonnes. In other words, the share of Australian commodity in total imports increased 19 percentage points to 53 per cent.

Another reason for the strong increase in Australian shipments was the Russian invasion in Ukraine at the end of February. Until the war started, the European Union imported around 1.6 million tonnes of rapeseed from Ukraine each year and Ukraine's share in EU imports amounted to just less than 50 per cent. In view of blockaded ports, however, exports from the Black Sea region stopped in the weeks that followed. As a result, Australia became more and more important as a supplier, and producer prices soared to record levels. Only small volumes of rapeseed left Ukraine also in the months that followed. In the 2021/22 marketing year, Ukrainian deliveries totalled just less than 1.7 million tonnes. This compares to 2 million tonnes a year earlier.

Chart of the week (28 2022)

EU soybean production 2022 to hit record level

EU-27 soy supply is expected to rise this year again, following an expansion in production area. Italy is seen to record the biggest increase.

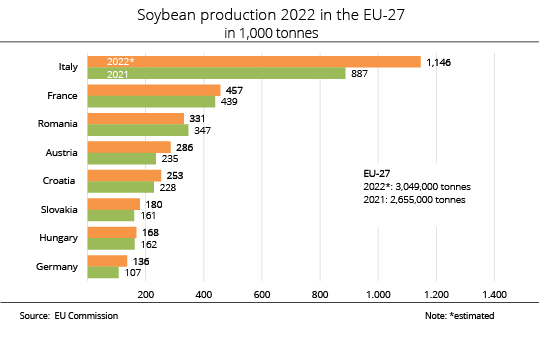

The soybean output of the European Union more than tripled over the past ten years. According to recent information published by the EU Commission, the 2022 harvest is likely to amount to around 3 million tonnes, which would be up just less than 15 per cent year-on-year. In other words, EU-27 soybean production would reach a new record high level. Italy is seen to remain the largest producer within the EU in 2022, with 1.1 million tonnes currently projected. This would translate to a 29 per cent rise year-on-year. In other words, Italy's share in European soybean production is set to rise to just less than 38 per cent. The Commission also sees other member states' soy supply exceeding the previous year's level. France, the second largest EU supplier of soybean, is expected to see a 4 per cent production increase to 457,000 tonnes. Austria's output is projected at 286,000 tonnes, just less than 22 per cent more than the previous year. German producers, who harvested a significant amount of soybeans for the first time in 2016, are expected to bring in 136,000 tonnes, around 27 per cent more than in 2021. This means that German output would have more than tripled over the past six years. By contrast, Romania's harvest, which is currently forecast at 331,000 tonnes, will probably fall 4 per cent short of the previous year's level.

According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the main reason for the growth in soy supply in the EU-27 is an expansion in area planted. The European Commission currently estimates the 2022 soybean area at around 1 million hectares. This translates to an expected rise in area of just less than 9 per cent on the previous year and would set a new record.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has expressly welcomed the positive development of European soybean farming, because it provides many farmers with a further crop to expand crop rotation and meet the growing demand for regionally produced products. At the same time, the association has pointed out that there is still significant need to invest in soybean breeding in order to come up with regionally adapted and competitive varieties. The new breeding technologies, such as CRISPR/Cas, could go a long way towards making such varieties available.

Chart of the week (27 2022)

Unexpected deliveries from Ukraine

The war in Ukraine has limited the country's export opportunities significantly. However, not all commodities from the 2021 crop came to Germany in lower quantities because of this.

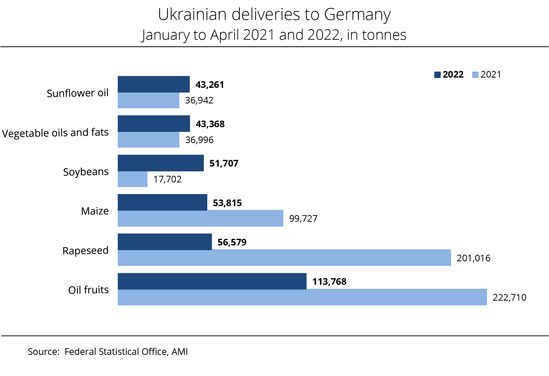

Russia's invasion in Ukraine and in particular the blockage of Black Sea ports have capped export volumes noticeably. In particular, bulk commodities such as wheat and rapeseed, of which millions of tonnes are normally exported, have been leaving the country only sporadically since the beginning of the war, according to research conducted by Agrarmarkt Informations-Gesellschaft (mbH). According to recent information published by the German Federal Statistical Office, Germany imported around 113,768 tonnes of oilseed crops from Ukraine in the first four months of the year 2022. This was down just less than 49 per cent on the period January through April 2021. The sharpest decline was recorded for rapeseed shipments. At 56,579 tonnes, they were just less than 72 per cent short of the previous year's volume. However, in previous years, Ukraine's share in German rapeseed imports for processing was comparatively low at 10 per cent. Also, Ukraine delivered around 53,815 tonnes of maize to Germany in the first four months, which was 46 per cent less than in the 2021 reference period.

The picture was different for products of which smaller batches had generally been exported already in the past. More specifically, the amount of GMO-free soybeans Germany received directly from Ukraine between January and April almost tripled to 51,707 tonnes in 2022. Contrary to what some market participants feared, shipments of sunflower oil, which amounted to 43,261 tonnes, also exceeded the previous year's volume, of 36,942 tonnes, by 17 per cent.

The Union zur Förderung von Proteinpflanzen e.V. (UFOP) believes that considerable losses could be possible in the imminent harvest. Although a large part of the Ukrainian cropland could be kept under cultivation, many crops could not be fertilised and maintained on schedule or sufficiently. Some regions are experiencing a shortage of diesel fuel and also storage facilities, because last year's crop could not be marketed. The UFOP has therefore welcomed the multiple initiatives of the trading sector and EU member states to provide support within the scope of possibilities, even though in terms quantity, exports transported by freight trains can by no means replace exports by ships. It remains to be seen whether, and to what extent, the land can be harvested and tilled for the next sowings as usual. The UFOP is therefore watching the rapeseed harvests in Canada and other countries with some anticipation as to the extent to which they can offset the likely absence of supply from Ukraine. This question also applies to all oilseeds, sunflower oil and wheat.

Chart of the week (26 2022)

Prices for rapeseed and wheat on a downward slide

Over the past weeks, producer prices of rapeseed and wheat fell from their plateau level, following the weakening trend on the futures markets.

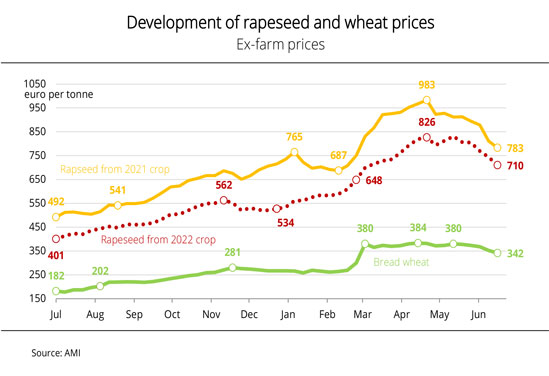

Price quotes for rapeseed on the futures markets dropped from their record high as they came under pressure due to prospects of a larger crop in Europe and waning buying interest. The harvest start in France also weighed price quotes down and sent cash market prices sliding. More specifically, the average price for old-crop batches reported at the end of June was EUR 783 per tonne. This was up around 65 per cent on the same time the previous year, but down EUR 200 per tonne from the record of EUR 983 per tonne reached in April 2022. Prices asked for the rapeseed crop that is about to be harvested also declined sharply recently. The average price of EUR 710 per tonne asked at the end of June was EUR 116 per tonne short of the record high of EUR 826 per tonne seen in April.

Spot prices for soft wheat also eased due to the forthcoming harvest, although yield prospects were clouded due to regional drought and extreme heat throughout Europe. In other words, asking prices plummeted EUR 38 per tonne, or 10 per cent, within five weeks. In some regions, price reductions caused producers' interest in forward contracts to perk up.

With a view to the development of prices outlined above, the Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has pointed out that a major portion the crop was already contracted at lower prices in the previous months. The association has underlined this factor, because the public debate on the question of market supply and the prices at which it takes place is frequently guided by the maximum prices rather than the prices at which the produce is, or was, actually marketed. The UFOP has added that the development of farmers' production costs, especially fertiliser costs, should also be borne in mind.

Consequently, a higher level of producer prices is necessary now, and likely will be in the future, to cover costs, because prices for energy, especially natural gas as a major energy source for fertiliser production, cannot currently be expected to decline. According to the association, consumers should gear themselves up to such higher price level. The UFOP has pointed out that due to reductions in fertiliser use and the impact of climate change, agricultural output is currently not expected to grow, especially because the new general conditions of the reform of the European Common Agricultural Policy (CAP) do not provide for any potential for development.

Chart of the week (25 2022)

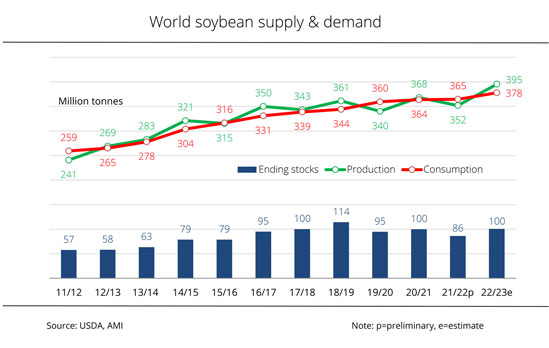

USDA raises soybean production forecast

In its latest monthly report, the USDA raised its global harvest estimate and foreign trade forecast for soybeans for 2022/23.

According to the USDA estimate, global soybean production in the marketing year 2022/23 is set to reach 395.4 million tonnes. This is up 680,000 tonnes on the previous month's estimate and up 12.3 per cent from 2021/22. The key reason for expectations of a bumper crop was prospects of increased soy supply in Ukraine, although forecasts from this region should be viewed with caution due to the continuing war. The USDA expects Ukrainian soybean production at around 2.8 million tonnes, which would be 500,000 tonnes more than previously expected, but nevertheless 1 million tonnes fewer than 2021/22. The estimates for Brazil and Argentina remained unchanged from the previous month at 149 million tonnes and 51 million tonnes respectively.

In view of the larger supply of soybeans, 2022/23 world trade is also expected to significantly exceed the previous year's volume. More specifically, the USDA put exports at 170.3 million tonnes, up 420,000 tonnes from the May forecast and 9.2 per cent from the level in 2021/22. Above all, the figure of the Ukrainian export potential in was raised.

As a consequence of higher yields, the USDA revised Argentine soybean output 2021/22 upward 1.4 million tonnes to 43.4 million tonnes. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the same applies to Brazilian production in 2021/22. Currently forecast at 126 million tonnes, Brazilian soy production is seen 1 million tonnes higher than in the May forecast. The upward revision was due to a larger soybean area in Mato Grosso. World soybean production in the running 2021/22 marketing year is projected at around 352 million tonnes, which would be 2.6 million tonnes more than previously expected.

Chart of the week (24 2022)

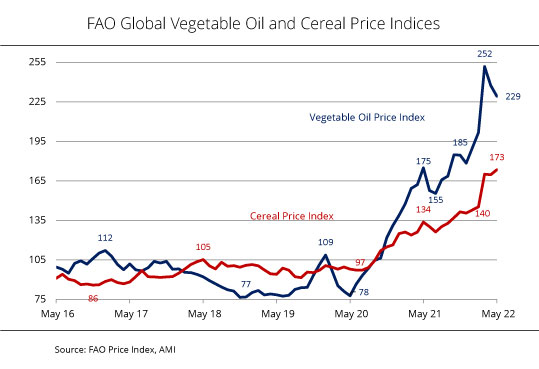

FAO cereal and vegetable oil price indices with contrasting trends

Whereas the FAO cereal price index continued to climb and hit a new record high in May, the vegetable oil price index declined, but still remained well above the previous year's level.

The FAO vegetable oil price index decreased 8.3 points or 3.5 per cent to, on average, 229.3 points in May, but was still clearly above its year-earlier level. The decline was mainly caused by falling prices for palm, sunflower, soybean and rapeseed oil. Such falling prices, in turn, were partly due to the end of the Indonesian ban on exports of refined palm oil. Other reasons included the drop in world market sunflower oil prices from a record high level and reduced asking prices for soybean and rapeseed oil in response to waning demand. In the case of palm oil, prices were driven up by the persistent labour bottlenecks in Malaysia and the associated limited supply of palm oil.

The FAO cereal price index reached an average of 173.4 points in May 2022, which was up 2.2 per cent month-on-month. This means that the gap over the previous year amounted to a spectacular 30 per cent. The rise was sparked by the increase in international prices for wheat after India announced an export ban and also concerns about export and harvest conditions in several leading wheat-exporting countries, especially lower production prospects in Ukraine due to the war. Prices for maize declined month-on-month based on slightly improved seeding conditions in the US, larger seasonal supply in Argentina and the imminent start of Brazil's main maize harvest. International sorghum prices also decreased, whereas prices for barley picked up based on strong wheat markets and concerns about harvesting conditions in the EU. International rice prices increased for the fifth successive month in May.

Chart of the week (23 2022)

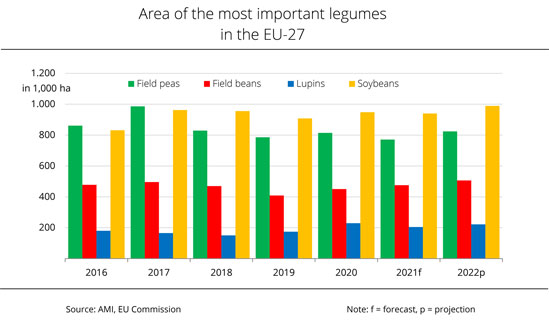

EU Commission expects significantly larger grain legume crop

Based on a 6 per cent expansion of legume production area to 2.5 million hectares, the EU Commission expects the 2022 legume harvest in the EU-27 to reach around 6.9 million tonnes. This would translate to a 16 per cent rise year-on-year. The extent of production area would hit a 5-year high.

Just as in the previous year, soybeans will presumably take up the largest share of the legume production area with a 5.2 per cent increase to a prospective area of 989,000 hectares. According to Agrarmarkt Informations-Gesellschaft (mbH), this would be a new record. In the latest estimate published by the EU Commission, the feed pea area is seen to expand just less than 7 per cent to 824,000 hectares. At just over 6 per cent and 8 per cent respectively, field beans and sweet lupins are also set to rise to 506,000 hectares and 222,000 hectares respectively.

Due to the expansions in hectarage devoted to soybeans, feed peas, sweet lupins and field beans, the harvest 2022 will probably also be larger, depending on future weather conditions, of course. As things stand at present, the soybean harvest could increase just less than 11 per cent year-on-year to 2.9 million tonnes. The output of dry peas will presumably to grow 21 per cent to 2.2 million tonnes. Field beans are expected at around 1.4 million tonnes, which would be up just less than 27 per cent on the previous year. By contrast, sweet lupins are seen to fall 12 per cent to 284,000 tonnes, despite a significant expansion in production area and mainly due to expected lower yields.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has said that the potential for grain legume production is far from being fully exploited. The association holds that the success of the European or national protein plant strategy is also judged by increases in production area. Legumes in all their diversity could go a long way towards enhancing biodiversity, climate change mitigation and the economic resilience of crop rotation in a comparatively short time. The UFOP has emphasised that to this end funding should be improved as the common agricultural policy (CAP) is reformed – along the lines of the benefits and targets of the Commission's "Farm to Fork" strategy.

However, the key factor is that the market, i.e. demand for grain legume-based products, must "pull" the production area. The UFOP has underlined that the potential for the development of legume crop uses is far from being fully exploited. The association has strongly demanded that funding of the BMEL protein plant strategy be improved. The association has complained that while the power sector is being swamped with support, the agricultural sector has to make do with relatively modest funding amounts to move things forward.

Chart of the week (22 2022)

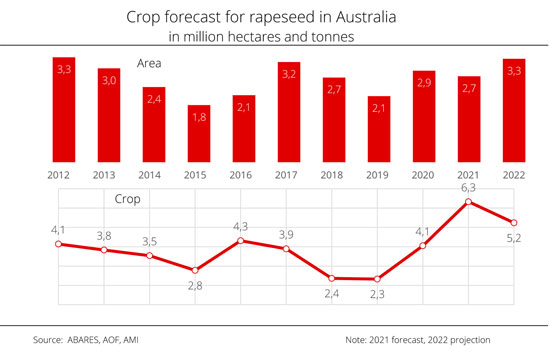

Australia: larger rapeseed area and lower yields expected

Previously good seeding conditions in many parts of the Australian production regions have allowed producers to expand the rapeseed area essentially as planned. The AOF expects the rapeseed area to reach 3.3 million hectares. This would translate to a 12 per cent rise year-on-year. However, 2022 yields are not expected to hit new record highs. In other words, the harvest could even be smaller than in the previous year. The 2021 yield amounted to 21.3 decitonnes per hectare. The 2022 rapeseed harvest is currently forecast at 5.2 million tonnes, which is down 17 per cent compared to the previous year's figure. According to the AOF, this would be an average yield.

Conditions at the time of seeding have so far largely been favourable, with sufficient rain in New South Wales, Victoria and Western Australia in the first three months of 2022. The AOF has forecast that on the east coast, the good conditions are likely to continue into winter, because the La Niña weather phenomenon is set to last longer than initially expected. By contrast, the Australian south is expected remain too dry.

s Jahres 2022. An der Ostküste dürften die guten Bedingungen bis in den Winter hinein anhalten, da sich das La-Niña-Wetterphänomen länger als zunächst erwartet halten dürfte, prognostiziert die AOF. Im Süden bleibt es dagegen zu trocken.

Chart of the week (21 2022)

EU Commission expects expansion of EU sunflower area

The EU Commission anticipates a significant increase in area for the 2022 harvest to a potential new record. The main reason is the expected expansion in production area in the most important sunflower-producing countries in the EU.

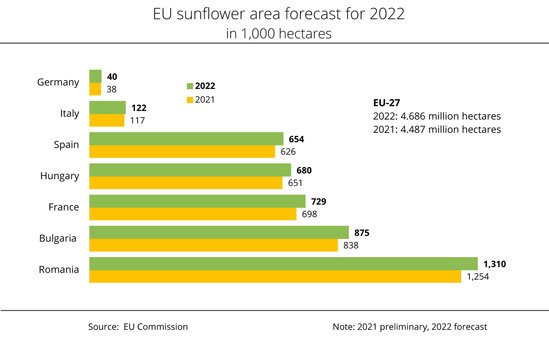

According to the EU Commission's forecast, the EU sunflower area for harvest in 2022 amounts to around 4.7 million hectares. This would translate to a 199,000 million hectare rise over the previous year. It would just exceed the 2013 peak of 4.6 million hectares. In view of an unclear situation for sowing and growing sunflowers in Ukraine due to the continued war, this is an important signal for the market supply of European oil mills.

Romania remains the biggest producer in the European Union in terms of area. The country expects an increase of 56,000 hectares to around 1.3 million hectares. It is followed by Bulgaria in second place with a currently projected area of 875,000 hectares. In other words, the hectarage is seen to expand 4.4 per cent. According to the latest information published by the EU Commission, France will probably also record a 4.4 per cent rise in area to 729,000 hectares. The sunflower hectarage in Hungary is expected to increase 29,000 hectares or 4.5 per cent on the previous year to 680,000 hectares.

In Spain, sunflower production is also forecast to expand 4.5 per cent compared to the previous year to 654,000 hectares. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), Germany is expecting a larger increase – though at a low level. The area under sunflowers will probably expand 5.3 per cent to 40,000 hectares.

In its outlook for 2022, the EU Commission has forecast yields at an overall average of 23.8 decitonnes per hectare. This translates to an almost 2 per cent rise year-on-year. The highest per-hectare yields are expected to be reached in Hungary. At presumably 29.7 decitonnes per hectare, Hungarian yields could exceed the previous year's level by more than 14 per cent.

Chart of the week (20 2022)

EU rapeseed crop 2022 projected at five-year high

Despite previously low rainfall in some regions, the EU Commission expects the German and French rapeseed harvests to be larger than the previous year.

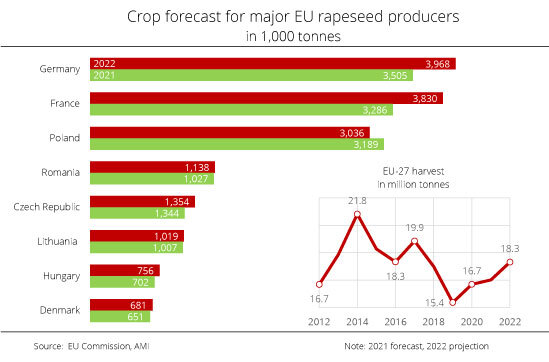

According to recent information published by the EU Commission, the EU rapeseed harvest in 2022 will likely exceed the previous year's by just under 8 per cent. It is currently projected at 18.30 million tonnes. In fact, it would be the largest harvest since 2017. The main factor for the presumably larger harvests in the most important rapeseed producing EU countries is the 7.5 per cent expansion in production area compared to the previous year to 5.7 million hectares. At this point in time, harvest estimates are naturally still vague, because the harvest result will be determined by weather conditions in the coming weeks.

There has been a lack of rain, especially in the north and east of Germany. However, pest pressure has been low due to persistently cool temperatures. As a result, most winter-planted crops are nevertheless in good condition all across Germany. The EU Commission expects the German rapeseed harvest to reach 3.97 million tonnes. This would translate to a 13 per cent rise year-on-year. France is also expected to see a harvest increase around of 16 per cent to 3.83 million tonnes of rapeseed compared to 2021, despite frosts and lack of rain. By contrast, according to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), Poland, the third most important rapeseed producer within the European Union, is likely to harvest just under 5 per cent less, around 3.04 million tonnes.

For the Czech Republic, Romania, Hungary, Lithuania and Denmark, the EU Commission expects an expansion in area planted, which supports the estimate of the total harvest.

Chart of the week (19 2022)

Use of oilseed meal in compound feeds declined

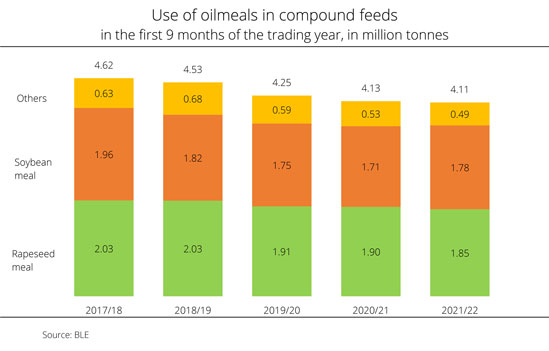

The use of oilseed meals from rapeseed and soybeans in feed production has dwindled over the past five years.

The use of oilseed meals in compound feeds has declined continuously over the past five years. In the first nine months of the 2017/18 marketing year, it amounted to 4.62 million tonnes. By 2021/22, the figure was down around 11 per cent to 4.11 million tonnes. Soy meal processing decreased just over 9 per cent to 1.78 million tonnes within five years. The same applies to the use of rapeseed meal, which also fell a good 9 per cent to 1.85 million tonnes. By contrast, the shares the meals had in total processing only changed marginally. Whereas the share of soybean meal rose from 42 to 43 per cent in the past four years, that of rapeseed meal increased from 44 to 45 per cent.

According to information published by Agrarmarkt-Informationsgesellschaft (mbH), most soybean meal used in feed production is GM soybean meal imported from non-EU countries, especially Argentina, the US or Brazil. It is mainly used in poultry and pig feeding stuff. The reason for the development of demand for GM-free rapeseed meal is the “without GM” label dairies introduced for their products and the cost-benefit ratio of the feed value of rapeseed for ruminants.

The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has pointed out the many years of projects the association has successfully promoted to optimise the use of domestic rapeseed meal in dairy cow feeding, as well as for pigs and poultry. These projects are the basis of UFOP's 10 +10 strategy which aims at improving supply with vegetable protein for animal feeds from domestic crop production. In future, such protein is to be increasingly used also in the human diet.

According to UFOP, another aim of the strategy is to expedite the exploitation of the potential for growing grain legumes to expand the crop rotation systems, with positive effects for biodiversity, soil quality and the associated added-value potential in resilience-oriented arable farming. The UFOP has urged that the arable farming strategy of the German Ministry of Agriculture and the leading farms that have been won for this purpose should take this approach to crop rotation into account as a demonstration for farmers and the public. This would fundamentally enhance the visibility of the protein crop strategy to the public, also with regard to the ecosystem service that was especially highlighted in a study conducted by the University of Hohenheim last year. The ecosystem service will also be a topic at the UFOP Perspektivforum 2022 which will be held in Soest on 22 September 2022 in cooperation with the South Westphalia University of Applied Sciences.

Chart of the week (18 2022)

European 2022/23 oilseed production expected marginally above previous year

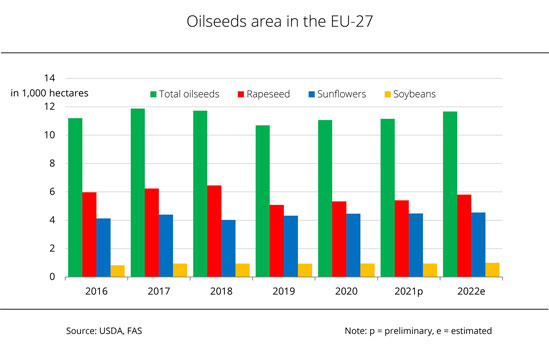

EU oilseed production is likely to exceed the previous year's level by only 0.4 per cent in the current crop year, although the oilseed area is expected to rise 5 per cent. The reason is prospective lower yields due to constraints on means of production.

According to Agrarmarkt Informations-Gesellschaft (mbH), the Russian invasion of Ukraine has led to massive volatility in the oilseed market. Especially, the additional sharp rise in prices for means of production such as energy, fertilisers and crop protection products have been exacerbating the already tense situation. The current forecasts for the 2022/23 crop year should therefore be viewed with some reservation. Production will naturally also depend on future weather conditions. Sowing and growing conditions have previously been favourable for all oilseed crops until well into spring.

According to information published by the USDA Foreign Agricultural Service (FAS), the EU oilseed area in 2022/23, which is currently forecast at 11.67 million hectares, will be just under than 5 per cent larger than the previous year, whereas the increase in output is seen to be small. The FAS has forecast production in the coming crop year at around 31.07 million tonnes. However, this would only be up 0.4 per cent on the 2021/22 season. The main reason for the marginal increase is seen to be a prospective sharp drop in yields. Especially, average sunflower yields are expected to fall significantly short of the previous year's record due to the shortage in means of production such as energy, fertilisers and crop protection products. The currently high costs for means of production are contrasted by attractive producer prices and a high value in crop rotation. In some regions, this could lead to an expansion in soybean production.

Chart of the week (17 2022)

Rapeseed prices reached unprecedented heights

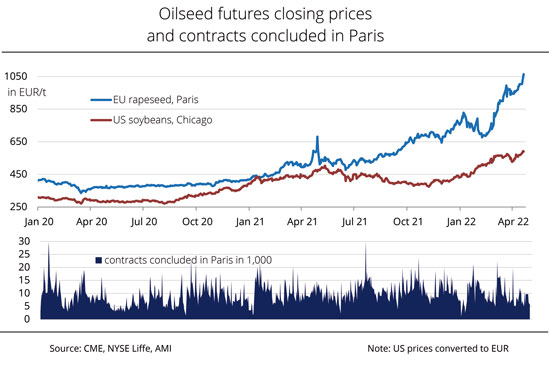

Prices for both rapeseed and soybeans have been flying high since the beginning of the year. Rapeseed recently closed in the four-digit range for the first time, while soybeans also hit a record high.

Paris futures market quotations for rapeseed have been climbing virtually unchecked for several months. The main reason for the strong price surge over the past few weeks is the crisis in the Black Sea region which was sparked by the Russian invasion in February 2022. Reports about the war in Eastern Europe fuelled prices at the international futures markets every minute at a time when prices were rising anyway due to tight supply to the market. Shortages in supply due to the absence of contractual delivery volumes from Ukrainian ports of export are now having a bearing on the entire global market. Concerns about global supply bottlenecks have also led to export restrictions or even bans, like the one the Indonesian government imposed on 28 April 2022. This situation caused rapeseed prices at the Paris stock exchange to explode. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), price fluctuations of up to EUR 68 per tonne in one day were the order of the day in March 2022. Currently, stock exchange prices are driven by snow and cold spells in Canada, where rapeseed sowings should be underway. Prices exceeded the level of EUR 1,000 per tonne for the first time. More specifically, the May 2022 nearby closed at EUR 1,064.50 per tonne on 21 April 2022. The close compares to EUR 561.75 per tonne at the same time a year earlier and as little as EUR 366.75 per tonne in April 2020. This means that stock exchange prices almost tripled within two years.

Soybean prices in Chicago have been rising since the beginning of the calendar year 2022. The focus in the soybean market has been on growing and harvesting conditions in South America and the US as well as brisk demand. Lack of rain diminished the yield potential of the current soybean crop in Brazil noticeably. Argentina is also likely to bring in a considerably smaller harvest than previously expected because of poor growing conditions. This drove prices at the CBOT to the equivalent of EUR 590 per tonne on 21 April 2022, which was not only close to the level of EUR 600 per tonne, but also a new record high.

Chart of the week (16 2022)

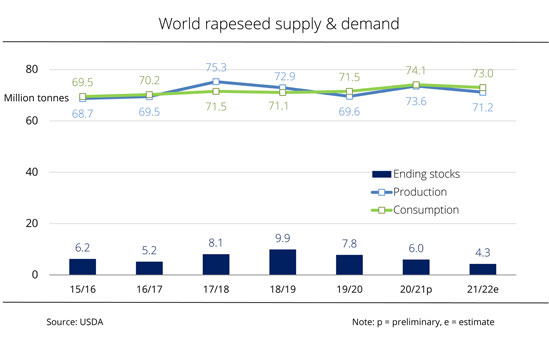

Global rapeseed supply/demand balance with marginal adjustments

The USDA currently estimates global rapeseed production for the running crop year 2021/2022 at 71.18 million tonnes, up 60,000 tonnes from the previous month's forecast. According to investigations conducted by the Agrarmarkt Informations-Gesellschaft (mbH), this would only be down 2.43 million tonnes on the previous crop year. In the European Union in particular, rapeseed output is likely to be larger than previously expected.

The USDA also revised 2021/22 global rapeseed consumption upward in its latest monthly report. At 72.99 million tonnes, consumption is seen to be 449,000 tonnes larger than forecast in March. In other words, consumption in the running crop year will presumably fall 1.14 million tonnes short of the previous year's level. The EU-27 is seen to consume 16.35 million tonnes, around 100,000 tonnes more than previously expected. The USDA anticipates even China's demand to rise.

In view of the increase in consumption, 2021/22 ending stocks are likely to decline. According to the USDA's April forecast, they will amount to 4.32 million tonnes. This is 130,000 tonnes lower than the previous month's forecast and clearly down on the previous year's figure of 5.97 million tonnes. Ending stocks in China in particular are seen to shrink significantly due to increased consumption. An expected rise in ending stocks in the United Arabian Emirates can only partially offset the decline.

By contrast, 2021/22 world trade in rapeseed is seen at 13.75 million tonnes, up around 19,000 tonnes from the previous month's forecast. Nevertheless, this would translate to a 4.24 million tonne decline over the previous crop year. As a consequence, the UK, Kazakhstan and Paraguay will likely supply somewhat more than previously expected. The USDA sees a significant drop in import demand in the European Union. The USDA forecast of Ukraine's 2021/22 exports is unchanged from the previous month at 2.7 million tonnes, which would be up 304,000 tonnes on the previous year's volume. Considering the bombed ports and suspension of shipments by sea, actual figures will likely be considerably lower than forecast. The figures quoted above should therefore be viewed with some reservation.

Chart of the week (15 2022)

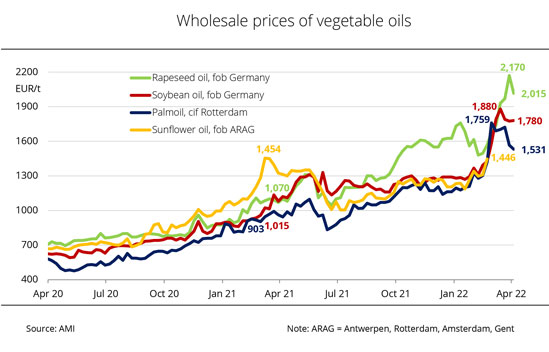

Vegetable oil prices reached all-time high

The generally tense supply situation in the international oilseed market and historic record levels in the futures markets have fuelled prices of the major vegetable oils in the German market.

Vegetable oil prices in March reached their highest level on record since Agrarmarkt Informations-Gesellschaft (mbH) started recording in 1995. They were fuelled by the war in Eastern Europe. The absence of deliveries of sunflower oil from the Black Sea region fanned concerns about a shortage of global supply. As a result, the war between Russia and Ukraine, the two top suppliers of sunflower oil to the global market, caused prices to skyrocket. After all, Ukraine accounts for around 50 per cent of global exports, followed by Russia with just less than 30 per cent.

Potential buyers now have to look for alternatives, which has led to a massive rise in demand for the remaining vegetable oils. Mid-March asking prices for soybean oil were at EUR 1,880 per tonne fob German mill, which was up around 85 per cent on the same time a year earlier. The main reason for the strong price increase was concerns over adequate feedstock supply, along with the crisis in Eastern Europe. Drought and extreme heat in the South American soy producing regions limited the yield potential, sending asking prices soaring.

Prices in the rapeseed oil market also escalated nearly unabated in March. Tight supply of feedstock, historic record levels in the futures markets and spiking demand caused asking prices to explode. This was also reflected in premiums of up to EUR 288 per tonne for rapeseed oil raffinate. More specifically, prices of EUR 2,170 per tonne fob German mill were reported for prompt batches at the end of March. This was more than twice the amount asked the same time a year earlier. Given the high volatility of the markets, the value could not be maintained at that level.

Asking prices for palm oil also rocketed as a result of the Russian invasion in Ukraine. The lack of vegetable oil shipments from the Black Sea region boosted the popularity of the oil and fuelled prices. At the beginning of March, asking prices were up 95 per cent on the same time a year earlier at the equivalent of EUR 1,759 per tonne CIF Rotterdam. Again, this level could not be maintained. The decline was triggered by an expansion of Malaysian supply.

The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) assumes that farmers in Germany and the EU will factor these price advantages in when preparing their planting schedules. The association has pointed out, however, that the significant increase in costs for transport fuels and fertilisers will also be born in mind when calculating the crop rotation. On the demand side, signs are very clear with a view to the development of wheat prices. According to the UFOP, with a processing capacity of more than 9 million tonnes, German oil mills will heavily rely on German and European rapeseed in the coming crop year to satisfy demand for rapeseed oil and rapeseed meal for animal feeding purposes.

Chart of the week (14 2022)

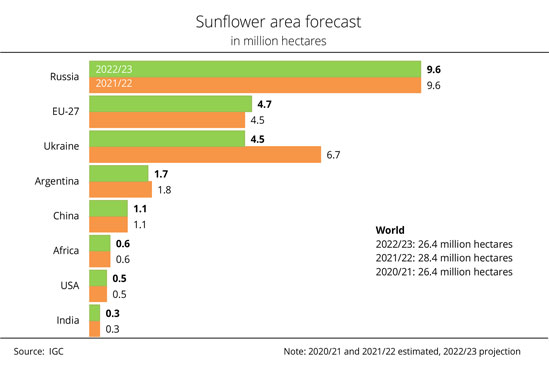

International Grains Council (IGC) expects significant decline in sunflower area in the 2022/23 season

According to recent information published by the International Grains Council (IGC), the global acreage of sunflowers is set to shrink 7.2 per cent in 2022/23. Ukraine, in particular, is likely to see a significant decline in acreage as a result of the war.

The IGC sees the area planted to sunflowers in the 2022/23 marketing year at 26.4 million hectares. This would be a sharp decline of 2 million hectares or 7.2 per cent. The main reason given for the significant decrease is the presumed lack of sowings on a large part of the crop land in the wake of the war in Ukraine. The IGC estimates the area sown with sunflowers in Ukraine at only 4.5 million hectares. According to Agrarmarkt Informations-Gesellschaft (mbH), this would be 32.4 per cent less than in the current sunflower season. However, this acreage forecast is subject to considerable uncertainty, because due to the ongoing fighting it is uncertain which areas of land can be fertilised, maintained and eventually harvested.

On the other hand, Russia is expected to remain the world's largest producer of sunflowers in the 2022/23 crop year, with an unchanged 9.6 million hectares under sunflowers. The IGC projects the 2022/23 sunflower area in the EU-27 at 4.7 million hectares, which would be up around 5.1 per cent on the current crop year. The presumed increase in area is seen to be driven by the historically high price level and foreseeable limited supply from the Black Sea region.

Chart of the week (13 2022)

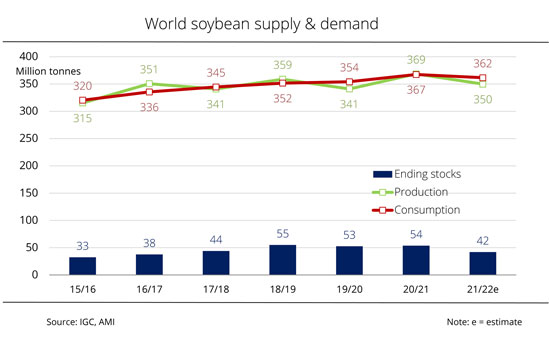

International Grains Council (IGC) cut soybean supply & demand significantly

In anticipation of large declines in yield in South America, the International Grains Council (IGC) lowered its forecast of global soybean production. Consumption, ending stocks and world trade were also forecast down.

The International Grains Council (IGC) lowered its estimate of global soybean production in the current crop year significantly in its latest monthly report. Production is expected at 350 million tonnes, which is down just over 3 million tonnes from the previous month's estimate and just less than 19 million tonnes from the previous year's volume. The main reason for the cut was lower harvest outlooks for Argentina and Brazil. which will considerably reduce the availability. Continued hot and dry growing conditions led the IGC to make this adjustment, although harvests in the northern hemisphere were abundant, with the US recording a record crop.

In the light of the tight supply situation the IGC also lowered the forecast of global soybean consumption. Consumption in the current crop year is projected at 362 million tonnes. This would translate to a 5 million tonne decline on the previous crop year. Some countries, first and foremost China and the US, are expected to see a slight increase in consumption which however is seen to be outweighed by a potential decrease in South America. The demand forecast for China does not yet take into account the potential implications of the corona lockdown recently imposed on Shanghai, a metropolis with a population of 26 million people.

In conjunction with its reduced harvest estimate, the IGC also lowered its outlook for global ending stocks 2021/22. At 42 million tonnes, the forecast is down just over 1 million tonnes from February. Compared to the previous crop year, this would translate to a decline of just under 22 per cent or 12 million tonnes. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the decrease is largely due to a sharp drop in stocks in Argentina and Brazil.

Chart of the week (12 2022)

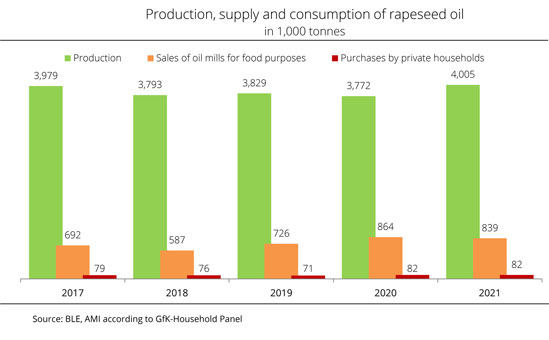

Private households account for 2 per cent of total German rapeseed oil consumption

UFOP: no need to panic buy and hoard edible oil.

German private households bought around 220,000 tonnes of edible oil in 2021. Their preference was for rapeseed oil, with a market share of 37 per cent, followed by sunflower oil, 30 per cent, and olive oil, just less than 19 per cent. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), private households purchased just less than 82,000 tonnes of bottled rapeseed oil in 2021. This was just about 10 per cent of total vegetable oil produced for food purposes and only 2 per cent of total rapeseed oil production.

With war raging in Ukraine and the particular importance the country has to the global supply of sunflower oil, panic purchases are emptying retail shop shelves. The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has stressed that there is no reason to panic because people can switch to edible rapeseed oil, which is of at least the same quality and can be used in hot or cold recipes. The new supply of rapeseed oil was already sown in the past autumn and is now growing on approximately 1 million hectares of land in Germany alone as temperatures are rising. In the EU-27, rapeseed is grown on approximately 6 million hectares. According to the UFOP, a total harvest of approximately 18 million tonnes of rapeseed would yield around 7.2 million tonnes of rapeseed oil.

At the same time, around 10.8 million tonnes of rapeseed meal for feeding would be obtained in rapeseed processing, replacing the corresponding volume of soy imports for animal feeding. Rapeseed meal has replaced soybean meal in dairy cow feeds, the UFOP has underlined, also with a view to the critical debate currently re-emerging on the use of cultivated biomass in biofuels.

The association has emphasised that supply of edible rapeseed oil is fundamentally secure and well beyond demand, adding that panic purchases emptying shop shelves and causing food retailers to introduce rationing are completely unnecessary.

According to the German Federal Office for Agriculture and Food (BLE), German oil mills produced just over 4.7 million tonnes of vegetable oil in 2021, including just over 4 million tonnes of rapeseed oil. This was around 234,000 tonnes more than the previous year. About 839,000 tonnes of the rapeseed oil produced went into the production of food (edible oil, mayonnaise etc.). Rapeseed oil was also used to produce animal feedstuff, as well as in the oleochemical industry and energy sector.

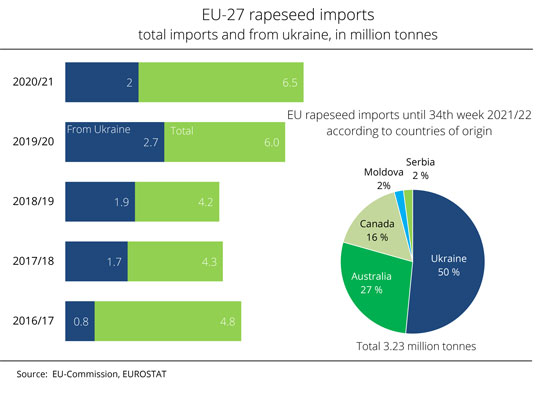

Chart of the week (11 2022)

Ukraine is the top supplier of rapeseed to the EU

The absence of deliveries from the Black Sea region is expected to severely exacerbate the global scarcity of available rapeseed. The running crop year is characterised by tight supply already.

The war in Ukraine is having an increasing impact on world trade, as Ukraine is one of the largest suppliers of rapeseed, along with Canada and Australia. The war will significantly affect global rapeseed supply, which is characterised by tight availability even now. Rapeseed imports to the European Union in the 2019/20 season totalled 6 million tonnes. Of this quantity, 45 per cent (around 2.7 million tonnes) came from Ukraine. According to information published by Eurostat, in the past crop year the share of imports fell to 31 per cent (2 million tonnes). This was virtually at the same level as imports from Canada, which accounted for around 32 per cent of European imports.

According to information published by the European Commission, EU-27 rapeseed imports in the current crop year until the end of February 2022 amounted to 3.23 million tonnes. The by far largest share of this quantity – 50 per cent or around 1.6 million tonnes – was sourced in Ukraine. Canada delivered only 0.5 million tonnes due to significant harvest losses in 2021/22. Consequently, the country only accounted for 16 per cent of EU rapeseed imports. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), Australia ranked second with a 27 per cent share of imports in the current season. If imports from Ukraine were to stop completely and in the long term due to blockaded ports, the supply situation would likely tighten significantly, both within the EU-27 and globally. Although Australian farmers brought in a larger harvest (5.5 million tonnes) than they did in the 2020/21 season, the lack of Ukrainian exports could not be fully offset if shipments were to be stopped altogether.

The UFOP has expressed fears that the supply situation will remain the same in the autumn, if no or little field work can be done in Ukraine in spring. This gap in supplies would have to be offset by an expansion of rapeseed area in Canada – producing good yields again. The association has emphasised that there is currently no way to predict supply volumes in the autumn. However, the high prices should incentivise producers to expand the rapeseed area in compliance with crop rotation restrictions when sowing in the autumn of 2022.

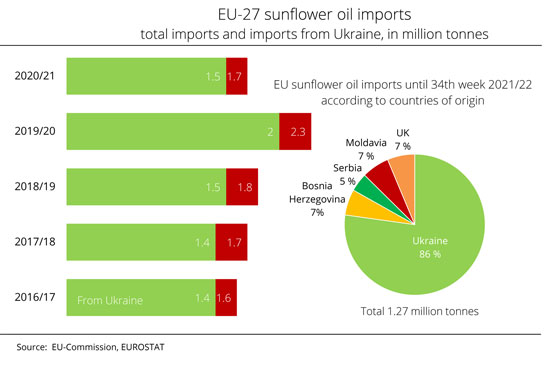

Chart of the week (10 2022)

Ukraine currently accounts for 86 per cent of European sunflower oil imports

The by far largest supplier of sunflower oil to the EU-27 is Ukraine. Bombed and blockaded ports, an export freeze and failure to make sowings for this year's harvest are likely to cut supply in the current crop year noticeably.

In view of the war in Eastern Europe and the absence of shipments from the Black Sea region, the implications for the supply situation within the EU-27 are becoming increasingly clearer. Ukraine is the largest supplier of sunflower oil to the European Union. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), imports in the crop year 2020/21 totalled around 1.7 million tonnes, of which 1.5 million tonnes, around 88 per cent, came from Ukraine. Although the Ukraine's share in EU imports was lower in the 2019/20 season, the country supplied 2 million tonnes more then than it did in the past season.

In the current crop year, the EU-27 imported a total of around 1.27 million tonnes of sunflower oil until the end of February. About 1.09 million tonnes came from Ukraine, which translates to a market share of 86 per cent. Ukraine was followed by Moldova, Bosnia and Herzegovina and the UK with a 7 per cent market share each. The UFOP has pointed out that if imports from Ukraine were to stop completely and in the medium term due to the export freeze, the European Union would face a serious supply problem.

Against this background, the UFOP has welcomed the announcements following last week's informal Agriculture Council: On the one hand, consideration is to be given to allowing the cultivation of protein crops on set-aside land. On the other hand, the "Farm to Fork" strategy is also to be reviewed with a view to its impact on the EU's security of supply. After all, the security of supply of agricultural feedstock starts in the field. Consequently, the "Farm to Fork" strategy should be geared to sustainable intensification instead of extensification of agricultural production. The association expects that farmers will adjust their summer crop sowing schedules, should additional land be released for crop production. At the same time, the UFOP has warned against unreasonably high expectations from such production, because crop rotation and suitability for cultivation involve tight constraints.

In view of collapsing supply chains, the UFOP has generally urged that agricultural policy place a stronger focus on the resilience of these chains. However, stakeholders of agriculture themselves are challenged to provide meaning to the term supply chain in the sense of fulfilling a binding function as contributors to the "Farm to Fork" strategy, for example by offering production and delivery contracts at an early stage. UFOP has called for soothing any unfounded supply fears of the public, which fears have also been triggered by significant increases in consumer prices. According to the association, there is no risk of supply bottlenecks like those seen at the beginning of the pandemic.

The UFOP has suggested that policymakers, together with representatives from the agricultural industry, take stock of the supply situation and, in this context, also properly assess the price increases in the food trade. The association believes that the increases are mainly due to the massive surge in energy prices. Further increases in energy prices must be expected in the coming years due to the continuing rise in carbon pricing. These prospects should be clearly communicated to consumers.

Chart of the week (09 2022)

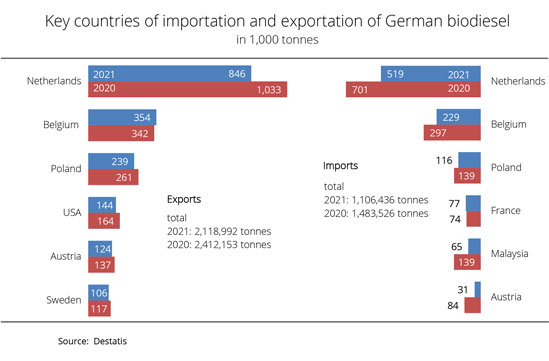

Foreign trade in biodiesel declines

Compared to the record levels shown in the quota year 2020, foreign trade in biodiesel declined only slightly in 2021. In both years, the export surplus was around 1 million tonnes. According to the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP), increases in exports were not to be expected in 2020, because the cap on greenhouse gas emission was raised from 4 per cent to 6 per cent that obligation year and the transfer of quotas from previous years was not possible.

The demand gap to meet the quota on GHG emission was bridged by importing approximately 1.04 million tonnes of hydrogenated vegetable oil (HVO) in 2020, according to the Federal Agency for Agriculture and Food (BLE) report published in December 2021. The UFOP has demanded that this fuel alternative, which is gaining in importance with regard to additional uses, be listed transparently in official statistics. The association has pointed out that the fuels are different and that each is covered by its own specific fuel standard. The UFOP has urged that all biofuels and in future also all synthetic fuels (e-fuels) be listed – similar to the regulation requirements governing fossil fuels.

The Netherlands remain the by far most important trading partner, although in some cases volumes declined sharply on the previous year. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), larger volumes also came from Belgium, Poland, France and Malaysia. Whereas France delivered almost as much as a year earlier, imports from other countries dropped significantly. Imports from Malaysia virtually collapsed, nosediving 54 per cent.

At the same time, Germany delivered around 846,000 tonnes to the Netherlands in 2021, which was 18 per cent less year-on-year. Exports to Poland, the US, Austria and Sweden also decreased. Only Belgium – with 354,000 tonnes the number two of the top five recipient countries – imported 3 per cent more biodiesel from Germany than the previous year.

Chart of the week (08 2022)

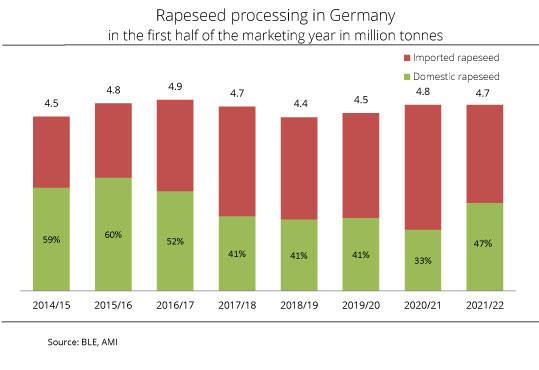

More domestic rapeseed processed

The share of imported rapeseed in rapeseed processing by German oil mills declined in the first half of the 2021/22 season. The share of domestic batches increased correspondingly.

According to information published by the German Federal Office for Agriculture and Food (BLE), traders at the co-op and wholesale level in Germany by the end of December 2021 had taken delivery of around 1.2 million tonnes of rapeseed. This was up 116,500 tonnes on the same period a year earlier. On the other hand, in the first half of the marketing year 2021/22, rapeseed processed by German oil mills amounted to around 4.7 million tonnes. This was down around 1.4 per cent on the period July to December 2020. The amounts of rapeseed oil and meal obtained were correspondingly smaller.

Whereas German oil mills processed increasingly less German rapeseed in recent years, the share rose over the first five months of the current crop year. According to calculations made by Agrarmarkt Informations-Gesellschaft (mbH), 47 per cent, or just less than half, came from Germany, which translates to a 43 per cent increase. In other words, the ratio of domestic and imported rapeseed was nearly balanced for the first time in five years. Until 2016/17, with harvests exceeding 4.3 million tonnes per year, more than half of the rapeseed supplied to German oil mills was domestic.

The UFOP has underlined the importance of and need for imports to utilize the capacities of the oil mills, which processed approximately 9.5 million tonnes of seed in 2021. The association is therefore watching the situation of conflict in Ukraine with concern, as the country is one of the most important suppliers to Germany, not only of rapeseed. Against this background and in view of the continued high level of producer prices, the UFOP has recommended that producers secure these prices in commodities futures and fully use the farms' potential for rapeseed production when sowing whilst taking into account the requirements of crop rotation.

Chart of the week (07 2022)

Increased rapeseed production reduces import demand

EU-27 rapeseed production in 2021/22 exceeded the previous year's output. Consumption is estimated lower, leading to reduced import demand.

According to information published by the EU Commission, the rapeseed harvest in the EU-27 was slightly larger in 2021 than in 2019. It is pegged at 17 million tonnes, which translates to a rise of just less than 340,000 tonnes compared to 2020. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the climb is a result of harvest increases, especially in Romania. Bulgaria, Denmark, Lithuania and Poland also recorded a rise. The harvest increases more than offset production declines in other member states. Nevertheless, the result is once again below average.

Demand from oil mills in the EU-27 in 2021/22 is estimated at 21.8 million tonnes, which translates to a decline of 6.3 per cent year-on-year. The slightly higher output and lower demand will likely cause the gap between production and processing to narrow somewhat in 2021/22. A year earlier, European production covered just less than 72 per cent of EU processing, but there were significant differences between member states. In 2021/22, EU rapeseed will presumably cover about 78 per cent. For this reason, the EU Commission expects that compared to the previous crop year, less rapeseed will have to be purchased from third countries. Imports are estimated at 4.9 million tonnes, which would be a 15 per cent drop. EU ending stocks are likely to remain unchanged from the previous year at the low level of 0.5 million tonnes.

Chart of the week (06 2022)

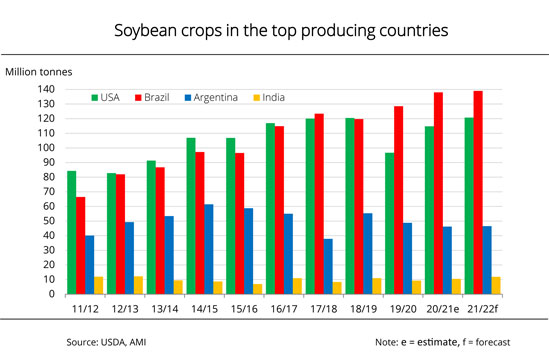

Soybean record crop in Brazil presumably smaller than expected

Brazil and Argentina are set to maintain their shares in the global soybean market this crop year. The soybean harvests both in Argentina and in Brazil are expected to be larger, although poor growing conditions dampen prospects of a bumper crop.

Brazil, the US and Argentina are the main soybean producing countries, collectively accounting for 80 per cent of global soybean output. India follows a long way behind with a share of 12 per cent. According to a USDA report, Brazil is projected to harvest a record soybean crop of 139 million tonnes in the current crop year, which would be up around 1 million tonnes from the previous year. Locally extreme growing conditions with dryness on the one hand and excessive rain on the other hand dampen prospects of a bumper crop which the USDA December outlook put at 144 million tonnes. Brazil is consolidating its number one position ahead of the US based on a 1.5 million hectare expansion in area planted. In the US, the soybean harvest was already complete at the end of the year 2021. The harvest amounted to around 120.7 million tonnes. This translates to a rise of around 6 million tonnes year-on-year.

In Argentina, the world's third largest producer, the harvest is expected to rise slightly to 46.5 million tonnes (from 46.2 million tonnes the previous year), following two years of decline. According to the latest USDA estimate, India also anticipates an increase in harvest of around 1.5 million tonnes year-on-year to 11.9 million tonnes.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has pointed out that, according to Agrarmarkt Informations-Gesellschaft (AMI), the increase in soy output in Brazil is based on a 1.5 million hectare expansion in production area. The association has said that such expansion should be viewed critically because it exacerbates the increasing debate about the transparency needed for deforestation-free procurement. Also, production of biofuel obtained from soybean oil will be affected by the future regulation that soybean oil-based biofuel, along with palm oil-based biofuel, can no longer be counted towards national quota obligations. The UFOP has noted that the French and Dutch governments have already excluded soybean oil from being counted towards quota obligations without any regulation having to be implemented by the EU.

Chart of the week (05 2022)

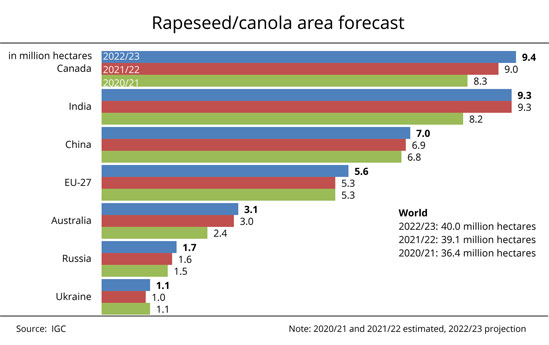

International Grains Council sees global rapeseed cultivation for the 2022 harvest at a record high

In its second projection of global rapeseed cultivation for the 2022/23 marketing season, the International Grains Council (IGC) has raised its estimate to a record level. The reason is considerable price increases and buoyant demand in the current crop year.

In view of the historically high price level and rising demand, the IGC expects the global rapeseed area to expand to a record of 40 million hectares for the 2022/23 marketing season. This would translate to a more than 2 per cent rise on the running crop year.

The IGC sees the largest increases in acreage in key rapeseed producing countries, such as Canada and the EU-27. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), around 5.6 million hectares of rapeseed could be available for harvest in the European Union in 2022, mainly due to expansions in France and Germany. Nevertheless, even taking into account the area under rapeseed cultivation in the UK, this would be down 1.0 million hectares on 2017, a year when the European rapeseed acreage hit a record at approximately 6.8 million hectares.

From the perspective of the UFOP, there is much to suggest that the IGC estimate is more on the conservative side, because rapeseed producers' marketing conditions regarding the 2022 harvests and sowings are set to remain attractive. The UFOP has pointed out that not only in Germany, but also in other EU member states, the option of counting palm oil-based biofuels (biodiesel/HVO) towards national quota obligations will end in 2023. The association expects that biofuel producers will have to look for appropriate alternatives before long. According to the UFOP, sustainable rapeseed oil would be the perfect choice. The association has drawn attention to the fact that feedstock procurement already starts with the sowing of seed. Because of this, appropriate initiatives for planning crop rotation for the 2023 harvest should be provided already at the time of the 2022 harvest.

The declines in yield in the 2021/22 season and the resulting significantly lower output are seen as having triggered the increase in international rapeseed prices. The IGC also anticipates a 4 per cent expansion in canola area in Canada to 9.4 million hectares. Rapeseed production in Ukraine is seen to remain unchanged from the IGC November estimate at 1.1 million hectares, which would be up 100,000 hectares on the previous season.

Chart of the week (04 2022)

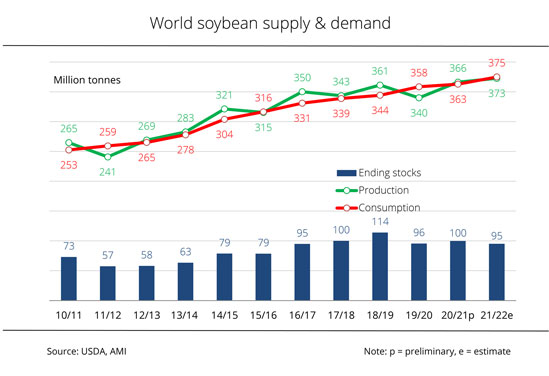

Global soybean supply and demand with significant adjustments

The continued dryness in South America led the USDA to revise the forecast of global soybean production considerably downward. Expectations for world trade, processing and season-ending stocks were adjusted accordingly.

In its latest report, the USDA significantly lowered its forecast of global soybean supply and demand. The biggest adjustment was in global production, which was forecast down 9.22 million tonnes to 372.56 million tonnes. In other words, the running crop year will presumably still exceed the 2020/21 season by 1.7 per cent. The main reason for the reduction was anticipated harvest losses as a consequence of the continued dryness in South America. More specifically, production in Brazil, the world's biggest soybean producer, was lowered 5 million tonnes to 139 million tonnes. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the soybean harvest in Argentina is also likely to be smaller at 46.5 million tonnes (down 3 million tonnes). The same applies to Paraguay, where the harvest is expected at 8.5 million tonnes, around 1.5 million tonnes down from the December estimate.

The forecast of global soybean processing was also forecast down 2.02 million tonnes to 325.72 million tonnes. Nevertheless, this would translate to a 10.15 million tonne rise over the previous year. The downward revision was based on lower expectations for Brazil, Argentina, Egypt and Paraguay. As a consequence of the decline in global output, global stocks are likely to decrease in the 2021/22 marketing year. The current estimate is for 95.20 million tonnes, down around 6.8 million tonnes from the December forecast. This translates to an expected decline of 4.7 percentage points over the 2020/21 season. The main reason for the revision was smaller ending stocks in Brazil and Argentina due to lower harvest expectations.

The forecast of world trade was also revised downward in the latest USDA report. At 170.74 million tonnes, trade in the current crop year is seen at around 1.6 million tonnes below the previous month's level and around 6 million tonnes above the level recorded for the 2020/21 season. The outlook is based on lower export expectations for Argentina and Paraguay. China is set to remain the world's primary soybean recipient with an unchanged import volume of 100 million tonnes. The USDA sees demand in the EU-27, Argentina, Egypt, Bangladesh and Turkey lower than projected in the December outlook.

Chart of the week (03 2022)

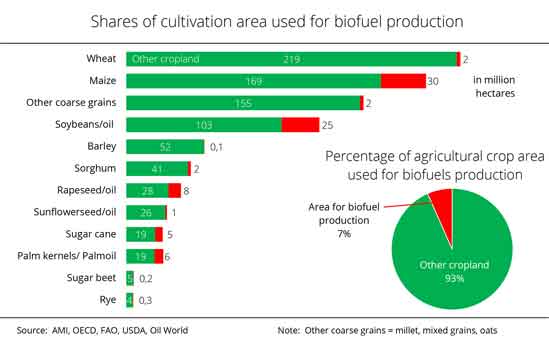

Only 7 percent of global crops is used for biofuels production

In 2020, 1.4 milliards ha of crops such as grain, oilseeds, protein, sugar and fibre plants, fruits, vegetables, nuts and others were grown worldwide. Most of this produce is used as food. Only around 7 per cent go into biofuels production.

Biofuel production is mostly located in countries where there is already a surplus of feedstock (especially maize, soy and palm oil) and legally prescribed blending obligations. If the surplus were not used to produce biofuels, it would have to be placed on the global market, where it would weigh heavily on feedstock prices. The use in biofuel production reduces the production overhang, generates extra value added and reduces the need for foreign currency for imports of crude or fossil fuels. This is primarily a problem in poorer countries.

Another advantage is the amount of high-quality protein feed that is generated in biofuel production, demand for which is steadily increasing. The amount and quality of these protein feeds have a strong influence on feedstock prices. Consequently, they also determine the amount of land dedicated to growing the feedstocks. In other words, biofuels are by no means the price drivers in the commodities markets. If necessary, the feedstocks grown for biofuel production are primarily available for food supply. In the case of politically motivated extensification, the EU Commission is currently pursuing with its reduction strategy for fertilizers and plant protection products as part of the "Green Deal", this option for "buffering" food demand would be omitted.

Chart of the week (02 2022)

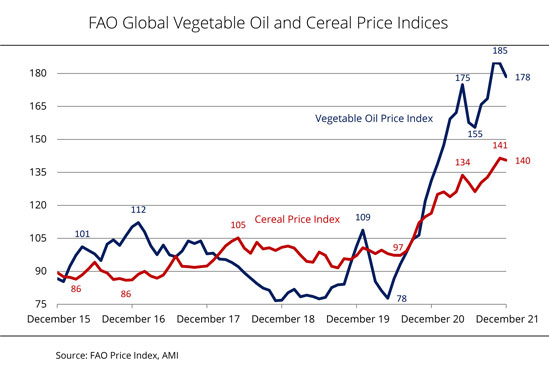

FAO vegetable oil price index 2021 hit new annual high

The FAO price indices of vegetable oil and cereals in November 2021 reached an all-time high at 185 and 141 points, respectively. In December, the indices declined slightly.

The December 2021 FAO vegetable oil price index was at on average 178.5 points, around 6.1 points shy of the previous months peak. This translates to a decrease of 3.3 percentage points. More specifically, palm oil suffered a sharp slump in value compared to the previous month. The price drop was first and foremost due to dampened global demand for imports due to concerns over the potential impact of the rebound of Covid-19. Prices for sunflower oil also declined. By contrast, the price levels of soybean oil and rapeseed oil remained the same. Asking prices received support from brisk import demand, especially from India, and continued scarce global supply.

Looking at the entire year 2021, the FAO vegetable oil price index was at on average 164.8 points, which was up 65.4 points from the previous year's level. This translates to a 65.8 per cent rise to a new annual high.

The FAO cereal price index in December dipped 0.9 points, or 0.6 per cent, to 140 points. Whereas export prices for wheat fell as a result of improved global supply and dwindling demand, prices for maize climbed. The latter received support from continued concerns over harvest losses as a consequence of dry weather in Brazil. The cereal price index for 2021 was established at on average 131.2 points, which translates to an increase of 28 points, or 27.2 percent, over the previous year. In other words, the index reached the highest level since 2012.

The FAO cereal price index is based on official daily stock exchange and trade prices for wheat, barley, maize, sorghum and rice, weighted according to their average shares in world trade.

Chart of the week (01 2022)

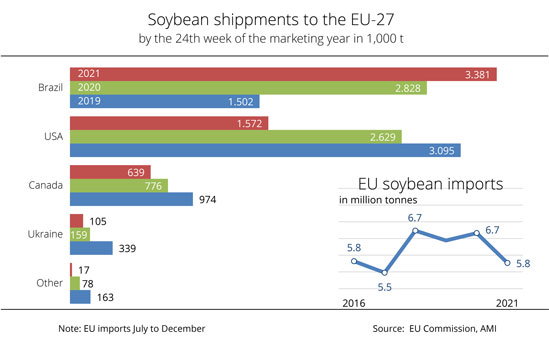

US shipped less soybeans to the EU-27

Soybean is the most important oilseed crop imported to the European Union, ahead of rapeseed. Soybean imports over the first five months of the running crop year amounted to around 5.8 million tonnes, just about 1 million tonnes less year-on-year. There were big changes among supplying countries.

Brazil and the US remained the top soybean suppliers to the EU, with volumes clearly shifting towards South America. Brazil delivered around 3.4 million tonnes in the period 1 July to 12 December 2021, one fifth more than over the same period a year earlier. In other words, 59 per cent of imports were sourced in Brazil. By contrast, the US supplied only just 1.6 million tonnes, which was an 840,000 tonne decline year over year. In other words, the US accounted for 27 per cent of EU-27 soybean imports. According to Agrarmarkt Informations-Gesellschaft (mbH) (AMI), one of the reasons for the sharp drop in US shipments is likely to be the damage Hurricane Ida caused to export terminals in the Gulf of Mexico, which severely hampered exports. Canada remained the third most important supplier, exporting 639,300 tonnes, followed by Ukraine with 104,911 tonnes. This translates to a share of 11 per cent and just less than 2 per cent, respectively. Uruguay ranked fifth with 16,530 tonnes.

In this context, the Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP) has pointed out that the EU Commission at the end of November 2021 presented a proposal to define future requirements for substantiating deforestation-free procurement of soybeans and palm oil, among other produce. With that, the Commission wants to stay abreast of the public debate on feedstock origins and transparency in the entire commodity chain.

The UFOP has underlined that such requirements are not news to the biofuels industry. In fact, appropriate requirements have been in place under the sustainability certification established by law since 2010. The dated evidence that land was used as area of cultivation before January 2008 is a parameter of particular importance. In view of the incipient debate to implement such requirements in Germany, the UFOP has urged that the scope of the documentation requirements for the commodity chain in question should be appropriate and reasonable in terms of practicability and bureaucratic effort and should be along the lines of the sustainability certification in the biofuels industry. “Duplicate evidence“ should be avoided. According to UFOP, it should be noted that a proof of land use is already required both for certified sustainable soybean oil for use in biodiesel production and for importation of such commodity to the EU. The certification is awarded irrespective of the final use of the soybeans and type of processed product. This means that the corresponding amount

of soybean meal is already included in the procedure. The German Federal Office for Agriculture and Food (BLE) has extensive experience in implementing the certification requirements and has also created a database that has attracted international attention.

With regard to fair competition that is necessary in the interests of environmental and climate protection, the UFOP has underlined the fundamental need for regulation. According to information published by AMI, the growth in Brazil's exports is based on the use of additional land that has previously not been located due to a lack of data. The UFOP has admitted that this issue can be resolved thanks to the progress of satellite technology and the Global Risk Assessment Services (GRAS) project funded by the BMEL. However, there is a risk of shift effects if key importing countries such as China do not impose analogous standards for imports. Internationally agreed sustainability standards could then be undermined and processed products would end up on European plates after all. The UFOP has urged that such shift effects and the associated distortion of competition to the detriment of the EU's agricultural sector should be avoided.

Union zur Förderung von Oel- und Proteinpflanzen E.V.

Union zur Förderung von Oel- und Proteinpflanzen E.V.