Charts of the week 2012

Chart of the week (51)

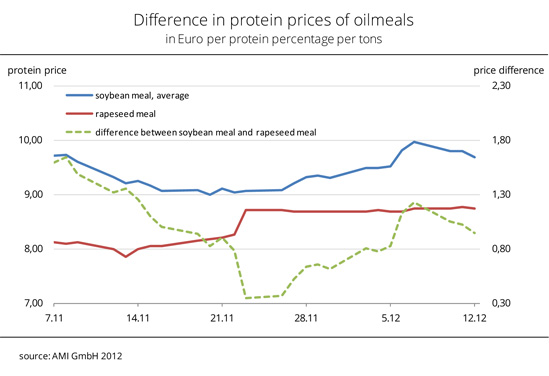

Rapeseed meal loses competitive advantage

At the end of November, rapeseed meal had lost much of its edge over soybean meal. The difference in protein price (in euros) between soybean meal and rapeseed meal dropped to 35 cent per protein percentage per tonne. This was the smallest difference since June 2011. The difference in prices hovered below 1.00 euro for nearly three weeks. At the beginning of December, it overshot that mark again. Recently, the price gap has minimized to 94 cent. At the beginning of October, it had been twice the amount. So far this year, the difference between soybean meal and rapeseed meal was biggest in August when it amounted to 3.19 euros per protein percentage per tonne. (AMI)

Chart of the Week (50)

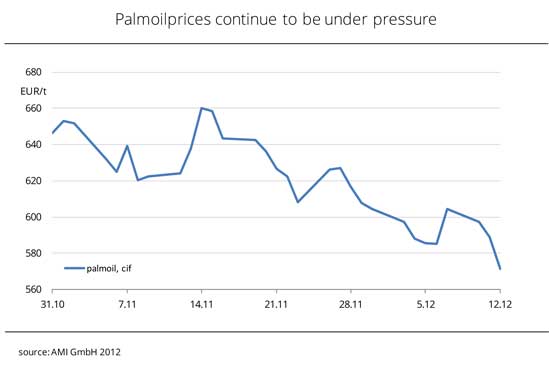

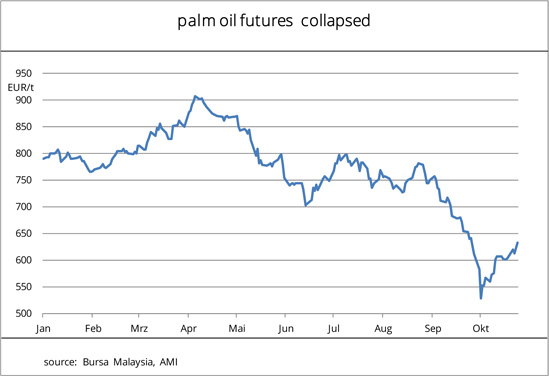

Palm oil supplies hit a new record high

Malaysian palm oil prices have recently recovered somewhat, but high palm oil stocks put an upper limit to increases in price. At the end of November, Malaysian palm oil stocks reached a record peak of 2.56 million tonnes. Market players had actually expected the low palm oil prices to attract demand. All the more so, because the Chinese New Year Celebrations normally increase the need for palm oil in China at this time. However, contrary to expectations November exports were down 6 per cent on the previous month. As a result, palm oil prices continue to be under pressure on the Malaysian cash market where refined palm oil sells at 597 euros per tonne at the moment. (AMI)

Chart of the week (49)

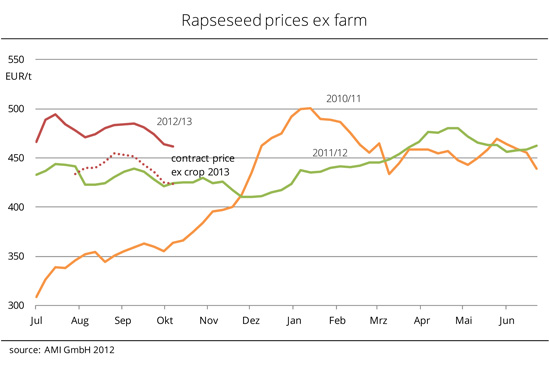

Rapeseed prices head downwards

The high rapeseed prices that were still offered in July or September cannot be realized at the moment. On the one hand, forward prices of rapeseed are trending downward; on the other hand, demand is low. German oil mills have their demand covered until the end of the year and are currently expressing their interest in deliveries from April onwards. However, there is no supply for that period. Making reference to the tight global supply and only small amounts of material left unsold on German farms, rapeseed growers avoid making premature sales. They hope to make higher profits again at the beginning of the new year. (AMI)

Chart of the week (48)

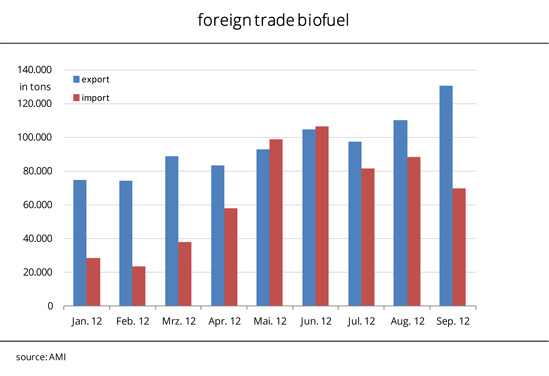

Foreign trade with biodiesel on downward trend

Germany is a net exporter of biodiesel. In the period between January and August 2012, exports exceeded imports by more than 200,000 tonnes. However, both items declined compared with the same period last year. During the period stated, Germany imported close to 521,000 tonnes of biodiesel. This figure is 16 per cent down year-on-year. The country's main supplier was the Netherlands, who accounted for 56 per cent of biodiesel imports. Exports of biodiesel amounted to around 724,000 tonnes in the period from January to August 2012. This is more than 200,000 tonnes down year-on-year. The Netherlands were also the main buyer of biodiesel from Germany. At close to 234,000 tonnes, the country even purchased 11 per cent more than in the same period last year. Imports of bioethanol have rocketed to close to 320,000 tonnes over the current year. In other words, imports have quadrupled since the same period last year. (AMI)

Chart of the week (47)

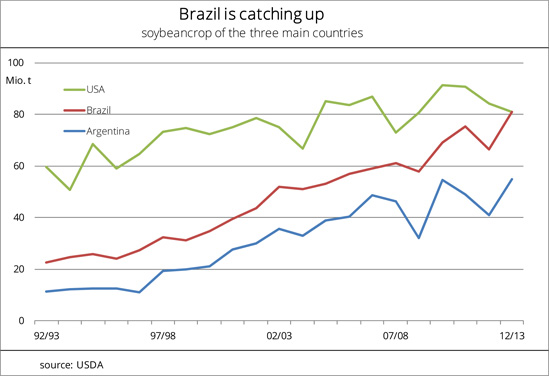

Brazil moves into the lead

Whereas US soybean production in 2012 was significantly lower than expected because of the drought (only about 81 million tonnes), the USDA believes that South American farmers will bring in a record crop. As farmers both across Argentina and in Brazil are currently sowing, it appears that despite less than ideal weather conditions, the soybean area will reach a new record high. The USDA estimates the Brazilian harvest potential at 81 million tonnes. This would be an increase of 15 million tonnes year-on-year. As a result, Brazil would assume the position as the world's number one soybean producer for the first time in history. The country could then also lead the list of soybean exporting countries. However, much can happen until the harvest in March 2013. Last year, drought conditions put a damper on harvest figures. (AMI)

Chart of the week (45)

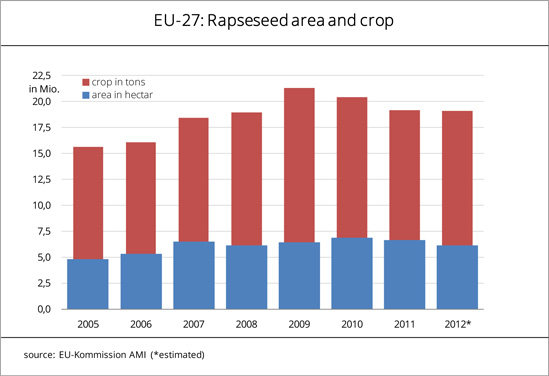

Higher per-hectare yields made up for reduction in planted area

Unfavourable seeding conditions and severe losses from winter kill, especially in Eastern Europe, led to a further reduction in rapeseed area for the 2012 harvest. At 6.17 million hectares, the area was 500,000 hectares down on the previous year's rapeseed plantings, slipping to a four-year low. This situation dashed hopes for a good rapeseed harvest in Europe and limited the scope for downward movements in price. Occasional poor growth conditions in spring fanned additional concerns about losses of earnings. However, those fears were not confirmed. Throughout Europe in 2012, the average yield of rapeseed per hectare (30.1 decitonnes) rose by a remarkable eight per cent. As a result, in 2012 the EU rapeseed harvest totaled 19.1 million tonnes, just barely falling short of the previous year's figure. German harvest figures stand out in particular. Although the rapeseed area was slightly smaller, the 2012 rapeseed harvest (4.8 million tonnes) exceeded last year's production by one million tonnes. (AMI)

Chart of the week (44)

Surplus of supply sent prices tumbling

After experiencing a sharp drop at the beginning of the month, palm oil prices are slowly recovering. Oversupply in Malaysia was the key factor for kicking off the steep dip in prices. Late September saw raw palm oil stocks exceeded the 1.6 million tons mark − a preliminary peak that had been looming the since July. At the end of June, supplies were still at 786,000 tons. Although demand (mainly for export) was buoyant and clearly exceeded last year's, it was too low to make up for the glut. Palm oil production reaches its seasonal peak in September/October. This year's September production (2 million tons) even outstripped last year's by 7 per cent. At the futures exchange in Kuala Lumpur, prices responded to the abundant oil supply by plummeting. On 3 October, the nearby closed at the equivalent of 465 euro per ton, hitting a three-year low. (AMI)

Chart of the week (43)

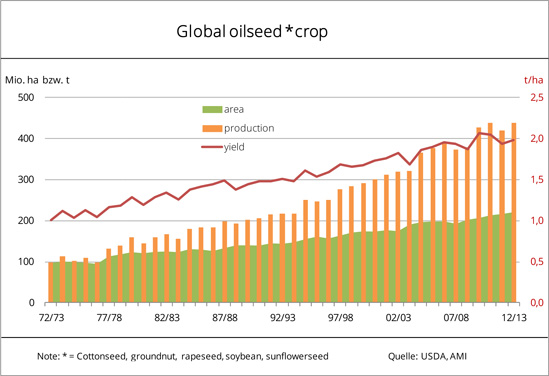

Yield of oilseed per unit area on the increase

Demand for oilseed has grown continuously over the past few decades. However, the rise in production could primarily be attributed to an increase in yield per unit of land rather than expansion in area of oilseed crops. Per-hectare yields doubled within a period of 40 years. On the one hand, all over the world more and more farmers now plant higher-yielding varieties. On the other hand, agricultural practices such as fertiliser applications, plant protection and the use of high-tech are refined further while at the same time they are becoming more popular. Of the five oilseed crops mentioned, soybean is the most productive, averaging around 2.4 t/ha. Over the past ten years, the pace of the increase in yields has slowed throughout the world. Forty years ago, global soybean yields averaged 1.5 t/ha. Cottonseed experienced the steepest rise. Whereas in 1972 only 0.7 tonnes were harvested per hectare of land worldwide, the global average yield reached 1.33 t/ha in 2012. (AMI)

Chart of the week (42)

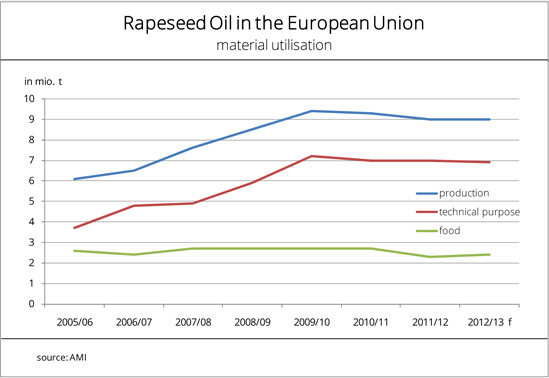

Decrease in the use of rapeseed oil for technical applications

After significant growth in the past few years, the rapeseed oil market in the European Union is now stagnant. This is true for production and consumption alike. The previous fast rise was due to demand for technical applications. In the meantime, demand for rapeseed oil for biodiesel production is in decline. The reasons for this downward trend are that biodiesel competition from overseas is increasing and other vegetable oils are being used. In general, the use of vegetable oils for technical applications (10.9 million tonnes) is stable compared to the previous year. However, producers occasionally use lower-cost soybean and palm oil to replace rapeseed oil. Germany is the top producer of biodiesel in the European Union, followed by France and Spain. However, other member states have been making up ground for quite some time. Whereas in 2005, Germany accounted for 45 per cent of EU biodiesel production, the country's proportion dropped to below 30 per cent in 2010. The use of rapeseed oil in food production is expected to rise slightly in 2012/13, after a significant decline in previous years. The general increase in demand for vegetable oil for food production and the simultaneous fall in soybean and sunflower oil consumption cause the proportion of oilseed rape oil to rise. (AMI)

Chart of the week (41)

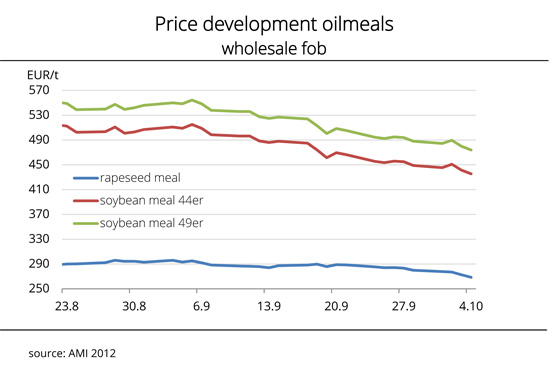

Oilseed meal prices in decline

After reaching record peaks again and again over the past few weeks, prices for oilseed meal are now declining. Recent negative trends at the futures exchanges in Chicago and Paris are now reflected in oil meal prices. Initially, a better than expected soybean harvest in the US created pressure on prices. Currently, soybean yields in South America are increasingly coming into focus. Farmers in the major countries of origin – Brazil, Argentina and Paraguay – have significantly expanded the soybean production areas. In recent forecasts, all three countries anticipate record harvests. The slump in soybean meal prices is also due to the weak dollar and decrease in prices for competing imports. At 428 EUR per tonne, soybean meal has dropped to a three-month low. Although rapeseed meal prices have been more stable, they fell below the 270 EUR per tonne mark for the first time since the end of June. On the spot market, manufacturers of compound feed are holding back from buying despite the decrease in prices. Only the Lower Rhine is seeing some trading of smaller quantities for the November to April dates. Market players expect that the pending USDA report will bring fresh impetus to the industry. (AMI)

Chart of the Week (38)

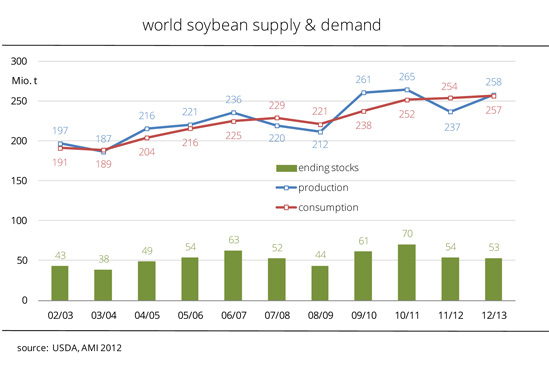

No recovery for stocks

In its recent monthly estimate for soybean supply, the United States Department of Agriculture (USDA) revised its figures again for 2012/13. US harvest figures in particular were disappointing. Although the soybean area had been expanded compared with the previous year, drought strongly limited yields. The estimate dropped to only 71.7 million tonnes. In previous years, the average crop was 84 million tonnes. In contrast, forecasts for South America are very optimistic. For the first time, Brazil could actually take the place of the United States as the most important country of origin. Although prices are high, the USDA believes there is still potential for growth in demand in China, Argentina and Paraguay. Such trend would have a negative impact on supplies which the USDA now forecasts at 53 million tonnes by the end of the 2012/13 business year. This amount would in theory satisfy demand for a period of 75 days. (AMI)

Chart of the week (37)

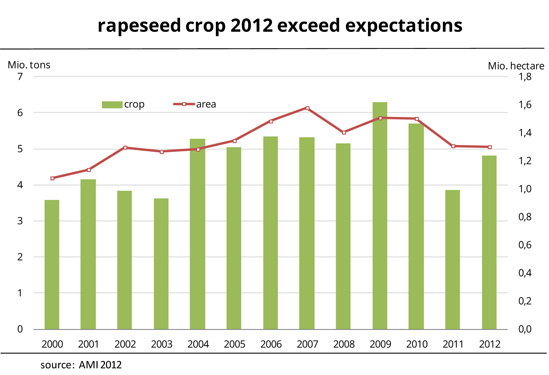

Rapeseed crop better than expected

German farmers are satisfied with the 2012 harvest of rapeseed, although it was the third worst crop since 2002. However, at 4.8 million tonnes, it clearly exceeded expectations and outstripped last year's poor figure. Since seeding conditions were difficult in the past autumn, producers were unable to meet seeding schedules. In addition, there was some winter kill. Very dry conditions in spring caused some concern among farmers, who feared another year of low yields. But in the end, per-hectare yields proved to be satisfactory. At 3.69 tonnes per hectare, yields were still average and 26% above last year's devastating figure. Per-hectare yields were highest in Schleswig-Holstein at 4.33 tonnes. In all other German states, they topped last year's poor results. In Brandenburg and Mecklenburg-Western Pomerania, they even increased by 40%. (AMI)

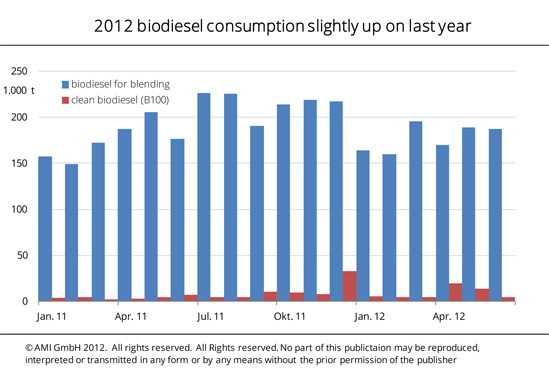

Chart of the week (36)

2012 biodiesel consumption slightly up on last year

In the first half of 2012, biodiesel consumption in Germany was slightly higher than in the same period of last year. The increase was primarily due to the surge in demand for pure fuel in April and May 2012. According to statistics published by the German Federal Office of Economics and Export Control (Bundesamt für Wirtschaft und Ausfuhrkontrolle/BAFA), the total amount of biodiesel was 1.12 million tonnes, 4% up on last year. About 1.07 (previous year: 1.05) million tonnes were used for blends. At 53,756 tonnes, the amount of pure fuel more than doubled compared to the same period of last year. In the final months of the first half-year, demand for blending purposes increased steadily at a high level. An average of 180,000 tonnes per month was called forward in the first half of the year. In contrast, demand for pure fuel dropped sharply again in June. Whereas pure fuel consumption amounted to 20,000 tonnes and 14,000 tonnes in April and May respectively, it was only around 5,000 tonnes in the other months. (AMI)

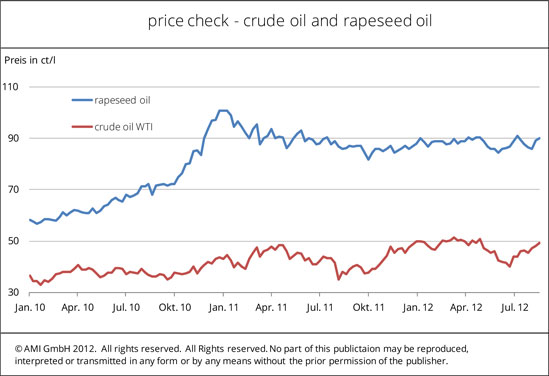

Chart of the week (35)

Rapeseed and crude oil prices are firming

Since the beginning of 2010, the New York Stock Exchange has seen crude oil prices firming up continually. Whereas at the time, West Texas Intermediate (WTI) crude oil was traded at 36.5 euro cents per litre, the price has surged to more than 49 euro cents per litre by today. Since late 2010, prices have rarely slipped below the mark of 40 euro cents per litre. In April 2011, the WTI price peaked at US$ 113.93, reaching its all-time high. However, this amount converted to only 49 euro cents per litre at the time. Due to the recent weakness of the euro, Europeans are having to spend more money on crude oil although futures prices have dropped. Recently, the crisis in the Middle East and hurricane Isaac have accounted for the firm crude oil prices. Rapeseed oil prices have not been able to hold their January 2011 peak. In 2012, the average asking price has been 88 euro cents per litre, and July saw a slight slump in prices due to easing rapeseed prices. Slow demand is putting a limit on strong price movements, and poor sales to the biofuel industry have beaten prices down to levels well below those of soybean oil. (AMI)

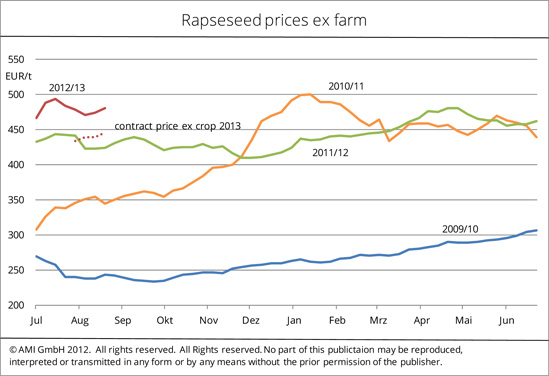

Chart of the week (34)

Rapeseed prices are firming

Concerns about rapeseed supply from the 2012 harvest have ended. In general, more rapeseed was harvested than had been thought possible two months ago. However, as every year, the country presents a very heterogeneous picture. Whereas yields were low in the south following winter damages and drought conditions, yields were occasionally above average elsewhere. Oil content is usually sufficient. At the producer level, prices established by AMI GmbH show a huge range. This is typical so soon after harvest. Reports range from EUR 470 to 495 per tonne ex farm. In most regions, producers obtained EUR 480 per tonne. Producer prices occasionally fall below this line only in very remote areas. One year ago, the price was EUR 425 per tonne. Whereas last year, producers already concluded many contracts for the next harvest, producers are holding back this year. Quotations for the 2013 harvest are around EUR 35 per tonne below current spot market prices. (AMI)

Union zur Förderung von Oel- und Proteinpflanzen E.V.

Union zur Förderung von Oel- und Proteinpflanzen E.V.