Charts of the week 2014

Chart of the week (52)

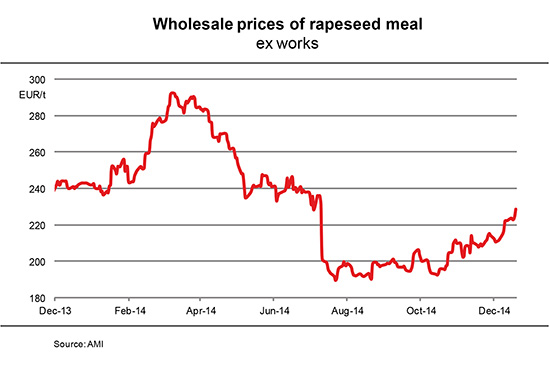

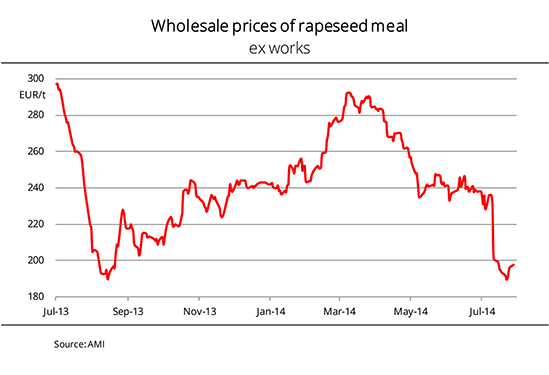

Rapeseed meal prices fight their way up

Although rapeseed meal prices are subject to strong fluctuations, the overall price trend is firm. Since reaching their annual low at just under EUR 190 per tonne at the end of August 2014, nearby supplies have surged by almost one fifth. However, this is still EUR 20 per tonne below the year-ago level. The upsurge in prices in recent months was driven by firm reference prices for feedstock in Paris and occasionally brisker demand. The reason for climbing demand was that as buyers feared rising prices they quickly stocked up to cover future need. Moreover, interest in this alternative source of protein was boosted by occasionally sharp rises in soybean meal prices. Meanwhile, supply of rapeseed meal is not large but adequate, because demand has recently been slow. Above all, prices for delivery at the end of the season climbed significantly in the wake of a reduced forecast of feedstock supply for the next year. (AMI)

Chart of the week (51)

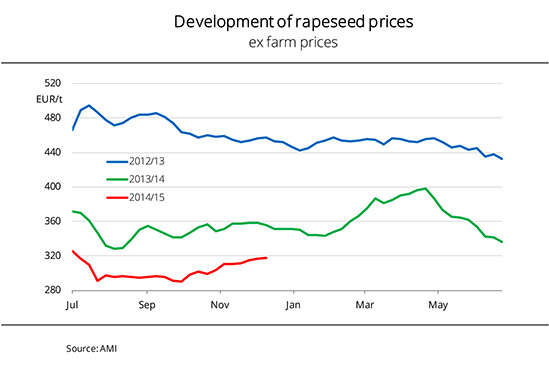

Farmers hardly sell any rapeseed despite climbing prices

Farm rapeseed prices rose steadily over the past several months. The surge was driven by a slight increase in demand, along with firm futures market prices in Paris, whereas supply has remained tight although the harvest was higher than average. Rapeseed ex-farm prices stand at around EUR 317 per tonne in December 2014, up EUR 23 per tonne from their seasonal September low. In other words, although the price approached the year-ago level, the gap was recently still just under EUR 37 per tonne. Against this background, farmers hardly deliver any rapeseed. Before the start of the slow Christmas season they already postponed marketing their rapeseed stock until next year. Consequently, the amount of unsold rapeseed is still large. The contract business for the 2015 crop is also on hold. Processors' demand increased primarily for nearby positions, because margins are fairly satisfactory there. However, the rise in interest has hardly translated to higher mark-ups over the season. (AMI)

Chart of the week (50)

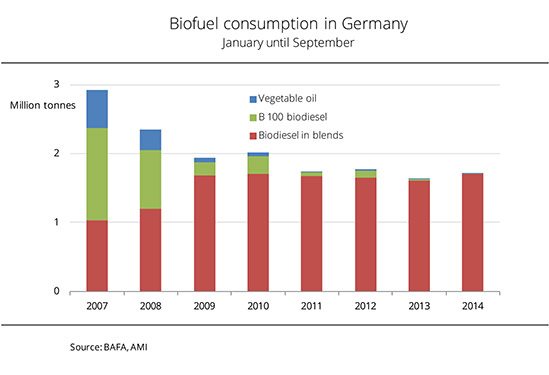

Biofuel consumption in Germany focuses on use in blends

The use of biofuels has slightly risen over the year. Consumption of biodiesel from January to September 2014 amounted to around 1.7 million tonnes, up 6 per cent from the same period last year. The blending quota in the total quantity surged to 99 per cent, although B100 consumption rose slightly over the past few months. With monthly demand for B100 averaging 400 tonnes, B100 consumption is marginal compared to biodiesel use in blends (just about 190,000 tonnes per month) and even lower than the amount of vegetable oil consumed. The latter averaged 560 tonnes. Nevertheless, this was more than in 2013. The use of vegetable oil fuel virtually sextupled in 2014 compared to the previous year, to 5,000 tonnes. However, this figure cannot hide the fact that pure biofuels have lost importance over recent years. Seven years ago, consumption of vegetable oil and B100 still amounted to 1.9 million tonnes. (AMI)

Chart of the week (49)

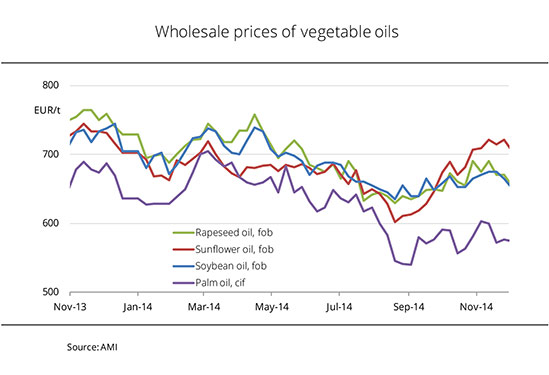

Slump in crude oil prices sends vegetable oil prices on a downward spiral

Chart of the week (48)

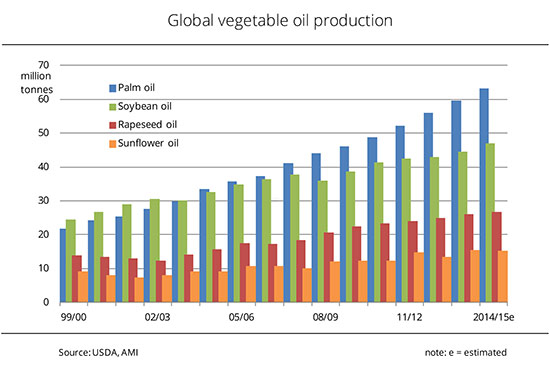

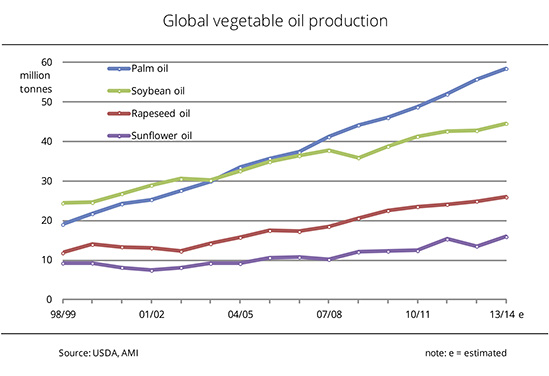

World production of vegetable oils increases – palm oil outpaces soybean oil

The global output of vegetable oils has climbed significantly in recent years. A USDA report indicates that the production of vegetable oils – including coconut, olive and peanut oil as well as oil from cottonseed – in the 2014/15 marketing year amounts to around 177 million tonnes. This translates to an approximately 4 per cent rise from the previous year. Palm oil surged most, by approximately 6 to 7 per cent per year. On a global scale, it has outpaced the competing soybean oil since 2004/05. Soybean oil production on average rose only half as much in recent years. The USDA forecasts that global palm oil production in the current marketing year will exceed the output of soybean oil by one third. The 2014/15 rapeseed oil production is predicted at just under 27 million tonnes, slightly up from the previous year. The 2014/15 global output of sunflower oil is expected to drop slightly to 15.3 million tonnes in the wake of a reduced availability of feedstock. (AMI)

Chart of the week (47)

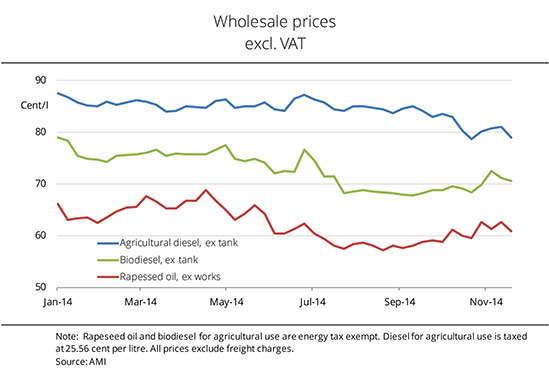

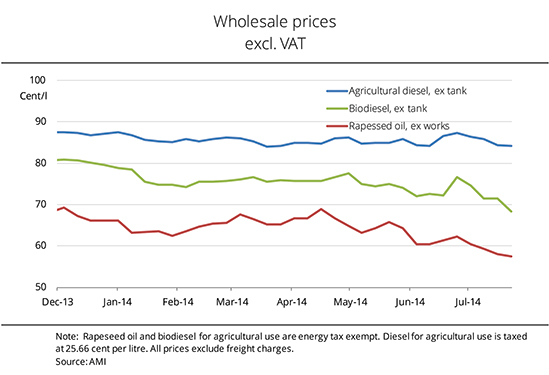

Prices for agricultural diesel and biodiesel converge

The prices for biodiesel and agricultural diesel converged again. After reaching around 17 euro cents per litre in mid September 2014, at the beginning of November the price gap amounted to just under 8 euro cents per litre. Whereas crude oil prices have been fairly weak in the wake of ample world supplies and declining demand, biodiesel prices rose considerably at the beginning of November, based on a significant surge in demand. However, demand has flagged since, beating down prices. Meanwhile, rapeseed oil prices have fluctuated greatly for several weeks. This situation complicates feedstock procurement for biodiesel producers. The latter are holding back their demand, waiting to see how prices will develop. Although demand absolutely exists, especially for the first and second quarter of 2015, with prices fluctuating by up to EUR 15 per tonne from one day to the next, not many contracts are concluded. (AMI)

Charts of teh week (46)

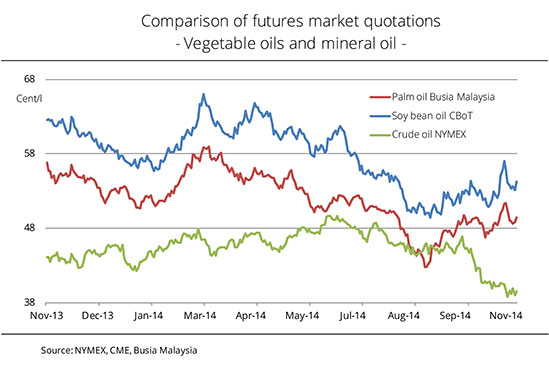

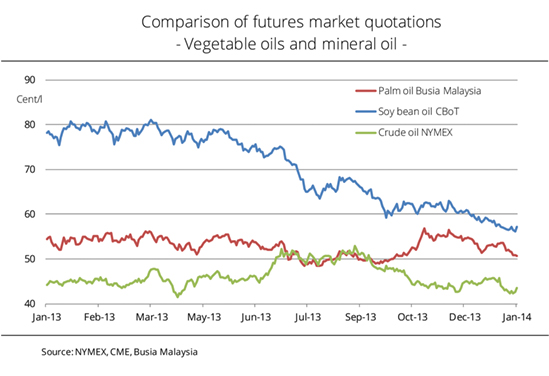

Trend in crude oil prices is distinct from price development for palm and soybean oil

In the wake of excess supply, crude oil prices have been on a downward trend worldwide for several months. The nearby dropped to a three-year low at the beginning of November 2014. Since August 2014, the price gap between crude oil and palm and soybean oil has widened considerably. Although fluctuating greatly, vegetable oil prices showed a slight upward trend. In October 2014, the surge in soybean oil prices in Chicago was mainly driven by the scarcity of feedstock supply to US processors. The delay in harvesting the record US soybean crop and buoyant demand from abroad limited soybean availability to oil mills and consequently cut domestic supply of soybean meal and oil. The weakness of US logistics in October added another limiting factor on supply to processors. Meanwhile, Malaysian palm oil production is on a slight downward trend while demand has also declined at the same time. Recent palm oil prices followed the trend of soybean oil. (AMI)

Chart of the week (45)

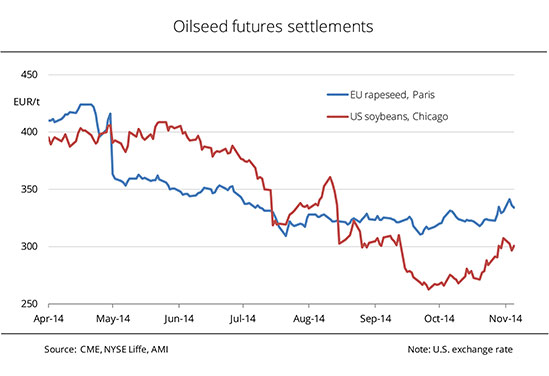

Soybean prices halt their downward slide on scarce US meal supply

Grafik der Woche (KW 44)

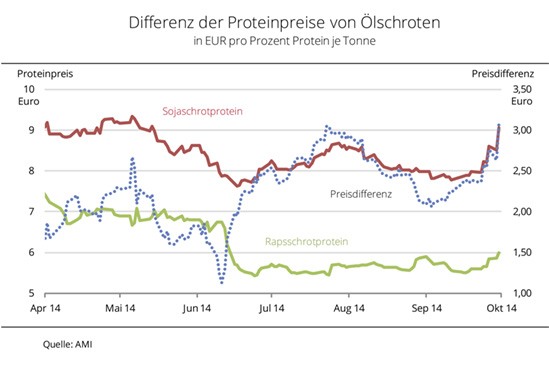

Preise für knappes Sojaschrotprotein legen deutlich zu

Die Proteinpreise am Kassamarkt sind seit Mitte Oktober 2014 kräftig gestiegen. Ausschlaggebend für den Anstieg waren feste Vorgaben der Rohstoffnotierungen an den internationalen Terminmärkten. So haben die US-Sojakurse aufgrund einer regen Nachfrage bei witterungsbedingt nur stockend voranschreitender US-Sojaernte, kräftig zugelegt und ungünstige Aussaatbedingungen in Brasilien ließen die Notierungen weiter steigen. Das hat auch den Pariser Rapskursen Aufwind gegeben. Da die Rohstoffverfügbarkeit der Verarbeiter wegen Logistikproblemen in den USA begrenzt ist, wurden die Kassapreise für Sojaschrot hüben wie drüben deutlich angehoben. So wuchs die Differenz des Proteinpreises von Soja- und Rapsschrot, errechnet aus dem Kassamarktpreis und Proteingehalt, Ende Oktober 2014 auf fast 3,10 EUR je Prozent einer Tonne Rohstoff und erreichte ein 2-Monatshoch. Die Wettbewerbsfähigkeit von Rapsschrot wächst wieder. (AMI)

Chart of the week (43)

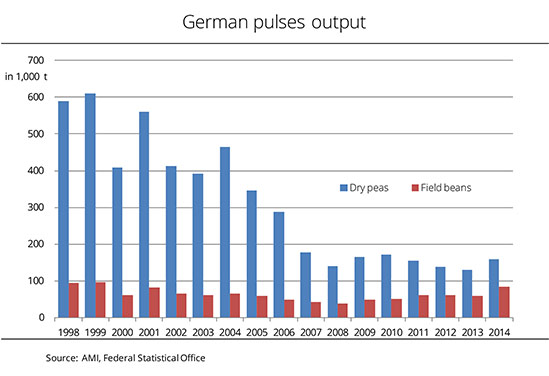

Germany reaps the largest field bean crop in 15 years

According to information published by the German Federal Statistical Office, German farmers harvested considerably more dry peas and field beans this year than last. At 158,000 tonnes, this year's dry pea crop exceeded the 2013 figure by 22 per cent. The main reasons were a substantial 13 per cent expansion of area, along with a 9 per cent increase in yield. The country saw the largest crop since 2010 when the harvest amounted to 172,000 tonnes. At 84,000 tonnes, the field bean crop was the largest in 15 years. The key factor driving up the harvest figure was the expansion of area. At 21,000 hectares, the area is estimated to have been up one third compared to the previous year. The increase in per-hectare yields also boosted harvest figures. German field bean yields averaged 40.9 decitonnes per hectare, outpacing the 2012/13 level by 13 per cent and even exceeding the long-term German mean by 14 per cent. Sweet lupine production in 2014 amounted to around 37,600 tonnes. This was up one fifth year-on-year. (AMI)

Chart of the week (42)

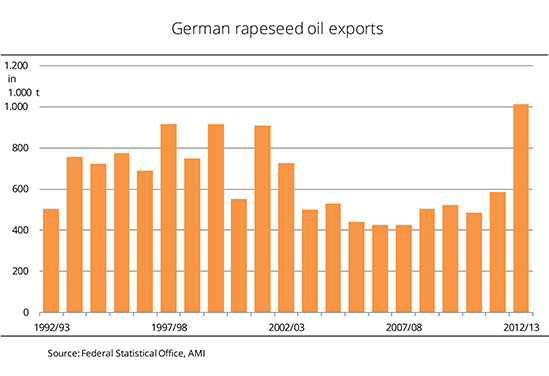

German 2012/13 exports of rapeseed oil hit record high

Germany had a record-breaking 2012/13 in rapeseed oil exports. Never before had the

country sold as many as one million tonnes abroad. In 2011/12, exports amounted to

586,000 tonnes. German production of rapeseed oil production in 2012/13 totalled

around 3.8 million tonnes. Due to weak national demand, German oil mills had to sell

one third of their production to foreign markets. 87 per cent of these exports went to

other EU states, 8 per cent to Asia and 4 per cent to EFTA states (Iceland, Norway and

Switzerland). The main buyer of German rapeseed oil were the Netherlands (just under

440,000 tonnes), followed by Belgium (120,000 tonnes). Taken together, the two

countries received 80 per cent more than the previous year. China (42,000 tonnes)

ranked fifth, after Great Britain and Poland and ahead of Norway (37,000 tonnes).

France only received 36,000 tonnes. However, 30,000 tonnes went to Singapore. In

previous years, China and Singapore had only received a fraction of this year's quantity.

(AMI)

Chart of the week (41)

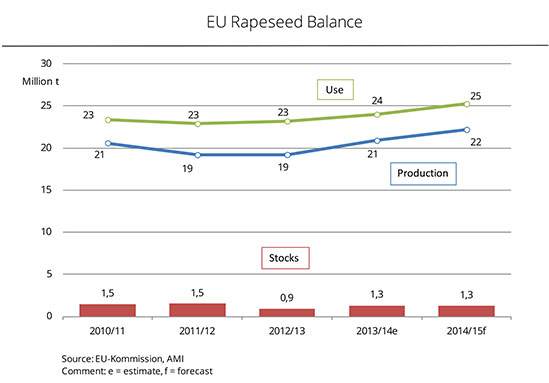

EU 2014/15 rapeseed ending stocks predicted at previous year's level

EU-28 rapeseed production in the 2014/15 marketing year is expected to exceed the previous year's output considerably. However, the EU Commission forecasts consumption to also rise sharply at the same time. Consequently, stocks of rapeseed in the stores at the end of the marketing year will presumably be virtually same as at the same time a year ago. At the end of 2013/14, ending stocks amounted to 1.3 million tonnes. The EU Commission currently forecasts total rapeseed production in 2014/15 at around 22.2 million tonnes, up just under 1.3 million tonnes from 2013/14. The chances are that supply will rise by just under 5 per cent, if imports are slightly reduced to

3 million tonnes while beginning stocks increase to 1.3 million tonnes. At the same time, consumption is expected to climb significantly by 5 per cent. An estimated 24 million tonnes will be used in processing. This is also a respectable 5 per cent rise. (AMI)

Chart of the week (40)

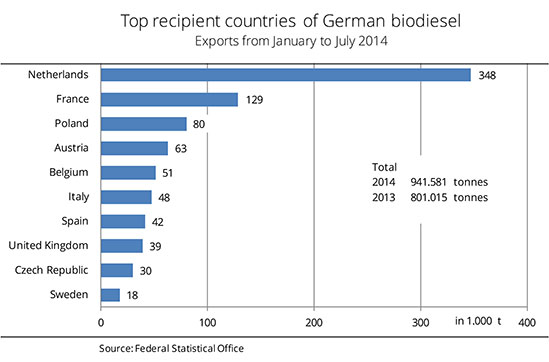

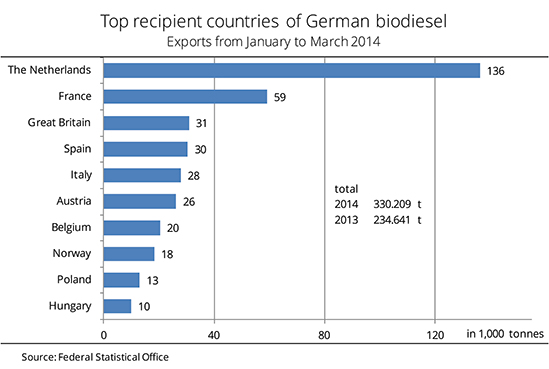

Biodiesel exports continue to boom

German biodiesel exports increased sharply over the first seven months of 2014. Totalling around 941,600 tonnes, biodiesel exports were up just under 18 per cent year-on-year. The Netherlands received more than one third of total exports. This translates to a 33 per cent rise and leaves the country in first place. Biodiesel exports to Spain shot up to 42,000 tonnes, from only 151 tonnes in the same period last year. Exports to France, Belgium and Sweden also rocketed, by 135, 68 and 29 per cent respectively. In other words, France secured second place again. Sweden, receiving 18,000 tonnes, ousted Hungary from tenth place on the list of top recipients. Between January and July 2014, EU countries absorbed around 94 per cent of German biodiesel exports. (AMI)

Chart of the week (39)

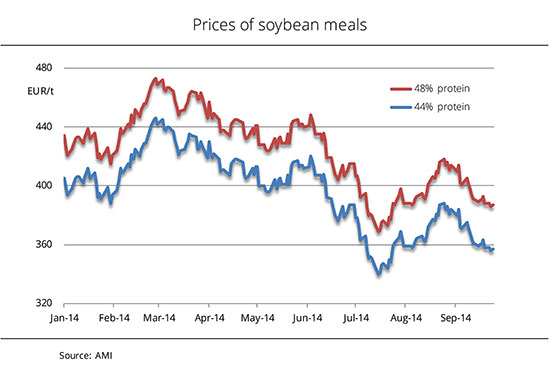

Prospects of bumper crop beat down soy meal prices

Soybean meal prices are in decline. Prospects of a US record crop put increasing downward pressure on soybean futures prices and consequently also on prices of byproducts. The key reason is that the vague US soybean crop forecasts are increasingly borne out by recent figures. The US harvest estimate of beans is at a record of 106.5 million tonnes, up 17 million tonnes year-on-year. In July 2014, the forecast of a bumper crop had already sent prices tumbling. However asking prices firmed as supply on the cash market was actually very tight. In Germany, soybean meal prices rocketed to a short-term high of up to EUR 384 per tonne for low-protein soybean meal (44%) fob Hamburg. Since then, soybean meal has trended downward, skidding below the level of EUR 360 per tonne. However, since nearby supply in Germany is scarce, the decline in prices will probably be limited. The weakness of the euro against the dollar also contributes to slowing down the price fall. (AMI)

Chart of the Week (38)

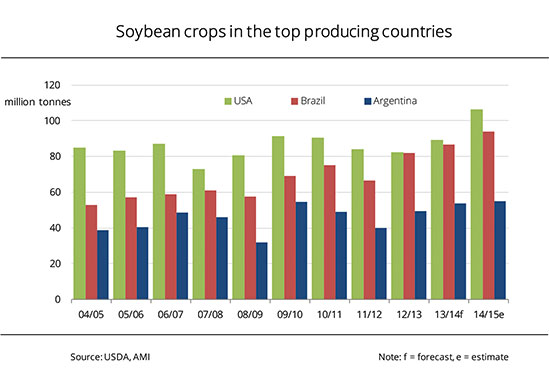

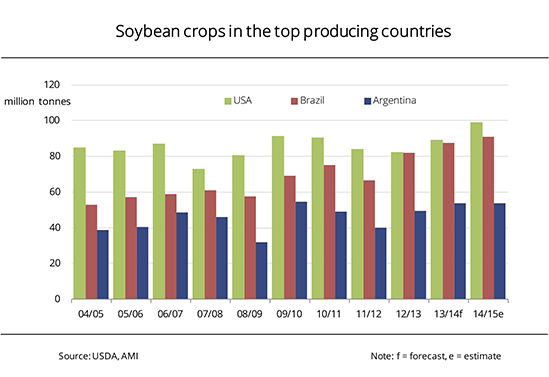

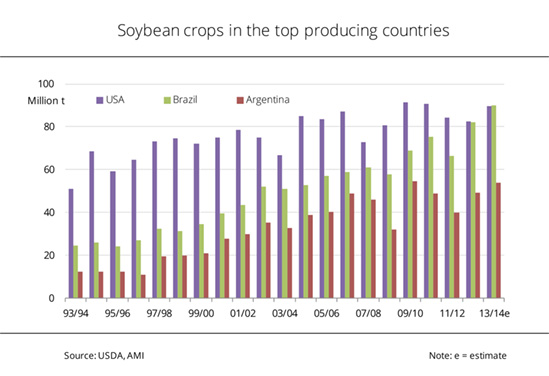

USDA massively boosts forecast of 2014/15 global soybean production

USDA's 2014/15 forecast of global soybean production increased by around 6.4 million tonnes from August 2014 to 311.1 million tonnes. The reason is that harvests in the top producing countries (US, Brazil and Argentina) even exceed previous estimates. The US crop alone will presumably amount to just under 106.5 million tonnes. This would translate into a 19 per cent increase compared to 2013 and a 2.6 million tonne rise compared to the previous month's forecast. The US is also expected to reap record crop yields from the record area planted with soybeans, because US soybean crops are at their best condition at this time of the season in more than 20 years. In its September outlook, USDA raised its forecast of Brazilian soybean production by 3 million tonnes from the previous month, to 94 million tonnes. Argentina's output was estimated at 55 million tonnes, up approximately 1 million tonnes. (AMI)

Chart of the Week (37)

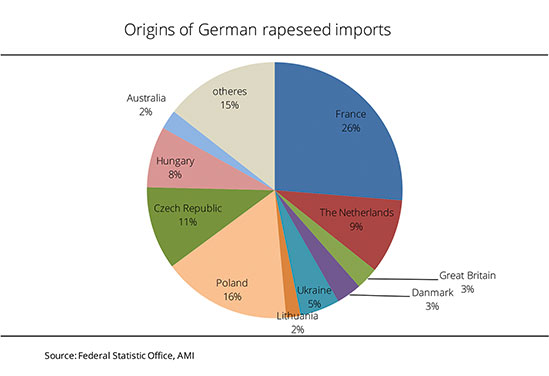

France and Poland are Germany's main rapeseed suppliers

In the 2013/14 marketing year, Germany received 4.4 million tonnes of rapeseed from abroad, 12 per cent more than the previous year. Germany's top rapeseed suppliers are its EU neighbour countries, headed by France. The country has traditionally supplied the largest quantity to Germany. Australia lost its position as second most important supplier, with exports dropping by around 80 per cent to 106,000 tonnes in 2013/14. By contrast, at just under 710,000 tonnes Poland delivered nearly twice the amount of 2012/13. The third most important supplier was the Czech Republic, supplying 458,000 tonnes, around two thirds more than 2012/13. The country took over third place from Great Britain, whose rapeseed deliveries slumped by 70 percent to 123,105 tonnes. Moreover, rapeseed imports to Germany via the Netherlands also increased, by around 17 per cent to 410,000 tonnes. Hungary raised its quantity delivered by 50 percent to 336,000 tonnes. The Ukraine even quadrupled its rapeseed exports compared to the previous year, to around 219,000 tonnes. (AMI)

Chart of the week (36)

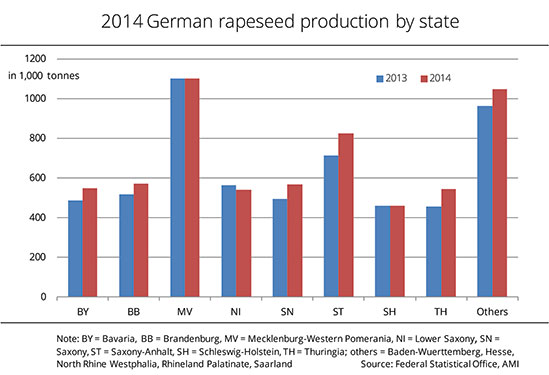

2014 German rapeseed harvest exceeds expectations

Expectations concerning the 2014 rapeseed crop were high, but were even exceeded. The German Federal Statistical Office's second harvest estimate puts overall production at 6.2 million tonnes. Although in Germany the area planted with winter rapeseed was reduced by around 4 per cent, to just under 1.4 million hectares, production climbed nearly 8 per cent compared to 2013. The rise was due to the fact that the average yield surged significantly, to 44.5 decitonnes per hectare. This translates to a 13 per cent rise year-on-year. In Baden-Wuerttemberg and Saxony-Anhalt, yields averaged more than 47 decitonnes per hectare. This figure surpasses the long-term German mean by 10 decitonnes per hectare. In all German states, with the exception of Lower Saxony and Schleswig-Holstein, harvest figures even exceeded last year's exceptional production considerably. Saxony-Anhalt and Thuringia reported the largest increase, despite slight reductions in area planted. At 1.1 million tonnes, Mecklenburg-Western Pomerania harvested about the same amount of rapeseed as the previous year. (AMI)

Chart of the Week (35)

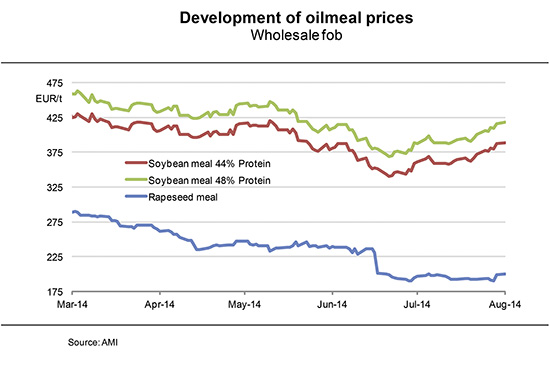

Price spread between soybean and rapeseed meals widens

Soybean meal prices on the German cash market were raised considerably over the past few weeks, widening the price gap with rapeseed meal. The latter has recently not gone beyond the EUR 200 per tonne mark. The tight nearby supply of soybean meal and the recent weakness of the euro has raised prices of both imports and supplies ex German mill. As US reference prices for soybeans and soybean meal were sometimes firm, 44% soybean meal fob Hamburg hit a two-month high at the end of August. Although the US are expecting a record soybean crop, the very tight supply of US old-crop beans and meals, above all, has most recently had an effect on the market. It drove up prices in Chicago, providing firm reference prices for price fixing on the cash market. (AMI)

Chart of the Week (34)

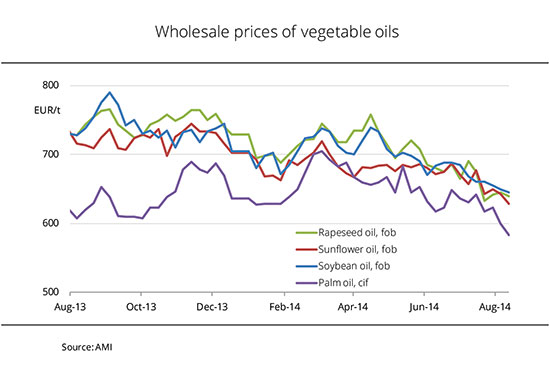

Palm oil prices slide

Wholesale prices for vegetable oils are on the decline. Above all, asking prices for palm oil were reduced sharply. As a result, the price spread between palm oil and the other vegetable oils has widened. In mid August 2014, palm oil cif North Sea harbours cost EUR 62 per tonne less than the competing soybean oil. The downward pressure on palm oil prices is due to declining futures market prices which slumped close to a five-year low in mid August. This slide was due to speculation about excess supply in Malaysia and increasing competition from other vegetable oils on the export market. At the same time, July palm oil production amounted to 1.67 million tonnes, up around 6 % from the previous month. Contrary to what market participants had expected, Malaysian stocks increased to 1.68 million tonnes at the end of July 2014, exceeding June figures by 2 %. Moreover, exports continue to fall short of expectations. The first twenty days of August saw a drop of just over 5 % from the same period in July, to 822,000 tonnes. (AMI)

Chart of the Week (33)

Rapeseed prices hit four-year low

As the rapeseed harvest kicked off, prices dropped sharply yet again. The seasonal slump set in early. Prospects for an abundant rapeseed crop in Germany and pressure from the well-supplied soybean markets opened scope for downward movement in prices. At the beginning of August 2014, farmers obtained on average EUR 295 per tonne for rapeseed, with bids varying locally between EUR 288 and EUR 300 per tonne. This was a respectable EUR 40 per tonne down from the same time a year ago and on average EUR 50 per tonne less than prices agreed in contracts for delivery at harvest time concluded in previous months. Against this background, farmers' inclination to sell has flagged. Since also markedly fewer supply contracts have been concluded this year, the market now actually lacks material. Oil mill owners stock up with rapeseed from EU neighbour countries. But because such rapeseed is not in abundant supply either, buyers hedge by concluding purchase contracts via the futures exchange. As a consequence, the tight supply has already driven up stock price quotes in Paris. (AMI)

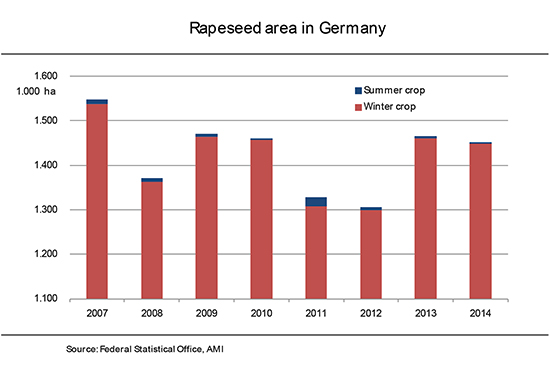

Chart of the Week (32)

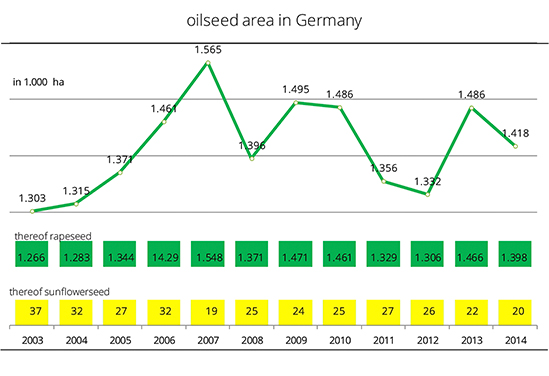

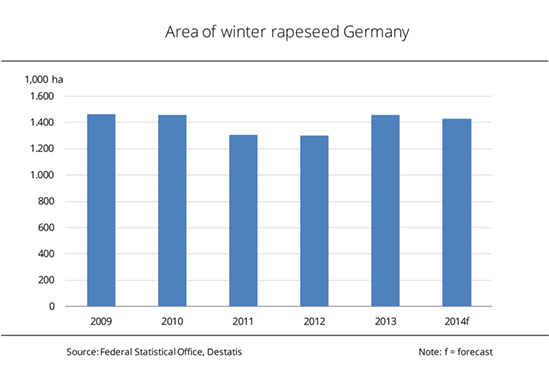

Oilseed production at a high level

Although the area planted with oilseeds for the 2014 harvest dropped by 4.3 per cent, it remains at a high level. In Germany, winter rapeseed is the single most important oil crop, accounting for 97.1 per cent of the oilseed area. Oilseed crops make up 12 per cent of total field crops. In 2010 and 2011, the sowing season of winter rapeseed was virtually thwarted by heavy rains in the fall. The expansion of summer rapeseed area failed to offset the resulting dip in rapeseed yields from the 2011 and 2012 harvests. Sowings for the 2013 harvest season were on schedule so that the area planted with rapeseed increased to more than 1.46 million hectares. Rapeseed area for the 2014 harvest was just under this figure, but at 1.4 million hectares, it was still higher than average. Rapeseed harvesting is still ongoing in many parts of Germany. Although farmers have been happy with crop yields so far, the output falls short of last year's top figures. (AMI)

Chart of the Week (31)

Growing supply of rapeseed meal sends prices plummeting

Following the beginning of the rapeseed harvest in the EU rapeseed producing countries in July 2014, a significantly larger supply of feedstock is now available to German processors. This beats down prices, which have dropped sharply, by nearly EUR 90 per tonne, since March. At the beginning of the year, the very tight supply of nearby material sent prices up. In the months that followed, spot commodity prices were largely determined by regional availability and demand. By contrast, prices asked for later positions were continuously adapted to the trends in Paris futures market quotations for rapeseed. Prospects of convenient feedstock supply in 2014/15 for some time led to massive price reductions. In July 2014, demand for rapeseed meal rose considerably as prices declined steadily. However, since nearby supply increases only slowly, asking prices have most recently been raised again. (AMI)

Chart of the Week (30)

Price for biodiesel close to hitting four-year low

At the end of July 2014, the wholesale price for biodiesel stands at 68 euro cents per litre, around 16 cent below the price for agricultural diesel. Due to the massive drop in rapeseed prices in the wake of the harvest and with prospects for a convenient global oilseed supply in 2014/15, prices of rapeseed oil, and consequently also biodiesel, have recently plummeted. They plunged significantly more sharply than prices for agricultural diesel. As a result, the price spread between the two fuels has widened by 7 cent since the beginning of 2014 alone. Asking prices for rapeseed oil fell to the lowest level since 2010. The price for agricultural diesel hit its lowest level since the beginning of 2011. However, demand for biodiesel is fairly low at the moment, because traders are speculating for a continued decline in vegetable oil prices as the rapeseed harvest is in progress all across Germany. (AMI)

Chart of the Week (29)

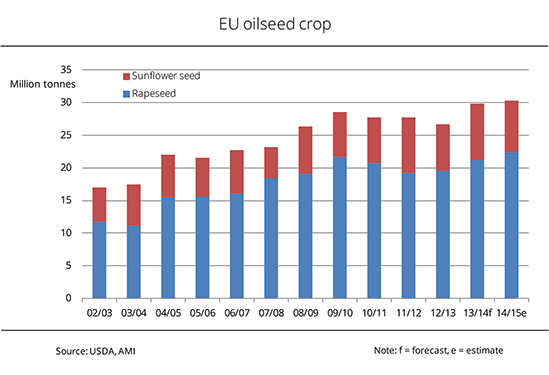

EU oilseed production slightly increases from previous year

Europe is expected to produce more oilseed in the 2014/15 marketing year than the previous year. USDA put the total output at around 32.3 million tonnes, expecting the crop to outpace the long-term average by 7 per cent. USDA even raised its forecast of European rapeseed production by 0.4 million tonnes to 22.4 million tonnes from the previous month. This would be an increase of just under one tenth compared to the long-term average. The surge is based on the very healthy condition of the oilseed rape field crops in the EU oilseed producing countries. It is also confirmed by a few first positive crop reports. The German Raiffeisenverband also recently upheld its optimistic harvest estimate. The organisation estimates the rapeseed crop yield at 5.9 million tonnes, based on a slightly increased rapeseed area. Prospects for sunflowers are not as encouraging as they are for rapeseed. In other words, 2014 EU harvest figures are expected to drop slightly from the previous year. USDA cut last month's forecast by 200,000 tonnes to 7.9 million tonnes. (AMI)

Chart of the Week (28)

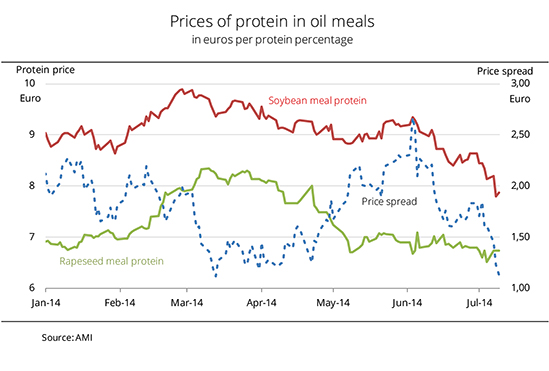

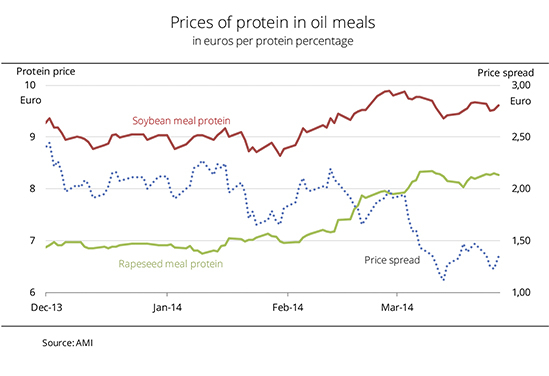

Price spread between soybean and rapeseed meal protein decreases markedly

The protein price spread between soybean and rapeseed meal, calculated from the spot market price and protein content, hit a preliminary 2014 low at approximately EUR 1 in mid March, followed by a massive rise. In other words, rapeseed meal prices slumped between the end of April and mid May, whereas asking prices for soybean meal largely maintained their high level, based on scarce supply even early in the season. As a result, the spread between the theoretical rapeseed protein price and that of soy protein virtually doubled. Soybean meal prices have practically been in steady decline since June as futures quotes for soybeans and soybean meal are coming down. In contrast, asking prices for rapeseed meal are supported by tight nearby supply. Consequently, the difference in price between the two proteins has recently melted down to EUR 1.13 per tonne. (AMI)

Chart of the Week (27)

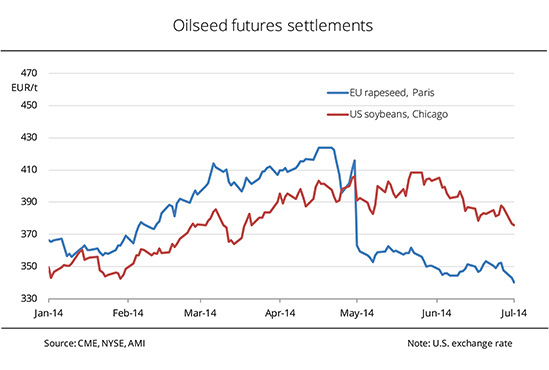

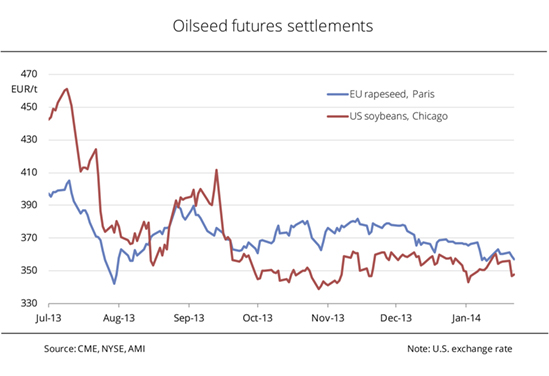

Oilseed prices head downward

Chicago and Paris oilseed prices have dropped sharply over the past few days. Above all, soybean prices were hit as USDA published its estimate of acreage and quarterly stocks report. USDA put the soybean planted area for the 2014 harvest at just under 34.3 million hectares, up 11 per cent from the previous year. At an average yield of approximately 30 decitonnes per hectare, the soybean harvest would amount to considerably more than 100 million tonnes, the highest quantity ever. At the same time, USDA published another positive report on the condition of soybean crops. This appraisal drove Chicago soybean prices down further. However, the very tight 2013/14 US supply balance (presumably showing the lowest US soybean stocks in ten years) puts a limit to the price slide. The current slump in soybeans has also dragged down rapeseed prices in Paris. The nearby dropped by almost EUR 10 per tonne within one week, staying barely above the EUR 340 tonne mark. (AMI)

Chart of the week (26)

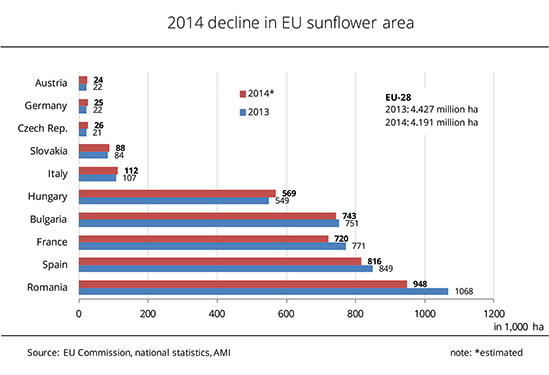

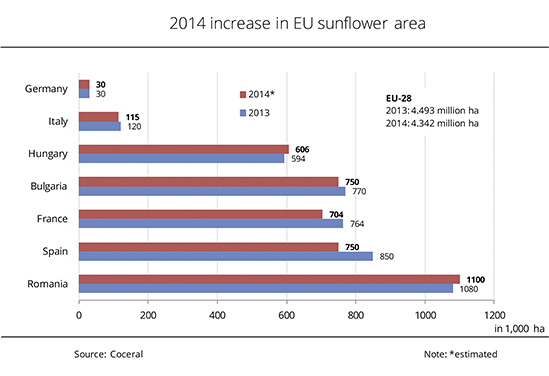

EU sunflower production is on the decline

In the wake of last year's large sunflower crop and the resulting price slump, EU farmers reduced the area planted with sunflowers this year. The shrinkage in area across the EU was just under 5 per cent. The main production regions in particular saw a dramatic reduction in sunflower area. Romanian farmers apparently cut the production area for the 2014 harvest by around 11 per cent. Spain saw a 11 per cent dip, France 9 per cent and Hungary 4 per cent. In these four countries alone, the area was reduced by more than 250,000 ha. The 19,000 ha expansion in sunflower area in Germany, Austria, Italy and Slovakia can hardly offset this reduction. However, the 2014 decline in EU sunflower output will not only be due to the reduction in area planted. Crop yields are also expected to fall short of the previous year's high figures. In 2013, EU sunflower yields averaged 20.5 decitonnes per hectare. The 2014 crop yield is estimated at 19.3 decitonnes per hectare, putting the total harvested amount at 8.07 million tonnes. (AMI)

Chart of the Week (25)

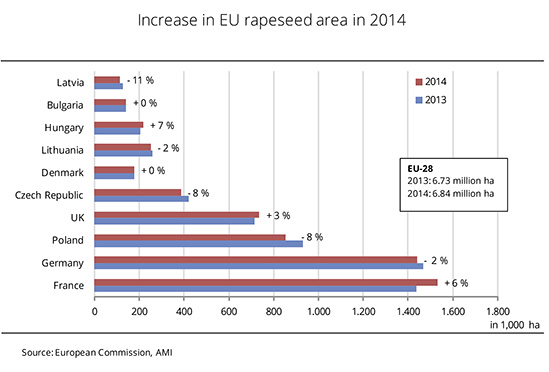

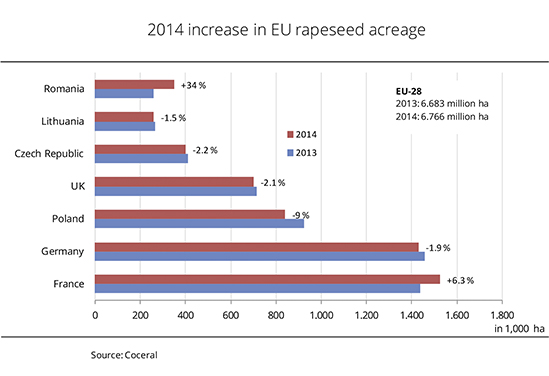

EU rapeseed production increases sharply

The massive increase in EU rapeseed production for the 2014 harvest is not only based on expansion of area, but also on climbing yields. The EU Commission estimates the crop at 21.2 million tonnes. Other analysts consider this figure very conservative, occasionally even talking of a bumper crop of 22 million tonnes. The rapeseed area for the 2014 harvest is expected to rise by 0.7 per cent to 6.8 million hectares. Above all, France, Hungary and Romania, but also Great Britain expanded their acreage of winter rapeseed. Virtually all other EU states are seeing a decline from the previous year. Along with the slight increase in total rapeseed area, yields are also expected to climb this year. Above all, France and Great Britain (these countries had to cope with wet weather last year) expect a return to standard yield levels at 10 to 20 per cent above the previous year's figures. The Commission's estimate puts yields across the EU at 3.12 tonnes per hectare. This would translate to a 0.5 per cent rise year-on-year. (AMI)

Chart of the Week (24)

German rapeseed area on a slight downward trend

The area planted with winter rapeseed in Germany for the 2014 harvest is just less than 1.45 million hectares. This figure is down 12,000 ha from the previous year, but still exceeds the long-time average by 50,000 ha. In all German states except Brandenburg, Lower Saxony, Saxony-Anhalt and Thuringia, the winter rapeseed area has declined. The biggest rise from 2013 (up 3 per cent) was seen in Saxony-Anhalt. At the same time, Rhineland-Palatinate experienced the sharpest drop (down just less than 5 per cent). Production of summer rapeseed is again massively reduced. Only 4,000 ha will likely be planted in Germany in 2014. This would translate into a slump by one third compared to the previous year and by more than one half compared to the long-time average. As growing conditions are very good, yields of winter rapeseed promise to be high, falling little short of last year's above-average 39.5 decitonnes per hectare. (AMI)

Chart of the week (23)

German biodiesel exports are higher than average

German biodiesel exports rose sharply in the first quarter of 2014, outstripping the long-term average by 60 per cent. At 398,000 tonnes, exports were up one fifth on the same period last year. The Netherlands received one third of total exports. This translates to a 30 per cent rise and leaves the country in first place. Exports to France, Spain and Norway rocketed by more than 100 per cent. Biodiesel exports to Spain shot up to 30,370 tonnes, from only 65 tonnes in the same period last year. France received twice this amount, advancing to second place. About 99 per cent of German biodiesel exports went to EU countries. By contrast, biodiesel exports to the US have nearly died down. They slumped to insignificant 6 tonnes, from more than 18,000 tonnes a year ago. New on the list of recipients is the aviation and shipping sector, which received 2,040 tonnes of biodiesel. (AMI)

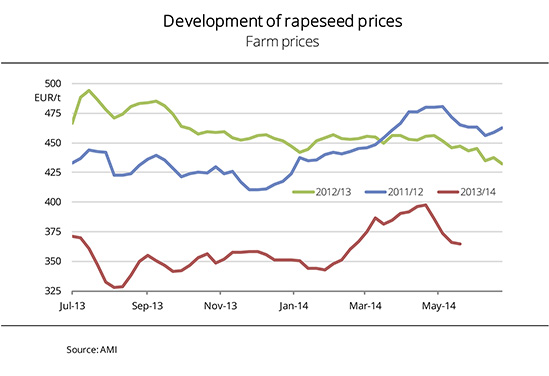

Chart of the Week (22)

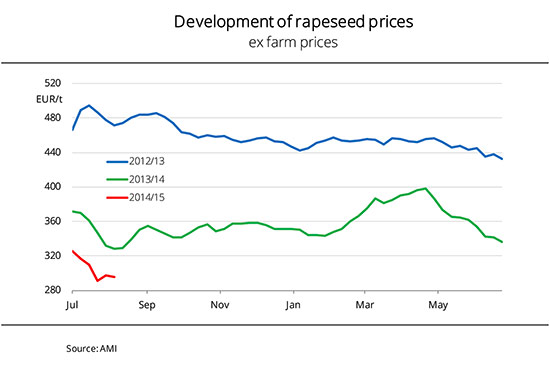

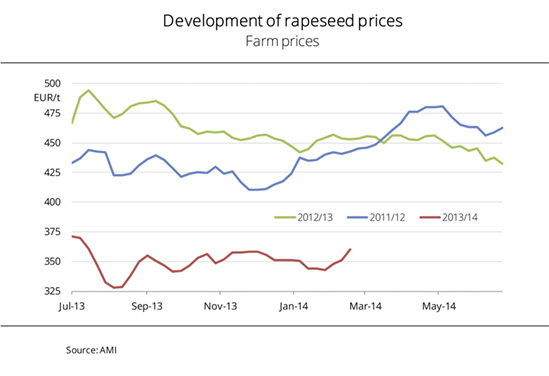

Rapeseed prices are in steep decline

In the second half the 2013/14 marketing year, German farm prices for rapeseed continue to remain considerably below the previous year's figures. After peaking at EUR 398 per tonne in mid April 2014, they have been on a downward slide ever since. In general, the rapeseed market lacks momentum. Prices reported for old-crop rapeseed are virtually of purely nominal nature, because rapeseed from the 2013 crop is hardly on offer and some stocks have already been cleared. Ex farm prices were reported at an average of around EUR 365 per tonne, down EUR 33 per tonne from their April high. Processors show little need and bear up until the new crop is available, in the expectation that it will be associated with the usual pressure on prices. On both sides, interest in contracts also continues to be below average. Farmers hope that prices will climb again. (AMI)

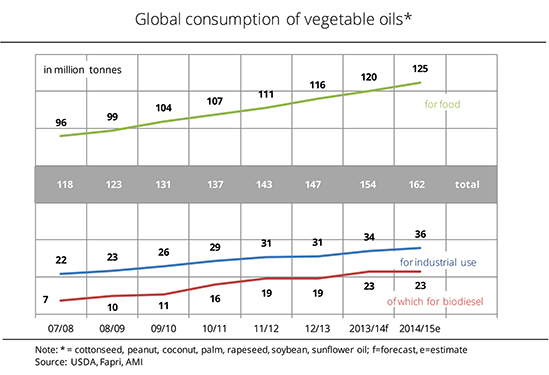

Chart of the Week (21)

Consumption of food oils increases steadily

The USDA forecasts a continued climb in the consumption of vegetable oils in 2014/15. Global demand is expected to rise to approximately 162 million tonnes, up just under 6 million tonnes from the previous year. Nearly 80 per cent will likely be used as food oil, the remaining one fifth for industrial purposes. Demand for use in biodiesel fuel production remains at the same level as a year ago. The global rise is primarily prompted by an increase in demand for palm oil. Consumption of palm oil alone is expected to amount to around 60.5 million tonnes in 2014/15. This would be 3.2 million tonnes up year-on-year. The combined rise in consumption of all other oils is only 3 million tonnes. As a result, the percentage of palm oil in total vegetable oil consumption will likely grow by 5.6 per cent to 37 per cent. The second most in-demand vegetable oil is soybean oil, at a proportion of just under 30 per cent, up 3.2 per cent from 2013/14. Global demand for rapeseed oil is on the increase. It will likely surge 3.9 per cent to 26 million tonnes. (AMI)

Chart of the Week (20)

2014 US soybean output at a record level

The USDA gives an optimistic outlook on soybean production. The 2014/15 global soybean production is expected to increase to just under 300 million tonnes, rising by more than 5 per cent. This would be by far the largest amount of soybeans ever produced. The USDA forecasts the US soybean output at nearly 99 million tonnes, up 11.4 million tonnes from the previous year. The crop forecast for Brazil and Argentina is also raised. Although rains have interfered with soybean harvest operations in Argentina, identified yields are higher than previously expected. The Buenos Aires Cereal Exchange raised its harvest estimate to 55.5 million tonnes. However, the USDA left its original forecast unchanged at 54 million tonnes. For Brazil, the 2014 crop is estimated at 87.5 million tonnes. This would be a 5.5 million tonne rise from the previous year, hitting a new record. (AMI)

Chart of the week (19)

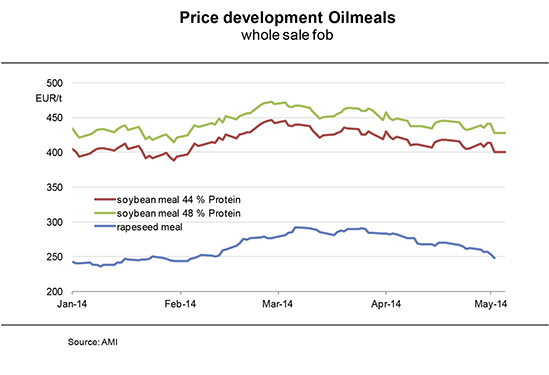

Oilseed meals at same price level as at the beginning of the year

Prices for 44 % soybean meal rose from EUR 405 per tonne at the beginning of 2014 to EUR 435 per tonne in mid March. Since then they have trended downward to EUR 400 per tonne, down EUR 27 per tonne on the previous year. Asking prices for rapeseed meal were up just under 20 per cent by the end of March, reaching their preliminary 2014 peak at EUR 290 per tonne. They have been on a steady decline since, now standing at EUR 248 per tonne. This is EUR 64 per tonne down on the same time a year ago. Compared to the previous year, the price spread between these oilseed meals has widened by EUR 37 per tonne to EUR 152 per tonne. (AMI)

Chart of the week (18)

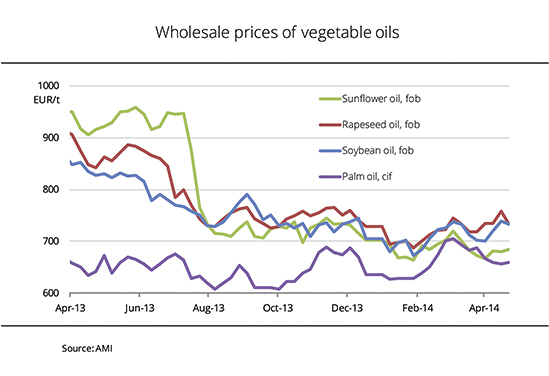

Vegetable oil prices are close

Never before have vegetable oil prices in Europe been as close as at the beginning of March 2014. The spread between the highest and lowest-priced vegetable oils was only EUR 26 per tonne. By comparison, in the previous year it amounted to EUR 250 per tonne. The reasons were the significant drop in the soft oils group on the one hand and the strong approximation of palm oil prices on the other. Due to the foreseeably tight supply, palm oil prices had jumped to levels that for some time even exceeded those of sunflower oil. At the same time, sunflower oil was down to the lowest price level in a long time. Ample supply resulting from the global bumper crop has beaten prices down. As a result, current marketing year sunflower oil prices have mostly even been lower than those for rapeseed or soybean oil. Not until the past few weeks have asking prices varied more strongly again. Due to the scarce supply of feedstock, rapeseed and soybean oil prices picked up again, whereas palm and sunflower oil continued their downward slide. (AMI)

Chart of the week (17)

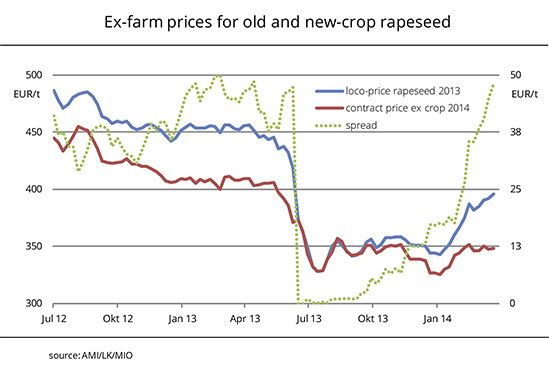

Rapeseed: Different price level, but same spread

The price gap between bids for spot rapeseed and new-crop shipments recently stood at just under EUR 50 per tonne, the same high level as a year ago. However, prices are at an entirely different level, around 15 per cent below the previous year's. Whereas processing margins for nearby positions support the high level of rapeseed prices, oil mill owners point out that the calculation base for the new crop is unsatisfactory, preventing premiums being accepted on prices for futures in Paris. Nevertheless, a EUR 13 per tonne mark-up was granted locally for the scarce spot supply. Since supply of old-crop rapeseed is tight, the large price spread will likely continue until the new harvest begins. However, harvest could start one month earlier this year than last year. (AMI)

Chart of the week (16)

Palm oil production increases substantially

Global vegetable oil production will likely continue to grow. According to information published by the USDA, global production in the current marketing year 2013/14 amounts to 169.5 million tonnes, approximately 9 million tonnes more than the previous year. Palm, soybean, rapeseed and sunflower oil are estimated to account for around 86 % of the total quantity. Since 2006/07, palm oil has ranked first in quantity produced. It has also shown the steepest increase in production over recent years. Palm oil production in the current marketing year is estimated at 58.5 million tonnes, up around 2.7 million tonnes from the previous year. Production of the other oils is also likely to grow compared to the previous year. The USDA expects the 2013/14 soybean oil supply to rise by around 4 percent to 44.6 million tonnes. Rapeseed oil production will also likely increase by 4 percent, to 26 million tonnes. Following the decline in the 2012/13 marketing year, supply of sunflower oil will surge by 2.4 million tonnes. The key reason for the rise in vegetable oil production is that supply of feedstock has stepped up considerably from the previous year. (AMI)

Chart of the week (15)

Fewer sunflowers in the EU-28

According to information published by Coceral, the European grain and oilseed traders' association, fewer sunflowers will be grown in the EU-28 in 2014. The estimated sunflower area (4.3 million hectares) is down around 3 per cent from the previous year's figure. The key reason is that the estimate of production areas in France and Spain was reduced. Coceral puts the decline at just under 8 percent in France and around 12 per cent in Spain. The anticipated expansion in area in other EU member states such as Romania and Hungary cannot offset the drop. Coceral forecasts an increase in average yields in the 2014 harvest in some sunflower producing countries (including the main producer, France), whereas yields per hectare in South European EU member countries are seen to decrease. Consequently, overall sunflower production is expected to decline. The 2014 sunflower crop in the EU-28 is forecast at 7.7 million tonnes, down around 13 per cent from 2013. (AMI)

Chart of the week (14)

EU rapeseed area expands

EU trade associations and the EU Commission estimate the rapeseed area for the 2014 harvest slightly higher than the previous year's figure. Coceral, the European grain and oilseed traders' association, estimates the rapeseed area in the EU-28 at 6.76 million hectares, up nearly 83,000 hectares from 2013. The forecast expects the area in most EU countries to decline or hardly deviate from the previous year's levels. However, an increase in production area is forecast for Romania, Bulgaria and France. Currently, drought is raising concerns about crop damage, especially in Eastern European countries. The first estimate puts the 2014 EU rapeseed crop at 21.15 million tonnes, up just under 400,000 tonnes from the previous year. (AMI)

Chart of the week (13)

Prices of rapeseed meal protein soar

Since the beginning of February 2014, oilseed meal prices have surged sharply, with rapeseed meal outdoing soybean meal. The reason for the steeper rise of rapeseed meal prices was that the feedstock price firmed on climbing forward prices. Consequently, rapeseed meal has lost some of its competitiveness against soybean meal. The protein price spread, calculated from the spot market price and the protein content, narrowed rapidly. On 13 March 2014, the theoretical selling price of rapeseed meal protein hit the EUR 8 per tonne mark, thereby approaching the level of soybean meal protein. At EUR 1.12 per tonne, the spread was down to the lowest level in nine months. Most recently, the competitiveness of rapeseed meal against soybean meal has seen a slight increase. Whereas prices of rapeseed meal changed only modestly, soybean meal picked up sharply as feedstock prices climbed. (AMI)

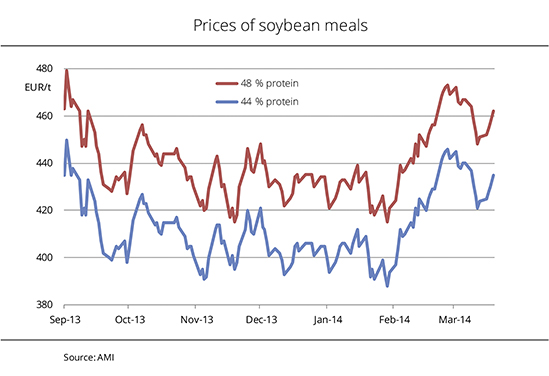

Chart of the week (12)

High soybean meal prices curb buyer interest

In February 2014, German prices asked for soybean meal climbed EUR 46 per tonne on average, to a level last seen early September 2013. The rise was driven by firm prices for soybeans and soybean meal in Chicago. Processors use the Chicago price trend as a guideline for pricing. At the beginning of March 2014, the surge (both in quotation and in price) stopped for the time being, because the USDA forecast estimated US soybean stocks higher than market participants had previously expected. Moreover, the rapid increase of soybean supply from South America also had a negative impact on prices. However, supply at the German cash market continues to be tight. For this reason, market participants do not expect any major price reductions in the long run, even if US reference prices for soybeans were to drop. Due to the current high price level, demand for soybean meal is slow and trading is rare. Buyers generally only address urgent shortages, especially because price curves slope upward again. (AMI)

Chart of the week (11)

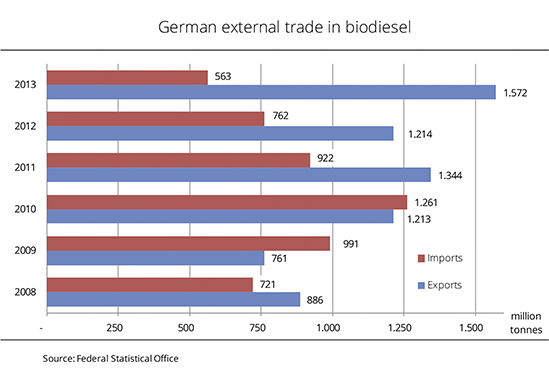

German biodiesel exports prevail over imports

German exports of biodiesel continue to increase. A preliminary estimate by the German Federal Statistical Office puts the 2013 export figure at approximately 1.57 million tonnes, up from 1.2 million tonnes in 2012 which had seen a slight decline. This translates to a more than 20 per cent rise. Five years ago, exports even amounted to only slightly more than half that amount (886,064 tonnes). The main recipients in 2013 were the EU countries, headed by the Netherlands. The latter alone received 37 per cent of total EU shipments (500,000 tonnes), raising their demand by 65 per cent. Austria (150,000 tonnes) and Poland (130,000 tonnes) were a long way behind in second and third place respectively, staying considerably below year-ago levels. The top trading partner outside the EU-28 was for the first time the US, receiving 180,000 tonnes, many times the previous year’s 405 tonnes. Biodiesel imports are on the decline. 2013 imports amounted to 563,500 tonnes, only 75 per cent of the previous year’s amount. Around 98 per cent came from the EU-28 and 342,000 tonnes were obtained from the Netherlands alone. Much of this material was likely imports from third countries and HVO diesel. About 7,585 tonnes came directly from Indonesia. Malaysia supplied only 880 tonnes, 95 per cent less than the previous year. (AMI)

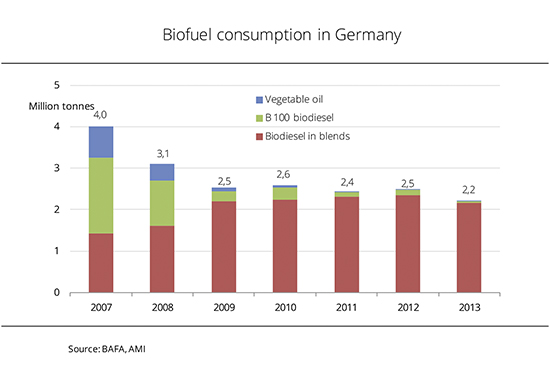

Chart of the week (10)

Use of biofuels decreased in 2013

In 2013, the use of biofuels slightly declined. This applied to both biodiesel and bioethanol. The drop in the proportion of biodiesel was especially sharp in 2013, because at the same time consumption of diesel fuel increased. At 2.2 million tonnes, the use of biodiesel for blending dipped 8 per cent. B100 use collapsed to 30,134 tonnes, from 131,032 tonnes in 2012. Due to the full taxation, B100 is no longer competitive. The theoretical petrol pump price at the end of February 2014 was at 166 euro cents per litre, whereas diesel was just under 139 euro cents per litre. The use of cold pressed rapeseed oil fuel also declined substantially. At 554 tonnes, it was down to only 5 per cent of the year-ago amount. (AMI)

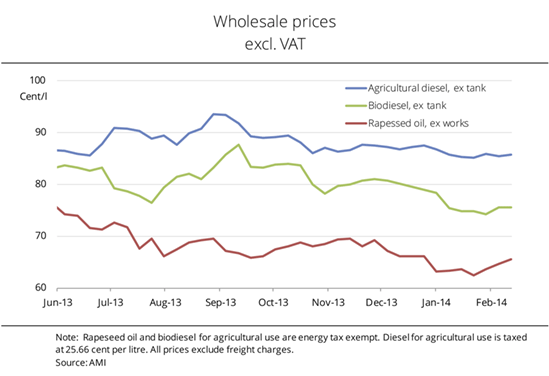

Chart of the week (09)

Competitiveness of biodiesel has increased

German wholesale prices for biodiesel currently stand at 75.58 euro cents per litre, a respectable 10 cents below agricultural diesel. In other words, the price gap between these fuels has widened. Since September 2013, prices for biodiesel have retreated. At the same time, demand and consumption have declined. Market participants expect this trend to stop when the summer fuel arrives by the second quarter of 2014. By contrast, prices for agricultural diesel are relatively stable at around 86 euro cents per litre. The recent sharp jump of crude oil prices in the US is not yet felt in Germany. The lack of impetus in the vegetable oil market drove rapeseed oil prices down. Not until mid January 2014 did firm prices for raw material send rapeseed oil climbing. Although the price slump stopped, prices now stand at 65.47 euro cents per litre, down 19 euro cents per litre year-on-year. In other words, rapeseed oil continues to be an attractive feedstock for producers of biofuels. (AMI)#

Chart of the week (08)

Rapeseed prices jumped

At the beginning of February 2014, farm prices of rapeseed climbed sharply. Most recently, buyers agreed to pay EUR 360 per tonne, EUR 12 per tonne more than earlier this month. However, the price gap against the previous year (EUR 93 per tonne) remains huge. Firm futures market quotations sent cash market prices rocketing. At the moment, soybean output in South America is at the centre of marketers' focus. Poor conditions there caused prices to increase. Moreover, the surprisingly large volume of US soybean exports is also supporting the price rise. In Germany, higher farm prices produced a short-term boom in supply. At the same time, rapeseed farmers showed more interest in marketing the 2014 crop, because contract prices also rallied. Given that the price climb in Paris ended abruptly, it is foreseeable that farm prices will soon be adjusted. (AMI)

Chart of the week (07)

Brazil outperforms US in soybean crop

For the first time in history, the US will only reach the second place among the world's top soybean producers in 2013/14, at an estimated 89.5 million tonnes. Raising the previous month's crop estimate by one million, USDA's current forecast sees Brazil taking the lead with an estimated 2014 soybean output of 90 million tonnes. Argentina, with a soybean outlook of 54 million tonnes, remains third in the list. In the wake of very dry conditions both in December 2013 and January 2014, USDA lowered its crop forecast for Argentina slightly by 0.5 million tonnes. In general, USDA expects the 2013/14 world soybean supply to be convenient. This month's forecast puts global supply at 287.7 million tonnes, up around 7 per cent from 2012/13. Global consumption in 2013/14 (238.7 million tonnes) is forecast to outstrip the previous year's figure by just under 10 per cent. Consequently, global ending stocks for the soybean marketing year could amount to 73 million tonnes, approximately 20 per cent more than at the same time the previous year. (AMI)

Chart of the week (04)

Price trend depends on the weather

On 19 September 2013, prices for soybeans at the Chicago Stock Exchange tumbled below those for rapeseed in Paris after the high expectations on the 2013 US soybean crop were met. In the subsequent months, fluctuations were less pronounced because supply was more comfortable than the past marketing year. Since mid October 2013, rapeseed prices have gradually dropped by EUR 10 per tonne. Soybean prices were relatively stable at a level of approximately EUR 352 per tonne between the end of November 2013 and beginning of January 2014. At the beginning January 2014, prices of rapeseed and soybean temporarily converged as soybeans soared. In Argentina, the drought delayed soybean plantings and led to firming prices as a result. At the same time, China's demand for US soy was huge, sending prices in Chicago rocketing from EUR 349 per tonne to more than EUR 360 per tonne within two weeks. Most recently, improved conditions in Argentina have started to put pressure on prices again. (AMI)

Chart of the week (03)

Palm oil loses competitive advantage

Palm oil has recently lost its competitive edge over mineral oil. Price curves have diverged again. In the summer months of 2013, forward prices for palm oil occasionally even fell below New York crude oil prices. Sluggish demand had led to an excessively large palm oil supply. In July 2013, the Malayan government responded by increasing the blending quota for biodiesel. The aim was to reduce the surplus of feedstock and cut expensive mineral oil imports. The decision also had a short-term impact on biodiesel exports, leading to a significant drop in export figures in August and September 2013. Whereas the spread between prices of palm oil and mineral oil has increased over the past few weeks, prices of soybean oil and mineral oil have been steadily converging. This trend improves the competitiveness of soybean oil for use in biodiesel production. In the US alone, production from January to October 2013 was almost 25 per cent up yearon-year. (AMI)

Chart of the week (02)

Area planted with winter rapeseed has declined slightly

Compared to the area harvested in 2013, the acreage sown with winter rapeseed for the 2014 harvest season is slightly reduced. The German Federal Statistical Office reports that around 1.43 million hectares were sown with winter rapeseed, 1.8 per cent down on the previous year. The biggest drop from 2013, both absolutely and as a percentage, is seen in Mecklenburg-Western Pomerania, at 7 per cent and 18,500 hectares respectively. In North Rhine Westphalia and the Saarland, the decline in winter rapeseed area is estimated at 5 per cent. By contrast, Brandenburg and Lower Saxony report a rise. Saxony, Saxony-Anhalt, Thuringia, Schleswig-Holstein and Hessen all report virtually no changes in area sown. (AMI)

Chart of the week (01)

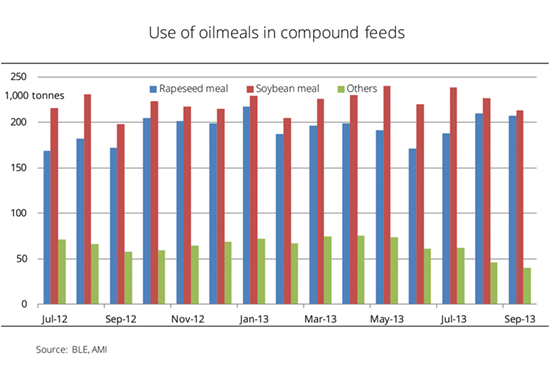

More rapeseed meal processed in compound feeds

The use of rapeseed meal in compound feeds increased significantly over the first three months of the 2013/14 marketing year, to 207,000 tonnes in September 2013, around 20 per cent more year on year. A total of 604,000 tonnes of rapeseed meal was used in compound feeds in the first quarter of the current marketing year. This was 82,000 tonnes up on the same period a year ago. They key reasons were improved availability on the one hand and, on the other hand, higher competitiveness of proteins against other oilseed meals, above all against soybean meal. The use of soybean meal was on the decline, dropping to 213,000 tonnes in September 2013, 6 per cent down from August. However, use has increased from 2012/13. In the first quarter of 2013/14, the amount processed totalled around 677,000 tonnes, up 5 per cent year on year. In other words, rapeseed meal and soybean meal have displaced other oilseed meals, such as sunflower, linseed, palm and coconut meals, from the compounds. The amount of these other oilseed meals used in the compound feed industry dropped from 195,000 tonnes in July/September 2012 to 148,000 tonnes in the same period 2013. (AMI)

Union zur Förderung von Oel- und Proteinpflanzen E.V.

Union zur Förderung von Oel- und Proteinpflanzen E.V.