Charts of the week 2015

Chart of the week (53)

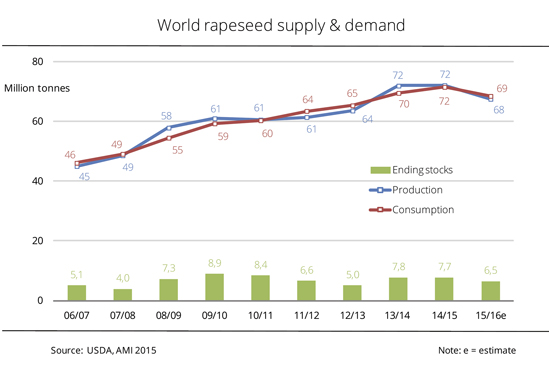

Rapeseed supply is larger than forecast – ending stocks at 6.5 million tonnes

Although the area planted with rapeseed was reduced and yields have come down significantly from the previous year, 2015/16 global supply of rapeseed will probably be better than predicted a few months ago. Ending stocks are forecast at 6.5 million tonnes while the estimate in august 2015 has been around 50 percent lower. Nevertheless, the dip from 2014/15 amounts to around 16 per cent. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), the key reason for the better prospect is that the Canadian harvest estimate has been raised considerably, to 17.2 million tonnes. Thus, rapeseed production surpasses the previous year's level by just under 5 per cent due to a massive rise in yields, whereas the market previously expected a 13 per cent decline. By contrast, Indian farmers are bringing in a significantly smaller harvest due to severe drought. However, the surge in Canadian output and drop in global crushing use more than offset this decline.

Chart of the week (52)

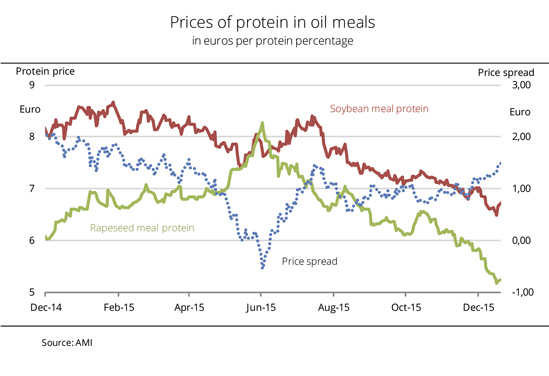

Demand for proteins is slac

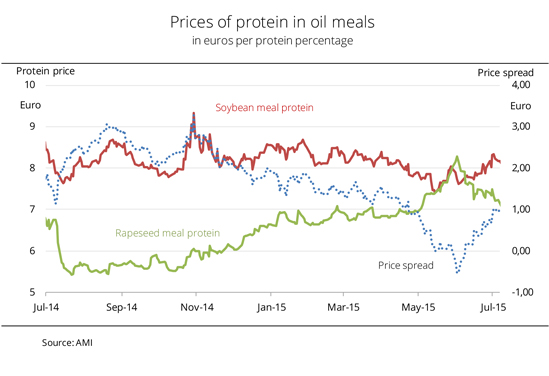

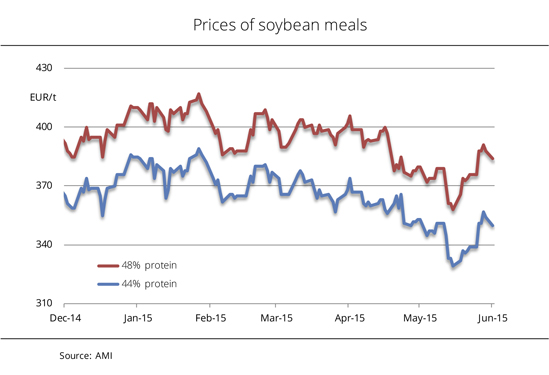

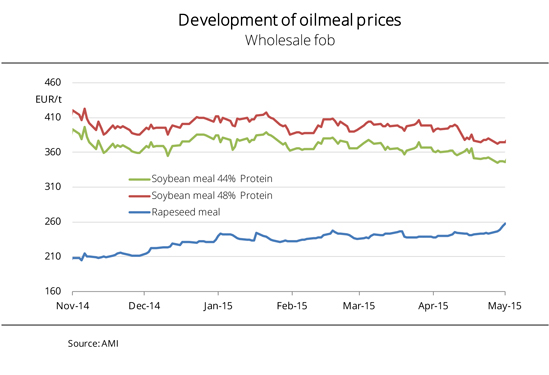

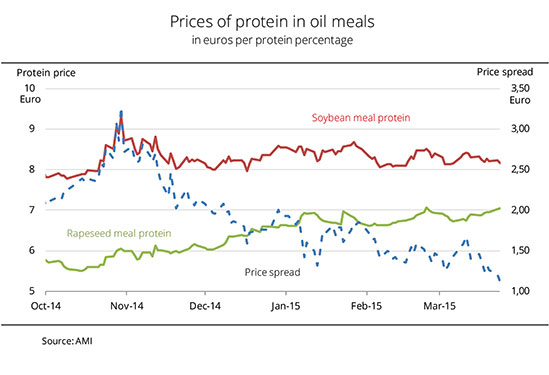

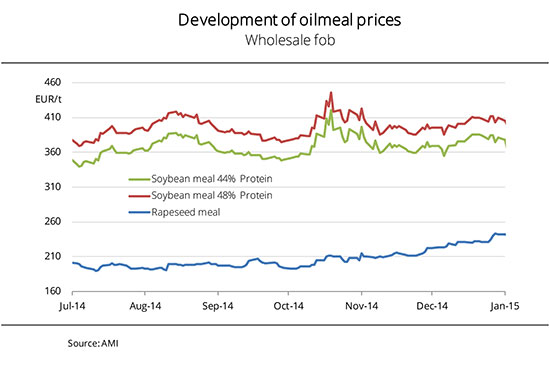

Over the past few months, the difference between prices for rapeseed and soybean meal protein hovered around the level of EUR 1 per protein percentage per tonne. This translates to a 50 per cent drop from a year earlier. Rapeseed meal in particular lost its edge, because its protein prices converged with those for soybean meal protein, Agrarmarkt Informations-Gesellschaft mbH (AMI) reports. At EUR 8.14 per protein percentage at the beginning of June 2015, rapeseed meal protein temporarily even topped soybean meal protein by 25 euro cents. Demand did not pick up, although protein prices dropped substantially in the wake of superabundant supply over the past few months, in some cases hitting lows. In other words, soybean meal hardly benefited from its price advantage. Buyers are stocked up well into the coming year.

Chart of the week (51)

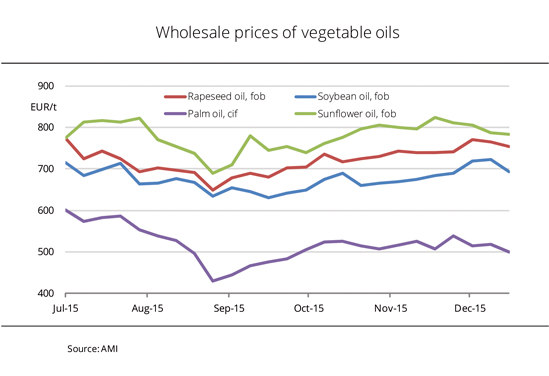

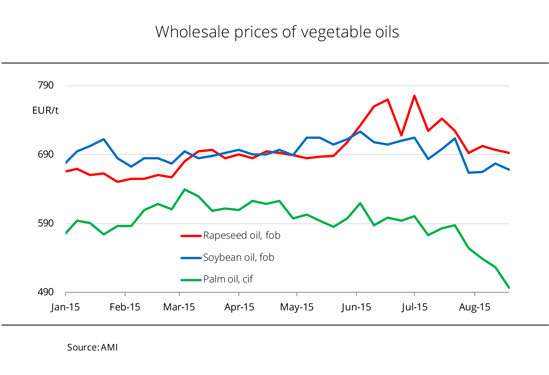

Palm oil continues to lag far behind

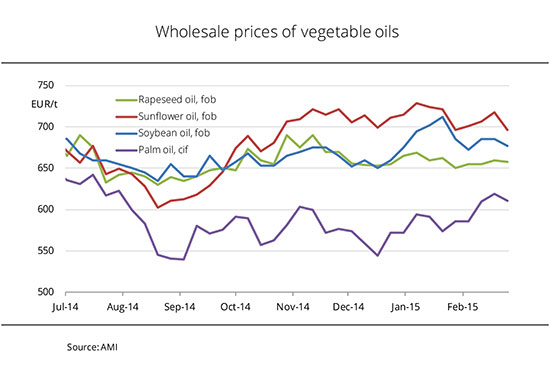

Whereas prices for rapeseed, soybean and sunflower oils are converging, palm oil prices continue to hover around a distant, significantly lower level, trending downward. Sales are virtually non-existent.

December 2015 trade in vegetable oils has been slow. Volatile futures market reference prices for crude oil, soybean oil and palm oil and strong fluctuations of currency dampen the mood and cause concerns among market participants, Agrarmarkt Informations-Gesellschaft mbH (AMI) reports. Demand is slack, especially because buyers are stocked up well into the new year. At the same time, supply is not abundant but adequate, considering the fact that buyer interest is small. Prices for rapeseed and soybean oils eased on weak feedstock reference prices in mid December 2015. Sunflower oil continues to be the most expensive vegetable oil. By contrast, palm oil prices are at a distant, very low level. Slow demand and Malayan supplies hitting a 15-year high put downward pressure on prices both in Kuala Lumpur and on the European cash market.

Chart of the week (50)

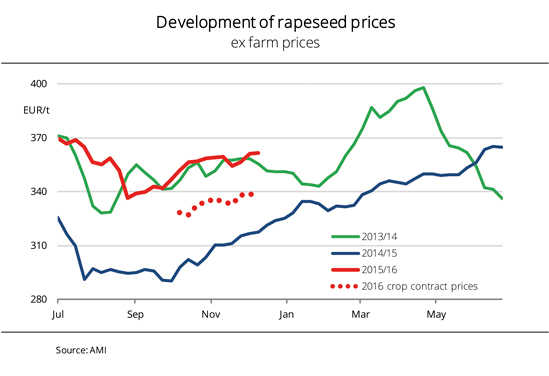

Lethargy returns in rapeseed market

Following several weeks of a lethargic cash market, early-December 2015 rapeseed sales were slightly up based on rising bids and somewhat increased supply. Meanwhile, the market has returned to a state of quiet.

Above all, the 2016 crop was discussed fairly frequently at the beginning of December and contracts were concluded sporadically. Wholesale prices for the upcoming crop hovered around EUR 360 per tonne, up approximately EUR 30 per tonne from a year earlier. According to information published by Agrarmarkt Informations-Gesellschaft mbH (AMI), processors still face gaps in demand, first and foremost for further forward positions. However, they continue to complain that margins are unsatisfactory, above all due to very slow sales of rapeseed meal. In the light of this, premiums for rapeseed have been unchanged for several weeks. Producers still have the majority of their stocks to sell, but will probably not address themselves to marketing until the coming year. Oilseed rape field crops are in a good condition and, despite unusually mild November temperatures, not in too advanced a stage of growth to go into dormancy.

Chart of the wee (49)

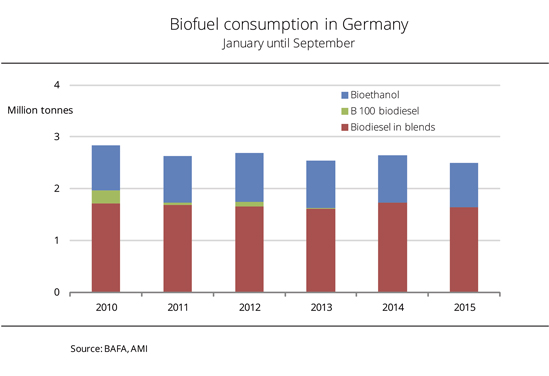

Biodiesel consumption continues to decline

German biodiesel consumption is on the decline in 2015. According to figures just published by the Federal Office for Economic Affairs and Export Control (BAFA), it dropped particularly sharply in September 2015.

At around 165,000 tonnes, the use of biodiesel in blends was down around 15 per cent from the same month the previous year. By contrast, demand for mineral diesel is brisk, rising 1 per cent in the wake of low crude oil prices, Agrarmarkt Informations-Gesellschaft mbH (AMI) reports. In the light of this, the blending quota of biodiesel fell to 5.15 per cent, from 5.85 per cent in August 2015 and just less than 6 per cent in September 2014. This is the lowest level seen since April 2013. Over the year as a whole, the blending quota of biodiesel until September 2015 amounted to 6 per cent, down 0.5 percentage points from the year-ago level. September 2015 consumption of bioethanol declined from the previous month, but was stable compared to the same month the previous year. The blending quota saw a slight rise to 6.5 per cent due to a drop in petrol consumption.

Chart of the Week (48)

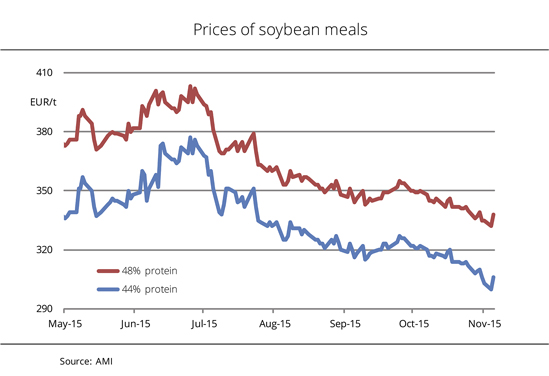

Soybean meal prices drop sharply

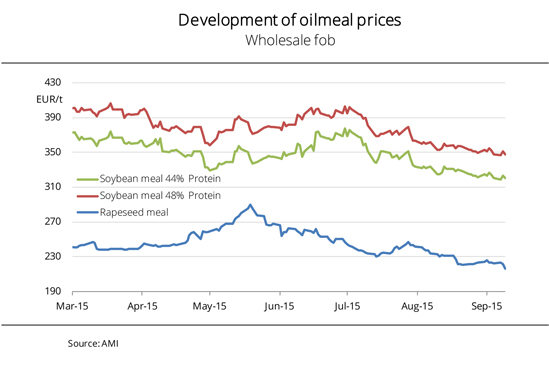

Prices of soybean meal have dwindled considerably. Nearby material is currently down almost one fifth from the July 2015 figure. Downward pressure on prices came, first and foremost, from weak US reference prices for soybean meal and sluggish demand.

Chicago prices for soybean meal have fallen significantly since the summer in the wake of another large feedstock harvest and extensive processing in the US. Agrarmarkt Informations-Gesellschaft mbH (AMI) reports that the nearby has dropped by one fourth since July 2015. Asking prices on the German cash market were also lowered considerably in view of weak cash prices on the futures market. At EUR 306 per tonne, low-protein soybean meal (44%) fob Hamburg most recently was down EUR 71 per tonne from mid July. High-protein material (48%) was reduced by EUR 65 per tonne, to EUR 338 per tonne. Supplies continue to differ greatly between North and South Germany. In the south, nearby supplies will be sold out by the beginning of the new year. January futures cost around EUR 20 per tonne more in the south than in the north.

Chart of the Week (47)

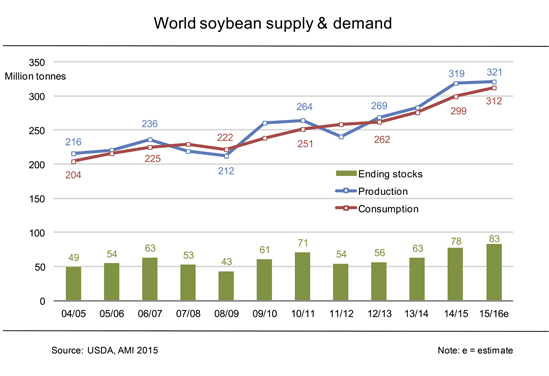

USDA raises estimate of US soybean harvest considerably

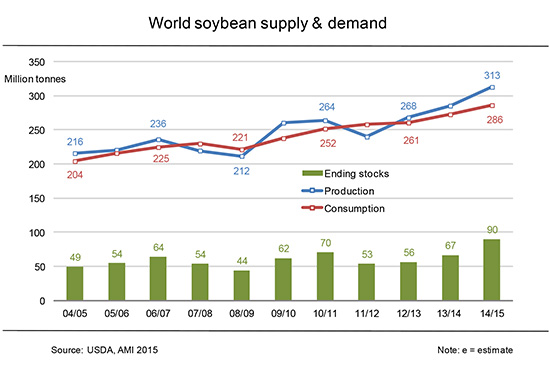

This year's US soybean harvest has apparently broken the previous year's record after all due to unexpectedly high yields. At the same time, seeding conditions in South America are so good that observers are seeing clear signs of world supply hitting a record in 2015/16.

According to Agrarmarkt Informations-Gesellschaft (AMI), USDA raised its estimate of US soybean production massively by 2.5 million tonnes in November 2015. If realized, the currently projected output of 108 million tonnes would outpace the previous year's record high by 1.5 million tonnes. USDA's significant adjustment is based on higher yields. The average crop yield per hectare is now put at 32 decitonnes. This is an all-time high. Global soybean production in 2015/16 is now estimated to increase to 1.5 million tonnes above the previous year's level. The forecast is unchanged for South America (100 million tonnes in Brazil and 57 million tonnes in Argentina) and lower than previously for India. Despite enormous production figures, final stocks as at the end of the 2015/16 marketing year could be significantly lower than originally expected as the export trade picks up and global processing increases, especially in China and Argentina. However, at 83 million tonnes, global soybean stocks would still be at the highest level ever recorded.

Chart of the week (46)

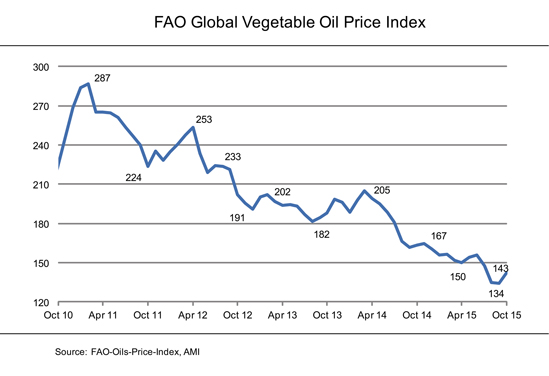

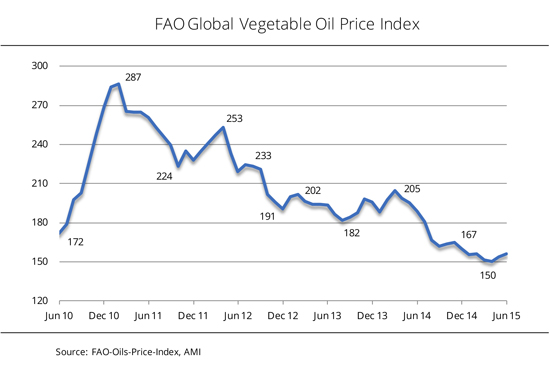

FAO vegetable oil price index sees turnaround

The FAO oil and fat price index is past its six-and-a-half-year low of 134 points hit in September 2015. Following a massive rise of more than 6 per cent, it averaged 143 points in October. This translates to a three-month high.

According to Agrarmarkt Informations-Gesellschaft (AMI) the index was first and foremost driven by rising prices for palm oil, the single most important vegetable oil included in the index. In other words, prices have recovered from their summer low in the wake of prospects for a slump in Southeast Asian (especially Indonesian) production, El Niño and surging demand on the global market. At the same time, prices for soybean oil also climbed on occasionally keen buyer interest and difficult sowing conditions in Brazil, South America's top soy producing country. The index also went up due to the bullish effect of declining global supplies of rapeseed and sunflower oil.

Chart of the week (45)

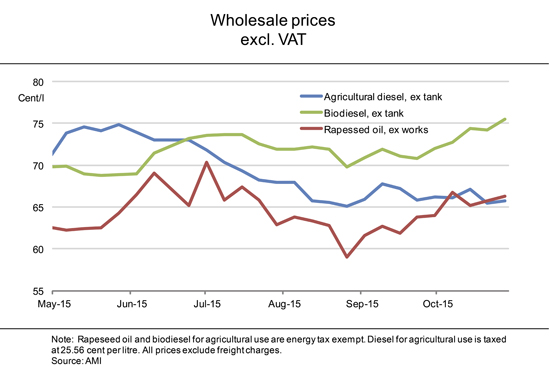

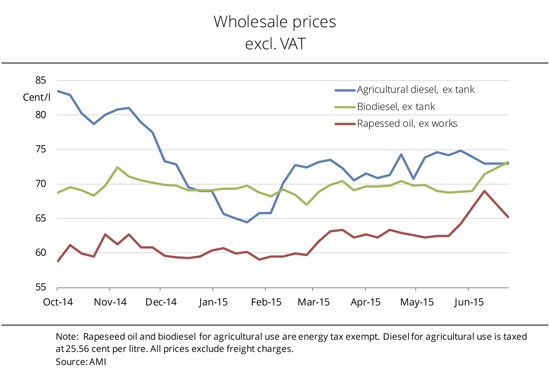

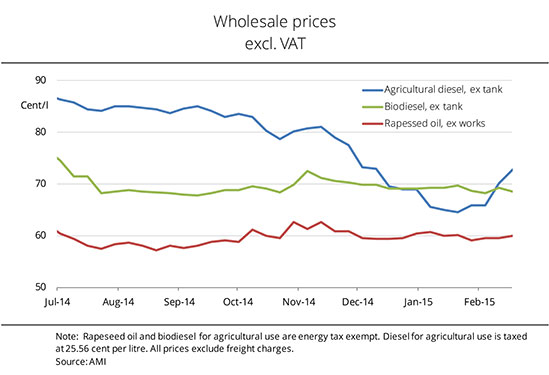

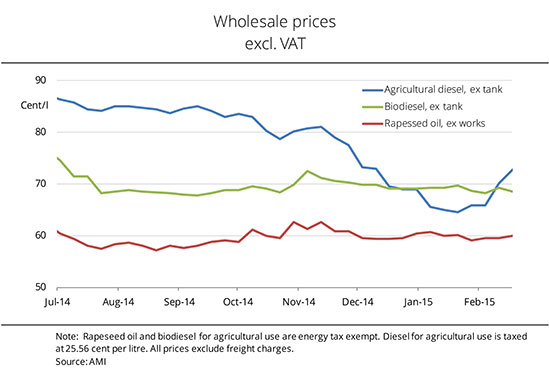

Prices for agricultural diesel and biodiesel diverge

The gap between wholesale prices for biodiesel and agricultural diesel has widened considerably over the past few weeks. By contrast, rapeseed oil and agricultural diesel are at virtually the same level.

At the end of October 2015, the wholesale price for biodiesel stood at around 75.60 euro cents per litre, excluding energy tax, thus exceeding the price for agricultural diesel by nearly 10 euro cents per litre. According to Agrarmarkt Informations-Gesellschaft (AMI), this was the highest price level since June 2014. The massive surge of biodiesel prices was due to rising feedstock costs, buoyant demand of RME in front of the cold season and high freight costs in the wake of low water levels of major waterways. At the same time, prices for agricultural diesel were under downward pressure from weak futures quotes for crude oil, dropping to a two-month low of, on average, 65.70 euro cents per litre. Rapeseed oil prices have been fairly firm over the past few weeks as buyer interest rose and supplies dwindled. Most recently, prices for rapeseed oil were at virtually the same level as those for agricultural diesel, at around 66.30 euro cents per litre for deliveries fob Hamburg.

Chart of the week (44)

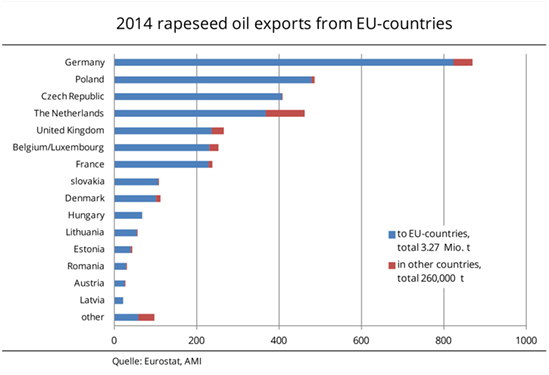

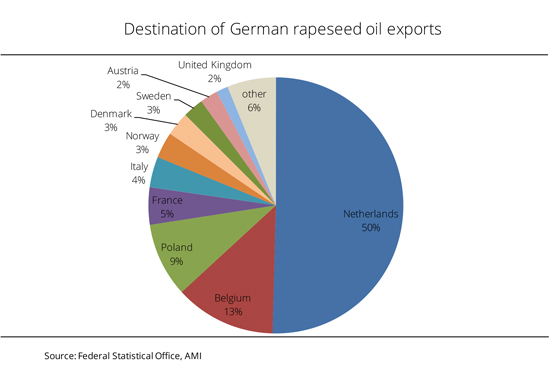

German rapeseed oil is in high demand in the EU

In 2014, exports of the EU-28 member states to third countries amounted to 260,000 tonnes in total. At the same time, trading of rapeseed oil within the Community was in excess of eleven times this quantity, totalling 3.3 million tonnes.

According to Agrarmarkt Informations-Gesellschaft GmbH (AMI), Germany was the single most important supplier in the intra-Community trade, delivering around 823,400 tonnes. The country was followed, a long way behind, by Poland, the Czech Republic and the Netherlands. In 2014 exports to third countries, German origins ranked second, at just under 46,100 tonnes, behind the Netherlands. The latter shipped 93,800 tonnes to non-EU countries, some of which was likely rapeseed oil from German oil mills. These figures highlight the role of the Netherlands as a hub of international trade. Great Britain took third place, exporting 29,600 tonnes to third countries.

Chart of the week (43)

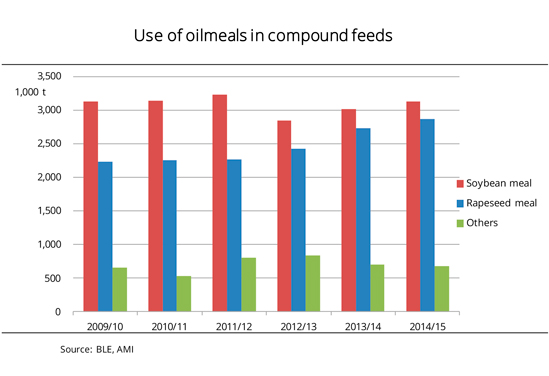

More and more rapeseed meal is used in compound feeds

The use of oilseed meals in compound feeds continued to rise in the past marketing year, reaching just less than 6.7 million tonnes. This translates to a 3.4 per cent rise from 2013/14. At the same time, the trend in oilseed use was mixed. Rapeseed and soybean meal went up, whereas at a total of 671.00 tonnes, the use of other oilseed meals, such as sunflower, linseed, palm and coconut meals, dropped again, sliding below the long-term average. Rapeseed meal surged by 5 per cent, to 2.9 million tonnes, and soybean meal by 4 percent, to 3.1 million tonnes. Consequently, the two oilseeds are increasingly converging. Whereas five years ago, these figures differed by just under 900,000 tonnes, by 2014/15 the difference had melted down to 265,000 tonnes. And this had nothing to do with prices advantage. In 2009/10, low-protein soybean meal (44 %) cost twice as much as rapeseed meal (EUR 300 per tonne fob). In 2014/15, it was only 60 per cent more expensive. (AMI)

Chart of the week (42)

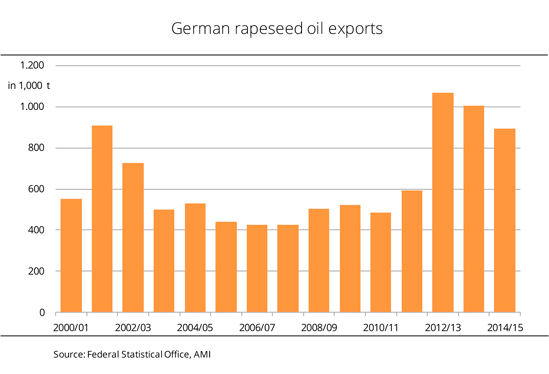

Rapeseed oil exports continued to decline in 2014/15

German exports of rapeseed oil continued on a downward trend in 2014/15. At not even 900,000 tonnes, foreign sales were down virtually 11 per cent from 2013/14. Around 94 per cent went to other EU states. This was a significant rise from the previous marketing year's 86 per cent. Like the previous year, around 4 per cent was supplied to the EFTA states (Iceland, Norway, Switzerland) in 2014/15. Israel took the majority of the remainder (around 9,000 tonnes). At just under 451,000 tonnes, the Netherlands, platform for international trade, were again the main EU buyer of German rapeseed oil, followed by Belgium (114,000 tonnes). Poland imported a total of 84,000 tonnes. This was down almost one third from a year earlier, relegating the country to third place. The key reason for the massive drop in German exports is that Chinese demand has slowed significantly. In other words, the country only ordered 173 tonnes in the entire marketing year. A year previously, Chinese purchases amounted to nearly 83,000 tonnes. (AMI)

Chart of the week (41)

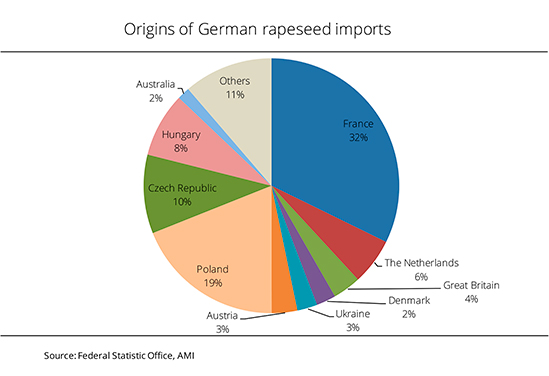

German rapeseed imports from EU countries increased in 2014/15

In the 2014/15 marketing year, Germany received 4.7 million tonnes of rapeseed from abroad, 10 per cent more than the previous year. The largest part came traditionally from France (just over 1.5 million tonnes). Consequently, imports from France more than doubled over the past three years. Like the previous year, Poland was the second largest supplier in 2014/15, delivering nearly 900,000 tonnes. The was up just over one fourth from 2013/14. The Czech Republic took third place again. German imports from there amounted to approximately 472,000 tonnes, dropping just slightly from a year earlier. Just over 94 per cent of total German rapeseed imports came from EU countries. This was a 5 per cent rise from 2013/14. Meanwhile, imports from the two key third countries delivering rapeseed to Germany (Australia and Ukraine) dropped sharply. Rapeseed imports from Australia slumped by nearly one third, whereas those from Ukraine nearly dropped by half. (AMI)

Chart of the Week (40)

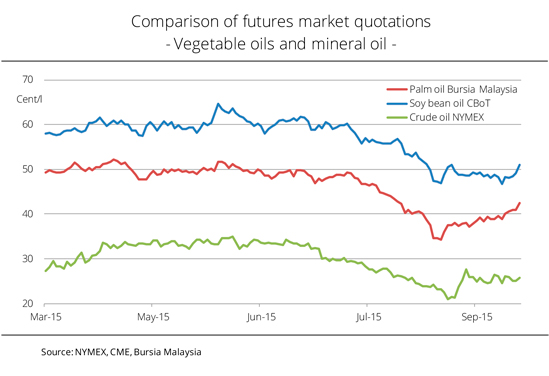

Crude oil prices continue at record low level, vegetable oil prices are under downward pressure

Prices for soybean and palm oil are fairly weak. The same continues to hold true for crude oil prices, even if the past months' freefall has slowed. However, despite numerous negotiations to curb the top producing countries' crude oil output, the fact that supply exceeds demand worldwide has not changed. US crude oil supplies are at an all-time high and growing still. Prices for palm and soybean oil are also under pressure from scant demand and ample global supply. Moreover, low crude oil prices reduce biodiesel competitiveness, and consequently, curtail demand for the two vegetable oils used in biodiesel production. Malaysian 2015 palm oil production is expected to reach around 20.1 million tonnes, the highest quantity ever. 2014/15 US soybean oil production is estimated at 47.1 million tonnes, also hitting a record. (AMI)

Chart of the week (39)

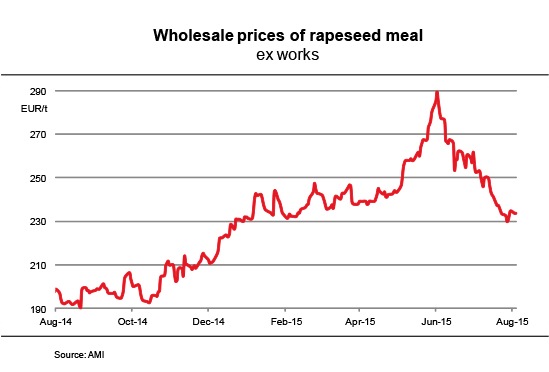

Oilseed meal prices are under downward pressure

Prices for rapeseed and soybean meal have dwindled massively over the past few weeks due to weak reference cash prices on the futures market and slack demand. Rapeseed meal currently stands at around EUR 217 per tonne fob oil mill. This is a nine-month low. Soybean meal (44% protein) is valued at EUR 320 per tonne fob Hamburg, the lowest level seen since March 2012. The competitiveness of rapeseed meal has declined due to these prices. A year ago, one protein percentage in rapeseed meal cost EUR 5.60 per tonne of rapeseed meal, approximately EUR 2.30 per tonne less than soybean meal. At currently EUR 6.30 per tonne, it is now only EUR 1 per tonne cheaper. The downward trend on the oilseed market encourages buyers to wait. They are stocked up very well for nearby positions anyway. However, interest in buying is low even for later positions, because buyers expect prices to be lowered further in the wake of weak prices for soybeans and soybean meal. (AMI)

Chart of the week (38)

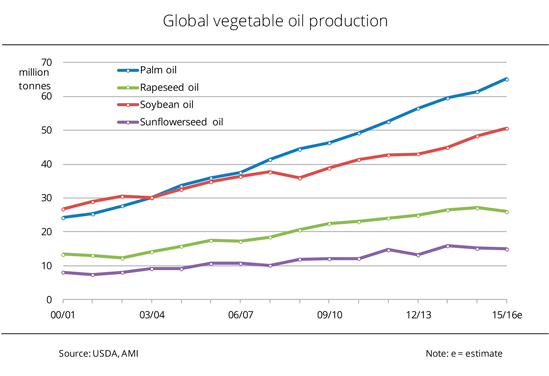

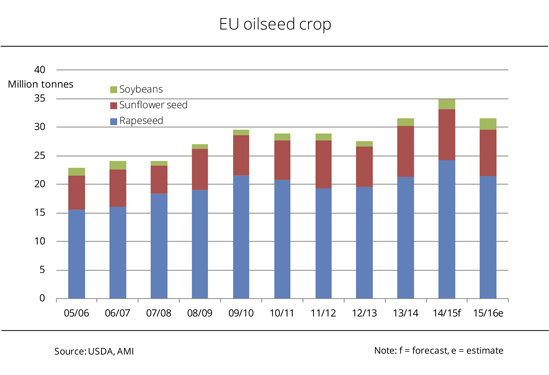

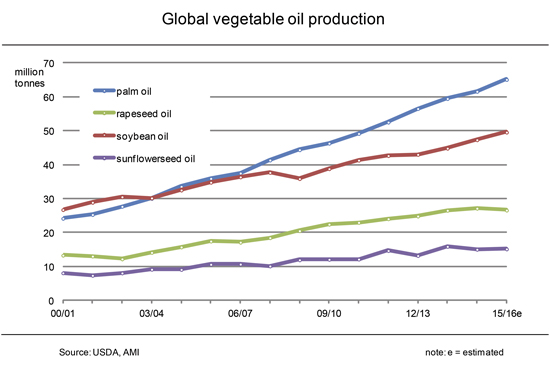

Palm and soybean oil continue upward trend

The USDA estimates the world's production of vegetable oils in the 2015/16 marketing year at 181 million tonnes, up 5 million tonnes year-on-year. Palm, soybean, rapeseed and sunflower oil account for the lion's share. Whereas soybean and palm oil continue their upward trends, production of rapeseed and sunflower oil is on the decline. The reason is that availability of feedstock is much tighter than a year earlier. The drop in rapeseed oil production is forecast to be sharpest, down around 4 per cent from the previous year. Consequently, the increase that has been happening since 2006/07 would have come to a halt. 2015/16 output of sunflower oil is down just over 1 per cent from the previous year, hitting a three-year low. Palm oil saw the largest growth, by just under 6 per cent, increasing its lead in output. Fears that El Niño could affect crop output have not been confirmed to date. Soybean production is estimated to rise by 5 per cent to a seven-year high. (AMI)

Chart of the week (37)

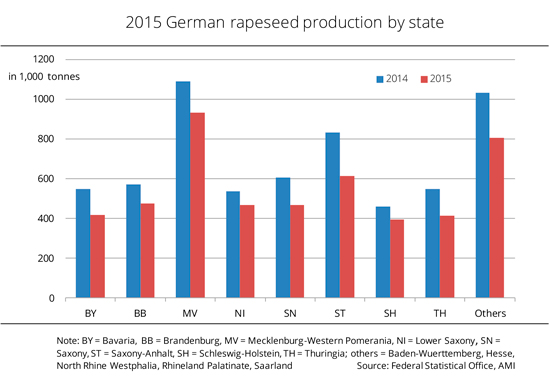

2015 German rapeseed crop is below average

The German Ministry of Agriculture and Food (BMEL) took stock of the country's 2015 rapeseed harvest and published the provisional results from the „Special harvest and quality survey“. The report puts the German harvest at 5.0 million tonnes. This is in line with previous estimates and down approximately one fifth from the previous year. The crop would fall short of the long-term average by around 8 per cent. The BMEL estimates the average crop yield at 38.9 decitonnes per hectare. This figure almost exactly corresponds to the long-term average but is just over 13 per cent below the previous year's very good level. Yields were highest in Schleswig-Holstein and Baden-Wuerttemberg (43 and 41 decitonnes per hectare respectively) and lowest in Brandenburg (36.5 decitonnes per hectare). Saxony-Anhalt experienced the biggest drop in production, at 26 per cent. Yields in Saxony-Anhalt dipped by more than one fifth from the previous year. (AMI)

Chart of the week (36)

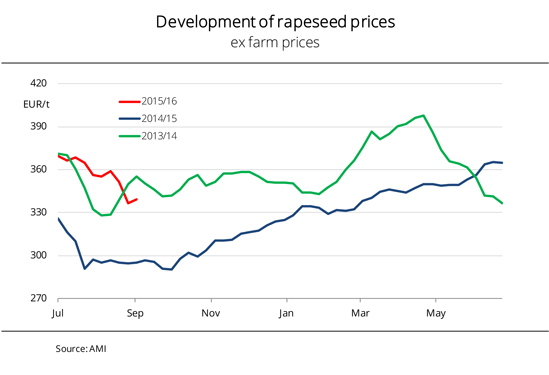

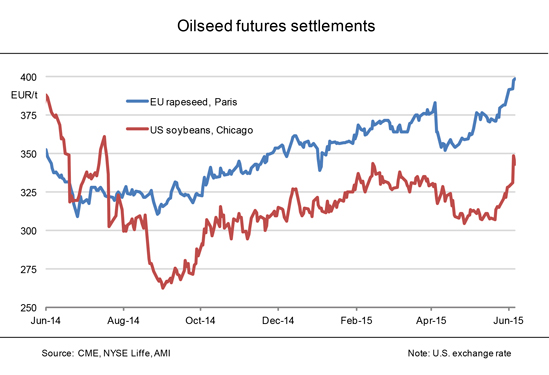

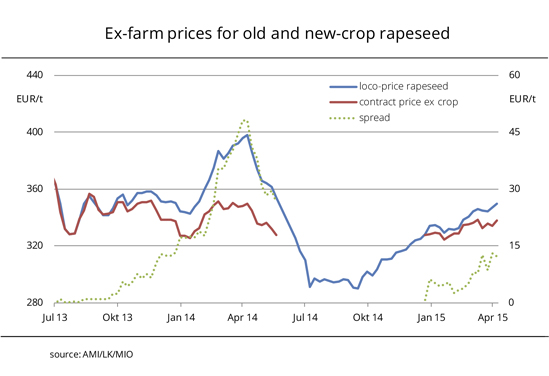

Weak futures markets pull down rapeseed prices

Weak prices for soybean and palm oil and, first and foremost, sliding crude oil prices put heavy pressure on quotes for rapeseed in August 2015. The nearby in Paris slumped below the mark of EUR 350 per tonne, reaching a six-month low. Although prices recovered slightly on only two days following massive losses of up to 4 per cent, volatility continues on the futures markets. Above all, this situation creates uncertainty and reluctance on the already weak cash market. Oil mill owners show little interest to buy and change their premiums hardly at all. As a result, the fluctuations on the futures markets have repercussions all the way down to the collection level. However, availability is also low, given the present farm prices that recently slumped significantly below the year-ago level. Having completed the harvest, farmers are leaving their crops in storage for the time being and probably till year-end. (AMI)

Chart of the week (35)

German rapeseed oil was mostly destined for Benelux

Just less than 900,000 tonnes of the estimated over 4 million tonnes of rapeseed oil produced in Germany in 2014/15 went abroad. This was 11 per cent down from the previous marketing year, but nevertheless one fifth above the long-time average. Most of the exported rapeseed oil was crude (around 44 per cent) or other rapeseed oil for food production (33 per cent). Around 23 per cent were for technical applications. Countries from the European Union were the main recipients of German rapeseed oil. About 94 per cent alone of all shipments went to other EU member states. The number one recipient was the Netherlands, with imports amounting to 450,000 tonnes. However, this figure is low compared with the previous year, translating to a drop of just under 25 per cent. Belgium took second place (114,000 tonnes) and Poland followed on third (84,000 tonnes). Imports to both countries saw a rise from 2013/14. Along with the EU countries, Norway and Israel also imported significant amounts of rapeseed oil (30,000 tonnes and 9,000 tonnes respectively). (AMI)

Chart of the week (34)

Palm oil continues to slide

The price gap between European oils and imported palm oil continues to widen. Whereas soybean and rapeseed oil went up on firm feedstock prices in the first half of the month, palm oil has been under downward pressure from abundant supply. Stocks in Malaysian tanks are growing. According to official information, inventories at the end of July 2015 were up around 40 per cent on the previous year. In such an environment, forward prices in Kuala Lumpur slumped to the lowest level since March 2009. The slide also pulled down asking prices for palm oil in the European import ports and came on top of downward pressure from the firm euro rate. Consequently, palm oil for use in biodiesel production has become more attractive. This is already reflected in surging demand. Palm oil is selling increasingly well, as this sustainable feedstock for fuel production is at its lowest price in five and a half years. Malaysia confirmed that palm oil exports to the EU-28 rose significantly in the first half of August. (AMI)

Chart of the week (33)

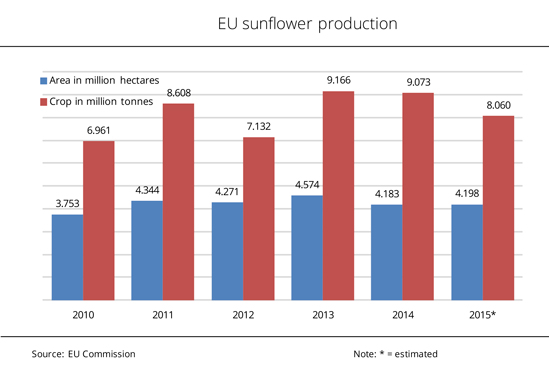

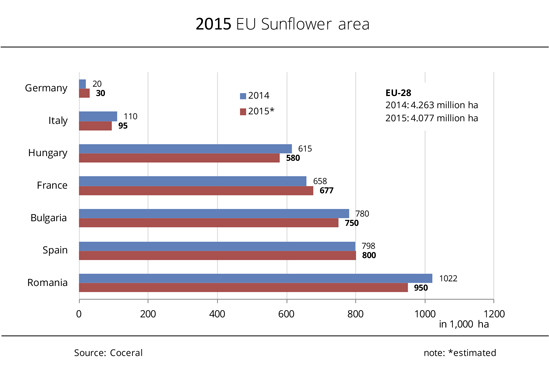

EU sunflower production is average

Following the excellent harvest figures for the previous two years, 2015 will see a marked cut in sunflowerseed production. Although all across the EU, the area planted with sunflowers was minimally expanded compared to the previous year, yields will fall short of the previous years' good figures. The EU Commission report puts the 2015 cultivation area at 4.2 million hectares. This would translate to a 0.4 per cent rise from the previous year. Following the dry spring and hot July, many countries, especially in southern Europe, lowered their crop forecasts dramatically in some cases. In other words, the current forecast for the EU-28 sunflower crop is 8.1 million tonnes, 11 per cent below the year-ago level. However, this isn't such a poor figure after all. Both area planted and harvest are merely 0.6 per cent and 1.6 per cent respectively below the long-standing average. (AMI)

Following the excellent harvest figures for the previous two years, 2015 will see a marked cut in sunflowerseed production. Although all across the EU, the area planted with sunflowers was minimally expanded compared to the previous year, yields will fall short of the previous years' good figures. The EU Commission report puts the 2015 cultivation area at 4.2 million hectares. This would translate to a 0.4 per cent rise from the previous year. Following the dry spring and hot July, many countries, especially in southern Europe, lowered their crop forecasts dramatically in some cases. In other words, the current forecast for the EU-28 sunflower crop is 8.1 million tonnes, 11 per cent below the year-ago level. However, this isn't such a poor figure after all. Both area planted and harvest are merely 0.6 per cent and 1.6 per cent respectively below the long-standing average. (AMI)

Chart of the Week (32)

Market booms in the run-up to the harvest

Prospects of a meagre crop due to low yields and fears of insufficient supply sent demand rocketing in May. The boom in demand coincided with seasonally low supply. Not only did prices shoot up, but supply was also sold out soon. Rapeseed meal prices surged 20 per cent in just one month. The market has been calm since. Oil mills are expecting the first contracted new-crop batches. However, these shipments are slow to arrive. Interruptions due to rains slowed down the 2015 rapeseed harvest. Yields and oil content proved to be average at best, but in most cases were better than expected. Very occasionally, yields even amounted to 50 decitonnes per hectare. As rapeseed processing activities are picking up pace, supply of rapeseed meal and rapeseed cake is growing. However, buyer interest is low because compound feed manufacturers have adopted a wait-and-see stance, hoping that the new crop will increase the downward pressure on prices. (AMI)

Chart of the Week (31)

2015/16 EU oilseed production drops considerably

In the EU-28 in the 2015/16 marketing year, the amount of oilseeds harvested is much smaller than a year earlier. While the output is estimated at 31.6 million tonnes, the decline could amount to nearly 10 per cent. The dip is primarily attributable to rapeseed. Due to the reduction in rapeseed area and weather-related yield losses, total EU rapeseed harvest in 2015 will only yield an estimated 21.4 million tonnes. This would translate to an around 12 per cent drop from the previous year's record, but still exceed the long-time average. 2015/16 EU sunflower production is also expected to plummet, by approximately 8 per cent from the previous year, to 8.2 million tonnes. The drop is first and foremost due to a decrease in area planted in Bulgaria and France. By contrast, the main sunflower producing country Romania is reported to have expanded its sunflower area. Soybean production has seen an upward trend since 2012/13 and continues to grow in 2015/16. At nearly 2 million tonnes, the EU could harvest its biggest soybean crop ever. (AMI)

Chart of the week (30)

Vegetable oil price index hits six-year low

The FAO oils and fats price index averaged 156.2 points in June, continuing at the lowest level in almost six years. Since March 2014, world vegetable oil prices have fallen virtually continuously, by more than one fourth, due to extensive feedstock supplies. Above all, falling prices for palm, soybean and rapeseed oil beat the index down. Record world supply and a massive decline in mineral oil prices had a significant negative impact on 2014/15 prices. Because weak mineral oil prices diminish competitiveness of biodiesel, they also weigh down prices for vegetable oils used in biodiesel production. Since May 2015 there have been signs that the trend of the index will reverse. The trend is expected to be firm in the coming months, considering that El Niño could affect crop output in the South Asian palm oil producing countries and global 2015/16 rapeseed supply will tighten considerably. (AMI)

Chart of the week (29)

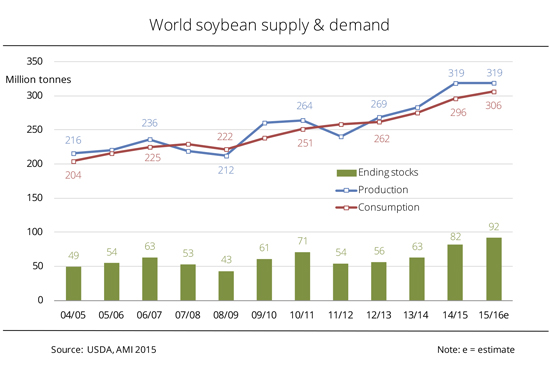

2015/16 supply of soybeans is tighter, but continues convenient

At 319 million tonnes, the world's 2015/16 soybean production could again be extremely large, reaching the previous year's record level. As consumption is expected to grow significantly to 306 million tonnes - of which an estimated 268 million tonnes will be processed - global final stocks as at the end of the marketing year are likely to increase less sharply than a year earlier. The surge is estimated at approximately 12 per cent, down from 30 per cent a year earlier. Nevertheless, ending stocks would hit a record. The US once again takes first place among the soybean producing countries. The 2015 US soybean harvest is estimated at 105.7 million tonnes, down only around 2.3 million tonnes from the previous year. The most recent forecast for Brazil - which is still vague, because sowing in South America will not start until autumn – expects the Brazilian soybean harvest to break the previous year's record, at 97 million tonnes. The chances are that Argentina will again take third place, with a significantly smaller harvest of 57 million tonnes. (AMI)

Chart of the week (28)

Spread between protein prices increases

After converging at the beginning of the year, prices of soybean and rapeseed meal protein have diverged since May 2015. The price per percentage of soybean meal protein, calculated from the spot market price and protein content, is currently, on average, around one euro higher than that of rapeseed meal protein. Fuelled by firm US soybean meal reference prices, soybean meal prices in Germany were raised massively. This put a damper on demand, especially because buyers have hardly any need. At the beginning of July 2015, soybean protein stand at on average EUR 8.33 per per cent per tonne, the highest level seen since March 2015. Meanwhile, rapeseed meal prices dropped over the past few weeks. At EUR 7.23 per tonne, rapeseed meal protein is down around one euro from the previous month. This translates to a rise of just under 50 euro cent from the same month the previous year. By contrast, soybean meal protein is valued slightly lower year-on-year. (AMI)

Chart of the week (27)

Soybeans and rapeseed pick up

Oilseed prices rose considerably over the past few weeks. Whereas rapeseed in Paris hit the highest level since April 2014, soy climbed to a six-month high in Chicago. The reason for the massive surge in prices for rapeseed (the nearby shot up by virtually 13 per cent since April 2015) is the pessimistic outlook for the 2015 rapeseed crop. In other words, crop expectations have dipped in the wake of protracted drought during the crop cycle which, in addition to the reduced rapeseed area, might push the output of rapeseed even below the previously expected level. Coceral (the European grain and oilseed traders' association) forecasts EU rapeseed production at 21.4 million tonnes. This would translate to an 11 per cent drop from the previous year. In Southeast Europe, this year's harvest has already started. No initial yield figures have been identified to date. In the meantime, planting of soybeans is still ongoing in the US after being delayed by strong rains. Soybean prices are on a firm trend as demand for US soy is buoyant. (AMI)

Chart of the week (26)

Biodiesel and agricultural diesel are at almost the same level

Wholesale prices for biodiesel and agricultural diesel have recently converged rapidly. At the end of June 2015, asking prices for biodiesel outpaced those for agricultural diesel for the first time in 19 weeks. With biodiesel standing at around 73 euro cents per litre, it has lost a great deal of its competitiveness. The sharp rise in biodiesel prices was due to the massive increase in prices of vegetable oils. In other words, asking prices for very scarce rapeseed oil surged by almost 10 per cent in four weeks, to the highest level in almost two years. This put a noticeable damper on demand. Nevertheless, rapeseed oil and also rapeseed oil raffinate for July 2015 delivery is practically sold out. Nearby offers are not available until August and already reflect the new rapeseed crop. These conditions explain the sharp peak. In the wake of the scarcity of feedstock and seasonal maintenance downtime of oil mills, rapeseed oil will continue to be in short supply in the coming weeks. (AMI)

Chart of the week (25)

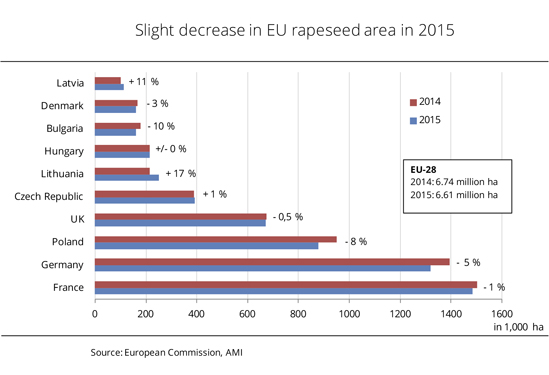

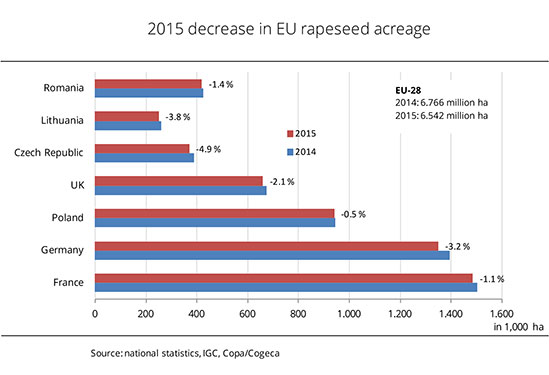

EU rapeseed production falls sharply

The most important rapeseed producing countries in the EU-28 reduced their rapeseed areas, with French and German farmers leading the way, followed by producers in Poland and Great Britain. By contrast, according to information published by the EU Commission, countries where rapeseed production only plays a secondary role saw a massive expansion in rapeseed area. Overall rapeseed production on a total of 6.6 million hectares of land (down about 1 per cent) could amount to around 22.4 million tonnes, around 1.9 million tonnes down from the 2014/15 record crop. However, this forecast is still very optimistic because rapeseed crops all across Europe have been affected by sometimes very poor conditions. Above all, the current drought will dent yields. Currently the EU Commission forecasts average yields to be at 33 decitonnes per hectare. This would translate to a drop of only 8 per cent from the previous year. Consequently, yields would still outpace the long-term mean. (AMI)

Chart of the week (24)

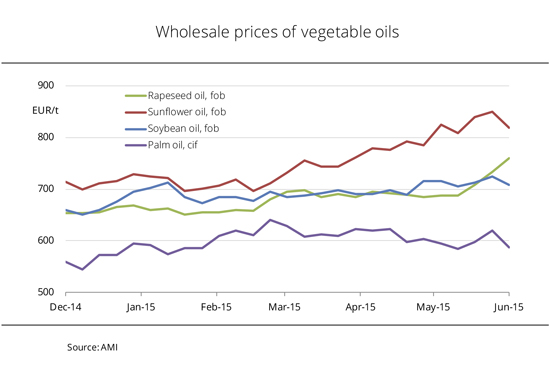

Vegetable oil prices diverge

The gap between vegetable oil prices has widened considerably over the past several months. The reasons for the increasing difference are different supplies of feedstock and diverging reference prices on the futures market. Whereas prices are by far highest for sunflower oil, palm oil marks the lower limit of the spread. The difference in price between the two vegetable oils shot up from EUR 85 per tonne at the end of March 2015 to EUR 230 per tonne at the beginning of June 2015. Soybean and rapeseed oil, which are otherwise generally at more or less the same price level, also diverged recently. In other words, at EUR 760 per tonne, spot rapeseed oil was around EUR 52 per tonne more expensive than soybean oil at the beginning of June 2015 in the wake of a sharp price rise. Buyers and sellers currently rarely find common ground, because they have different price expectations. However, demand does exist and there is generally no lack of supply. (AMI)

Chart of the week (23)

Supply of soybean meal continues to be limited

German prices of soybean meal rose considerably from its three-year low at the end of May 2015. The surge was due to firm reference prices for futures and a strike in Argentina that hampered shipments from there. As imports from South America are sluggish, supply continues to be low. High-protein soybean meal for delivery in June and July 2015 in particular has recently been available only in small quantities. This shortfall resulted in a large price gap with low-protein soybean meal (44%) which amounted to approximately EUR 34 per tonne at the beginning of June 2015. Weak prices for US soybean meal prompted suppliers to slightly reduce prices at the beginning of June 2015. However, as demand from compound feed manufacturers is brisk, there will be little scope for downward movement in the near future. Moreover, a weaker euro also made imports more expensive. (AMI)

Chart of the week (22)

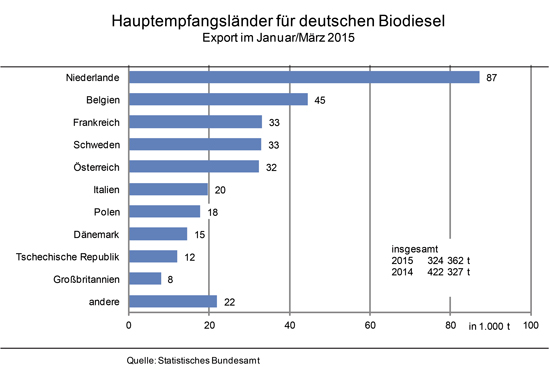

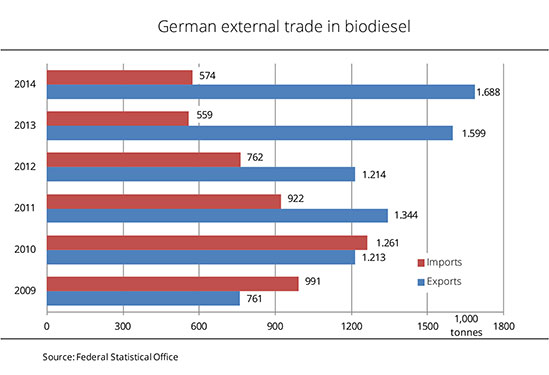

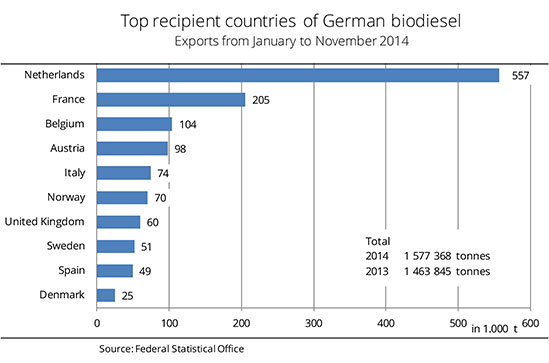

2015 biodiesel exports fall well below the previous year’s level

German biodiesel exports saw a massive decline in the first quarter of 2015, dropping to around 324,000 tonnes, virtually one fifth below the year-ago level. However, the figure outpaced the long-term average by just under 5 per cent. The Netherlands received approximately one fourth of total exports. Consequently, despite a sharp 45 per cent slump in imports from the same period last year, the country continued to be the main importer. The biggest growth was seen in Sweden. The country absorbed approximately 33,000 tonnes in the first quarter, compared to only 143 tonnes in the same period last year. The German Federal Statistical Office also recorded a substantial rise for Belgium and Denmark. By contrast, France imported significantly less and barely continued on third place, with Austria fourth. Around 97 per cent of German biodiesel exports went to other EU countries. Norway was again the principal recipient country outside the EU. (AMI)

Chart of the week (21)

World production of rapeseed oil declines

The global output of vegetable oils will generally increase. Data from the USDA indicates that global vegetable oil production in the coming marketing year 2015/16 will amount to 181 million tonnes, up approximately 6 million tonnes year-on-year. Palm, soybean, rapeseed and sunflower oils will presumably account for around 87 per cent of the total quantity. Palm oil has ranked first since 2004/2005 and since then has seen an annual grosth of on average 7 per cent. Over the same period, production of soybean oil rose by 4 per cent per annum. Whereas these two vegetable oils will likely continue on a rising trend in the future, the upward trend for rapeseed oil is probably over. USDA reports that for the first time since 2006/07, the chances are that rapeseed oil production will go down. Global output is forecast at 26.65 million tonnes, down 2 per cent from the previous year. The EU-28 output might even drop by 3 per cent. (AMI)

Chart of the week (20)

Difference in oilseed meal prices declines

Oilseed meal prices converge as price trends in oilseed meals are mixed. Whereas prices of soybean meals have been fairly weak, rapeseed meal recently overshot the EUR 250 per tonne mark. This was an all-year high. Interest in rapeseed meal recently picked up surprisingly sharply, with demand being particularly high for nearby material. Apparently, compound feed manufacturers failed to stock up sufficiently after all. In view of buoyant demand and prospects for continued limited supply, prices are trending firm. Interest in US soybean meal will probably drop considerably in the wake of the expanding avian flu outbreak in the US. In the light of this situation, prices in Chicago are under downward pressure. In Germany, prices were recently lowered only slightly, because the expected rise in supply from new imports has not materialised to date, providing support to asking prices. However, as demand for soybean meal is weak, there is also hardly any scope for upward movements in prices. (AMI)

Chart of the week (19)

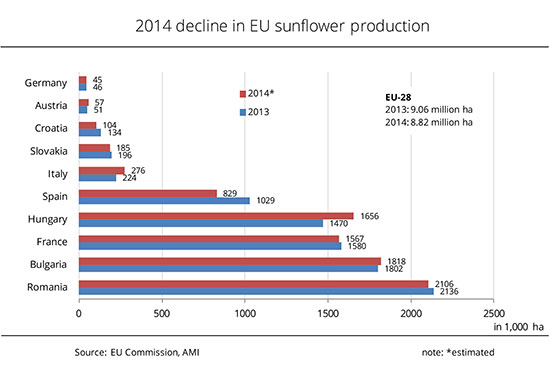

Decline in sunflower production in the EU-28 continues

Coceral, the European grain and oilseed traders' association, forecasts that the 2015 area planted with sunflowers in the EU-28 will be reduced massively again compared to the previous year. At 4.1 million hectares, the area will presumably decline by around 4 per cent. The drop is primarily due to smaller estimates of Romanian, Bulgarian and Hungarian sunflower areas. Apparently, Romania alone, the main sunflower producing country in the EU, will cut its sunflower area by 7 per cent. An expansion in area is only expected to take place in France, the Czech Republic and Germany. However, sunflower production is only of secondary importance in the latter countries. Because Coceral not only anticipates a reduction in area, but also a drop in average crop yields in 2015, the association expects EU sunflower production to slump sharply. In other words, the Coceral forecast puts the EU-28 sunflower crop at 8.1 million tonnes, down around 9 per cent from the 2014 figure. (AMI)

Chart of the week (18)

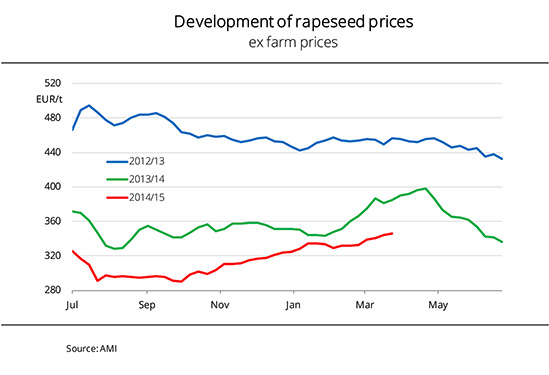

Closing of contracts for upcoming crop has fallen to a record low level

Farmers delay marketing of rapeseed for an unusually long time this marketing year. The key reason is that prices are significantly lower than they were in recent years. In the wake of the large 2014 rapeseed crop in Germany and the bumper crop in the EU-28, prices made a weak start to the new season. Farm prices have risen sharply over the past several months. The surge was primarily fuelled by very tight supply on the cash market and recently underpinned by prospects for a significant drop in rapeseed production in 2015. Despite the rise, the current average ex farm price of EUR 350 per tonne hardly lures producers to sell stock. The 2015 crop is also rarely a topic of conversation. Not even one fifth of the estimated 5.3 million tonnes (this figure would be 18 per cent down from the previous year) was contracted by April 2015. This is a record low. (AMI)

Chart of the week (17)

Rapeseed meal prices fluctuate at a high level

Chart of the week (16)

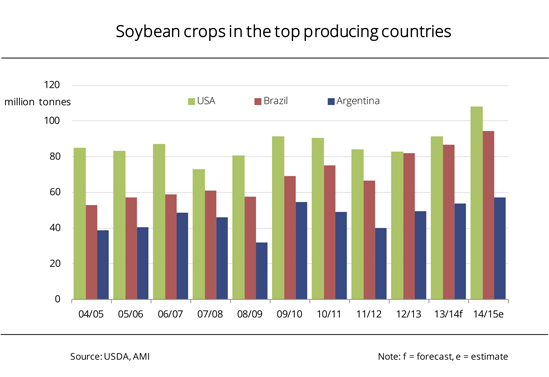

US soybean prices pressured by yet another bumper crop

Soybean supply in the 2014/15 marketing year has been very convenient. In the US alone, final stocks will be four times the previous year’s quantity. The worldwide surge is expected to amount to 35 per cent. The key reason is the bumper crops in the top soy producing countries US, Argentina and Brazil. Whereas the US soybean harvest for the 2014/15 period was already brought in in the summer of 2014, harvesting in South America is in full swing now. In the wake of expansions in area planted and favourable growing and harvesting conditions, crop yields are at record levels this season too. The forecast for Argentina was recently even raised by one million tonnes, to 57 million tonnes. Supplies in Brazil are projected at 94.5 million tonnes. Stiff competition is giving US Americans a rough time in the export business. The explanation is that the strong dollar has appreciably reduced the competitiveness of US soybeans. Futures prices respond to this change with a decline. (AMI)

Chart of the Week (15)

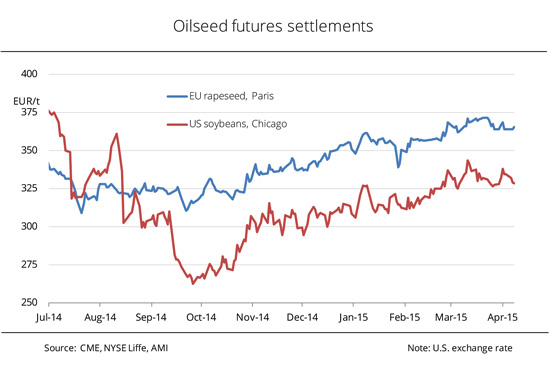

Upward trend has stopped for the time being

Rapidly increasing supply from South America and, at the same time, falling demand for US soybeans put downward pressure on Chicago soybean prices. The soybean harvest in Brazil and Argentina is making very good progress, increasing competition for US soybeans. Consequently, analysts expect that USDA will raise the soybean production forecast for Argentina in the USDA supply and demand estimate that is to be published on 9 April 2015. The rapeseed market is quiet. Farmers' inclination to sell is low, given the reduction in bids. However, market participants expect that a large part of the apparently extensive quantities that still remain in storage will be sold over April. Rapeseed prices are under downward pressure from weak prices in Paris. Paris prices follow the reference prices from Chicago without any impetus of their own. However, they are slightly supported by the lack of supply. (AMI)

Chart of the week (14)

Supply is scarce despite climbing farm rapeseed prices

Farm prices of rapeseed surged sharply in March 2015 as futures market quotations rose and demand grew. The average ex-farm price in Germany in March was at EUR 343 per tonne, up EUR 12 from the previous month. Consequently, prices went up by EUR 35 per tonne since the season started in July 2014. However, they remained clearly below the year-ago level. The 2015 crop has become a topic of conversation and producers concluded significantly more contracts than earlier this year. Ex-farm prices of new-crop rapeseed in March were on average EUR 335 per tonne, up EUR 8 per tonne from the previous month. Meanwhile, very scarce supply limits trading on the rapeseed cash market. Although farmers divest themselves of stored rapeseed more often as bids rise, the quantities they sell are insufficient to cover demand. (AMI)

Chart of the week (13)

Difference in price between soybean and rapeseed meal proteins declines

Prices for soybean and rapeseed meal proteins have converged over the past few months, but continue to vary significantly. This especially applies to soybean meal, because asking prices are adjusted on a daily basis depending on the trend in soybean and soybean meal prices. At the end of March 2015, the spread between soybean and rapeseed meal protein prices, calculated from the spot market price and protein content, amounted to EUR 1.20. This was the lowest level since July 2014. Whereas rapeseed meal protein approached the mark of EUR 7 per protein percentage per tonne on firming rapeseed reference prices in Paris and more vivid demand, prices of soybean meal protein varied between EUR 8.10-8.40 at the end of March 2015. Meanwhile, the cash market for oilseed meal is very slow. Nearby supply, especially of soybean meal, is very moderate. At the same time, demand is slack also, because buyers are stocked up well. (AMI)

Chart of the week (12)

Biodiesel exports are on the rise again

German Biodiesel exports surged in 2014, but less so than in 2013. The increase from the previous year amounted to just under 6 per cent. In 2013, exports rallied by nearly one fifth from 2012. In other words, the upward trend (with the exception of 2012) continues. Other EU countries were still the main recipients in 2014, headed by the Netherlands. At a record amount of nearly 599,100 tonnes, the Netherlands alone absorbed 35 per cent of total German deliveries to the EU. This translates to a 19 per cent increase from 2013. France took second place, absorbing twice the amount of 2013 (221,600 tonnes). Consequently, Poland (143,100 tonnes) was relegated to third position. The country's imports dropped by approximately one fifth from the previous year. Norway was the number one export partner outside the EU-28. German biodiesel imports surged slightly in 2014, ending their downward slide. A significant rise from 2013 was seen in imports from France, Italy and Austria, among other countries. (AMI)

Chart of the week (11)

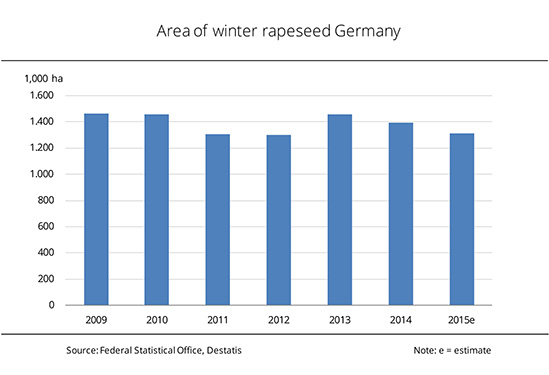

Rapeseed area declines

Experts expect a reduction of EU rapeseed area for the 2015 harvest compared to the previous year. The area devoted to growing rapeseed in the EU-28 is estimated at 6.54 million hectares, down 224,000 ha from the 2014 figure. All of the member states are seeing a decline in area. At the same time, in most cases winter rapeseed crops are in good condition. The key reason is the mild winter which hardly caused any plant damage. However, insect and disease pressure will be higher than in previous years. EU farmers will most probably not see last year's record harvest figures in 2015. First vague harvest estimates put the 2105 EU rapeseed crop at 21-21.4 million tonnes. This translates to an up to 12 per cent drop from 2014. (AMI)

Chart of the week (09)

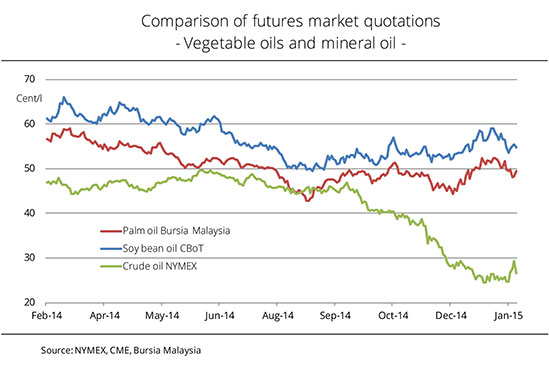

Weak mineral oil prices beat down prices of vegetable oil

Vegetable oil prices dropped - in some cases sharply - at the end of February 2015. The slide was driven by falling mineral oil prices and scant demand. Mineral oil traded on the NYMEX continued its downward trend as supply exceeded demand. As a result, the nearby slid below the mark of USD 50 per barrel for some time. In the wake of weak reference prices on the futures markets, vegetable oil prices were reduced considerably on the European cash market at the end of February. However, demand has not been generated, because buyers still find current prices hardly financially appealing. Sales of rapeseed oil continue sluggish because falling mineral oil prices reduce the competitive advantage of biodiesel and, consequently, the interest in feedstock. Rapeseed oil currently stands at EUR 657.50 per tonne fob Hamburg, EUR 20 per tonne below the level of soybean oil. At EUR 696 per tonne, sunflower oil continues to be the most expensive vegetable oil. (AMI)

Chart of the week (08)

Wholesale prices for biodiesel are lower than for agricultural diesel

In December 2014, weak mineral oil prices forced down prices for agricultural diesel to a level below that of biodiesel. For some time at the end of January 2015, biodiesel cost a respectable 5 euro cents per litre more than agricultural diesel. However, the tide is turning because mineral oil prices have picked up over the past few weeks, also driving up prices of agricultural diesel. Reports of a drop in active drilling for oil in the US sent the NYMEX nearby for crude oil above the mark of 50 US-dollar per barrel. However, since global supply continues to exceed demand considerably, there has most recently not been any increase in price gains. In Germany, agricultural diesel stands at 72.7 euro cents per litre. This is 7 euro cents per litre higher up on the beginning of February and around 4 euro cents per litre higher than biodiesel. Due to scant demand, rapeseed oil prices have remained virtually unchanged over the past few weeks. (AMI)

Chart of the week (07)

Pressure on soybean meal prices increases

Due to scarce nearby supply, prices of soybean meal remained unaffected by the slump in Chicago reference prices for feedstock for a long time. However, over the past few days they dropped massively. The plunge was driven by weak reference prices for US soybean meal and scant demand on the cash market. In view of ample supply from South America, the trend is bound to continue weak over the long term. Since the first export shipments were loaded in Brazilian ports at the end of January 2015, prices for spot material have dwindled by just under EUR 15 per tonne, hitting a two-month low. Trade in soybean meal is currently very sluggish because compound feed manufacturers are stocked up well and only occasionally buy small quantities. In the light of this, not even falling prices will generate demand. (AMI)

Chart of the week (06)

Crude oil prices continue at record low level, vegetable oil prices are under downward pressure

Prices for soybean and palm oil are fairly weak. The same continues to hold true for crude oil prices, even if the past months' freefall has slowed. However, despite numerous negotiations to curb the top producing countries' crude oil output, the fact that supply exceeds demand worldwide has not changed. US crude oil supplies are at an all-time high and growing still. Prices for palm and soybean oil are also under pressure from scant demand and ample global supply. Moreover, low crude oil prices reduce biodiesel competitiveness, and consequently, curtail demand for the two vegetable oils used in biodiesel production. Malaysian 2015 palm oil production is expected to reach around 20.1 million tonnes, the highest quantity ever. 2014/15 US soybean oil production is estimated at 47.1 million tonnes, also hitting a record. (AMI)

Chart of the week (05)

Drop in EU sunflower acreage, but rise in yields

After the large 2013 crop with very unsatisfactory prices, some EU farmers cut sunflower production sharply in 2014. The EU Commission puts the shrinkage in area across the EU at nearly 8 per cent, to about 4.2 million hectares. However, yields were significantly better than expected, even outpacing the previous year's figures. At 21 decitonnes per hectare, yields were up just under one decitonne per hectare. Austria had the highest yields at 28 decitonnes per hectare, followed by Hungary at 27 decitonnes per hectare and Croatia at 26 decitonnes per hectare. Yields in Spain were by far lowest. Due to poor weather conditions during the crop cycle, they were at only 10 decitonnes per hectare. This drop is also reflected in the harvest figures. At 839,000 tonnes, the harvest was down one fourth from the previous year. The total EU crop amounted to 8.8 million tonnes, a slide of just under 3 per cent from 2013. (AMI)

Chart of the week (04)

German 2014 biodiesel exports pick up slightly

Chart of the week (03)

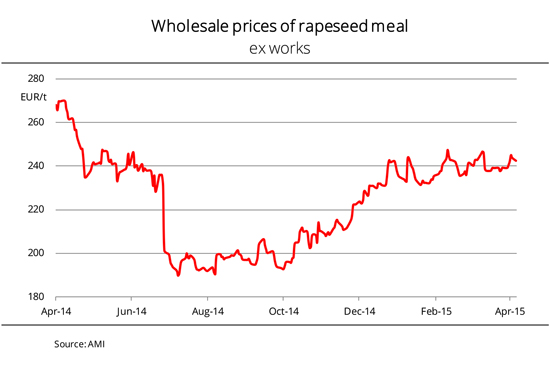

Oilseed meal trade is slow to kick off in the new year

The oil meal market has not yet kicked into gear in 2015. Whereas the soybean meal business primarily lacks supply, trade in rapeseed meal is paralysed by very scant demand. Due to the massive price rise, demand decreased to virtually nil over the past few weeks. In mid January 2015, rapeseed meal for prompt delivery stands at EUR 242 per tonne fob oil mill, a price not seen since June 2014. Prices have rallied by nearly EUR 30 per tonne since the beginning of December 2014 alone. The surge even put off buyers who had absolute need after the turn of the year. However, they were not many. The key reason for the sharp price increases was the firm trend of Paris feedstock prices. (AMI)

Chart of the week (02)

German area planted with winter rapeseed decreased from the previous year

Chart of the week (01)

The world is awash in soybeans in 2014/15

Global soybean supply gets more convenient year after year. Although the past decade saw a few exceptions, global annual production exceeded consumption significantly in most years. At the same time, stocks increased. However, the 2014/15 marketing year is breaking all records. At 313 million tonnes, the global soybean crop is presumably the biggest ever. All three top soy producing countries - the US, Argentina and Brazil - are expected to gather a bumper crop. The US alone accounts for more than one third of the total output. Global consumption also rises, but it does so less sharply. Consequently, global ending stocks could surge to a high of nearly 90 million tonnes, exceeding the 2013/14 figure by more than one third. However, the soybean crops in Brazil and Argentina leave plenty of room for guesswork as the soybean harvest will not start for several months. (AMI)

Union zur Förderung von Oel- und Proteinpflanzen E.V.

Union zur Förderung von Oel- und Proteinpflanzen E.V.