Charts of the week 2016

Chart of the week (52)

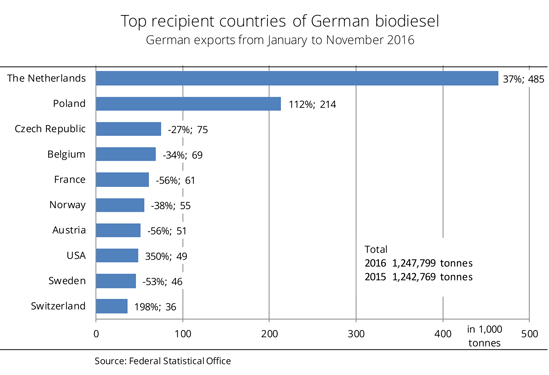

German biodiesel exports on a slight rise

German biodiesel exports over the first ten months of 2016 slightly exceeded those of the same period in 2015. The significant drop in demand for biodiesel from the majority of European trading partners was offset by an increase in shipments to the Netherlands and Poland. German biodiesel exports reached 1.25 million tonnes by the end of October 2016, exceeding the previous year's figure by 0.4 per cent. This means that the previous downward trend no longer continues. According to Agrarmarkt Informations-Gesellschaft mbH, the Netherlands continue to be the primary recipient country. The export volume went up by 37 per cent from the previous year, to around 485,000 tonnes. Surprisingly, Polish trading partners purchased more than twice the biodiesel amount of the previous year. This moved Poland up to the second position among the main importing countries. By contrast, countries such as the Czech Republic, France or Austria reduced their imports by between 27 per cent and 56 per cent. Biodiesel exports to Switzerland and the US saw the biggest increases, with Switzerland raising its purchases by virtually 200 per cent and the US increasing imports by 350 per cent. However, at 36,000 tonnes and 49,000 tonnes respectively, the volumes were comparatively small.

Chart of the week (51)

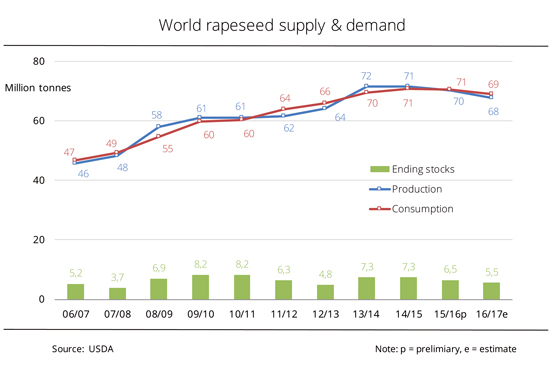

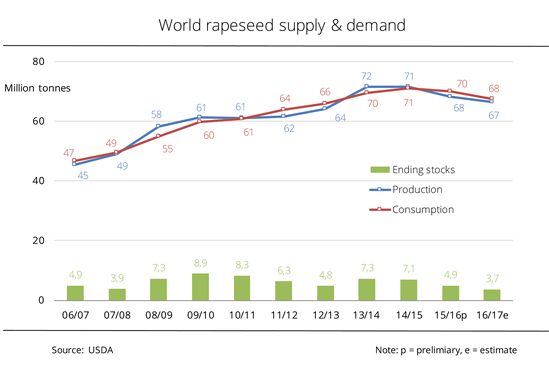

Smaller rapeseed harvest reduces stocks

Global rapeseed consumption will clearly exceed production in the 2016/17 marketing year. This is likely to result in a decrease in ending stocks and changes in the flows of goods. According to USDA's December forecast, global rapeseed production in the 2016/17 marketing year is going to decline by around 3.5 per cent from the previous year to just under 68 million tonnes. According to information published by Agrarmarkt Informations-Gesellschaft mbH (AMI), rapeseed output is going to increase, in some cases significantly, in some countries, such as Australia or India, but the rise is not sufficient to offset the almost 10 per cent decline in both China and the EU-28. Since worldwide use of rapeseed oil remains unchanged while production is likely to drop by 3 per cent concurrently with rapeseed production, the global supply/demand balance for the 2016/17 marketing year is much tighter than a year earlier. Global rapeseed consumption is forecast to fall to just under 69 million tonnes, but the decline of 2.4 per cent is smaller than the drop in production. Consequently, rapeseed ending stocks are projected to shrink by more than 15 per cent to 5.5 million tonnes, which means that in terms of figures, global stocks would not even last for one month. AMI believes that due to scarce supply, farm prices are likely to remain attractive until the next harvest.

Chart of the week (50)

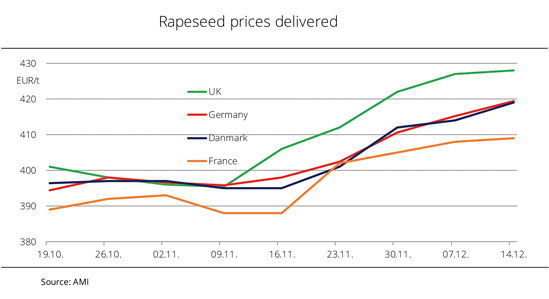

UK rapeseed prices on the rise

The tight rapeseed supply situation in the UK sent local spot market prices soaring. At the same time, lower availability markedly curbed shipments abroad. The small 2016 rapeseed harvest in the UK, which was down 30 per cent from the previous year, has had noticeable effect. The tight supply situation produced a sharp rise in spot prices. Since the beginning of November, wholesale prices rose by EUR 32 per tonne to, most recently, EUR 428 per tonne for delivery free of all charges. In other words, the premium over the futures quotes increased by EUR 15 per tonne. Relying strongly on shipments from abroad to expand the small domestic supply especially this year, the UK is now a net importer of rapeseed with little to offer on the global market. Whereas UK exports exceeded imports by 112,000 tonnes in 2015/16, in 2016/17 the country has had net imports of 6,600 tonnes to date. This situation is also reflected in exports to Germany. In October 2016, these rapeseed exports collapsed by just less than 85 per cent compared to the previous year. It seems also unlikely that any rapeseed will come from the UK in the coming months.

Chart of the week (49)

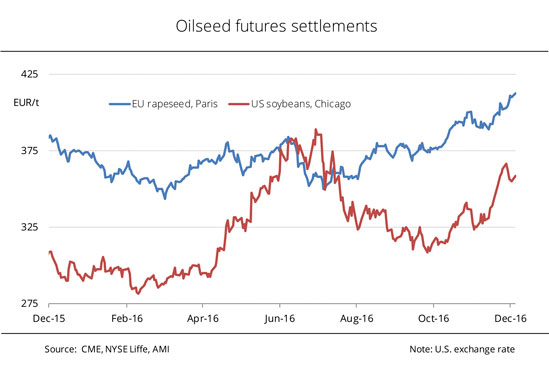

Sharp rise in oilseed prices

Firm prices for soybeans, palm oil and crude oil have sent prices for rapeseed on a sharp climb over the past few days. At the futures exchange in Paris on 6 December 2016, the nearby closed at EUR 412.50 per tonne, the highest level since April 2014. Consequently, rapeseed increased in value by 6 per cent in only three weeks. In the same period, US soybeans even rose by 7.5 per cent. Above all, soybeans benefited from an unexpected buying interest by China. Also, the falling dollar improved the prospect of future business. At the same time, the incipient weather markets in South America made an impact. More specifically, as Argentine growing conditions for freshly sown beans seemed to be too dry, renowned analysts already reduced their harvest estimates. In other words, the chances are that the crop could be even smaller than the previous year. This situation has lent support to prices and shifted the focus to the development in South America. However, as conditions in Brazil have been fine, the crop forecast remains at an estimated record high of 102 million tonnes. German rapeseed prices also benefited from the firm prices for palm oil in Malaysia. The foreseeable scarcity of supply has already supported prices over the past few weeks. Given a weak domestic currency that encourages exports, the gap between supply and demand could narrow further, especially because this month's palm oil output is estimated lower than the previous month's volume. Palm oil prices went up 13 per cent over the above-mentioned three-week period. Due to tight domestic supply, rapeseed prices in Paris did not completely reflect wholesale prices in Germany. In some cases, oil mill owners accepted a premium of EUR 13 per tonne for nearby supplies, according to information published by Agrarmarkt Informations-Gesellschaft mbH. The supply situation in Great Britain was tighter still, with premiums amounting to as much as EUR 15 per tonne. By contrast, the small French rapeseed crop failed to secure a bonus as bids from oil mills remained below the forward rate.

Chart of the week (48)

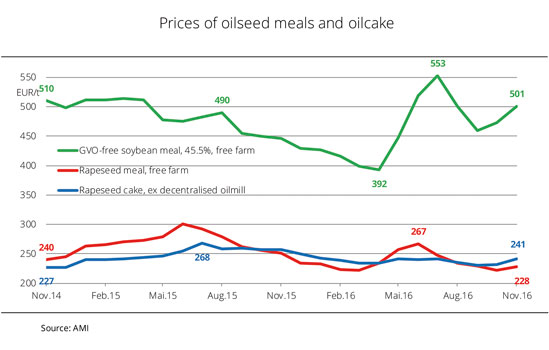

Rapeseed cake - a cost-effective alternative

Decentralised oil mills provide a considerable contribution towards supplying their regions with rapeseed cake. Due to the special method used to make rapeseed cake, this GVO-free protein feed contains more fat than rapeseed meal, with fat being a major energy source in animal feed. Whereas prices for GVO-free soybean meal delivered free to yard jumped in the early summer due to tight supply and rising world market prices, rapeseed cake and rapeseed meal only saw a comparatively slight price rise. However, rapeseed meal was temporarily more expensive than rapeseed cake. As demand slowed, prices went down again. Above all, rapeseed meal fell to new lows, while oilseed cake remained at the same level. Soybean meal remained relatively expensive and most recently even surged, driven by firm forward prices and the weak euro which also made imports more expensive. The rise also pulled up asking prices for the competing meals. However, as demand for rapeseed meal continues to be slack, nearby batches that are unloaded onto the market offer opportunities from time to time. Protein in rapeseed meal is even less costly, Agrarmarkt Informations-Gesellschaft mbH reports. The two-year average price free farm for rapeseed meal protein was 30 per cent below that for 45 % soybean meal protein. Clearly, not all animal farmers are aware of the ruminant feed cost saving potential rapeseed meal offers. For this reason, UFOP believes that there is still a considerable need for information and advice.

Chart of the week (47)

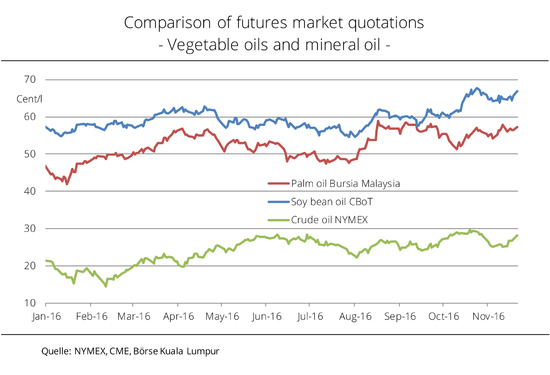

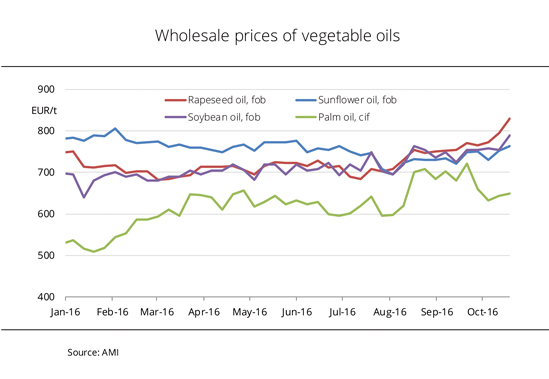

Rise in vegetable oil prices continues

A decline in palm oil production and sharp increase in soybean processing have sent vegetable oil prices climbing. Buoyant demand and surging crude oil prices are additional factors driving the development. Vegetable oil prices went up substantially over the past six months. The price spread between soybean and palm oil has narrowed significantly since the beginning of August 2016. Prices of palm oil soared by around 24 per cent at the beginning of August, to almost the level of soybean oil. The reason was a surprising 3 per cent decline in output while demand continued to be brisk, which spawned uncertainty. At the same time, decreasing US supplies of soybean oil have driven up soybean oil prices significantly since mid October. US soybean processing reached new record levels and sent soybean prices up as a result. The development in the vegetable oil market is fuelled by the price of crude oil. As crude gets more expensive, vegetable oils gain a competitive advantage as feedstock for biodiesel, boosting demand. In other words, the firming trend in vegetable oil prices will continue on strong demand despite the record soybean crop in the US.

Chart of the week (46)

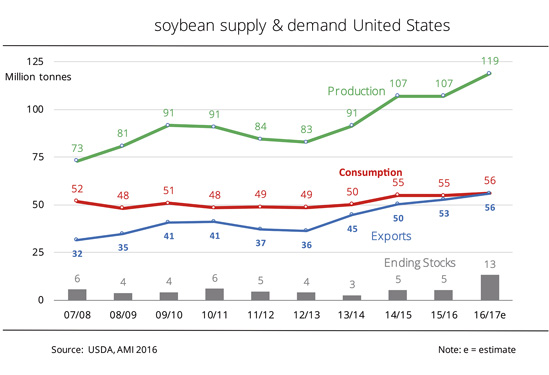

USDA raises already-record soybean crop forecast

The US soybean harvest is coming to a close. Nevertheless, the USDA sprang a surprise with its latest harvest estimate. However, the price effect was fleeting. The 2016 US soybean crop was forecast higher than expected. The previous month's forecast was raised 2.5 million tonnes to 118.8 million tonnes, outpacing the previous year's figure by just under 12 million tonnes. Higher yields in Minnesota, North Dakota and Kansas led the USDA to raise the overall yield for the US to 35.3 decitonnes per hectare. Prices at the futures exchange responded with significant losses which were, however, recouped over the subsequent few days. Since the USDA raised its US exports estimate by 0.5 million tonnes to 55.8 million tonnes, it also at the same time lowered domestic crush by 0.5 million tonnes to 52.5 million tonnes, a figure closer to the previous year's level of 51.3 million tonnes. Consequently, exports are taking a new place in the US soybean balance sheet as of this year as they draw level with domestic use. US season-ending soybean stocks for 2016/17 were projected at 13.1 million tonnes. This figure not only exceeds expectations by 2.3 million tonnes, but also outstrips the previous year's level by just under 8 million tonnes.

Chart of the week (45)

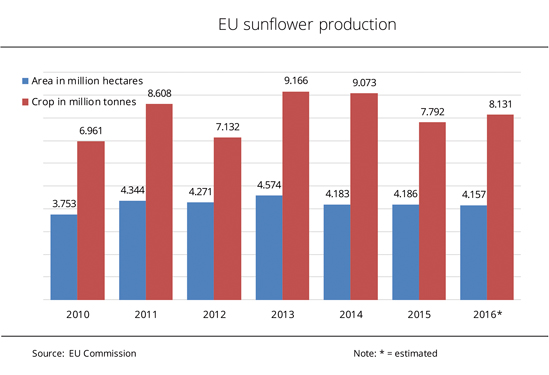

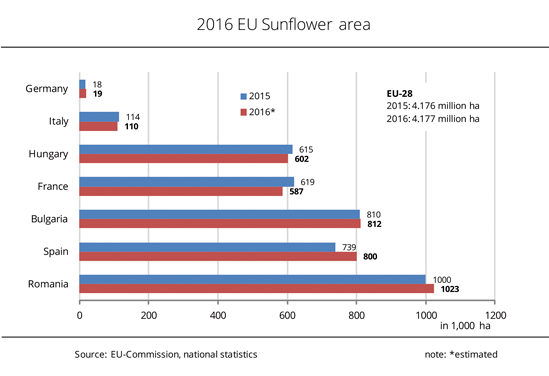

Sunflower production up from previous year

Despite a reduction in sunflower area, sunflower production in the EU-28 picked up from the previous year. In particular, the extensive production in Hungary accounts for the growth. According to current estimates, the 2016 production of sunflowerseed will likely outstrip the fairly average 2015 output. Although the area planted with sunflowers dropped slightly from a year earlier, harvest estimates exceed the previous year's figures throughout the EU. According to information published by Agrarmarkt Informations-Gesellschaft mbH, the EU Commission puts the 2016 sunflower area at around 4.16 million hectares, which is a minimal reduction of 0.7 per cent compared to the previous year. By contrast, the EU-28 sunflower harvest is currently forecast at 8.13 million tonnes, up 4.4 per cent from the year-ago level. The growth in output despite the reduction in area is accounted for by an increase in productivity. Compared to 2015, average yields rose by 5.4 per cent to just less than 20 decitonnes per hectare. The key reason for the increase in harvest and yield in the EU-28 is the rise in Hungarian output. Hungary has become the biggest producer of sunflowers in the EU-28 in the current season.

Chart of the week (44)

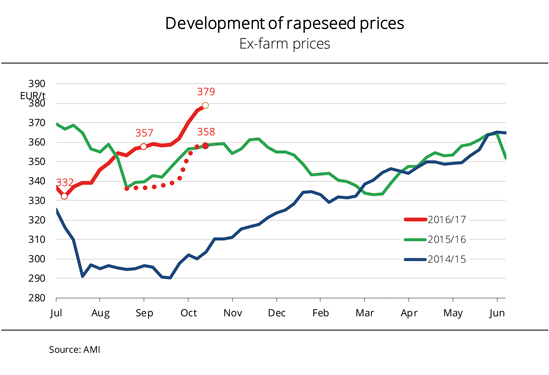

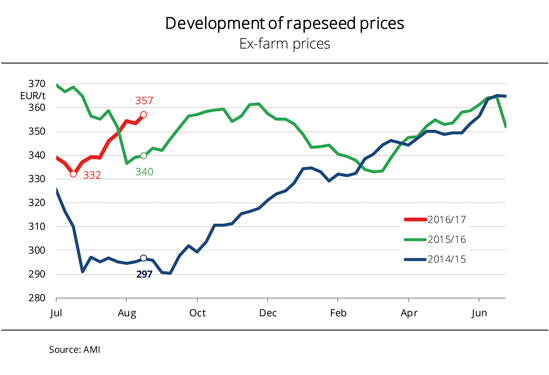

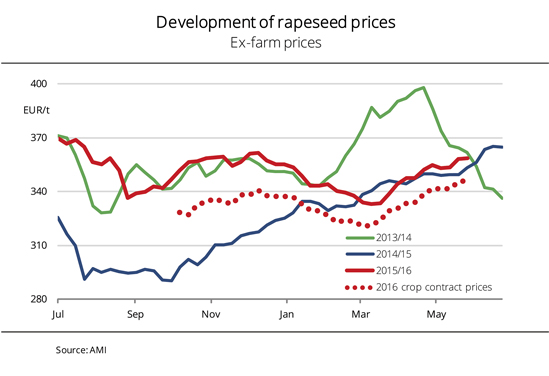

Rapeseed prices rise sharply

Most recently, the average price farmers received for rapeseed was at just under EUR 380 per tonne free storage facility, a level not seen since May 2014. The factors that contributed to supporting the rapeseed price originated, first and foremost, from overseas. German rapeseed prices have climbed continuously since the 2016 harvest began. However, the price surge has been especially sharp over the past two weeks, Agrarmarkt Informations-Gesellschaft mbH reports. Rapeseed prices were, first and foremost, supported from overseas. On the one hand, prices for soybeans went up significantly due to brisk demand from China, surpassing the psychological barrier of USD 10 per bushel (EUR 340 per tonne). On the other hand, the rapeseed harvest in Canada is severely hampered by snow and rainfall. At the ICE in Winnipeg, quotes soared by ten per cent in only three weeks. Vegetable oil prices also rose strongly in response to brisk demand for, and tight availability of, palm oil. At the same time, crude oil trended higher, whereas the weak euro increased EU export prospects. In other words, forward prices of rapeseed in Paris climbed above the EUR 400 per tonne mark to an 18-month high and pushed up producer prices in Germany.

Chart of the week (43)

Prices for vegetable oils surged

Spot prices for vegetable oils were raised significantly in the wake of the rally for palm and soybean oil. Having risen to a three-year high at EUR 830 per tonne, rapeseed oil is more expensive than sunflower oil. Prices for rapeseed oil picked up especially sharply as their surge was additionally driven by rising feedstock costs and the weak euro (which encourages exports). Feedstock prices are also supported by the fact that conditions for harvesting rapeseed have been less than optimal following snowfalls in Canada. Moreover, the European biodiesel industry has an increased demand for rapeseed oil because it has to comply with the quality requirements for winter diesel as laid down by the biodiesel standard. On the European vegetable oil market in Rotterdam, rapeseed oil is more expensive than sunflower oil, reflecting the contrary supply situation clearly. In the Netherlands, even premiums are currently paid on contracts for rapeseed. In Germany, the situation is exacerbated by the low water levels on inland waterways. On the one hand, feedstock cannot be delivered, and, on the other, vegetable oil cannot be called forward. Agrarmarkt Informations-Gesellschaft mbH reports that the rally on the futures market was triggered by the reduced supply outlook for palm oil and the small supplies of soybean oil in the US.

Chart of the week (42)

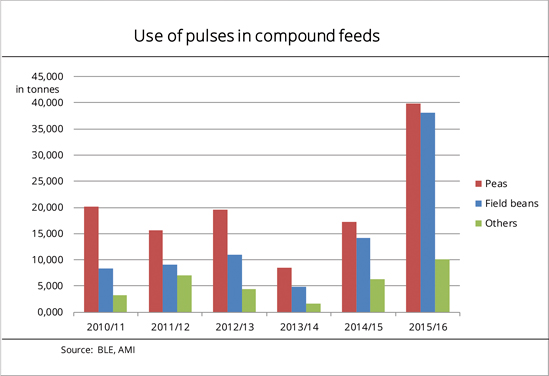

More pulses in compound feed

The changes in agricultural aid have given a boost to the production of legumes. Pulses are mainly used in farm-made feeds as a major source of protein. However, the mixed feed industry has discovered home-grown pulses too. In view of the Greening requirements, German farmers planted around 160,400 hectares with legumes in 2015. The harvest of peas, field beans and sweet lupines amounted to around 450,000 tonnes. This was a level of quantity that also aroused the interest of the German mixed feed industry, which, according to the Federal Office for Agriculture and Food (BLE), used around 88,000 tonnes of pulses in compound feeds in 2015/16. Although this figure is small compared to that of cereals, it provides a clear signal after several years of decline. After all, the quantity processed was more than twice the previous year's volume. No other feed component has seen such growth rates. However, the chances are that this trend could soon end as the EU Commission plans to introduce more stringent requirements for receiving the Greening payment, Agrarmarkt Informations-Gesellschaft mbH reports. The tightening of conditions would include a ban on applying crop protection products in legume production, although control of pests and diseases is essential to maintaining crop yields and quality. As a result, growing pulses would become unattractive to farmers. Pulses would sink back into their tiny niche, delivering a heavy blow to the German government's protein plant strategy.

Chart of the week (41)

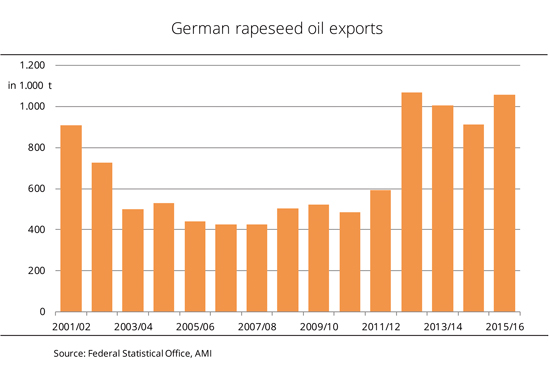

Strong demand for German rapeseed oil in 2015/16

German exports of rapeseed oil hit a three-year high in the 2015/16 marketing year. Order volumes from some EU member states and third countries grew substantially. German 2015/16 exports of rapeseed oil climbed significantly, according to figures published by the German Federal Statistical Office. At around 1.1 million tonnes, they were up almost 16 per cent from 2014/15. Around 91 per cent went to other EU countries, which was 3 per cent less than the previous period. The Netherlands, the hub of international trade, were again the main buyer, accounting for 484,000 tonnes (up 7 per cent). The Netherlands were followed by Poland, where imports were up by 53 per cent to 157,000 tonnes. Belgium occupied third place, despite a massive decline in imports to 87,000 tonnes. The EFTA states (Iceland, Norway, Switzerland), on the other hand, purchased a record volume of 78,000 tonnes, Agrarmarkt Informations-Gesellschaft mbH reports.

Chart of the week (40)

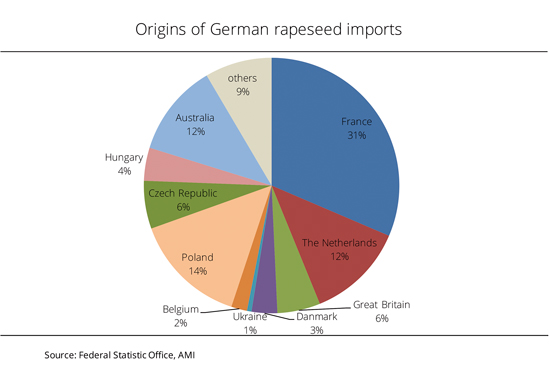

Strong increase in rapeseed imports in 2015/16

The German Federal Statistical Office reports significant increases in rapeseed imports in 2015/16, which reached a record peak at 5.4 million tonnes. In the 2015/16 marketing year, the oil mill industry imported 5.4 million tonnes of rapeseed. This was up just over 14 per cent from a year earlier and the highest quantity ever. Traditionally, the largest quantity came from the EU-28, although their share decreased considerably to 86 per cent. The main EU supplier, France, supplied 1.7 million tonnes, approximately 12 percent more than the previous year. In addition, German imports of non-EU rapeseed via the Netherlands rose to just under 672,500 tonnes. According to information published by Agrarmarkt Informations-Gesellschaft mbH, this quantity translates to a record high and double the 2014/15 figure. The largest third-country supplier, Australia, was overall third most important supplier despite substantial growth in exports to an all-time high of 636,000 tonnes.

Chart of the week (39)

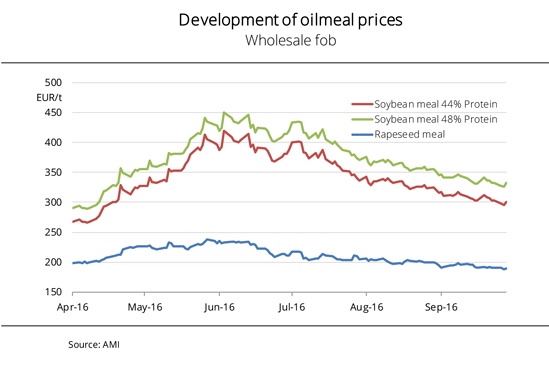

Rapeseed meal remains competitive

Following the sharp slump in prices for soybean meal, prices for extracted rapeseed meal have reached the lower price threshold. Price support is derived from the fact that demand is still focussed on GM-free sources of protein, and extracted rapeseed meal is a preferred choice in this respect.

In Germany, prices for genetically modified (GMO) soybean meal have dropped significantly in light of a record world supply in 2016/17. At the end of September 2016, nearby supplies were at the lowest level since April 2016. Extensive global supplies and sluggish demand put pressure on asking prices in Germany. Buyers' interest in extracted rapeseed meal has nevertheless been growing, because extracted rapeseed meal is increasingly used in dairy farms as a domestic source of protein. The reason is that more and more dairies and, ultimately, retailers are demanding products labelled “GMO free” to meet consumer requirements. According to information published by Agrarmarkt Informations-Gesellschaft mbH, GMO-free soybean meal is also in strong demand, so that prices remain at their present level of EUR 100-110 per tonne above the price for GMO soybean meal. This price would be the actual reference price for extracted rapeseed meal, given that the meals are interchangeable.

Chart of the week (38)

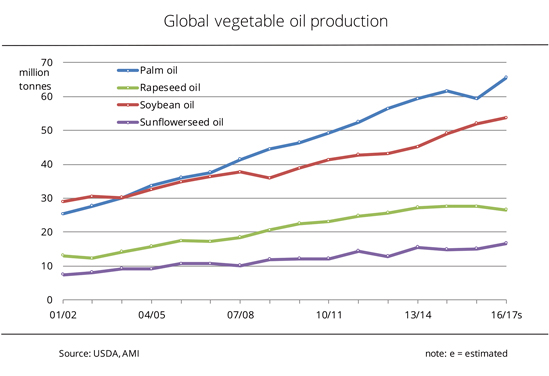

Global 2016/17 vegetable oil production to hit record level

Palm oil, soybean oil, rapeseed oil and sunflower oil account for around 87 per cent of production. The remainder consists of coconut oil, olive oil and peanut oil, among others. Palm oil and sunflower oil are expected to see the biggest rise in production in 2016/17, with volumes up approximately 10 per cent from the previous year. Palm oil production is predicted to recover from its sharp slump in the wake of El Niño in 2015/16 and is headed for a record high. Soybean oil production is estimated to increase by 3 per cent over last year, which will also translate to a record level. Only rapeseed oil is anticipated to see a decline to around 26.6 million tonnes. The falloff is due to a significant drop in feedstock supply on a global scale, Agrarmarkt Informations-Gesellschaft mbH reports.

Chart of the week (37)

Reduced crop obliges mills to adjust purchasing plans

In their efforts to source rapeseed, oil millers accepted higher prices than the previous week. However, traders didn't always respond to bids, as supply from farmers was short. Overall, the rapeseed market picked up somewhat, but supply remained tight. Oil millers managed to keep their premiums stable, even as prices in Paris rose. Growing demand for rapeseed oil for use in biodiesel fuel production has improved margins for mills, enabling the millers to accept higher asking prices. According to information published by Agrarmarkt Informations-Gesellschaft mbH, bids ranging from EUR 385 - 390 per tonne free of all charges slightly stimulated trading. However, the German cash market remained undersupplied. Processors are expected to still see shortfalls even in September 2016. They had anticipated increased supplies of new-crop rapeseed and lower prices for the month. However, due to the poor rapeseed harvest, these prospects have not materialised. Now supply is short, and there is hardly any prospect of an improvement. One of the reasons is that farmers are still holding on to their produce, which is hardly surprising in view of current price trends. Buyers in the north agreed to EUR 363 per tonne, but that was only EUR 1 per tonne more than a week earlier. Although mark-ups reached up to EUR 5 per tonne in remote regions, producers still considered the higher levels on offer to be of little interest.

Chart of the week (36)

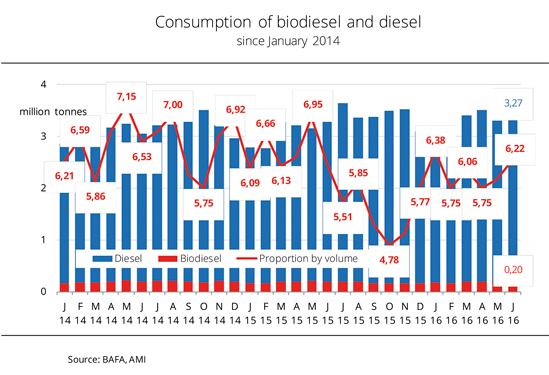

Biodiesel in blends rebounded to 6 per cent

The comparatively low purchase prices for biodiesel have stimulated demand appreciably. The June 2016 volume of biodiesel in blends surged to 6.22 per cent, the highest level since the beginning of the year. Total June 2016 consumption of diesel fuel shot up by just less than 5 per cent, to 3.3 million tonnes, from the previous month. Consequently, the volume amounted to around 18.6 million tonnes in the first half year. This translates to a 7 per cent rise year-on-year. The trend also drove up consumption of biodiesel - to a much lower degree - by one per cent, to 1.1 million tonnes. In other words, the volume of biodiesel in blends remained below the level of 6 per cent most of the time. Consumption figures did not rise substantially until June 2016. The Federal Office for Economic Affairs and Export Control (BAFA) reported that demand for biodiesel for blending amounted to 203,223 tonnes that month. The was the largest quantity in more than one year. If demand for mineral diesel continues to rise, it could also support sales of biodiesel. However, this outlook is dampened by the fact that over the past few weeks biodiesel prices have continuously increased compared to diesel, according to Agrarmarkt Informations-Gesellschaft mbH (AMI).

Chart of the week (35)

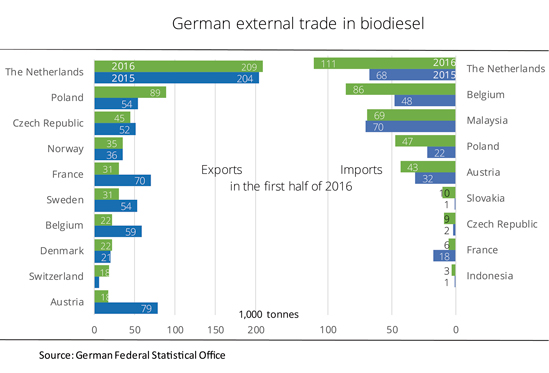

Biodiesel trade gap has narrowed

Demand for German biodiesel waned significantly in the first half of 2016. At just over 570,000 tonnes, exports to other European countries was down just about one fifth from the 2015 reference period. Above all, countries that absorbed only small amounts the previous year bought even less in 2016. By contrast, sales to the main destinations, such as the Netherlands and Poland, increased. At the same time, Germany imported more biodiesel from abroad. At 390,000 tonnes, the rise amounted to 46 per cent. More imports came via the European import ports in the Netherlands and Belgium, as well as from Poland and Austria. By contrast, direct shipments from Southeast Asia saw a slight dip. Agrarmarkt Informations-Gesellschaft mbH (AMI) indicated that the foreign trade statistics consequently reflect that nevertheless biodiesel exports continue to play an important role in the utilization of German biodiesel plants. There is currently no way of knowing whether this trend is going to continue in the second half year. The growing use of biodiesel from Used Cooking Oil Methyl Ester (UCOME) may be one factor explaining the current slump in foreign demand. UCOME may be counted double towards renewable quota obligations in countries like the Netherlands, Poland and Great Britain.

Chart of the week (34)

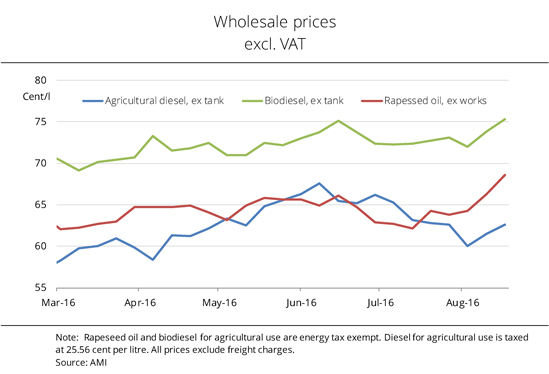

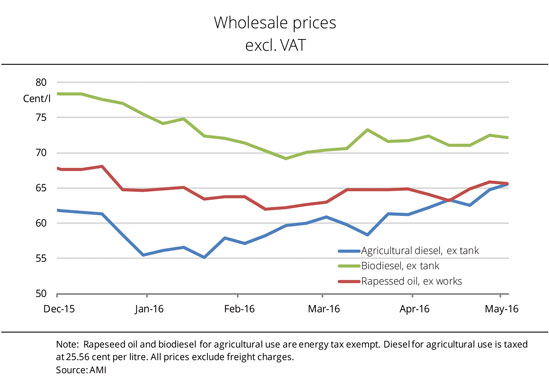

Wholesale fuel prices are on a firm trend

Wholesale prices for agricultural diesel, biodiesel and rapeseed oil have gone up considerably in August. Rapeseed oil fuel and biodiesel hit record levels. Agricultural diesel continued to be the lowest-priced alternative despite the price rise. Prices for agricultural diesel and biodiesel were raised massively in mid August 2016 as manufacturers' feedstock costs surged. In other words, WTI crude oil prices shot up by around 9 per cent within a single week. Prices of vegetable oils used in biodiesel fuel production also rallied in the wake of poor yields. Rapeseed oil for nearby delivery most recently cost just less than 69 euro cents per litre, a price not seen since mid December 2015. As a result, the selling price for standard biodiesel with an around 60 per cent potential for reducing greenhouse gas emission compared to fossil fuels rose to 75 euro cents per litre. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), this price not only translates to an eight-month high, but has also increased the gap over agricultural diesel to almost 13 euro cents per litre.

Chart of the week (33)

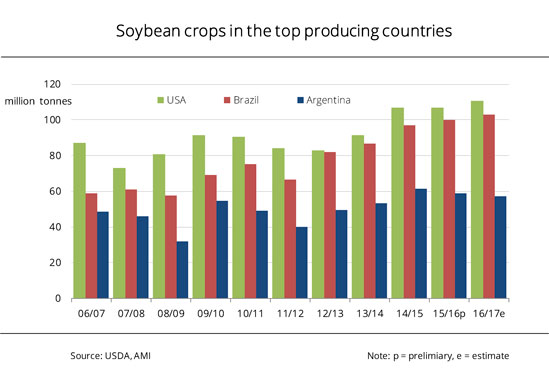

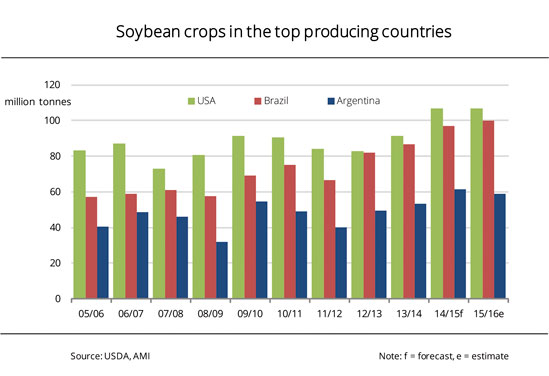

US soybean production hits record level

In the US, growing conditions for soybeans continue to be optimal. Fears of losses caused by drought are history now. The record area planted with soybeans could allow farmers to bring in the biggest ever soy harvest this autumn. The USDA forecast pegs this year's US soybean crop at around 110.5 million tonnes. This figure would exceed the 2014 record by 3.6 million tonnes. Favourable growing conditions, also in the development stage in August that is key in determining yield, have further improved prospects and led USDA to raise its recent crop forecast by 4.5 million tonnes. Since Brazil is also expecting a bumper crop of an estimated 103 million tonnes in the spring of 2017, global 2016/17 production could rise to unprecedented levels. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), the strong downward pressure on US soybean prices could only be counteracted by very brisk demand. The latter is already on the horizon.

Chart of the week (32)

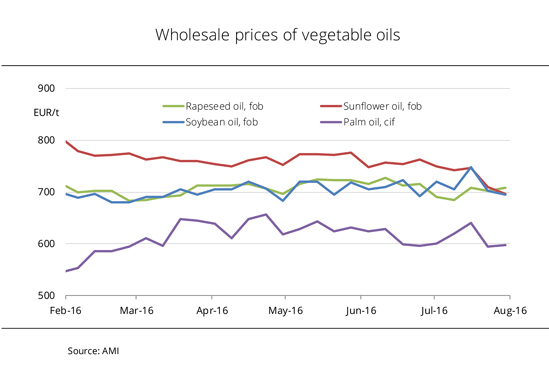

Rapeseed oil prices trended firm

Vegetable oil prices on the European cash market converged. Only palm oil continued to lag far behind. The trend for the coming months is mixed. Prices for rapeseed oil, soybean oil and sunflower oil converged in July 2016. Whereas soybean oil and sunflower oil were on a sluggish trend due to abundant supply of feedstock, the price curves for rapeseed oil showed a slight upward trend. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), oil mills are currently stocked up well with feedstock. However, supply could become increasingly difficult and more expensive in the coming months because of smaller than expected EU rapeseed supply. In addition, demand is picking up because the cap on greenhouse gas emission will rise from 3.5 to 4 per cent in 2017 and demand for biodiesel is going to surge as a result. This development is likely to stabilise the upward trend in prices of rapeseed oil. August volatility of soybean oil prices continues to be large due to the US weather market. The downward pressure on palm oil is expected to grow continuously in view of a record production in Southeast Asia in 2016/17.

Chart of the week (31)

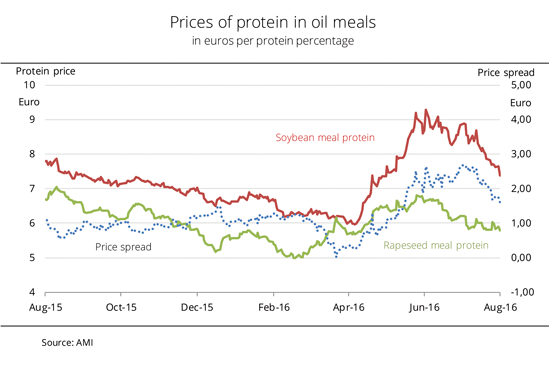

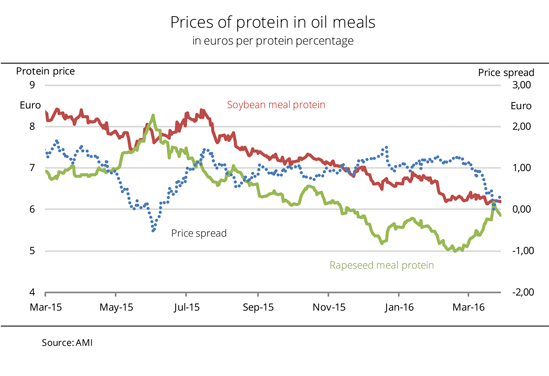

Rapeseed meal is in high demand

Strong price fluctuations and a generally higher price level curb demand for soybean meal. Meanwhile, due to the lower protein price and comparatively stable asking prices, rapeseed meal increasingly goes into feed mixes. Rapeseed meal is especially suited to fully replace soybean meal in ruminant feeds, without any loss in yield. Buoyant demand on nearby positions and prospects for smaller rapeseed crops in Germany and the EU-28 cause rapeseed meal prices to firm. Since prices per protein percentage per tonne of rapeseed meal nevertheless continue to be significantly below the level of soybean meal protein, demand currently focuses on extracted rapeseed meal. According to Agrarmarkt Informations Gesellschaft mbH (AMI), the price spread against soybean protein recently amounted to EUR 1.70 to EUR 1.90 per tonne. Lower fluctuations in price compared to soybean meal make rapeseed meal more attractive to feed millers. Moreover, rapeseed meal is the primary GM-free source of feed. UFOP has observed that the number of dairies that label products as “without GM” is steadily increasing.

Chart of the week (30)

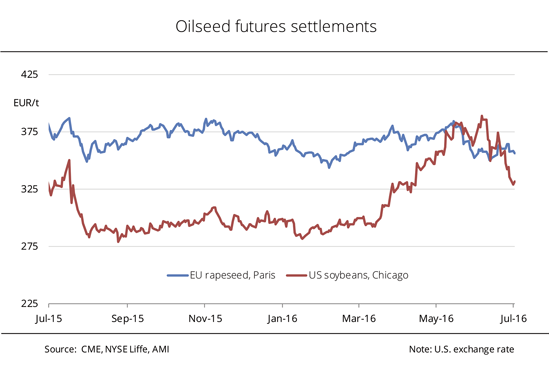

Paris quotes for rapeseed withstand soybean weakness

Positive crop prospects in the US put massive downward pressure on soybean prices. This has hardly had any impact on rapeseed in Paris to date. Neither are there any signs of decline in harvest. An anticipated drop in supply in the EU in 2016/17 and slow harvest progress sent prices on a slight upward trend. The nearby for soybeans in Chicago slumped below the level of USD 10 per bushel (the equivalent of EUR 334 per tonne) this week for the first time since April 2016. Fears of drought-related harvest losses in the US caused by the La Niña weather phenomenon are decreasing. In other words, the US crops have developed very well and provided the weather will be as favourable as has been forecast for the coming weeks yields could at least reach the previous year's level. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), rapeseed prices in Paris cannot quite escape the pressure from overseas. However, prices are increasingly firming up. This trend is supported by a slow progress in the EU harvest and prospects for a general scarcity of supply in the EU in 2016/17.

Chart of the week (29)

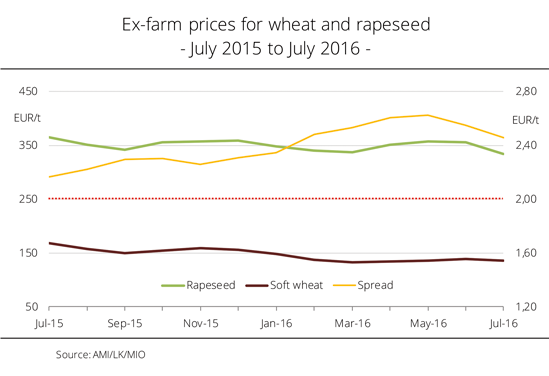

Rapeseed price exceeds that of wheat

The price gap between rapeseed and wheat has widened at the end of 2015/16. As harvest pressure wanes, this trend could continue in 2016/17 because, due to poor weather, the EU harvest will be considerably smaller. The European grain and oilseed traders' association Coceral/Copa-Cocega estimates the 2016/17 EU rapeseed supply at 21.2 million tonnes, expecting it to be even tighter than the previous marketing year. The reason is weather-related declines in yield. Although wheat was also affected by the unfavourable weather, especially in May and June 2016, prospects for supply are significantly better as global production is expected to hit a record. Meanwhile, there is scope for upward price movements of rapeseed based on decreasing production both in the EU and worldwide. In other words, the reduced supply to the market will be reflected in prices this year too. Buyers paid around EUR 334 ex farm per tonne of rapeseed already in July 2016. This was just less than EUR 200 per tonne more than what they paid for wheat.

Chart of the week (28)

Rapeseed stocks continue to slide in 2016/17

Global demand for rapeseed is likely to exceed supply in 2016/17, as it did in 2015/16. Consequently, supplies could continue their slide, opening room for price increases in the long term. USDA currently estimates the 2016/17 global rapeseed production at 66.5 million tonnes, down just under 1.7 million tonnes from the previous year. Harvests in the top producing countries – Canada, China and the European Union – are expected to drop. China is projected to see the largest reduction in output, by around 7 per cent, to 13.3 million tonnes. At the same time, the USDA forecast puts the amount of rapeseed used in processing at 64.8 million tonnes. This figure is down from the previous year, but continues to be large. As at the end of the marketing year, global ending stocks could amount to around 3.7 million tonnes. This would translate to a 13-year low.

Chart of the week (27)

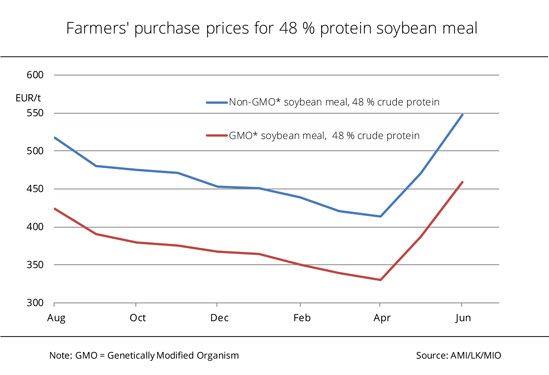

Soybean meal prices shot up

Spiking soybean prices have very recently also pulled up soybean meal prices in Germany. Wet conditions delaying harvest operations in Argentina and affecting soybean quality sent forward prices rocketing to a ten-month high. In April 2016, the previous downward slide of soybean meal prices ended abruptly. Prices delivered free to yard were up 14 per cent already in May 2016 and even saw a 17 per cent rise in June. At the same time, GMO and non-GMO soybean meal went up to virtually the same extent. The price spread between the two feed components recently amounted to EUR 89 per tonne. This is little more than the EUR 85 per tonne seen in the previous 2016 period. Consequently, the premium actually declined steadily compared to the previous years. In 2015, buyers had to pay on average EUR 99 per tonne more for GMO-free soybean meal and in 2013, it was in fact EUR 115 per tonne more. Until now, especially dairies in southern Germany have been known for focussing on milk produced without GMO feed or even without soybean meal. Now it is reported that some dairies from Schleswig-Holstein are planning to stop accepting the use of soybean meal feed as of October 2016.

Chart of the week (26)

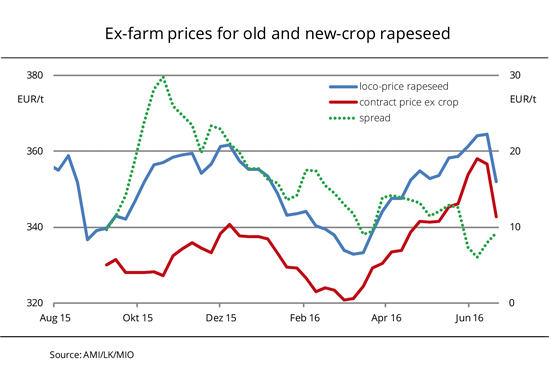

Prices for the two rapeseed crops converge

The comparatively low producer prices have dampened trade in the upcoming rapeseed crop for a long period of time. As a result, less rapeseed than usual has been bound in contracts to date. June bids for rapeseed on the cash market saw a massive decline in the wake of substantially declining rapeseed prices in Paris and slow demand. Prices 'free to the Lower Rhine' as at the end of the month were reported at EUR 352 per tonne, down EUR 19 per tonne from the previous month. Against this background, there was hardly any rapeseed offered. Taking advantage of the firm prices of the past few months, farmers contracted into agreements for the supply of their usual quantities in 2016/17. These would amount to approximately 30-40 per cent of the estimated harvest. Before offering anything, farmers are now waiting for the harvest to start and provide first crop figures. Rapeseed was not spared by the poor weather that affected many European areas. Drought in the east and heavy rainfalls in the south-west and south-east of Europe have reduced the yield potential. To date, MARS experts have projected the yield at 32 decitonnes per hectare. Although this figure would exceed the long-time average by 1 per cent, it is down 1 decitonne per hectare from the May 2016 estimate.

Chart of the week (25)

Volatile soybean meal prices curb demand

A volatile euro rate ahead of the Brexit referendum is generating substantial price movements. However, soybean meal remains at a high level, putting an additional damper on demand. The UK's referendum on EU membership is creating uncertainty in the international finance and futures markets. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), the uncertainty also has an impact on prices for soybean meal imports in that prices are adjusted daily – and sometimes substantially. Nevertheless, at around EUR 390 per tonne for 44 per cent soybean meal and EUR 420 per tonne for 48 per cent soybean meal, wholesale prices continue to be at their highest level in 17 months. In view of the exceptionally large price volatility, there is great uncertainty among market participants, especially because they speculate on price reductions in the wake of the upcoming US soybean harvest. First, however, markets must stabilise, which could take some time if Britain actually leaves the EU-28.

Chart of the week (24)

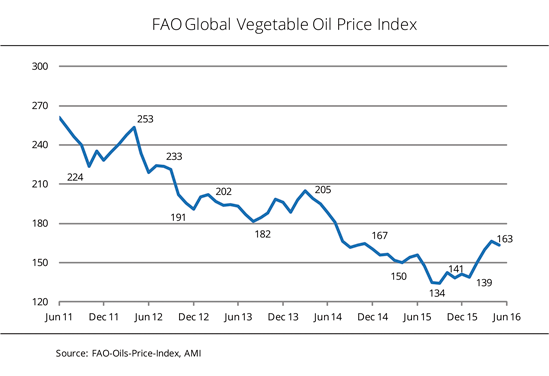

Weak palm oil prices force down vegetable oil price index

The vegetable oil price index of the Food and Agriculture Organization of the United Nations (FAO) dropped by 3 per cent in May 2016, interrupting the upward trend seen since January. Following a sharp rise by virtually one fifth since the beginning of the year, in May the upward trend was stopped for the time being. Prices for palm oil, the world's most important vegetable oil, saw a sharp drop in the wake of slack global demand combined with a surprisingly high output in the top palm oil producing countries. According to information published by Agrarmarkt Informations-Gesellschaft mbH (AMI), the index of 163 points was down 3 per cent from the previous month, but up 6 per cent on the previous year's level. The FAO price index measures the changes in international prices for ten different vegetable oils, weighted with their export shares in world trade. The Union for the Promotion of Oil and Protein Plants e.V. (UFOP) believes that raising the biodiesel blending requirements for biodiesel from palm oil is the only choice that is immediately effective on a large scale in the palm oil producing countries. The example of Malaysia illustrates this point. The country recently increased the blending quota to 10 per cent. Along with EU-based refineries producing hydrogenated vegetable oil (HVO), the chemical industry also benefits from this pressure on prices. UFOP points out that in Germany, the entire rapeseed crop has been certified as sustainable to meet legal requirements. According to UFOP, the leading palm oil exporting countries continue to be far from meeting this kind of standard. In fact, EU politicians should take this year's forest fires in Indonesia as a warning to further develop the sustainability requirements for biofuel feedstock specified in the European Renewable Energy Directive, instead of virtually abolishing them as the current funding period expires in 2020, UFOP suggests.

Chart of the week (23)

Heavy rains damage French sunflower crops

The sunflower area in France, the EU's fourth biggest producer of sunflowers, will likely be significantly smaller than expected. Consequently, the EU Commission could reduce its previously positive area forecast to project negative figures for 2016. France apparently suffered significant losses as heavy rains caused flooding. The French ministry of agriculture currently estimates the sunflower area at 587,000 hectares, down 5 per cent from a year earlier. The EU Commission projected 619,000 hectares for France still in May. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), the Commission's forecast is still very vague anyway. The experts in Brussels have previously put EU sunflower production for the 2016 harvest slightly higher than a year earlier. However, given what has been happening not only in France, the previous year's level will probably be difficult to attain.

Chart of the week (22)

Rapeseed prices rally

Cash market prices for rapeseed have gone up considerably and exceeded the previous year's level for several weeks. Producers are paid more than previously also for new-crop contracts. The upward trend continues for the time being given the significantly tighter 2016/17 supply. Rapeseed for prompt delivery currently fetches on average EUR 359 per tonne free storage facility. This translates to a rise of EUR 6 per tonne on the previous year. Buyers accept to pay EUR 346 per tonne for new-crop material. This is even a EUR 11 per tonne surge from the same time a year earlier. According to information published by Agrarmarkt Informations-Gesellschaft mbH (AMI), with the exception of only a few locations, little new business is generated despite rising prices in the old-crop positions. The reason is that supply is very tight. Interest in contracts is also small, because farmers speculate on additional price increases. Such increases are likely because global supply declines while 2016/2017 demand will presumably be brisk.

Chart of the week (21)

Diesel prices rally substantially

Prices for partially taxable agricultural diesel are on a firm trend, moving closer to those for biodiesel and almost reaching the level of rapeseed oil. The trend is driven by a massive rise in crude oil prices. The nearby futures price on the NYMEX currently stands at just under the mark of 50 USD per barrel, hitting a eight-month high. The competitive position of biodiesel at the wholesale level has improved over the past few weeks. In other words, standard biodiesel having a potential greenhouse gas emission reduction of around 60 per cent over fossil fuels currently costs 72 euro cents per litre. This is only 7 euro cents per litre more than agricultural diesel. At the beginning of April 2016, the difference still amounted to almost 15 euro cents per litre. The surge in diesel prices is due to a massive increase in prices for crude oil. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), crude oil prices are driven up by rising global demand combined with declining supply. Rapeseed oil prices in Germany also trend firm based on scarce nearby supply and climbing feedstock prices.

Chart of the week (20)

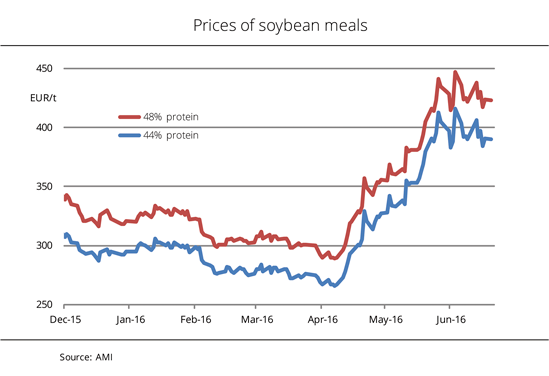

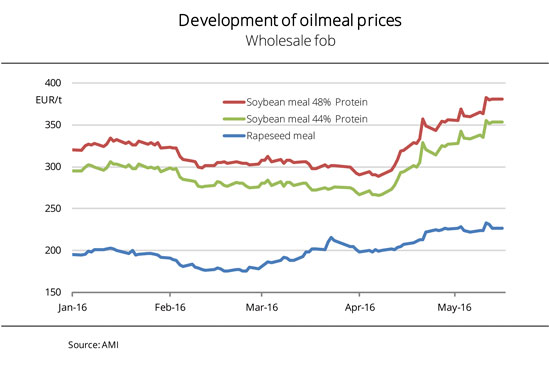

Oilseed meals increase in price

Prices for oilseed meals have soared over the past few weeks. The key driver was, first and foremost, the sharp rise in soybean prices. However, the sometimes tight supply also lent support to asking prices. Soybean meal is currently at its highest level since the end of July 2015. According to information published by Agrarmarkt Informations-Gesellschaft (mbH), wholesale prices for 44% soybean meal most recently overshot the level of EUR 350 per tonne, while high-protein meal (48%) was in excess of EUR 380 per tonne. The sharp upturn in prices, which started early April 2016, was primarily driven by the surge in raw material prices in response to the poor Argentine soybean harvest. Currently, what is driving prices up is the slow pace of sowing in the US. Consequently, soybean meal is also getting increasingly expensive. Buyers now hope that the boom will wane. However, the prospects for another tightness in global supply with declining ending stocks are likely to maintain prices at high levels for the time being. Rapeseed meal most recently exceeded the EUR 225 per tonne mark. Tight nearby supply has sent prices rising to a level last seen seven months ago.

Chart of the week (19)

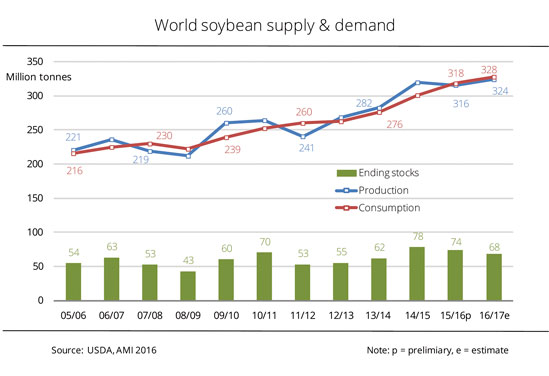

2016/17 global soybean demand exceeds output

The coming marketing year's demand for soybeans is set to outpace production by approximately 4 million tonnes. This is the outcome of the preliminary USDA estimate. Nevertheless, supply to the market will be more than sufficient, as ending stocks are expected to decline by 74 million tonnes to 68 million tonnes. According to this first official forecast, stocks would still be at the fourth highest level on record. The reason for the reduction in stocks is that consumption is projected to climb by around 10 million tonnes, to a historic high of just under 328 million tonnes. At the same time, production is estimated to rise by 8 million tonnes to 324 million tonnes. This is also the largest soybean output in history. According to information published by Agrarmarkt Informations-Gesellschaft (mbH), the surge is first and foremost based on an increased forecast for Brazil and India compared to the previous year. China and India are the main driver in boosting demand, as they have been in recent years.

Chart of the week (18)

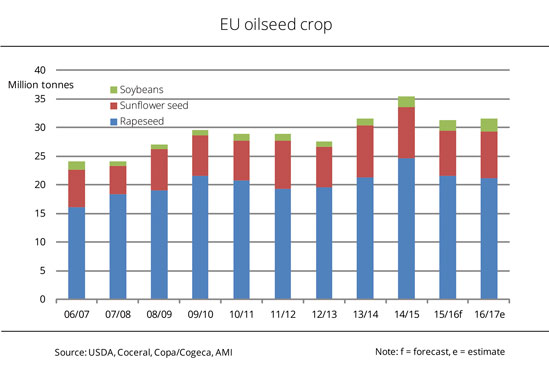

Low forecast of 2016 EU oilseed crop supports prices

Total 2016 oilseed production in the EU-28 could see a slight rise from the previous year. However, whereas an increase is expected in soybeans and sunflowers, the rapeseed harvest could dip further. This situation supports prices. The EU-28 member states are estimated to harvest 31.6 million tonnes of oilseeds in 2016, approximately 200,000 tonnes more than a year earlier. According to Agrarmarkt Informations-Gesellschaft (mbH), the rise is accounted for by a growth in sunflower and soybean output. In other words, the sunflower harvest is expected to increase by around 8.1 million tonnes (approximately 4 per cent) based on a slight expansion of sunflower area. Soy production could increase by 13 per cent, to a record peak of 2.3 million tonnes. By contrast, EU rapeseed production is expected to drop. The European oilseed associations Copa/Cogeca and Coceral peg the decline at an estimated 400,000 tonnes, to 21.2 million tonnes. The associations put the slide down to the slight reduction in rapeseed area. Yields by hectare could exceed the the long-term mean.

Chart of the week (17)

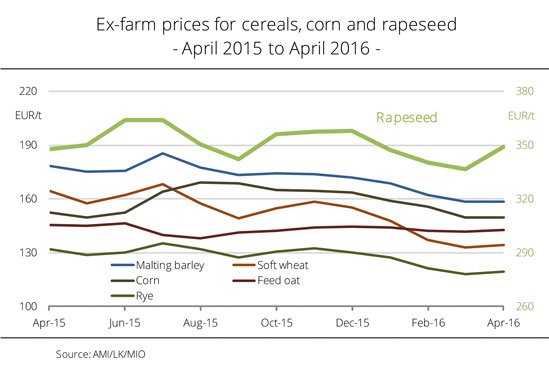

Farmers received more money for rapeseed only

Farm prices of rapeseed are currently the only prices that are above the previous year's level. Meanwhile, cereals and corn saw a sharp dip. Following a strong rise over the past several months, April 2016 rapeseed prices not only shot up to the highest level since the end of 2015, but even climbed above the year-ago level. Consequently, rapeseed is currently the winner among the field crops, Agrarmarkt Informations-Gesellschaft (mbH) reports, because for all types of cereals as well as corn, farmers are receiving less money than at the same time a year ago. As supply exceeded demand, the price drop was especially strong for soft wheat, amounting to virtually 20 per cent. In contrast, fodder oat and corn saw a moderate dip of just under 2 per cent. April 2016 bids for rapeseed were on average EUR 349 per tonne ex farm, up just over EUR 1 per tonne from the same month a year ago.

Chart of the week (16)

Fewer soybeans from Argentina?

The 2015/16 South American soybean production could be much smaller than has long been expected because of weather-induced losses in Argentina. In Brazil, harvest figures more or less match forecasts as the harvest is coming to a close. Several days of heavy rain in Argentina might result in harvest losses of up to 3 million tonnes, in addition to reducing soybean quality. USDA has recently put the 2015/16 Argentinian soybean production at 59 million tonnes, down approximately 2 million tonnes from 2014/15. Brazil is expected to produce a record crop of 100 million tonnes. Almost 90 per cent of its soybean area has been harvested. The Brazilian crop compares to the (narrow) US record of 107 million tonnes in the autumn of 2015, diminishing the gap between the two countries. According to Agrarmarkt Informations-Gesellschaft (mbH), preliminary estimates for the upcoming year 2016/17 indicate another large soybean output. In other words, as matters stand, the US soybean area for the 2016 harvest will fall just short of the previous year's record.

Chart of the week (15)

Palm oil takes break from climbing

Palm oil prices followed a downward trend, recently virtually plummeting to a one-month low. However, the tide could soon turn in the wake of continued buoyant interest in buying. Crude oil prices are soaring. Palm oil prices in Kuala Lumpur have registered heavy losses over the past few days. According to information published by Agrarmarkt Informations-Gesellschaft (mbH), demand continued to be brisk. On the other hand, however, Malaysian production exceeded expectations. Instead of the expected losses caused by poor weather, Malaysia saw a rise in output by virtually 17 per cent to 1.2 million tonnes in March 2016, the Malaysian Palm Oil Board (MPOB) reported. Nevertheless, stocks slumped significantly as interest in buying continued to be strong. Since the annual replenishment of stocks in the run-up to the fasting month of Ramadan is set to start before long in Muslim countries, demand could continue to rally, sending prices back up again. Meanwhile, soybean oil in Chicago largely followed palm oil. Crude oil prices shot up massively to a five-month high as global supplies declined.

Chart of the week (14)

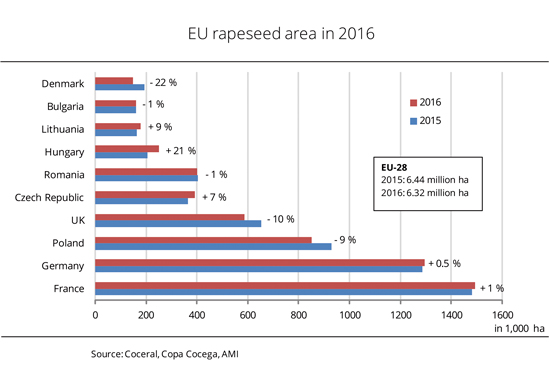

EU rapeseed area declined slightly

The area planted with winter rapeseed in the EU-28 for the 2016 harvest is estimated at 6.32 million hectares. This translates to an almost 120,000 ha drop from the previous year. Total output could decline slightly if yields will be average. The development of acreage devoted to rapeseed production differs widely in the various member states, Agrarmarkt Informations-Gesellschaft (mbH) reports. Whereas farmers in the most important rapeseed growing countries France and Germany expanded the area planted with rapeseed somewhat in the autumn, all other countries recorded significant reductions. In Poland, difficult sowing conditions and extensive losses due to winter kill account for the drop. In Great Britain, farmers already planned to reduce the area at the time of sowing. According to an assessment by the MARS (Monitoring Agricultural ResourceS) project of the EU Commission, crop areas are in a good condition in nearly all regions this spring. In some locations, the crops are in an advanced stage of growth due to the mild winter.

Chart of the week (13)

Rapeseed meal prices hit five-month high

Temporarily very keen interest in buying nearby material and firm feedstock prices in Paris have driven up prices of rapeseed meal substantially at the end of March 2016. Meanwhile, soybean meal prices remained at a fairly low level. Prices for rapeseed meal climbed to almost EUR 6.20 per protein percentage per tonne last week. Consequently, they not only hit a five-month high, but also reached the price level of soybean meal protein. Above all, the growing demand in the run-up to the holidays sent prices for nearby positions rising. However, most orders were only for minimal amounts. According to information published by Agrarmarkt Informations-Gesellschaft (mbH), the sharp rise in prices quickly curbed buyer interest. As a result, the high price level could not be maintained as there was no shortage of supply. However, as breaks in processing are imminent and a large oil mill is set to close down, chances are that supply could shrink appreciably before long.

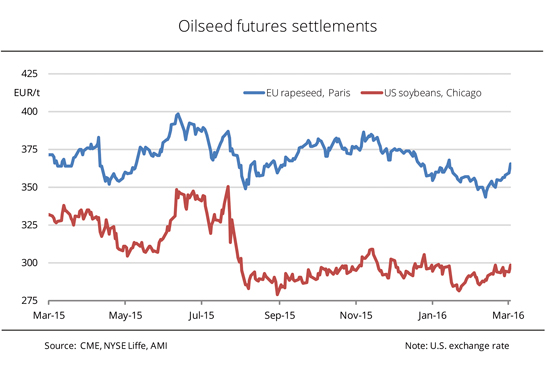

Chart of the week (12)

Rapeseed recovers from its low

Early this year, the quotes for rapeseed in Paris registered heavy losses in the wake of weak crude oil prices and a stagnant market. Currently, an upward trend is looming on the horizon, driven by firm soybean and vegetable oil prices. Harvest delays in South America caused by poor weather and buoyant demand for US material have sent soybean profits leaping in Chicago in March 2016. The nearby surged by just over 7 per cent over the month, exceeding the mark of USD 9 per bushel (the equivalent of EUR 295 per tonne) for the first time since December 2015. Rapeseed in Paris also benefited from the upswing of soybean prices, hitting a six-week high in contracts for both the 2015 crop and the upcoming crop. Even a firm euro rate did not prevent the rise, Agrarmarkt Informations-Gesellschaft (mbH) reports. Rapeseed prices received additional stimulus from the fact that the competitive advantage of rapeseed oil increases as vegetable oil and crude oil prices are on a general rise.

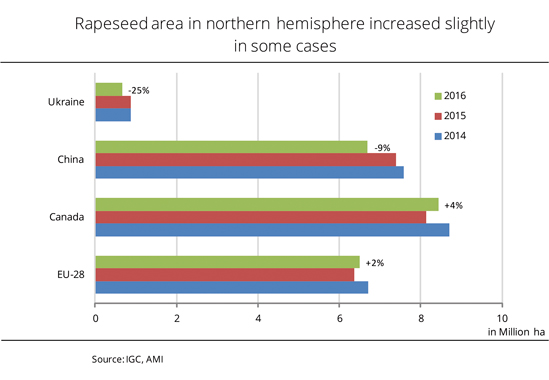

Chart of the week (11)

Prices for vegetable oils remain at a record low

In the northern hemisphere, winter rapeseed has been in the ground for months. Now, it shows how the crops made it through the winter. Only in a few regions suffered larger than usual damage this year. In some countries, even planting was ill-fated. Above all, a sharp drop in rapeseed area is forecast for Ukraine in 2016. Drought severely affected plantings and is also responsible for above-average losses over the winter. According to information published by Agrarmarkt Informations-Gesellschaft (mbH), the Ukrainian rapeseed area may potentially be down one fourth from a year earlier. Some failed areas will be re-planted with summer rapeseed. However, yields of summer rapeseed are lower than those of winter rapeseed. In Poland, the cold winter resulted in more winterkill losses than usual. In Great Britain, the crops suffered from flooding. Nevertheless, the area of winter rapeseed is forecast to expand across the EU. In China, the area planted with rapeseed will probably be reduced because rapeseed is less competitive than other crops. For exactly the opposite reason, the area of summer rapeseed in Canada is projected to rise.

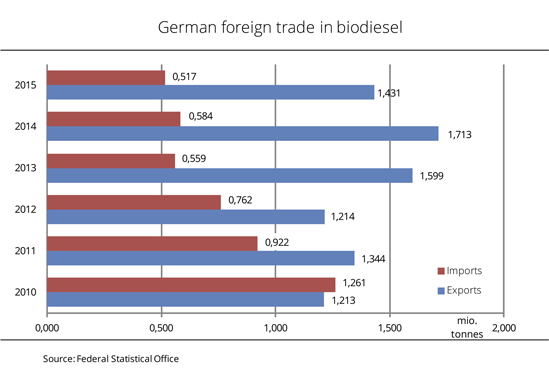

Chart of the week (10)

Strong demand for biodiesel from Germany continued in 2015

Although German foreign trade in biodiesel was not quite as brisk in 2015 as a year earlier, export figures published by the German Federal Statistical Office verify that interest in biodiesel from Germany continued to be high. German 2015 biodiesel exports amounted to just over 1.43 million tonnes. Consequently, exports were down 16 per cent from the 2014 record, but still exceeded the long-term mean. Just under 90 per cent of deliveries traditionally went to EU member states. Above all, the Czech Republic and Sweden ordered more than usual, whereas top recipients such as the Netherlands, Poland and France imported less. According to the German Federal Statistical Office, Norway was the most important third country, importing almost 128,000 tonnes. This translates to a virtually 50 per cent rise from a year earlier. At the same time, German demand for foreign biodiesel dropped by approximately 11 per cent, to 517,000 tonnes. This was to the lowest level on record, Agrarmarkt Informations-Gesellschaft (mbH) reports. Malaysia supplied 132,000 tonnes, just over one third more than in 2014.

Chart of the week (09)

Decentralised oil mills increase sales to CHP facilities

Pure cold-pressed rapeseed oil fuel is hardly competitive given the sharp drop in diesel prices. However, demand to generate electricity and heat increased as palm oil prices surged. In February 2016, batches of rapeseed oil were sold to combined heat and power plants (CHP facilities) again, following a massive rise in prices for competing palm oil. At decentralised oil mills, selling prices for cold pressed rapeseed oil were slightly lowered in February 2016, Agrarmarkt Informations-Gesellschaft (mbH) reports. At on average 79.90 euro cents per litre net ex decentralised mill, cold pressed rapeseed oil was slightly down from the previous month, improving its competitive position compared to mineral diesel somewhat. After all, February diesel prices rose by just under 2 per cent. BAFA consumption figures also show the dwindling sales of rapeseed oil fuel, putting the drop at around 2,000 tonnes in 2015. This is not even half the year-ago volume

Chart of the week (08)

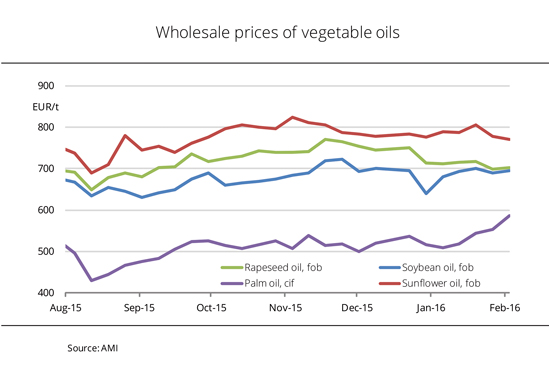

Rapeseed oil improves its competitive position

Prices for rapeseed and soybean oil are converging again. Palm oil continues to be low-priced, but the price gap against the other vegetable oils has narrowed significantly in the wake of the past few weeks' sharp price rise.Prices for soybean oil have returned to almost the level of rapeseed oil prices following their surge on the European vegetable oil market mid February 2016. The rise was based on firming feedstock prices in Chicago. At EUR 702.50 per tonne, rapeseed oil for nearby delivery fob Hamburg most recently only cost EUR 6.50 per tonne more than soybean oil. Palm oil prices also moved considerably closer to those of rapeseed, reflecting their past weeks' nearly ten per cent surge. At recently EUR 116 per tonne, the palm oil to rapeseed oil spread has narrowed by half since the beginning of the year. The palm oil price rally has been driven by prospects for limited supply in the most important palm oil producing countries in 2016 due to poor growing conditions caused by El Niño. These expectations temporarily sent palm oil prices in Kuala Lumpur to a 21-month high.

Chart of the week (07)

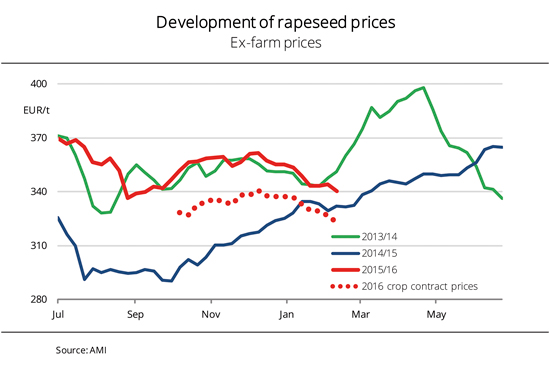

Rapeseed set to be cheaper again

Cash market prices for rapeseed barely maintained the price gap against the previous year. Prices buyers currently pay for the upcoming crop are even below the year-ago level. The massive decline in crude oil prices and the temporarily firm euro sent rapeseed prices in Paris plummeting to the lowest level in five months at the beginning of February 2016. The price slide also put massive pressure on spot prices, especially because processors do not provide any incentives to thwart it, given the premiums they pay on stock market quotes. At the same time, producers hardly offer any batches, hoping that prices will rise significantly towards the end of the season. The 2016 crop is also rarely a topic of conversation. Producers obtained EUR 340 per tonne free storage facility for spot material in mid February, Agrarmarkt Informations-Gesellschaft mbH (AMI) reports. This was down EUR 4 per tonne from a week earlier and, consequently, up EUR 8 from the previous year. Buyers most recently accepted to pay EUR 323 per tonne for new-crop rapeseed, EUR 4 per tonne less than the same time a year ago.

Cash market prices for rapeseed barely maintained the price gap against the previous year. Prices buyers currently pay for the upcoming crop are even below the year-ago level. The massive decline in crude oil prices and the temporarily firm euro sent rapeseed prices in Paris plummeting to the lowest level in five months at the beginning of February 2016. The price slide also put massive pressure on spot prices, especially because processors do not provide any incentives to thwart it, given the premiums they pay on stock market quotes. At the same time, producers hardly offer any batches, hoping that prices will rise significantly towards the end of the season. The 2016 crop is also rarely a topic of conversation. Producers obtained EUR 340 per tonne free storage facility for spot material in mid February, Agrarmarkt Informations-Gesellschaft mbH (AMI) reports. This was down EUR 4 per tonne from a week earlier and, consequently, up EUR 8 from the previous year. Buyers most recently accepted to pay EUR 323 per tonne for new-crop rapeseed, EUR 4 per tonne less than the same time a year ago.

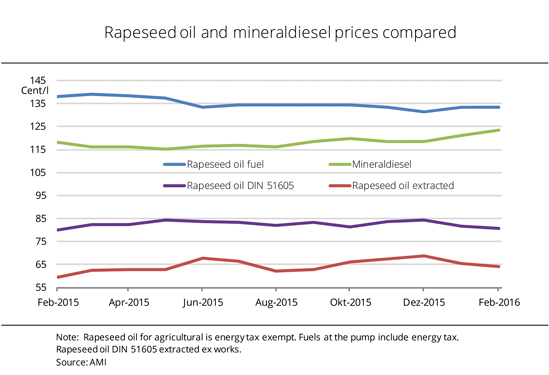

Chart of the week (06)

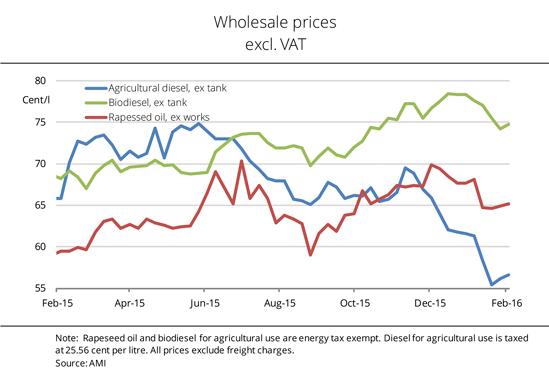

Agricultural diesel prices continue at a low level

Weak crude oil prices keep the prices for mineral diesel at a low level, and consequently also those for agricultural diesel. Meanwhile, biodiesel prices surged from the previous year based on rising feedstock costs. At the beginning of February 2016, the wholesale price for mineral diesel was around 31 euro cents per litre, excluding energy tax. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), this translates to a drop by virtually 10 euro cents per litre from February 2015, to an eleven-year low. Taking into account reimbursements to farmers, agricultural diesel currently costs around 57 euro cents per litre, 18 euro cents per litre less than tax-advantaged biodiesel.

Weak crude oil prices keep the prices for mineral diesel at a low level, and consequently also those for agricultural diesel. Meanwhile, biodiesel prices surged from the previous year based on rising feedstock costs. At the beginning of February 2016, the wholesale price for mineral diesel was around 31 euro cents per litre, excluding energy tax. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), this translates to a drop by virtually 10 euro cents per litre from February 2015, to an eleven-year low. Taking into account reimbursements to farmers, agricultural diesel currently costs around 57 euro cents per litre, 18 euro cents per litre less than tax-advantaged biodiesel.

Chart of the week (05)

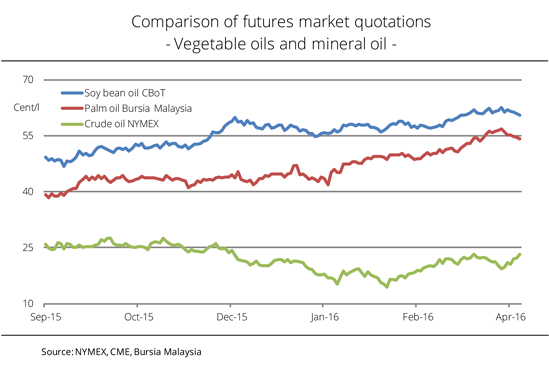

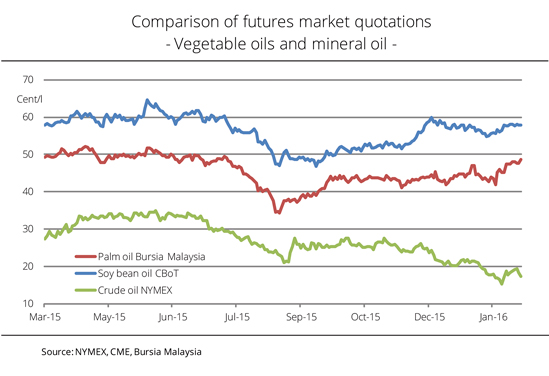

Vegetable oil prices hold stable as crude oil prices hit 12-year low

The January dive of New York crude oil prices widened the gap with prices of palm and soybean oil even further.

Global surplus put strong downward pressure on crude oil prices on the futures market. Positive stimuli usually only had a short-term effect. Although prices on the NYMEX temporarily surpassed the mark of USD 30 per barrel at the end of January 2016, they remained at the lowest level in 12 years. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), palm oil prices continued to benefit from fears of reduced crop yields in Southeast Asia in the wake of the El Niño phenomenon. Soybean oil prices in Chicago also recorded gains based on firm feedstock prices.

Chart of the week (04)

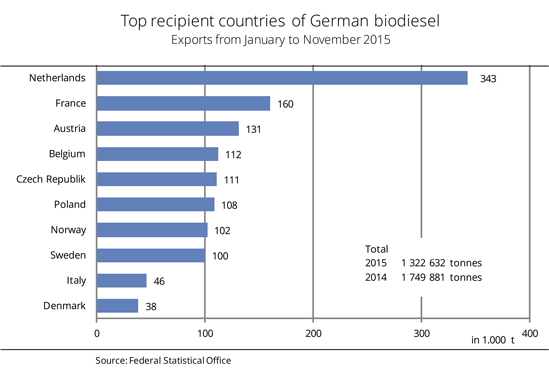

German biodiesel exports decline

German biodiesel exports in the first 11 months of 2015 were down almost one fourth from same period in 2014. This is shown by German Federal Statistical Office foreign trade figures. A respectable 90 per cent of exports went to EU member states.

According to Agrarmarkt Informations-Gesellschaft mbH (AMI), the sharp drop in biodiesel exports was first and foremost based on a massive decline in deliveries to the Netherlands, France and Poland. Demand from the Netherlands alone was down around 42 per cent on the same period the previous year. Orders from Poland plummeted by 38 per cent. Exports to France slumped by 26 per cent, allowing the country to barely maintain its second position. Austria took third place, as exports to there rose by just under one fifth. By contrast, the volume of exports to the Czech Republic and Sweden went up significantly from the same period the previous year. German biodiesel exports to the Czech Republic were the highest ever, rising almost 80 per cent to a total of 111,000 tonnes.

Chart of the week (03)

Soy processing grows substantially

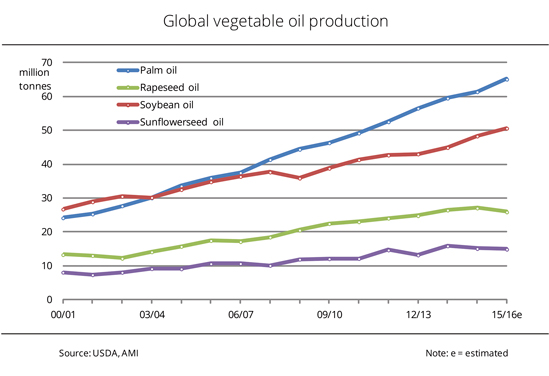

Global soybean oil production rises approximately 5 per cent, based on the 2015/16 record supply of feedstock. By contrast, production of rapeseed oil declines from the previous year. Smaller and, consequently, more expensive feedstock supply increases competition with other oils.

The nosedive of mineral oil prices has put a heavy damper on demand for vegetable oils. Biodiesel based on vegetable oils can currently hardly compete with mineral diesel, Agrarmarkt Informations-Gesellschaft mbH (AMI) reports. But there is hope. OPEC expects crude oil prices to surge again over the next few years in the wake of rising costs. Nevertheless, 2015/16 global output of vegetable oils rises by just under 2 per cent, to 179 million tonnes. At the same time, soybean oil production increasingly converges with that of palm oil, the world's leading vegetable oil. Production of rapeseed oil falls for the first time in nine years, but continues to exceed the long-term mean. Production of sunflower oil stagnates.

Chart of the week (02)

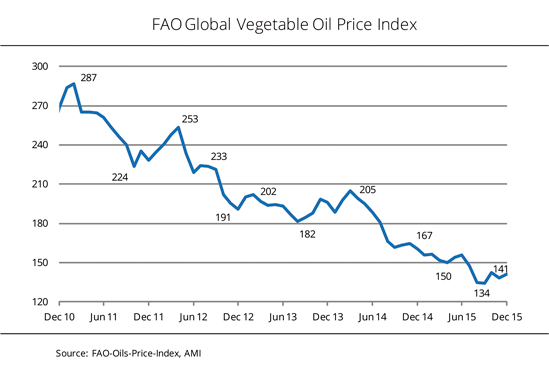

Prices for vegetable oils remain at a record low

The vegetable oil price index of the Food and Agriculture Organization of the United Nations (FAO) rose by almost 2 per cent in December 2015, but continues at a nine-year low even though biodiesel production has increased. The downward slide came to a halt in December 2015 for the time being. The reason was that prices for soybean oil surged, hitting a six-month high in the wake of reduced global feedstock supply and growing demand. At the same time, prices for palm oil, the most important vegetable oil, were stable. Continued fears that the weather could have a negative impact on crop output in Southeast Asia had offset slow demand, Agrarmarkt Informations-Gesellschaft mbH (AMI) reported. Nevertheless, at 141 points, the December index was one fifth below the previous year's level. The FAO price index measures the changes in international prices for ten different vegetable oils, weighted with their shares in world trade.

Chart of the week (01)

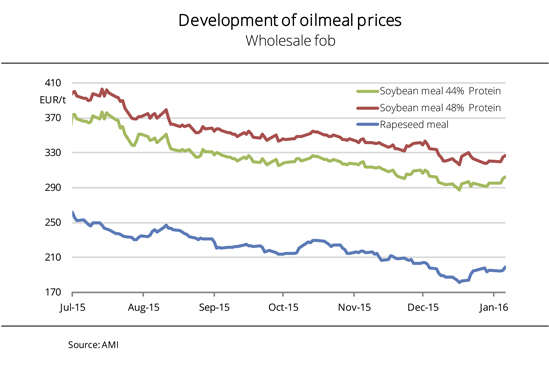

Oilseed meal prices have slightly firmed

Prices of soybean meal and rapeseed meal recovered at the end of December 2015, after downward for several months. However, pressure continues to be large.

At the beginning December 2015, overabundant supply and slack demand sent oilseed meal prices on the cash market skidding to a four-year low. Rapeseed meal temporarily cost only around EUR 180 per tonne fob mill, whereas soybean meal (44% protein) approached the mark of EUR 290 per tonne fob Hamburg. According to Agrarmarkt Informations-Gesellschaft (mbH), the downward slide stopped immediately before Christmas in the wake of rising feedstock prices in Paris and Chicago. The temporary decline of the euro also drove up prices for imported soybean meal. Asking prices recently climbed to a one-month high. However, the long-term price trend is weak because global supply of feedstock is at a record high. Most recently, rapeseed meal approached the EUR 200 per tonne mark, although demand continues to be limited to nearby positions.

Union zur Förderung von Oel- und Proteinpflanzen E.V.

Union zur Förderung von Oel- und Proteinpflanzen E.V.