Chart of the week (51)

2019/20 world rapeseed production set to be stable

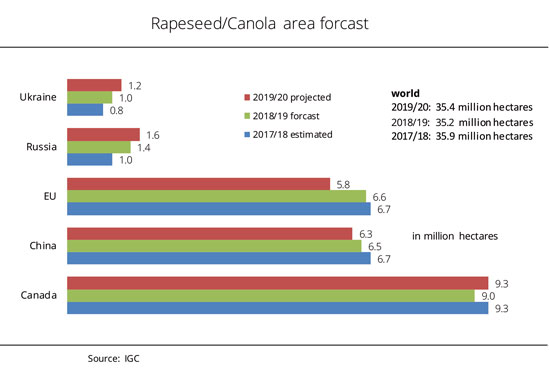

The rapeseed area for the 2019 harvest is expected to increase in many countries, whereas in the EU it is anticipated to decline substantially.

For this reason, the International Grain Council (IGC) assumes the global area planted with rapeseed to expand minimally by less than 1 per cent.

Following an extremely difficult season in 2018/19, EU prospects of an average harvest in the coming marketing year were noticeably clouded already at the time of sowing. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), the prolonged period of drought not only forestalled sowings in many places, but also gave field crops a poor start. This situation has fuelled fears of winter kill. In the EU, there are numerous signs of a significant reduction in rapeseed area. The 5.8 million hectares that have been projected for the marketing year 2019/2020 would be the poorest area basis in 12 years.

By contrast, sowings in Ukraine went well. By the beginning of November sowings were up 16 per cent from 2017. In Ukraine, winter rapeseed accounts for around 90 per cent of the area devoted to growing rapeseed, whereas summer rapeseed prevails in Russia. Russia is also expected to see an increase in rapeseed area. The current estimate is 1.6 million hectares, which translates to a 14 per cent rise from the previous year. In the south of China, sowings of winter rapeseed are reported to be just about complete. Since state funding has been discontinued, the negative trend in area is likely to continue in 2019/20.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has called on the EU Commission to create economically sustainable prospects for European rapeseed – the crop that is the primary GM-free source of protein and flowering plant in cereal-dominated crop rotations. In connection with the revision of the European Renewable Energy Directive (Red II), UFOP expects the Commission to send a clear political signal that the use of palm oil for biofuels will be significantly reduced in the EU in 2019 and gradually tapered down to nil. This goal should be legally anchored in the delegated act the EU Commission is required to submit by 1 February 2019. The association has also urged that the preconditions required for restricting imports should be created in the ongoing anti-subsidy proceedings against Indonesia as soon as possible.

Chart of the week (50)

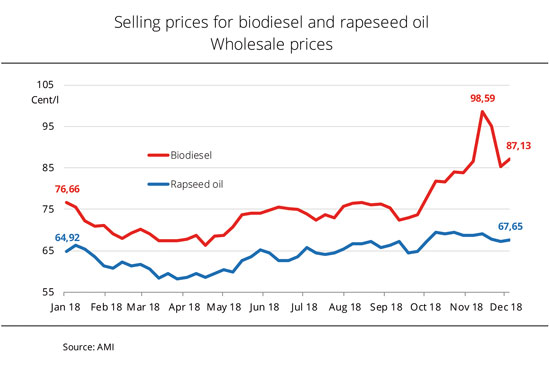

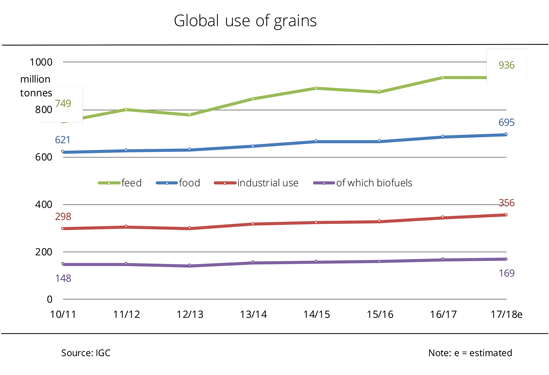

Biodiesel prices rise sharply

It is often argued that the EU biofuels policy drives prices for agricultural feedstock, yet there is nothing to prove this. When prices for agricultural commodities and staple foods exploded globally in 2007 and 2008 and prices became volatile as a result, the focus was on issues surrounding global nutrition. Continued famine and poverty since then have primarily been associated with changes in international prices for agricultural feedstock and the promotion of biofuels. Environmental associations in particular have frequently, and very effectively, made the case that the main cause is in the EU’s biofuels policy.

However, they fail to take into account that according to the FAO, suppliers respond by intensifying production and increasing yields. For several years now, bumper crops have led to global oversupply and, as a consequence, a build-up of stocks at high levels. At the same time, the shares of biofuels in the top agricultural commodity exporting countries in Asia and North and South America reached new record highs. Governments have responded to the surpluses by raising the national biofuels mandates to stabilise producer prices. The current biodiesel hype, which has little impact on selling prices of raw rapeseed oil, shows that fuel prices have little influence on agricultural commodity prices. Demand for rapeseed methyl ester over the past few weeks caused a decline in supply, but feedstock remained abundant at all times. Consequently, rapeseed oil prices only rose slightly. At the same time, the price gap between rapeseed oil and palm oil widened to approximately EUR 300 per tonne, according to information published by Agrarmarkt Informations-Gesellschaft mbH (AMI). The key issue affecting the product chain of rapeseed processing and biodiesel production in Germany is the uncertain transport situation due to low water levels in Germany's rivers that have curtailed the flow of goods and led to rising prices.

Chart of the week (49)

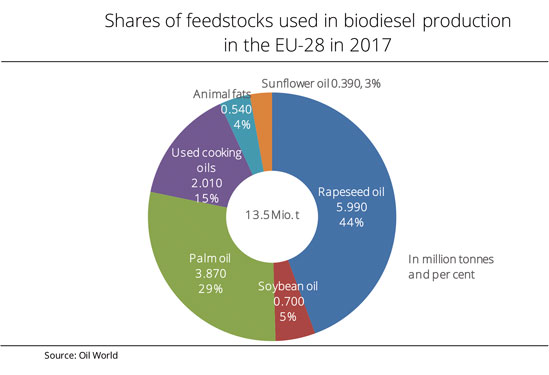

Rapeseed oil remains the most important biodiesel raw material in the EU

The availability and price of vegetable and animal oils and fats also play a key role in biodiesel production. In the European Union, rapeseed oil continues to be the most important source of raw materials for biodiesel production.With the lower supply and the resulting increase in the price of the raw material, however, the share shrank slightly from 48% in 2016 to 44% in 2017. The growing competition of cheap raw materials from overseas combined with scarce and thus expensive rapeseed oil reduced the opportunities for domestic oilseeds. The share of biodiesel and hydrogenated vegetable oil (HVO) from Southeast Asia in EU biodiesel production (including HVO) grew to 29%. In countries such as Italy, Spain and the Netherlands, imported palm oil is the No. 1 raw material for biodiesel production, in Germany and France it is rapeseed oil. By contrast, the use of yellow grease has increased only marginally, although the policy particularly encourages its use. With the exception of Germany, biofuels from waste and residual materials will be counted twice towards national quota obligations (energetically) in order to increase the share of renewable energies in the transport sector, which is binding for all member states, to 10% by 2020.

Against the background of the revision of the Renewable Energy Directive recently confirmed by the European Parliament and the Council, the Union zur Förderung von Oel- und Proteinpflanzen (UFOP) is calling for the mandatory phasing out of the use of palm oil as a raw material to be determined in the delegated act to be submitted by the EU Commission by 1 February 2019. The association emphatically recalls this compromise reached with the European Parliament within the framework of the trialogue procedure. In its April 2017 resolution, the European Parliament adopted the ban, which was not enforceable in the trialogue. The UFOP stresses the strategic importance of the biofuel market for European rape seed cultivation, in particular for sustainable crop rotation systems. Some 6 million tonnes of sustainably certified biodiesel made from rape seed oi not only make a noticeable contribution to climate protection in transport. The resulting GMO-free rapeseed meal of approx. 9 million tonnes reduces the import of GMO soy to the same extent and the land requirement otherwise required for this. These compensation effects are insufficiently recognised in the iLUC debate and on the question of the definition of raw materials with a high "iLUC risk", the UFOP criticises.

Chart of the week (48)

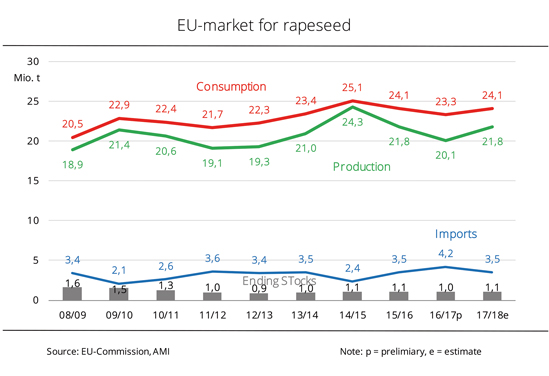

Rapeseed market goes calmly into winter

The feed market is one of the main beneficiaries of biodiesel production, because rapeseed meal is generated as a by-product of rapeseed oil production. Throughout Europe, rapeseed meal is the primary domestic GM-free source of protein for livestock feeding, concludes the Union zur Förderung von Oel- und Proteinpflanzen(UFOP).

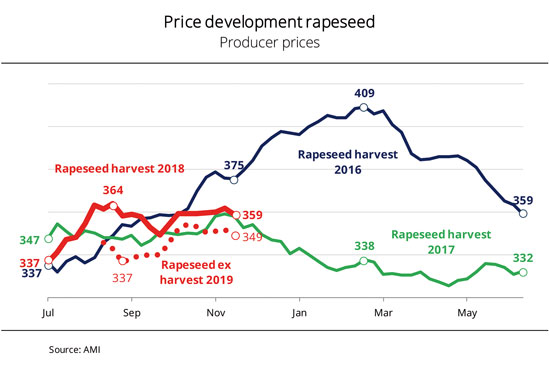

Rapeseed prices have moved up slightly in very small steps since rising sharply in the summer due to the smaller rapeseed harvest. Consequently, the gap over soybean prices, which were in decline, widened, although rapeseed failed to reach previous years' levels. The recently reported price of EUR 359 per tonne matched the year-ago level. Consequently, rapeseed was down EUR 26 per tonne from two years ago, when the German rapeseed harvest was considerably larger. The current changes in prices and comparatively low stocks motivate farmers not to sell their rapeseed for the time being. According to information published by Agrarmarkt Informations-Gesellschaft (AMI), sales opportunities are expected to improve for the second quarter of 2019 when supply of oil mills will still be very patchy. Nevertheless, rapeseed producers and agricultural traders will not be in a rush to sell the commodity during that marketing period, because even now there are many speculations on price increases in the transition to the 2019 crop. The small EU rapeseed crop in 2018, the foreseeable low export potential of Australia – traditionally the EU's most important supplier –, and not least the difficult winter rapeseed sowings in Germany and France all fuel hopes that rapeseed supply will be scarce and prices will rise as a result. The rapeseed market is therefore not expected to pick up at the beginning of the new year, because price expectations of oil millers and farmers are likely to be still too disparate then.

Chart of the week (47)

Significantly less GM-free rapeseed meal without biodiesel production

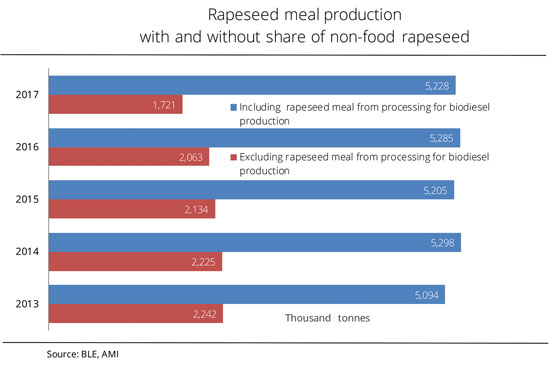

The feed market is one of the main beneficiaries of biodiesel production, because rapeseed meal is generated as a by-product of rapeseed oil production. Throughout Europe, rapeseed meal is the primary domestic GM-free source of protein for livestock feeding, concludes the Union zur Förderung von Oel- und Proteinpflanzen (UFOP).German rapeseed processing in 2017 amounted to 9.2 million tonnes, yielding just less than 4 million tonnes of rapeseed oil and 5.2 million tonnes of rapeseed meal. Since rapeseed is produced in Europe and many other countries throughout the world without using genetic manipulation (GM), its by-product, rapeseed meal, is also classified as GMO-free. This classification promotes the use of rapeseed meal mainly in dairy feeding, where it can fully replace soybean meal. The key factor is that demand for dairy products that bear the attribute of “without GM” are in strong demand.

What is more, rapeseed meal also reduces the dependence on imports of GMO soy or GMO soybean meal. Only about 33 per cent of the 4 million tonnes of rapeseed oil were used for human or animal consumption and 66 per cent for technical applications or energy production. If demand for rapeseed oil for use in biodiesel production were to shrink in the future, which would be the case if biodiesel is no longer seen as a contribution towards decarbonising the transport sector, more than 60 percent of today’s rapeseed meal production would no longer be available. As a result, this gap would have to be filled with soybean imports. In purely arithmetic terms, the rapeseed meal gap in the past year would have amounted to 3.5 million tonnes. To offset the shortage, Germany would need to import an extra 2.7 million tonnes of soybean meal annually, which translates to 1 million hectares planted with soybeans. Consequently, the situation would reverse the trend of promoting domestic GM-free protein sources. It has only been since 2012 that rapeseed meal accounts for half of the meal fed to animals in Germany. An aspect that is not given enough attention in the current debate on what is called indirect changes in land use (iLUC), UFOP argues. Taking this substitution effect into account in greenhouse gas assessments would improve the competitive edge of domestic rapeseed in terms of GHG efficiency. UFOP has recommended applying this approach to safeguard the significance the cultivation of rapeseed has in cereal-dominated crop rotation systems, very especially in view of the agricultural strategy announced by the German Ministry of Agriculture. According to UFOP, domestic rapeseed production would consequently contribute to minimising greenhouse gases both in the field and in the tank.

Chart of the week (46)

Good soybean supply – rapeseed slightly scarcer

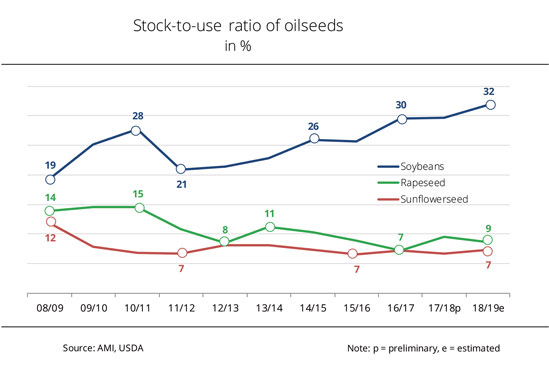

The stock-to-use ratios for soybean and sunflower seed have improved due to larger crops globally; rapeseed has gone down slightly. The ratio of supplies to consumption (also called the stock-to-use ratio) is a key figure in estimating supply and, consequently, potential price trends. The stock-to-use ratio for rapeseed and sunflower seed has been in decline for years now. The picture is somewhat different for soybeans. Bumper crops are causing supply and stocks to rise strongly. However, there is also a steady growth in demand for soy protein for animal feed, especially in China. Due to the positive development of the economy and income in the world's most populous country, purchasing power is increasing and so is demand for meat and, consequently, oilseed meals to feed the growing numbers of livestock. China's growth in demand for soy coincides with bumper crops in the US and Brazil in 2018/19. This correlation generates dynamic changes in price. However, the dynamics are weakened given the good supply to the market. The Union for the Promotion of Oil and Protein Plants (UFOP) has found that not even the debate about the shift of soybean imports from South America in the wake of the trade conflict between China and the US has led to a lasting upward trend in prices. This again confirms just how sound supply to the market is. It also highlights the flexibility of European oil mills that switch from rapeseed to soybean processing. In this sense, the feedstocks are interchangeable at will, with the exception of those with the unique selling point of “without GM”. Although this situation ensures that feedstock is utilised locally, consumers need to drive local use by purchasing locally, UFOP has underlined. In the important fuel sector, the question is if biodiesel producers are aware of the responsibility they have, UFOP has warned in view of the ongoing debate between the EU Commission and EU member states on banning palm oil in European biodiesel production.

Chart of the week (45)

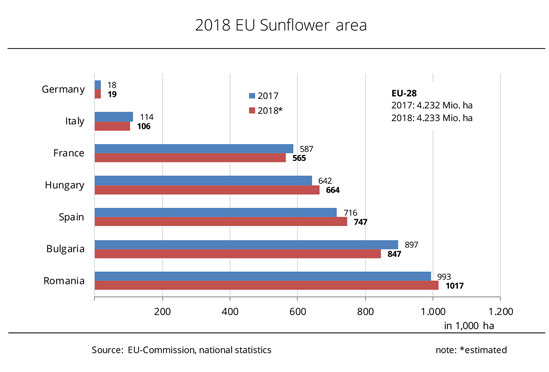

Unexpectedly good sunflower harvest

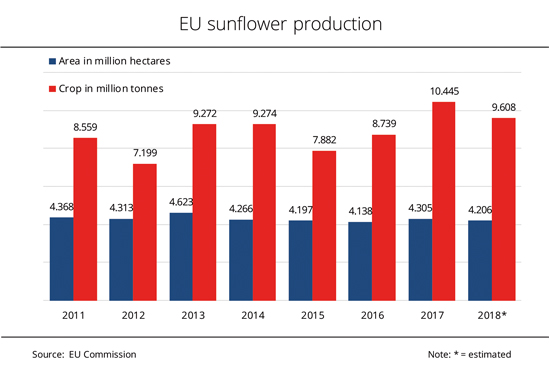

Sunflower seed is the second most important oilseed crop in Europe, accounting for one third of the 2018 cultivation area.Sunflowers were affected less severely by unfavourable growing conditions that hit winter-planted crops and rapeseed extremely hard this year. Conditions at the time of sowing in spring were good and around 4.2 million hectares across the EU were devoted to sunflowers for the 2018 harvest. This was only a very slight decline from the previous year. What is more, the hot and dry summer did not harm the sunflowers by any means. Agrarmarkt Informations-Gesellschaft mbH (AMI) has indicated that the crop also benefited from the absence of quality-impairing rain towards the end of the season. In fact, sunflower seed is one of the few field crop species where harvest came in better than forecast. The latest yield estimate of 23.9 decitonnes per hectare clearly exceeded the 22.4 decitonnes per hectare expected in June and fell only 6 per cent short of the year-ago yield. Consequently, in a comparison over several years, 2018 yields were even higher than average. The key sunflower-producing countries include Romania, Bulgaria and Hungary as well as Spain, France and Italy. In Germany, sunflower production only plays a very small role. Since East European yields were in fact generally higher than those in Western Europe, the total of sunflower seed harvested in the EU in 2018 amounted to roughly 9.6 million tonnes. This was down 8 per cent from 2017 but exceeded the long-time average by 6 per cent. Due to the lack of roughage in Germany, demand for high-fibre feed components is stronger than ever. This especially applies to sunflower meal. Whereas nearby meal is sold out, sunflower meal for delivery from December onwards is up 60 per cent year on year at EUR 205 per tonne.

Chart of the week (44)

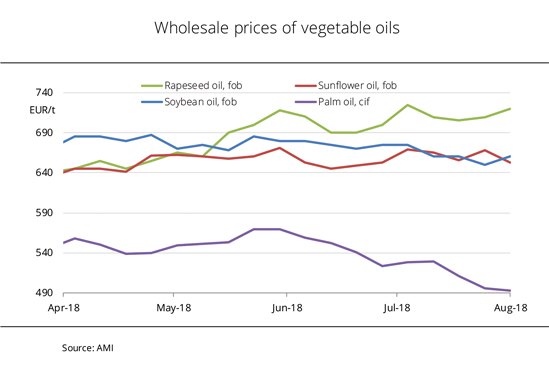

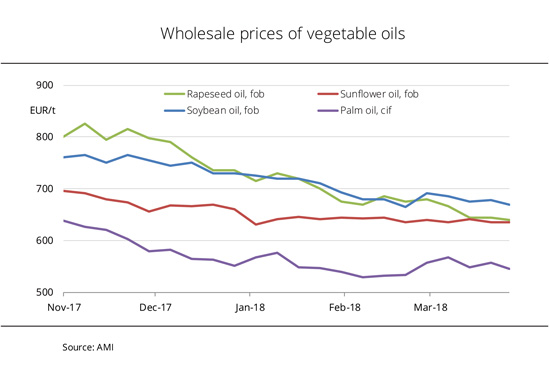

Rapeseed oil prices shooting upwards

Wholesale prices for rapeseed oil and palm oil have been moving in opposite directions for 7 months. The price difference between rapeseed oil fob Germany and palm oil cif Rotterdam rose from 87 EUR/t to more than 300 EUR/t between April and the end of October. Agrarmarkt Informations-Gesellschaft mbH (AMI) last noted such an unusually large gap in December 2012. The main reason for this uneven price development lies in differing supply-side trends: rapeseed oil is in demand and is scarce due to low harvest levels; palm oil supply, on the other hand, is plentiful.

Blenders continue to show unabated interest in purchasing rapeseed methyl ester biodiesel due to its better winter properties. Even if demand is likely to calm down by the end of the year, there will still be a shortfall to be filled, which will provide market impetus. Smaller rapeseed harvest yields are just one of the factors that have caused prices to rise. Water levels on the waterways have also been low for weeks, pushing up freight costs for seed delivery, as well as for transport of products, especially rapeseed meal.

In contrast, demand for palm oil has gradually weakened and hit a three-year low at the end of October. This was triggered by rising inventories in producer countries as a result of scant exports. Production was at times lower than during the same period last year. In addition, production rises seasonally in the second half of the year, with volumes likely to even be significantly higher than last year. Companies in the food and chemical industries that process palm oil will benefit from this downward price trend.

The Union for the Promotion of Oil and Protein Plants (UFOP) notes that market price differentiation between palm oil certified as sustainable and non-certified palm oil has not yet become established in market price quotations. The industry platform “Sustainable Palm Oil Forum” (FONAP), supported by the Federal Ministry of Agriculture, recently rightly complained about sluggish development in particular concerning sustainable palm oil for material use, still with a 27% share of this market, despite an oversupply of certified palm oil. The UFOP raises the question of whether sustainable palm oil production is even possible at 464 EUR/t, particularly if social criteria are factored in.

Chart of the week (43)

Agricultural diesel – the most expensive option

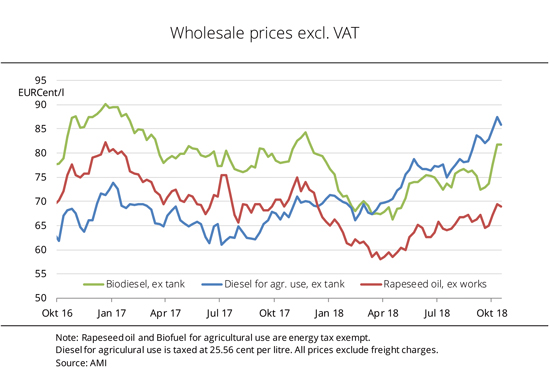

Wholesale prices for agricultural diesel, biodiesel and rapeseed oil surged considerably over the past several months. However, none of these transport fuels shot up as sharply as agricultural diesel did.

October crude oil prices reached a four-year high, causing prices of agricultural diesel – the tax-privileged option for agricultural equipment – to rise to 87.50 euro cents per litre. In March 2018, agricultural diesel and biodiesel stood at the same level, whereas rapeseed oil fuel has been cheaper than agricultural diesel since the end of 2017. Price curves are similar, but price gaps have widened significantly in some cases. This means that it pays off to process rapeseed oil into biodiesel. What is more, the latter sells fast for blend uses, not least because it is needed to meet quality requirements for winter diesel. The unexpectedly brisk demand for fuel has also driven up prices for biodiesel, along with mineral oil prices. According to information published by Agrarmarkt Informations-Gesellschaft mbH (AMI), biodiesel prices are currently up 22 per cent from spring 2018. However, low water, smaller harvests in 2018 and reductions in sowings for 2019 are also factors that add to the price of rapeseed.

Chart of the week (42)

Disappointing pulse crop due to dry weather

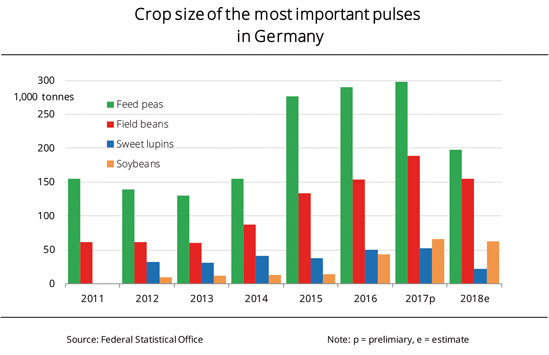

The reduction in area planted in spring already paved the way for a smaller grain legume crop in Germany in 2018. Moreover, pulse yields shrank massively due to the long period of drought, as did other crop yields.

Overall, an estimated 436,400 tonnes of pulses were harvested in 2018. This translates to a 28 per cent drop from a year earlier. All across Germany, average yields fell significantly short of the previous year. The smallest decline, of 20 per cent, was seen in feed peas. Sweet lupins were affected hardest, with yields crashing just less than 50 per cent. Together with the 20 per cent reduction in hectarage, the large crop losses produced a 58 per cent slump from 2017 to 22,300 tonnes of sweet lupins. Feed peas also fell significantly short of the previous year's figure. Based on a 17 per cent decline in area planted and a 20 per cent drop in yields, the volume of feed peas harvested of 197,900 tonnes was down one third from a year earlier. The field bean harvest of 154,300 tonnes was also 18 per cent lower than the previous year. The massive drop in yield of almost one third was partly offset by a 20 per cent expansion of area planted. Soybeans compare favourably, because the 25 per cent increase in hectarage almost offset the decline in yield. As a result, the harvest of just less than 62,000 tonnes was down only 6 per cent from 2017. Agrarmarkt Informations-Gesellschaft mbH (AMI) has indicated that the main reason for the poor yields was the long period of drought in many parts of northern and eastern Germany and the high share of plantings on marginal sites. More specifically, in Saxony-Anhalt yields of sweet lupins slumped 67 per cent from 2017, according to information published by the German Federal Statistical Office.

According to the Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP), the reduction in grain legume hectarage is due to the ban on using crop protection products on greening land. While the decision was negative in terms of agricultural policy, its effects were attenuated by the weather in the autumn of 2017, which made it impossible for farmers to till winter-planted crops. This made land available for growing grain legumes.

Chart of the week (41)

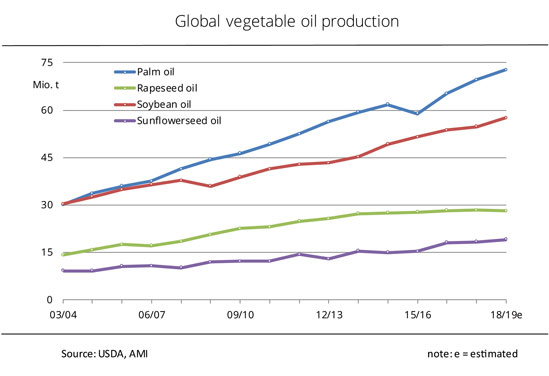

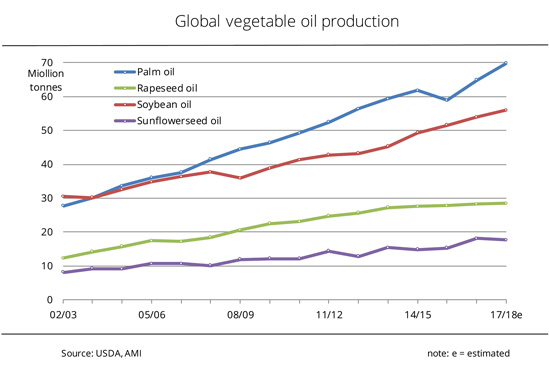

Global vegetable oil production set to reach new peak

The US ministry of agriculture USDA has projected a record high vegetable oil production of 204 million tonnes worldwide for 2018/19. Supply of palm and soybean oil could see a particularly sharp increase. According to the USDA forecast, 2018/19 world vegetable oil production will probably rise more than 3 per cent from the previous year to a record level of just less than 204 million tonnes. Palm, soybean, rapeseed and sunflower oil account for around 87 per cent of that figure. Soybean oil is expected to see the biggest growth at 5 per cent. The development benefits from ample availability of feedstock from the 2018 bumper harvests of soybeans in Brazil and the US and continued buoyant international demand for processed soybean products. Favourable growing conditions in Southeast Asia and surprisingly high yields on palm oil plantations are seen to lead to a 4.5 per cent rise from 2017/18 to 72.8 million tonnes. Production of sunflower oil is expected to rise 4 per cent, because Ukrainian sunflower production is up around 6 per cent from a year earlier. By contrast, 2018/19 output of rapeseed oil of 28.1 million tonnes is projected 1 per cent lower than in the 2017/18 marketing year. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), the reason is drought-induced disappointing rapeseed harvests in the EU-28 and Australia in 2018.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has forecast that in the wake of this trend in supply, pressure on prices will persist in the international vegetable oil markets. Prices of vegetable oils have long since decoupled from crude oil prices, forcing vegetable oil producing countries to adopt more active biofuel policies. Countries like Indonesia, Brazil and Argentina have tried to handle the price pressure by raising biofuel mandates, arguing that as palm oil prices are on a declining trend while crude oil prices are rising at the same time, biofuel mandates are becoming economically more attractive.

Chart of the week (40)

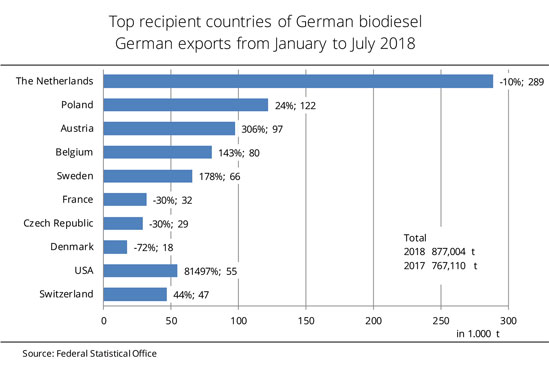

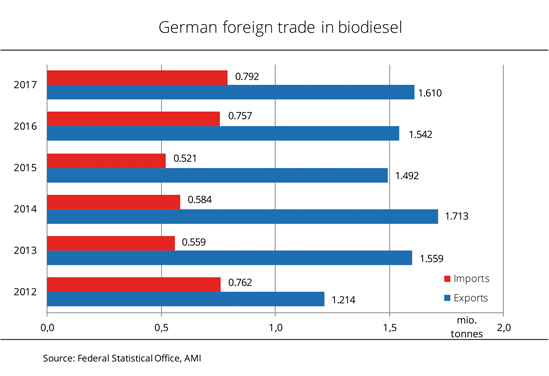

German biodiesel exports hit record high

In the first half year of 2018, German biodiesel exports climbed considerably. Demand from the US, but also from Sweden and Austria, increased sharply. In the first six months of 2018, German exports of biodiesel surged more than 14 per cent to 877,000 tonnes compared to the year-earlier period. Just less than 88 per cent of this tonnage was marketed within the EU-28. This was up 7.5 from the year-earlier period. The Netherlands remained the primary recipient country of German biodiesel despite a 10 per cent decline in imports to 288,800 tonnes. By contrast, Poland's orders for biodiesel of 121,800 tonnes were up around one fourth from the first half year of 2017. Quadrupling its imports, Austria outpaced Belgium and moved into third place, although Belgium more than doubled its biodiesel imports. However, the US recorded the biggest growth in imports, absorbing 54,670 tonnes. In same period in 2017, US imports were extremely low at 67 tonnes. According to Agrarmarkt Informations-Gesellschaft (mbH), Sweden and Switzerland also imported considerably more German biodiesel than in the reference period. By contrast, biodiesel shipments to France, the Czech Republic and very especially Denmark declined. Demand from Denmark crashed 72 per cent to around 17,600 tonnes.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has underlined the competitive advantage the German oil mill and biodiesel industries have over the rest of Europe and the important contribution they are making towards safeguarding German and European rapeseed production. The association said that although the actual share of rapeseed oil-based biodiesel in the entire biodiesel market was unknown, it could be indirectly deducted from the utilization of rapeseed processing capacities. Neverthelesss, UFOP has expressed fears that oil mill changeovers from rapeseed to soybean processing cannot be ruled out, depending on feedstock costs and where technically possible. The reasons are large global supply and market distortions following the tariff conflict between the US and China. UFOP has pointed out that the GMO soybean oil that would accumulate would have to be utilized for engineering or energy-related uses, unless it would be possible to sell the oil outside the EU‑28 for food purposes.

Chart of the week (39)

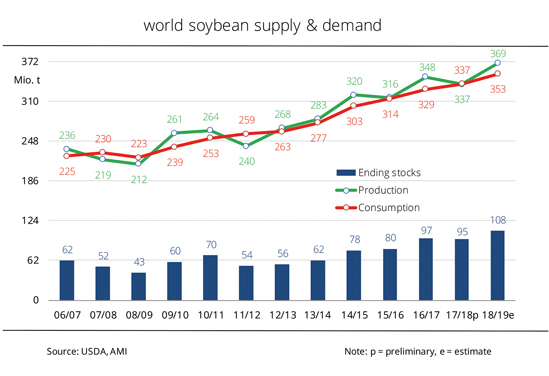

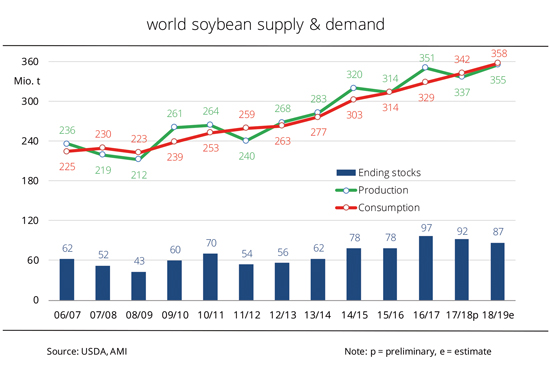

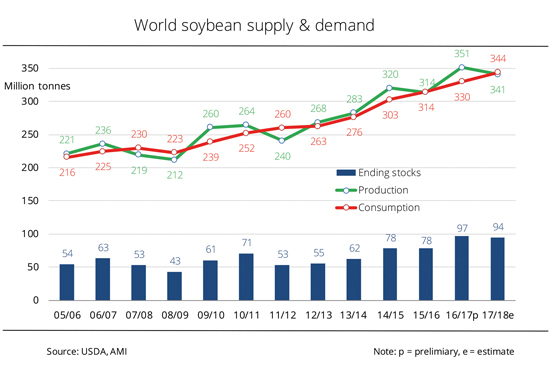

Soybean ending stocks increasing strongly

World soybean production in the 2018/19 marketing year will likely be higher than previously expected. Since Chinese demand is shrinking, stocks could surge to a record high. In its September report, the USDA raised its estimate of global soybean production for 2018/19 by 2.2 million tonnes to 369.3 million tonnes. This would be up 32.5 million tonnes from the previous marketing year. With a forecast bumper crop of 127.7 million tonnes, the US is seen to be the largest soybean producer. According to the USDA outlook, 2018/19 global consumption is likely to exceed the previous year's level by 16 million tonnes. Nevertheless, the volume of soybeans processed of 353 million tonnes would still be 16 million tonnes smaller than the tonnage harvested. According to an Agrarmarkt Informations-Gesellschaft (AMI) estimate, global ending stocks will likely exceed the previous year's figure substantially at the end of the marketing year. Based on the current forecast of 108 million tonnes, the increase would amount to around 13 million tonnes compared to 2017/18, resulting in the largest ending stocks in history. Just in June 2018, ending stocks were only forecast at 87 million tonnes. China will still be the world's most important soybean importer in 2018/19. At 94 million tonnes, imports are projected at the previous year's level. The stagnation in soybean imports is due to the trade dispute with the US. Just a few months ago, USDA projected Chinese soy imports at more than 103 million tonnes.

Chart of the week (38)

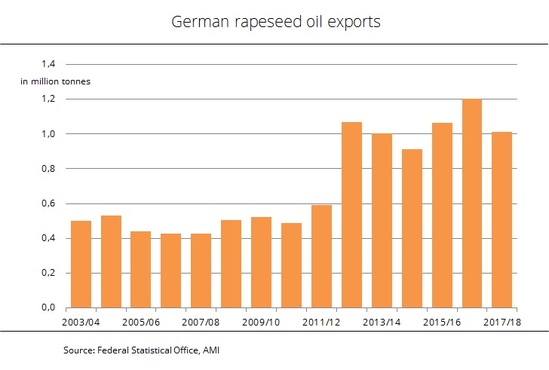

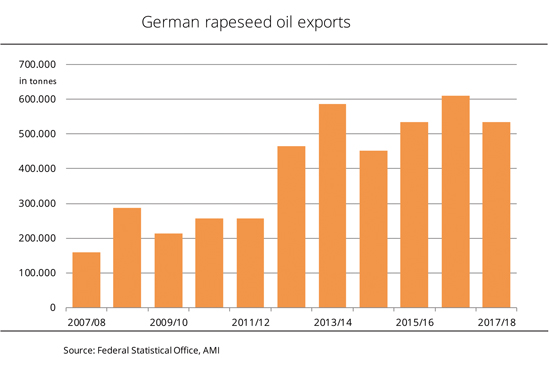

German rapeseed oil export shrinks

German exports of rapeseed oil in the 2017/18 marketing year fell short of the previous year's record level. Above all, some EU member states purchased considerably less rapeseed oil. According to figures published by the German Federal Statistical Office, German exports of rapeseed oil declined for the first time in three years in 2017/18. At around 1 million tonnes, sales to foreign countries were down almost 16 per cent from 2016/17. Agrarmarkt Informations-Gesellschaft mbH has suggested that the decline is probably due to the scarcity of feedstock and high level of competition from other vegetable oils. Just about 96 per cent of exports went to other EU countries, which translates to an approximately 12 per cent decrease year-on-year. The Netherlands, the hub of international trade, were the main buyer of German rapeseed oil, with imports amounting to around 570,400 tonnes. This was down 4 per cent from a year earlier. Polish imports dwindled just less than 37 per cent to 132,000 tonnes. Belgium occupied third place among the main recipients, seeing a 23 per cent drop to 69,900 tonnes. Demand from EFTA states (Iceland, Norway and Switzerland) for German rapeseed oil slumped 66 per cent from the previous year to 26,900 tonnes. By contrast, Kenya ramped up its imports 200-fold to 1,800 tonnes and is now among the top 20 recipient countries of German rapeseed oil. The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has expressed fears that in the wake of the decline in sales, pressure on producer prices will persist despite the drop in rapeseed harvest all across the EU. The main reason is seen in surplus supply of rapeseed oil based on the slowdown in demand from the biofuels industry. UFOP has called for urgent action to develop additional sales options, for example by raising the GHG reduction quota by no later than the beginning of 2019 or by tapping into new non-EU markets as part of export promotion programmes.

Chart of the week (37)

Biodiesel share increased despite declining diesel consumption

Consumption of road traffic diesel and petrol in the first half year of 2018 was lower than in the 2017 reference period. However, the use of biodiesel and bioethanol saw a significant rise. The strongest demand for biodiesel in the past six months and the largest quantity since August 2017 was recorded in May 2018 at just about 205,000 tonnes. In the preceding months, consumption had already been considerably higher compared to the year-earlier period. Domestic consumption of biodiesel in the period from January through June 2018 increased to just less than 1.2 million tonnes. This was up 11 per cent from the first half year of 2017. Since at the same time, consumption of diesel declined 5.2 per cent from the previous year to 17.05 million tonnes, the incorporation rate rose significantly. Whereas in 2017, it amounted to around 5.7 per cent, Agrarmarkt Informations-Gesellschaft mbH (AMI) calculated it at 6.4 per cent for 2018 to date. According to information published by the Federal Office for Economic Affairs and Export Control (BAFA), the incorporation rate of bioethanol also saw a rise to around 6.7 per cent in the first half year of 2018, consequently outstripping the previous year's figure of 6.1 per cent for the same period. The surge in the incorporation rates of bioethanol and biodiesel could be due to the availability of less costly feedstocks for the production of these two biofuels. In the first few months of 2018, asking prices for palm and rapeseed oil fell to the lowest level for several years. However, maize prices in Paris also dropped significantly below the year-earlier level in the first quarter of 2018.

Chart of the week (36)

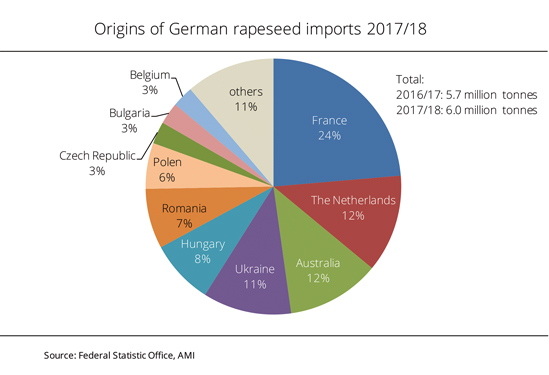

Further increase in German rapeseed imports in 2017/18

According to information published by the German Federal Statistical Office, Germany saw another rise in rapeseed imports in the 2017/18 marketing year. Imports hit a record high at just under 6 million tonnes. In the 2017/18 marketing year, the German oil mill industry imported around 6 million tonnes of rapeseed. This translates to an almost 6 per cent surge from the previous year to the highest quantity ever. The largest amount came from the EU-28, although its share dropped around 2 per cent from the year-earlier period, to 75 per cent. France was the main supplier country, accounting for 1.4 million tonnes, which was, however, down around 4 per cent from 2016/17. The Netherlands were a long way behind in second position, exporting 0.74 million tonnes of third-country rapeseed. Australia, the largest direct third-country supplier, exported around 0.71 million tonnes of rapeseed to Germany. This translates to a 27 per cent decline from a year earlier. However, the biggest growth was recorded for imports from Ukraine. Based on data from Agrarmarkt Informations-Gesellschaft mbH, the country's rapeseed shipments to Germany tripled to 0.67 million tonnes compared to the previous year. This made Ukraine the fourth biggest supplier country, accounting for more than 11 per cent of total imports.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has underlined the importance of rapeseed processing in Germany. The country processes approximately 10 million tonnes of rapeseed. The driving force behind the development of the oilseed sector, which plays an important role in German agriculture, was, not least, sales of rapeseed oil for biodiesel production. Investments were not only made to expand biodiesel plants, but also to enhance Germany's rapeseed crushing capacity. As a result, within the EU internal market Germany is the primary purchaser from its neighbouring countries. This again underscores the role of the biodiesel market in maintaining the share of rapeseed in crop rotation systems in the European production regions also in the future. What is more, approximately 9.4 million tonnes of seed yield around 5.5 million tonnes of GM-free rapeseed meal, which today accounts for more than 50 per cent of protein supply from European production for use in domestic animal feed.

Chart of the week (35)

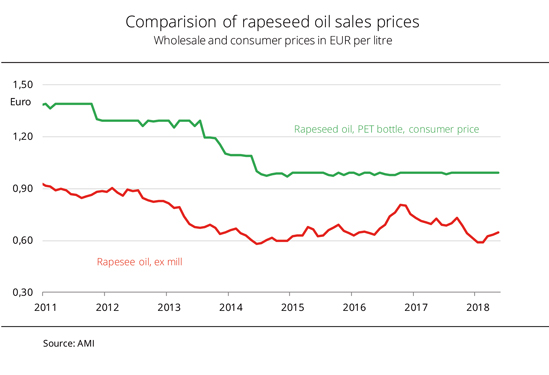

High feedstock prices hardly reached consumers

The scarcity of supply of agricultural feedstock due to drought-related declines in yield had little impact on consumer prices. The main factors driving prices up were labour or energy costs. In the 2018 crop report for Germany, the German Minister of Agriculture, Ms Julia Klöckner, put the rapeseed harvest at 3.65 million tonnes (2017: 4.27 million tonnes). This was the lowest tonnage in more than 18 years. Below-average yields regularly raise the question as to whether bread prices will rise or consumers will have to fork out more for rapeseed cooking oil or processed products such as margarine. However, disappointing harvest figures, which also have a negative financial impact on producers, are only of limited use for drawing conclusions on the development of consumer prices. According to information published by Agrarmarkt Informations-Gesellschaft (mbH) (AMI), consumer prices for rapeseed oil have remained virtually unchanged over the past four years at on average EUR 0.99 per litre. By contrast, wholesale prices for rapeseed oil ex oil mill have fluctuated much more strongly without repercussions on prices at the consumer level. Likewise, changes in producer prices of rapeseed and oil mills' asking prices are often not directly related. Whereas rapeseed prices have hardly declined since November 2017, rapeseed oil has shown a strong downward trend. Pressure came, first and foremost, from a drop in palm oil prices combined with falling demand in rapeseed oil for use in biodiesel production. Similarly, wheat prices at the producer level have had hardly any impact on bread roll prices at the retail level. Current wheat prices would roughly have to increase by EUR 19 per decitonne to EUR 40 per decitonne to lead to a one-cent rise in bread roll prices. The key factors driving prices up are labour or energy costs.

Chart of the week (34)

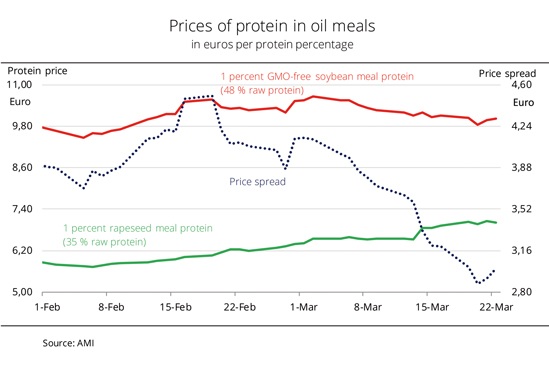

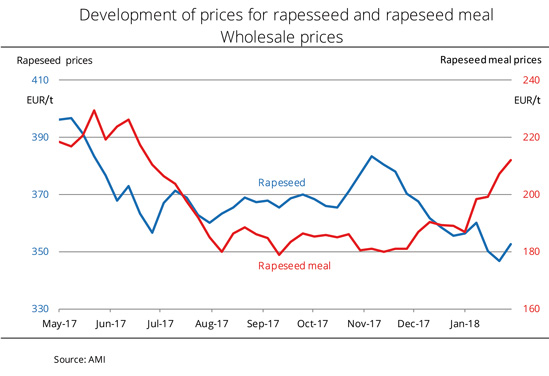

Rapeseed meal prices firmed significantly

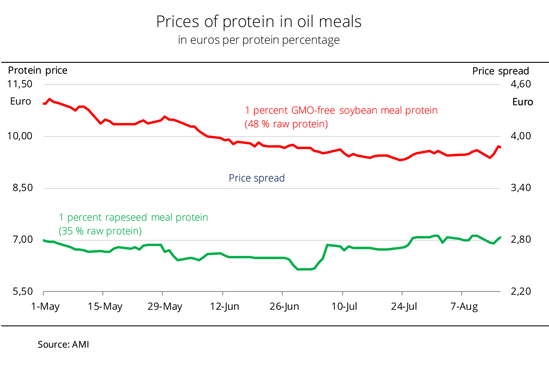

The disappointing 2018 EU rapeseed crop and brisk demand from compound feed manufacturers pushed rapeseed meal to a three-year high. The rise has reduced the price advantage over GMO-free soybean meal. Wholesale prices for rapeseed meal firmed considerably over the past few weeks. Since the beginning of July 2018, asking prices have risen by just about 16 per cent to the recent level of EUR 249 per tonne ex works. This was the highest level in more than three years. The 30-day average for nearby rapeseed meal for the period from mid July to mid August was reported at EUR 243 per tonne, up 32 per cent from the same period last year. Agrarmarkt Informations-Gesellschaft mbH (AMI) sees dimmer harvest prospects in wide parts of the EU-28 as the drivers of the surge. Also, there had been extensive contract business with livestock farmers. At the same time, prices for Brazilian GMO-free soybean meal containing 48 per cent crude protein weakened slightly over the reference period. Asking prices have dropped 11 per cent since the beginning of May, to recently EUR 472 per tonne FOT (Free On Truck) Brake. The price gap between one per cent of crude protein in rapeseed meal over one per cent of crude protein in GMO-free soybean meal lately even hit a low at EUR 2.27 per tonne, but most recently saw a slight rise. The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has underlined the importance of comparing rapeseed meal prices with those of GM-free soybean meal. The association holds that the current changes in supply and prices confirm the steady increase in demand for foodstuffs labelled as "without GM". At the same time, producers meet the sustainability requirements as regards the dated proof of origin of the production area of rapeseed as a feedstock for rapeseed meal production. Such rapeseed is grown on land that was in agricultural use before January 2008 already. UFOP has questioned whether analogous evidence is also feasible for GM-free soybean imports.

Chart of the week (33)

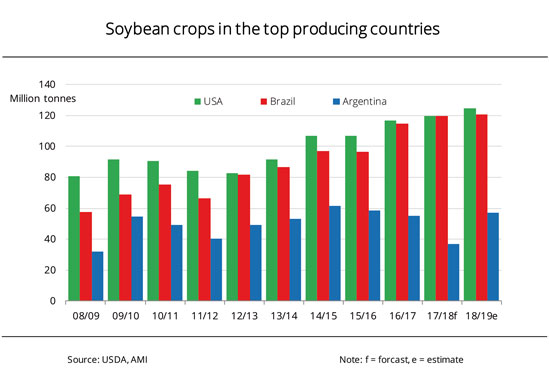

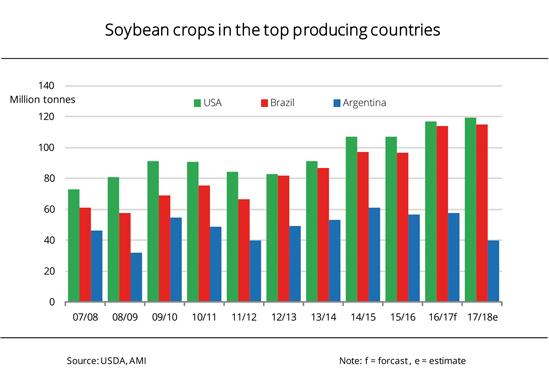

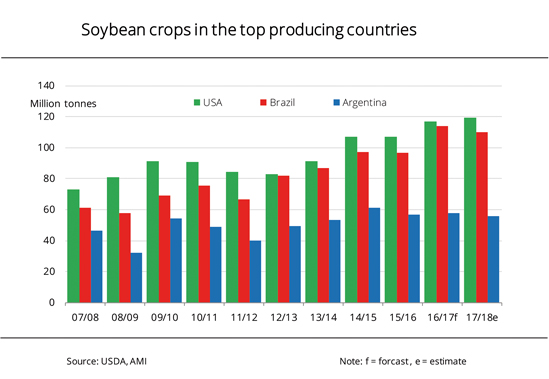

Global soybean production in 2018/19 could reach record level

Global 2018/19 soybean production is estimated significantly higher than the previous month. The USDA has raised its forecast for the US considerably, now expecting a bumper crop. The US Department of Agriculture (USDA) has raised its current outlook for global soybean production for the 2018/19 marketing year significantly. The reason is an unexpected strong increase in US crop expectations for 2018. According to the outlook, the US could harvest just less than 125 million tonnes of soybeans. This would be up around 5 million tonnes year-on-year and just about 8 million tonnes more than expected in July. According to information published by Agrarmarkt Informations-Gesellschaft (AMI), the US soybean acreage is slightly smaller than 2017. However, virtually optimal growing conditions could raise yields to a level more than 5 per cent higher than the previous year. The forecast of Brazilian soybean production in 2019 is unchanged at just less than 121 million tonnes. This translates to a rise of 1 million tonnes from the previous season. Argentina is expected to reach an average level of 57 million tonnes in 2019, following drought-related losses of about 20 million tonnes in 2018. Against this background, the USDA projects world soybean production in 2018/19 at 367 million tonnes, which would be up 30 million tonnes year-on-year.

Chart of the week (32)

Brisk demand stimulates rapeseed oil price

Asking prices for rapeseed oil recovered considerably over the past few weeks. In contrast, palm oil fell to a multi-year low. German wholesale prices for vegetable oils developed very disparately in the second quarter of 2018. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), recent asking prices for rapeseed oil amounted to EUR 720 per tonne fob Hamburg. This translates to a rise of just about 12 per cent from this year's mid-April lows. The surge was due to stable demand for biodiesel in the EU-28. In view of expectations for a small 2018 EU rapeseed crop, biodiesel producers were ready to pay significant premiums on rapeseed oil in order to get their hands on the commodity. In contrast, prices asked for palm oil gradually weakened, hitting a three-year low of EUR 493 per tonne cif Rotterdam at the beginning of August. The reason was weaker palm oil prices in Kuala Lumpur which recently fell significantly due to disappointing Malaysian export figures. Also, there were some concerns over the magnitude of seasonal growth in production in the second half of the year and the time when the peak of production would probably be reached. Likewise, soybean oil fell to a two-and-a-half-year low of EUR 660 per tonne fob Hamburg at the end of July. Ample global supply of soybeans and concerns over an escalation of the trade conflict between China and the US further added to burdening the market. The Union zur Förderung von Oel und Proteinpflanzen (UFOP) expects that the higher prices for rapeseed oil will also lead to higher producer prices. The association has pointed out that the sowings in August and September will lay the groundwork for rapeseed supply in the coming marketing year. UFOP expects that the biodiesel industry's European customers and biofuel producers themselves will keep an eye on the outcome of the negotiations on the revision of the Renewable Energy Directive (RED II) and the clear political vote – especially of the EU Parliament – to reduce the use of palm oil-based biofuels or palm oil as a feedstock in biofuels production. The debate about the sustainability of palm oil is quite unfairly at the expense of European rapeseed production. The latter, however, is set to be a key element of a European strategy for an as GM-free as possible supply of high-protein animal feed.

Chart of the week (31)

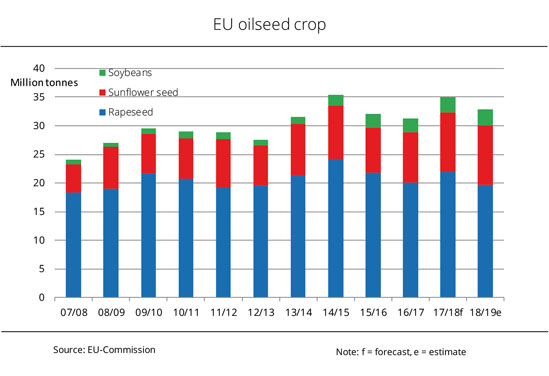

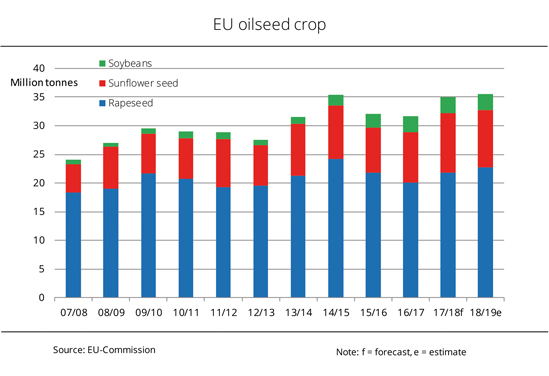

EU oilseed crop likely to come in below expectations

According to the EU Commission's preliminary estimates, the 2018/19 oilseed output in the EU-28 could fall short of last year's level. The main factor is declines in rapeseed yield. In its latest monthly report, the EU Commission has projected the 2018 EU-28 oilseed harvest at 33.1 million tonnes. Consequently, production of rapeseed, sunflowerseed and soybeans would fall 6 per cent or 2 million tonnes from the previous year's level. According to the current outlook, production of rapeseed, the most important oilseed crop in the EU-28, could decline 10 per cent to around 19.7 million tonnes from the previous year. This would be the lowest value since 2012. Soybean output is forecast at 2.8 million tonnes, just less than 7 per cent above the previous year's level, although the soybean area could decline almost 3 per cent from a year earlier to 0.9 million hectares. As regards sunflower production, the EU Commission expects a 0.6 per cent increase to 10.4 million tonnes, despite a 1.7 per cent decline in cultivation area. This would set a new record high. According to information published by Agrarmarkt Informations-Gesellschaft (mbH), rapeseed crops in Germany and France have suffered extremely heavily in the past weeks' drought and heat conditions. By contrast, sunflower output in Southeast Europe was above average due to favourable growing conditions. The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has underlined that the averages stated must not obscure the fact the individual farmers have been severely affected. In some regions, cash crop farmers are suffering sharp declines in yield that come close to total loss. Because of this, the UFOP has urged the German federal and state governments to soon reach an agreement on a non-bureaucratic procedure to provide liquidity assistance to farmers that are particularly strongly affected. The association expects the agricultural strategy the German Federal Ministry of Food and Agriculture (BMEL) announced it would create to take into account the issue of climate change and strategic actions to adapt crop rotation systems to the changing conditions, including a forward-looking approach to plant breeding.

Charts of the week 2018

Chart of the week (30)

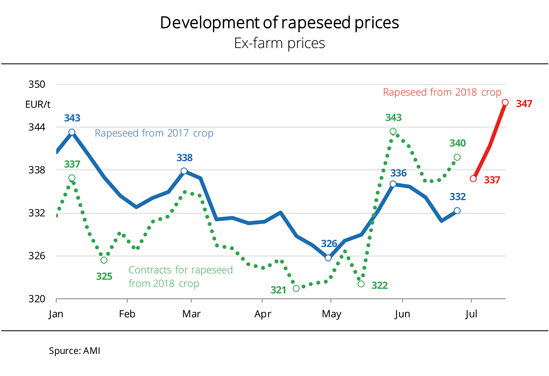

Rapeseed prices spiking – Smaller crop has sent producer prices higher

The ongoing heatwave in the EU-28 is anticipated to lead to a significantly smaller rapeseed harvest than previously expected. Prices have already risen considerably and are likely to increase further. German ex-farm prices of rapeseed from the 2018 crop have surged substantially over the past few weeks. Since the beginning of July 2018, asking prices have surged on average by around EUR 11 per tonne to EUR 347 per tonne. Consequently, rapeseed prices have gone up more than 6 per cent since hitting this year's lows at the end of April. This is due to the foreseeably disappointing rapeseed harvest in many countries of the EU-28. In Germany and France, and also outside the EU in Ukraine, crop yields and in some cases oil content are expected to be low. Depending on region, the decline in yield amounts to 10 per cent to 40 per cent compared to the previous year, Agrarmarkt-Informationsgesellschaft (AMI) has reported. Based on the first threshing results, market observers expect Germany to see the smallest rapeseed harvest in ten years. However, it is too early for results to be conclusive. Accordingly, producers' supply of new-crop rapeseed is low. On the one hand, no one wants to run the risk of not being able to comply with contracts they entered into. On the other hand, farmers are speculating on significantly firmer prices due to the foreseeably tight availability. The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has indicated that it hopes the current development in prices will make rapeseed more interesting for the oncoming sowing season. For reasons of crop rotation, there is no alternative to rapeseed as the most important leaf crop in most production regions.

Chart of the week (29)

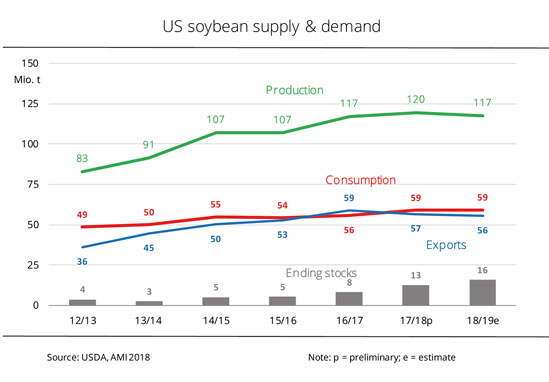

Trade conflict puts damper on USDA export outlook

The US Department of Agriculture expects the US export potential to shrink because of the slowdown in demand from China in the wake of the trade dispute with the US. The USDA has raised its forecast of 2018/19 US soybean production and now expects output to reach 117.3 million tonnes, up from the previous month's estimate of 116.5 million tonnes. Although this figure is slightly lower than a year earlier, it is set to lead to a swell in ending stocks. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), the explanation is that sales, especially to foreign countries, are in danger of dwindling in the wake of the trade conflict between the US and China. Both countries have imposed high punitive tariffs on each other's imports. China charges import duties of 25 per cent on US soybeans and is consequently looking for alternative sources. This situation is already reflected in the current USDA export estimate, since the forecast has been lowered significantly to 55.5 million tonnes, from 62.3 million tonnes the previous month. This means that US exports will shrink to even less than the previous year’s volume. A large crop and smaller exports cause the already large US soybean stocks to increase further to record high levels. USDA expects stocks to climb to just less than 16 million tonnes. This translates to a 25 per cent rise from the previous year.

Chart of the week (28)

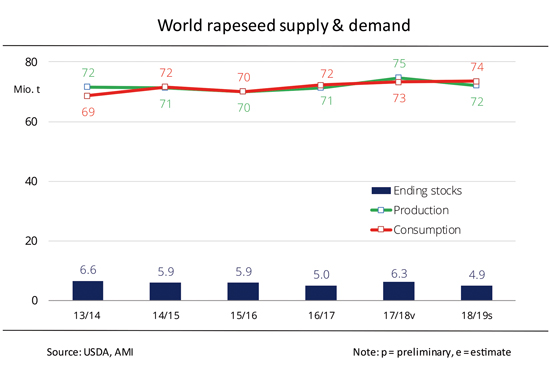

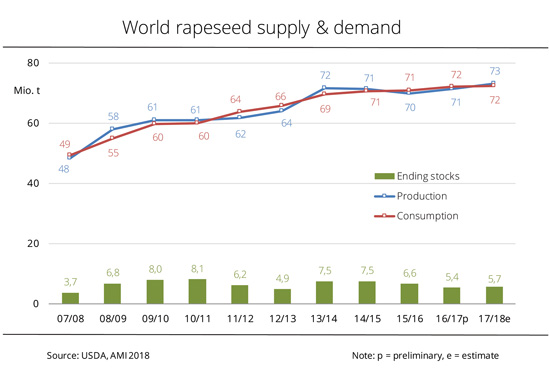

Global rapeseed stocks could shrink to six-year low

The current IGC report on global rapeseed supply in 2018/19 expects world rapeseed stocks to see a significant decline. The reason is smaller harvests, especially in the EU-28 and Australia. In its outlook for the 2018/19 marketing year, the International Grain Council (IGC) projects global rapeseed production at 72.1 million tonnes. This translates to a 1.1 million tonne drop from the previous month's estimate and a 3.5 per cent decrease from the previous year. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), the main reason is significantly lowered harvest outlooks for the EU-28 and Australia, where drought has put a damper on yield potentials. Although the production area is projected to go down slightly, the main reason for lowering the forecast was lower yield expectations. The current harvest estimate for the EU-28 is 20.5 million tonnes. This is 7 per cent below the year-ago level.. As regards Australia, the IGC puts rapeseed production at 3.1 million tonnes, down virtually 16 per cent from the previous year. At the same time, the agricultural experts expect global consumption to hit a record at just less than 74 million tonnes. In other words, rapeseed consumption would exceed production by around 1.4 million tonnes. As a result, global supplies are seen to shrink to 4.9 million tonnes. This would translate to a 22 per cent drop from 2017/18 to the lowest value in six years.

In view of these forecasts, the Union zur Förderung von Oel- und Proteinpflanzen (UFOP) expects producer prices to pick up at harvest. The association has underlined that this price signal must be set in good time, because farmers decide now what the proportion of rapeseed will be in the rotation of crops for the 2019 harvest and, consequently, what amount of feedstock will be available in the next campaign.

Chart of the week (27)

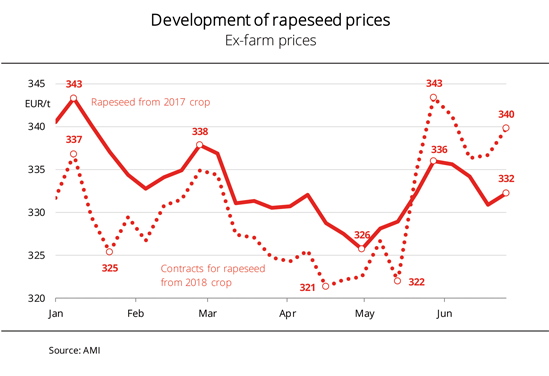

Rapeseed prices could rise

Due to the lower harvest estimates for key rapeseed producing countries and prospects of brisk demand from China, asking prices for rapeseed are poised to exceed previous expectations. Prospects of a weaker rapeseed harvest in the EU-28 are gradually having repercussions on prices, leading to firming prices in Paris. Prices for soybeans in Chicago and for palm oil in Kuala Lumpur recently headed downward, but rapeseed prices have been supported by the weaker euro. The surge at the futures exchange is also reflected in wholesale prices. Bids to producers have also been raised recently. There is virtually no trade in old-crop rapeseed. Consequently, the chances are good that rapeseed prices will increase. According to information published by Agrarmarkt-Informations Gesellschaft, rapeseed is likely to grow tight, on the one hand, because of lowered crop forecasts in Europe, Australia and Canada, and on the other hand, because of the escalating trade conflict between China and the US. Considering the import duties the Chinese government announced it would impose on US soybeans, it is doubtful whether China will be able to cover its demand for oilseeds with soybeans from Brazil, because around one third of Brazilian soybean production is needed in Brazil's domestic meat sector. To ensure protein supply nevertheless, China could increasingly focus on rapeseed meal or rapeseed. As a consequence, more produce from the EU-28 could be marketed in China.

Chart of the week (26)

Soybean stocks likely to decline further

World soybean production could grow significantly in the 2018/19 marketing year. However, output will unlikely be sufficient to satisfy demand, which would lead to a further reduction in stocks. In its June report, the USDA has projected global soybean production in 2018/19 at 355 million tonnes. This translates to an 18.5 million tonne rise from the ending marketing year. Brazil is seen to be the largest soybean producer of an estimated 118 million tonnes. According to the USDA outlook, 2018/19 global consumption is likely to exceed the previous year's level by 16 million tonnes. At 358 million tonnes, the volume of soybeans used in processing would exceed the amount of soybeans harvested by around 3 million tonnes. According to Agrarmarkt Informations-Gesellschaft (AMI), global ending stocks could shrink for two years running at the end of the marketing year. Based on the current forecast of 87 million tonnes, world stocks would be down around 5 million tonnes from a year earlier, but nevertheless the third largest ending stocks in history. China will still be the world's most important soybean importer in 2018/19. Demand is estimated to rise more than 6 million tonnes from the previous year, hitting a new high at 103 million tonnes. This means that just under 64 per cent of soybeans traded worldwide would be shipped to China.

Chart of the week (25)

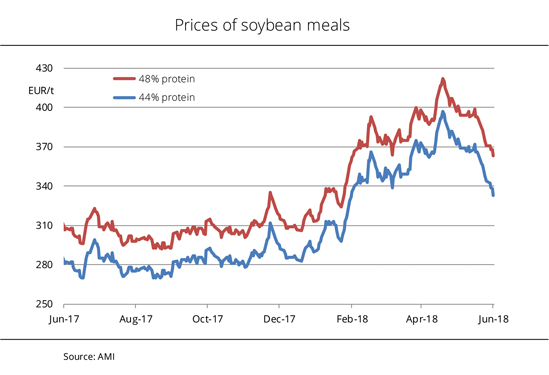

Prices of conventional soybean meal took a nosedive

Prices of conventional soybean meal have come down significantly since the beginning of May 2018. Ample supply from Brazil, favourable growing conditions in the US and the escalating trade dispute between China and the US are putting downward pressure on prices. Asking prices of soybean meal have weakened considerably following a sharp rise in the first quarter of 2018. Since their annual highs at the beginning of May, soybean meals fell 14 per cent to EUR 363 EUR per tonne (48 per cent protein) and 16 per cent to EUR 333 per tonne (44 per cent protein) respectively. Nevertheless, in each case prices are still around 18 per cent above the level seen in June 2017. The significant drop in asking prices over the past few weeks is due to the weakening trend in the futures market, Agrarmarkt Informations-Gesellschaft (AMI) has reported. Soybean meal prices in Chicago have fallen continuously since the beginning of May 2018. The market outlook continues to be bearish. The Brazilian soybean harvest is seen to be even larger than previously expected. Since US soybean stocks are developing very well in virtually optimal weather conditions, the US could also bring in a bumper crop. The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) expects that the recent escalation of the trade dispute between the US and China and the associated introduction of import duties on US soybeans will shift trade flows noticeably before long. This would put pressure on US soybean prices, because US soybeans would have to find new markets. The EU could stand to benefit from this situation, especially because oil mills are there and ready to process corresponding soy quantities. UFOP has underlined that global supply of oilseeds is good. The Argentine crop failures are not felt in the market, UFOP has pointed out. Instead, the trade conflict combined with good harvest outlooks in the US and Brazil are the key factors determining the market conditions. The USDA recently estimated the Argentine 2017/2018 soybean harvest just under 36 per cent lower at approximately 37 million tonnes.

Chart of the week (24)

EU sunflower production expected at clearly below year-ago level

Although the sunflower area has remained constant in the EU-28, the EU Commission anticipates a sharp drop in sunflowerseed production. Yields, especially in Romania and France, could be disappointing. According to figures just published by the EU Commission, the 2018 EU-28 sunflower area of 4.2 million hectares has remained virtually unchanged from the previous year. While Spain and Hungary each expanded their sunflower areas by around 4 per cent, Italy, Bulgaria and France reduced theirs. Growing sunflowers on more than 1 million hectares, Romania is the most important producer of sunflowerseed within the European Union. The country once more expanded its production area by 2 per cent. Nevertheless, the EU Commission anticipates a decline in output. The estimate of 9.7 million tonnes is down just less than 2 per cent from the April outlook and more than 6 per cent below the 2017 level. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), the main reason for the lower crop forecast is lower yield expectations. Romania is projected to see an almost 18 per cent decline from the previous year. Production in Spain and France is also expected to come down 12 per cent and 14 per cent respectively from the past season. The reason for the lower yield expectations is the wet weather at the beginning of April 2018, which caused substantial delays in sowing in Southeast Europe and around the Mediterranean Sea.

Chart of the week (23)

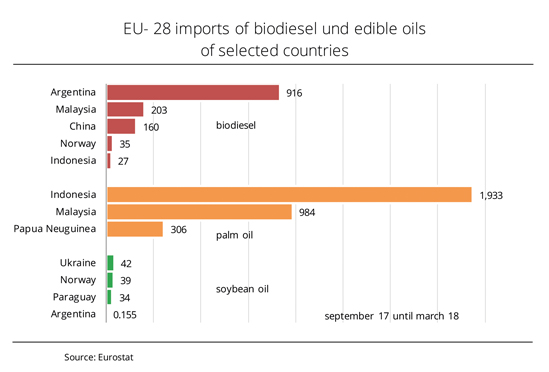

Argentina accounts for almost two thirds of EU biodiesel imports − Indonesia is the largest palm oil exporter to the EU

Biodiesel imports from Argentina have increased considerably over the past several months. In contrast, imports of soybean oil as feedstock from Argentina have been virtually non-existent. The reverse trend can be seen in regard to imports from Indonesia. Since EU import duties were lowered in September 2017, deliveries of Argentine SME (soy methyl ester) have been on a steady increase. By the end of March 2018, they amounted to 915,983 tonnes, which translates to 62 per cent of all EU biodiesel imports. Because of anti-dumping duties, there had not been any biodiesel shipments from Argentina for four years. The EU imported 203,002 tonnes of PME (palm oil methyl ester) from Malaysia, 160,200 tonnes from China, and only 26,700 tonnes from Indonesia. Most Argentine biodiesel shipments went to the Netherlands and Spain. Deliveries of Argentine soybean oil in the same period was negligible at 155 tonnes. These figures underline the success of the Argentine government's export promotion policy in support of its domestic biodiesel industry, the Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has noted. UFOP has repeatedly pointed out that the subsidies granted by the Argentine government have a market distorting effect. The association sees the current situation as proof that fears of a surge of extremely large quantities of biodiesel from Argentina into the EU, thereby putting pressure on vegetable oil prices, are coming true. UFOP has criticised that although this development results from the surplus in the global vegetable oil markets, the price fall is also at the expense of Argentine soybean producers. The association therefore expressly welcomes that, alongside the anti-subsidy proceedings against Argentina, import volumes are being recorded since the end of May. If the proceedings have a positive outcome, duties will have to be paid on these volumes in retrospect.

The Argentine government has understood that this sector provides opportunities for generating income and raised the export tax from 8 per cent to 15 per cent as of 1 July 2018 to relieve some of the pressure on its national budget. However, it remains to be seen whether the export tax and registration of import volumes will actually have an easing effect on the market.

In any case, the EU-28 did not import much soybean oil from third countries (134,000 tonnes). It did, however, import a great deal of palm oil in the above-mentioned period, amounting to 2.8 million tonnes – mainly from Indonesia (1.93 million tonnes) and Malaysia (0.9 million tonnes) – with the Netherlands, Spain and Italy being the main receiving countries. The majority of Indonesian palm oil imports, around 67 per cent, went to technical uses, i.e. transport fuels. UFOP has expressed its fears that imports could swell to 3 - 5 million tonnes, a level last seen in 2012 before import duties on biodiesel from Argentina and Indonesia come into force. UFOP has said that for this reason, the EU Commission should act in the same manner it did in the case of Argentine biodiesel imports, reacting against a further increase in palm oil imports. UFOP believes it is a paradoxical situation that in its revision of the renewable energy directive the EU Commission is holding on to the iLUC policy and even intends to exclude EU-produced rapeseed oil while at the same time is refusing to ban palm oil as the European Parliament has been calling for.

Chart of the week (22)

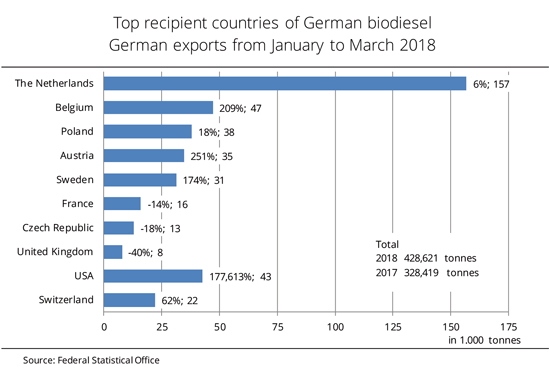

Biodiesel exports rose strongly

In the first three months of 2018, German exports of biodiesel rose strongly. Above all, demand from the US, but also from Belgium and Austria saw a sharp increase. In the first quarter of 2018, biodiesel exports increased just less than 31 per cent from same period last year to 428,620 tonnes. Around 84 per cent of these exports were shipped to EU-28 countries. This was up 16 per cent from the previous year. The top purchaser of German biodiesel continued to be the Netherlands, with imports rising 6 per cent to 156,860 tonnes. Belgium moved up to second place, outstripping Poland and doubling its imports to 47,650 tonnes. Nevertheless, Poland's biodiesel purchases from Germany went up around 18 per cent. The US recorded the biggest growth in imports, absorbing 42,651 tonnes. In the same period last year, US imports were very low at 24 tonnes. According to Agrarmarkt Informations-Gesellschaft (mbH), Austria, Sweden and Switzerland also imported considerably more German biodiesel than in the 2017 reference period. In contrast, biodiesel deliveries to France, the Czech Republic and especially Great Britain declined. Demand from the UK crashed 40 per cent to just less than 7,800 tonnes. The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has underlined the importance exports have for the German biodiesel industry. The association pointed out that in view of the forthcoming rapeseed harvest exports took pressure off the market.

Chart of the week (21)

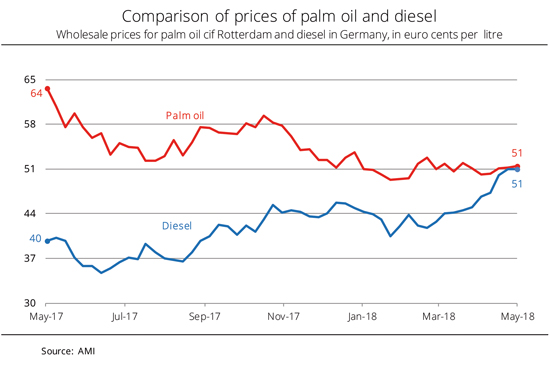

Diesel fuel prices draw level with palm oil prices – UFOP urges trialogue parties in Brussels to reconsider their position on biofuels

Asking prices for diesel fuel and palm oil have reached virtually the same level. The reason is contradictory price trends for crude and palm oil. Pointing to the fact that the vegetable oil markets face oversupply worldwide, the Union zur Förderung von Oel- und Proteinpflanzen (UFOP) expects that the preference for using palm oil as a feedstock in biofuels production will grow, especially in non-EU countries that impose virtually no sustainability requirements on the feedstocks.

German wholesale prices for diesel have soared virtually 47 per cent to around 51 euro cents per litre since their last low at the end of June 2017. The reason is the significant rise in crude oil prices, which have a determining influence on diesel pricing. Crude oil prices are driven up by steady demand based on the global economic upswing, OPEC's and Russia's cut in production levels and the threatened US penalties against Iran's oil industry. In contrast, asking prices for palm oil have dropped around 19 per cent year-on-year. According to Agrarmarkt Informations-Gesellschaft (mbH), a decline in international demand, higher Indian import duties on palm oil and an increase in stocks in Indonesia and Malaysia have put downward pressure on palm oil prices over the past three months. Based on this combination of factors, wholesale prices for diesel and palm oil have gradually converged to reach the level of around 51 euro cents per litre. Palm oil is a major feedstock in biodiesel production, hydrogenated vegetable oil production (HVO) and for co-processing in petroleum refineries. The latter is provided for in the 37th Federal Immission Control Ordinance, but limited to the period ending 2020.

The savings palm oil offers are already reflected in China’s import policy, UFOP notes. According to information published by Reuters News Agency, China has indicated that the country is poised to step up its annual palm oil imports from Indonesia by 0.5 million tonnes. Indonesia also sees this as a possibility of compensating for a reduction in palm oil exports to the European Union due to a potential ban on using palm oil in biofuels production from 2021 onwards. UFOP claims that the world's largest palm oil exporter is already looking for new or additional sales channels for palm oil. Sustainability requirements along the lines of the European Renewable Energy Directive standard are unlikely to play a major role in these exports.

In view of the ongoing trialogue negotiations to revise the Renewable Energy Directive (REDII), UFOP underlines the fundamental worldwide importance the certification systems that are approved by the EU Commission have for biofuels from cultivated biomass. UFOP warns that by adopting the options that are discussed in the trialogue negotiations to reduce the allowability of first-generation biofuels, the EU would give up the possibility of influencing the implementation of sustainability standards in third countries through legislation.

Chart of the week (20)

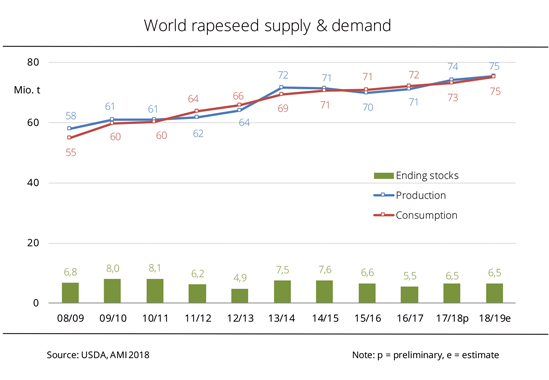

2018/19 global rapeseed consumption could rise to record levels

The current USDA report on global rapeseed supply projects hardly any changes for the running season. However, production and consumption are predicted to reach new record levels in 2018/19. In its May forecast, the USDA sees global 2017/18 rapeseed production unchanged from the previous month's estimate at 74.3 million tonnes, up around 4.4 per cent from the previous year's level. World rapeseed consumption is revised slightly lower to 73.1 million tonnes. Consequently, global rapeseed supplies would grow by 0.3 million tonnes to just less than 6.5 million tonnes, exceeding the previous year's figure by around 1 million tonnes. In its first estimate for the upcoming marketing year 2018/19, the USDA anticipates a surge in global rapeseed production by 1.1 million tonnes to 75.4 million tonnes. According to Agrarmarkt Informations-Gesellschaft mbH (AMI), this would set a new record, driven mainly by production gains in the EU-28, Australia and India. In contrast, crop projections for Canada and China have been lowered. Global trade is seen to amount to a total volume of 17.5 million tonnes, which would also set a new high. The trend is mainly fuelled by strong demand from China. Despite the anticipated high consumption of 75.1 million tonnes, USDA expects a slight rise in global rapeseed stocks to slightly more than 6.5 million tonnes. The IGC and the EU Commission forecast similar figures. The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) says that it disagrees with these ambitious forecasts. The predicted high consumption volume of rapeseed does not strike the association as convincing, considering the difficult conditions for marketing rapeseed oil in the EU-28, the associated slow-down in processing at European oil mills and the high level of competition in the world market.

Chart of the week (19)

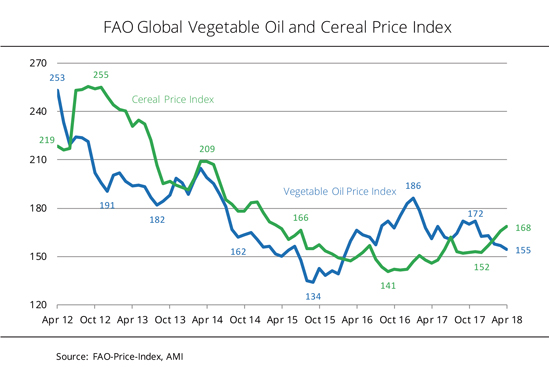

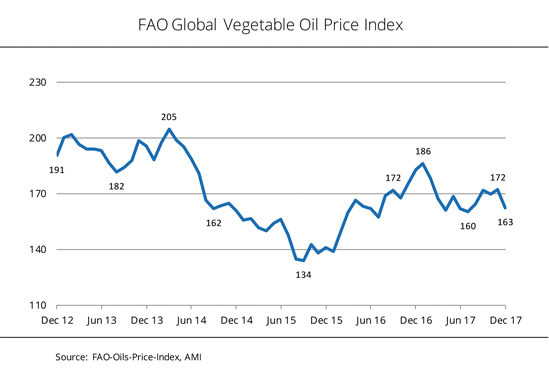

Contrasting changes in global prices for vegetable oils and cereals

The FAO (Food and Agriculture Organization of the United Nations) price indices for vegetable oils and cereals have recently trended in opposite directions. Whereas vegetable oils have been under considerable downward pressure, cereal prices have increased since the beginning of the year. Asking prices for vegetable oils decreased considerably over the first four months of 2018. After rising to the third highest level in 16 months in November 2017, the FAO vegetable oil price index, which illustrates the changes in international prices of the ten most important vegetable oils in world trade, has came down by 10 per cent, hitting its lowest level in more than two years. Weaker asking prices for palm and soybean oil weighed especially heavily on the index, Agrarmarkt Informations-Gesellschaft (AMI) reported. Significant growth in output at oil palm plantations combined with falling international demand put downward pressure on palm oil. Prices for soybean oil were pulled down by a surplus on the global market where soybean meal production yields more soybean oil than is currently used. By contrast, the FAO cereal price index has increased more than 10 per cent since the beginning of the year, following many years of weakness. This was mainly due to firm wheat prices, which rose sharply due to unfavourable growing conditions in the US. Asking prices for maize also firmed, driven by concerns over drought-related losses in Argentina and recently also Brazil.

Chart of the week (18)

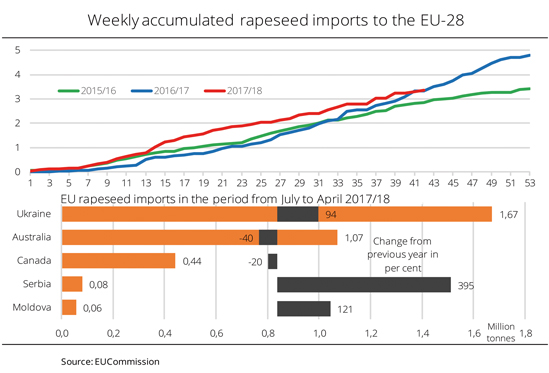

EU rapeseed imports levelled off

The excessive EU rapeseed imports which previously characterised the marketing year have waned. At the beginning of April, the total volume stood at the previous year's level. Extensive rapeseed imports from third countries were a major feature of the EU rapeseed market already early in the running marketing year. This was the case although internal supplies were sufficient since the 2017 harvest of 22.3 million tonnes exceeded the 2016 output by 2.1 per cent. Nevertheless, rapeseed imports outpaced the mark of 1 million tonnes as early as October 2017. In 2016/17, this level was not reached until early December. The reason was probably lower-priced supply from the Ukraine after the 2017 harvest. Weekly imports from third countries continuously exceeded the previous year's level as the marketing year progressed, Agrarmarkt Informations-Gesellschaft mbH reported. They amounted to 83,500 tonnes on a monthly average, which was up 33,000 tonnes from the previous year. The pace of imports has slowed since February. Nevertheless, one-time shipments continue to be disproportionately frequent. As a result, March 2018 imports totalled 287,500 tonnes, which was 50,000 tonnes fewer than 2017. At the beginning of April, EU imports from third countries reached the previous year's level.

Chart of the week (17)

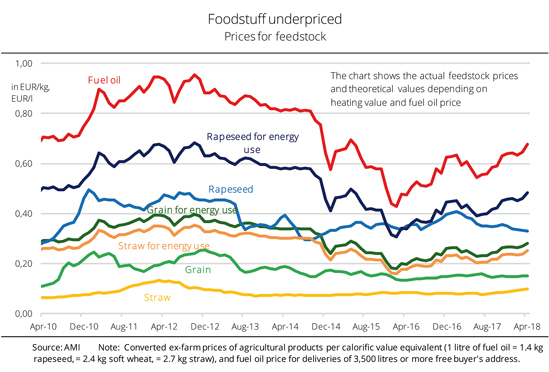

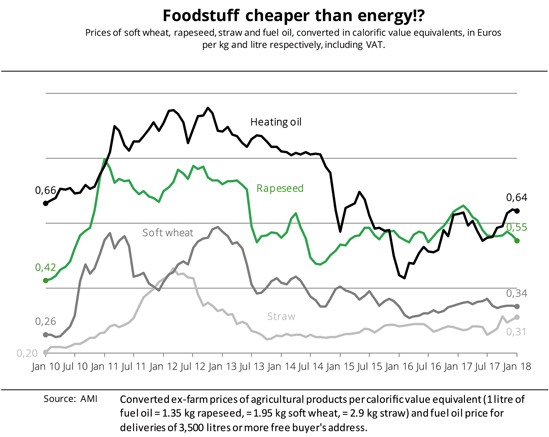

Value of grain and rapeseed declines relative to oil price

As crude oil prices rise, energy uses of rapeseed, grain and, first and foremost, crop straw are increasingly attractive. The German Union zur Förderung von Oel- und Proteinpflanzen (UFOP) draws attention to this trend at a time when pressure on prices in the grain and rapeseed markets is increasing. The development of prices for food and feed uses lags behind that of prices for the "fuel value" of these feedstocks. Brent crude oil recently hit the level of 74 US dollar per barrel. This price is also the key currency for value comparisons with food feedstocks. Farms are in urgent need of new sales markets that will enable them to create sustainable value and invest in the future. There is no doubt that there is a lot of research going on in bioeconomics. However, farmers are still waiting for a breakthrough that would also be reflected in volumes and prices, UFOP points out. Politics has not yet given an answer as to which steps can be taken to combat the pressure on volumes and prices in the agricultural markets. According to UFOP, the situation is in fact quite the opposite, – the pending trade agreements are fuelling fears that pressure from imports, for example in the vegetable oils market, will grow. In the international agricultural market, EU farmers compete at world market prices, but not subject to the same legal regulations. At the end of the 90s, the set-aside of agricultural land was replaced by energy uses such as the production of electricity and biofuels from biomass. Today, there are definite signs that the revision of the Renewable Energy Directive (RED II) will have a dampening effect on the use of cultivated biomass in sustainable and greenhouse gas-optimised biofuels that will threaten farmers' existences. UFOP also criticises politicians for discussing a EU protein plan instead of looking ahead and tapping at least domestic GM-free sources of protein that accumulate when processing oilseed and grain to produce biodiesel and bioethanol.

Chart of the week (16)

Global soybean crop smaller than expected

The world's 2017/18 soybean output will be significantly smaller than previously expected. Argentina is set to harvest one third less than initially projected. Larger harvests in Brazil and the US will not suffice to offset the shortfall. There are signs that global supply of soybeans in the 2017/18 marketing year will be lower than expected a few weeks ago. In many parts of Argentina in the past months, field crops were adversely affected by exceptionally high temperatures and lack of rain. According to Agrarmarkt Informations-Gesellschaft (AMI), harvest estimates have been forecast down steadily over the past few weeks. The current USDA forecast puts the Argentinian soybean crop for 2017/18 at only 40 million tonnes. This is down around 7 million tonnes from the previous month and virtually one third from forecasts made early this year. By contrast, the crop forecast for Brazil was raised 2 million tonnes to 115 million tonnes due to practically optimal growing conditions. Accordingly, global soybean output could reach 335 million tonnes in the running marketing year. This translates to a just less than 5 per cent drop from the previous year. The Argentine share is likely to fall by 4 per cent to below the level of 12 per cent.

Chart of the week (15)

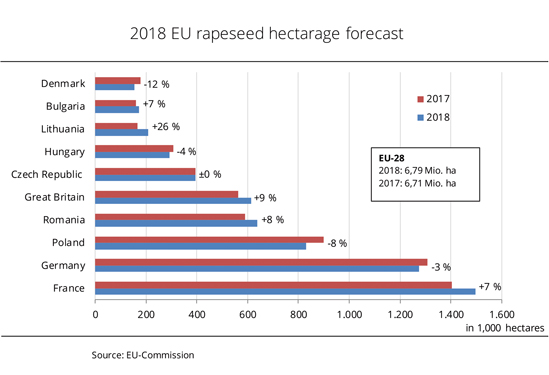

2018 EU rapeseed area increased from previous year

In the EU-28, an estimated area of 6.8 million hectares is planted with winter rapeseed for the 2018 harvest. This translates to a more than 80,000 ha rise from 2017. The development of rapeseed area is very different in the different EU member states. According to Agrarmarkt Informations-Gesellschaft (mbH), German and Polish production may decline compared to the previous year due to winter kill losses in eastern Germany and western Poland and poor conditions at the time of sowing in North Germany. Also, the rapeseed area in Denmark is seen to remain significantly below the year-ago level. By contrast, farmers in France and Romania expanded their rapeseed hectarages because of the profitability of area. The Romanian rapeseed area has been on a steady rise for several years. It is set to exceed the five-year mean by more than 50 per cent in 2018. The majority of EU-28 cultivation areas have hardly suffered any crop damage because the winter was mild in most parts of the Union.

Chart of the week (14)

Rapeseed oil price fell to a multi-year low

Prices of vegetable oils declined. Above all, rapeseed oil weakened considerably, but soybean oil also came down sharply. The reduction of tariff rates on palm oil Indonesia pushed through at the WTO and the lowered tariff rates on biodiesel from Argentina, which have been applied since September, increasingly weighed down prices of vegetable oils in Germany. Rapeseed oil, the domestic feedstock for biodiesel, was most heavily affected by the imports. Competition in the market grew further, with asking prices being on a steady decline. According to information published by Agrarmarkt Informations-Gesellschaft mbH (AMI) prices were recently reported at EUR 640 per tonne fob Hamburg. This was the lowest level in three and a half years. Asking prices for soybean oil also fell in the first quarter of 2018, averaging EUR 678 per tonne fob Hamburg in February and March. In the same months last year, prices stood at, on average, EUR 778 per tonne. The reason for the plunge in prices was, first and foremost, the level of reference prices on the soybean oil futures markets in Chicago. However, palm oil launched into a short recovery rally in February, before falling back from its higher level. Current production figures from Malaysia suggest that there was significant growth in the first three weeks of March. The German Union zur Förderung von Oel- und Proteinpflanzen (UFOP) said that the only way forward was to raise rapeseed oil exports significantly, because due to rather unambitious regulations, the European biofuels market did not provide a potent stimulus to demand that would have a positive impact on volumes and, consequently, prices.

Chart of the week (13)

Rapeseed meal significantly more expensive

Brisk demand for rapeseed meal drove prices to a three-year high. This reduced the price advantage compared to GMO-free soybean meal in compound feeds. German wholesale prices for rapeseed meal rose substantially over the past few weeks. Asking prices have surged by around 21 per cent since the beginning of February 2018, recently hovering around EUR 247 per tonne ex works. This was the highest level in almost three years. The mid February to mid March 30-day average price for nearby rapeseed meal amounted to EUR 223 per tonne, which was up 10 per cent from the previous 30-day period. According to information published by Agrarmarkt Informations-Gesellschaft mbH (AMI), the price rise is due to an extreme scarcity of supply. Only four out of ten mills currently offer spot rapeseed meal to meet the considerable growth in demand from the compound feed industry. In the reference period, the increase in asking prices for Brazilian GMO-free soybean meal containing 48 per cent crude protein was less sharp. At recently EUR 489 per tonne FOT (Free On Truck) Brake, buyers had to fork out only 5 per cent more than at the beginning of February. The price spread between one per cent of crude protein in rapeseed meal over one per cent of crude protein in GMO-free soybean meal recently even hit a low at EUR 2.92 per tonne. The German Union zur Förderung von Oel- und Proteinpflanzen (UFOP) hopes that this trend in demand and prices will continue. In the light of growing vegetable oil surpluses, utilising feedstock locally to produce more GMO-free rapeseed meal is becoming more and more important for the level of producer prices of rapeseed. UFOP expects the production of rapeseed, the most important GMO-free and sustained source of protein, to play a significant role in EU Commission's protein plan.

Chart of the week (12)

German rapeseed oil exports on the decline

German exports of rapeseed oil in the first half year 2017/18 fell short of the previous year's level. Both EU member states and third countries purchased considerably less rapeseed oil than a year earlier. According to information published by the German Federal Statistical Office, German exports of rapeseed oil declined for the first time in three years. At 535,000 tonnes in the first half year of 2017/18, foreign sales were down 12 per cent from the 2016/17 reference period. Nearly 95 per cent of the exports, 505,000 tonnes, went to other EU countries. This amount translates to an 8 per cent drop from a year earlier. Purchases by the Netherlands, the hub of international trade in vegetable oils and biggest purchaser of German rapeseed oil, amounted to 278,800 tonnes, which was down around 12 per cent from the previous year's level. By contrast, Polish imports climbed virtually 4 per cent to 88,500 tonnes. Belgium occupied third place despite a 28 per cent slump to 33,800 tonnes. According to Agrarmarkt Informations-Gesellschaft mbH, the EFTA states (Iceland, Norway, Switzerland), the second most important recipient region of German rapeseed oil, purchased 57 per cent less rapeseed oil than a year earlier (21,300 tonnes). The growth in exports to Switzerland did not offset the slowdown in trade with Norway.

Chart of the week (11)

Declining production causes soybean stocks to shrink