Chart of the week (51 2021)

Record year of oilseed production

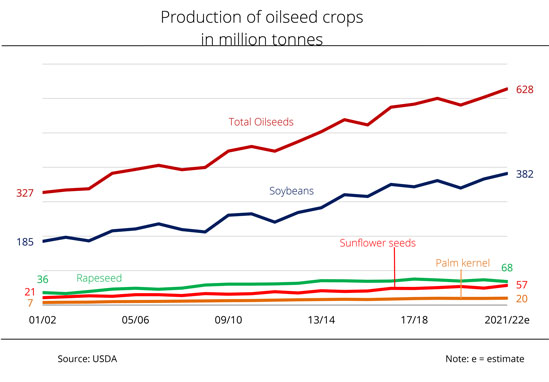

According to current USDA estimates, global production of oilseeds in the crop year 2021/22 is set to hit a peak of around 627.6 million tonnes, which would be up around 4 per cent year-on-year. After recent expectations of an output of 628 million tonnes, the current forecast is slightly more cautious.

Global processing of oilseeds is also set to rise to a record high of 527.2 million tonnes, according to the most recent USDA outlook. This would be up around 18.3 million tonnes on the crop year 2020/21. Global ending stocks will presumably amount to 114.1 million tonnes, which would exceed the previous year's level by 400,000 tonnes. However, ending stocks are seen to be clearly below the 133.9 million tonne record high recorded in the 2018/19 season. Also, world trade in oilseeds is expected to increase 6 million tonnes to 196 million tonnes.

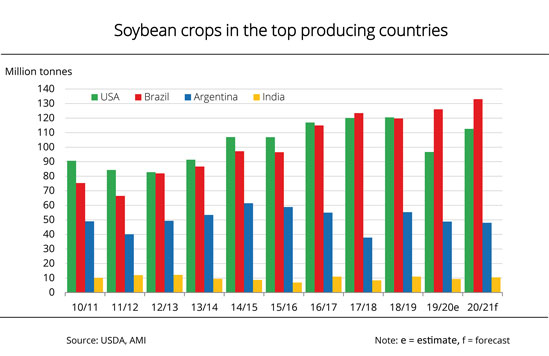

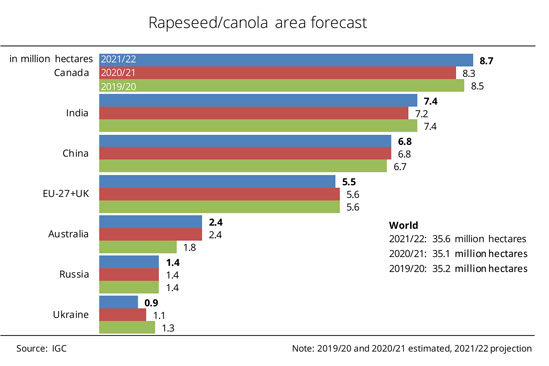

At 382 million tonnes, the current crop year's soybean harvest is expected to be larger than ever. Global output of sunflower seed is also set to increase on the year, 14 per cent to 57 million tonnes. By contrast, world rapeseed production is seen to decline 4.8 million tonnes to 68.4 million tonnes year-on-year. According to Agrarmarkt Informations-Gesellschaft (mbH), this outlook is based on harvest declines in major rapeseed producing countries, especially Canada. It should be noted that the USDA oilseed estimate also includes peanuts (approximately 51 million tonnes) and cottonseed (approximately 44 million tonnes), among other oilseeds.

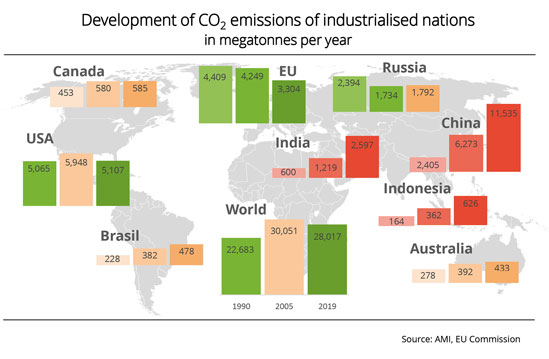

The rise in soybean output is due to an expansion in area in the wake of adjustments in crop rotation in North and South America and in South America also to changes in land use (clearing primeval forest). This is why the EU Commission and the German government are working towards deforestation-free procurement of feedstuff. The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has pointed out that with respect to biofuels from cultivated biomass, a compulsory certificate of crop area origin dated 2008 has already been a requirement for recognizing the sustainability certificate in the commodity chain and consequently for accessing the EU market ever since the Renewable Energy Directive (2009/28/EC) was implemented. This certification requirement can basically be applied irrespective of use. The administrative prerequisites, including the database, are in place, at least in Germany. The certification requirements are being tightened under the EU Commission's proposal to amend the Renewable Energy Directive (RED II), which proposal provides, among other things, for the creation of an EU database along the lines of the "Nabisy" database of the Federal Agency for Agriculture and Food (BLE). The BLE has just published the Evaluation and Progress Report 2020, which transparently shows how data were acquired and analysed. This is not least a significant contribution to acceptance of biofuels from cultivated biomass among politicians and the public.

Chart of the week (50 2021)

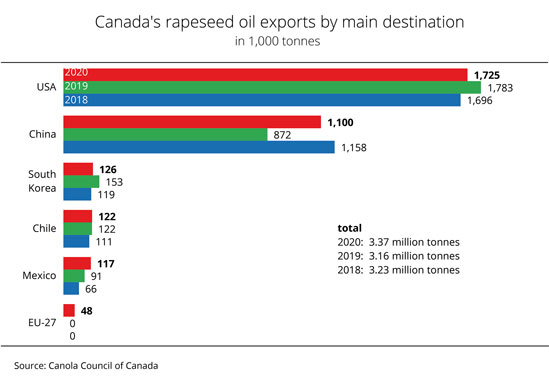

Rapeseed oil exports reached record level

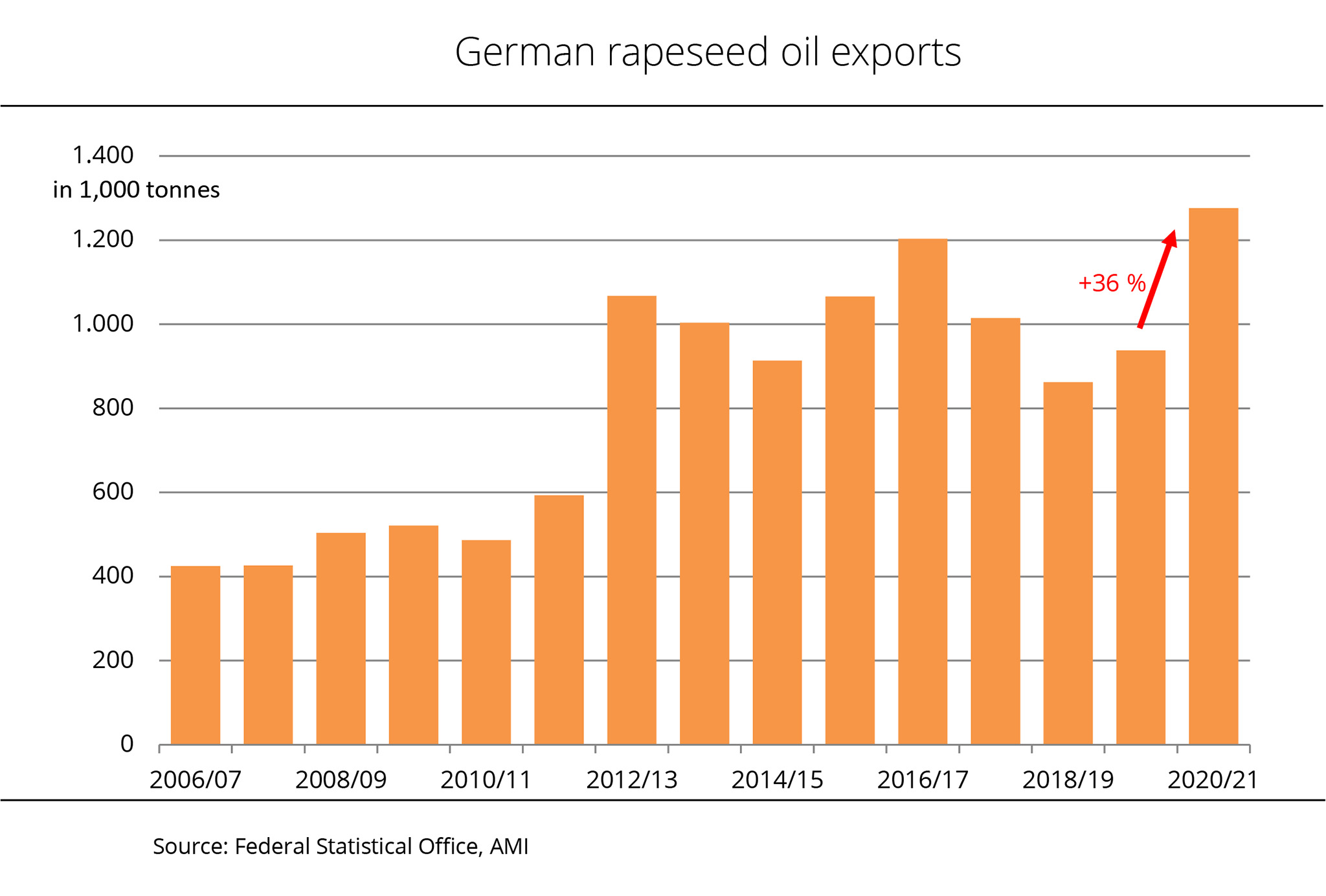

German exports of rapeseed oil reached a new record, exceeding the level seen in the peak year of 2016/17.

German rapeseed oil exports increased again in the 2020/21 crop year, following a significant decline in 2017/18 and 2018/19. In fact, with total exports of rapeseed oil amounting to 1.3 million tonnes, they even outstripped the peak of 1.2 million tonnes in the 2016/17 marketing year. This translates to a 36 per cent rise over the previous marketing year. The by far largest recipient country of rapeseed oil in 2020/21 was the Netherlands, which acts as a central hub for world trade in agricultural commodities. The country was followed by Belgium, Denmark, France and Norway as the most important destinations for German rapeseed oil. Belgium purchased around 102,600 tonnes from Germany (+ 8 per cent), whereas Denmark imported 57,300 tonnes (- 6 per cent). France received more than it did the past marketing year. The country remained an important market for Germany, with purchases amounting to 54,700 tonnes (+ 10 %). Great Britain, the Czech Republic and Finland also imported significantly more than 2019/20, whereas exports to Poland, Hungary and Austria declined.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has underlined the significance of the European biodiesel industry as the most important recipient of rapeseed oil. The UFOP has ascribed the growth in exports from Germany and import demand from other European states to the low availability of rapeseed and rapeseed oil due to harvest declines throughout Europe. The neighbouring countries also had to meet biofuels mandates to avoid penalties. The association has added that during the winter months of November to April practically only rapeseed oil-based biodiesel can be used for blending to meet winter-grade diesel quality requirements. This genetic edge provided by the fatty acid composition of rapeseed oil entails a sales potential that could only be achieved during this period using hydrotreated vegetable oil (HVO), which is more expensive than rapeseed methyl ester (RME).

The UFOP has recommended that in view of the supply to the market and development of prices the biodiesel industry should consider offering an incentive for farmers to grow sunflowers in 2022 by presenting appropriate forward contracts. The association has pointed out that, along with rapeseed potential, there is also a land and feedstock potential that can be exploited to improve biodiversity and expand crop rotations. In view of the fact that coronavirus-related restrictions can be expected to be maintained or tightened, feedstock supply of used cooking oils and fats is unlikely to increase. The option of counting biofuels based on waste category 1 and 2 animal fats, which will be permitted in Germany for the first time in 2022, will

not change this. The UFOP sees this as just a compensation of export volumes that will be missing

elsewhere.

Chart of the week (49 2021)

Top yields of German soybeans

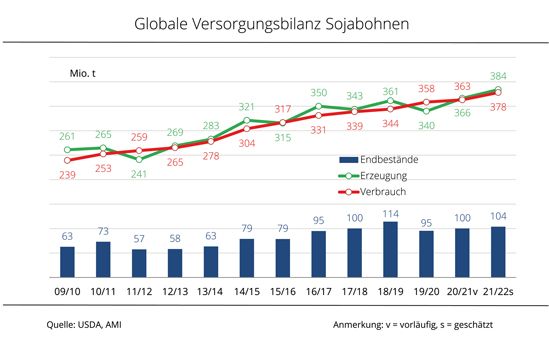

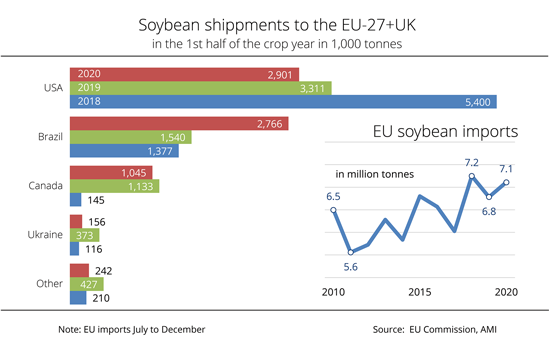

Global soybean production could exceed consumption for the second year running. This could led to a rise in ending stocks.

In its forecast of world soy production, the USDA expects an all-time high of 384 million tonnes. The record estimate is due to the almost 6 million tonne US harvest increase compared to the previous year and positive outlooks for South America (+3 million tonnes for Argentina and +6 million tonnes for Brazil). However, this trend is paralleled by a rise in demand in 2021/22. At 378 million tonnes, the USDA anticipates an increase of 15 million tonnes over the 2020/21 marketing year, mainly based on the consumption forecast for China, which has been raised once again. In China, soybean consumption could increase to just less than 118 million tonnes in 2021/22, which would be up around 6 million tonnes on the previous marketing year. According to Agrarmarkt Informations-Gesellschaft (mbH), this means that China covers almost one third of global demand. It is followed by the US in second place (63 million tonnes), with Brazil (50 million tonnes) and Argentina (49 million tonnes) behind. Soybean consumption in each of these three countries is also set to rise, but less strongly so than in China, by approximately 1-2 million tonnes. In contrast, the EU is expected to see a slight decline in soybean stocks to 17.6 million tonnes.

Despite the strong growth in demand in China, global stocks are set to rise to 104 million tonnes, mainly based on production increases in North and South America.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has pointed out that the rise in soybean output is not just due to increases in yield, but also to expansions in area. The issue of deforestation-free sourcing and greater transparency through labelling is also moving into focus for the new German government. The provisions of the Renewable Energy Directive (2009/28/EC) for biofuels certification, which came into force in 2009, also provide for a dated proof of origin for crop areas. The UFOP has pointed out that these certification requirements are currently being tightened by the implementation of the revised Directive (RED II), including the creation of an EU database as from 2022. The requirement of sustainability certification does not apply unless the products in question are to be credited towards quota obligations. As a consequence, the entire rapeseed area in Germany is certified and, with that, so are all products obtained from it, including rapeseed meal.

The association has explained that the groundwork for a proof of origin has been laid by the EU biofuels policy and could be used as a blueprint also for other crops. The UFOP has emphasised that this approach to creating a proof of sustainability could help support the EU Commission's aim to strengthen added value in the production regions as part of its "Farm to Fork" strategy. This would apply to domestic grain legumes in general. For this reason, the UFOP has called on the new German government to take a holistic view of the biofuels policy and grain legume production and place a focus on domestic protein crops in suitably expanded crop rotations.

Chart of the week (48 2021)

Top yields of German soybeans

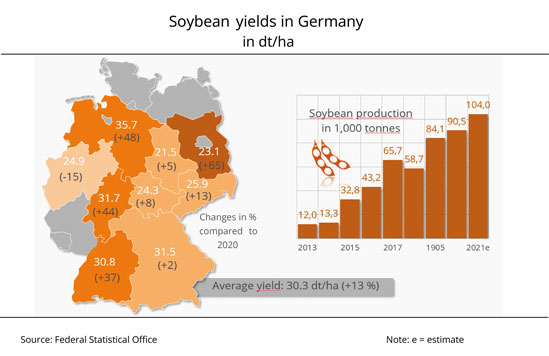

According to the German Federal Statistical Office, around 104,000 tonnes of soybeans were harvested in Germany in 2021. This was the largest quantity ever.

After the cold spring had only allowed for a slow start to the growth period, growing conditions were just about optimal in the summer and early autumn, as the amount of rain and heat was sufficient. This led to a boost in soybean yields for the 2021 harvest. Yields reached a record high at presumably 30.3 decitonnes per hectare. Consequently, German farmers harvested a bumper crop of more than 100,000 tonnes in 2021, although the hectarage had barely been increased. This was just over three times more than six years earlier.

German soybean production has grown more than tenfold since 2012 due to a steady expansion in production area. The soybean area for the 2021 harvest amounted to 34,300 hectares, which was up 1.4 per cent year-on-year. Also, yields were higher than average and showed enormous increases compared to the drought year 2020, especially in Eastern Germany. More specifically, in Brandenburg they rose 65 per cent over 2020. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), Baden-Wuerttemberg, Lower Saxony and Hesse also recorded very large increases of 34-48 per cent.

The UFOP regards this positive trend in yields per hectare as evidence of successful breeding of soybeans. Soybeans are an increasingly interesting complementary crop to crop rotations, both in economic and ecological terms. However, in view of climate change and the need to develop climate-resilient crop rotation systems, this trend has to be expedited for all large-grained pulses, especially by providing a boost to push-funding for breeding work. From the perspective of the UFOP, what is needed is a research and investment budget, analogous to that introduced to expand renewable energy. According to the association, there is a need for a sustainable funding environment also for research in crop breeding (similar to that for research in e-mobility) and it should be combined with measures to facilitate market access.

The UFOP expects the German Ministry of Agriculture to move up several gears under the new leadership in order to make an ecological bioeconomy strategy finally visible across the board. In this context, UFOP has drawn attention to the EU Commission's and previous German government's proposals and measures for deforestation-free procurement. The latter starts in the local field, the association has emphasised, making reference to projects initiated and carried out by UFOP in cooperation with scientific and plant breeding experts (https://www.ufop.de/agrar-info/forschu/berichte/ - in German only).

Chart of the week (47 2021)

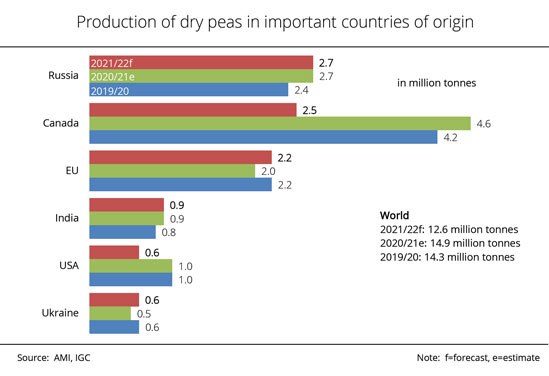

World harvest of dry peas declined

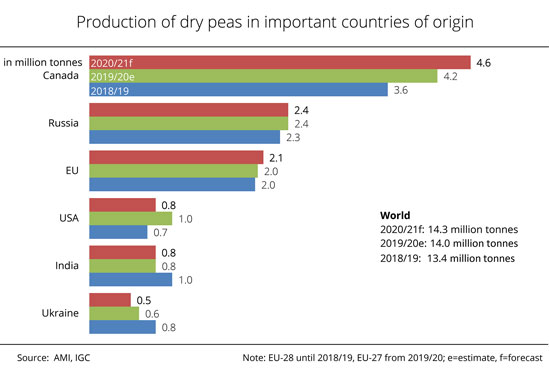

The drought that hit North America has severely affected the production of dry peas this season. After all, the US is one of the top five producers and exporters, along with Canada.

The International Grains Council (IGC) currently assumes that the global dry pea harvest will amount to 12.6 million tonnes in 2021/22. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), this would translate to a 16 per cent (2.3 million tonne) drop which is mainly due to production decreases in North America. The dry pea harvest in Canada is currently estimated at 2.5 million tonnes, which would be down 45 per cent on the year-earlier level. Continued hot and dry conditions in western production regions at the time of planting and during the growing season resulted in the smallest harvest in almost two decades.

Russia moved to the top of the list of dry pea producers with an output of 2.7 million tonnes, although the harvest was around 1.5 per cent smaller than the previous year. The EU-27 follows in third place with production amounting to 2.2 million tonnes. This translates to a 7 per cent increase over 2020 and is due to an expansion in dry pea area in Germany and France. Also, France harvested outstanding yields that were impossible to achieve in Germany due to poor weather conditions.

The declines in North America cannot even remotely be offset by the 21 per cent, or 100,000 tonne, increase in Ukraine. At 600,000 tonnes, the Ukrainian output was the same level as that of the US as the US harvest slumped 44 per cent due to drought.

In the southern hemisphere, the picture is mixed. Whereas according to the IGC forecast, the upcoming dry pea harvest in Australia is set to fall 15 per cent short of the previous year's figure, to 0.3 million tonnes, Argentina's harvest is seen to grow 16 per cent over 2020, based on a first official estimate of production area and assuming a return to average yields.

In view of the EU Commission's proposal for a regulation on deforestation-free products, the Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has underlined the great potential for growing dry peas and other large-grained pulses, such as field beans, lupines and soybeans. The UFOP has contended that both the EU Commission and the German government have failed to coordinate the funding opportunities that basically exist in a way that would allow the production of protein crops – similarly to that of rapeseed – to develop into a backbone of supply with GM-free protein for food and feed in the EU-27.

The association has acknowledged that the Commission' s proposal is a basically appropriate approach to thwarting the still concerning slash and burn activities with their tremendous impact on climate change. In this context, the UFOP has drawn attention to the results of the UFOP Perspektivforum event held in September 2021 (presentations and video recordings are available for download at www.UFOP.de/forum21) . The results included a substantial need for communication to consumers by means of adequate labelling in order to provide information on feedstock origins and, with that, the ecosystem service of extended rotation systems.

The UFOP expects the new German government to develop an overall approach strategy to create economically self-sustaining prospects for arable farms, the first link in the value chain.

Chart of the week (46 2021)

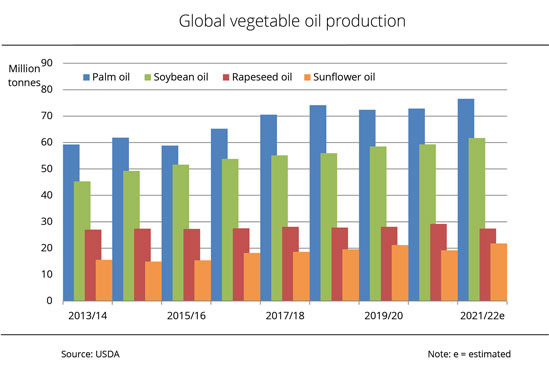

Global vegetable oil production set to reach new record highs in 2021/22

Global production of vegetable oils continues to increase in the 2021/22 crop year to reach new record highs. An expected decline in rapeseed oil output can be more than offset by production increases in palm, sunflower and soybean oil.

According to the recent USDA outlook, 2021/22 global production of vegetable oils will amount to 214.8 million tonnes. This would be an 8.21 million tonne rise compared to 2020/21. In other words, production will presumably fully cover demand of 211.8 million tonnes also in the current crop year.

According to investigations conducted by the Agrarmarkt Informations-Gesellschaft (mbH), palm oil is set to remain the world's most important vegetable oil in terms of production and consumption, with output estimated at 76.5 million tonnes. This translates to a 3.6 million tonne rise over 2020/21. In other words, palm oil accounts for just less than 36 per cent of total vegetable oil production. Indonesia remains the largest palm oil producer with an output of 44.5 million tonnes, followed by Malaysia with 19.7 million tonnes and Thailand with 3.1 million tonnes.

Production of soybean oil is expected to grow 4 per cent to 61.7 million tonnes based on larger harvests and could hit a new record. China remains the most important producer with production amounting to 17.6 million tonnes, whereas the USA ranks second with 11.6 million tonnes. Production of sunflower oil is expected to climb as much as 14 per cent to 21.8 million tonnes in 2021/22 due to larger harvests in Eastern Europe and the EU-27. On the other hand, the USDA has projected a 6 per cent decline in global rapeseed oil production to 27.4 million tonnes based on inadequate rapeseed supply.

The Union zur Förderung von Oel- und Proteinpflanzen e.V. (UFOP) expects the persistently high prices for sunflower oil to boost the expansion of sunflower area for the 2022 sowing campaign.

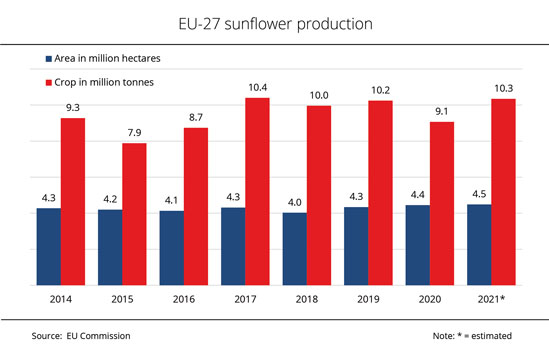

Chart of the week (45 2021)

Not a EU sunflowerseed record crop after all

In the EU-27, the 2021 harvest of sunflowerseed was considerably larger than the previous year. It also far exceeded the long-term average. However, the 2017 record level was not topped.

An estimated 10.3 million tonnes of sunflowerseed were produced in the European Community in 2021. This was a 14 per cent rise over the previous year and translates to a 10 per cent increase on the long-term average. The sunflower area was also expanded compared to the previous year, although only just under 1 per cent to 4.5 million hectares, 7 per cent more than the five-year average. The average yield amounted to 23 decitonnes per hectare, which was a 13 per cent growth on the weak previous year. In other words, this year's yield fell just under 0.6 per cent short of the long-term average.

According to investigations conducted by Agrarmarkt-Informationsgesellschaft (mbH), the significant rise in production was especially due to production increases in France, Romania, Bulgaria and Slovakia. With a growth of 0.8 million tonnes to around 3 million tonnes, Romania remains the largest producer of sunflowerseed within the European Community, followed by Bulgaria which produced 1.9 million tonnes. Mostly favourable weather conditions helped farmers bring in larger harvests, after lack of rain during the yield-forming period and torrential rain at harvest time had led to high harvest losses in Bulgaria and Romania the previous year. In contrast, the harvest in Hungary was presumably smaller than the previous year, as drought hampered yield formation during the vulnerable growing period.

Chart of the week (44 2021)

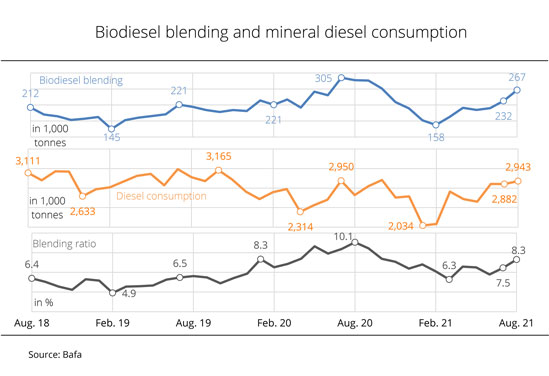

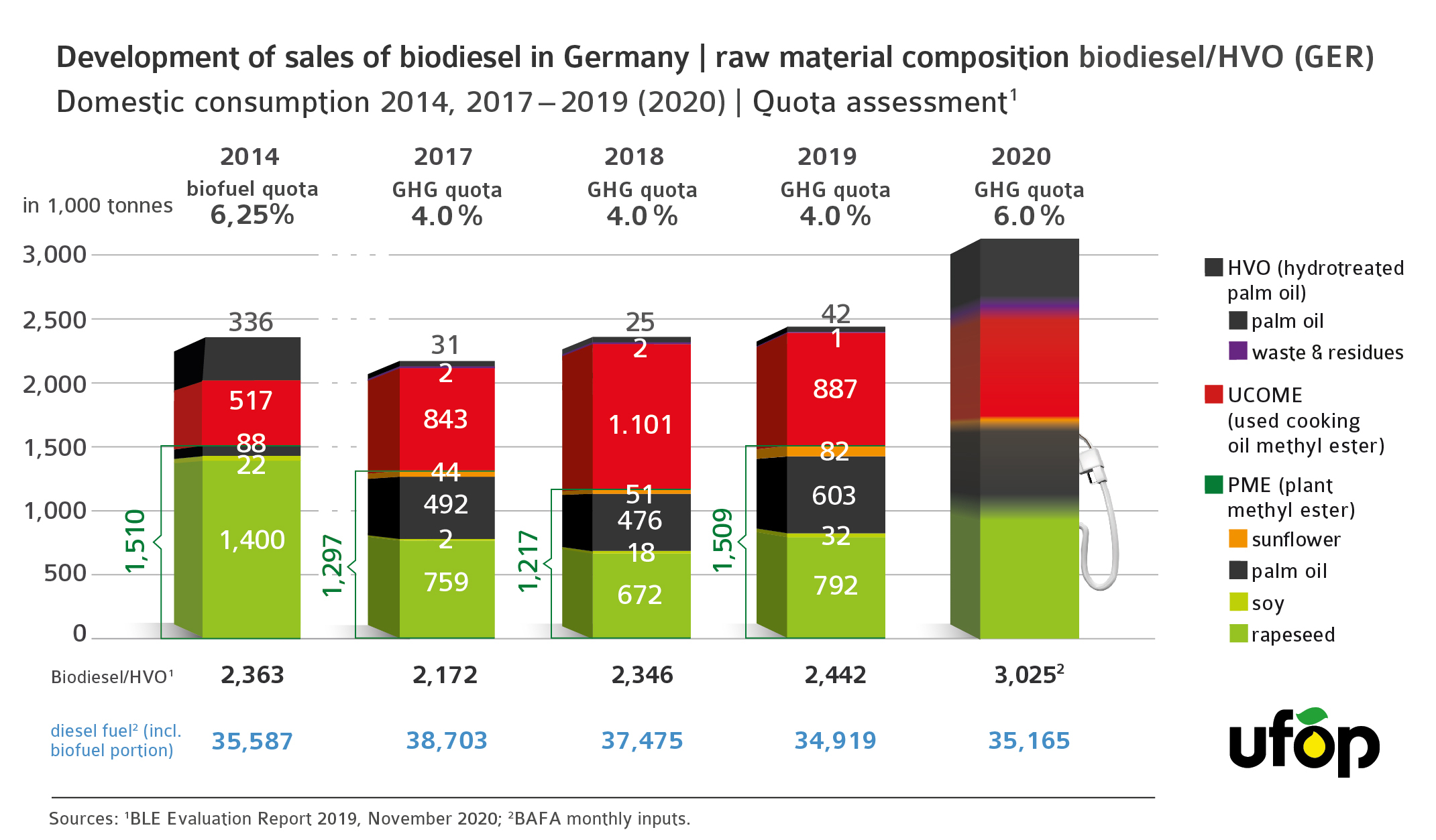

Percentage of biodiesel contained in diesel fuel reached annual high

The percentage of biodiesel contained in diesel fuels rose to 8.3 per cent in August, the highest level in ten months.

In August 2021, 266,710 tonnes of biodiesel were used for blending, which was up 15 per cent on the previous month. Since at the same time, consumption of diesel increased only 2 per cent to 2.9 million tonnes, the incorporation rate rose to 8.3 per cent. Consequently, total consumption of diesel and biodiesel amounted to 3.2 million tonnes in August, which was down 1.6 per cent compared to August 2020. In the period from January to August 2021, consumption of biodiesel totalled 1.6 million tonnes, whereas the incorporation rate averaged 7.3 per cent, comparing to 8.8 per cent in the same period last year.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has pointed out that the standard for diesel fuel, DIN EN 590, places a cap on the percentage of biodiesel at 7 per cent by volume. The blending percentage exceeding this limit is hydrotreated vegetable oil (HVO). The association has contended that these volumes are still not listed by the Federal Office for Economic Affairs and Export (BAFA).

The UFOP estimates biodiesel/HVO demand at approximately 2.5 million tonnes for the calendar year. In other words, sales are seen to decline approximately 0.5 million tonnes on the extreme year 2020. According to European Fuel Quality Directive regulations, EU member states had to reduce emissions by 6 per cent the previous year without being permitted to carry over quotas. This meant they had to meet GHG quota obligations mainly by means of physical material. The carryover option to meet climate protection targets has only been reintroduced in 2021. Another reason for the decline was the continuous decrease in demand for diesel and energy due to the growth of e-mobility and the superior energy efficiency associated with this type of powertrain.

However, the UFOP has underlined that more than 35 million cars will still be powered by combustion engines in 2030, the target year of the European Climate Law and German Climate Change Act (the latter having been toughened just this year, especially as regards the transport sector). The association has explained that in order to meet the GHG quota obligation, which will gradually rise to 25 per cent by 2030, and emission requirements, the world needs any and all options without giving preference to any specific technology and that such options would include certified sustainable greenhouse gas-efficient biofuels from cultivated biomass, residues and wastes. Looking at products that do not need to meet requirements of the same standard, the UFOP has pointed out that proof of sustainability should be the "permit" to access the market and being granted credits towards the cap on GHG emissions.

Chart of the week (43 2021)

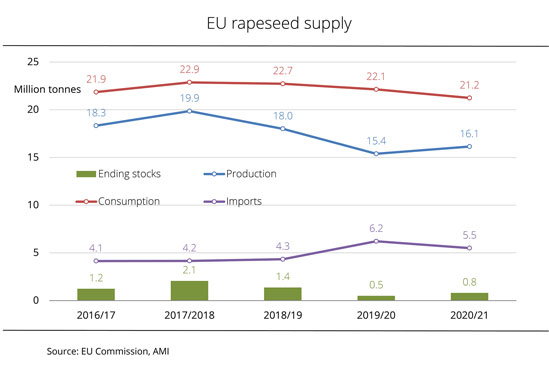

EU rapeseed imports fell below year-ago level

This year's rapeseed harvest was larger than that of 2020. For this reason, the EU-27 has needed fewer imports from third countries to date.

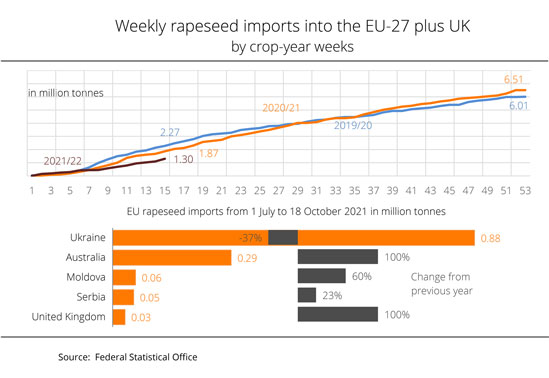

The EU-27 imported around 1.3 million tonnes of rapeseed in the first 15 weeks of the 2021/22 season. This was a 43 per cent decline compared to the same period last year and a 75 per cent drop over 2019/20. Such fluctuations not only depend on rapeseed output in the European Union, but also on rapeseed availability on the global market. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the European rapeseed crop will presumably amount to 16.9 million tonnes in the current marketing year. Although this would be just less than 0.8 million tonnes up year-on-year, it would not be sufficient to cover demand. German oil mills alone process more than 9 million tonnes of rapeseed. The EU Commission has estimated additional import demand for 2021/22 at 5.7 million tonnes. This volume would only be around 150,000 tonnes smaller than that recorded in 2020/21.

However, the availability of rapeseed on the global market is severely limited as a result of considerable harvest losses suffered by Canada, the main rapeseed supplier. Consequently, the market has had to rely on Australian rapeseed already at the beginning of the season. Normally, Australia is a guarantor of rapeseed deliveries in the second half of the marketing year. Even the UK, which was still a member of the EU at the same time a year earlier, is now sourcing imports from third countries. Restrained deliveries from the Ukraine have also added to the gap. Although the harvest was larger, rapeseed deliveries from Ukraine were down 37 per cent year-on-year. This shortfall was only insufficiently offset by the larger deliveries from Moldova and Serbia.

Chart of the week (42 2021)

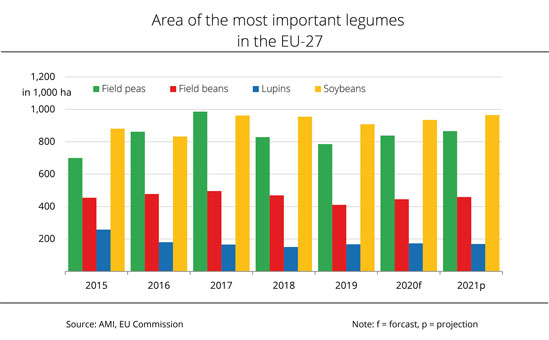

Another increase in EU legume crop

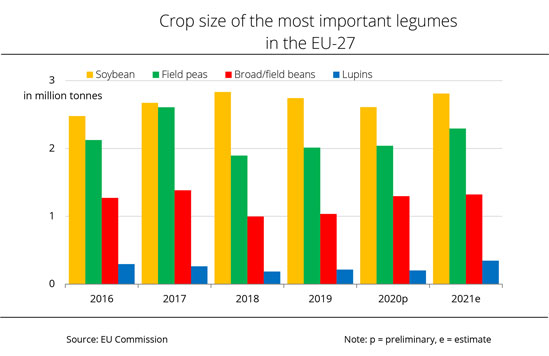

Production of legumes in the EU-27 for the 2021 harvest increased significantly by 10 per cent. The biggest growth was recorded for sweet lupins.

In 2021, EU-27 legume production has grown the third year running. According to the EU Commission's estimate, the total harvest amounted to just less than 6.8 million tonnes. This was up 10 per cent year-on-year, but remained short of the 7 million tonne record harvest of 2017. Of the legume crops listed, sweet lupins saw a particularly big increase in output compared to the previous year. The 2021 harvest was approximately 347,000 tonnes, which translates to a 71 per cent rise on the previous year which saw a sharp decline in sweet lupin area. Consequently, the current harvest is 49 per cent larger than the long-term average. According to Agrarmarkt Informations-Gesellschaft (mbH), the increase is exclusively due to the expansion in area, because yields were lower than a year earlier. The 2021 field bean harvest amounted to 1.3 million tonnes, which was up 2 per cent on 2020. Again, the increase is based entirely on the larger field bean area since yields remained below the previous year's level. Compared to the past five years, an increase of 11 can be identified.

The most important legume crop in the EU-27 is soybean, which accounts for a slightly lower share of around 43 per cent of grain legume production. Farmers harvested around 2.8 million tonnes in 2021, approximately 8 per cent more than the previous year. This is mainly due to a 7 per cent growth in yield, since the soybean area was only marginally expanded. The second most important legume crop in the EU-27 is feed pea. At 2.3 million tonnes, production surged 13 per cent from 2020. The main reason is a 9 per cent expansion in area planted. Yields were up 3 per cent year-on-year. In the long-term comparison, production of feed peas was up 7 percent and that of soybeans 5 per cent.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has said that this development in production confirms the basic upward trend in grain legume production and farmers' interest in opening up new markets and making crop rotation systems more resilient and less risky in view of climate change. Addressing the new German government, the UFOP has underlined its call to make the necessary accompanying steps sufficiently attractive. According to the association, the toolbox is basically in place and all that is needed is a forward-looking bold approach. The UFOP has renewed its call for an adequate premium scheme to promote the production of grain legumes as part of the "Diverse Crop Rotation" ECO scheme that is currently being discussed, as well as demanding adequate funding of the protein crop development strategy. Both issues are important "guidelines" for a future arable farming strategy that deserves the name and is also appreciated by consumers.

The UFOP has drawn attention to its studies on the expansion of crop rotation systems and the specific and monetarily quantifiable contribution grain legumes make towards climate protection. These studies were presented at the “UFOP Perspektivforum” event on 23 September 2021. At a UFOP conference that is to be held on 2 November 2021, the value of the protein components of rapeseed and grain legumes for a healthy, varied and climate-friendly diet and the added-value potential that could be utilised at a regional level will be presented and discussed. For the conference programme, please see here.

With this information, the UFOP has underlined its claim to be a competent contact partner for the coming legislative period.

Chart of the week (41 2021)

Surprisingly high ending stocks beat down US soybean prices

The quarterly report on US soybean stocks published at the end of September took market participants by surprise. As a result, soy prices at the Chicago stock exchange tumbled.

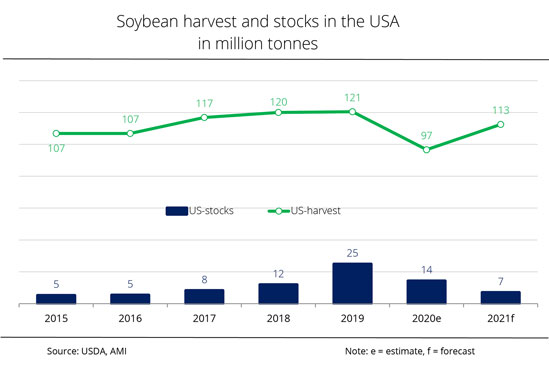

The quarterly USDA stocks report once again caused a stir in the soybean market in October 2021, because market participants had not expected the figures to reach the level they did. The nearby in Chicago fell abruptly to levels not seen since January 2021 in one day.

According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the US had just less than 7 million tonnes of soybeans in storage on 1 September 2021. As expected, this was less that at the same time a year earlier. Market participants had only expected 6.4 million tonnes. The new estimate put pressure on soybean prices. The USDA lowered its forecast for demand for fodder production in the new outlook. Also, shipping delays are to be expected because port facilities in the Gulf of Mexico suffered damage from hurricane Ida in late August 2021.

Around 73 per cent of soybean stocks (5.1 million tonnes) were stored off farm, as they were the previous year. However, this was only around half the previous year’s amount in external storage (10.4 million tonnes). By the end of the 2020/21 season, producers had sold 98.4 per cent of the 112.5 million tonnes harvested in 2020, which was significantly more than a year earlier. In 2019, the harvest had been smaller at 96.7 million tonnes, 4 per cent of which were still in storage on the farms in early September.

Chart of the week (40 2021)

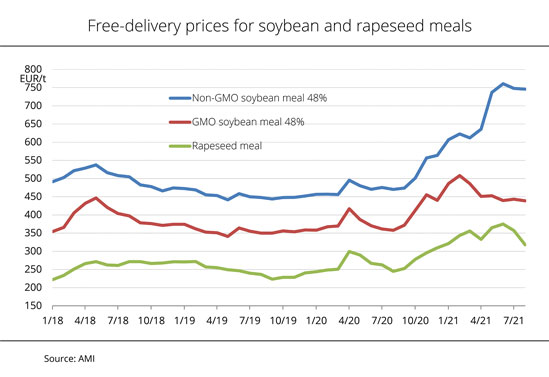

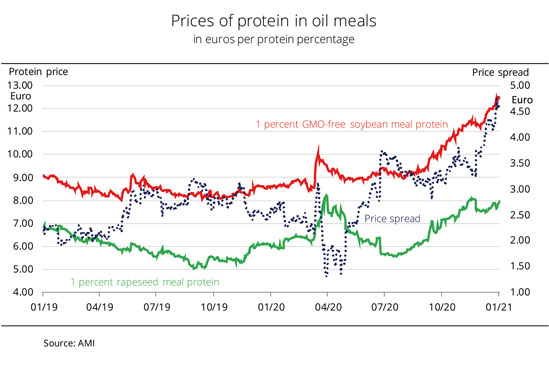

Prices for oilseed meals stepped up

Whereas there was occasional demand for spot supplies of oilseed meal, interest in longer-term futures was small. Feed compounders also bought less.

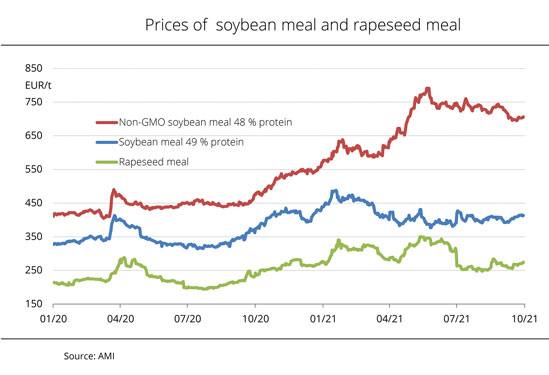

Supply on the rapeseed meal market remained limited in some regions, but demand was also low. Anyone requiring rapeseed meal had to accept the prices asked. On the other hand, buyers were found only sporadically. September prices consistently showed a firm trend, but started off from a relatively low level. The average monthly price was only slightly higher than that recorded for August. Most recently, the bullish rapeseed market led to a sharp increase in prices. Agrarmarkt Informations-Gesellschaft (mbH) reported an average price of EUR 275 per tonne for spot rapeseed meal ex mill on 30 September 2021. This compares to EUR 265 per tonne at the beginning of the month. In other words, asking prices increased 0.8 per cent compared to the previous month and as much as 17 percent over the previous year's level.

The soybean meal market remained calm in September. Supply was adequate, both on nearby and further forward positions, although shipments from Argentina continued to be slow. Buying interest was focused on spot commodity, whereas futures for further forward positions or longer-term delivery periods were avoided in view of the recent sharp rise in asking prices. Soybean meal containing 48 per cent crude protein was priced at on average EUR 404 per tonne fob mill in September. This was only slightly up on the previous month's average but also 17 per cent higher than the wholesale price recorded in September 2020.

Chart of the week (39 2021)

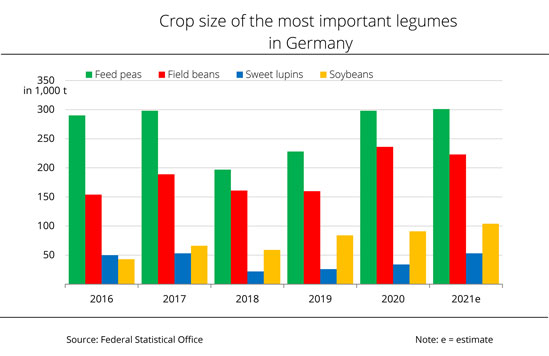

Increase in sweet lupins and soybeans

Germany is set to bring in a bumper crop of legumes this year. The main reason is the sometimes significantly larger area planted, because not all legumes delivered good yields.

The total area of land planted with feed peas and other legumes for the 2021 harvest was expanded 11 per cent to 219,000 hectares. This was despite the fact that, according to Agrarmarkt Informations-Gesellschaft (mbH), there was less scope for producers to make decisions in the spring than there was in the previous year. The area for winter-planted crops for the 2021 harvest had been expanded to its old extent, because the weather was right at the time of planting. Nevertheless, farmers decided to plant more pulses, especially peas (+18 per cent) and sweet lupins (+32 per cent). The soybean area remained stable, whereas the field bean area declined 2 per cent.

The conditions for plant growth and pod formation were good, but the rainy summer cut yields this year, especially in feed peas. As a result, the pea harvest was up only 1 per cent on the previous year at 301,000 tonnes. Field beans were also affected by the poor weather, with 223,000 tonnes harvested, which is around 6 per cent less than in 2020. Soybean production is seeing a sharp rise and expected to reach 104,000 tonnes. This would be an increase of 14 per cent, although the area planted remained unchanged. Sweet lupins were left unperturbed by the wet summer. As they were mostly planted in drier sites, they experienced optimal conditions for the first time in years. Based on a 13 per cent increase in yield, the harvest volume is estimated to reach 53,000 tonnes. This would translate to a 56 per cent rise on the year.

Chart of the week (38 2021)

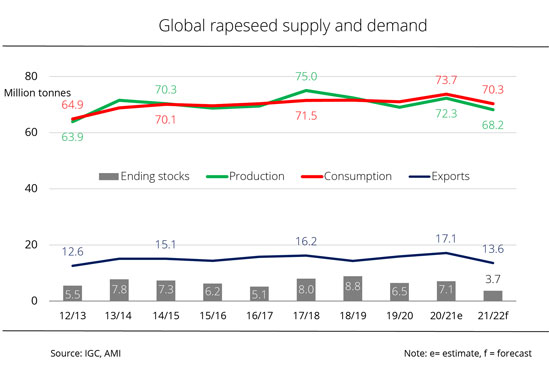

Rapeseed production to reach new lows

The USDA again lowered its forecast for global rapeseed supply in its latest outlook – to an unexpectedly large extent.

According to the latest USDA forecast, world rapeseed production in the crop year 2021/22 will presumably amount to 68.17 million tonnes. In other words, production was forecast down 1.8 million tonnes from the August estimate. This translates to a 4.12 million tonne drop over the previous year and would be the lowest level in nine years. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the EU-27 remains the biggest rapeseed producer. Heat and extreme dryness in Canadian rapeseed producing regions are having a tremendous impact on Canada's output.

Global consumption was also forecast down 0.76 million tonnes to 70.31 million tonnes. Reductions for China, Canada and the EU-27 were not offset by a higher consumption forecast for Japan.

The USDA put 2021/22 global ending stocks of rapeseed at 3.65 million tonnes. This would not only be a 40 per cent decline on the 2020/21 marketing season's ending stocks, but also the lowest level on record.

In the USDA outlook, exports were forecast down 0.55 million tonnes to 13.56 million tonnes from the previous month. Whereas Canada in particular will supply less due to the slump in production, the export outlook for the EU-27 was raised. Despite the declines, Canada is set to remain the main exporter with exports amounting to 5.8 tonnes.

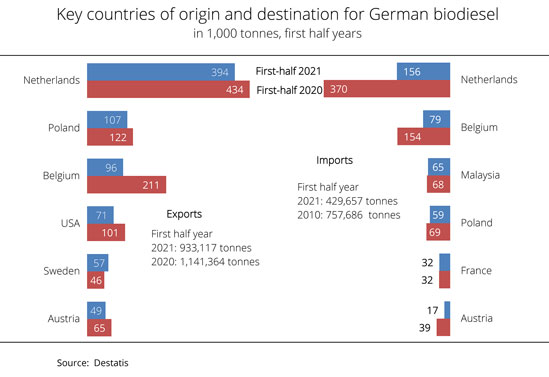

Chart of the week (37 2021)

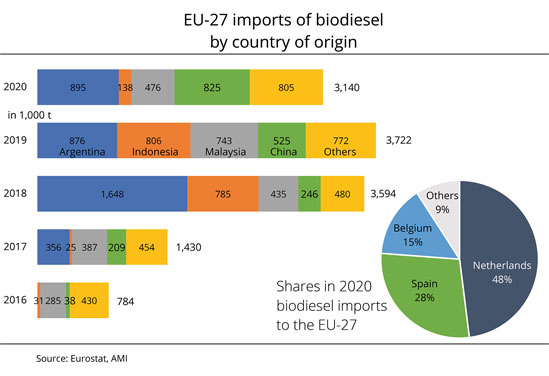

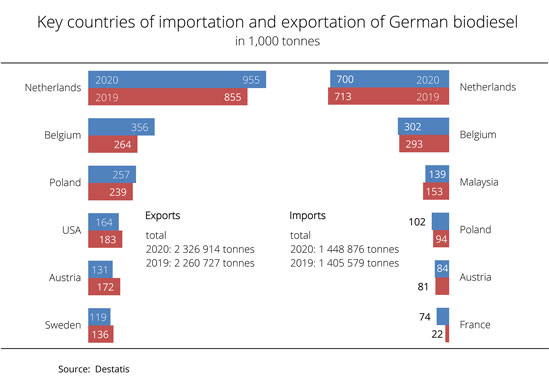

German biodiesel exports remain above average

Foreign trade in biodiesel is poised to decline in 2021. In the first half year, exports already plummeted 18 per cent and imports as much as 43 per cent. The supply and demand balance shows an export surplus of 503,460 tonnes, which is up 31 per cent year-on-year. Whereas exports exceeded the long-term average of 923,200 tonnes, imports dropped below the average level of 559,000 tonnes.

According to figures published by the German Federal Statistical Office, Germany exported around 933,117 tonnes of biodiesel in the first half of 2021 while importing only 429,657 tonnes. The Netherlands, the main EU marketplace for trading biodiesel, continued to be the primary trading partner, accounting for 42 per cent and 36 per cent of total exports and imports respectively. However, imports decreased significantly by 60 per cent. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), larger import volumes also came from Belgium, Malaysia and Poland, although they were smaller than in the year-earlier period. Imports were dominated by supply from other EU countries (84 per cent). Malaysia was the most important non-EU supplier country, once more ranking third, but only providing just less than 65,000 tonnes of biodiesel.

The main recipient countries of German biodiesel also were EU countries (88 per cent), headed by the Netherlands, Poland and Belgium. The most important non-EU country was the USA. The country took fourth place in the first half of 2021, although imports dropped 30 per cent year-on-year to just below 71,000 tonnes.

The UFOP has pointed out that these statistics take into account exclusively biodiesel. They do not include paraffinic fuels such as hydrotreated vegetable oil (HVO). In light of today's EU consumption level of approximately 3.6 million tonnes and the growing importance of such fuels in the future for meeting greenhouse gas reduction targets in all member states, the UFOP has underlined the urgent need to adapt official statistics – both at the domestic and the European level. More specifically, HVO should be listed separately.

The UFOP has explained that the fact that HVO is produced to a separate fuel specification and traded separately from biodiesel is an argument in favour of collecting HVO consumption data separately.

The association has pointed out that HVO can be blended in fossil diesel fuel at a rate of up to 26 per cent, which compares to a maximum rate of 7 per cent in the case of biodiesel. The promotion of synthetic fuels (e-fuels) as initiated by the German federal and state governments and the approvals vehicle manufacturers have given for pure fuel consuming operating mode are additional reasons for collecting statistics on paraffinic fuels separately. The UFOP has indicated that the volumes of HVO consumed in Germany will not be listed until the Bundesanstalt für Landwirtschaft (BLE - Federal Office for Agriculture and Food) publishes its Evaluation and Progress Report at the end of the year.

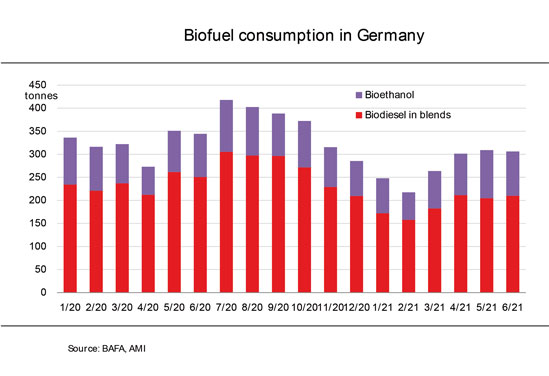

Chart of the week (36 2021)

Less biodiesel consumed in the first half of 2021

The amount of diesel fuel consumed by road traffic was lower in the first half of the year 2021 than it was in the 2020 reference period. Accordingly, the use of biodiesel dropped by one fifth. On average, biodiesel was blended in at 7.1 per cent, which compares to 8.1 per cent in the year-earlier period.

In the first half of 2021, the use of biodiesel for blending amounted to around 1.14 million tonnes. This translates to a 19.6 per cent drop over 2020. If the trend in consumption were to continue along these lines in the second half of the year, the total use of biodiesel for blending would reach 2.4 million tonnes in 2021, according to calculations made by Agrarmarkt Informations-Gesellschaft (mbH). This figure compares to 3 million tonnes in 2020.

The Union zur Förderung von Oel- und Proteinpflanzen e. V. (UFOP) has pointed out that the quota years 2020 and 2021 are not comparable although mineral oil companies had and have to meet a greenhouse gas (GHG) reduction target of 6 per cent in both years. In 2020, all EU member states were required to implement the 6 per cent GHG reduction target in accordance with European Fuel Quality Directive regulations. However, quotas could not be carried over from the 2020 obligation year, but they can be brought forward again in 2021. The UFOP expects that the possibility to carry GHG quotas over will curb demand for biodiesel this year.

The UFOP finds it difficult to make a final assessment of how biodiesel use is going to develop in 2021, because the GHG reduction target will be raised to 7 per cent in 2022 and diesel consumption will tend to decline as a result of increasing e-mobility. State funding of e-mobility will first and foremost lead to a reduction in the number of diesel passenger cars. Against this background, the level of GHG reduction quotas that will be defined for the 2022 quota year as part of the RED II implementation is of importance for the exports of the German biodiesel industry. The time pressure for climate protection is strong. The increasingly smaller residual budget for GHG emissions permitted until 2030 also clearly illustrates the need to act. Consequently, the GHG mitigation potential of certified biofuels should be used as the EU's contribution towards meeting the 1.5 degree target in 2030.

Chart of the week (35 2021)

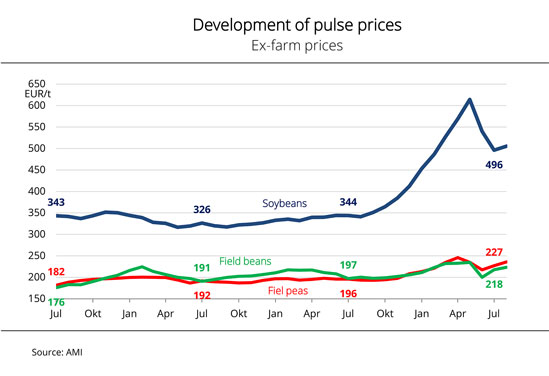

Pulse prices one fourth up on previous year

The 2021/22 season has started off with clearly higher prices for feed peas, field beans and soybeans grown in Germany. Field crops are yielding significantly higher prices than the previous year as the season starts. This also applies to pulses for grain use. Support also is coming form the global market, where prospects are bullish.

Although global supply of pulses is expected to be more abundant than the previous season, there is plenty of scope for speculation as long as the soybean crop has not been harvested in the US, the top exporter of soybeans. Uncertainty is also fuelled by the difficulty in estimating demand from the world's largest consumer, China. This environment determines prices also in Germany.

The German total area sown with feed peas, field beans and soybeans has been expanded 14 per cent compared to the previous year. Whether the expansion will lead to a rise in output in 2021 remains to be seen, because yields will not come close to the previous year's level due to poor weather conditions.

Nevertheless, producer prices of soybeans showed the typical harvest-related decline. However, the dip started from a significantly higher price level this year. According to Agrarmarkt Informations-Gesellschaft (mbH), the 2021/22 crop year kicked off with July producer prices around 24 per cent higher than a year earlier. Field beans showed the smallest rise at 10 per cent and soybeans the largest increase at 44 per cent. Feed peas were in between at 16 per cent. However, pricing was not finished yet, nor was harvesting.

According to the UFOP, the rise in the food industry's demand for domestic feedstock for vegetarian and vegan food production – especially peas and lupins – accounts for the price increases in grain legumes. There is reason to assume that this trend will continue in the next few years.

Chart of the week (34 2021)

Marketing of new-crop rapeseed meal in progress

Not only did byers expect the marketing season for by-products of new-crop rapeseed to start earlier than it did. They also hoped for more substantial price concessions. But the commodity remained in short supply.

At the end of July, spot commodity cost around EUR 300 per tonne ex mill. Deliveries from August onwards were at EUR 250 per tonne, up EUR 50 per tonne year-on-year. Asking prices have not declined since then, because the feedstock has become more expensive. Buyers were hoping for supply from the oil mills to exceed demand and for prices to fall. But it did not look like this was actually going to happen. Rapeseed meal was valued at the same price until the October delivery date, whereas premiums were asked for delivery from November onwards.

The fact that rapeseed meal was available again was reflected in ex-farm prices, which declined EUR 40 per tonne to EUR 318 per tonne compared to the previous month. In fact, in some regions – especially those close to processing locations – rapeseed meal was available at less than EUR 300 per tonne. However, this price did not exactly encourage buyers to conclude longer-term supply contracts, because it was still 30 per cent higher than a year earlier.

The price for soybean meal hardly changed, with asking prices only around 0.8 per cent lower than the previous month. This still translates to an almost 24 per cent rise year-on-year. GVO-free soybean meal was very expensive because it was very scarce. Even at the wholesale level, asking prices were up just over 60 per cent compared to a year earlier, although they most recently seemed to be on a weaker trend.

Chart of the week (33 2021)

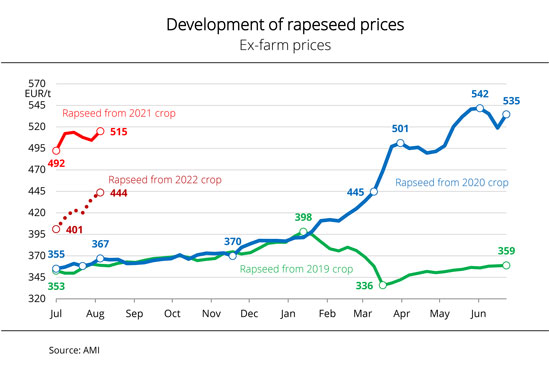

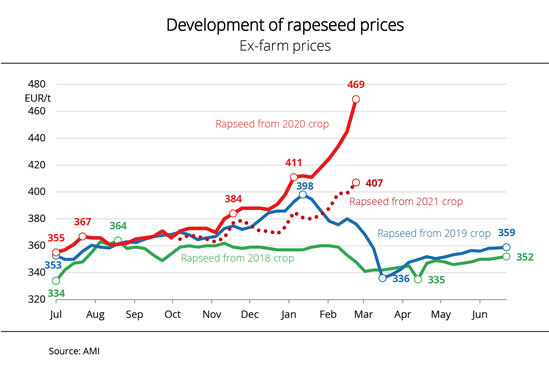

Rising rapeseed prices at time of harvest

Delayed harvests in Europe with average results that did not always live up to expectations and dull harvest prospects in Canada which suggest that global supply is set to remain tight are currently driving producer prices for rapeseed.

The strong increase in prices is fuelled by the sluggish harvest in Western and Eastern Europe and continued dampened harvest prospects in Canada. Support also came from rising soybean prices over the same period. Paris listed new record levels for all futures traded on 13 June 2021 but, according to information published by Agrarmarkt Informations-Gesellschaft (mbH), maintained the familiar inverse that the stock market price declined for more distant futures. By contrast, cash market premiums tend to offset this development, at least until year-end.

Farmers' inclination to sell was mostly limited to commodity tied up in contracts. In fact, deliveries were made directly to the oil mills in some cases. The decision in favour of storage clearly prevailed. Producers were not entirely satisfied with the results of the 2021 harvest, having hoped for higher yields and oil content. Only very occasionally did producers take advantage of recent significantly higher bids to sell new-crop lots or conclude contracts for the 2022 crop.

Spot commodity ex farm was valued above the level of EUR 500 per tonne in all regions. The price of EUR 515 per tonne reported in calendar week 32 was just under EUR 11 per tonne higher than the price reported the previous week and up 43 per cent on the price reported at the same time a year earlier. The range of prices between regions remained large with prices from EUR 490 to EUR 535 per tonne free to warehouse. EUR 422-453 per tonne were under discussion for the 2022 crop.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has stated that producers base their selling behaviour on their experience in marketing last year's harvest. They sold too much too early in 2020. The UFOP sees producer prices at a level necessary to compensate lower yields and higher spending on crop protection. The association has said that the marketing year shows the price trend that will be needed for all types of crops if arable farming loses productivity permanently as a result of the implementation of the EU Commission's "Farm to Fork" strategy. If, despite all critical indications in current impact assessment studies, the general suggestions for reduction are actually implemented, the introduction of effective "external protection" will be a compelling requirement. The association has pointed out that otherwise imports from third countries will undermine the EU's Level of Ambition.

Chart of the week (32 2021)

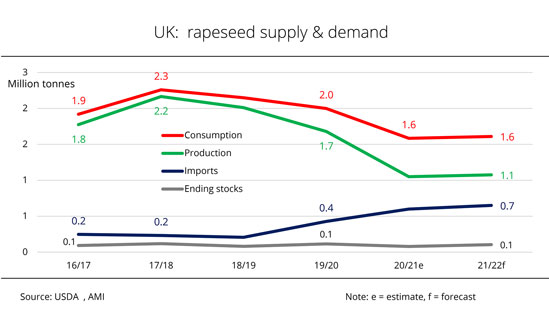

Another small rapeseed harvest in Great Britain

Great Britain was the fourth largest rapeseed producer and hardly relied on imports during its membership in the European Community. This has changed since the small 2020 harvest and there are no signs of a turnaround in the 2021/22 season.

By 27 July 2021, the British winter rapeseed harvest was approximately 9 per cent complete, according to the first harvest progress report of the Agriculture and Horticulture Development Board (AHDB). Rapeseed crops have been slow to mature, delaying the harvest. In terms of harvest progress, the 2021 harvest is currently the second slowest since 2014. Also, the area of land to be harvested, 315,000 hectares, is 17 per cent smaller than a year earlier.

Based on early yield indications, the AHDB puts the average yield of the 2021 winter rapeseed harvest in the range of 30-34 decitonnes per hectare, which is close to the long-term average of 33 decitonnes per hectare. This is as much as 19 per cent higher than the previous year's weak 27 decitonnes per hectare. Oil content is assessed in the range of 43-45 per cent. Drying has not been required due to the high temperatures in Eastern England.

The 2021 rapeseed harvest is estimated at 1.1 million tonnes, which would be only marginally up on the previous year's volume. In other words, extensive imports will once again be required for the 2021/22 marketing year, because domestic consumption (estimated at 1.6 million tonnes) could reach the long-term average of just less than 2 million tonnes. Consequently, the level of self-sufficiency is set to remain at the low level of 66 per cent. This compares to 100 per cent in the period from 2016 to 2018.

Chart of the week (31 2021)

Record harvest forecasts for EU soybeans and sunflowerseed

The oilseed harvest in the EU-27 is likely to see yet another rise in 2021. The main reason is prospects of bumper crops of soybeans and sunflowerseed. The rapeseed harvest is also seen to increase.

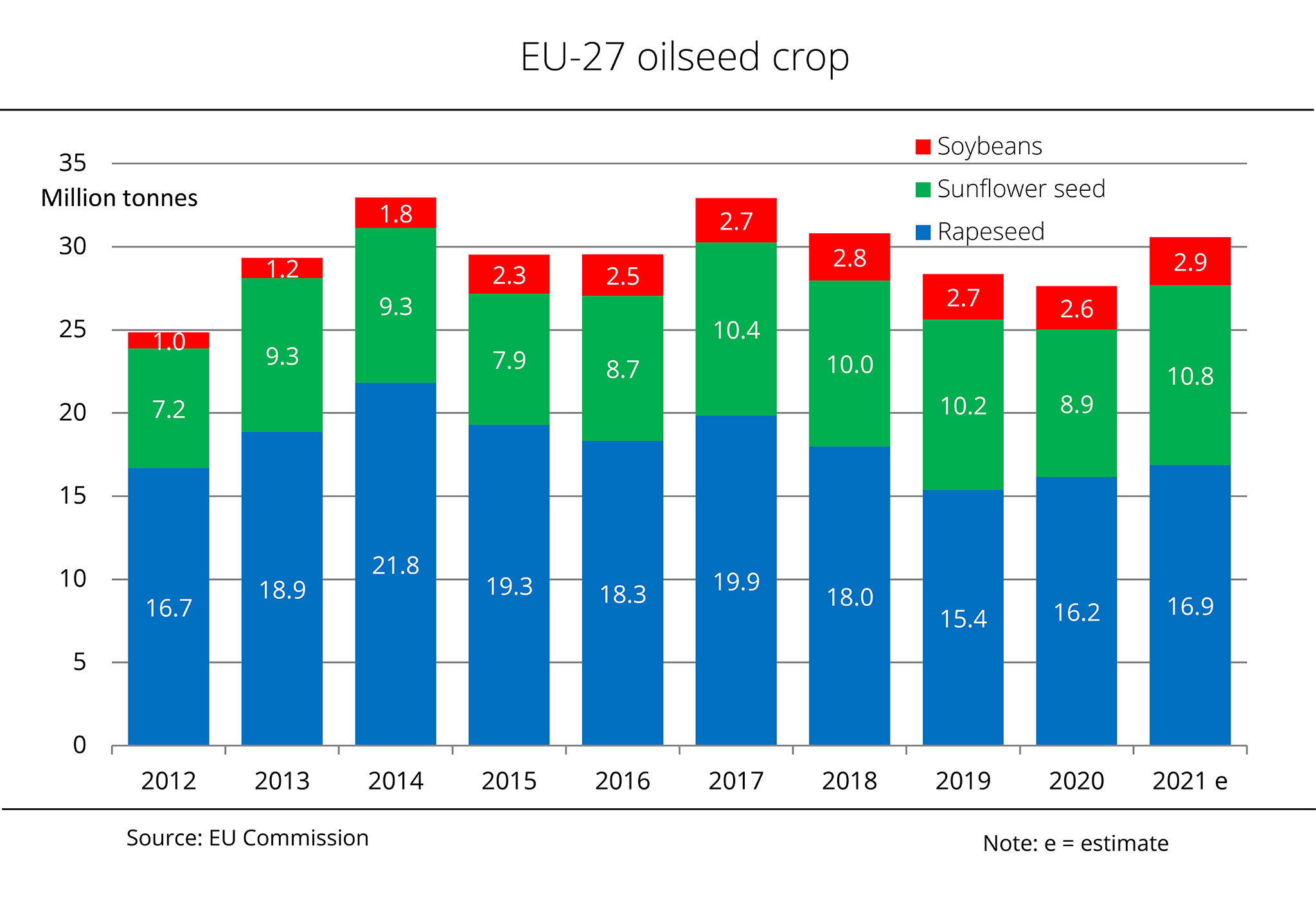

The oilseed harvest in the EU-27 could increase compared to the two previous years. The EU Commission currently estimates output for 2021 at 30.6 million tonnes. This would translate to a rise of just under 11 per cent over the extremely weak previous year. However, production would still fall about 1 per cent short of the long-term average.

The projected increase in sunflowerseed is particularly sharp. The main reason is expected exceptional yields, since the sunflower hectarage was changed only marginally compared to the previous year. The recently forecast 10.8 million tonnes would not only be a rise of just about one fourth year-on-year, but also a record volume. Based on quantity, sunflowerseed is the second most important oilseed crop in the EU-27. Rapeseed traditionally accounts for the largest share in oilseed output. The course was set early for a larger rapeseed harvest by a 3 per cent expansion in area. However, yields fail to meet expectations due to unfavourable growing conditions. In its latest estimate, the EU Commission lowered yield prospects 1.5 per cent to 31.8 decitonnes per hectare. However, this would still be up 2 per cent year-on-year and 4 per cent on the long-term average. In other words, the total EU rapeseed harvest in 2021 could amount to 16.9 million tonnes. This would be up 4 per cent year-on-year.

The third most important oilseed crop is soybeans. According to Brussels, based on a 3 per cent expansion in area planted and an estimated increase in yield of 8 per cent (which would come very close to that of 2019), the EU soybean harvest could reach 2.9 million tonnes. This would mean an 11 per cent rise year-on-year and the largest harvest ever in the EU-27.

In view of these yield expectations and the current very positive development of vegetable oil and oilseed meal prices, the Union zur Förderung von Oel- und Proteinpflanzen (UFOP) e. V. has underlined the improved overall profitability and importance of these crops with respect to the need to adapt crop rotations to be more climate-resilient, and as flowering plants for more biodiversity in the future. Referring to the future arrangement of the arable farming strategy of the German Ministry of Agriculture, the association has emphasised that in Germany there is still significant potential for developing and growing grain legumes to optimise the climate performance and ecosystem services associated with nitrogen fixation by these leguminous crops.

Chart of the week (30 2021)

Rapeseed meal exports reached record volume

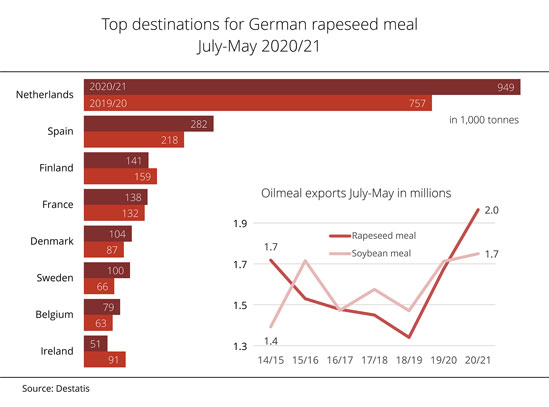

German rapeseed meal exports have reached a record level. In the period July 2020 to May 2021, exports were up 17 per cent on the previous year and larger than ever before. The Netherlands and Spain traditionally received the largest amounts for milk production.

From July 2020 to April 2021, Germany exported just less than 2 million tonnes of rapeseed meal. According to information published by the German Federal Statistical Office, this was up approximately 17 per cent year-on-year and the largest tonnage on record. Most of this, just less than 1.9 million tonnes, remained in the European Union. The Netherlands was the largest recipient, taking 950,000 tonnes (up 25 per cent), followed by Spain which received 282,000 tonnes (up 29 per cent). Finland held third place, despite a decline of 12 per cent to 141,000 tonnes. Exports to France increased marginally to 139,000 tonnes. Switzerland was once more a key recipient outside the European Union with imports remaining virtually unchanged at 38,500 tonnes. The old EU partner Great Britain is a new addition to the list of non-EU recipients. The country doubled its imports in the period stated to just less than 45,000 tonnes. According to Agrarmarkt Informations-Gesellschaft (mbH), exports of rapeseed meal exceeded those of soybean meal in 2020/21 for the first time since 2015/16, namely by 12 per cent.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has stated that in terms of processing capacity (approximately 9 million tonnes of rapeseed), Germany is the primary production site and supplier of GM-free rapeseed meal within the EU 27. The "without GM" label, which is used for a steadily growing range of products, is an important unique selling point. The association has said that the label is well received in the market by consumers, but also believes that there is still an enormous potential for promoting the origin of the protein feeds to provide more transparency and build regional bonding. Referring to the EU Commission's "Farm to Fork" strategy, the association has strongly criticised that politicians have previously failed to think integrated bioeconomy through.

Chart of the week (29 2021)

Heat in Canada reduces rapeseed supply

Prospects of tight rapeseed supply at the world's biggest rapeseed exporter has driven up prices also in the EU, a major recipient of Canadian commodity.

In Winnipeg, the July contract reached a new record high at the equivalent of just less than EUR 661 per tonne on 13 July 2021. An exceptional increase had already been recorded in the days before, the limit-up price and the biggest possible gain in one trading day having been reached. In other words, rapeseed rose around EUR 100 per tonne in Canada in a single week.

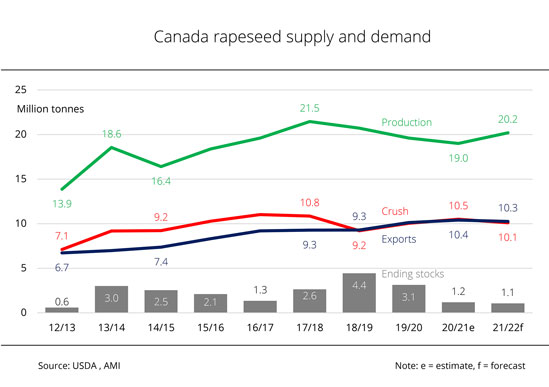

The surge was driven by expectations of heat-related crop failures in Canada, the world's largest exporter. Continued high temperatures and drought in the Canadian plains have severely affected the development of the rapeseed plants. This will limit the yield potential. In its most recent estimate, the USDA lowered its yield forecast to 22.4 decitonnes per hectare based on reports from Canada. This level is below the long-term average. As a consequence, the potential output is also reduced. The estimate was lowered 0.3 per cent from the previous month to 20.2 million tonnes. The extremely scarce supply of Canadian rapeseed had led to a strong upsurge in prices already in the weeks before. However, such upsurge will hardly dampen demand. The EU alone will need 0.15 million additional tonnes of rapeseed from abroad because its own supply is inadequate.

Whereas Canada's stocks from 2019/20 amounted to just over 3 million tonnes the previous year, the country's storage facilities are virtually empty at 1.2 million tonnes prior to the 2021 harvest. Even if the harvest were to reach the estimated volume of just over 20 million tonnes, exceeding the previous year's output by 1 million tonnes, total supply would slide to a level 740,000 tonnes below the previous year's figure and 1.5 million tonnes below the five-year average. This situation will limit rapeseed supply on a global scale and stabilise producer prices at the current appealing level.

Chart of the week (28 2021)

Rapeseed imports hit record level

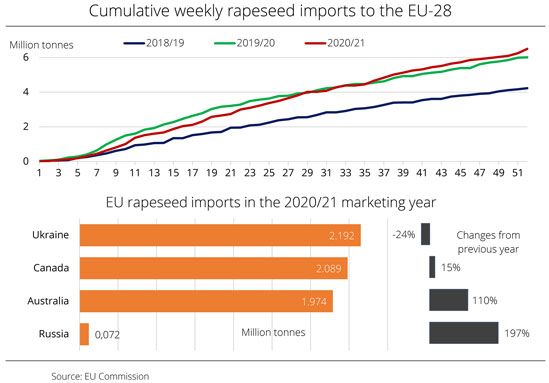

EU-28 rapeseed imports from third countries reached a new record high at approximately 6.5 million tonnes in the 2020/21 marketing year. This is a result of the significant rise in demand for rapeseed oil and rapeseed meal. Ukraine, the main supplier, lost much of its importance due to a small harvest.

Although the EU rapeseed harvest was somewhat larger in 2020 than a year earlier, total supply in the EU-28 in the 2020/21 marketing year was not even 300,000 tonnes larger than that in the weak 2019/2020 marketing year. This was due to lower beginning stocks, which were estimated at 17.6 million tonnes. At the same time, the monthly demand outlooks needed constant adjusting, because demand for by-products was more dynamic than expected. Such demand gave a boost to processing accordingly. The 2020/21 processing volume increased 6.4 per cent to 23.1 million tonnes of rapeseed.

The continuous rise in demand was initially covered by EU production. Starting in the first half of the marketing year, more and more rapeseed had to be imported from Canada and, later, from Australia to meet demand. Due to the smaller supply following a reduced harvest in Ukraine, imports from there amounted to only around 2.2 million tonnes in 2020/21. This translates to a 24 per cent drop over 2019/20 and a decline in the share of Ukrainian origins in total imports from 49 per cent in 2019/20 to 34 per cent. The gap was partially closed by deliveries from Canada, which rose 13 per cent to 2.1 million tonnes. Canada's share in total imports only rose marginally, by 1 percentage point to 32 per cent. Australia delivered a total of 1.8 million tonnes from February 2021 onwards. The country's share in total rapeseed imports amounted to 30 per cent. In the last few weeks of the marketing year, the EU-28 received just less than 190,000 tonnes from Australia. Additional Australian imports will be required should the start of the harvest in the EU be further delayed.

Chart of the week (27 2021)

Linseed production area increased significantly

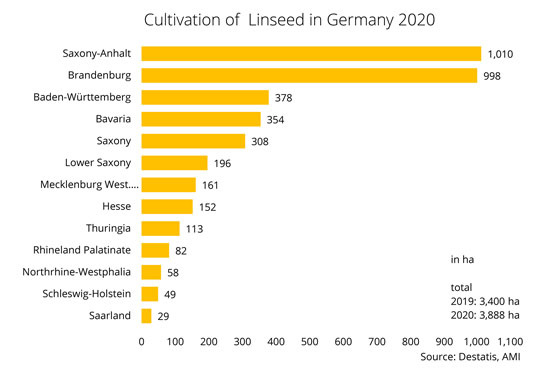

Unfavourable growing conditions in the autumn of 2019 led to a considerable growth in summer crops in 2020. Linseed was one of the crops seeing a significant rise in production area.

For the first time since 2016, the German Federal Statistical Office published the German linseed hectarage by state in mid June 2021. The unfavourable conditions at the time of sowing in the autumn of 2019 restricted the sowings of winter rapeseed, winter wheat and winter barley. As a result, a larger area was left for summer crops. It was especially used to expand the area planted to linseed. Linseed production has shown a pronounced east-west divide for years. Around two thirds of the area dedicated to linseed cultivation is situated in the eastern German states. In some regions, it was considerably expanded for the 2020 harvest. In Saxony-Anhalt, the linseed area doubled from 500 hectares to 1,010 hectares. Consequently, Saxony-Anhalt moved into lead, outpacing Brandenburg, which had around 998 hectares under linseed after a decline of 200 hectares. Another major linseed production region is the south of Germany. Bavaria recorded 354 hectares and Baden-Wuerttemberg 378 hectares of linseed cultivation in 2020.

The total linseed area in Germany for the 2020 harvest amounted to 3,888 hectares. This translates to a 14 per cent rise on the year.

Chart of the week (26 2021)

Soybean area in the EU-27 is growing

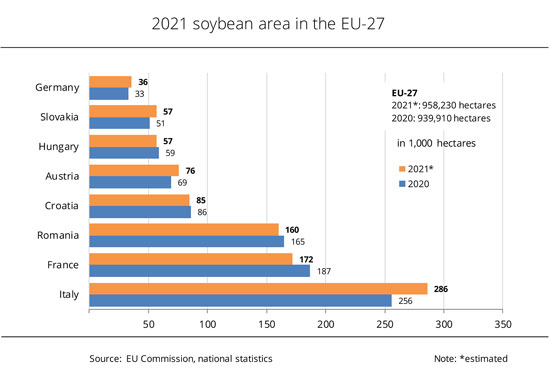

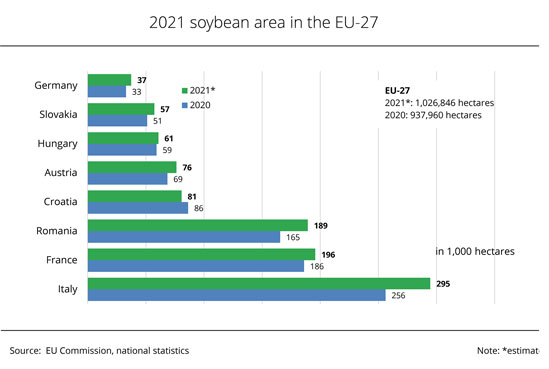

The production area for soybeans in the EU-27 has again been expanded in almost all member states in 2021.

According to information published by the EU Commission, the soybean production area in the EU-27 has more than doubled over the past ten years. The area planted with soybeans in 2021 is reported to amount to almost 958,000 million hectares. This is up around 2 per cent year-on-year. Italy remains by far the largest EU soybean producer with an area of presumably 286,000 hectares and an 11 per cent increase in area. The country accounts for around 30 per cent of the total EU soybean planted area. The soybean area has also been significantly expanded in other EU member states. Slovakia has recorded an increase of just about 12 per cent to 57,000 hectares, whereas Austria has seen a 10 per cent expansion to 76,000 hectares. German producers also dedicated more land to soybeans than they did the previous year. 36,000 hectares translate to a 9 per cent increase. Romanian farmers had very strongly expanded the soybean area in the past year, so they reduced the area slightly by 3 per cent in 2021. With an estimated 160,000 hectares, Romania continues to be the third largest soybean-producing country, following France with 172,000 hectares.

According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the EU soybean harvest is also likely to increase because of the expansion in production area in many EU countries. Germany did not harvest any significant amount of soybeans until 2016. This year, the EU Commission expects the country to harvest 101,000 tonnes. This means that German output would have more than doubled over the past five years. Romania is assumed to see the biggest increase in production, of more than 20 per cent to 384.000 tonnes. In 2021, harvests are expected to grow by 11 per cent in France (despite a reduction in area), 10 per cent in Austria and 7 per cent in Germany.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has welcomed the positive trend in European soybean farming over recent years. The crop provides many farmers with an additional option at expanding their crop rotation and meeting the growing demand for regionally grown produce. At the same time, the association has pointed out that there is still significant need to invest in soybean breeding in order to come up with regionally adapted and competitive varieties for many different growing areas, including the northern regions of Germany.

Chart of the week (25 2021)

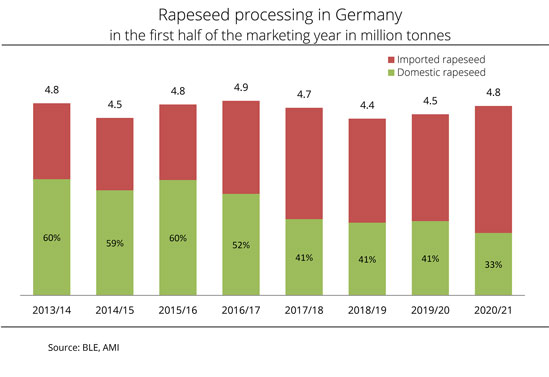

Significant increase in rapeseed processing

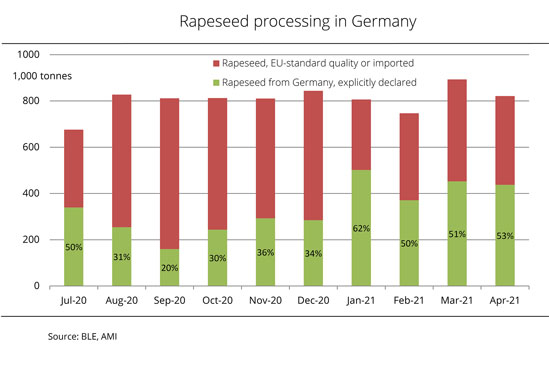

Rapeseed processing in Germany rose considerably in the first four months of 2021 compared to the previous year. Domestic rapeseed accounted for a major share of the increase.

In the first four months of 2021, around 3.27 million tonnes of rapeseed were processed in Germany. This was up nearly 10 per cent on the same period the previous year. One of the reasons was a rise in the use of rapeseed grown in Germany, which, according to calculations made by Agrarmarkt Informations- Gesellschaft (mbH), accounts for around 42 per cent of the rapeseed volume processed in the current marketing year. Whereas in the first four months of last year, approximately 1.31 tonnes were explicitly identified as commodity from Germany, in the same period of 2021, the tonnage amounted to more than1.50 million.

However, the actual volumes of rapeseed from Germany cannot be determined accurately. They could be larger or smaller, because many processors report batches received from German suppliers as EU-quality commodity to the Bundesanstalt für Landwirtschaft (German Federal Office for Agriculture and Food / BLE), but these batches could actually be rapeseed grown in Germany or imports from neighbour states.

In April 2021, around 834,000 tonnes of rapeseed were processed in Germany. The oil mills had to draw on their stocks, because only 821,500 tonnes of rapeseed were delivered that month. Nevertheless, the amount of feedstock was significantly larger than the same month a year earlier, when the BLE reported 714,000 tonnes.

In the current marketing year, German oil mills have processed approximately 8.05 million tonnes of rapeseed, which is around 7 per cent more than the previous year's 7.5 million tonnes.

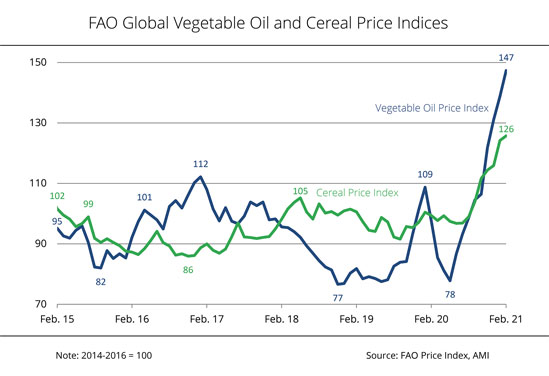

Chart of the week (24 2021)

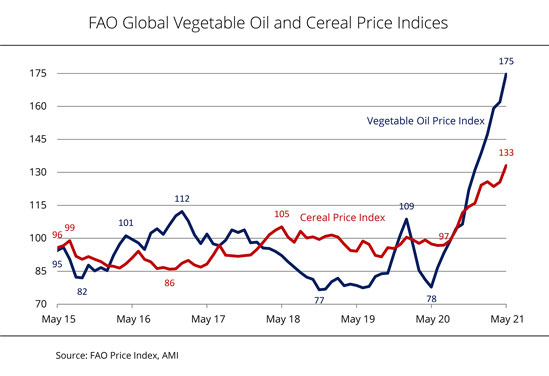

FAO vegetable oil price index at 13-year high

The FAO vegetable oil index has been rising steadily for twelve months, reaching the second highest level in June 2021 since records began in 1990. Similarly, the cereal price index has increased to an eight-year high.

The FAO's vegetable oil price index illustrates the changes in international prices of the ten most important vegetable oils in world trade, weighted according to their export shares. The index reached an average value of 174.7 points in May 2021. This translates to an increase of just less than 8 per cent month-on-month and around 224 per cent compared to the same month a year earlier. Prices of palm oil also continued their upward trend in May 2021, reaching their highest level since February 2011. The slow growth in production in Southeast Asia failed to keep pace with rising global demand, with the result that palm oil stocks in leading exporting nations remained at a relatively low level. Soybean oil received support from prospects for strong global demand, especially from the US biodiesel sector, whereas prices for rapeseed oil were assisted by the continued tightness of global supply.

The FAO cereal price index reached 133.1 points in May, which was 6 per cent above the previous month's mark. Prices for maize saw the strongest rise (of virtually 90 per cent year-on-year), climbing to their highest level since January 2013. Global export prices for wheat showed signs of weakness in the second half of May. However, the monthly average remained 7 per cent above the previous month's mark and, consequently, was 29 per cent up on the previous year.

The FAO cereal price index is based on official daily stock exchange and trade prices for wheat, barley, maize, sorghum and rice, weighted according to their average shares in world trade.

Chart of the week (23 2021)

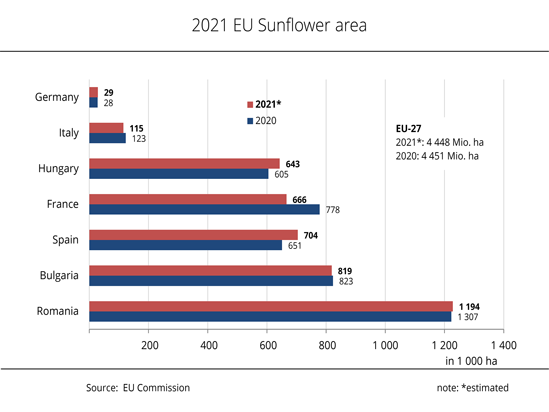

EU Commission forecasts larger harvest from stable area under sunflower cultivation

The EU Commission estimates the EU sunflower area for harvest in 2021 at the same level as the previous year.

According to the EU Commission's forecast, the EU sunflower area for harvest in 2021 amounts to around 4.4 million hectares. In terms of area, Romania continues to be the top producer in the EU-27 with around 1.23 million hectares (2020: 1.22 million hectares). Hungary has expanded its sunflower area 6.3 per cent to presumably 643,000 hectares compared to 2020. The expansion in sunflower area in Spain is expected to be even larger at 8.1 per cent year-on-year. In Germany, the increase in area is seen at 3.6 per cent to 29,000 hectares. The EU Commission's statistics, as analysed by Agrarmarkt Informations-Gesellschaft (mbH), show that the declines in area in France (-14.4 per cent) and Italy (‑6.5 per cent) are offset by the expansions in the other sunflower-producing countries. Consequently, the total production area remains unchanged.

In its outlook for 2021, the EU Commission has forecast yields at an overall average of 23.9 decitonnes per hectare. This translates to a 20.2 per cent rise year-on-year. In the past year, excessive rainfall in Bulgaria and Romania in particular reduced the overall yield. German farmers are estimated to harvest 21 decitonnes per hectare in 2021 (2020: 22.1 decitonnes per hectare). The highest per-hectare yields are expected to be reached in Hungary. At presumably 31.8 decitonnes per hectare, Hungarian yields could exceed the previous year's level by more than 15 per cent.

Chart of the week (22 2021)

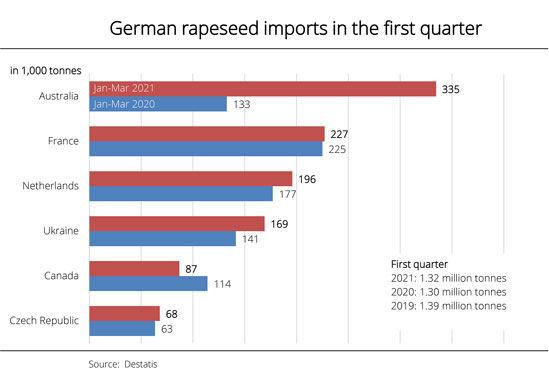

Australia is now a major rapeseed supplier

Whereas Canadian rapeseed imports have lost pace since January, imports of Australian rapeseed to the German market have increased.

Although Germany's 2020 rapeseed harvest was larger than that of 2019, it was nevertheless below average. This means that large rapeseed imports have been required again in the 2020/21 marketing year. Canada, Ukraine and the Baltic countries were important suppliers of rapeseed in the first half of the season.

In the first quarter of 2021, Canada and Ukraine contributed large volumes. Ukraine actually delivered more rapeseed to Germany - 169,000 tonnes - than in the same period the previous year, whereas Canada's shipments dropped almost one fourth to 87,000 tonnes. The reason for the decline is that at the beginning of January, Canadian rapeseed stocks were already lower than in earlier years. France and the Netherlands provided larger shipments, as they usually do in the first quarter.

However, since the turn of the year, Australia has been the main origin of rapeseed for Germany. In the first quarter of 2020, the country had provided only small volumes after significant harvest declines had substantially reduced its export potential. In the current season, Germany received around 335,000 tonnes of Australian rapeseed in the period from January to March. This translates to a more than 150 per cent increase over last year's period.

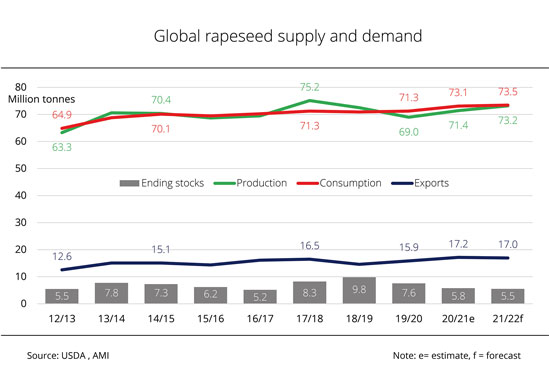

Chart of the week (21 2021)

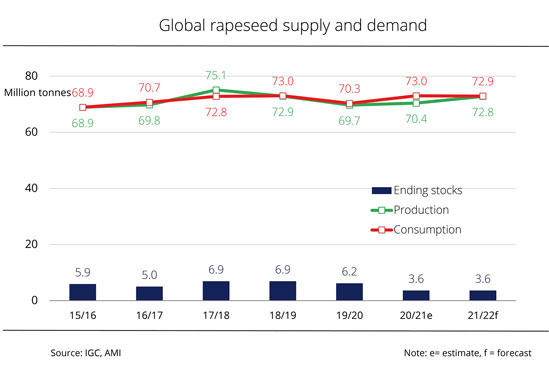

Global rapeseed supply remains tense

The USDA expects increases in rapeseed harvests for the most important rapeseed-producing countries in the 2021/22 marketing year. Nevertheless, global supply remains tight.

According to an initial USDA assessment, the supply situation in the global rapeseed market will likely remain tense in the 2021/22 marketing year. Rapeseed output is anticipated to increase 2.5 per cent to 73.2 million tonnes. However, global rapeseed consumption is expected to rise somewhat at the same time, by 0.5 per cent to 73.5 million tonnes.

The expectations for harvest increases in the 2021/22 season are mainly based on increases in Canada and the EU-27. The USDA estimates rapeseed output in Canada at around 20.5 million tonnes, up 1.5 million tonnes from the previous year. The rapeseed crop in the EU-27 is estimated at 16.6 million tonnes, which would be up 0.4 tonnes on 2020. Globally, Ukraine is a comparatively small producer of rapeseed, but with the harvest expected to amount to approximately 3 million tonnes, the country is a major supplier to the EU-27.

Agrarmarkt Informations-GmbH presumes that the level of rapeseed output and rapeseed availability for export in Canada and Ukraine will be of key importance for the EU-27 to supplement its own production in the 2021/22 season. Eventually, EU rapeseed supply could be slightly more adequate than it is in the 2020/21 marketing year because of the harvest increases in the EU and presumably larger import potential from Ukraine and Canada. The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has pointed out that an expansion in area planted to rapeseed in the autumn of 2021 as a consequence of currently attractive producer prices could go a long way towards improving and safeguarding supply.

Chart of the week (20 2021)

EU soybean area hits record level

According to current figures published by the EU Commission, the biggest increases in 2021 soybean production are recorded in Italy and Romania, two major soy-producing countries. However, the soybean area in Germany has also risen strongly.

According to EU Commission estimates, the soybean production area in the EU-27 for harvest in 2021 for the first time exceeds 1 million hectares. With an increase of 9.5 per cent on the year and just about 12 per cent on the long-term average, it has reached a new record level. In other words, the EU soybean area has tripled in 12 years. Italy has taken the lead in this development with an estimated production area of 295,000 hectares and a strong increase of 15 per cent over the previous year. France ranks second with 196,000 hectares and a comparatively lower expansion of 5 per cent. Romania is also growing significantly more soybeans, having expanded the area 14 per cent to 189,000 hectares. Germany ranks eighth in the EU comparison with 37,000 hectares of soybean area, but has also seen a strong expansion in area of 14 per cent.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) e. V. has welcomed this positive development as a result of continuously growing demand for GM-free soybean meal in all animal husbandry sectors. Soy is also used as a source of protein in the food market for a steadily expanding range of products. Rising demand due to product innovations can also be observed in field beans, peas and lupins. According to UFOP, this trend is basically positive. However, comparing the protein strategies in Germany and France, the association sees a clear need to improve implementation in Germany. UFOP has said that the German protein plant strategy lacks specific targets to serve as "drivers". France provides massive support to research in breeding. This alleviates the cost pressure on seed.

Referring to the double-zero strategy for rapeseed in the early 1990s, the UFOP has stated that to date, this strategy is a successful example of increasing added value at the producer level by providing market access to the food, biodiesel and feedstuff sectors. Also, at the time more plant breeders entered the market, which in turn expedited breeding progress. The UFOP has emphasised that a lot of staying power is needed, as are integrated and comprehensive approaches with a sound funding environment in all areas of the economy. Such value chain can serve to make the integrated bioeconomy visible and also highlight the ecosystem services provided by the rotation systems expanded to include these crops. The networks funded by the BMEL have contributed to laying the foundations over the past years. UFOP has emphasised that in the interests of climate protection this process should be moved forward faster.

Chart of the week (19 2021)

Germany remains the most important rapeseed producer in the EU

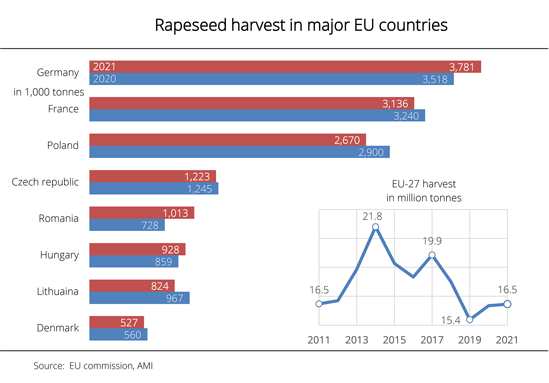

Despite unfavourable weather conditions in Germany, the EU Commission expects the 2021 German rapeseed harvest to be larger than a year earlier. The outlook for France and Poland is quite different.

Since the beginning of March, the weather in Germany has been dominated by large temperature fluctuations. Following a warm weather period at the end of March, the coldest April across Germany in 40 years has slowed plant growth. Nevertheless, winter-planted crops are generally in a good condition. No significant damage has been observed so far. The EU Commission expects the German rapeseed harvest to reach 3.8 million tonnes. This would translate to a 7.5 per cent rise year-on-year. By contrast, in France the prolonged period of frost severely affected some of the rapeseed crops that were in flower at the time. Also, drought has prevented a rapid recovery of the crops. According to investigations conducted by Agrarmarkt Informations-Gesellschaft (mbH), the EU Commission lowered the harvest outlook for France by 6 per cent from the previous month to 3.1 million tonnes. This would translate to a 3.2 per cent decline on the year. Poland could also see a drop in harvest in 2021. Estimated at 2.7 million tonnes, the country's harvest would fall 8 per cent short of the previous year's figure.

The increases expected to occur in Germany, Romania and Hungary will not be able to offset the decreases in other countries. As a result, this year's EU-27 rapeseed harvest of presumably 16.5 million tonnes is set to exceed the previous year's level by only 1 per cent while remaining below average overall.

Chart of the week (18 2021)

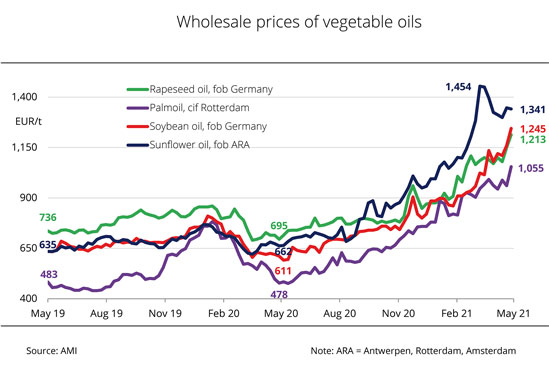

Vegetable oil prices continue to rise

Generally tense supply on the international oilseed market with mostly strong prices has fuelled prices of the most important vegetable oils.

Vegetable oil prices in April reached their highest level on record since Agrarmarkt Informations-Gesellschaft (mbH) started recording in 1995. Sunflower oil was valued at EUR 1,341 per tonne fob ARA at the end of April 2021, which was more than double the previous year's level. Support mainly came from limited feedstock supply in the EU, Ukraine and Russia. The scarcity curbed processing and, as a result, reduced availability.

Asking prices for soybean oil stood at EUR 1,245 per tonne fob Germany in the last week of April. This was double the previous year's level. The main reason for the strong price increase was concerns over adequate supply of feedstock. Initially, the Brazilian soybean harvest was delayed. Then, concerns sparked by a lower-than-expected US soybean area estimate for 2021 drove prices up further. Strong demand from China provided yet another boost to prices.

Rapeseed oil market participants too were concerned that supply could tighten in the current season. Again, these concerns were stoked by the limited availability of feedstock. China's buoyant buying interest further fuelled the mood of tension. At EUR 1,213 per tonne fob Germany, rapeseed oil traded at around 75 per cent above the previous year's level at the end of April.

Palm oil recorded the biggest year-on-year increase at 121 per cent to EUR 1,055 per tonne CIF Rotterdam. Stocks of the second largest exporter – Malaysia – are expected to dwindle sharply. The reason is that the country suffered a lack of workforce due to Covid-19, which resulted in restricted production and, consequently, curtailed global supply.

The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has welcomed the price trend as a fundamentally positive development. After all, especially in the case of rapeseed, price incentives, along with crop rotation restrictions, are the main factor leading to economically optimised crop rotation plans. In other words, these price signals have come at the right time for farmers to take them into account when planning sowings. According to the UFOP, with a processing capacity of more than 9 million tonnes, German oil mills heavily rely on German and European rapeseed to satisfy demand for rapeseed oil and GM-free rapeseed meal for animal feeding purposes.

In light of the uncertain conditions due to the GAP reform, biofuels policy and crop protection policy, an adequate price level is needed. The UFOP has strongly emphasised that the development in prices anticipates the trend required to set off the reduction in yields intended by the EU Commission for all kinds of crops and the cut in farmers' incomes due to the new set-aside policy. The association has said that instead of developing marketing alternatives for the industrial and energy use of sustainably produced greenhouse gas-efficient feedstock, the EU Commission's policy is putting a curb on existing and proven sales paths. As a consequence, the Commission prevents a clear and prospective signal from being given to farm owners' successors. The UFOP is convinced that the EU Commission's policy will be reflected in market prices – just as it will be consumers who will ultimately have to bear the cost of fossil CO2 emission pricing.

Chart of the week (17 2021)

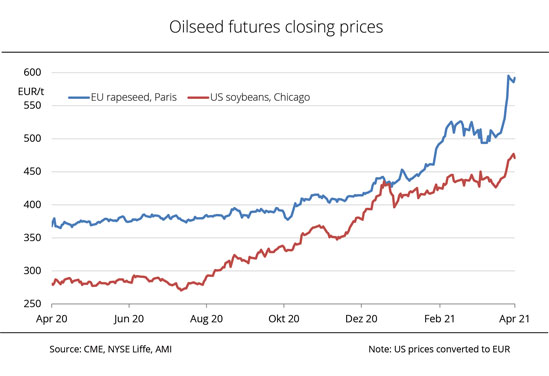

Forward prices on a healthy upward trend

Prices for both rapeseed and soybeans have been flying high for several months. Rapeseed recently closed at a record level.

Paris rapeseed futures have rallied significantly since the beginning of the calendar year 2021. On 22 April 2021, they reached a record high at EUR 595 per tonne. They have maintained this level since then. The reason for latest sharp price surge was the cold snap that gripped France. According to Terres Inovia, the South West, the North East and Normandy were affected most severely. In these areas, around 10 per cent of the land planted to rapeseed (approximately 90,000 hectares) was broken up due to winterkill losses. Considering the progress of plant growth, yields are also set to fall short of expectations in some locations due to frost. Tight EU rapeseed supply in 2020/21 has driven prices since the beginning of the year. Imports from the Baltic countries and Ukraine slowed due to declining stocks. Shipments from Canada also dwindled as a result of a steady decrease in supply. In the first half of the trading year, Canada exported rapeseed at a record pace. This led to a sharp reduction in the country's scarce stocks. Canada will presumably start the new season with extremely low beginning stocks.