Charts of the week 2013

Chart of the week (52)

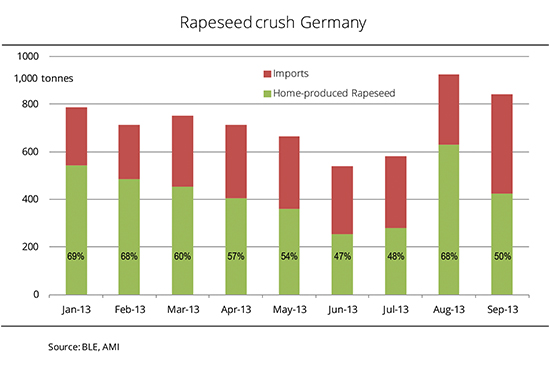

Start into the new season was delayed

About 6.5 million tonnes of rapeseed have been processed since the beginning of the calendar year. There was a seasonal decline in processing at the end of the 2012/13 marketing year. At the same time, the proportion of German rapeseed processed decreased. The drop was due to the small 2012 German rapeseed harvest and resulting hike in feedstock prices. By contrast, the 2013 rapeseed crop was significantly larger. At 5.8 million tonnes, it exceeded the previous year's harvest figure by 1 million tonnes. However, the harvest came in very late. In other words, German oil mills were short of material in July 2013. Extensive rapeseed processing did not recommence until August 2013, with a substantial increase in domestic rapeseed. Since January 2013, Germany has absorbed around 3.3 million tonnes of rapeseed from abroad, of which 77 per cent came from EU countries, 15 per cent from Australia and 4 per cent from the Ukraine. (AMI)

Grafik der Woche (KW 51)

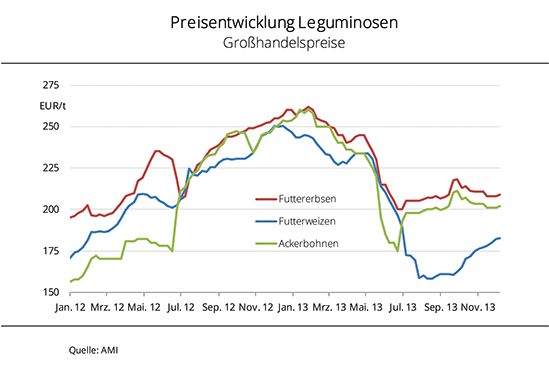

Großer Preisabstand zum Futterweizen

Nicht so stark wie für Getreide, gab es auch für Hülsenfrüchte in diesem Jahr einen kräftigen Preisknick, obwohl die Ernten 2013 in Deutschland geringer ausfielen als im Vorjahr. Aber der Druck vom Getreidemarkt und von den internationalen Proteinmärkten öffnete auch für heimische Hülsenfrüchte den Preisspielraum nach unten. Von diesem Tief konnten sie sich jedoch schnell erholen. Stetige Nachfrage bei gleichzeitig unzureichendem Angebot sorgte für steigende Erzeugerpreise, die sich nach der Hauptvermarktungsphase im August/September 2013 stabilisierten und seither wenig verändert haben. Damit schrumpfte Anfang Dezember 2013 der Preisabstand von Futtererbsen gegenüber Futterweizen auf 26 EUR/t. Im August lag er noch bei über 55 EUR/t. Im Vorjahr waren es höchstens 28 EUR/t gewesen. (AMI)

Chart of the week (50)

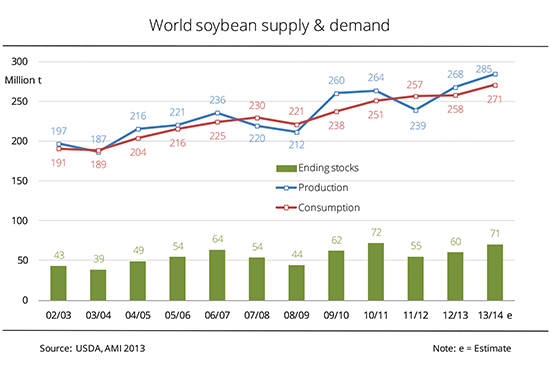

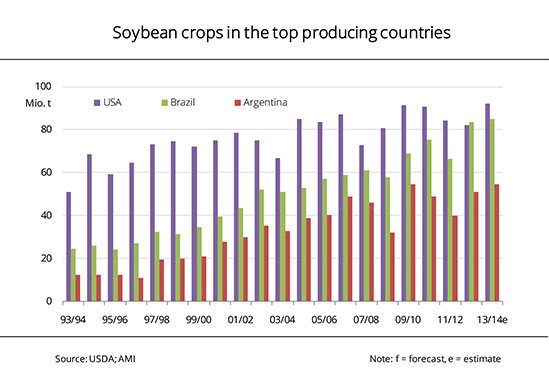

Convenient supply of soybeans in 2013/14

The global bumper crop of soybeans ensures easy supply to the market and increasing stocks. The USDA forecasts a substantial rise in soybean output compared to the previous year, particularly for South America. However, farmers there have only just completed planting, and consequently, the estimates are still very vague. Larger supply will also drive up demand. The USDA estimates puts global consumption at 271 million tonnes. The top purchaser China could import 69 million tonnes this marketing year, 10 million tonnes more than the previous year. Global trade will also surge to a new record high as a result. Nevertheless, stocks at the end of the marketing year are recovering and stand at just under 71 million tonnes, a level last seen in 2009. (AMI)

Chart of the week (48)

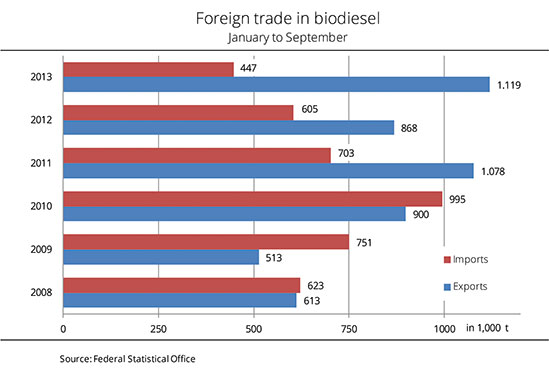

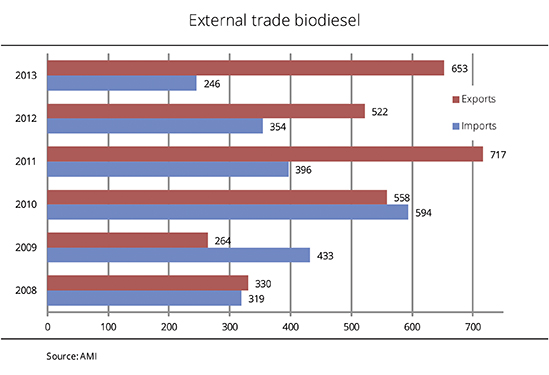

Germany turns into a strong exporter of biodiesel

German biodiesel exports have rocketed this year. The German Federal Statistical Office puts foreign sales between January and September 2013 at 1.1 million tonnes, almost 29 per cent up on the same period in 2012. In other words, Germany has become an even larger net exporter as imports have dropped by one quarter from the previous year, to 446,833 tonnes. Export surplus amounted to well over 672,000 tonnes, significantly more than the previous year’s 264,000 tonnes. The EU countries continue to be the top recipients of German biodiesel, receiving around 89 per cent of the total quantity. Top of the list by far is the Netherlands, importing more than 355,000 tonnes, around one third of German deliveries to the EU. They are followed by Poland and Austria, at around 113,000 tonnes each, and France, at 76,000 tonnes. Furthermore, 2013 was for the first time Germany delivered nearly 100,000 tonnes of biodiesel to the US. In previous years, exports to the US had averaged a meagre 500 tonnes. (AMI)

Chart of the week (47)

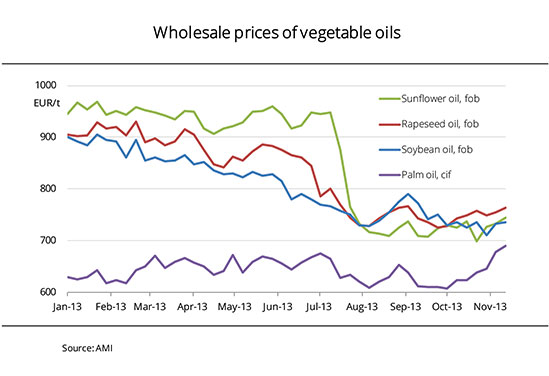

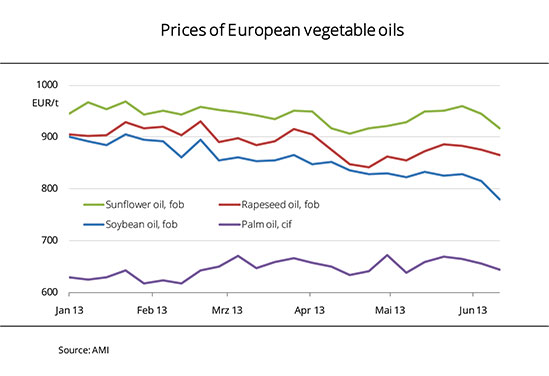

Vegetable oil prices rise

At the beginning of the 2013/14 marketing year in July 2013, prices dropped sharply. This was due to the optimistic supply outlooks of oilseeds. Availability of EU-28 rapeseed alone is up 7 per cent from the previous year. The EU sunflower crop exceeds the 2012/13 figure by even 17 per cent. On a global scale, availability of oilseeds is also more convenient than 2012/13. At the beginning of August 2013, rapeseed oil hit this year's low at EUR 728 per tonne, nearly EUR 240 per tonne below the year-ago level. In October 2013, the announcement that anti-dumping duties on biodiesel from overseas would be increased sent demand rocketing. As a result, prices rose steeply and rapeseed oil was more expensive than soybean oil again. Prices remained at these high levels, and the jump in palm oil prices in the wake of the typhoon in Southeast Asia drove up asking prices even further. (AMI)

Chart of the week (45)

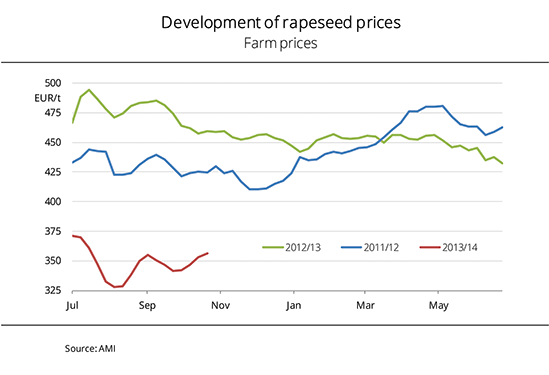

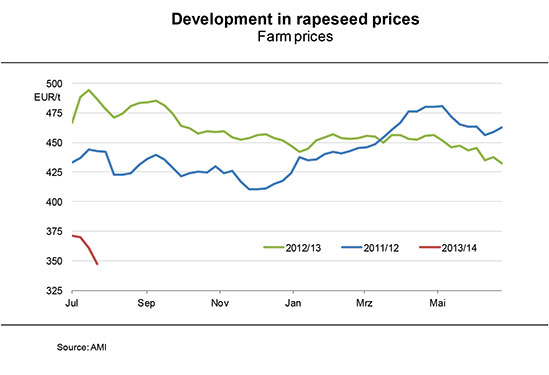

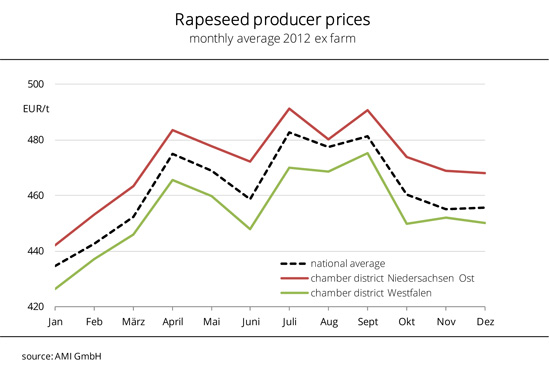

Rapeseed prices have stabilised

Prices of rapeseed meal have recently gone up significantly. The rise has been driven by climbing feedstock prices and, above all, the scarce supply for nearby positions. As the 2013 rapeseed harvest started, asking prices dropped sharply to 193 EUR/t (a level last seen in February 2012) due to prospects for a more comfortable supply situation for feedstock. Also, at that time, rapeseed hit its lowest price level this year, at less than 330 EUR/t ex farm. By mid September 2013, feedstock had risen by a good 10 per cent, pushing up prices of byproducts too. At the same time, soybean meal was relatively expensive and more rapeseed meal was used in compound feed as a result. At the end of October, prices reached a preliminary marketing-year interim high. This put a heavy damper on rapeseed demand, the more so as soybean meal prices had been declining since September. (AMI)

Chart of the week (44)

Rapeseed prices have firmed

Following the price slump at the time of harvest, rapeseed prices stabilized in September 2013 and have persisted at the higher level also in October. The key factorfor the recovery was the developments at the European and overseas futures exchanges, because in the German cash market, trade has been slow. The majority of the 2013 rapeseed harvest has already been sold and farmers are still speculating for an increase in price of the remaining quantities, which have already been put in the traders' stores. After all, there has been an enormous 111 EUR per tonne price drop from the previous year. Prices are anticipated to change little over the next few weeks. As the northern hemisphere oilseed harvest is almost complete, no big surprises are expected and as a result there will be hardly any stimulus for price movements. In the last quarter of 2013, the market focuses on the development of soybeans in South America. Although in Argentina soy crop development is way behind schedule because of the severe drought, experts forecast a new record overall crop. As a result, buyers are speculating for a decline in prices. This same trend was also observed in the two previous years. (AMI)

Chart of the week (43)

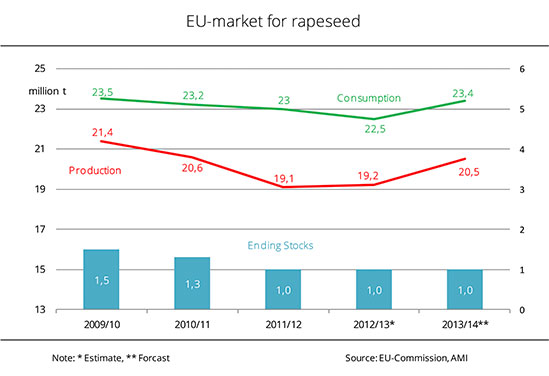

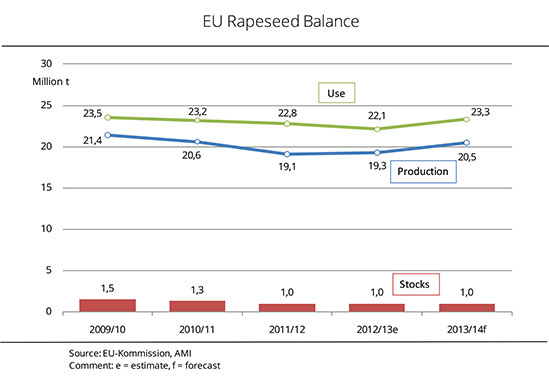

Larger rapeseed crop also increases consumption

Brussels forecasts a 2013 EU rapeseed crop of 20.5 million tonnes. The 1.3 million tonne rise over the previous year is due to a 7 per cent increase in area planted. Average yields are at the year-ago level of 31.1 decitonnes per hectare. The larger global supply of rapeseed and the resulting lower market prices stimulate demand. Consumption is expected to surge back to more than 23 million tonnes in the 2013/14 marketing year. Crushing is forecast at 22.5 million tonnes, compared to only 21.7 million tonnes the previous year. The EU Commission estimates import demand at 3 million tonnes, 0.4 million tonnes lower than 2012/13. In other words, the final stocks of 1 million tonnes could remain untouched. The International Grain Council (IGC) in London even expects EU rapeseed ending stocks to rise. A year ago, the ICG still put stocks at 1.3 million tonnes. In 2013/14, the figure could climb to 1.9 million tonnes, a high level not seen in recent years. (AMI)

Chart of the week (42)

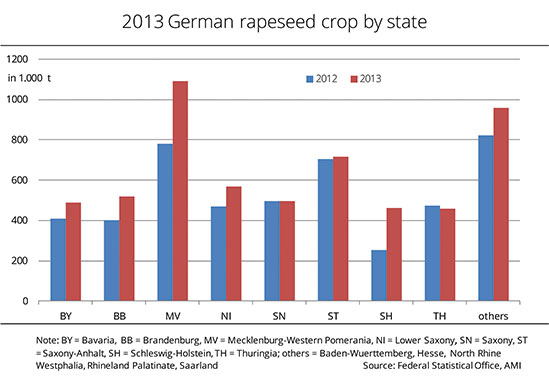

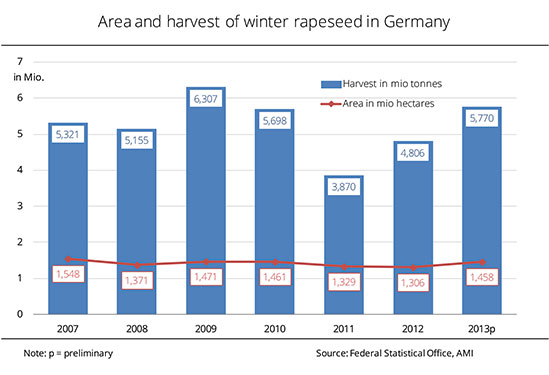

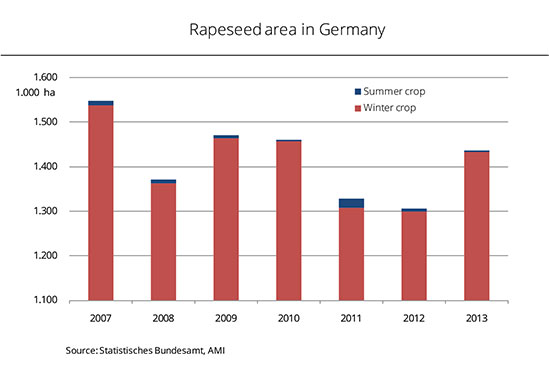

Outstanding 2013 German rapeseed harvest

The 2013 rapeseed harvest in Germany was surprisingly good. Despite unfavourable growing conditions, the harvest figures markedly exceeded the previous year's levels in all German states but Thuringia. According to the final German Federal Statistical Office estimate, the German rapeseed crop totalled 5.78 million tonnes, 20 per cent more than 2012. The almost one million tonnes increase was due to both a rise in area planted and higher yields. Good conditions at the time of planting enabled farmers to keep to schedule for the first time in three years. As a result, they planted 1.46 million hectares, around 12 % more than 2012. Contrary to expectations and despite the long winter, the crops benefited from the cold and wet weather in May. At 39.6 decitonnes per hectare, yields outpaced the long-term average by 7 per cent. In Mecklenburg-Western Pomerania alone, the rapeseed crop (1.09 million tonnes) was up 40 per cent on 2012, in Schleswig-Holstein the rise amounted to 80 per cent. (AMI)

Chart of the week (41)

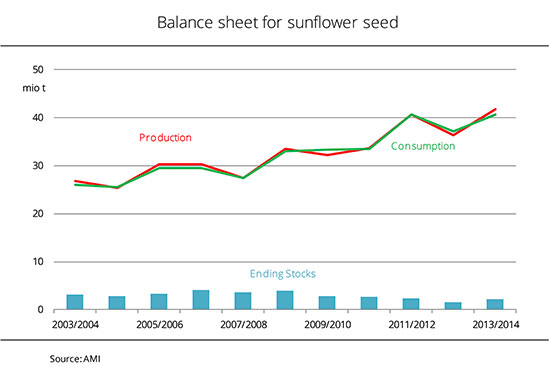

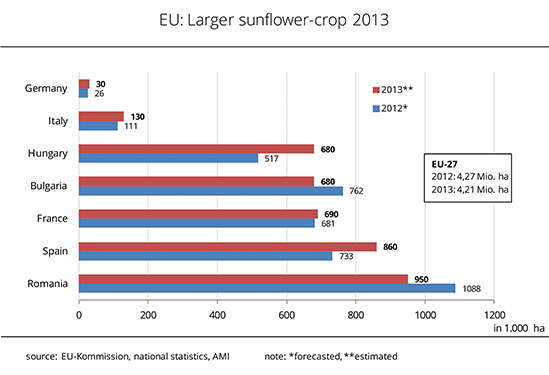

USDA estimates record sunflower crop

The USDA expects a record global sunflower seed crop of 41.76 million tonnes for 2013/14 due to increased planted areas and a foreseeable rise in yields. This figure would top the 2012/13 level by 5.4 million tonnes. Considerably increased crop expectations on the northern hemisphere play a major role. Compared to 2012/13, the 2013/14 sunflower seed crop is expected to rise 2.5 million tonnes in the Ukraine, 1.4 million tonnes in the EU-28 and just under 1 million tonnes in Russia. As a result, the Black Sea region alone would provide 21.8 million tonnes of sunflower seed. Sunflower seed has the lowest shelf life of all oilseeds. As a result, it only accounts for less than 4 per cent of the world oilseed trade. The main production areas process the seed locally. The principal product of sunflower seed processing on the market is high-quality sunflower seed oil, of which the former CIS countries are the top suppliers. The Ukraine sells 86 per cent of is sunflower oil production on the world market, Russia 35 per cent. The EU-28 is a net importer of sunflower oil. (AMI)

Chart of the week (40)

Exports of biodiesel increase

Biodiesel imports in the 2012/13 grain marketing year came down one fourth from the previous year to 652,145 tonnes. The majority (around 97 per cent of the total quantity) was imported from EU member states. The Netherlands (372,002 tonnes) and Belgium (154,511 tonnes) were the main suppliers. However, these figures also include unquantifiable imports from third countries. All EU trading partners, with the exception of Poland and Austria, supplied less biodiesel to Germany in 2012/13 than the previous marketing year. Significant quantities of biodiesel were also imported from Indonesia and Malaysia. Whereas Malaysia delivered 2,798 tonnes (more than ten times the year-ago amount), imports from Indonesia slumped to 5,007 tonnes (one fourth the year-ago level). At the same time, biodiesel exports in the grain marketing year 2012/13 increased to 1.35 million tonnes. This was 17 per cent up on the 2011/12 figure, but 22,600 tonnes below the 2010/11 record. The main destination was the Netherlands (receiving one fourth of the total shipments), followed by Austria and the Czech Republic (well over 17,000 tonnes or 13 per cent each). About 95 per cent of German biodiesel exports went to EU states. Apart from that, significant quantities were only sold to the US in 2012/13. Exports to the US amounted to 61,062 tonnes. This was 73 times the year-ago level. (AMI)

Chart of the week (39)

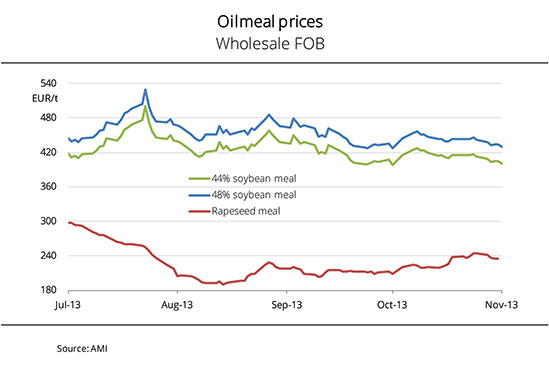

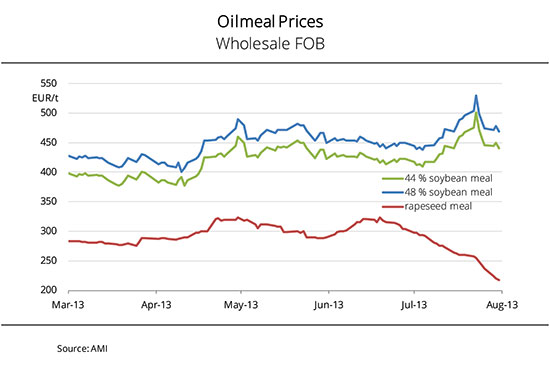

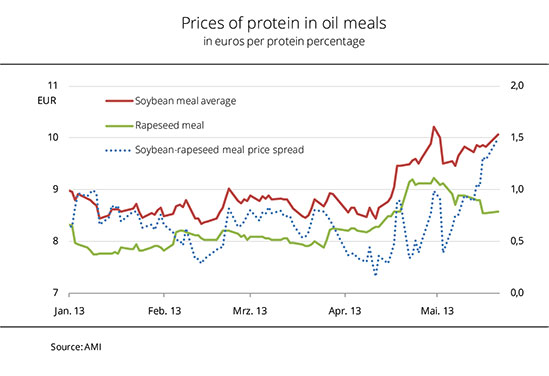

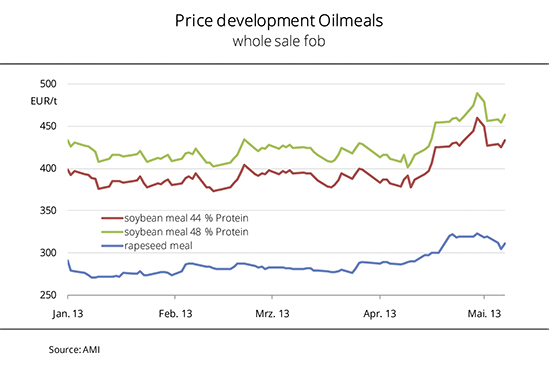

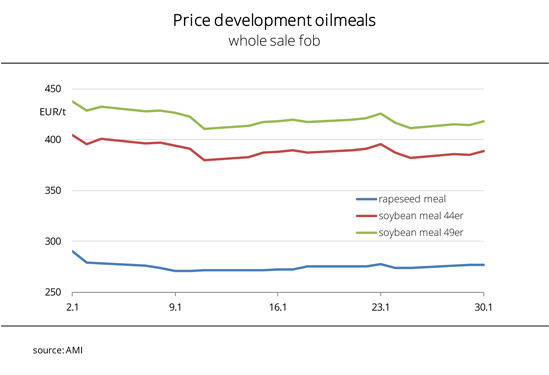

Soybean meals remain expensive

Although prices of soybean meals have recently dipped, they still remain at a high level. The market had anticipated an early September decline in prices, at the time when the US soybean harvest usually starts. However, this year harvesting is delayed due to poor weather conditions during the crop cycle. Moreover, the initial crop forecasts will likely not be met. Over the past few months, official harvest outlooks have continually been lowered, and the most recent estimate of US soybean production was down to 85.7 million tonnes, only 3.7 million tonnes above the 2012 level. These prospects not only maintain prices at a high level, but have also lend to a very volatile price trend over the past few weeks. In the third week of September, the asking price for soybean meal (44% protein) averaged EUR 413 per tonne, slightly down from the previous 2013 average of EUR 415 per tonne. At the same time a year ago, the average price amounted to EUR 502 per tonne. (AMI)

Chart of the week (38)

Vegetable oil price index hits three-year low

The FAO Fats/Oils Price Index dropped to 185.5 points in August, 3 per cent below the July figure. This price level was last seen in 2010. The decline in prices for vegetable oil has been unbroken since February 2013. The main factor driving the recent slump in vegetable oil prices is the increase in palm oil supplies in Southeast Asia. The output of palm oil has exceeded expectations, whereas demand has hardly risen compared with the same period a year ago. At the same time, prices for soybean oil have also been on a downward trend. Ample supply from Argentina and initially very high forecasts of the 2013/14 global soybean crop put pressure on prices. Poor growing conditions for the US soy crop have stopped the fall in soybean oil prices for the time being. However, in view of the 7 million tonne rise in global vegetable oil production in the 2013/14 marketing year and the simultaneous increase in ending stocks, there remains some scope for downward prices. (AMI)

Chart of the week (37)

2013 rapeseed harvest above average

From the German farmers' viewpoint, this year's rapeseed harvest was better than ex-pected. First official estimates put the winter rapeseed harvest at 5.8 million tonnes, up one million tonnes from the previous year. For the first time in four years, the crop ex-ceeded the long-term mean of 5.2 million tonnes. The rise resulted from both an expan-sion of area planted and a considerable increase in yields. For the first time in two years, farmers had been able to keep to planting schedules due to favourable planting condi-tions in autumn last year. Moreover, losses due to winter kill were limited. Despite the long winter and summer drought, the crops developed well and produced above-average yields. At 3.96 tonnes per hectare, yields surpassed the long-term average by 7 per cent and outpaced the meagre year-ago figure by 7.4 per cent. Mecklenburg-Western Pomerania produced the highest output. In this German state alone, the har-vest was 325,000 tonnes up year-on-year, based on a 33 per cent increase in area planted and a 7 per cent rise in yield. With the exception of Saxony and Thuringia, all German states reaped a greater rapeseed harvest in 2013 than in 2012. (AMI)

Chart of the week (36)

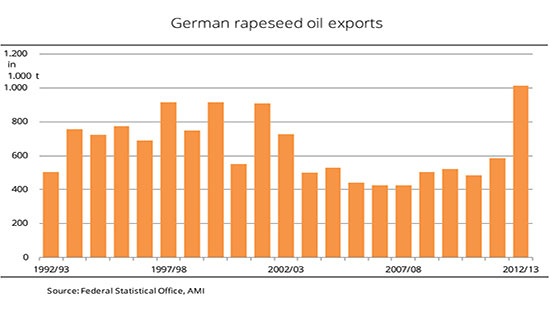

German 2012/13 exports of rapeseed oil hit record high

Germany had a record-breaking 2012/13 in rapeseed oil exports. Never before had the country sold as many as one million tonnes abroad. In 2011/12, exports amounted to 586,000 tonnes. German production of rapeseed oil production in 2012/13 totalled around 3.8 million tonnes. Due to weak national demand, German oil mills had to sell one third of their production to foreign markets. 87 per cent of these exports went to other EU states, 8 per cent to Asia and 4 per cent to EFTA states (Iceland, Norway and Switzerland). The main buyer of German rapeseed oil were the Netherlands (just under 440,000 tonnes), followed by Belgium (120,000 tonnes). Taken together, the two countries received 80 per cent more than the previous year. China (42,000 tonnes) ranked fifth, after Great Britain and Poland and ahead of Norway (37,000 tonnes). France only received 36,000 tonnes. However, 30,000 tonnes went to Singapore. In previous years, China and Singapore had only received a fraction of this year's quantity. (AMI)

Chart of the week (35)

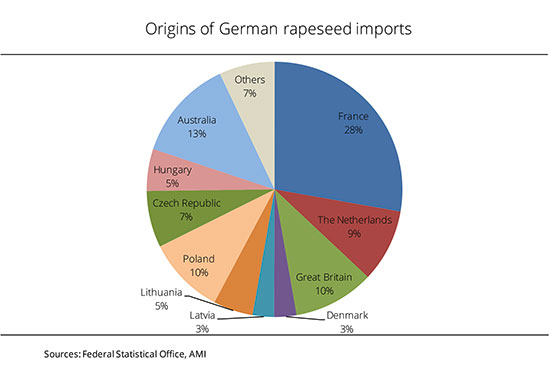

France and Australia satisfy the German market

In the 2012/13 marketing year, Germany received 3.8 million tones of rapeseed from abroad, 8 percent less than the previous year. Germany's top rapeseed suppliers are its EU neighbor countries, headed by France. The country has traditionally supplied the largest quantity to Germany. However, although France's 2012 rapeseed harvest outpaced the 2011 crop, the country's 2012/13 rapeseed exports to Germany only amounted to just over one million tones, one fifth less than 2011/12. Imports to Germany from Great Britain and Denmark also went down. In contrast, shipments from Poland (375,000 tones) almost tripled versus 2011/12. Deliveries from the Baltic countries also rose considerably. Rapeseed imports from the Czech Republic increased by one third, whereas imports from Hungary dropped one third. Moreover, a larger amount of third country rapeseed entered Germany via the Netherlands. At just under 350,000 tones, deliveries were 9 per cent up on 2011/12. Australia is the second largest supplier of rapeseed to Germany. This is true even though in 2012/13 Australian shipments were down 16 percent (487,500 tones). (AMI)

Chart of the week (34)

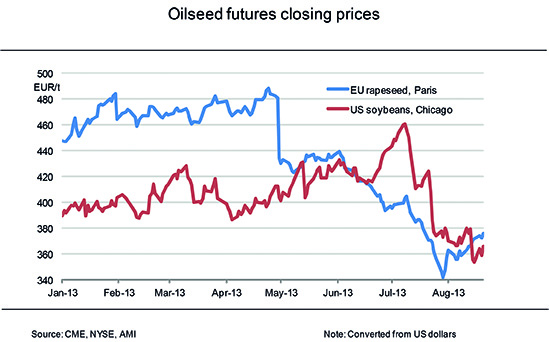

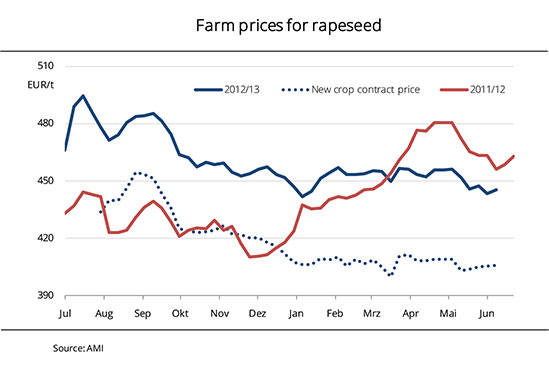

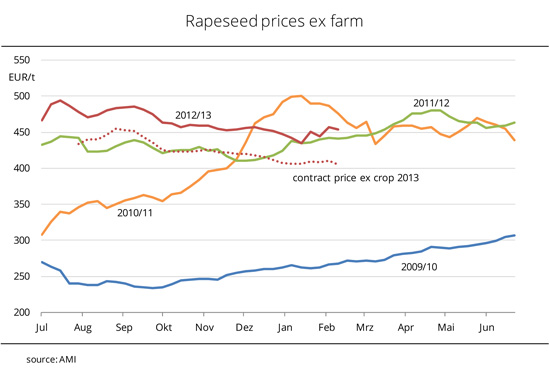

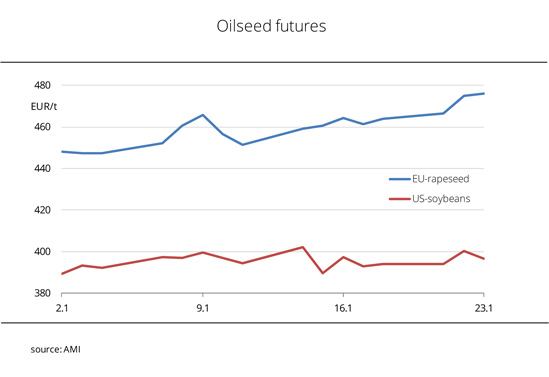

Downward spiral of rapeseed prices has apparently come to a halt

In view of a foreseeable larger 2013 EU rapeseed crop, prices slumped in May 2013 as the nearby changed from the old-crop May contract to the new-crop August contract. Exceptional weather raised doubts concerning the yield potential and in June 2013 prices rose slightly as a result. However, the first positive crop figures sent prices tumbling to EUR 342 per tonne, a level last seen in July 2010. Not even the very firm US soybean prices were able to slow this downward trend. Soybean prices rose sharply in response to poor planting and growing conditions. Prospects of a US record crop then depressed prices even in Chicago and also affected rapeseed prices in Paris. However, the weakness in the market appears to have ended. Above all, the firm soybean prices are making an impact. The current drought in the US is increasing concern about the harvest. (AMI)

Chart of the week (32)

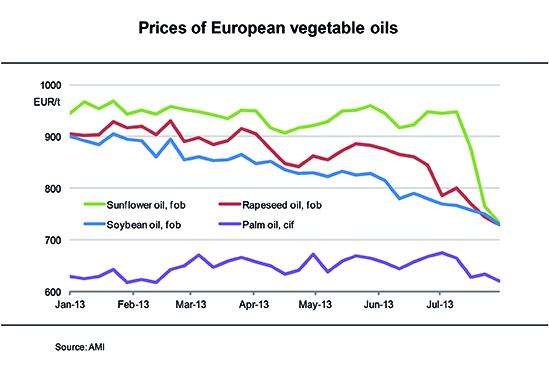

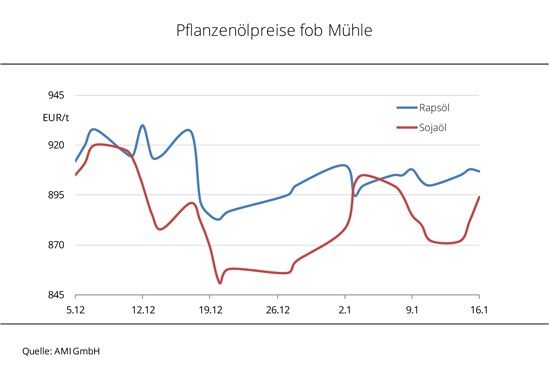

Vegetable oil prices dip further

The weakness on the vegetable oil markets continues. Buyers wait for the supply of vegetable oils from the new crop. Slackness of demand is bound to continue until such supply will be available. Vegetable oils are in short supply and predominantly requested to cover nearby demand. In July 2013, nearby rapeseed oil was available at very high premiums only. In the west of Germany, supply had run very low by mid month. Rapeseed and soybean oils for delivery from November 2013 are hardly traded at all. Rapeseed and soybean oils for September delivery have recently been valued at the same levels. The recent price fob Hamburg was EUR 728 per tonne. In other words, rapeseed oil was down EUR 72 EUR per tonne from the previous month. Reductions in prices for soybean oil were less sharp, amounting to EUR 39 EUR per tonne. Bids for soybean and rapeseed oil raffinates are currently only made on demand. Nearby sunflower oil is short in supply and buyers must fork out high premium charges as a result. (AMI)

Chart of the week (31)

New-crop oilseed meal continues in short supply

Prices of oilseed meals reflect the late availability of the new crops. The delay in soybean shipments from South America and the local delays in the European rapeseed harvest have cut supply from German oilmills substantially. Due to the high price level and volatile trend, demand for soybean meal concentrates on nearby positions. For the first time, August has been divided into two periods of delivery. The reason is that oilmills are unable to provide a precise schedule for the supply of the first new-crop rapeseed meal. Suppliers of soybean meal also adopted this system for July and August. Over the past few days, prices for rapeseed meal have come down markedly on weak quotes for rapeseed and slack demand. In the past four weeks alone, rapeseed meal prices for prompt delivery dropped nearly 32 %. This translates to a decrease of almost EUR 94 per tonne. On the other hand, prices asked for soybean meal continue to be high despite occasional strong fluctuations. (AMI)

Chart of the week (30)

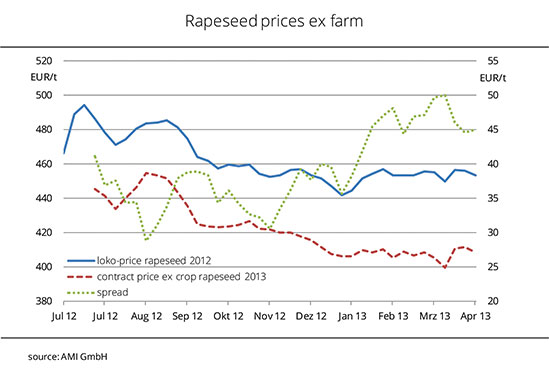

Downward pressure on rapeseed prices

Unlike in other years, rapeseed prices did not start to collapse to new-crop price levels in spring this year, but plummeted in a flash crash instead. At the end July, the majority of oil mills withdraw their bids. They key reason was the two entirely different levels of rapeseed supply. Whereas in 2012/13, supply of rapeseed was limited and sent prices soaring as a result, ample supply is expected for the new season. Given average yields, this year's German rapeseed crop will exceed the previous year's harvest by at least 500,000 tones. The EU might see the highest crop yield in three years (20 million tonnes). Against this background, contract prices for rapeseed from the 2013 crop had been an average of EUR 44 per tonne lower than 2012-crop prices since the beginning of the year. This price gap continued until the turn of the fiscal year. As a result, the market is currently seeing a sharp price slump. (AMI)

Chart of the week (29)

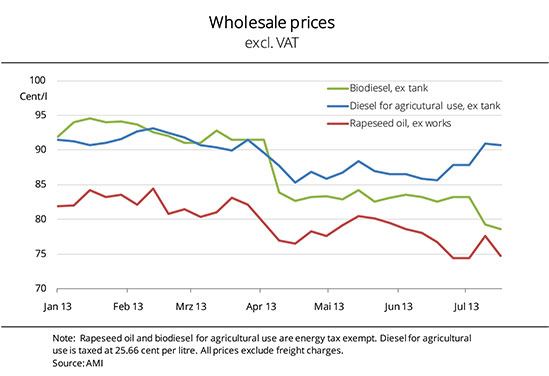

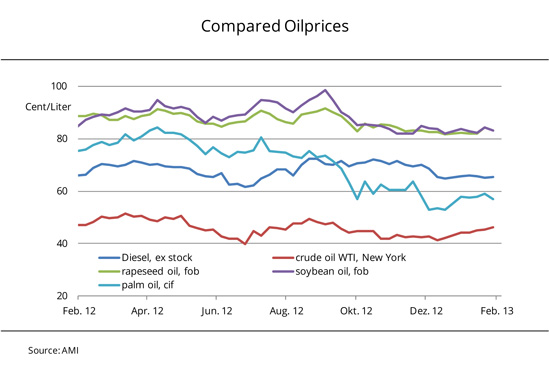

Biofuels are of interest to farmers

In terms of closing the loop of local resources, using vegetable oil and biodiesel in agriculture and forestry seems the natural choice. In Germany, full tax privileges are still attached to these types of fuels. Although energy tax to be paid amounts to 45.07 cent per litre, it is fully refunded under the procedure of the agricultural diesel tax refund. In the case of diesel fuel, the pro rata refund is 21,48 cents per litre. The difference in tax advantages reflects the savings at the wholesale level. However, it is also the trend in the prices of the fuels shown in the chart that determines the difference in price. If pressure on new-crop rapeseed oil continues to increase, switching will become more and more attractive, particularly if the price of diesel rises. Tax on the corresponding quantities of pure fuel could subsequently be recaptured in conjunction with quota trading in order to meet the quota obligation. The chart shows wholesale prices. In other words, it does not reflect freight or delivery costs or quantity-related discounts, if any. (AMI)

Chart of the week (28)

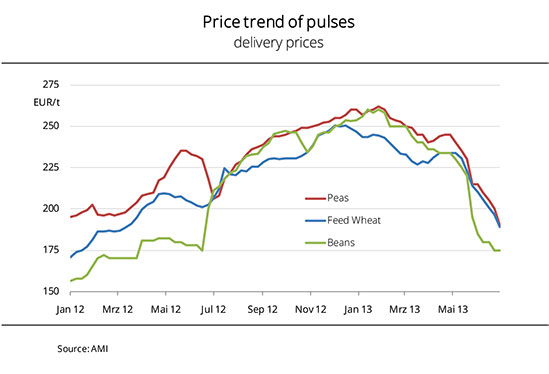

High prices asked for pulses

The increase in asking prices for cereals and proteins on the cash market were also reflected in the price trend for pulses. According to the weekly AMI survey, producer prices of fodder peas closely followed fodder wheat prices in the 2012/13 marketing year, averaging a 20% increase over the previous year level. Prices of broad beans climbed even higher. At EUR 238 per tonne, they were not only nearly identical to those of fodder peas (in 2011/12, the price gap had been EUR 36 per tonne), but also 42% up on the previous year level. (AMI)

Chart of the week (27)

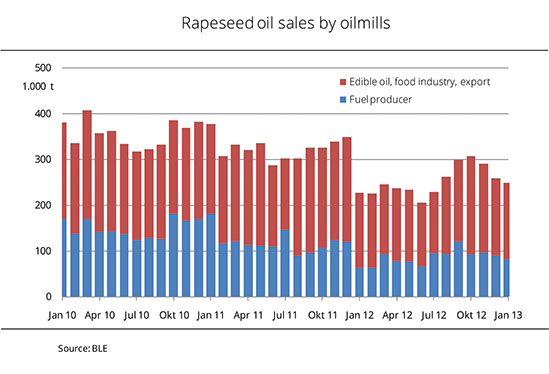

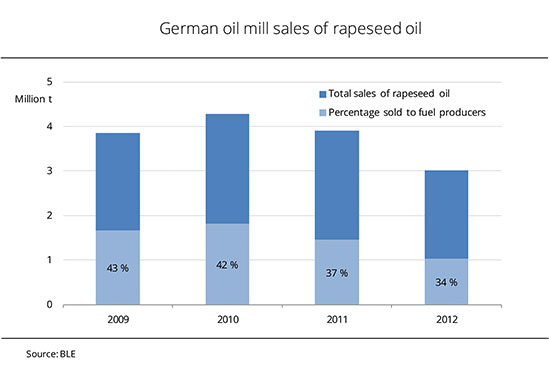

Rapeseed oil sales to biodiesel producers dwindle

Rapeseed oil sales by oil mills have slowed considerably over the past several months. The year 2012 saw the impact of eight months downtime at the oil mill in Mannheim following a fire. At the same time, there was a steady decline in biodiesel producers’ demand for rapeseed oil. Whereas in 2010, German oil mills sold around 1.8 million tonnes of rapeseed oil to biodiesel producers, sales dropped to 1.4 million tonnes in 2011 and around 1.03 million tonnes in 2012. Although rapeseed oil sales as a whole declined over these years, the proportion used for fuel production fell from 42% in 2010 to 34% in 2012. In January 2013, it even accounted for less than one third. The proportion of German rapeseed that was processed into rapeseed oil also went down. Whereas domestic rapeseed accounted for around 70% in the marketing year 2010/11, it slumped to just 52% in 2011/12. (AMI)

Chart of the week (26)

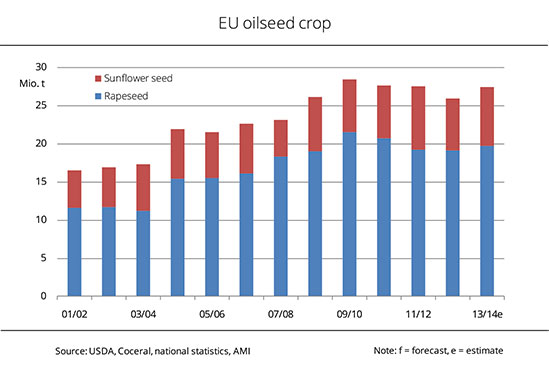

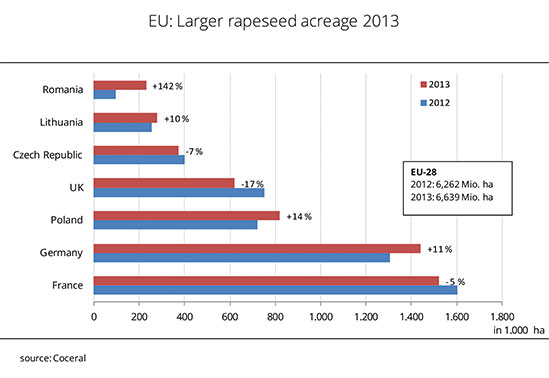

Coceral expects larger EU oilseed harvest

EU sunflower production will be considerably larger than last year. By contrast, only low growth rates are expected for rapeseed. In its most recent estimate, Coceral, the umbrella association of European trade in cereals and oilseeds, projects the EU rapeseed crop yield at 19.94 million tonnes, 2% above the year-ago level. In March, the estimate was still above 20 million tonnes. However, crop development in France and Germany has reduced forecasts. Coceral estimates the EU-28 sunflower production in 2013 at around 7.7 million tonnes, up 1 million tonnes from the previous year. In other words, the March estimate has only slightly been revised up. Romania, Hungary, Spain and France in particular are expected to bring in more sunflowers compared with last year. Whereas Coceral reports that the EU production area of sunflowers has increased by only around 2% over last year, per hectare yields are forecast to rise 12%. (AMI)

Chart of the week (25)

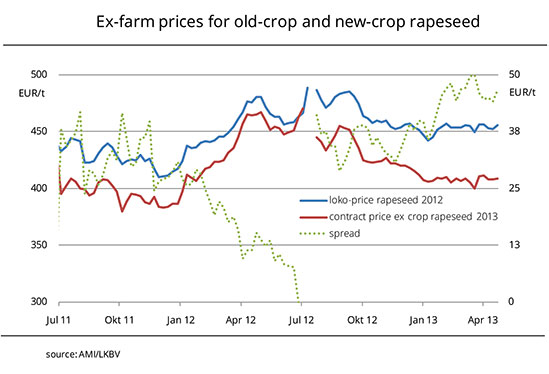

Downward pressure on rapeseed prices

Prospects of a large rapeseed harvest in 2013 sent rapeseed prices tumbling below the level of EUR 440 per tonne for the first time in 17 months. Prices asked for old-crop rapeseed far exceed those for the 2013 crop, which was at the same time only valued at EUR 401 per tonne. At the end of the marketing year, supply of old-crop rapeseed is very moderate, but demand is down too. Although material that is occasionally offered can be traded swiftly, it rarely sells at the prices asked. Futures quotes for rapeseed are also trending downward. Prospects of larger rapeseed harvests in Germany and the EU, but also in Canada, open up scope for downward movement. The relatively firm prices for soybeans fail to have any positive impact on rapeseed. (AMI)

Chart of the week (24)

High premiums for nearby rapeseed oil

Prices for vegetable oils are sliding and an end to the decline is not yet in sight. Where rapeseed oil is concerned, there is a highly technical market for nearby positions. On positions for delivery by August, low supply is matched by slow demand. Buyers regard prices asked for old-crop material as being too high and try to postpone purchases to cover their demand until July until as late as possible, hoping that prices will be adjusted to the much lower levels of later delivery dates. Where postponement is not possible, buyers have to fork out the EUR 875 per tonne asked. This is EUR 50 per tonne more than for August positions. Old-crop sunflower oil is currently also valued at a EUR 70 per tonne higher level than deliveries from October 2013 onwards. Soybean oil prices have recently seen the sharpest drop. It was prompted by weak prices at the Chicago Stock Exchange. As a result, the price gap between rapeseed oil and soybean oil has widened again. (AMI)

Chart of the week (23)

More winter rapeseed, less summer rapeseed

Good seeding conditions in late summer and a favourable rapeseed-wheat price relationship motivated farmers in Germany last year to grow more winter rapeseed than the previous year. After all, throughout the season rapeseed prices were twice as high as prices of bread wheat. The mild winter did not cause any significant winterkill. In other words, there was hardly any extra land available for spring plantings. At the same time, the cold and wet spring slowed summer crop planting, minimizing the seeding of summer rapeseed as a result. An estimated 1.4 million hectares were sown with winter rapeseed for the 2013 harvest in Germany. This was up 10% on the previous year. In Mecklenburg-Western Pomerania in particular, the winter rapeseed area rose 26% to almost 250,000 ha, a hectarage last seen in 2010. That applies to other German states, too. In contrast, the area of summer rapeseed slumped to the lowest level in decades to 3,300 ha. (AMI)

Chart of the week (22)

Rapeseed meal has become more competitive again

Over the past few days, the competitiveness of rapeseed meal against soybean meal has improved. The decline in soybean meal prices that had been expected since April did not occur. Forecasts had predicted a downward price trend on account of the large soybean harvests in South America. However, due to logistical problems in South America, soybean shipments are slow to arrive in Germany, while German supply of soybean meal is insufficient. As a consequence, asking prices have recently rallied strongly on steady demand. With nearby material very short in supply, additional mark-ups have become prevalent. At the end of May, low-protein soybean meal (44%) for prompt delivery was EUR 450 per tonne fob Hamburg, EUR 27 per tonne more expensive than June shipments. In contrast, asking prices for rapeseed meal were reduced in line with the downtrend in rapeseed prices, widening the spread between rapeseed and soybean meal again. (AMI)

Chart of the week (21)

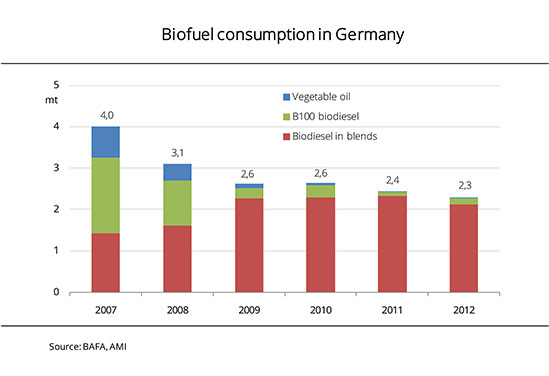

Biodiesel consumption is on a downward trend

Demand for biodiesel in Germany is declining. Since peaking at more than 4 million tonnes in 2007, consumption of biodiesel and vegetable oil fuels has dropped continuously. The key factor driving the decline was the withdrawal of tax exemption. The tax imposed on these fuels (19 euro cents per litre) caused a dramatic drop in competitiveness against mineral diesel. At the same time, more and more car manufacturers withdraw the approval of their vehicles for biodiesel use. As a result, the amount of biodiesel sold as B100 (pure fuel) at petrol stations dwindled. In order to meet the required blending quotas, the mineral oil companies have had to increase the percentage of biodiesel in blends since 2009. Since 2013, the amount of tax per litre of B100 and pure vegetable oil as fuels is around 45 euro cents. As a consequence, both types of fuel are bound to vanish from the market. (AMI)

Chart of the week (20)

US soybean crop forecast at a record in 2013/14

The USDA gives an optimistic outlook on soybean production. Global soybean production is expected to rise to 286 million tonnes in the 2013/14 marketing year, up 16 million tonnes from a year ago. It would be by far the largest amount of soybeans ever produced. US farmers are currently sowing in less than ideal weather conditions. In South America, the last soybean fields have just been cleared and it is still five months to go until sowing. Nevertheless, the USDA forecasts the soybean area to expand because of the benefits the crop offers to farmers. For example, it has a greater resistance to drought than maize, while also enabling farmers to create more added value. However, harvest estimates remain very vague. The key factor influencing the crop is the growing conditions. A year ago, the USDA had also forecast a record crop in the US, but a drought eroded these prospects. (AMI)

Chart of the week (19)

Higher prices are asked for oilseed meal on the cash market

Following a relatively stable price trend in the first quarter of 2013, German cash market oilseed meal prices have recently matched the upward trend of stock price quotes for feedstock. This rise curbs demand. Supply in nearby positions is moderate anyway, but demand is also sluggish. At the end of April, prices asked fob Hamburg rallied to EUR 460 per tonne for low-protein soybean meal (44%) and to EUR 490 per tonne for highprotein soybean meal (48%). Such levels were last seen in September 2012. However, they did not last long, because quotations for raw material were also in decline. The upsurge in prices for rapeseed meal (up EUR 4 to EUR 323 per tonne) was not quite so sharp at the end of April 2013. However, recent asking prices (EUR 311 per tonne) still exceeded the year-ago level by EUR 56 per tonne. (AMI)

chart of the week (18)

Prices for old-crop and new-crop rapeseed are far apart

The gap between bids for old-crop and new-crop rapeseed has recently been just under EUR 50 per tonne, maintaining its high level. In other words, changes will be needed over the next few weeks. However, the big question is whether the market will see a clear drop in quotations for material from the 2012 harvest or a rise in 2013 crop prices. In the previous marketing year, prices started to converge already in November. Since yield prospects were bad, bids for the new crop caught up. As there are no signs for any such development at the moment, it is more likely that prices for old-crop material will come down. (AMI)

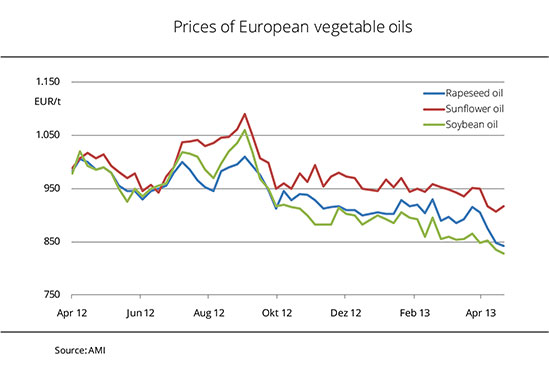

Chart of the week (17)

Downswing in vegetable oil prices

Since vegetable oil prices peaked in the summer of 2012, there has been a considerable downward slide in prices for vegetable oil. The key reasons were the drop in feedstock prices and the sometimes very sluggish demand. However, prices for sunflower oil increased their premium on the other prices over the past months. Smaller global harvest figures above all had driven a surge in feedstock prices and a less strong drop in prices for oil as a result. Soybean oil prices initially benefited from speculations on a devastating US soybean crop in 2012. Harvest was better than expected and prices have dropped continuously as a result. In other words, soybean oil did not maintain its price advantage over rapeseed oil for long. As demand declined in Europe, the difference in price increased more and more in favour of rapeseed oil since January 2013. At the beginning of April, it amounted to EUR 57 per tonne. This was the biggest price gap of the current season. The difference has now slid back down to EUR 14 per tonne. (AMI)

Chart of the week (16)

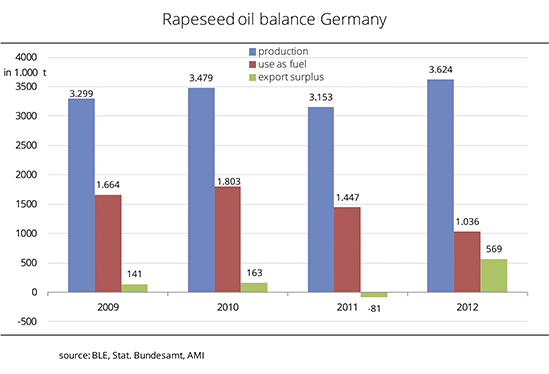

German domestic rapeseed oil sales are difficult

Less and less rapeseed oil from German oil mills is used for biodiesel fuel production. Since other uses such as cooking oil and food and other technical oils have very little potential for development, the domestic market offers few marketing possibilities. As a result, more rapeseed oil moves to the export sector. Other EU countries are the main buyers, with the number one, the Netherlands, buying up close to 40% of total German exports (300,000 tonnes) in 2012. Belgium and Great Britain (just under 100,000 tonnes each) were the number two and three buyers respectively. According to information published by the Bundesanstalt für Landwirtschaft (the German Federal Office for Agriculture and Food), the amount of German rapeseed oil used for biodiesel fuel production slumped to 1.036 million tonnes in 2012. This was 28% down on 2011 and even 43% less than 2010. Due to buoyant demand from abroad, German oil mills produced around 3.6 million tonnes of rapeseed oil in 2012. This was a 15% increase over 2011.

chart of the week (15)

Rapeseed prices stable over a long period of time

Over the past weeks, producer prices for rapeseed from the 2012 and 2013 crops have diverged. Rapeseed from the 2012 crop has been scarce, not only in Germany but also in EU neighbour states. As a consequence, prices have been stable at the 454 EUR/t level. Futures quotes fluctuated considerably in some cases, but resulted in little price effect on the cash market since cash market trading activity was slow. In contrast, prices for rapeseed from the coming season showed a slight but steady downward trend. In view of positive harvest estimates, processors withdraw their bids. It was only the chilly March weather that stopped the rapeseed price downswing. The delay in plant development puts a damper on yield prospects. However, the poor weather also affects the pricing of old crop rapeseed, because a delayed rapeseed harvest will extend the 2012/13 season, increasing processors' demand for rapeseed. (AMI)

chart of the week (14)

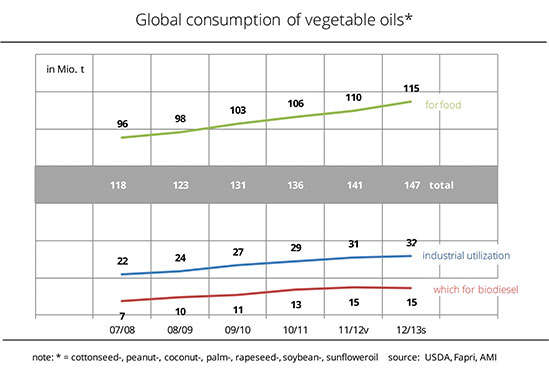

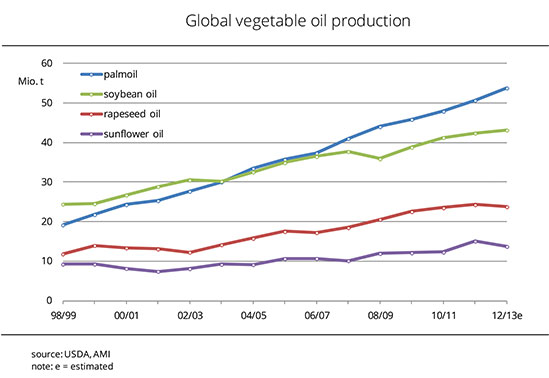

Global use of food oils increases inexorably

The use of vegetable oils will continue to rise in 2012/13. Global use is estimated at 147 million tonnes, just under 6 million tonnes up on the previous marketing year. Nearly 80% will be used as food oil, the remaining one fifth for industrial purposes. However, demand for vegetable oil for use in biodiesel fuel production is stagnating. The major driving force behind the global rise in demand for vegetable oil is the surge in palm oil use. It is expected to amount to around 52 million tonnes in 2012/13. This would be 3.3 million tonnes up year-on-year. The combined increase in use of all other oils is only 2.5 million tonnes. Palm oil use accounts for 36% of the total vegetable oil use, followed by soybean oil at less than 30%. Demand for soybean oil is around 43 million tonnes, of which demand for use in biodiesel production amounts to 6.3 million tonnes and is trending upward. Demand for rapeseed oil languishes at 23.8 million tonnes on a global scale, with demand for rapeseed oil for use in biodiesel production (less than 8 million tonnes) even declining. (AMI)

Chart of the week (13)

EU anticipates increase in 2013 sunflower crop yields

Following a meagre sunflower crop in 2012 due to poor weather, the EU expects supply to rise this year. Although the EU sunflower area might drop marginally, the EU could see a boost in per-hectare yields and overall larger sunflower crop yields as a result. Oilseed associations anticipate the EU-28 acreage of sunflowers to amount to 4.24 million hectares in 2013. This would be 19,000 hectares fewer than in the EU-27 in 2012. If per-hectare yields reach the expected 18.1 dt/ha average level, the chances are that the EU sunflower crop yield could amount to around 7.6 million tonnes in 2013. This would be 10% up year-on-year, but 1.2 million tonnes down on the 2011 record crop. (AMI)

Chart of the week (12)

EU production of rapeseed is on the rise

The chances are that there will be more rapeseed this year than 2012. This is what the associations and the EU Commission unanimously predict in their initial forecasts. The major reason is the foreseeable rise in production area. Coceral, the European grain and oilseed traders' association, estimates the rapeseed area in the EU-27 at 6.6 million hectares, nearly 400,000 hectares more than 2012. Coceral expects rapeseed areas to increase in almost all EU countries except France, Great Britain and the Czech Republic. In these three countries, bad weather conditions delayed sowing last autumn. In other countries, the acreage of winter rapeseed bounces back to normal levels, following a serious reduction last year because of winter kill. The preliminary EU rapeseed crop estimates for 2013 amount to 20.5 million tonnes, up 1 million on last year. (AMI)

Chart of the week (11)

Production of palm and soybean oil expands

The global use of the nine major vegetable oils continues to increase. It is estimated at 156 million tonnes in the marketing year 2012/13, just about 6 million tonnes more than a year ago. As a result, it has more than doubled over the past 14 years. The main reasons are the rise in the world’s population and growing affluence. Due to Southeast Asia’s growth markets, palm oil is the single most important oil to meet global demand. It has recorded the highest increases over the past decade. Palm oil use has more than tripled in 14 years, and due to its versatile uses and relatively low price, palm oil is now the world’s most important vegetable oil. However, supply of soybean oil has also gone up considerably and will continue to rise over the next few years. In contrast, rapeseed oil and sunflower oil production seem to be stretched to their limits. Supply has not risen to any significant degree in recent years. (AMI)

Chart of the week (10)

More rapeseed – more crushing

Brussels has recently published the first forecast of the supply and demand balance for rapeseed. The rapeseed crop yield could rise considerably in 2013 and stimulate crushing as a result. Rapeseed production could climb to 20.5 million tonnes in 2013, outstripping the 2012 figure by 1.2 million tonnes. Brussels assumes imports to stagnate at 3 million tonnes. At the same time, beginning stocks are estimated at 1 million tonnes, the same level as 2012/13. As a result, in the 2013/14 marketing year total supply of rapeseed would amount to 24.5 million tonnes. This figure compares to an estimated total use of 23.5 million tonnes. The Commission sees more potential, especially in crushing, and raised the forecast of crushing uses to 22.5 million tonnes. This is also 1.2 million tonnes up year-on-year. Total domestic uses are expected to rise to 23.3 million tonnes. Exports to third countries are forecast to be unchanged at 0.2 million tonnes. As a result, final stocks would remain at the same level as previous years. (AMI)

Chart of the week (09)

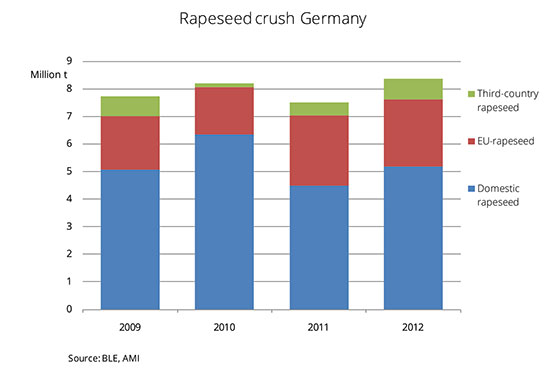

Imported rapeseed supports sharp rise in rapeseed crush

According to information published by the Bundesanstalt für Landwirtschaft (the German Federal Office for Agriculture and Food), German oil mills processed around 8.4 million tonnes of rapeseed in the 2012 calendar year. Of this rapeseed quantity, 5.2 million tonnes were produced in Germany. This was a slight increase over 2011, following extensive imports because of a meagre domestic crop. France alone accounted for more than one third of the 2.4 million tonnes of rapeseed from EU countries. Large quantities of rapeseed also came from Great Britain, Hungary, the Czech Republic and Poland. However, imports from the Netherlands (425,000 tonnes) were probably from third-country production. The rapeseed was imported via the Dutch North Sea harbours and shipped on to Germany. The proportion of third-country rapeseed processed rose to 9%, the majority of which came from Australia. (AMI)

Chart of the week (08)

Use of rapeseed oil for fuel production dwindles

According to information published by the Bundesanstalt für Landwirtschaft (the German Federal Office for Agriculture and Food), German oil mills processed around 8.4 million tonnes of rapeseed in the 2012 calendar year. The office estimates that the oil mills produced approximately 3.6 million tonnes of rapeseed oil. This was around 435,000 tonnes up year-on-year and more than in any of the past five calendar years. Of the rapeseed oil produced in 2012, 3 million tonnes were sold to processors. Of this quantity of rapeseed oil, fuel producers purchased 1.04 million tonnes for use as feedstock. This was less than ever before. As a result, only 34 % of the total sales were for use in fuel production. This was a drop from 37 % in 2011 and even from 43 % in 2009. (AMI)

Chart of the week (07)

Rapeseed is hard to trade

Although rapeseed is in short supply on the global market, in Germany this oil crop is currently difficult to trade. Oil mills stocked up well during harvest and are now only calling forward contract material. They cover peak demand sporadically on the spot market. However, peak demand has occurred very rarely over the current business year, because processing volumes have been moderate. Because of tight calculations based on low rapeseed oil prices, processors are not willing to accept the prices asked. Making reference to the scarcity of supply, German suppliers are asking for a mark-up on the contract prices quoted at the futures exchange. (AMI)

Chart of the week (06)

Diesel prices do not reflect the climb in prices of mineral oil

The New York Futures Exchange has seen a strong upward trend in crude oil prices since the beginning of December. However, in German markets the weak dollar exchange rate curbed the price rise. As a consequence, wholesale diesel has been valued at a stable 65.50 euro cents per litre for several weeks. This translates into 112.50 euro cents per litre including energy tax. Trends in feedstock used for biodiesel production have been mixed over these past weeks. Palm oil has stabilized most recently, following a tremendous fall in value in the summer. Moreover, the price gap between palm oil and other vegetable oils has levelled off at 26 euro cents per litre. In line with futures quotations for soybeans, soybean oil did not show any clear price trend but has most recently skidded to rapeseed oil levels. The rapeseed oil market has in fact recently seen some price movement on a temporary upswing in buyer interest. (AMI)

Chart of the week (05)

Sluggish demand for oilseed meal

Soybean meal prices are trending firmer again, following a sharp fall at the end of last week. This trend has been supported by firmer soybean prices and an increase in prices asked for competing imports. However, prices of 44 % soybean meal have not reached the EUR 400 per tonne level since the beginning of the year. Demand for nearby soybean meal is currently on the sluggish side. As a result, for January material, markups over futures are impossible to achieve. There is also hardly any interest in the remaining quantities of spot rapeseed meal. At best, processors are demanding the lower-priced material for March and April futures, which is offered at an average price of EUR 272 per tonne. (AMI)

Chart of the week (04)

Marked gains for oilseeds

Soybean prices rose to a one-month high in the early morning of the trading day following the US holiday at the beginning of this week. At the close of the market, market prices stayed at the level of 400 euros per tonne. Excessively dry conditions in the South American cultivation areas were the single largest factor driving up soybean prices. It remains to be seen whether the weather situation will ultimately lead to reduced yields. Most recently, soybean prices were pressured by profit taking. Rapeseed prices climbed to exceed the level of 465 euros per tonne early this week. They most recently jumped to 475 euros per tonne on support from higher soybean prices. The cash market remained calm. Given the low margin of rapeseed, the occasional oil mills that are looking for material are not willing to accept higher mark-ups. As a result, producers have no reason to sell their remaining quantities of rapeseed now. (AMI)

Chart of the week (03)

Sluggish demand caps vegetable oil prices

Weak demand prevents prices for vegetable oil from benefiting from the firmer prices for palm oil and soybean oil. Soybean oil prices are trending firmer but remain clearly below the EUR 900 per tonne level. Two weeks ago, the approval of retrospective subsidies of biodiesel production had sent forward prices soaring in the US. Asking prices for soybean oil climbed to EUR 905 per tonne. However, this level could not be maintained, even in Chicago. Whereas rapeseed oil still sold reasonably well last week, interest in raw rapeseed oil is now dropping as the biodiesel industry is not available as an outlet. (AMI)

Chart of the week (02)

Producer prices fail to benefit from climbing rapeseed prices

Rapeseed prices in Germany have recently made gains as they moved away from negative Chicago references. Above all, this trend has been supported by buoyant buyer interest at the exchange. Buyers must now accept higher mark-ups on the cash market in order to get hold of the scarce material. Due to the weak market, producer prices have not yet benefited from the recent positive trend at the exchange. At EUR 441.95 per tonne, they are currently EUR 10 down on the previous week. At the moment, sellers and buyers do not come together easily. With the USDA report pending, both producers and processors are holding back for the time being while waiting for new stimulus. (AMI)

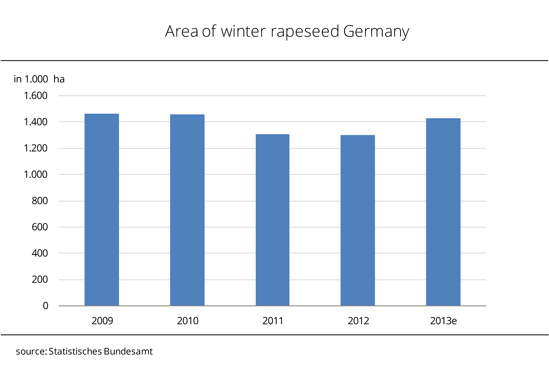

Chart of the week (01)

Area of winter rapeseed increased

The acreage of winter rapeseed in Germany for the 2013 harvest has been expanded. According to the German Federal Statistical Office, rapeseed growers in Germany planted around 1.43 million hectares with winter rapeseed for the 2013 harvest season. This acreage is 8 per cent up on the previous year. In the majority of German states, the expansion was minimal. However, winter rapeseed cropland in Schleswig-Holstein (+89 per cent) and Mecklenburg-Western Pomerania (+24 per cent) went up considerably on the previous year. On the other hand, in Bavaria and Thuringia areas planted with winter oilseed rape were down 1 per cent. (AMI)

Union zur Förderung von Oel- und Proteinpflanzen E.V.

Union zur Förderung von Oel- und Proteinpflanzen E.V.